The price of bitcoin continued to decline over the weekend, dropping an additional 7.7% in the last 24 hours. It plummeted to a daily low of $61,384 per coin, prompting a significant wave of leveraged liquidations on Saturday. Bitcoin Value Declines Amid Market Instability; Extensive Liquidations Reported By 4:00 p.m. Eastern Time on Saturday, bitcoin’s […]

The price of bitcoin continued to decline over the weekend, dropping an additional 7.7% in the last 24 hours. It plummeted to a daily low of $61,384 per coin, prompting a significant wave of leveraged liquidations on Saturday. Bitcoin Value Declines Amid Market Instability; Extensive Liquidations Reported By 4:00 p.m. Eastern Time on Saturday, bitcoin’s […]

Source link

CoinNews

At first glance, Coinbase Global (NASDAQ: COIN) looks like a terrible investment right now.

The stock price has more than tripled in 52 weeks. The cryptocurrency exchange operator’s shares trade at the lofty valuation of 103 times free cash flows and 950 times earnings. I mean, it’s enough to make even seasoned growth investors reach for the smelling salt.

Many investors won’t look any further. Happy to skip this seemingly overvalued crypto stock, they move on to the next idea.

And that could be a big mistake. Coinbase is going through the usual four-year cycle of boom and bust in the crypto space, and the rising bottom-line profits barely clicked above the breakeven line so far.

Let me show you two reasons you should consider making Coinbase your next stock investment.

1. Coinbase runs a sophisticated business

Sure, Coinbase’s stock looks expensive at the moment. The crypto market is waking up from another cold, hard winter, and the whole industry is soaring. Bitcoin (CRYPTO: BTC) is up 138% over the last year, while Ethereum (CRYPTO: ETH) gained 85%. Low-priced altcoins are jumping even higher, led by Solana (CRYPTO: SOL), posting a 730% one-year gain. Coinbase saw a 270% return over the same period, and for good reason.

The company doesn’t build value by holding Bitcoin coins or Ethereum tokens. Its digital currency holdings are minimal and only used to facilitate its customers’ crypto trades as smoothly as possible. Coinbase doesn’t even record changing values in digital assets as a revenue item but as a part of its operating costs.

Instead, it makes money from transaction fees, interest and blockchain rewards, and subscription-style services. You know, pretty much like any ordinary bank, just based on a different set of financial assets. The company’s financial health is more closely related to basic interest in cryptocurrencies than to the price of any specific digital currency.

2. This crypto cycle is not like the others

Coinbase has been around since the early days of crypto. Founded in 2012, with only three cryptocurrencies on the market and one Bitcoin worth less than $7, the exchange has experienced three of Bitcoin’s halving cycles. The fourth one is coming up next week, cutting the rewards for mining Bitcoin in half again. Each halving so far has fueled a dramatic run-up in Bitcoin prices, giving the crypto industry another turn in the spotlight and inspiring larger transaction volumes across different digital coin types.

So, that scenario is about to play out again, but things are different this time. And it’s all about exchange-traded funds (ETFs) tied to Bitcoin’s spot price.

Spot Bitcoin ETFs give investors a radically different way to invest in this newfangled asset class. Instead of opening a new account with Coinbase or some other crypto exchange, learning a different set of trading rules and processes, and taking direct ownership of digital currencies, you can now make Bitcoin trades pretty much like you’d buy or sell an ordinary stock. The Securities and Exchange Commission (SEC) approved 11 applications for this brand-new ETF type in January, and they already manage more than $53 billion of Bitcoin assets.

The expected arrival of spot Bitcoin ETFs inspired an early start to the fourth halving surge. As noted earlier, many cryptocurrencies and related stocks have soared over the last year thanks to halving expectations, ETF plans, and a calmer economic inflation trend. On top of this robust launching pad, Coinbase will record higher trading volumes thanks to the new ETFs.

But wait a minute — why would that be a good thing? Aren’t these ETFs taking away potential crypto-trading volume from the Coinbase system?

Thanks for asking. As it turns out, most ETFs are using a third-party custodian service to execute Bitcoin trades and hold the crypto assets in a secure digital wallet. And nine of the 11 ETFs rely on Coinbase.

“We’re earning revenue, not just on custody, but also on trading and financing,” Coinbase CEO Brian Armstrong said on an earnings call in February, four weeks after the ETF approvals. “Every institution is now starting to hold crypto, the asset class will be a standard part of every diversified portfolio. The financial system is officially adopting crypto. This is really good, and Coinbase is the most trusted partner here.”

So, Coinbase found a new revenue stream while giving the whole crypto market a helpful push. That’s a win-win.

Coinbase is growing into its rich valuation

Coinbase’s valuation shrinks dramatically if you look forward to the incoming market surge. The stock trades at 12 times the average next-year revenue estimate and 108 times earnings projections. And in the last five quarterly reports, the company has exceeded the consensus revenue target by an average of 11% — and earnings have more than doubled the average Wall Street projections.

Past performance is no guarantee of future results, but Coinbase has a proven history of leaving analyst estimates behind — and the company has a unique set of growth-driving balls in the air right now. Keep this up throughout the 12-to-18-month span of the halving cycle’s bullish action, and the current stock price quickly starts to look cheap.

That’s why you should consider picking up a few Coinbase shares now. They will not stay this deceptively cheap forever.

Should you invest $1,000 in Coinbase Global right now?

Before you buy stock in Coinbase Global, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coinbase Global wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

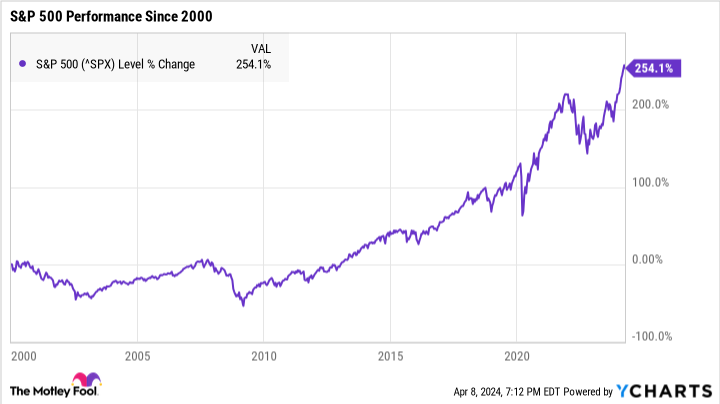

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Anders Bylund has positions in Bitcoin, Coinbase Global, Ethereum, and Solana. The Motley Fool has positions in and recommends Bitcoin, Coinbase Global, Ethereum, and Solana. The Motley Fool has a disclosure policy.

2 Reasons to Buy Coinbase Stock Like There’s No Tomorrow was originally published by The Motley Fool

This Is Hands-Down the Simplest Way to Earn $1 Million or More in the Stock Market

With a few simple steps, you could be on your way to millionaire status.

Investing in the stock market is a tried-and-true way to generate long-term wealth, and while reaching $1 million may seem like a lofty goal, it’s not as difficult as it might appear.

You don’t have to be a stock market expert to earn $1 million or more, but you will need the right investing strategy. There’s no single correct way to invest, and the best approach for you will depend on your preferences and risk tolerance.

That said, there’s a simple and straightforward strategy to maximize your long-term earnings while minimizing risk. Whether you’re new to the stock market or just want a no-fuss way to build wealth, this step-by-step process can take you from $0 to $1 million or more.

Image source: Getty Images.

1. Get started investing right now

The more time you give your money to grow, the less you’ll need to invest each month to reach $1 million. Thanks to compound growth, your investments will accumulate exponentially faster over time. Getting started as soon as possible, then, is key to maximizing your earnings.

Even if you can’t afford to invest much right now, every year counts. For example, say you’re earning a modest 9% average annual return on your investments — which is just under the market’s historic average. Here’s approximately how much you’d need to invest each month to reach $1 million, depending on how many years you have to save:

| Number of Years | Amount Invested per Month | Total Portfolio Value |

|---|---|---|

| 20 | $1,700 | $1.044 million |

| 25 | $1,000 | $1.016 million |

| 30 | $625 | $1.022 million |

| 35 | $400 | $1.035 million |

| 40 | $250 | $1.014 million |

Data source: Author’s calculations via investor.gov.

It’s never too early to start investing, and the sooner you begin, the easier it will be to build a substantial amount of wealth. You can always invest more later if you can swing it, but you won’t get this precious time back.

2. Don’t worry about timing the market

The stock market will always be volatile to a degree, and it can be nerve-wracking trying to determine the best time to buy. Many people are understandably worried about investing right before prices drop, and it can be tempting to hold off on buying until the perfect moment.

However, there’s never going to be a perfect time to invest in the stock market, and the longer you wait to invest, the harder it will be to catch up later. While it may seem counterintuitive, it’s often safer to simply invest consistently no matter what the market is doing.

This approach is called dollar-cost averaging, and it involves investing a set amount at regular intervals throughout the year. Sometimes you’ll end up buying when prices are at their peaks, and other times you’ll snag investments at steep discounts. Over time, those highs and lows should average out.

Dollar-cost averaging can help take the guesswork out of when to buy, making it easier to invest consistently. Again, time is your most valuable resource when building wealth, so consistency is key to reaching $1 million or more.

3. Choose long-term investments

All investments are subject to short-term volatility, but stocks from healthy companies with solid underlying fundamentals have the best chance of recovering from downturns and earning positive long-term returns.

These types of stocks won’t see explosive growth overnight, but they are more likely to earn consistent returns over time. This makes them much safer than short-term investments promising to make a quick buck.

If you’d prefer a more low-maintenance investment, a broad-market index fund or ETF may be your best bet. The S&P 500 index fund, for example, tracks the S&P 500 index and includes stocks from all 500 companies within the index itself. This can help create an instantly diversified portfolio with next to no effort, limiting your risk while still setting you up for positive long-term returns.

If you’re willing to put in more effort for the chance to earn above-average returns, investing in individual stocks may be a better fit. This approach requires more research, as you’ll need to study each stock you’re interested in buying as well as keep up with industry trends going forward. But with the right portfolio, you could earn far higher-than-average returns over time.

Building a million-dollar portfolio isn’t necessarily easy, but it’s simpler than it might seem. By getting started early, investing consistently, and keeping a long-term outlook, you’ll be on your way to becoming a stock market millionaire.

As the countdown to the much-anticipated 2024 bitcoin halving event nears its climax, the cryptocurrency world finds itself amidst a whirlwind of excitement and speculation.

Social media platforms have become abuzz with discussions surrounding the impending halving, according to data from Santiment. This increase in social media chatter indicates a potential for significant price movements in the volatile crypto market, sparking both FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, Doubt) among investors.

Social Media Surge Fuels Speculation On Bitcoin’s Fate

The surge in social media chatter around the halving event has not gone unnoticed by analysts, who suggest that such peaks in activity often coincide with notable shifts in market sentiment and price action.

While some believe that the heightened discussions could signal a potential price rally, others remain cautious, pointing out the recent flat market conditions that may dampen the event’s impact.

⌛️🗣️ As #Bitcoin has now drawn to its final week before the #halving, social dominance toward the topic has peaked at its highest level of the year at 9pm UTC. The spikes in this topic should be received as high confidence price reversals for #crypto markets. Markets have been… pic.twitter.com/U2dOujjhLj

— Santiment (@santimentfeed) April 12, 2024

Unique Dynamics Surrounding Bitcoin 2024 Halving

This forthcoming halving event carries a unique set of circumstances, setting it apart from its predecessors. Bitcoin’s current trading position above its previous cycle’s high adds an element of unpredictability to the equation, making it challenging to forecast the duration and intensity of the impending bull run.

Experts weigh in on the confluence of reduced supply and growing ETF demand as potential catalysts driving Bitcoin into uncharted territory.

Source: Santiment

Antoni Trenchev, co-founder of Nexo, highlights the importance of understanding the demand dynamics in the market, particularly with regards to whale demand for BTC, involving veteran Bitcoiners, newcomers, and ETF holders.

Related Reading: XRP To Blast Off? Analyst Predicts ‘Realistic’ 5x Surge To $3

Trenchev suggests that this heightened demand could magnify the impact of the impending supply shock, paving the way for a shorter but more intense bull market.

Total crypto market cap is currently at $2.38 trillion. Chart: TradingView

Expert Perspectives: Optimism Vs. Caution

While some experts remain cautiously optimistic about the potential outcomes of the halving event, others warn against overestimating its impact.

Steven Lubka, Head of Private Clients at Swan Bitcoin, emphasizes the importance of maintaining a level-headed approach amidst the frenzy surrounding the halving. Lubka suggests that while the event may spark short-term price fluctuations, its long-term effects are likely to be more subdued.

Bitcoin price action in the last day. Source: Coingecko

As the countdown to the bitcoin halving event reaches its crescendo, the crypto community finds itself grappling with a mixture of hope and caution. While some anticipate significant changes in the market landscape, others brace themselves for a more tempered response.

Featured image from ZebPay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Severe Impact Expected for Miners With Outdated Hardware in Upcoming Bitcoin Halving

Following the downturn in bitcoin’s price on Friday, the hashprice of bitcoin has declined from slightly above $119 per petahash per second to marginally over $116 per PH/s on a daily basis. Should the prices remain low leading up to the forthcoming halving event scheduled for next week, certain mining devices may only be viable […]

Following the downturn in bitcoin’s price on Friday, the hashprice of bitcoin has declined from slightly above $119 per petahash per second to marginally over $116 per PH/s on a daily basis. Should the prices remain low leading up to the forthcoming halving event scheduled for next week, certain mining devices may only be viable […]

Source link