On Tuesday, Proshares introduced two new offerings: the Ultra Bitcoin exchange-traded fund, sporting the ticker BITU, and the Ultrashort Bitcoin exchange-traded fund (ETF), known as SBIT. While BITU is designed to deliver two times the daily returns of bitcoin, SBIT is structured to produce double the inverse of bitcoin’s daily returns. Proshares Introduces Leveraged and […]

On Tuesday, Proshares introduced two new offerings: the Ultra Bitcoin exchange-traded fund, sporting the ticker BITU, and the Ultrashort Bitcoin exchange-traded fund (ETF), known as SBIT. While BITU is designed to deliver two times the daily returns of bitcoin, SBIT is structured to produce double the inverse of bitcoin’s daily returns. Proshares Introduces Leveraged and […]

Source link

CoinNews

Shiba Inu To Rally 100% To $0.000062? Analyst Reveals Why This Is Possible

A crypto analyst has identified a key technical indicator in the Shiba Inu price chart that suggests that the cryptocurrency is set to witness a major price rally to new highs.

Asymmetrical Triangle Signaling SHIB Price Surge Appears

A crypto analyst identified as Captain Faibik on X (formerly Twitter) has unveiled a distinctive technical pattern in Shiba Inu’s price chart. Sharing a 6-hour chart of Shiba Inu’s native token, SHIB against Tether (USDT), the analyst revealed an asymmetrical triangle pattern, which indicated that the cryptocurrency may enter a bullish trend during the first two weeks of April.

The asymmetrical triangle pattern is a technical indicator which displays a period of consolidation before the price of a cryptocurrency is forced to break out or down. Oftentimes, the triangle patterns are interpreted as bullish, especially if the cryptocurrency is already in an uptrend. This is because the emergence of the technical pattern is a sign that the price of the token will continue moving upwards.

Regarding Shiba Inu, Faibik has interpreted the technical pattern as a potential bullish breakout, predicting an upcoming rally that could see the price of Shiba Inu doubling. The price chart has revealed that SHIB’s price could potentially rise between 0.00058 to 0.00062 around the second to third week of April.

At the time of writing SHIB is priced at $0.000271, reflecting a 0.45% dip in the last 24 hours. Over the past week, the cryptocurrency saw a decrease of more than 10%. The emergence of this new technical pattern may offer investors renewed optimism, viewing declines as buying opportunities.

Shiba Inu Surpasses Bitcoin In Trading Volume on Indian Exchange

Prominent Indian crypto exchange, WizarX recently revealed its top five most traded cryptocurrencies in March 2024, with Shiba Inu dominating the pack as the platform’s most traded cryptocurrency. The doggy-themed meme coin claimed first position, surpassing Bitcoin (BTC), the world’s largest cryptocurrency, which took second place.

Ranking third to fifth place were Pepe (PEPE), Dogecoin (DOGE), and Floki (FLOK), respectively, which are some of the trendiest meme coins in the crypto space currently.

Shiba Inu’s accomplishment as the most traded cryptocurrency on this Indian crypto exchange underscores its growing popularity across various global regions. The meme coin recently made headlines for being one of the top most searched cryptocurrencies on Google. Moreover, SHIB has consistently experienced a notable increase in demand and interest from investors and traders alike within the crypto space.

SHIB price recovers to $0.000027 | Source: SHIBUSDT on Tradingview.com

Featured image from Analytics Insight, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The Bank of England (BoE) and the UK Financial Conduct Authority (FCA) have announced the launch of the Digital Securities Sandbox (DSS) on April 3.

The new framework aims to facilitate the use of emerging technologies, such as distributed ledger technology (DLT), in issuing, trading, and settling financial securities. It will allow participating firms to explore innovative technological applications within a structured regulatory environment.

The initiative represents an effort by UK financial regulators to integrate cutting-edge technologies into the financial market infrastructure, aiming for a more efficient and resilient financial system.

Digital finance

Designed as a five-year program, the DSS is intended to let firms undertake roles traditionally associated with central securities depositories, including the issuance, maintenance, and settlement of securities.

Furthermore, the framework enables the integration of these roles with trading venue functionalities, potentially leading to the creation of new business models in the financial sector.

The DSS has been established with three key objectives: to encourage innovation in the financial system, to maintain financial stability, and to uphold market integrity.

It encompasses a variety of financial instruments, such as equities, bonds, money market instruments, and units in collective investment undertakings — excluding the trading and settlement of derivative contracts and unbacked digital assets like Bitcoin.

The initiative aims to seamlessly integrate new technological solutions into the financial markets, allowing for regular interaction between DSS participants and other market players. Securities issued within the DSS are intended to be used in conventional financial transactions, including as collateral and in derivative contracts, subject to existing regulatory standards.

Mitigating risks

To mitigate risks to financial stability, the Bank of England plans to set limits on the value of securities that can be issued within the DSS. This approach reflects the experimental nature of these technologies in significant financial contexts.

The DSS will introduce a phased structure of permitted activities, with each phase designed to gradually increase the scope of allowed operations for participating firms.

The sandbox is anticipated to offer considerable benefits to the financial system, particularly in enhancing the efficiency of post-trade processes. This could lead to significant cost reductions for various market participants, including pension funds, investment firms, and banks.

The Bank and FCA have initiated a consultation period to gather input on the DSS’s proposed operation and regulatory framework. The consultation is directed at potential infrastructure providers and stakeholders interested in the DSS, including firms, law firms, and industry bodies.

Following the consultation, the central bank and FCA will issue a response and finalize the guidelines and regulations for the DSS, with plans to accept applications starting summer this year.

Latest Alpha Market Report

Solana’s stablecoin supply surges past $3 billion, USDC leads the charge

Stablecoin supply on the layer-1 blockchain network Solana has increased steadily since the beginning of the year, crossing the $3 billion mark during the past week.

Data from the blockchain analytical platform Artemis shows that the stablecoin supply on the network has increased by 55.72% in the last three months to reach $3.12 billion.

Notably, this number pales significantly against the balance on the network in 2022, when more than $6 billion worth of these assets were on the blockchain. However, it plummeted to as low as $1.4 billion during the bear market situation before embarking on the recent upward trend.

Meanwhile, stablecoin transfer volume on Solana surged by 164% to $1.4 trillion, reflecting the significant amount of activity the network has enjoyed.

USDC dominates

A breakdown of stablecoins on Solana shows Circle’s USD Coin’s (USDC) dominance, accounting for 73% of such assets on the network.

For context, Artemis data show that USDC accounted for a significant $63.69 billion of stablecoin transfer volume on April 2, overshadowing USDT’s $812.41 million. EURC completes the top three with less than $100,000 in volume.

USDC’s dominance on Solana can be directly linked to Circle’s launch of its Cross-Chain Transfer Protocol (CCTP) on the network on March 26.

Why Solana stablecoins balance is rising

Stablecoins play a crucial role as an intermediary between traditional fiat currencies and digital assets. An increasing stablecoin supply indicates heightened liquidity and is indicative of increased capital infusion.

Market observers have explained that this upsurge reflects the significant influx of capital into the network, coinciding with the frenzy surrounding memecoins and the expanding DeFi activity within the Solana ecosystem.

Over the past year, the Solana blockchain ecosystem has witnessed notable expansion despite its previous ties to Sam Bankman-Fried, the controversial founder of FTX. This growth has attracted a wave of new users and forged significant partnerships with major global financial entities, including Visa and Shopify.

The post Solana’s stablecoin supply surges past $3 billion, USDC leads the charge appeared first on CryptoSlate.

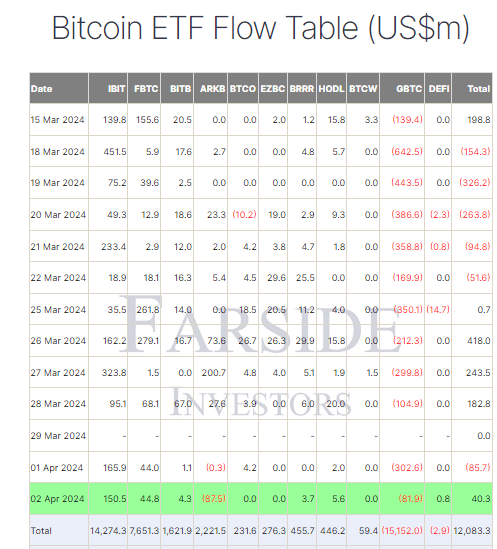

Despite Grayscale and ARK’s outflows, Bitcoin ETF market records net inflow

Quick Take

Bitcoin (BTC) exchange-traded funds (ETFs) on Apr. 2 experienced a moderate net inflow of $40.3 million, according to Farside data. Particularly noteworthy is the Grayscale Bitcoin Trust (GBTC), which saw a relatively smaller outflow of $81.9 million, signaling a significant slowdown from previous outflows. GBTC has now totaled $15,152.0 billion in net outflows.

Farside data reports that the ARK ETF (ARKB) recorded its largest single-day outflow of $87.5 million, yet it has accumulated total inflows of $2,221.5 billion. On the other hand, BlackRock’s (IBIT) Bitcoin ETF attracted a healthy inflow of $150.5 million, boosting its total net inflow to an impressive $14,274.3 billion. In a positive turn, the Hashdex Bitcoin ETF (DEFI) saw its first net inflow since Feb. 21 of $0.8 million, reducing its total outflows to just $2.9 million.

According to Farside data, cumulative net inflows across all Bitcoin ETFs now stand at $12,083.3 billion.

The post Despite Grayscale and ARK’s outflows, Bitcoin ETF market records net inflow appeared first on CryptoSlate.

Bitcoin Technical Analysis: Price Consolidates Following Bearish Downturn

On Wednesday, bitcoin’s trade volume and overall value provided insights into its current technical situation. With a daily trading volume reaching $45.30 billion and a total market value of $1.29 trillion, the cryptocurrency’s liquidity and market breadth still stands strong. However, recent downturns have left traders wary. Currently, bitcoin has declined by 6% this week […]

On Wednesday, bitcoin’s trade volume and overall value provided insights into its current technical situation. With a daily trading volume reaching $45.30 billion and a total market value of $1.29 trillion, the cryptocurrency’s liquidity and market breadth still stands strong. However, recent downturns have left traders wary. Currently, bitcoin has declined by 6% this week […]

Source link

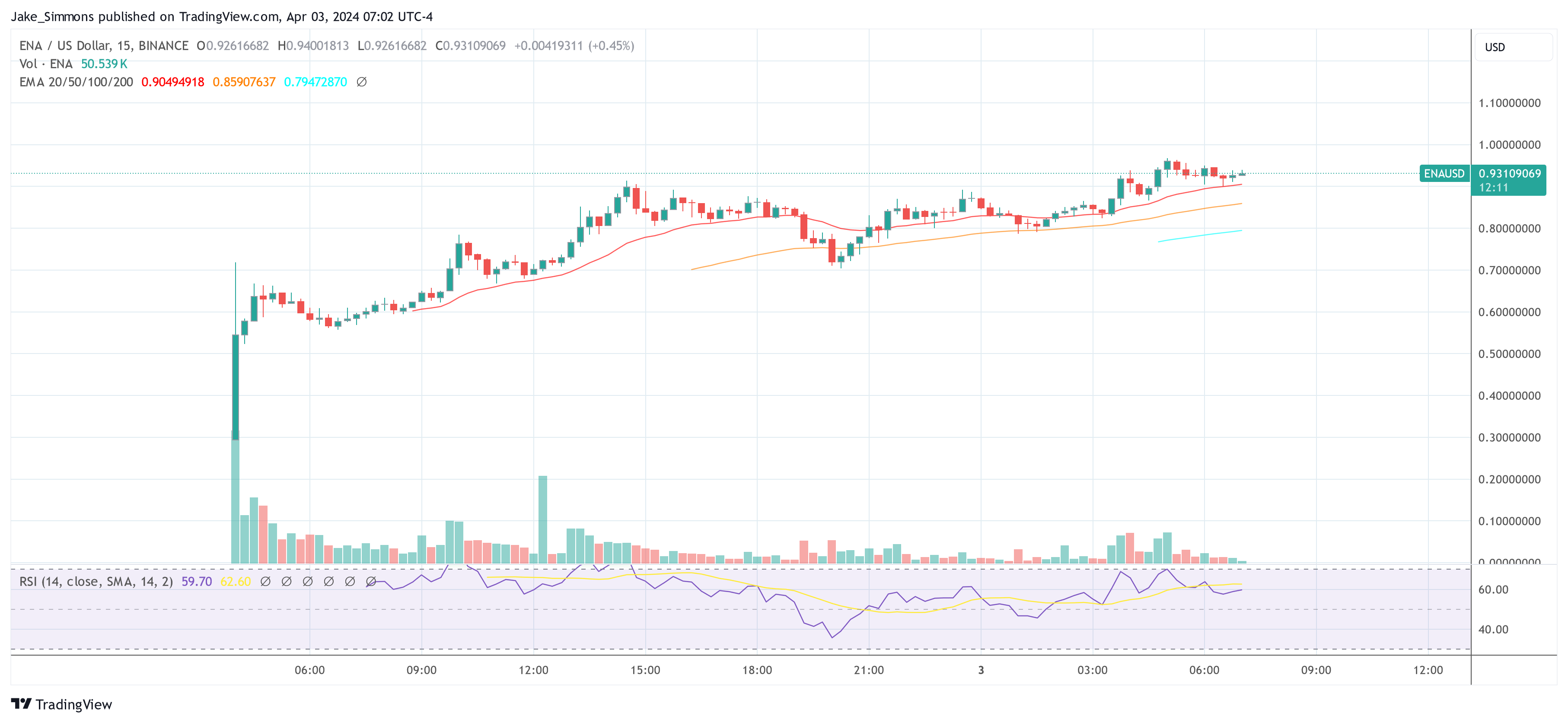

Ethena Labs’ new governance token, ENA, is witnessing a staggering 60% increase in its value, shortly after its introduction to the market. The spike in ENA’s price to approximately $0.96 has catapulted its market capitalization to nearly $1.34 billion, ranking ENA as the 80th largest cryptocurrency by market cap.

This ascent followed Ethena’s strategic distribution of 750 million ENA tokens, representing 5% of its total supply, through an airdrop to holders of its USDe token. The USDe, a synthetic dollar, is central to Ethena’s offering, leveraging a blend of ether liquid staking tokens and short Ether (ETH) perpetual futures positions to maintain a target value near $1.

The Ethena Labs airdrop went live 2 hours ago, with $450M of ENA to distribute.

The largest $ENA recipient so far has been 0xb56, who received 3.30M ENA worth $1.96M.

Track ENA on Arkham: pic.twitter.com/l6c7bqKghG

— Arkham (@ArkhamIntel) April 2, 2024

At the heart of Ethena’s value proposition is the ENA token, engineered to facilitate a digital dollar platform on the Ethereum blockchain. This platform seeks to provide a viable alternative to conventional banking mechanisms through its innovative ‘Internet Bond’. By harnessing the potential of derivative markets and staked Ethereum, the Internet Bond offers a dollar-denominated savings instrument accessible globally, independent of traditional banking infrastructure.

The total supply of ENA tokens is capped at 15 billion, with an initial issuance of 1.425 billion tokens. The distribution plan prioritizes ecosystem development (30%), core contributor rewards (30%), investor engagement (25%), and foundation support (15%), embodying a holistic approach to tokenomics. Notably, Binance’s endorsement of ENA as the 50th project on its Binance Launchpool, enabling users to farm ENA tokens by staking BNB and FDUSD, underscores the token’s appeal.

At press time, ENA traded at $0.93, up 60% in the past 24 hours.

Fantom Co-Founder Warns Of Luna-Like Collapse

Andre Cronje, co-founder of the Fantom Foundation, issued a warning on X, recalling the concerns that preceded the collapse of Terra Luna. Cronje dissected the structure of perpetual contracts (perps), a derivative product that enables traders to speculate on the price movement of an asset without holding the actual asset.

This mechanism operates on a system of funding rates meant to tether the perpetual price closely to the underlying asset’s spot price. However, Cronje highlighted a critical vulnerability in this system: the reliance on yield-generating assets, such as staked Ethereum (stETH), as collateral.

This approach theoretically allows for a “neutral” position, where the gains from yield should offset losses from the short position if the asset’s price drops. Yet, this equilibrium is precarious, as negative shifts in funding rates can erode the collateral, leading to liquidation.

“The mechanism – the theory here is that you can generate a ‘stable’ $1000, by buying $1000 of stETH, using this as collateral to open a $1000 stETH short, thereby achieving being ‘neutral’, while getting the benefit of the stETH yield (~3%) + whatever is paid in funding rates,” Cronje explained.

Cronje’s concerns are not unfounded. The crypto industry witnessed the dramatic implosion of Terra’s algorithmic stablecoin UST in 2021, a debacle that resulted in significant financial losses across the board. By drawing a parallel between the structural weaknesses he perceives in Ethena’s framework and the mechanisms that led to Terra’s downfall, Cronje raises a red flag about the sustainability of complex financial products that lack transparent risk mitigation strategies.

Every so often we see something new in this space. I often find myself on the mid curve for an extensive amount of time. I am comfortable here. That being said, there have been events in this industry I wish I was more curious about, there have also been events I definitely did…

— Andre Cronje (@AndreCronjeTech) April 3, 2024

Responding to Cronje’s critique, the founder of Ethena Labs Guy Young aka Leptokurtic, acknowledged the validity of the concerns raised. “These aren’t mid curve concerns at all Andre Cronje, you rightly point out risks that absolutely do exist here. Will work on a longer form response for you by end of this week with some thoughts,” Young stated on X.

Featured image from LinkedIn, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Deribit’s Dubai Unit Receives ‘Conditional’ Virtual Asset Service Provider License

Deribit FZE, an entity owned by crypto derivatives platform Deribit, has secured a conditional virtual asset service provider from the Dubai virtual assets regulator. The license, which covers spot and derivative trading, will remain non-operational until Deribit meets the regulator’s localization requirements. Meeting Dubai’s Localization Requirements Deribit FZE, a wholly owned entity of the crypto […]

Deribit FZE, an entity owned by crypto derivatives platform Deribit, has secured a conditional virtual asset service provider from the Dubai virtual assets regulator. The license, which covers spot and derivative trading, will remain non-operational until Deribit meets the regulator’s localization requirements. Meeting Dubai’s Localization Requirements Deribit FZE, a wholly owned entity of the crypto […]

Source link

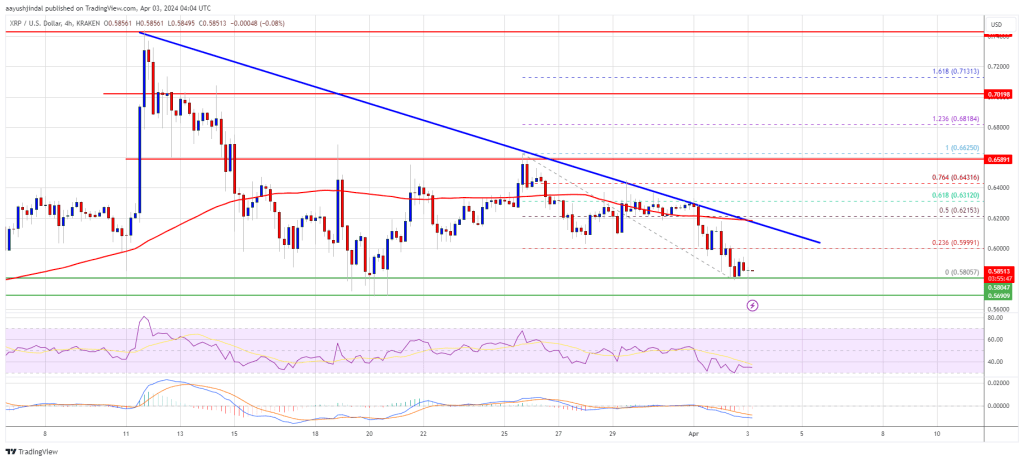

XRP price is struggling below $0.620. The price must stay above the $0.5680 support to attempt a fresh increase in the near term.

- XRP is slowly moving lower from the $0.6620 resistance zone.

- The price is now trading below $0.620 and the 100 simple moving average (4 hours).

- There is a major bearish trend line forming with resistance near $0.600 on the 4-hour chart of the XRP/USD pair (data source from Kraken).

- The pair could gain bearish momentum if there is a close below the $0.5680 support.

XRP Price Faces Many Hurdles

In the past few sessions, XRP price saw a steady decline from well above the $0.650 level. There was a drop below the $0.620 and $0.605 support levels, like Bitcoin and Ethereum.

The price tested the $0.580 support. A low was formed near $0.5805 and the price is now consolidating losses. There is also a major bearish trend line forming with resistance near $0.600 on the 4-hour chart of the XRP/USD pair.

Ripple’s token price is now trading below $0.620 and the 100 simple moving average (4 hours). On the upside, immediate resistance is near the $0.600 zone and the trend line. It is close to the 23.6% Fib retracement level of the downward wave from the $0.6625 swing high to the $0.5805 low.

The next key resistance is near $0.620. It is close to the 50% Fib retracement level of the downward wave from the $0.6625 swing high to the $0.5805 low. A close above the $0.6250 resistance zone could spark a strong increase. The next key resistance is near $0.6620.

Source: XRPUSD on TradingView.com

If the bulls remain in action above the $0.6620 resistance level, there could be a rally toward the $0.680 resistance. Any more gains might send the price toward the $0.700 resistance.

More Losses?

If XRP fails to clear the $0.600 resistance zone, it could start another decline. Initial support on the downside is near the $0.580 zone.

The next major support is at $0.5680. If there is a downside break and a close below the $0.5680 level, the price might accelerate lower. In the stated case, the price could retest the $0.5250 support zone.

Technical Indicators

4-Hours MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

4-Hours RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $0.580, $0.5680, and $0.5250.

Major Resistance Levels – $0.600, $0.6250, and $0.6620.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Hokkoku Bank Launches Tochika, Japan’s First Deposit-Backed Stablecoin

Hokkoku Bank, a regional financial institution in the Ishikawa prefecture, launched Tochika, Japan’s first deposit-backed stablecoin. Customers of the bank will be able to purchase the currency using Tochitsuka, an app developed by Digital Platformer, that previously allowed users to earn points from city services. Hokkoku Bank Reaches Milestone With Deposit-Backed Stablecoin Tochika Hokkoku Bank […]

Hokkoku Bank, a regional financial institution in the Ishikawa prefecture, launched Tochika, Japan’s first deposit-backed stablecoin. Customers of the bank will be able to purchase the currency using Tochitsuka, an app developed by Digital Platformer, that previously allowed users to earn points from city services. Hokkoku Bank Reaches Milestone With Deposit-Backed Stablecoin Tochika Hokkoku Bank […]

Source link