Higher U.S. inflation is dashing investors’ hopes for multiple Federal Reserve rate cuts this year, while opening the door to 5% Treasury yields across the board and cleaving the stock market into distinct categories of winners and losers.

Source link

CoinNews

If these companies are good enough for some of the world’s richest investors, why wouldn’t they be good enough for the rest of us?

There’s an old saying that success breeds success. When it comes to investing, many folks take that saying to mean that it might make sense to pay attention to what other successful investors are buying, and then follow their leads into the same investments. After all, even if you don’t get entirely the same return as those other folks do, you might be able to ride their coattails to get some decent gains.

Fortunately for folks looking to follow in the investing footsteps of billionaires, many of the world’s biggest investors need to disclose what they buy and sell, every quarter. To see what those potentially market-moving money managers are buying, three Motley Fool contributors went looking for signs of what transactions those major investors have been reporting. They uncovered that billionaire investors have been buying Nvidia (NVDA -2.68%), Starbucks (SBUX -1.14%), and Chevron (CVX -1.81%). Read on to find out why, and decide for yourself whether following those investors’ leads might help you build your own wealth.

Image source: Getty Images

This Magnificent Seven stock is hot, hot, hot these days

Eric Volkman (Nvidia): Billionaire Ray Dalio’s monster hedge fund Bridgewater Associates is clearly all in on the future of artificial intelligence (AI). That’s the strong signal being sent by Bridgewater’s more than quintupling of its position recently in one of the Magnificent Seven stocks more readily associated with AI, Nvidia.

Nvidia’s stock in trade is graphics processing units (GPUs), many of which are used to power AI functionalities in data centers. The rush to develop these functionalities has sharply increased demand for all sorts of hardware needed to support them, and Nvidia GPUs are front and center in this drive.

It’s no wonder that the company’s latest set of quarterly figures was so impressive. Do you think a year-over-year doubling of revenue is a feat? Well, that’s nothing compared with Nvidia’s 265% top line improvement in its fourth quarter, not to mention the nearly 500% surge in non-GAAP (adjusted) net income.

AI is a technology with a very long runway, and since it can be applied to a great many processes and systems, it has the potential to produce many revenue streams. If Nvidia’s products remain central to this — a likely scenario — we can expect the company to have more blowout quarters in the future.

The one serious caveat with Nvidia is that it’s on a lot of investor radar screens these days; it seems almost every individual and institution on the market wants the stock in their portfolio. Even with those out-of-this-world recent fundamentals, the company is very pricey on its valuations, so its explosive share price growth might be a thing of the past.

More than a quick jolt

Jason Hall (Starbucks): While perusing SEC form 13-F filings recently, I noticed something interesting for Starbucks: Two of the largest and most successful quantitative trading firms, D.E. Shaw, and Renaissance Technologies, both bought shares in their most-recently reported quarter. For those who don’t know, David Shaw and Jim Simons, the two founders of the former and latter, are worth nearly $40 billion combined, with their two firms easily the two most successful quantitative trading funds operating.

Both Shaw and Renaissance make most of their money relatively quickly. Their business is at least partly high-speed trading and leveraging data to make lots of bets on lots of stocks. For example, D.E. Shaw opened almost 594 new stock positions last quarter, added to another 1,607, and completely sold out of another 535 stocks. That’s more than 2,700 stocks in a single quarter.

We don’t know exactly when Shaw or Renaissance bought, held, or sold some of its Starbucks shares. But we do know that at the end of the quarter, they both still owned some. And with shares of the global coffee giant down over 6% since the beginning of the fourth quarter of 2023, and 20% off the high, there’s likely some short-term opportunity for a profit for these firms.

But that’s their game. For individual investors, we can’t win there.

However, Starbucks looks very appealing for the long term. Its business in China has recovered, with comps up 10%, and strong 5% same-store growth in the U.S., too. Management is looking for 15%-20% earnings-per-share growth this year as well. Combine that growth with a reasonable price below 23 times earnings and a dividend yield above 2.5%, and long-term investors can profit by owning Starbucks, too.

Buffett Thinks There’s Still a Future In Oil

Chuck Saletta (Chevron): Warren Buffett’s Berkshire Hathaway recently elected to buy nearly 16 million shares of oil company Chevron, according to its most recently published filings of its quarterly holdings. This is yet another clear signal — on top of Berkshire Hathaway’s massive investments in energy pipelines — that Buffett and his crew believe there’s still a future in hydrocarbon-based fuels.

They’re not exactly alone on that front. According to the U.S. Energy Information Administration’s most recent Annual Energy Outlook, net demand for oil and natural gas is expected to hold relatively consistent at least through 2050. And of course, in a world where that demand is consistent over the next couple of decades, it’s unlikely that people will simply stop using those fuels entirely as soon as 2051 rolls around.

The reality is that even if you assume a limited future for carbon-based fuels, at the right price, an investor can make a decent return by owning shares of companies involved in them. It’s a value investing strategy based on good-old-fashioned practice of looking at what the company’s cash flows will look like over time.

Trading at around 14 times its earnings, an investor doesn’t have to project massive growth to have a chance at decent returns from Chevron. That’s particularly true when you recognize that Chevron pays its investors a decent dividend yield of around 4%.

Even looking simplistically, with a 4% yield that holds steady, an investor would get his or her money paid back over the course of 25 years. That provides a potential path to a complete return of invested capital over that time, while the investor would still own the shares that generate those dividends. And of course, since demand is likely to continue beyond that point, there’s a chance to earn even more.

Net — even in the absence of a massive growth story, there’s good reason to believe there’s still value to be extracted from the oil patch. And if that’s good enough for Buffett, it just might be good enough for us mere mortals.

Are you ready to follow these leading investors?

Ray Dalio’s purchase on Nvidia, D.E. Shaw’s and Renaissance’s ownership of Starbucks, and Buffett’s Berskhire Hathaway’s buy of Chevron showcase that there are many ways to look to profit from the market. These leading investors appeared to follow three very different approaches to determine which stocks looked worthy of their money.

That should give you good reason to believe that you, too, should be able to find a path to decent returns from investing. Nobody — not even successful billionaires — can guarantee what you’ll earn in the stock market, but as their successes over time has shown, a big part of making money in the market comes from simply showing up and following a reasonable strategy over time.

So get started now, and make today the day you decide to follow these great investors into the market, whether or not you actually buy the exact same investments that they do.

The price of Bitcoin took a nose dive on Saturday following reports of Iran launching missile and drone attacks on Israel. Alongside the market leader, many other prominent cryptocurrencies also experienced a significant selloff as news of a brewing international conflict in the Middle East circulated on the internet.

Bitcoin Suffers Major Decline For Second Consecutive Day

According to multiple reports on April 13, Iran commenced a drone attack against Israel in retaliation to an attack on an Iranian diplomatic building in Syria on April 1 which claimed the lives of nine Iranian officers, including a highly ranked general in Iran’s Islamic Revolutionary Guards.

This incident marked Iran’s first-ever direct assault on the Jewish state following years of rising political tensions between both countries. With the Iranian forces confirming further missile attacks on “specific targets” in Israel, it is likely that both nations may be heading for a full-scale war.

Following reports of the drone attacks in the Middle East, Bitcoin’s price dropped by 8.07%, falling from $67,132.1 to $61,710.58, reflecting a high selling pressure. Interestingly, this price action marked the second consecutive day the maiden cryptocurrency suffered a significant loss following a 5% decline on Friday amidst minor turbulence in the US stock markets.

Generally, Bitcoin has shown an underwhelming performance in the past weeks, recording a 12.51% loss in the last month based on data from CoinMarketCap. The maiden cryptocurrency has struggled to replicate its bullish form seen at the beginning of 2024 when it achieved a new all time high price of $73,750.07. However, with the Halving event fast approaching, BTC investors are likely optimistic about a potentially massive price gain in the coming months based on historical price data.

Currently, Bitcoin trades at $63,943, showing a 3.61% gain from its earlier slump on Saturday. In tandem, the token’s daily trading volume is up by 22.46% and valued at $57.37 billion.

Bitcoin trading at $63,971 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Altcoins Not Spared From Market Crash

Alongside Bitcoin, the price of altcoins also decreased significantly due to the escalated geopolitical tension in the Middle East. Ethereum, the most popular altcoin and second largest cryptocurrency, suffered a loss of 10.89%, falling as low as $2,880.16

Meanwhile, other prominent tokens such as Solana (SOL), XRP, and Avalanche (AVAX) also recorded price dips to the tune of 12.68%,18.11%, and 16.00%, respectively. Generally, the total crypto market cap declined by 7.78%, falling to around $2.2 trillion.

Featured image from Shutterstock, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Kiyosaki Reacts to $200 BTC Crash Prediction, Miners Offload BTC Ahead of Halving, and More — Week in Review

Robert Kiyosaki expressed his stance on potentially investing more in Bitcoin if its price plummets to $200, as economist Harry Dent has forecasted. Cryptoquant data reveals that Bitcoin miners are selling off their holdings in anticipation of the network’s upcoming halving event, which is expected to impact their rewards. JPMorgan has speculated that the SEC […]

Robert Kiyosaki expressed his stance on potentially investing more in Bitcoin if its price plummets to $200, as economist Harry Dent has forecasted. Cryptoquant data reveals that Bitcoin miners are selling off their holdings in anticipation of the network’s upcoming halving event, which is expected to impact their rewards. JPMorgan has speculated that the SEC […]

Source link

Could This Be The Mystery Stock Billionaire Warren Buffett Has Been Adding to Berkshire Hathaway’s Portfolio?

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett is a legend in the investing world. Since taking over the failing textile business in 1965, Buffett has given investors nearly 20% returns annually. Put differently, a $100 investment in the company back then would be worth nearly $4.4 million today.

Berkshire’s long track record of success has drawn much attention, which is why investors eagerly track the company’s investment portfolio like a hawk. However, because of the popularity of Berkshire’s investments, the conglomerate occasionally requests confidential treatment when building an equity position so it doesn’t tip off the markets until it’s finished buying.

In the last two quarters of last year, Berkshire Hathway accumulated an estimated $5.3 billion stock position, with investors speculating about what it could be. One company on my short list has earned high praise from Buffett and his longtime partner Charlie Munger and has other connections to Berkshire.

Berkshire bought around $5 billion in one company’s stock last year

In the second quarter, Berkshire reported $23.5 billion in investments in “banks, insurance, and finance.” This amount increased to $27.1 billion by the end of the year, or a $3.6 billion increase. Berkshire also eliminated equity positions in Globe Life and Markel, so the investment is around $5.3 billion.

Another thing we know is that if Berkshire’s ownership stake exceeded 5% of shares outstanding, it would be required to report this to the Securities and Exchange Commission. With this in mind, Berkshire likely invested in a company with a large market capitalization of $100 billion or more, significantly narrowing down the list of potential candidates.

Progressive has earned high praise for Berkshire Hathway’s leaders

One company that could fit the Berkshire Hathaway criteria is Progressive (NYSE: PGR), the second-largest automotive insurer in the U.S. behind State Farm. GEICO, wholly owned by Berkshire Hathaway, rounds out the top three.

When it comes to the automotive insurance industry, Buffett sees it as a two-horse race between Progressive and GEICO. He has said:

I have always thought for a very long time [that] Progressive has been very well run. They have an appetite for growth. Sometimes they copy us. Sometimes we copy them. And I think that will be true five years from now, ten years for now.

Buffett’s right-hand man, the late Charlie Munger, also praised Progressive, saying, “In the nature of things, every once in a while, somebody is a little better at something than we are.”

Progressive’s underwriting advantage

Thanks to its stellar underwriting ability, Progressive has gotten Buffett’s and Munger’s attention over the years. The company has committed to underwriting profitable insurance policies since 1971, when it went public. At the time, it was common to think that insurers should break even on their policies and make their actual returns from their investment portfolios.

CEO Peter Lewis bucked the trend then and prioritized achieving a combined ratio of 96, meaning the company would earn $4 of profit for every $100 in premiums written. This goal has been core to Progressive’s disciplined underwriting and is a big reason for the stock’s long-term outperformance.

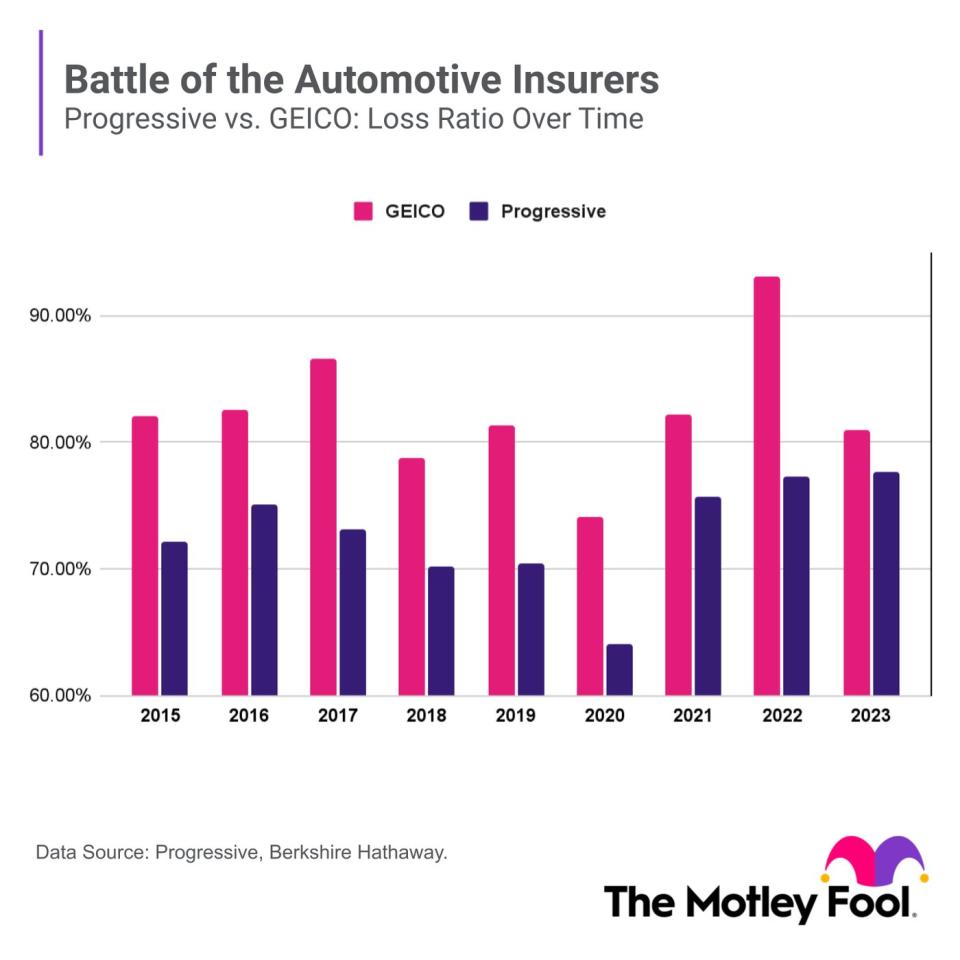

One way to assess Progressive’s stellar performance is to examine its loss ratio. This is one component of the combined ratio and the ratio of losses to premiums earned. Over the last nine years, Progressive’s loss ratio has averaged 73%, an excellent number in the highly competitive auto insurance industry. GEICO, also a solid underwriter, averaged 82% over that period.

Berkshire’s other connection to Progressive

Progressive could also be a candidate for Berkshire Hathaway because of Todd Combs’s connection to the insurer. Combs works alongside Ted Weschler to help manage Berkshire’s investment portfolio with Buffett. Combs worked at Progressive as a pricing analyst in the late ’90s and is quite familiar with the company.

During an interview on the “Art of Investing” podcast, Combs recounted talking to Buffett in 2010 before being offered a job at Berkshire Hathaway. Buffett asked Combs his opinion on Progressive vs. GEICO, and Combs told him that GEICO excelled at marketing and branding, but Progressive’s focus on data would drive its long-term success. Combs was right about Progressive’s data advantage — the stock has crushed it over the past few decades.

A quality company for long-term investors

Berkshire Hathaway has long had its eye on Progressive as a competitor, and the conglomerate may have seen an excellent opportunity to scoop up the insurer at the end of last year. Progressive continued its profitable underwriting streak, maintaining an annual combined ratio below 96 for the 23rd consecutive year. The stock has climbed 28% since the start of the year.

We won’t know if Berkshire is buying Progressive until its 13-F filing for the first quarter is made available in mid-May, assuming it’s not marked as confidential again. Regardless, Progressive has been an excellent stock for long-term investors. Even if Berkshire isn’t buying it, it can make a solid addition to your portfolio today.

Should you invest $1,000 in Progressive right now?

Before you buy stock in Progressive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Progressive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Courtney Carlsen has positions in Progressive. The Motley Fool has positions in and recommends Berkshire Hathaway and Markel Group. The Motley Fool recommends Progressive. The Motley Fool has a disclosure policy.

Could This Be The Mystery Stock Billionaire Warren Buffett Has Been Adding to Berkshire Hathaway’s Portfolio? was originally published by The Motley Fool

It has been a volatile ride, but investors will be encouraged to know that SoFi Technologies (SOFI -4.06%) has benefited from the market’s broad rally. Shares of this banking innovator are up 64% since the start of 2023.

However, this fintech stock is still 71% below its peak price. And its current market cap of $8 billion keeps it in mid-cap territory.

I believe SoFi certainly makes for a solid long-term investment opportunity. But can the stock make you a millionaire?

SoFi is taking on a massive industry

One of the reasons I think SoFi should be on everyone’s radar is because of how it has found remarkable success in disrupting the massive financial services sector. The business was founded in 2011, during a time when consumers might have been skeptical of the banking industry following the Great Recession. Moreover, smartphones were in the early stages of their adoption phase, making mobile banking a novel activity.

Riding this powerful trend over the past decade has boosted SoFi to attract a user base of 7.5 million customers today. But that’s a drop in the bucket compared to what really could be viewed as the company’s total addressable market opportunity.

For what it’s worth, JPMorgan Chase, the leading bank in the U.S. by assets, says it serves 80 million consumers. This means SoFi has huge potential for growth, which definitely works in its favor when thinking about its ability to make its shareholders millionaires in the future.

The business has found success by leaning into a tech- and digital-first approach, focusing intensely on providing a better user experience. Getting its customers to use more products over time is a key strategic pillar.

In the fourth quarter of 2023, the average customer used 1.5 products, a figure that has moved higher historically. While someone might initially be drawn to SoFi thanks to its above-market savings rate of 4.6%, they could then be incentivized to open up a brokerage account or take out a mortgage. This can lead to greater revenue in the long run.

Throughout its history, SoFi was a money-losing enterprise. This changed last quarter when the company reported positive quarterly generally accepted accounting principles (GAAP) net income. Management is confident that the bottom line will expand at a rapid clip in the years ahead, indicating SoFi’s scale and operating leverage. Combine top-line gains with earnings expansion, and investors have a lot to be excited about.

SoFi’s path to a seven-figure position

Even after the stock’s climb in the last 15 months, it’s not expensive. In fact, it might be an attractive valuation. Shares trade at a price-to-sales ratio of 3.4. substantially below their historical average.

In my opinion, SoFi looks like a smart stock to buy right now. It focuses on its users and their needs, plus it is set to grow revenue and net income at high rates going forward.

I believe people who are able to invest a larger initial capital outlay while also having a very long-term time horizon could indeed become millionaires off of this company. However, it’s important to understand important risk factors.

One pressing risk to keep in mind is SoFi’s loan book, which is mostly made up of personal loans. How these perform in a possible recessionary scenario should be closely watched. The hope is that default rates are kept in check.

Earlier I applauded SoFi’s ability to successfully innovate in an outdated industry. That deserves credit. But the threat of competitive forces should remain on top of shareholders’ minds. At their core, financial services are basically just commoditized offerings. It’s not uncommon for people to use multiple banking institutions for their various needs. SoFi must continue finding ways at bringing on more users.

As we look at the situation today, I remain bullish on this business over the long term. Investors might just reach the seven-figure milestone on this holding.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.

Former Security Engineer Sentenced to Three Years for Hacking Two Decentralized Exchanges

A former security engineer, who stole digital assets valued at more than $12 million from two decentralized exchanges, has received a three-year prison sentence. In what has been characterized as the “first-ever” conviction for a smart contract hack, the U.S. Judge also ordered the ex-engineer to forfeit roughly $12.3 million. Ex-Engineer Sentenced to Three Years […]

A former security engineer, who stole digital assets valued at more than $12 million from two decentralized exchanges, has received a three-year prison sentence. In what has been characterized as the “first-ever” conviction for a smart contract hack, the U.S. Judge also ordered the ex-engineer to forfeit roughly $12.3 million. Ex-Engineer Sentenced to Three Years […]

Source link

Both companies benefit from the AI semiconductor boom, but one of them looks like a better investment right now.

Shares of Nvidia (NVDA -2.68%) and Arm Holdings (ARM -3.66%) have been in fine form on the stock market in 2024 with impressive gains of 75% and 66%, respectively, so far, and artificial intelligence (AI) has played a key role in this solid surge.

While Nvidia’s fiscal 2024 fourth-quarter results, which were released in February, established the company’s dominance in the fast-growing market for AI chips, Arm also joined the AI bandwagon following its latest quarterly results. However, if you are looking to buy an AI stock right now and need to choose between Nvidia and Arm Holdings, which one should you buy?

Let’s find out.

The case for Nvidia

Nvidia’s eye-popping stock market surge can be justified by the company’s terrific share of the AI chip market, which has led to a sharp acceleration in the company’s revenue and earnings growth in recent quarters. The graphics specialist ended fiscal 2024 with $60.9 billion in revenue, an increase of 126% over the prior year.

Additionally, Nvidia’s non-GAAP (adjusted) earnings shot up 288% in fiscal 2024 to $12.96 per share, driven by a jump of 14.6 percentage points in the company’s gross margin. That’s not surprising as the chipmaker has been enjoying immense pricing power in the AI chip market. Its flagship H100 AI processor reportedly carries a hefty margin of 1,000%, according to financial services and investment banking provider Raymond James.

What’s more, customers have been willing to pay the high prices of Nvidia’s AI processors as they don’t want to be left behind in the race to develop AI applications. Meta Platforms, for instance, is going to spend more money on procuring Nvidia’s H100 processor in 2024. It is also worth noting that major cloud computing providers have already set their sights on deploying Nvidia’s next-generation AI GPUs based on the Blackwell architecture.

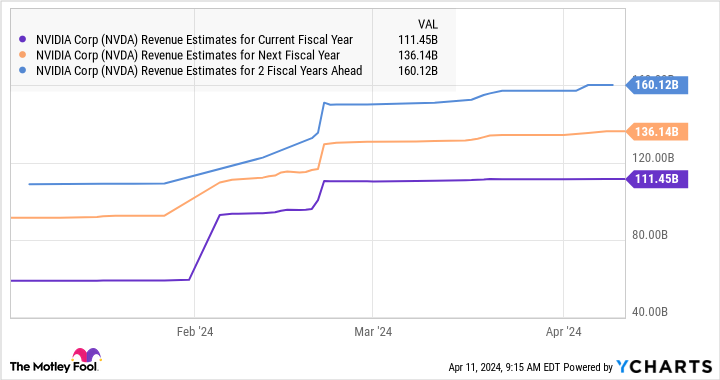

All this indicates why Nvidia is anticipating that the demand for its upcoming AI processors will continue to be higher than supply, even though the company has been taking steps to boost its production capacity. The healthy demand for Nvidia’s AI chips explains why analysts have significantly upgraded their revenue growth expectations from the company for the current fiscal year and beyond.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

Even better, analysts estimate that Nvidia’s robust share of the AI chip market is likely to translate into healthy long-term growth, with its data center revenue alone jumping to $280 billion by 2027. As such, Nvidia could continue to be a top growth stock thanks to the fact that it currently controls more than 90% of the lucrative AI chip market, which is expected to generate more than $300 billion in annual revenue by the end of the decade.

The case for Arm Holdings

Like Nvidia, Arm Holdings is also a play on the AI chip market. However, unlike Nvidia, the company isn’t involved in manufacturing chips. Instead, Arm licenses its intellectual property (IP), software tools, and architecture to chipmakers so that they can develop and manufacture different types of processors such as central processing units (CPUs), neural processing units (NPUs), and graphics processing units (GPUs).

The demand for all these types of chips is increasing thanks to the growing adoption of AI servers, personal computers (PCs), and smartphones. Not surprisingly, the number of companies looking to develop AI chips with the help of Arm’s IP has also increased. Arm reported that 27 companies are using its total access license at the end of the third quarter of fiscal 2024, up from 18 at the end of fiscal 2023.

The company credits the new licensing agreements to the growing demand for “high-performance CPUs etc. to embedded AI into every end device.” The new licenses explain why Arm’s revenue pipeline saw a significant improvement. Its remaining performance obligations (RPO), which refers to the total value of a company’s unfulfilled contracts, shot up to $2.4 billion in fiscal Q3, up 38% from the year-ago period.

There is a solid chance that Arm will be able to sustain this newly found momentum in the long run as well. That’s because the company’s architecture powers more than 50% of the chips that have a processor inside them. Also, the adoption of the company’s AI-specific Armv9 architecture, which commands double the royalty compared to the previous generation’s architecture, is increasing at a nice pace.

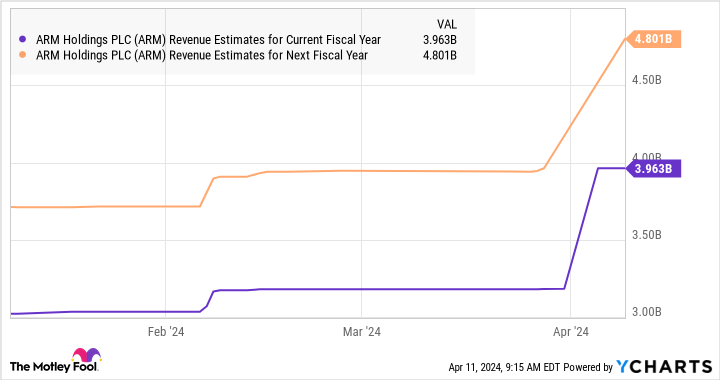

In all, it is easy to see why analysts raised their revenue growth projections from Arm as well.

ARM Revenue Estimates for Current Fiscal Year data by YCharts

Also, analysts forecast the company’s earnings to increase at an annual rate of just over 44% over the next five years, which is higher than the 38% annual earnings growth expected from Nvidia.

The verdict

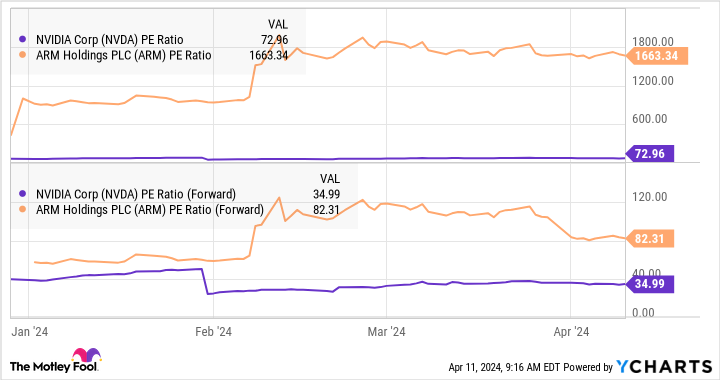

Both Arm Holdings and Nvidia benefit from the proliferation of AI chips. However, investors looking to choose one of these two AI stocks now would be better off investing in Nvidia.

That’s because Nvidia stock is significantly cheaper than Arm Holdings right now from a valuation perspective. Nvidia’s sales multiple of 36 is lower than Arm’s reading of 44. A similar story unfolds if we look at their trailing and forward earnings multiples.

NVDA PE Ratio data by YCharts

Moreover, Nvidia is growing at a much faster pace than Arm, as the latter’s revenue is expected to increase 19% this year. Arm, therefore, is expensive if you consider the potential growth that it is expected to deliver, making Nvidia the better AI stock to buy right now as it is not only delivering stronger growth but also has a much cheaper valuation.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool has a disclosure policy.

1 Unstoppable Stock That Could Join Microsoft, Apple, Nvidia, Alphabet, Amazon, and Meta in the $1 Trillion Club

The speed with which artificial intelligence (AI) caught on last year took many investors by surprise, and it sparked a changing of the guard among the ranks of the world’s most valuable companies. Apple was finally dethroned by Microsoft, which now tops the list as the only company that currently has a market cap of more than $3 trillion. Nvidia, fueled by its industry-leading AI processors, has tripled over the past year to take the No. 3 spot, behind Apple with $2.6 trillion. Alphabet, Amazon, and Meta Platforms are all major players in the AI revolution and also members of this auspicious fraternity.

With a market cap of just $53 billion (as of this writing), it might seem like hyperbole to suggest that Super Micro Computer (NASDAQ: SMCI), also called Supermicro, could make a run at the $1 trillion club. However, the accelerating demand for AI-centric servers and the company’s decades of expertise suggest that Supermicro is a dark horse candidate in the race.

Servers of the stars

While Supermicro has been creating customized server solutions for more than 30 years, the company was working in relative obscurity until the accelerating adoption of AI kicked off. It turns out that Supermicro has amassed quite a pedigree out of the glare of the spotlight.

Supermicro has built its reputation by providing highly customizable, energy-efficient, liquid-cooled rack-scale servers designed to handle the rigors of AI and hyperscale data centers. The company has developed strong working relationships and works hand-in-hand with all the top AI chipmakers to ensure its rack-scale servers are top performers while also providing energy efficiency and the lowest total cost of ownership in the industry. It boasts partnerships with Nvidia, Advanced Micro Devices, and Intel, among others.

This is a winning strategy that has its AI-centric servers flying off the shelves. For its fiscal 2024 second quarter (ended Dec. 31), Supermicro’s revenue surged 103% year over year to $3.7 billion, while its earnings per share (EPS) of $5.10 jumped 85%. Management is forecasting its triple-digit growth will continue, raising its full-year guidance to $14.5 billion, which would represent growth of 104%.

Management reports that Supermicro grew five times faster than the industry average over the preceding 12 months, suggesting the company is stealing market share from its rivals. Analysts at Northland agree, suggesting the company has increased its market share to 11%, leaving “plenty of room for future share gains.”

The path to $1 trillion

Supermicro is in an enviable position among AI server makers. The company is small enough to be nimble and has a long history of providing customized server solutions to enterprises. Furthermore, the strong and enduring relationships Supermicro has forged with chipmakers give it the inside track and an abundant supply of the processors used for AI. Despite those advantages and the clear opportunity, a lot will have to go right for Supermicro to join the ranks of the trillionaires.

According to Wall Street, Supermicro is poised to generate revenue of $14.7 billion in 2024, giving it a forward price-to-sales (P/S) ratio of roughly 3.6. Assuming its P/S remains constant, Supermicro would have to grow its revenue to about $275 billion annually to support a $1 trillion market cap. To be clear, the company is currently ramping up production to support annual sales of $25 billion, so revenue of that magnitude is still a ways off.

If the company were able to keep up its triple-digit, year-over-year growth, Supermicro could reach the $1 trillion market cap threshold by 2031. That said, it’s unlikely the company will keep up its current rate of parabolic growth. If we cut its revenue growth rate assumption to 50%, Supermicro could potentially reach a $1 trillion market cap by 2035.

There’s reason to believe strong demand for AI-centric servers will continue. BofA analyst Ruplu Bhattacharya suggests the data center market will grow at a compound annual growth rate (CAGR) of 50% over the next three years, and Supermicro’s revenue could grow even faster.

Nvidia CEO Jensen Huang is equally bullish, suggesting that the installed base of data centers will double to $2 trillion over the coming four to five years.

If Supermicro captures even a small part of that vast opportunity, the company will soon join the $1 trillion club.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Danny Vena has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Super Micro Computer. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Bank of America, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

1 Unstoppable Stock That Could Join Microsoft, Apple, Nvidia, Alphabet, Amazon, and Meta in the $1 Trillion Club was originally published by The Motley Fool

US, UK, Germany Among Countries With Largest Government Crypto Holdings, Arkham’s Data Shows

The United States, United Kingdom, and Germany rank among the top countries holding cryptocurrencies at the government level, according to data from Arkham Intelligence. The crypto analytic firm’s onchain analysis shows that the U.S. government holds 212,847 bitcoins while El Salvador has been purchasing one bitcoin daily as announced by its president. Top Government Holders […]

The United States, United Kingdom, and Germany rank among the top countries holding cryptocurrencies at the government level, according to data from Arkham Intelligence. The crypto analytic firm’s onchain analysis shows that the U.S. government holds 212,847 bitcoins while El Salvador has been purchasing one bitcoin daily as announced by its president. Top Government Holders […]

Source link