Oil prices probably won’t spike, but buy the yen if they do.

Source link

CoinNews

These companies have proven themselves in the past — and could go on to win in the future.

With the S&P 500 climbing, extending its gains in this bull market, you may wonder if it’s too late to get in on the action. But I’ve got some good news for you: When you invest over the long term — at least five years — you’ll find great investing opportunities during any market environment. In investing, time is on your side, offering you the chance to benefit as a company evolves and delivers on various promises from product launches to earnings growth.

Today is a particularly interesting moment to invest in technology as we head for what could be the next revolution in the field: artificial intelligence (AI). Some AI stocks have soared, while others haven’t yet gained momentum — and in both of these areas, you’ll find players likely to gain over the long term. That’s why if you have $50,000, or even a smaller amount, that you don’t need for everyday expenses and want to grow over time, it’s a fantastic idea to invest it in a basket of tech stocks that may benefit from the AI boom.

So now, let’s talk about the best stocks to buy right now. The following four all could become AI winners, but they also have solid businesses beyond this technology. So, when you buy them, you aren’t betting the farm on just one particular area, and this offers you a fantastic combination of growth and safety.

Image source: Getty Images.

1. Super Micro Computer

Super Micro Computer (SMCI -1.75%) stock has soared a mind-boggling 2,200% over the past three years, so you may hesitate to get in on this story now. But this actually could be just the beginning of Supermicro’s growth story because we’re in the early days of AI development — and Supermicro can benefit from growth of all of the top AI chipmakers.

This is because the maker of servers, full rack scale solutions, and other equipment needed for AI includes chips of these players in its systems — and it follows their product development closely so that it can immediately make these innovations available to its customers.

Supermicro said recently that it’s seeing ongoing record demand for its rack scale solutions for AI including some of these best-selling chips. And new releases, such as the upcoming launch of Nvidia‘s Blackwell architecture could further boost orders. All of this should translate into ongoing earnings growth well into the future and push the shares higher.

2. Intel

Intel (INTC 1.74%) is the leading maker of central processing units, the key component of a computer. But Intel hasn’t yet benefited from the excitement surrounding AI. The chipmaker fell behind in the AI space, and that’s been one of the elements weighing on its shares.

But things may be about to change for two reasons. Intel recently launched a new portfolio of AI products, including its Gaudi 3 AI accelerator that may even challenge Nvidia’s H100 chip.

Of course, Nvidia’s preparing to launch its most powerful chip ever based on the Blackwell architecture as mentioned above — so I don’t expect Intel to beat this market leader. But it doesn’t have to. Gaudi 3’s performance and affordability could help it carve out enough market share to boost Intel’s earnings and eventually share price over time.

And Intel’s second bit of good news? The company is opening up its manufacturing to others, and this could result in a whole new growth driver as the AI boom continues.

3. Amazon

Amazon (AMZN -1.35%) has a long track record of earnings growth thanks to its leadership in the high-growth markets of e-commerce and cloud computing. And this is likely to continue as the company has invested to help it maintain leadership here. In e-commerce, Amazon has revamped its fulfillment network to make deliveries faster, a move that pleases customers and makes Amazon more cost efficient.

As for cloud computing, AI is set to play a big role in growth moving forward. Amazon Web Services (AWS) is heavily investing to serve the AI customer’s every need — from the basics like chips and software to a fully managed service that allows customers to tailor popular large language models for their own use.

This should help AWS keep its long-held position as the world’s No. 1 cloud computing services provider — and lift revenue over time. That’s particularly good news because AWS historically has been the driver of overall profit at Amazon. And all of this means Amazon stock has plenty of room to run, even after recent gains.

4. Alphabet

Alphabet (GOOG -1.80%) (GOOGL -1.82%) is known for helping most of us on a daily basis. It’s the owner of Google Search, the search engine with more than 90% share of the global search market. Alphabet’s top business even has managed to enter our language, with people often answering a question with: “let’s Google it.”

And now, Alphabet’s investment in AI is likely to further strengthen the company’s leadership in the search market. Alphabet recently launched Gemini, it’s most advanced AI model yet, and is incorporating AI in all products and services — including search. The move is making search better and making the advertising process easier, and this should keep advertising revenue climbing. This is key because Alphabet makes most of its revenue through Google advertising.

Alphabet also offers investors a solid track record of earnings growth, and even during the recent difficult economic times, advertising revenue held up pretty well. That makes this company one of the safest AI bets on my list, and a great place to park a portion of your $50,000 today.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Quick Take

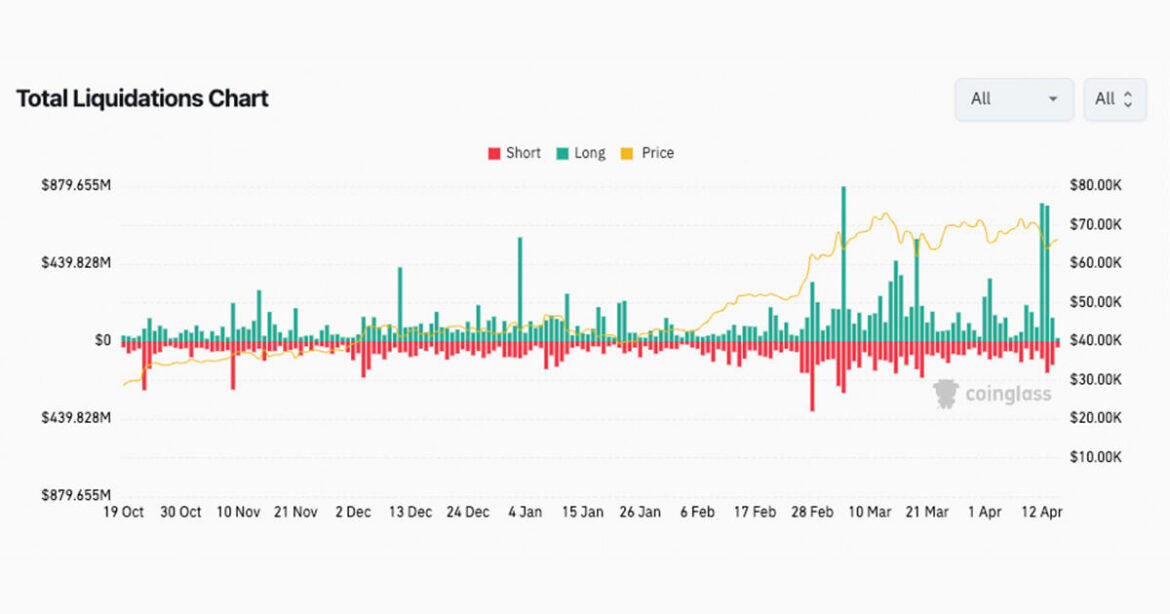

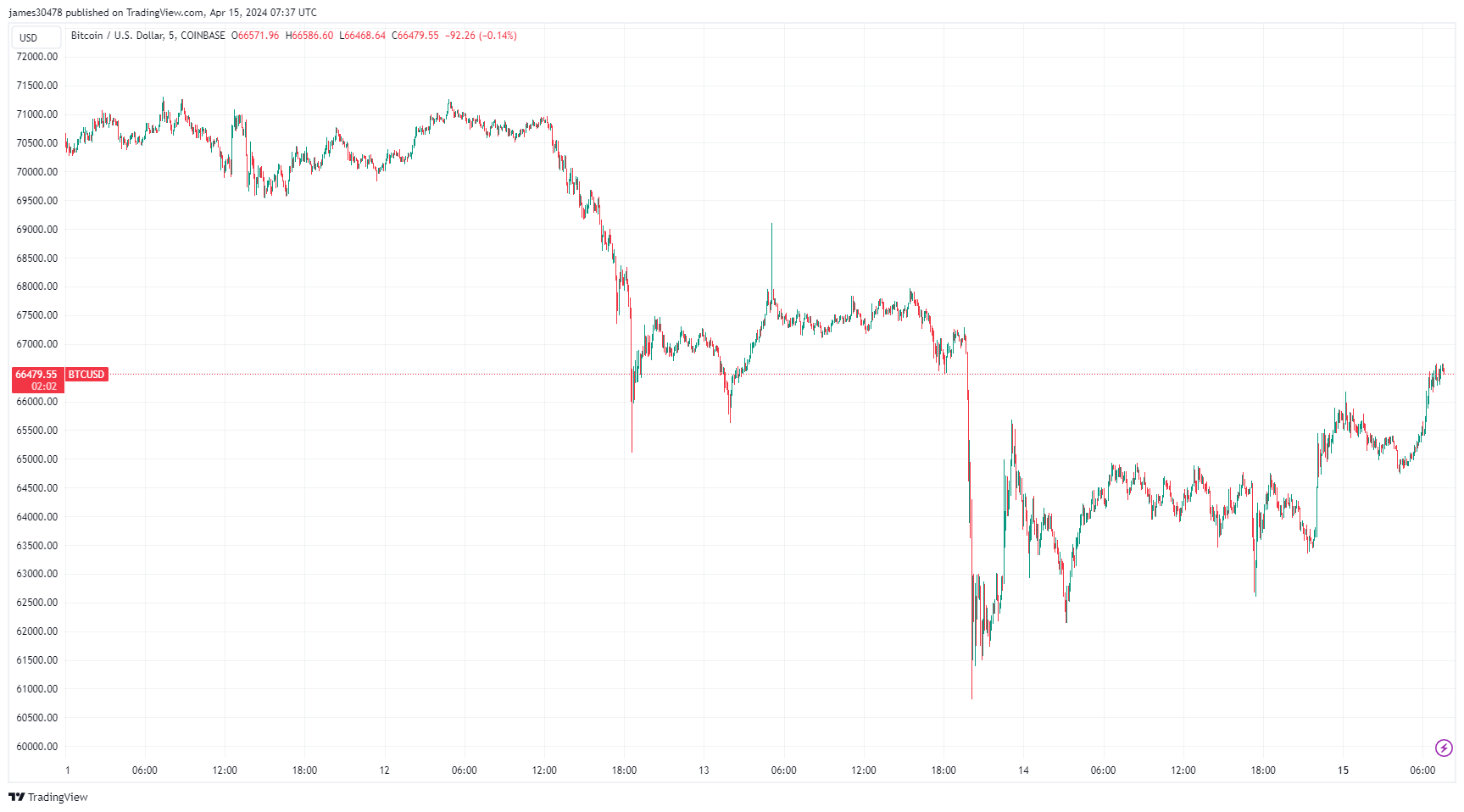

The digital asset ecosystem experienced a shaky weekend, with Bitcoin plummeting to around $65,000 from its $70,000 trading price on Friday, April 12. The downward trend continued into the weekend, with Bitcoin further declining to $60,800 amidst geopolitical tensions in the Middle East on Saturday evening. However, following a reduction in tension and the approval of Hong Kong ETFs Bitcoin has recovered back above $66,000.

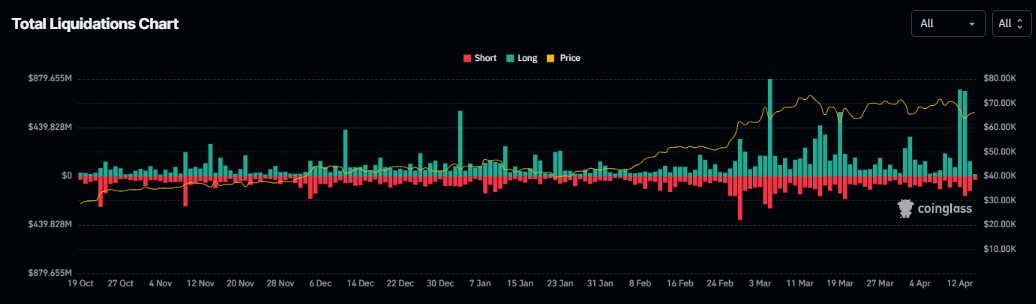

According to Coinglass, April 12 witnessed approximately $880 million in liquidations, with long liquidations accounting for roughly $780 million. The following day, April 13, saw even more liquidations at roughly $950 million, with long liquidations comprising around $770 million. These two events marked one of the most significant long liquidation incidents since October, second only to March 5, which saw liquidations exceed $850 million.

The post Bitcoin back above $66k after weekend of panic selling appeared first on CryptoSlate.

Billionaires Are Selling Nvidia Stock and Buying 2 Supercharged Artificial Intelligence (AI) Stocks Instead

Select Wall Street billionaires were selling Nvidia during the fourth quarter, while buying shares of Amazon and Palantir Technologies.

The artificial intelligence (AI) gold rush is in full swing, and Nvidia has been one of the biggest winners thus far. Its chips power the most advanced AI systems, including ChatGPT from OpenAI, and its share price rocketed 230% over the past year. But Goldman Sachs thinks software and services companies could be the biggest beneficiaries in the long run..

Several Wall Street billionaires seem to be thinking along the same lines. The hedge fund managers listed below sold down their positions in Nvidia in the fourth quarter and reinvested capital in AI stocks that fit more neatly into the software and cloud services categories.

- Israel Englander at Millennium Management sold 1.7 million shares of Nvidia, reducing his stake by 45%.

- Steven Cohen at Point72 Asset Management sold 1.1 million shares of Nvidia, reducing his stake by 66%.

Meanwhile, Englander and Cohen purchased shares of Amazon (AMZN -1.39%) and Palantir Technologies (PLTR -3.33%) during the fourth quarter, supercharged AI stocks that soared 84% and 170%, respectively, over the past year.

1. Amazon

Amazon reported fourth-quarter results that crushed Wall Street’s expectations. Sales increased 14% to $170 billion, the third straight quarter in which growth has accelerated sequentially. That was primarily due to momentum in advertising and retail, but cloud computing sales also accelerated from the previous quarter. Meanwhile, GAAP net income improved to $1.00 per diluted share, up from $0.03 per diluted share in the prior year.

Amazon is set to maintain that momentum given its strong presence in three markets. It runs the most popular e-commerce marketplace in the world as measured by monthly visitors, and the largest online marketplace in North America and Western Europe as measured by sales. Amazon is also the largest retail advertiser and the third largest ad tech company in the world. And Amazon Web Services (AWS) is the largest provider of cloud infrastructure and platform services.

That puts Amazon on a glidepath to double-digit sales growth through 2030. I say that because the online retail, digital advertising, and cloud computing markets are projected to grow at annual rates of 8%, 16%, and 14%, respectively, during that period. Indeed, with those tailwinds at its back, Wall Street expects Amazon to grow sales at 11% annually over the next five year.

However, Amazon could surprise Wall Street depending on how successfully it monetizes artificial intelligence (AI), particularly in its cloud computing business. The company has designed custom chips for AI training and inference, called Trainium and Inferentia. Those chips cannot outperform Nvidia graphics processing units (GPUs), but they are more cost effective in certain situations and could bring more business to AWS.

Additionally, Amazon Bedrock is a cloud service that lets businesses customize large language models and build generative AI applications. Likewise, Amazon Q is a conversational business assistant that leans on generative AI to search and summarize information from various internal and external data sources. The chatbot can also answer questions and automate tasks like writing blogs and social media posts. Collectively, those products could drive faster-than-expected sales growth for Amazon.

Shares currently trade at 3.4 times sales, a tolerable valuation if Wall Street’s consensus is correct and a more reasonable valuation if the company manages to grow sales faster than 11% annually. Personally, I think Amazon is a worthwhile long-term investment as its current price.

2. Palantir Technologies

Palantir reported reasonably good financial results in the fourth quarter, beating expectations on the top line and meeting expectations on the bottom line. Its customer count increased 35% to 497 and the average existing customer spent 8% more. In turn, revenue rose 20% to $608 million, reflecting 32% growth in commercial sales and 11% growth in government sales. Non-GAAP net income doubled to reach $0.08 per diluted share.

CEO Alex Karp commented on Palantir’s AI ambitions in his annual sharholder letter. “Every part of our organization is focused on the rollout of our Artificial Intelligence Platform (AIP), which has gone from prototype to product in months. And our momentum with AIP is now significantly contributing to new revenue and new customers,” he wrote. AIP brings support for large language models to Palantir’s commercial platform, Foundry.

To elaborate, Palantir builds software that helps businesses integrate and analyze data, develop and manage machine learning (ML) models, and build applications that improve decision-making. Forrester Research has recognized Palantir’s Foundry as a leading AI/ML platform. AIP enhances Foundry, such that clients can develop and utilize generative AI to improve business outcomes. For instance, one of the largest U.S. healthcare organizations is using AIP to generate shift schedules that consider employee preferences, decision costs, and demand predictions.

In other news, the U.S. Army recently selected Palantir to build its Titan ground station system, which uses AI/ML to rapidly process data received from sensors placed in terrestrial, aerial, high altitude, and extraterrestrial locations. The 24-month contract is valued at $178 million, so it will not significantly move the needle for Palantir, but it does highlight its versatility and the contract could lead to further deals with the U.S. government.

Going forward, the data analytics market is forecasted to grow at 27% annually through 2030. While I doubt Palantir will match that pace given its past performance and small customer base, the tailwind still has positive implications for the company. Wall Street expects Palantir to grow sales at 21% annually over the next five years.

In that context, its current valuation of 23.5 time sales looks expensive, especially when the three-year average is 17.8 times sales. Also noteworthy, Palantir currently carries a consensus sell rating among Wall Street analysts, and the stock bears a median price target of $20.50 per share, which implies 10% downside from its current price of $22.80 per share. I would steer clear of Palantir until the stock trade at a more reasonable valuation.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon, Nvidia, and Palantir Technologies. The Motley Fool has positions in and recommends Amazon, Goldman Sachs Group, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

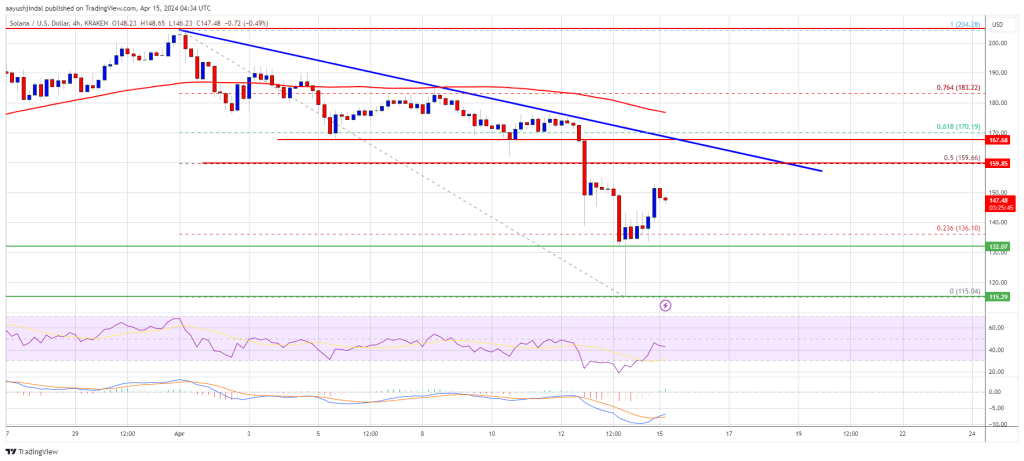

Solana tumbled and declined toward $110. SOL price is now correcting losses above $140 and facing hurdles near the $160 resistance zone.

- SOL price gained bearish momentum and declined below $150 against the US Dollar.

- The price is now trading below $160 and the 100 simple moving average (4 hours).

- There is a key bearish trend line forming with resistance at $160 on the 4-hour chart of the SOL/USD pair (data source from Kraken).

- The pair could continue to recover if it clears the $150 and $160 resistance levels.

Solana Price Starts Recovery

Solana price started a major decline below the $180 and $160 support levels. SOL declined over 20% and even tumbled below the $150 level. Finally, the bulls appeared near $110.

A low was formed at $115.04 and the price is now attempting a recovery wave like Bitcoin and Ethereum. There was a decent increase above the $125 and $132 levels. The price cleared the 23.6% Fib retracement level of the downward move from the $204 swing high to the $115 low.

Solana is now trading below $150 and the 100 simple moving average (4 hours). Immediate resistance is near the $150 level. The next major resistance is near the $160 level.

Source: SOLUSD on TradingView.com

There is also a key bearish trend line forming with resistance at $160 on the 4-hour chart of the SOL/USD pair. The trend line is near the 61.8% Fib retracement level of the downward move from the $204 swing high to the $115 low. A successful close above the $160 resistance could set the pace for another major increase. The next key resistance is near $182. Any more gains might send the price toward the $200 level.

Are Dips Supported in SOL?

If SOL fails to rally above the $160 resistance, it could start another decline. Initial support on the downside is near the $140 level.

The first major support is near the $132 level, below which the price could test $125. If there is a close below the $125 support, the price could decline toward the $115 support in the near term.

Technical Indicators

4-Hours MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $140, and $132.

Major Resistance Levels – $150, $160, and $182.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tax Day reveals a major split in how Joe Biden and Donald Trump would govern

WASHINGTON (AP) — Tax Day reveals a major split in how Joe Biden and Donald Trump would govern: The presidential candidates have conflicting ideas about how much to reveal about their own finances and the best ways to boost the economy through tax policy.

Biden, the sitting Democratic president, released his income tax returns on the IRS deadline of Monday. Filing jointly with his wife, Jill, he reported gross income of $619,976 and paid a federal income tax rate of 23.7%.

On Tuesday, Biden is scheduled to deliver a speech in Scranton, Pennsylvania, about why the wealthy should pay more in taxes to reduce the federal deficit and help fund programs for the poor and middle class.

Biden is proud to say that he was largely without money for much of his decades-long career in public service, unlike Trump, who inherited hundreds of millions of dollars from his father and used his billionaire status to launch a TV show and later a presidential campaign.

“For 36 years, I was listed as the poorest man in Congress,” Biden told donors in California in February. “Not a joke.”

In 2015, Trump declared as part of his candidacy, “I’m really rich.”

The Republican former president has argued that voters have no need to see his tax data and that past financial disclosures are more than sufficient. He maintains that keeping taxes low for the wealthy will supercharge investment and lead to more jobs, while tax hikes would crush an economy still recovering from inflation that hit a four-decade peak in 2022.

“Biden wants to give the IRS even more cash by proposing the largest tax hike on the American people in history when they are already being robbed by his record-high inflation crisis,” said Karoline Leavitt, press secretary for the Trump campaign.

The split goes beyond an ideological difference to a very real challenge for whoever triumphs in the November election. At the end of 2025, many of the tax cuts that Trump signed into law in 2017 will expire — setting up an avalanche of choices about how much people across the income spectrum should pay as the national debt is expected to climb to unprecedented levels.

Including interest costs, extending all the tax breaks could add another $3.8 trillion to the national debt through 2033, according to an analysis last year by the Committee for a Responsible Federal Budget.

Biden would like to keep the majority of the tax breaks, based on his pledge that no one earning less than $400,000 will have to pay more. But he released a budget proposal this year with tax increases on the wealthy and corporations that would raise $4.9 trillion in revenues and trim forecasted deficits by $3.2 trillion over 10 years.

Still, he’s telling voters that he’s all for letting the Trump-era tax cuts lapse.

“Does anyone here think the tax code is fair? Raise your hand,” Biden said Tuesday at a speech in Washington’s Union Station to a crowd predisposed to dislike Trump’s broad tax cuts that helped many in the middle class but disproportionately favored wealthier households.

“It added more to the national debt than any presidential term in history,” Biden continued. “And it’s due to expire next year. And guess what? I hope to be president because it expires — it’s going to stay expired.”

Trump has called for higher tariffs on foreign-made goods, which are taxes that could hit consumers in the form of higher prices. But his campaign is committed to tax cuts while promising that a Trump presidency would reduce a national debt that has risen for decades, including during his Oval Office tenure.

“When President Trump is back in the White House, he will advocate for more tax cuts for all Americans and reinvigorate America’s energy industry to bring down inflation, lower the cost of living, and pay down our debt,” Leavitt said.

Most economists say Trump’s tax cuts could not generate enough growth to pay down the national debt. An analysis released Friday by Oxford Economics found that a “full-blown Trump” policy with tax cuts, higher tariffs and blocking immigration would slow growth and increase inflation.

Among Biden’s proposals is a “billionaire minimum income tax” that would apply a minimum rate of 25% on households with a net worth of at least $100 million.

The tax would directly target billionaires such as Trump, who refused to release his personal taxes as presidents have traditionally done. But six years of his tax returns were released in 2022 by Democrats on the House Ways and Means Committee.

In 2018, Trump earned more than $24 million and paid about 4% of that in federal income taxes. The congressional panel also found that the IRS delayed legally mandated audits of Trump during his presidency, with the panel concluding the audit process was ” dormant, at best.”

Biden has publicly released more than two decades of his tax returns. His tax filings provide key financial details on mortgage interest payments ($20,525) and the $20,477 donated to 17 different charities, including $5,000 to the Beau Biden Foundation and $2,100 to St. Joseph on the Brandywine, the Catholic church he attends in Delaware.

Trump has maintained that his tax records are complicated because of his use of various tax credits and past business losses, which in some cases have allowed him to avoid taxes. He also previously declined to release his tax returns under the claim that the IRS was auditing him for pre-presidential filings.

His finances recently received a boost from the stock market debut of Trump Media, which controls Trump’s preferred social media outlet, Truth Social. Share prices initially surged, adding billions of dollars to Trump’s net worth, but investors have since soured on the company and shares by Friday were down more than 50% from their peak.

The former president is also on the hook for $542 million due to legal judgments in a civil fraud case and penalties owed to the writer E. Jean Carroll because of statements made by Trump that damaged her reputation after she accused him of sexual assault.

In the civil fraud case, New York Judge Arthur Engoron looked at the financial records of the Trump Organization and concluded after looking at the inflated assets that “the frauds found here leap off the page and shock the conscience.”

__

Colvin reported from Palm Beach, Florida.

JPMorgan has warned of a downside risk in crypto markets, citing subdued crypto venture capital flows. The global investment bank’s analysts also remain cautious about the U.S. Securities and Exchange Commission (SEC) greenlighting spot ethereum exchange-traded funds (ETFs) in May. Crypto Market’s Downside Risk Warning Global investment banking giant JPMorgan published a report on Thursday, […]

JPMorgan has warned of a downside risk in crypto markets, citing subdued crypto venture capital flows. The global investment bank’s analysts also remain cautious about the U.S. Securities and Exchange Commission (SEC) greenlighting spot ethereum exchange-traded funds (ETFs) in May. Crypto Market’s Downside Risk Warning Global investment banking giant JPMorgan published a report on Thursday, […]

Source link

Billionaire Dan Loeb Sold Amazon and Microsoft but Bought This “Magnificent Seven” Stock

Dan Loeb is known as a mover and a shaker in the investing world. He founded the New York-based hedge fund Third Point in 1995. It now has roughly $11.5 billion in assets under management. Loeb’s net worth stands at $3.3 billion, according to Forbes.

The activist investor did some moving and shaking in his hedge fund’s portfolio in the fourth quarter of 2023. Loeb reduced his stakes in Amazon (NASDAQ: AMZN) and Microsoft (NASDAQ: MSFT). However, the billionaire investor bought another “Magnificent Seven” stock.

Taking profits

Loeb sold 210,000 shares of Microsoft in Q4. While this reduced Third Point’s stake in the tech giant by over 9.4%, Microsoft remains the second-largest holding in the hedge fund’s portfolio.

The billionaire investor has owned Microsoft off and on since 2006. He most recently initiated a new position in the fourth quarter of 2022, just in time to ride the generative AI wave started by OpenAI’s launch of ChatGPT. Microsoft was a major beneficiary of this wave thanks to its partnership with OpenAI.

Third Point first owned Amazon in late 2019 and held the stock through the second quarter of 2022. Loeb didn’t stay on the sidelines long with the e-commerce and cloud services leader. He initiated a new position in Amazon in the second quarter of 2023. Although he reduced Third Point’s stake in the stock by nearly 10.3% in Q4 2023, Amazon still ranks as the hedge fund’s third-largest holding.

Why did Loeb trim his positions in Amazon and Microsoft? The most likely reason is he wanted to take some profits. Both stocks delivered impressive gains last year.

A bigger bet on Meta

Although Loeb cooled somewhat on two Magnificent Seven stocks, he placed a bigger bet on Meta Platforms (NASDAQ: META). The hedge fund manager increased Third Point’s stake in Meta by nearly 5.5% in Q4 2023. The $410.6 million value of the position made Meta the sixth-largest holding for Third Point at the end of 2023.

Loeb’s history with Meta goes back to the second quarter of 2016 when he first bought the stock. He owned shares of the social media company for a little over two years before exiting the position. The activist investor again bought Meta stock in the second quarter of 2020 and maintained a position through 2021 Q4. Loeb went back to the well in the third quarter of 2023 with another new stake in Meta.

Like Amazon and Microsoft, Meta enjoyed a generative AI tailwind last year. However, I suspect that wasn’t Loeb’s primary reason for adding to his position in the stock. Instead, my hunch is that Loeb liked Meta’s moves to increase its profitability.

Those efforts are paying off. Meta’s earnings more than tripled year over year in 2023 Q4. Full-year profits jumped 69%.

Did Loeb make the right moves?

In one sense, Loeb went one for three with these Magnificent Seven transactions. Loeb’s decision to increase Third Point’s stake in Meta is already paying off. Meta stock has skyrocketed over 45% since the end of 2023. However, Amazon and Microsoft are also up by double-digit percentages year to date. Loeb could have made more money by holding his shares in both companies.

However, trimming the positions in Amazon and Microsoft could still have been the right call for Loeb. Both stocks make up significant percentages of Third Point’s portfolio. You can’t blame any investor for wanting to ensure their holdings aren’t overly concentrated in a handful of stocks.

Over the long term, I think that Loeb — and other investors — will be well served by owning all three of these stocks. Amazon’s and Microsoft’s cloud businesses should continue to grow robustly thanks largely to AI. I like Meta’s focus on business messaging and smart glasses with embedded AI assistants. I predict Amazon, Microsoft, and Meta will remain magnificent for a long time to come.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Amazon, Meta Platforms, and Microsoft. The Motley Fool has positions in and recommends Amazon, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Dan Loeb Sold Amazon and Microsoft but Bought This “Magnificent Seven” Stock was originally published by The Motley Fool

Bitcoin Bonanza Before The Halving? Analyst Sees Pre-Crash Buying Window

Bitcoin, the pioneer and flagbearer of the digital currency realm, has once again captured the attention of investors. Recent market dynamics have prompted discussions among analysts and enthusiasts alike, with the spotlight firmly fixed on the possibility of a significant retracement in Bitcoin’s price.

Renowned crypto analyst Rekt Capital has examined the current state of the Bitcoin market, drawing parallels with historical cycles to offer insights into potential future movements.

As the market experiences a period of relative calmness compared to previous weeks, speculation abounds regarding the likelihood of a major retracement looming on the horizon.

Bitcoin: Historical Patterns and Potential Retracement

Drawing from historical precedents, Rekt Capital points to significant corrections observed in 2016 and 2020, where Bitcoin underwent retracements of nearly 30% and 20%, respectively.

Building upon this analysis, the possibility of a more substantial downturn, potentially around 40%, emerges as a distinct possibility. According to Rekt Capital, such a retracement could signify a crucial reaccumulation stage for Bitcoin, akin to patterns observed before previous halving events.

New YouTube video is live!

Bitcoin On The Cusp of a Deeper Retrace Before the Halving?

Enjoy and Subscribe!#BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) April 12, 2024

Amidst these discussions, specific price levels take center stage in Rekt Capital’s analysis. Former resistance levels have transitioned into newfound supports, indicating a strengthening market foundation. However, the presence of sophisticated-level resistance has led to instances of “upside wick rejections,” where prices briefly surge before receding.

Bitcoin Pre-Halving: Strategic Opportunity

One of the key takeaways from Rekt Capital’s analysis is the notion of a “pre-halving retrace,” a phenomenon observed before previous halving events. This stage typically presents investors with a prime buying opportunity, as prices dip before the impending halving.

Total crypto market cap is currently at $2.267 trillion. Chart: TradingView

With Bitcoin’s halving event looming on the horizon, Rekt Capital advises investors to remain vigilant for potential entry points, as historically, such buying opportunities have been followed by significant price growth.

Expanding on the broader implications of retracement stages, Rekt Capital underscores the cyclical nature of Bitcoin’s market movements. Past retracements have invariably been succeeded by periods of consolidation, followed by upward trends, signaling potential gains for astute investors who can navigate these market dynamics effectively.

Investor Sentiment And Market Outlook

Rekt Capital’s observations have ignited fervent debate within the crypto community, with investors closely monitoring the market for signs of the anticipated retracement. With the countdown to Bitcoin’s halving event in full swing, anticipation is running high, and investors are poised to seize what could potentially be the last significant buying opportunity before the next major rally.

At the time of writing, Bitcoin was trading at $64,223, down 3.8% and 7.5% in the 24-hour chat and weekly timeframe, data from Coingecko shows.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

US Spot Bitcoin ETFs See $55.1M Outflow; GBTC Divests 2,048 BTC Amid Market Volatility

Data shows that U.S. spot bitcoin exchange-traded funds (ETFs) experienced negative outflows on Friday, totaling $55.1 million, with Grayscale’s Bitcoin Trust (GBTC) seeing another notable decrease. Metrics from Thursday reveal GBTC held 316,193.43 bitcoins, but after a decline of 2,048.23 bitcoins, the fund’s holdings reduced to 314,145.2 bitcoins. Blackrock and Fidelity Absorb Bitcoin Despite GBTC’s […]

Data shows that U.S. spot bitcoin exchange-traded funds (ETFs) experienced negative outflows on Friday, totaling $55.1 million, with Grayscale’s Bitcoin Trust (GBTC) seeing another notable decrease. Metrics from Thursday reveal GBTC held 316,193.43 bitcoins, but after a decline of 2,048.23 bitcoins, the fund’s holdings reduced to 314,145.2 bitcoins. Blackrock and Fidelity Absorb Bitcoin Despite GBTC’s […]

Source link