“His portfolio is still down from the April slump when everybody else’s accounts have gone up.”

Source link

CoinNews

Institutional adoption of Bitcoin has reached a new peak, with over 10% of the total BTC supply now held by public companies or in exchange-traded funds.

Charles Edwards, CEO of Capriole Investments, shared the update in a July 24 thread on X, noting a significant surge in institutional accumulation.

Edwards pointed out that the share of Bitcoin held by institutions, including ETFs, public companies, and investment trusts, has climbed from 4% over the past 18 months to an all-time high of over 10%.

Data from Bitcoin Treasuries supports this trend, showing that exchange-traded funds now control approximately 1.62 million BTC, while publicly listed companies hold around 918,000 BTC. At current market prices of roughly $118,838 per coin, institutional holdings are valued at more than $250 billion.

According to Edwards, these significant holdings were bolstered by the fact that the institutional purchases have been absorbing Bitcoin at a rate far beyond its natural issuance. In some cases, the daily demand from corporate buyers is ten times greater than the number of new coins mined.

He stated:

“The daily percentage of all Bitcoin in existence that is being acquired by institutions per day (blue) is currently 10X higher than the Bitcoin mining Supply Growth Rate (red)! Notice how every time institutional buying has exceeded the Supply Growth Rate, price went VERTICAL.”

This accelerating trend can be traced back to 2020, when Strategy (formerly MicroStrategy) began converting portions of its balance sheet into Bitcoin.

Since then, a growing number of firms, especially under President Donald Trump’s pro-crypto administration, have adopted Bitcoin as a strategic reserve asset and have acquired the top crypto en masse.

Bitcoin price correlation

Meanwhile, Edwards also noted a correlation between institutional activity on Coinbase, the largest US-based crypto exchange, and Bitcoin price.

According to him, whenever institutional trading makes up between 10% and 50% of the platform’s daily activity, “price has historically rocketed.”

This shows an increasingly significant correlation between BTC’s price and institutional activity.

Considering this, Edwards believes this trend is fueling a bullish outlook for the top crypto asset, saying:

“It’s hard not to be bullish with the exponential growth in the number of treasury companies, the amount of Bitcoin they are buying, and the frequency at which they are buying. It’s never been seen before in history. The demand these companies have for Bitcoin is striping 1000% of the daily Bitcoin supply out of the market every day.”

As a result, he believes that the Bitcoin price will soon break back above the $118,000 range.

Mentioned in this article

Latest Alpha Market Report

Key Notes

- Dogecoin price has plummeted to $0.24, marking a sharp dip from $0.26.

- Though the altcoin had benefited from broader market recovery, the recent plunge is attributed to macroeconomic concerns.

- Ali Martinez believes that DOGE may still pull a stunning recovery to attain $0.33 and $0.40.

From $0.26, canine-themed meme coin Dogecoin

DOGE

$0.24

24h volatility:

0.9%

Market cap:

$35.55 B

Vol. 24h:

$14.77 B

has seen its price plummet to $0.24. This sharp dip, which represents about 11% of the coin’s initial value, happened during the trading session that extended to July 24. It is quite clear that DOGE is faced with sustained institutional sell pressure and extreme volatility.

DOGE Price Fluctuates Sideways

Over the last couple of months, the top dog mem ecoin has been stuck in a narrow price range between $0.17 and $0.21.

All of a sudden, Dogecoin got entangled in the broader crypto market rebound, recording a rally of approximately 77.7% in 30 days. This brought the price of the digital asset to $0.24, and it attempted to break through this level, at least to reach the psychologically important $0.25 level.

Fortunately for DOGE, July became the month when it gained the required momentum to break through the $0.25 to $0.26 mark. This was the period when Bit Origin Ltd raised $500 million for the Dogecoin treasury, signaling growing institutional interest.

The resulting surge opened up the memecoin for a couple of short-term price targets. According to a tweet posted by crypto trader Ali Martinez, sustaining the $0.25 neckline level is crucial for Dogecoin’s price to reach $0.33 and $0.40.

If it is unable to maintain this level, he claimed DOGE may revert to the $0.17 and $0.21 levels. However, market watchers do not believe the ecosystem lacks the fundamentals to propel further gains.

At the time of writing, DOGE was trading at $0.2325, according to data from CoinMarketCap. The current price level represents a 12.7% decline over the last 24 hours. The coin’s RSI and Moving Average indicators shows signs of bearish distress at play.

Dogecoin Daily Price Chart | Source: TradingView

Generally, altcoins are currently experiencing some fragility in market sentiment, which stems from macroeconomic concerns. Precisely, global trade tensions and hawkish policy tone are exacerbating risk-off flows. Investors are disappointed with the current market situation.

It is worth noting that the Federal Reserve’s determination to either lower interest rates or not at its meeting at the end of July could serve as the most significant near-term catalyst for Dogecoin price.

Snorter Bot Project Presale Secures Over $2 Million

Rather than lose your millions to the fluctuations in DOGE price, it may be a wise decision to push funds into Snorter Bot, an aardvark-themed cryptocurrency project.

Currently ranked as one of the best crypto presales of 2025 among its counterparts, SNORT scours data to equip traders with real-time insights and convenient trading features. As a result, investors are not pushing in funds blindly; instead, they make informed trading decisions.

According to data on the official presale website, the token price is set to be adjusted in 25 hours. Until then, investors’ funds can be put to work to earn passive income.

Current Presale Stats:

- Current price: $0.0991

- Amount raised so far: $2.02 million

- Ticker: SNORT

- Operating platform: Telegram

Purchases can be completed using credit or debit cards, as well as cryptocurrency.

next

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Cryptocurrency News, News

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

From left, Sen. Susan Collins, R-Maine, and Sen. Lisa Murkowski, R-Alaska, talk as they arrive for a vote in the U.S. Capitol on Wednesday, April 30, 2025.

Bill Clark | Cq-roll Call, Inc. | Getty Images

Republican Sens. Susan Collins and Lisa Murkowski are joining Democrats to back a new bill that would exempt millions of U.S. small businesses from President Donald Trump’s tariffs on Canadian goods.

The two-page bill, titled the “Creating Access to Necessary American-Canadian Duty Adjustments Act” — which shortens to the CANADA Act — comes as Trump threatens to slap a blanket 35% tariff on Canadian imports starting Aug. 1.

The tariff threat is the president’s latest salvo in an on-again, off-again trade war with America’s longtime economic and political ally, which is the largest export partner for nearly three dozen U.S. states.

“Imposing tariffs on Canada, Maine’s closest trading partner, threatens jobs, drives up costs, and hurts small businesses that have long relied on cross-border cooperation and exchange,” Collins said in a statement in support of the new bill.

Murkowski in her own statement said, “I’ve heard loud and clear from small businesses in Alaska: tariffs are forcing prices to rise and making it difficult to plan long-term.”

“I’m hopeful this legislation sends a clear message to the administration that we want to continue this strong partnership by alleviating the effects of these tariffs on our small businesses,” she said.

The legislation introduced by Sen. Peter Welch, D-Vt., is cosponsored by five other Democrats including Senate Minority Leader Chuck Schumer of New York and Oregon’s Ron Wyden, the Senate Finance Committee’s ranking member.

The bill targets the tariffs that Trump first announced on Feb. 1, a 25% blanket duty on Canadian goods imported to the United States and a 10% tariff on Canadian energy imports.

If enacted, the legislation would make those tariffs inapplicable “with respect to goods imported by or for the use of small business concerns” as defined under federal law.

The White House did not immediately respond when CNBC requested a comment on the bill and asked if Trump would consider signing it, should it make it to his desk.

In a phone interview with CNBC on Wednesday, Welch said that other U.S. tariffs targeting Canada — including Trump’s threatened 35% duty — will “all be on the table.”

The impact of Trump’s tariffs goes beyond concerns that they will ultimately raise prices on U.S. consumers, Welch said.

“Vermonters really love Canadians, and are very upset about what has happened to the relationships that many of our businesses have built up over the years,” the senator said.

Likewise, Canada “understandably is furious and hurt by the way they’ve been treated” by the U.S., and that has affected Vermont’s hospitality industry, he added.

Canadian travel to Vermont — and the U.S. in general — is reportedly down sharply so far this year.

Trump said he imposed the Feb. 1 tariffs in response to Canada’s alleged failure to stop the flow of drugs and crime over the U.S. northern border. But he quickly issued a 30-day pause on those tariffs, after then-Canadian Prime Minister Justin Trudeau vowed to take steps to address Trump’s concerns.

In a March 2 executive order, Trump further amended the Canada tariffs by delaying the end of the so-called de minimis trade exemption, a carve out which allowed low-value goods shipments to enter the U.S. duty free.

Read more CNBC politics coverage

The Canada tariffs — alongside 25% duties on Mexican goods and a total 20% import tax on China — nevertheless took effect on March 4, prompting retaliation from Ottawa.

One day later, Trump granted a monthlong tariff pause for major U.S. automakers whose cars comply with the trilateral North American trade pact known as USMCA.

The day after that, Trump issued temporary tariff exemptions for USMCA-compliant imports from Canada and Mexico. That covered about 38% of goods entering the U.S. from Canada, the White House said at the time.

Canada was excluded from Trump’s April 2 “liberation day” tariffs, which imposed a near-global 10% duty and significantly higher rates on dozens of individual countries. But Ottawa has continued to grapple with U.S. blanket tariffs on its imports of steel and aluminum and autos.

OTC Crypto Spot Transaction Volume Surges 95% in H1 2024, Driven by Institutional Interest

The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

Source link

Nvidia’s stock outpaced Apple’s in 2024 and could continue to do so next year.

It’s been nearly impossible to escape coverage on Nvidia (NVDA -6.62%) over the last year, as its stock has been on a historic bull run, soaring 762% since the start of 2023. The chipmaker’s rise dwarfed the growth of many of the most prominent tech companies, including Apple (AAPL -2.53%), which saw its stock increase by 80% in the same period.

The disparity between the companies’ stock growth is significant, considering Apple is the world’s most valuable company with a market cap of $3.5 trillion. Nvidia’s rally has seen it become the first chipmaker to achieve a market cap above $3 trillion, putting it third on the list of most valuable companies (after Microsoft, which is in second).

Nvidia’s swift rise saw it temporarily overtake Apple in market cap earlier this year, but it didn’t last. However, the chipmaker’s consistent ability to outpace Apple in growth suggests it’s a matter of when, not if, Nvidia will one day be worth more than Apple. Meanwhile, the company’s dominance in the chip market and lead over its competitors indicates that day might not be very far away.

So, will Nvidia be worth more than Apple by 2025? Let’s assess.

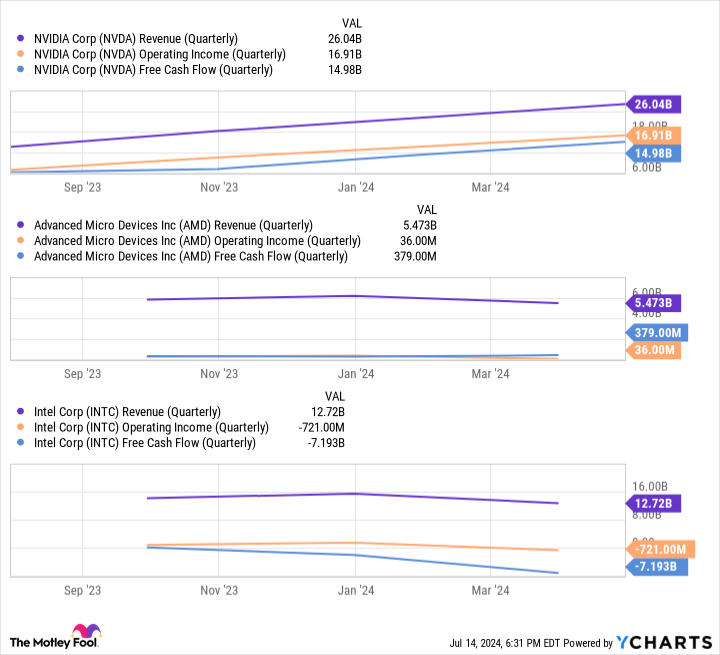

Nvidia is in a far better financial position than its rivals

Nvidia’s recent rally was primarily driven by its dominance in artificial intelligence (AI). The company’s graphics processing units (GPUs) are the preferred hardware for developers worldwide, with Nvidia now responsible for an estimated 70% to 95% of the AI chip market.

The company’s success in the industry has seen its earnings skyrocket over the last year, even while rivals like Advanced Micro Devices and Intel launched competing products.

Data by YCharts

Nvidia has taken a massive financial leap Nvidia over its competitors in the last 12 months, with far more revenue, operating income, and free cash flow. The figures suggest Nvidia is far better equipped than AMD and Intel to continue reinvesting in its technology and stay ahead in AI.

Comparatively, Apple’s AI competitors are in similar financial positions to the iPhone maker. Microsoft and Alphabet are investing heavily in the generative technology, even pulling ahead of Apple since the start of 2023, and have the financial resources to do so. As a result, Apple will likely continue to face fiercer competition in AI than Nvidia, which could mean slower earnings and stock growth as it develops in the sector.

Data by YCharts

Additionally, Nvidia’s more established position in AI means it’s already enjoying major gains from selling its hardware to the industry. At the same time, it remains to be seen if Apple will, in fact, attract consumers to the soon-to-be-launched AI features in its iPhones, Macs, and iPads.

Market trends suggest it’ll be challenging for rivals to overcome Nvidia

Past chip trends indicate it will be an uphill battle for Nvidia’s competitors to chip away at its leading market share in AI. For instance, Nvidia’s share of the discrete desktop GPU market has grown from 65% in 2014 to 88% this year. The company’s position has risen despite AMD’s investment in the sector, with AMD’s share falling from 35% to 12% in the same period.

A similar example has occurred with central processing units (CPUs). Since 2017, AMD’s CPU market share has risen from 18% to 33%. While Intel’s position in the industry has declined since then, it has held onto its majority market share, which was 64% as of the first quarter of 2024.

Historical trends in the chip market show that once a company takes a dominant position, it can be nearly impossible for a competitor to steal the top spot. As a result, Nvidia will likely retain its dominance in AI GPUs for years, especially as it continues widening the financial gap to its peers.

Meanwhile, in the first six weeks of 2024, Apple’s iPhone sales tumbled 24% in China, while domestic rival Huawei’s smartphone sales soared 64%. Apple has responded to the market shift by introducing heavy discounts on its iPhones. However, the situation suggests Apple’s dominance in some regions could be more fickle than previously thought.

Nvidia’s business has exploded since the start of 2023 and has shown no signs of slowing. Apple has delivered solid stock growth more recently, hitting a new high in its share price this year. However, Nvidia’s lead in AI and more extensive financial resources than its competitors indicate it could surpass Apple in 2025.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Former President Trump hints at new NFT series, stresses need for US leadership in crypto

Former US President and Republican Presidential Candidate Donald Trump has hinted at the possibility of launching a new NFT collection, following the success of his previous ones.

In an interview with Bloomberg Businessweek, Trump highlighted the strong demand from his supporters for more digital assets. This demand could influence his decision to release a new collection. He stated:

“We had one year to sell it out and it sold out in one day. The whole thing sold out: 45,000 of the cards. And I did it three times [and] I’m going to do another one, because the people want me to do another one.”

Over the past few years, Trump has launched three NFT collections, generating both success and criticism from the community.

His first NFT collection, launched in December 2022, received much acclaim but experienced significant value losses, similar to his Series 2 collection launched in April 2023 and the Mugshot edition in December 2023.

These projects have also faced broader complaints. Early reports suggested that the company controlling the project reserved several NFTS for the team. It was also alleged that many card designs plagiarized stock images from popular websites like Amazon.

Meanwhile, Trump mentioned that his involvement in NFTs changed his views about the crypto industry. He said:

“I did things like NFTs and, you know, stuff. And I noticed that 80% of the money was paid in crypto. It was incredible…The thing I really noticed was everything was paid in—I would say almost all of it was paid in crypto, in this new currency. And it opened my eyes.”

Reports from last year indicate that Trump has earned around $5 million from his NFT collections.

Maintaining US crypto dominance

Trump explained that his pro-crypto stance aims to position the US as a leader in the industry.

He believes the industry is young and here to stay, making government intervention essential. He emphasized the importance of not letting another country take the lead.

Trump said:

“If we don’t do it, China is going to pick it up and China’s going to have it—or somebody else, but most likely China. China’s very much into it. Also, it’s not going away. It’s amazing.”

Mentioned in this article

1 Vanguard ETF That Could Soar 41.5% in the Remainder of 2024, According to a Select Wall Street Analyst

Small-cap stocks might be a great place to invest for the rest of 2024 if interest rates fall as expected.

Wall Street doesn’t always get things right, but Tom Lee from Fundstrat Global Advisors is one analyst with a hot hand right now. He predicted the S&P 500 index would close above 4,750 in 2023, and it ended the year at 4,769. He also entered 2024 with an S&P index target of 5,200, which was the highest on Wall Street at the time, and the index blew past that level within the first three months.

Lee also predicted the Russell 2000 could soar 50% in 2024. This index is home to approximately 2,000 of the smallest listed stocks in the U.S., with the largest company in the index worth just $53 billion. Lee cites valuations and the potential for lower interest rates as key reasons for his prediction.

The Russell 2000 had a sluggish first half of 2024, so it will have to climb 41.5% between now and the end of the year to meet Lee’s forecast. The Vanguard Russell 2000 ETF (VTWO -0.63%) closely tracks the performance of the index, so it’s a simple way for investors to capture that gain if he turns out to be right.

The Vanguard Russell 2000 ETF is a great way to invest in small caps

Thanks to the meteoric rise of trillion-dollar giants like Nvidia, technology is the largest sector in the S&P 500, with a weighting of 30%. The Russell 2000 is a little more balanced — the industrial sector has the largest weighting at 19%, followed by healthcare at 15.2% and financials at 14.8%.

The top-10 holdings in the Vanguard Russell 2000 ETF make up just 5.2% of its total value, so its performance isn’t beholden to a mere handful of stocks:

|

Stock |

Vanguard Russell 2000 ETF Portfolio Weighting |

|---|---|

|

1. Super Micro Computer |

1.50% |

|

2. MicroStrategy |

0.85% |

|

3. Comfort Systems USA |

0.44% |

|

4. Onto Innovation |

0.40% |

|

5. Carvana |

0.39% |

|

6. Elf Beauty |

0.38% |

|

7. Fabrinet |

0.33% |

|

8. Scientific Games |

0.32% |

|

9. Weatherford International |

0.32% |

|

10. Abercrombie & Fitch |

0.32% |

Data source: Vanguard. Portfolio weightings are accurate as of May 31, 2024 and are subject to change.

Super Micro stock is up a whopping 218% this year so far. Investors are bullish on the company’s role in artificial intelligence (AI), which includes selling networking, server, and storage equipment for the data center.

MicroStrategy stock is also having a great year with a 103% gain. It offers a portfolio of software products designed to help businesses extract more value from their data using AI. But the company is also a proxy for Bitcoin, given that it holds around $12.5 billion worth of the cryptocurrency.

Carvana stock also roared back to life this year with a 178% return, but it’s still down 62% from its all-time high, which was set during the tech frenzy of 2021. The company sells used cars online with a focus on automation using its vending-machine style buildings.

Elf Beauty and Abercrombie & Fitch are further examples of consumer companies putting up strong numbers this year.

Small companies should benefit from lower interest rates

According to the CME Group‘s FedWatch tracker, the U.S. Federal Reserve will cut interest rates three times before the end of the year (in September, November, and December). In that environment, risk-free assets, like cash deposits and bonds, will be less attractive. This often pushes investors into stocks, instead. That’s good news for the overall market but especially positive for small caps.

Small companies often borrow money to fuel growth and typically have more floating-rate debt, which is very sensitive to changes in monetary policy. In contrast, the tech giants that dominate the S&P 500 are sitting on billions of dollars in cash. Apple, for example, just announced a $110 billion stock-buyback program, which basically means the company makes so much money that it can’t find a better use for it internally.

Lower interest rates will drive down borrowing costs for small caps, which means they can take on more debt and potentially drive faster growth. Plus, smaller interest payments will be a direct tailwind for each company’s earnings.

Lee cites valuations as another reason the Russell 2000 could soar. The index trades at a price-to-earnings (P/E) ratio of 16.9 (excluding companies with negative earnings). The S&P 500 trades at a P/E ratio of 24.3, which makes the Russell look quite attractive by comparison.

Of course, the S&P 500 trades at a premium because of the quality of its constituents. Investors will always pay a higher valuation for stocks like Microsoft, Apple, and Nvidia because they’re secure organizations with track records of success spanning decades. But if lower rates boost small-cap earnings, the valuation gap could narrow.

Image source: Getty Images.

Will Lee be right?

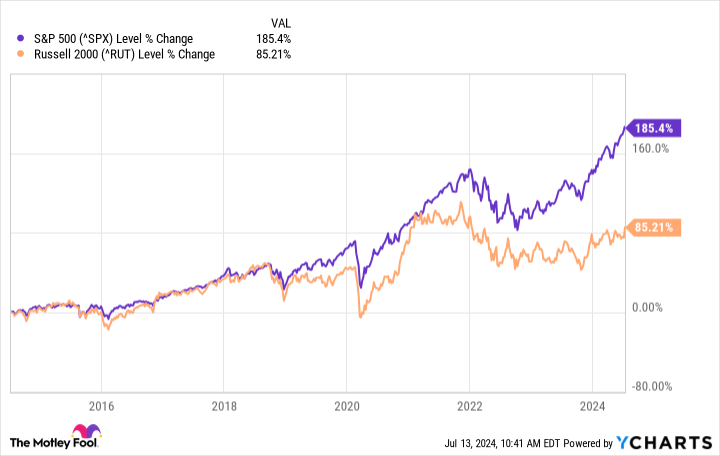

Here’s where things get tricky. Going all the way back to 1988, the Russell 2000 has never recorded an annual gain of 50%. In fact, it consistently underperformed the S&P 500, on average.

The federal funds rate was below 1% for most of the last decade, yet the Russell 2000 was up just 85% over that period, compared to a 185% gain in the S&P 500:

Plus, the Vanguard Russell 2000 ETF has delivered a compound annual return of 9.9% since its inception in 2010, sharply lagging the 14.5% average annual return of the Vanguard S&P 500 ETF. That 4.6% differential substantially impacted returns when compounded over the last 14 years:

|

Starting Balance (2010) |

Compound Annual Return |

Balance In 2024 |

|---|---|---|

|

$10,000 |

9.9% (Russell 2000 ETF) |

$37,734 |

|

$10,000 |

14.5% (S&P 500 ETF) |

$66,651 |

Calculations and chart by author.

While it’s entirely possible for the Russell 2000 to deliver a positive return in the remainder of 2024, history suggests it’s extremely unlikely to climb 41.5% to end the year with a 50% gain. With that said, small caps might be a good place for investors to park their money when interest rates begin to fall, so adding the Vanguard Russell 2000 ETF to a balanced portfolio isn’t a bad idea.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bitcoin, Microsoft, Nvidia, Vanguard S&P 500 ETF, and e.l.f. Beauty. The Motley Fool recommends CME Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.