“He and his daughter have not seen each other or spoken to each other in at least three years.”

Source link

CoinNews

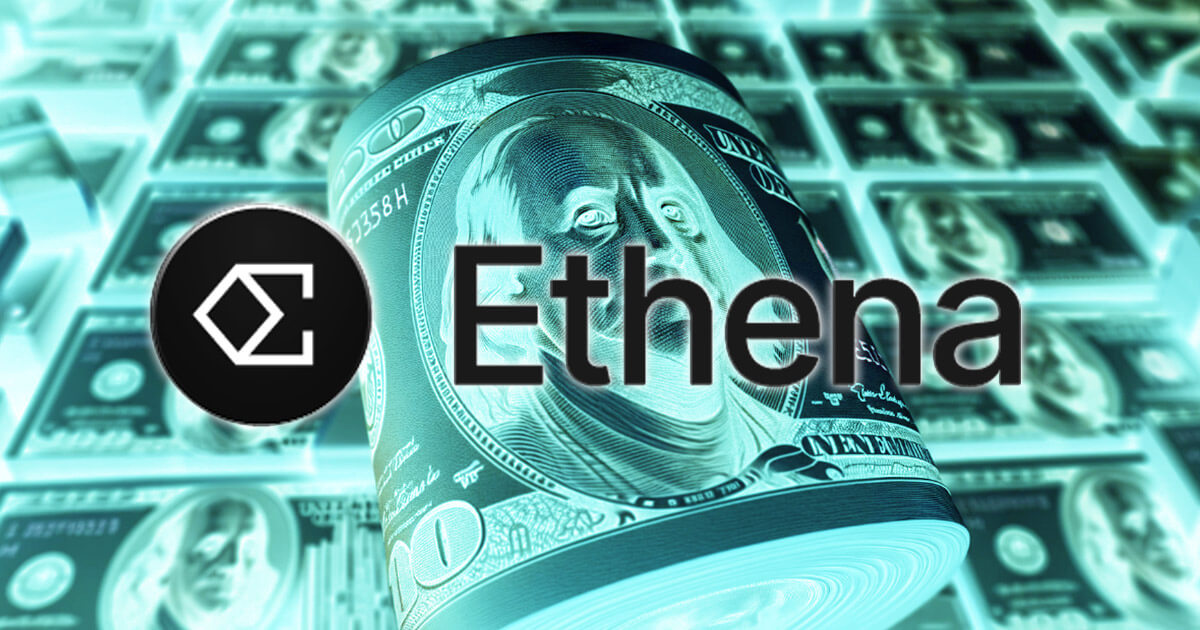

USDe maintains full collateralization amid first market ‘stress test’

Ethena Labs, the entity behind the USDe synthetic dollar, has released the asset’s first attestation report, which shows the stablecoin remained fully collateralized over the past week despite significant turbulence in the crypto market.

The report follows a brief depegging incident during a market-wide downturn during the weekend.

Attestation report

As of April 15, the current supply of USDe stands at $2.358 billion. The aggregate value of assets, comprising Bitcoin, Ethereum, liquid-staked Ethereum, and Tether’s USDT stablecoin, securing the issued tokens totals $2.365 billion, reflecting an excess reserve of $32.7 million.

Three distinct custodians hold these assets. Copper manages $1.279 billion, Ceffu oversees $1.066 billion, and Cobo handles $4.871 million. All assets backing USDe are securely stored off-exchange within institutional-grade custodial solutions.

Furthermore, $15.65 million is in the Ethena mint/redeem contract, while $32.7 million is in the reserve fund address.

The protocol said the attestation report represents its efforts towards enhanced transparency and has committed to delivering monthly updates to the public.

Stress test

The release of the attestation report comes after USDe experienced a brief depegging event during the weekend amid heavy market volatility triggered by Iran’s attack on Israel.

On April 13, USDe’s value plummeted to as low as $0.995 before reclaiming the $1 peg as market conditions improved.

Seraphim Czecker, Ethena’s head of growth, lauded USDe’s resilience during this market turbulence, describing it as passing its inaugural stress test.

However, dissenting voices argue otherwise, asserting that the crypto market’s inherent volatility renders the recent price dip as commonplace. Consequently, they suggest the protocol could face heightened risk should the market experience more significant declines.

Eric Forgy, the founder of crypto firm CavalRe, said:

“That wasn’t a stress test. By crypto standards, that was a typical afternoon. Let’s see what happens when ETH has a 40+% daily move.”

Mentioned in this article

Latest Alpha Market Report

Amid a Week of Severe Crypto Lows, TON and ONDO Record Gains Despite Broad Market Declines

The past week has not been favorable for the majority of cryptocurrency assets, with only four specific digital currencies recording gains. This week, ONDO appreciated by 13.2%, TON increased by 11.3%, PENDLE grew by 6%, and LEO saw a slight uptick of 0.5%. Market Update: A Tough Week for Crypto With Few Standouts The landscape […]

The past week has not been favorable for the majority of cryptocurrency assets, with only four specific digital currencies recording gains. This week, ONDO appreciated by 13.2%, TON increased by 11.3%, PENDLE grew by 6%, and LEO saw a slight uptick of 0.5%. Market Update: A Tough Week for Crypto With Few Standouts The landscape […]

Source link

Quick Take

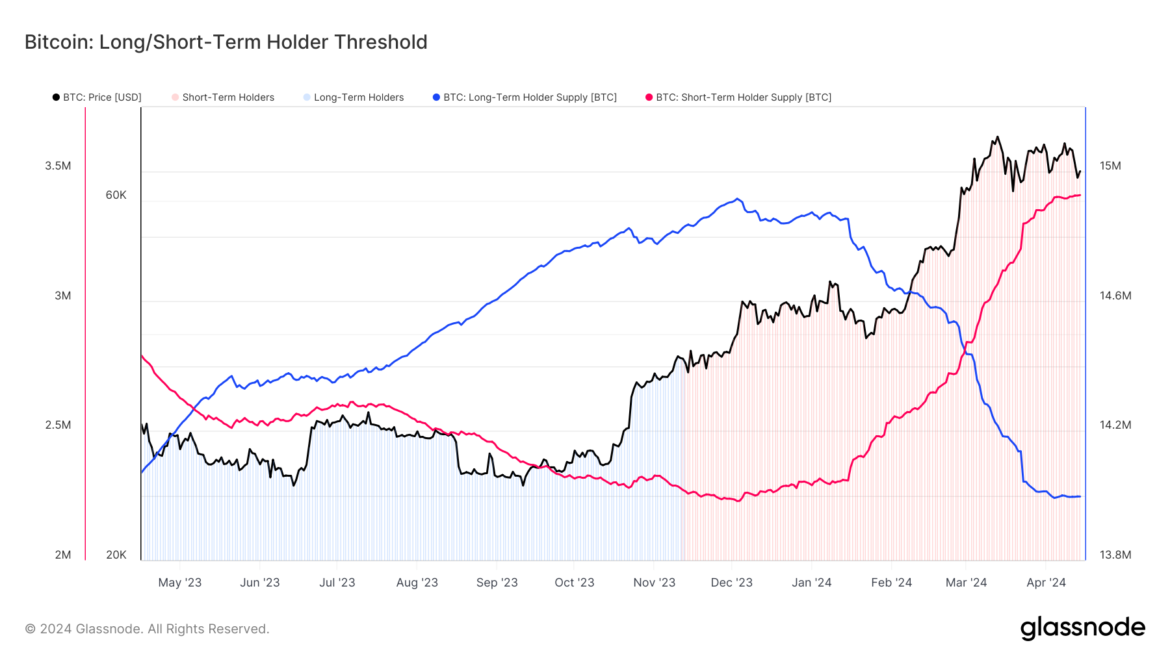

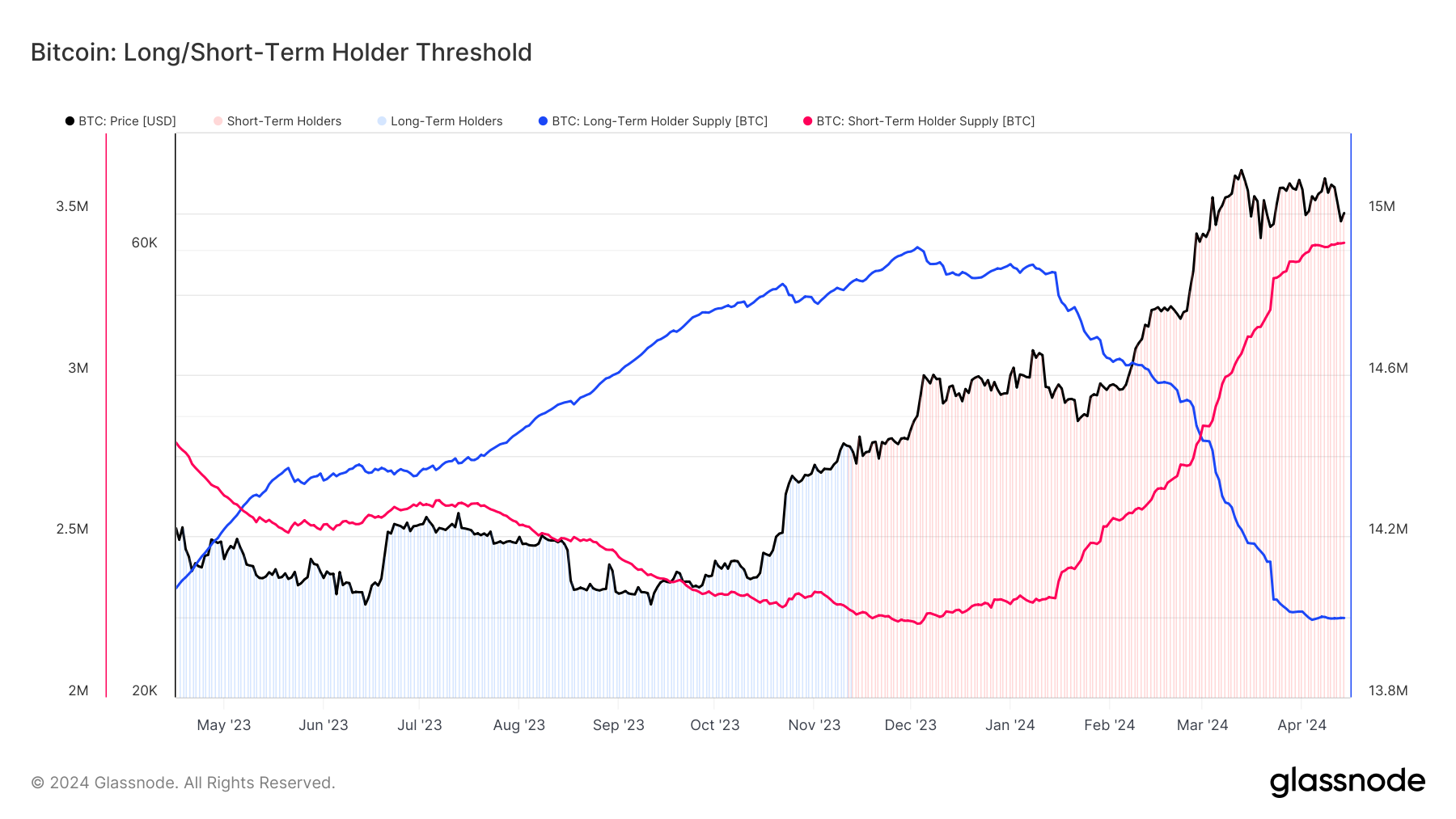

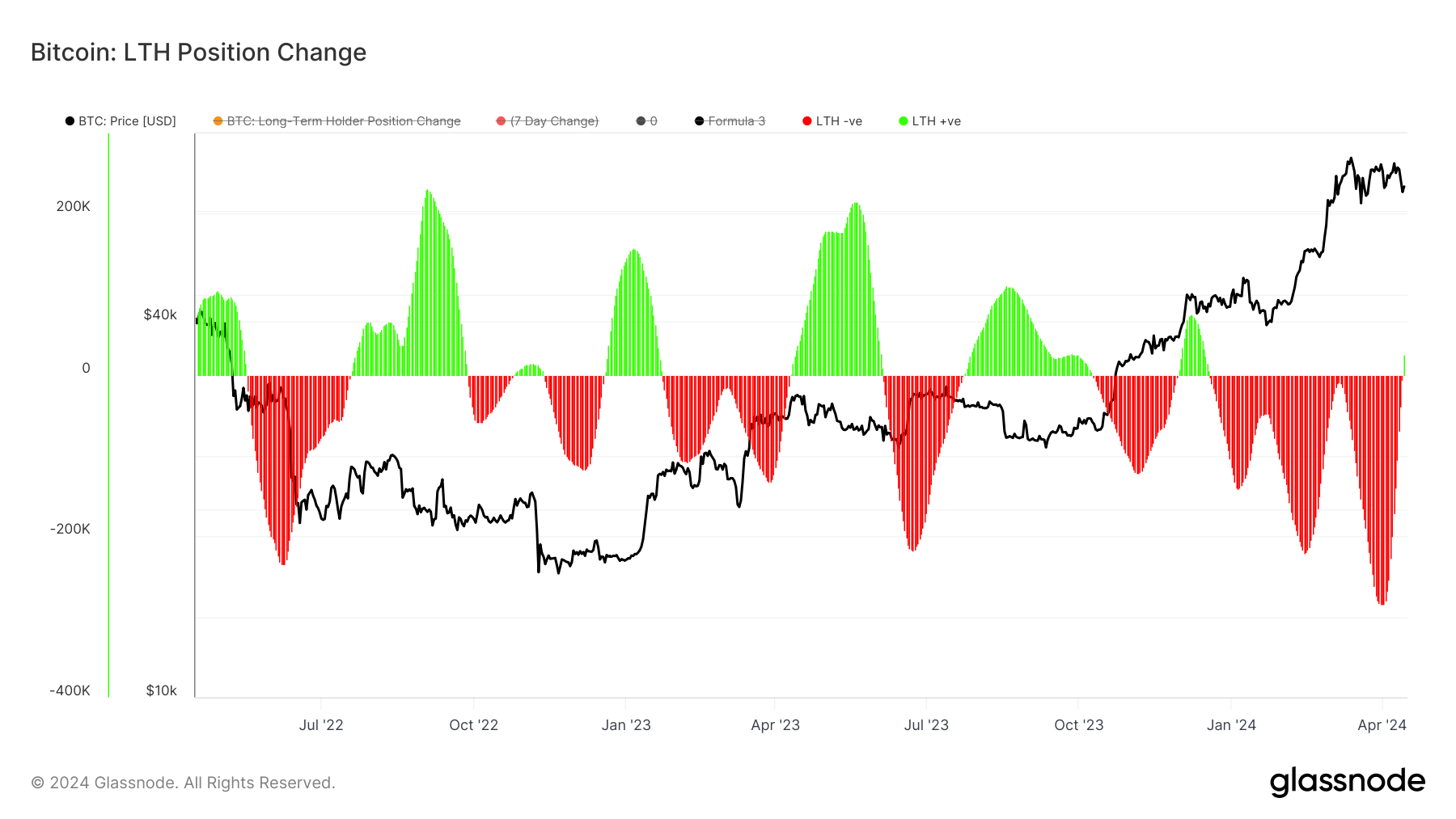

Long-term holders (LTHs) are defined by Glassnode as investors holding Bitcoin (BTC) for 155 days or more. Renowned for their astute investment strategies, LTHs typically accumulate BTC during bear markets and sell during bull runs to generate profits.

Glassnode data shows that since December, LTHs have offloaded around 1 million BTC; however, the recent GBTC sell-off has impacted Bitcoin’s long-term holder metrics. Excluding GBTC holdings, this accounts for roughly 700,000 Bitcoin sold by LTHs.

In contrast, short-term holders (STHs), those holding BTC for less than 155 days, persist in accumulating. During the period in which LTHs sold 1 million BTC, STHs have purchased approximately 1.2 million BTC, according to Glassnode data. While STHs have tapered their acquisition pace in the last 14 days, they remain active buyers. The interaction between LTHs and STHs indicates a promising outlook for short-term Bitcoin prices, with reduced sell pressure from LTHs.

As we can now discern from the data, because it takes 155 days to observe an LTH purchase, LTHs have capitalized on the opportunity amid the price surge from $25,000 in October 2023. Using a 14-day moving average, the LTH supply has experienced a slight increase, indicating accumulation. Currently, LTHs collectively hold approximately 14 million coins.

The post Bitcoin’s long-term holders shift to accumulation appeared first on CryptoSlate.

Bitcoin has found a rebound back above the $66,000 mark following a drop towards the on-chain cost basis of the short-term holder whales.

Bitcoin Drawdown Had Nearly Put Short-Term Whales Under Pressure

As pointed out by an analyst in a CryptoQuant Quicktake post, BTC’s price had neared the Realized Price of the short-term holder whales during the recent drop, but had still managed to remain above the level.

The “Realized Price” here refers to an on-chain indicator that, in short, keeps track of the cost basis (that is, the acquisition price) of the average investor in the Bitcoin market.

When the spot price of the cryptocurrency is trading above this level, it means that the investors as a whole are in a state of unrealized profits right now. On the other hand, it being under implies the overall market is carrying losses.

In the context of the current discussion, the Realized Price of the entire Bitcoin market isn’t of interest, but that of only a part of it: the short-term holder (STH) whales.

The STHs refer to the BTC investors who bought their coins within the past 155 days, while the whales are categorized as entities holding greater than 1,000 BTC. As such, the STH whales would refer to the large investors who bought during the last five months.

Naturally, the Realized Price of this group would indicate the average whale buying price over the past five months (and this price would obviously have to be one the cryptocurrency had traded at on some occasion inside this timeframe).

Now, here is a chart that shows the trend in the Bitcoin Realized Price for the STH whales over the last decade:

The value of the metric appears to have shot up in recent months | Source: CryptoQuant

From the graph, it’s visible that the Realized Price of the STH whales has rapidly climbed alongside the sharp rally Bitcoin has gone through this year. This makes sense, as the STHs represent the new hands coming into the market, who would have to buy at higher prices as the asset’s surge would continue.

Not only that, but the STHs who age past the 155 days mark (that is, those who bought at the relatively low prices) exit out of the cohort, thus raising the average even further.

The group that these matured investors advance to is known as the long-term holder (LTH) cohort. In the same chart, the quant has also attached the data for the Realized Price of the LTH whales as well.

It would appear that these veteran whales have their cost basis at just $21,500, meaning that these investors would be getting some big rewards for their patience. In contrast, the STH whales have their Realized Price at $60,700.

During Bitcoin’s recent drawdown, the asset had come close to retesting this mark. Such retests have historically lead to reactions in the market and during bull runs, this reaction has often appeared in the form of buying. This may be why the cryptocurrency found its rebound near the $60,700 level.

BTC Price

With its latest rebound, Bitcoin has so far managed to recover back towards the $66,500 level.

Looks like the price of the coin has made some recovery from its recent drop | Source: BTCUSD on TradingView

Featured image from Thomas Kelley on Unsplash.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Royal Caribbean is leading the charge in the cruise industry comeback

Americans are cruising again — and at record-breaking levels.

Carnival, Norwegian and Royal Caribbean all reported entering the year with record highs for individual bookings and cruise pricing.

It’s an impressive turnaround after the industry was largely halted for 15 months after the Centers for Disease Control and Prevention issued a no-sail order in March 2020 at the onset of the Covid pandemic in the U.S.

And Royal Caribbean has been leading the way. It’s seen the highest ticket revenue increase relative to 2019 out of the big three cruise giants. And last month, its share price surpassed its pre-pandemic high. Carnival and Norwegian both trade more than 50% lower than their 2019 levels.

“The No. 1 reason why Royal Caribbean has outperformed its peers and recovered the fastest is because they issued the least amount of equity during the pandemic. All of the companies had to issue equity. … All the companies had to issue convertible debt, and Royal Caribbean was able to manage its cash position in a way that utilized the least amount of equity,” said Brandt Montour, Barclays senior equity research analyst.

Watch the video to learn more.

Don’t miss these exclusives from CNBC PRO

Quick Take

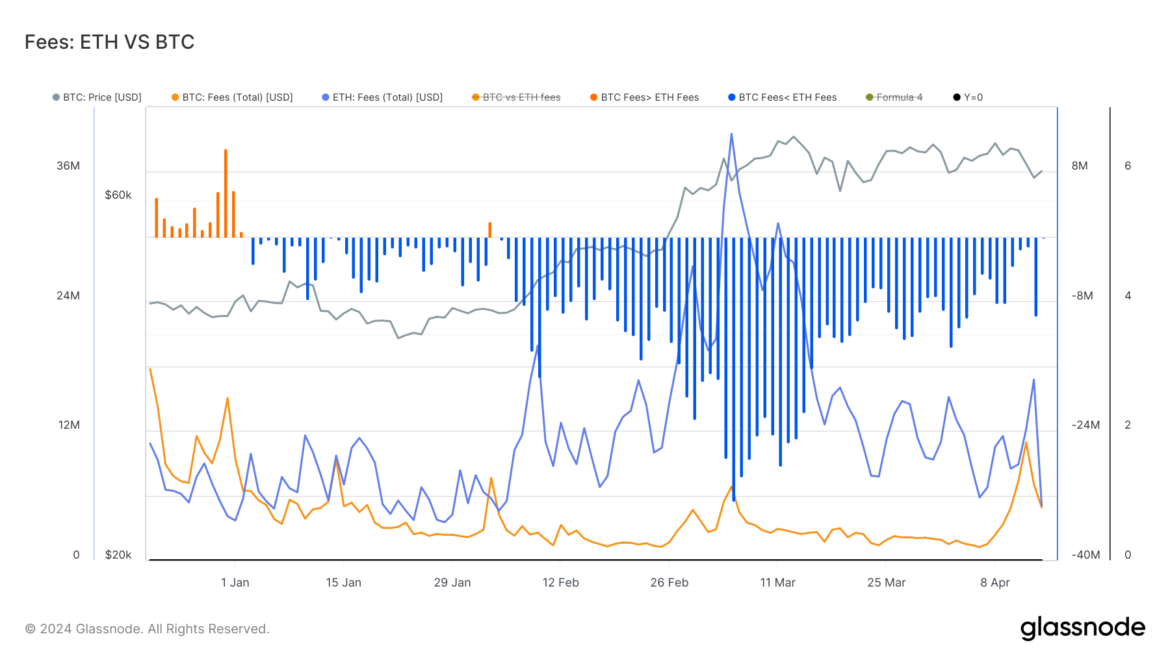

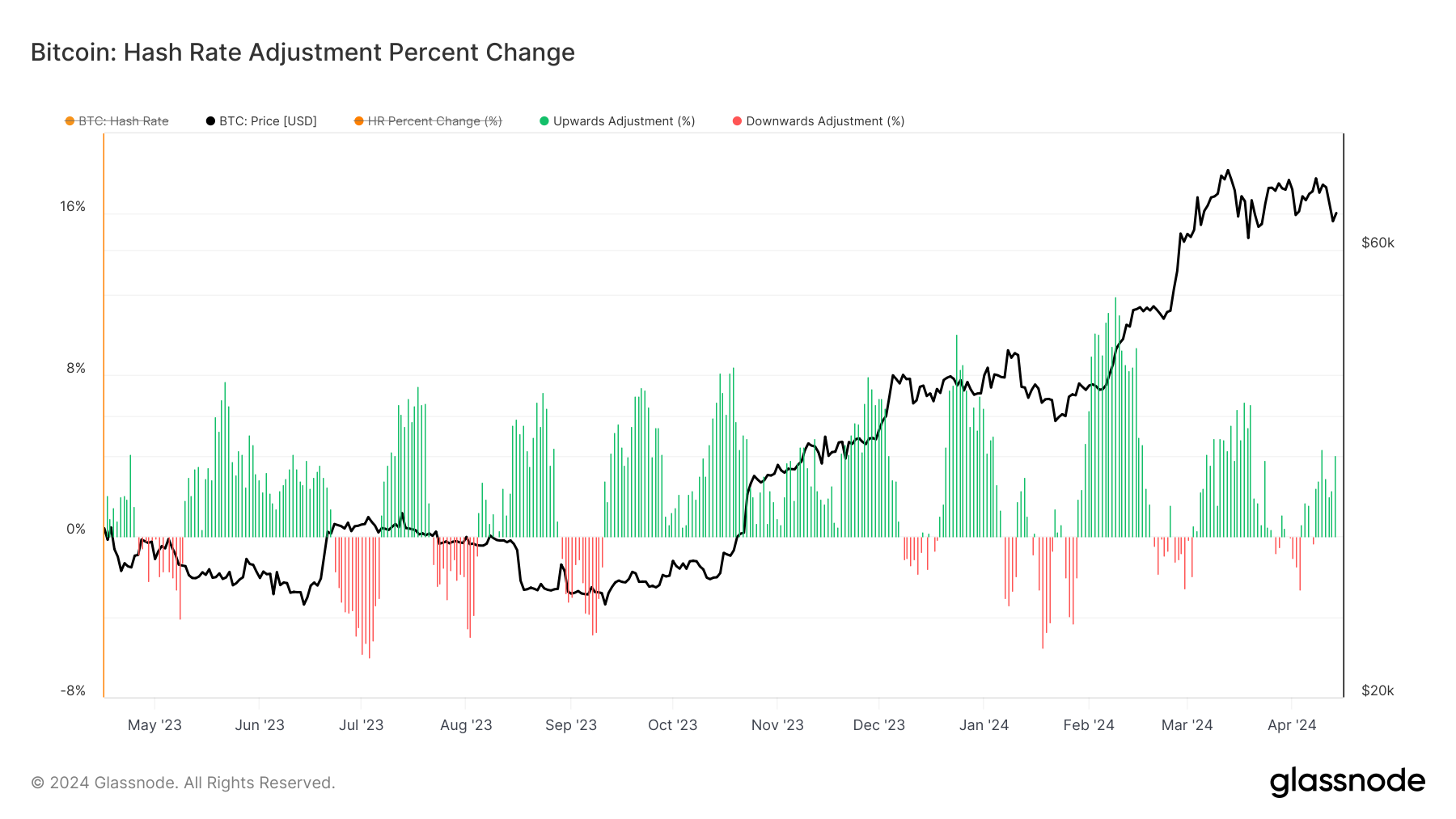

As the Bitcoin halving draws near, Bitcoin activity is witnessing a significant uptick in fees and hash rate.

Fees

On April 12, Bitcoin recorded its highest one-day fees in 2024, reaching an impressive $11 million. CryptoSlate reported on April 10 that this fee surge had gradually increased since early April.

Interestingly, Bitcoin and Ethereum fees are starting to converge, with a difference of just $190k on April 14. Ethereum fees on April 14 hit $5 million, the lowest amount since Feb. 5.

Hash Rate

Moreover, Bitcoin’s hash rate continues to trend higher, with a 4% increase in April, reaching an all-time high of 625 eh/s using a 14-day moving average. This continued growth in hash rate is partly due to the Bitcoin halving, which is just days away.

The post Bitcoin sees record fees in 2024 as halving approaches appeared first on CryptoSlate.

Bitcoin Technical Analysis: Indicators Suggest a Potential Shift in Market Momentum

As of April 15, 2024, bitcoin presents a mixed landscape of consolidation and subtle recovery hints, reflecting a crucial moment for potential bullish or bearish trends. Bitcoin Despite the current market indecisiveness indicated by the 1-hour chart, the 4-hour and daily charts suggest underlying movements that could influence future price actions. The 1-hour chart displays […]

As of April 15, 2024, bitcoin presents a mixed landscape of consolidation and subtle recovery hints, reflecting a crucial moment for potential bullish or bearish trends. Bitcoin Despite the current market indecisiveness indicated by the 1-hour chart, the 4-hour and daily charts suggest underlying movements that could influence future price actions. The 1-hour chart displays […]

Source link

Photo Of Robot Examining Invoice With Magnifying Glass.

Andreypopov | Istock | Getty Images

Even as the IRS makes headlines for cracking down on the wealthy, state tax collectors have become even more aggressive with audits of high earners, according to tax attorneys and accountants.

In New York, the tax department reported 771,000 audits in 2022 (the latest year available), up 56% from the previous year, according to the state Department of Taxation and Finance. At the same time, the number of auditors in New York declined by 5% to under 200 due to tight budgets.

So how is New York auditing more people with fewer auditors? Artificial Intelligence.

“States are getting very sophisticated using AI to determine the best audit candidates,” said Mark Klein, partner and chairman emeritus at Hodgson Russ LLP. “And guess what? When you’re looking for revenue, it’s not going to be the person making $10,000 a year. It’s going to be the person making $10 million.”

Klein said the state is sending out hundreds of thousands of AI-generated letters looking for revenue.

“It’s like a fishing expedition,” he said.

Most of the letters and calls focused on two main areas: a change in tax residency and remote work. During Covid many of the wealthy moved from high-tax states like California, New York, New Jersey and Connecticut to low-tax states like Florida or Texas.

High earners who moved, and took their tax dollars with them, are now being challenged by states who claim the moves weren’t permanent or legitimate.

Klein said state tax auditors and AI programs are examining cellphone records to see where the taxpayers spent most of their time and lived most of their lives.

“New York is being very aggressive,” he said.

On remote work, states like New York that have so-called “convenience rules” argue that if you are employed by a New York company, from their New York office, you owe New York taxes — even if you live and work in Colorado.

Many of the wealthy in New York City who moved kept their apartments with most of their belongings. State tax authorities are claiming that since they didn’t move with all of their household items, for tax purposes they didn’t actually move.

“The state says, ‘Well, you didn’t really move since all your TV and all your stuff is still in New York,'” Klein said. “They don’t understand, the wealthy can buy more stuff for the Florida home. They can buy another TV.”