The Federal Reserve should keep credit conditions tight for now.

Source link

CoinNews

Why a $100,000 salary no longer buys the American Dream in most places

The American Dream — which for many people involves some combination of owning a home, getting married, having kids and making enough after expenses to save for retirement and spend on leisure — is becoming increasingly expensive.

“The benchmark of a six-figure salary used to be the gold standard income,” Sabrina Romanoff, a clinical psychologist, told CNBC. “It represented the tipping point of finally earning a disposable income and building savings and spending based on your wants, not just your needs.”

More than half (52%) of Americans say they would need at least $100,000 a year to feel financially comfortable, with 26% saying they would need a salary in the range of $100,000 to $149,000 per year, according to a 2023 CNBC Your Money survey conducted by SurveyMonkey.

As part of its National Financial Literacy Month efforts, CNBC will be featuring stories throughout the month dedicated to helping people manage, grow and protect their money so they can truly live ambitiously.

“Unfortunately, what has happened is that wages haven’t kept up with the cost of living, by and large, for the last 50 years or so,” said Elise Gould, senior economist at Economic Policy Institute.

“It becomes increasingly hard for many families to be able to attain that sort of middle-class lifestyle, that American Dream,” Gould said.

Consumers using the popular 50-30-20 budget guideline aim to spend 50% of their income on essential expenses, with another 30% for discretionary spending and the remaining 20% for savings.

A new report from GOBankingRates used that framework to analyze how much money a family of two adults and two children would need in each state to own a home, a car and a pet. The report tallied estimated annual essential expenses for such a family and then doubled that figure.

Using that framework, GoBankingRates found that all 50 states require more than a $100,000 annual income, according to the report, with 38 states needing more than $140,000.

Economists have suggested that debt growth has become a substitution for income growth. Student loan debt reached an all-time high of $1.77 trillion in the first quarter of 2023 and Americans collectively owe $1.13 trillion on their credit cards as of the fourth quarter of 2023. This debt can have a ripple effect, especially when entire generations are starting their adulthoods with thousands of dollars in debt.

“Now people making well over six figures are still living paycheck to paycheck,” Romanoff said. “So what used to symbolize financial freedom is now keeping people stressed about making ends meet.”

Watch the video above to learn how much families in the U.S. need to make to achieve the American Dream.

Don’t miss these exclusives from CNBC PRO

This ETF Has Crushed the Markets and Even the Tech Sector: Don’t Let Fearmongers Keep You Out

This “risky” sector has returned the biggest rewards.

Investors love their long-term gains, but short-term investors can’t stand volatility. And that very fear on the part of shorter-term-minded investors, particularly people nearing retirement, can potentially offer huge opportunities for investors with a long-term mindset.

The best-performing sector in the market over the past 10 years offers such an opportunity. While many investors often stay away from this sector due to its extreme booms and busts, over the long term, it has actually provided superior long-term gains.

Don’t let the fearmongers and naysayers keep you out. The sector remains a long-term winner.

Throw your chips in with the chips

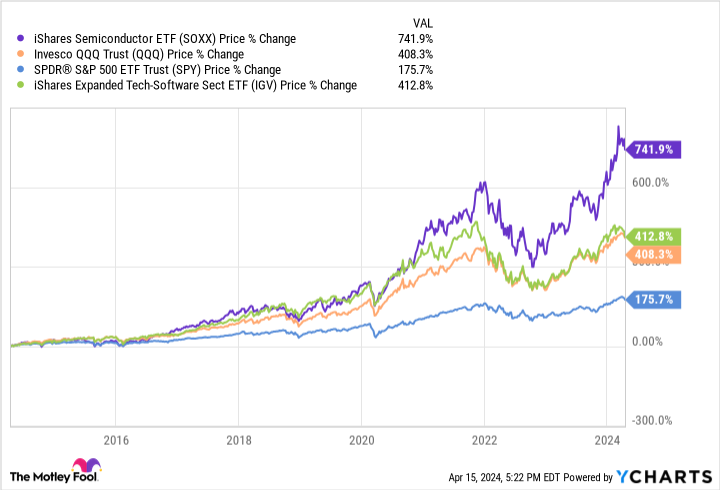

The sector in question is the semiconductor sector. Looking at the performance of one low-cost exchange-traded fund (ETF) tracking the chip sector, the iShares Semiconductor ETF (SOXX 0.49%), one can plainly see how chip stocks, in aggregate, have crushed the broader market, even outperforming the general technology and software sectors over the past 10 years.

The broader S&P 500 has appreciated 176% over the past decade, giving long-term shareholders a nice return well above the rate of inflation. Of course, with strong innovations in cloud computing, e-commerce, smartphone applications, and now artificial intelligence (AI), the technology sector has rallied much more.

The tech-heavy Invesco QQQ Trust (QQQ -0.02%), meant to closely reflect the Nasdaq 100, has appreciated 408% over that time. Within the tech sector, the super-high-growth cloud software sector has pushed the iShares Expanded Tech-Software Sector ETF (IGV 0.51%) an even higher 413%.

But that all pales in comparison to the semiconductor sector, which has rallied a whopping 742%! That’s nearly double the returns of the overall technology sector and over 4.2 times the return of the broader market over the past decade.

Why many shy away from the chip sector

In light of the semiconductor sector’s long-term outperformance, it may be surprising that many investors shy away from it. After all, Warren Buffett had never once bought a semiconductor stock until he purchased Taiwan Semiconductor Manufacturing (TSM -0.69%) in late 2022, only to sell it all within two quarters over geopolitical fears.

The refrain by many Buffett acolytes and value investors, in general, is that the chip sector moves too quickly, with fast-changing technology making long-term competitive advantages somewhat hard to identify or more breach-able by the competition.

There is some truth to this; after all, just look at how Nvidia (NVDA 0.90%) and foundry partner TSMC have overtaken Intel (INTC -0.52%), which used to be regarded as the sector’s undisputed champion a mere decade ago. Now, Intel has suddenly fallen far behind in a relatively short amount of time and is attempting an ambitious turnaround for its very survival.

But that’s the beauty of buying an ETF. With an ETF, you are betting on the industry’s long-term growth with a diversified mix of winners and losers. Eventually, the winners rise to a top-weighting, buoying result.

Young and investing? Don’t ignore the semis. Image source: Getty Images.

How have semiconductors done it? It’s more than just AI

As you can see in the chart above, the chip sector had basically appreciated in line with the broader software sector for the first six years or so of the past decade and only began to do a bit better than the Nasdaq around late 2020, when the chips started to separate from the pack.

Yes, the technology sector began to take off in earnest during the pandemic, as companies ran to cloud computing to keep their businesses going, and consumers purchased new laptops and smartphones with stimulus checks for the stay-at-home economy. That benefited software, the internet, and semiconductors alike.

However, late in 2020 and into 2021, separation began to happen — even before the thunderous debut of ChatGPT in late 2022. Why was that?

I think it was due to a renewed investor focus on stock valuations as inflation and interest rates began to pick up from rock-bottom levels. In that period, software valuations tended to be much higher than those of chip stocks, as software is thought to be more of a stable “recurring” subscription business, and chip sales can fluctuate year to year.

However, rising interest rates lower the present value of earnings far out in the future. That tends to depress the valuations of high-multiple stocks such as software.

On the other hand, semiconductor stocks tended to trade at lower valuations, especially back then. Many chip leaders are also dividend payers and share repurchasers on top of their tech-powered growth. Those shareholder returns only add to the sector’s long-term numbers.

And while semiconductors overall may not grow as fast as, say, cloud software, semiconductors are still holding their own in terms of long-term growth. While the sector may boom and bust in any single year, the overall sector is projected to grow at an 11.6% annualized growth rate over the 2023 to 2030 time period, according to DataHorizzon Research.

So, starting from a lower valuation with a lower hurdle to clear may have been a key factor behind the sector’s outperformance as interest rates normalized.

It’s not just Nvidia

Of course, many may scoff at the sector’s rise as the work of Nvidia alone. As the first-mover in graphics processing units (GPUs) needed for generative AI applications, Nvidia’s stock has taken off over the past two years. And with AI being a potentially transformative technology to society and humanity, Nvidia has become the poster child of success.

But it’s actually not just Nvidia driving the gains in the sector. In fact, seven of the 10 best-performing S&P 500 stocks over the past decade are all in the semiconductor sector, encompassing four of the top five.

Producing leading-edge chips with billions of tiny transistors is difficult, and past cycles have allowed the chip sector to consolidate into a handful of exceptional companies with these unique technological capabilities. As such, it’s perhaps no surprise that not one but a handful of stocks all participating in AI chip design and manufacturing ecosystem would reap the rewards.

While the chip sector may not achieve the gains in the next 10 years that it did over the past 10, owing to higher starting valuations, our world only appears to be getting more automated, intelligent, and connected. All of that is powered by semiconductors. And that still makes this ETF a must-have for any ETF investor with a time horizon beyond 10 years.

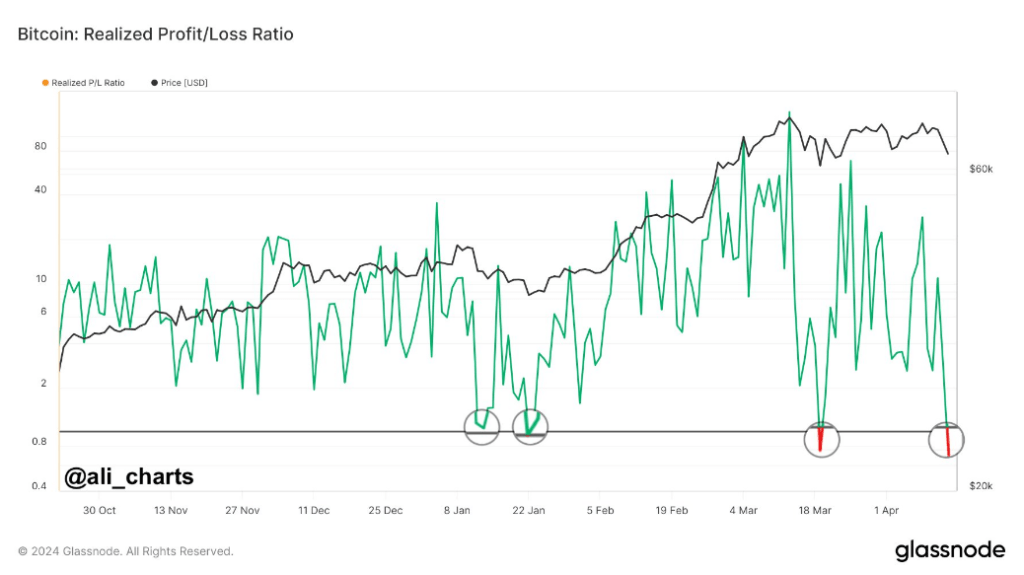

Investors are bracing themselves for a rollercoaster ride as Bitcoin, the flagship digital asset, navigates through choppy waters. Recent data from Glassnode has revealed a noteworthy development: the Realized Profit/Loss Ratio for Bitcoin has dipped below one.

This crucial metric, which compares the sell value of Bitcoin with the price at which it was bought, indicates that investors are currently realizing more losses than profits. Historically, such a dip has often heralded a potential bottoming out of Bitcoin’s price, serving as a vital signal for market watchers.

Sense Of Optimism Despite Bitcoin Price Decline

The past 24 hours have witnessed significant volatility in Bitcoin’s price trajectory. A sharp decline early in the day saw Bitcoin’s price plummet to approximately $64,000, worrying many investors.

However, a remarkable recovery ensued, with the price steadily climbing and peaking at around $66,000. This robust rebound has instilled a sense of optimism, with a prevailing bullish sentiment taking hold as the day progressed.

Total crypto market cap currently at $2.261 trillion. Chart: TradingView

Institutional interest in Bitcoin continues to grow, with recent developments signaling potential shifts in capital inflows. The approval of a spot Bitcoin ETF by Hong Kong regulators has opened the floodgates for increased institutional engagement, particularly from Asia.

This move could inject fresh capital into Bitcoin markets, potentially fueling further price momentum. Furthermore, regional dynamics play a significant role in shaping investor sentiment and behavior. Varying investment trends across different regions highlight the diverse responses to prevailing market conditions.

While some regions may exhibit cautious sentiment amidst volatility and geopolitical uncertainties, others may embrace Bitcoin as a hedge against inflation and currency devaluation.

Critical Support Levels

Bitcoin analyst Willy Woo has pinpointed a critical support level at $59,000. Breaching this threshold could signify a transition into a bearish market sentiment. Conversely, there’s anticipation among investors for potential short liquidations that could drive the price upwards, potentially reaching between $70,000 and $75,000, provided that current support levels hold steady.

These anticipated events hinge on market liquidity and investor reactions to the rapidly evolving price movements. As Bitcoin continues its consolidation phase near all-time highs, investors remain cautiously optimistic about its future prospects.

The upcoming halving event adds another layer of complexity to the already intricate market dynamics, with expectations of heightened volatility in the days ahead.

Analysts suggest that this period of lateral movement serves as a crucial stage for the redistribution of assets among investors, potentially laying the groundwork for a more sustainable recovery in the long run.

The cryptocurrency market, particularly Bitcoin, is navigating through a period of heightened uncertainty and volatility. The recent dip in the Realized Profit/Loss Ratio signals a potential turning point in Bitcoin’s price trajectory, while institutional interest and regional dynamics continue to shape market sentiment.

Featured image from Pexels, chart from TradingView

Edward Snowden Sounds Alarm on NSA’s Plans to Expand Surveillance Under New FISA Amendment

NSA whistleblower Edward Snowden has warned that the National Security Agency (NSA) is on the verge of significantly expanding its surveillance capabilities through a new bill amending Section 702 of the Foreign Intelligence Surveillance Act (FISA), potentially allowing the government to compel a wide array of businesses and individuals to assist in NSA surveillance operations. […]

NSA whistleblower Edward Snowden has warned that the National Security Agency (NSA) is on the verge of significantly expanding its surveillance capabilities through a new bill amending Section 702 of the Foreign Intelligence Surveillance Act (FISA), potentially allowing the government to compel a wide array of businesses and individuals to assist in NSA surveillance operations. […]

Source link

Bitcoin Readying For A 12-Year Bull Run To $650,000 If Bulls Take Charge: Analyst

Even with Bitcoin prices facing pressure from sellers, Willy Woo, an on-chain analyst, thinks the coin will reach new highs thanks to the launch of new Bitcoin exchange-traded funds (ETFs). In a post on X, Woo said the coin could soar to as high as $91,000 in a bear bottom but soar to as high as $650,000 in a bull market top.

However, Bitcoin will only soar to these mega valuations, assuming that leading asset managers will fully deploy their recommended allocations to the world’s most valuable crypto asset.

Bitcoin In A Wide Range

At spot rates, Bitcoin looks shaky. Even after the surge to all-time highs of over $73,000 in mid-March 2024, the coin has been under pressure. So far, prices are within a range. There are caps at $73,800, or an all-time high, on the upper end and around $61,000 on the lower end of its current range.

As long as prices are inside this zone, the uptrend remains. This preview considers the formation established in the better part of Q1 2024 after the first spot of Bitcoin ETFs in the United States was approved.

In the post on X, the analyst should note that the rise to $91,000 and $650,000 are long-term targets and not for the current market cycle. Most importantly, Woo added, it will depend on how fast and aggressively asset managers like BlackRock add BTC to their diversified portfolios.

Even so, this projection excludes inflows from non-custodial wallets. Capital flows from these wallets are projected to be higher due to rising crypto adoption.

Here’s How BTC Will Soar In The Coming Years

In Woo’s assessment, asset managers manage around $100 trillion globally. If they decide to invest 2% of their holdings in Bitcoin as Fidelity recommends, the asset could receive around $2 trillion. Additionally, considering the coin’s value, based on on-chain movement, worth around $561 billion, the total investment would reach $2.56 trillion.

Using the Market Value to Realized Value (MVRV) ratio, Woo said BTC could soar to a market high of $650,000 in a bull cycle. The MVRV is a metric that compares market capitalization to on-chain investment.

Conversely, BTC could reach a swing low of $91,000 if the crypto market crushes. The MVRV ratio is typically 5X in bull market tops and 0.7X in bear market bottoms.

Woo thinks Bitcoin, like gold, is ready for a 12-year bull run. Even so, adoption and emerging regulations in Europe and Asia will shape the path to $91,000 and $650,000.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Buenos Aires charges Worldcoin with consumer law violations, warns of $1.2 million fine

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Over the weekend, the Bitcoin (BTC) crash had the crypto community on its toes. With the price dropping to $60,000, many investors worried that the flagship cryptocurrency was in trouble ahead of the “Halving” event.

Amid the correction, Bitcoin critic Peter Schiff claimed that his previous predictions regarding spot Bitcoin ETFs (exchange-traded funds) were correct and presented the possibility of a doom drop for BTC.

Peter Schiff’s Doomsday Prediction For Bitcoin

Back in March, known Bitcoin opposer Peter Schiff asserted what he thought was the problem with Bitcoin ETFs. According to the economist, the problem with owning these investment products was that liquidity was limited to US market hours, which would mean that investors could not sell if the market crashed overnight.

As I warned if #Bitcoin starts selling off tonight, #BitcoinETF owners can do nothing but watch and wait until the NYSE opens tomorrow morning. In the meantime it will be a long night hoping that Bitcoin doesn’t crash before they have a chance to sell.

— Peter Schiff (@PeterSchiff) April 14, 2024

On Sunday afternoon, Schiff claimed that, as he previously warned, Bitcoin ETF owners would be helpless if the flagship cryptocurrency started selling off that night. BTC traded around $63,460 at the time of his post and recovered in the following hour to trade above the $65,000 support level.

Earlier that day, Schiff had warned of a critical support zone for BTC. To the economist, breaking below $60,000 could “create a formidable triple top.” This trend reversal could lead to an “immediate downside projection” of $20,000.

Following his dooming scenario, Schiff stated that, at that price, MicroStrategy would “have a $2.7 billion unrealized loss on 214K Bitcoin acquired at an average price of $34K.” Additionally, he believes that BTC’s price could increase “before it crashes.”

Analysts Unfazed By BTC’s Correction

Several analysts concurred that the correction was a “minor drop” in the macro picture. According to MacroCRG, Bitcoin’s chart “looks incredible.” The analyst stated: “They threw a full-on war at her and all it managed to do was wick the range low.”

Similarly, trader and analyst Rekt Capital considers that BTC “successfully protected the Range Low of its Re-Accumulation Range as the week of the Bitcoin Halving begins.”

Per the analyst’s chart, Bitcoin is at the “Last Pre-Halving Retrace” during the “Pre-Halving Rally.” If history is to repeat itself, after April 19, BTC will enter the “Re-Accumulation” phase before experiencing the “Post-Halving Parabolic Upside.”

Bitcoin phases during the "Halving" event. Source: Rekt Capital on X

Moreover, Crypto Jelle urged investors to “not get shaken out” as BTC is “consolidating above the previous cycle highs.” The analyst and investor reaffirmed his prediction of $82,000 after the upcoming “Halving” event.

However, Jelle also set a higher target for this bull cycle. The bullish megaphone pattern on BTC’s chart “still has a pattern of $180,000” despite the recent correction, as stated in the post. The analyst claims he wouldn’t be surprised “if the meme pattern plays out once again.”

The correction caused BTC to register bleeding numbers for several periods. The biggest cryptocurrency exhibits an 8.4% and a 3.1% dip in the weekly and monthly timeframes. Similarly, BTC’s market activity has decreased by 32.1% in the past day, with a trading daily volume of $42.56 billion.

Nonetheless, Bitcoin has recovered 3.5% from its price 24 hours ago, currently trading at $66,275. Since the lowest point of this correction, BTC has surged 10.3%.

Bitcoin's performance on the three-day chart. Source. BTCUSDT on TradingView

Featured Image from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Analyst Predicts $650K Bitcoin Price Once ETF Investors Fully Deploy Asset Manager Recommendations

Popular onchain analyst Willy Woo has predicted a potential bitcoin price surge to $650,000 at the bull market’s peak. His prediction hinges on spot bitcoin exchange-traded fund (ETF) investors fully deploying their assets based on recommendations from asset managers. “These are very conservative numbers. Bitcoin will beat gold cap when ETFs have completed their role,” […]

Popular onchain analyst Willy Woo has predicted a potential bitcoin price surge to $650,000 at the bull market’s peak. His prediction hinges on spot bitcoin exchange-traded fund (ETF) investors fully deploying their assets based on recommendations from asset managers. “These are very conservative numbers. Bitcoin will beat gold cap when ETFs have completed their role,” […]

Source link