Following the debut of the Dencun upgrade and Ethereum blobs, enthusiasts have devised methods to embed data akin to how Ordinal inscriptions operate. Since this development, inscription-based activities now account for over 40% of blob transactions, leading to a significant increase in network activity. This uptick has resulted in a congestion of blob transactions, pushing […]

Following the debut of the Dencun upgrade and Ethereum blobs, enthusiasts have devised methods to embed data akin to how Ordinal inscriptions operate. Since this development, inscription-based activities now account for over 40% of blob transactions, leading to a significant increase in network activity. This uptick has resulted in a congestion of blob transactions, pushing […]

Source link

CoinNews

TRON DAO Reveals Exciting Updates to Sponsor and Judge List for HackaTRON Season 6

Geneva, Switzerland, March 28, 2024 – HackaTRON Season 6, co-hosted between TRON DAO, HTX DAO, BitTorrent Chain, and JustLend DAO, introduces an exciting lineup of new sponsors, partners, and judges.

Showcasing HackaTRON Sponsors

Diamond Sponsors:

Ankr: Specializing in decentralized infrastructure services for DApp development, Ankr supports the seamless integration and deployment of blockchain applications.

ChainGPT: Platform that merges the power of AI with blockchain to significantly enhance Web3’s accessibility and efficiency. Contributing to the discerning panel of judges, ChainGPT introduces:

Ilan Rakhmanov, Founder & CEO: A visionary entrepreneur with a knack for blending coding, compliance, and business to guide ChainGPT’s strategic direction.

Sharon Sciammas, CMO: Armed with vast tech marketing knowledge, Sharon aims to broaden the event’s impact and participant engagement.

Max Martinez, Advisor: With his expertise in AI, FinTech, Blockchain, and Web3, Max offers invaluable insights into product strategy and innovation.

AI-Tech Solidius: A champion of eco-friendly computing and a marketplace linking AI and blockchain, emphasizing sustainable tech development. Joining the judge lineup from AI-Tech Solidius are:

Paul Farhi, Founder & CEO: Leading with a vision for integrating AI within blockchain, driving the future of decentralized technologies.

Talha Tayyab, Marketing Manager: Brings strategic marketing insights to highlight innovative solutions and engage the global community.

Adrian Stoica, Founder and Head of Technology and Development: Offers a deep tech perspective to evaluate the technical robustness of projects.

Platinum Sponsor:

Kima: A decentralized protocol for blockchain-based money transfers, enabling interchain transactions and accessibility for any user across any blockchain. It promotes an innovative approach to liquidity management and transaction assurance, ensuring seamless and secure transfers every time.

Gold Sponsor:

GT-Protocol: As our Gold Sponsor, GT-Protocol revolutionizes DeFi with its suite of decentralized tools aimed at enhancing efficiency and transparency. Embracing the core values of open finance, GT-Protocol brings to the judge’s table:

Balaban Vladyslav, Co-founder: A fervent blockchain advocate, investor, entrepreneur, futurist, and the driving force behind GT Protocol’s innovative vision.

Celebrating Strategic Partnerships and Industry Experts

HackaTRON Season 6’s innovation and integrity are amplified by the diverse expertise of our partners and their distinguished judges:

Huawei Cloud: Represented by Bian Wenchao, who is spearheading the charge towards a vibrant Web3 ecosystem.

Blockchain.com: Matt Arney, leading business development, brings a dynamic approach to fostering startup growth within the blockchain space.

ChainSecurity: Pietro Carta, a Blockchain Security Engineer known for identifying and mitigating critical vulnerabilities in blockchain infrastructures.

ChainAnalysis: Pablo Navarro, Technical PMM & Developer Marketing, combines his Web3 experience with offensive security to enhance blockchain safety.

Nansen: Edward Wilson, Social Media Manager, offering insights into on-chain data and DeFi from a user experience perspective.

Into The Block: Nicolas Contasti, Head of Sales & Business Development, shares his rich experience from transforming today’s financial services industry through blockchain and crypto innovations.

CryptoQuant: Ben Sizelove, Senior Data Consultant, represents CryptoQuant’s commitment to providing top-notch on-chain and market data analytics.

CryptoRank: Sergei Zubakov, a chief analyst with deep expertise in the DeFi sector, adds a layer of analytical prowess to the event.

Arkham: Alexander Lerangis, Head of Business Development, focuses on leading Arkham’s partnerships, branding, and growth initiatives.

Unprecedented Prize Pool and Community Engagement

With up to $650,000* in prizes, including $500,000 in TRX, TRON network’s native utility token, and $150,000 in energy, which can be used to subsidize transactions and smart contract interactions on the TRON network. HackaTRON Season 6 invites developers to demonstrate their skills and contribute to the ecosystem’s growth. View HackaTRON Season 6 for more details.

*All prizes are issued in TRX or TRON network Energy, not USD, restrictions applied. All contest rules can be viewed here:

About TRON DAO

TRON DAO is a community-governed DAO dedicated to accelerating the decentralization of the internet via blockchain technology and dApps.

Founded in September 2017 by H.E. Justin Sun, the TRON network has continued to deliver impressive achievements since MainNet launch in May 2018. July 2018 also marked the ecosystem integration of BitTorrent, a pioneer in decentralized Web3 services boasting over 100 million monthly active users. The TRON network has gained incredible traction in recent years. As of March 2023, it has over 217.61 million total user accounts on the blockchain, more than 7.27 billion total transactions, and over $25.91 billion in total value locked (TVL), as reported on TRONSCAN.

In addition, TRON hosts the largest circulating supply of USD Tether (USDT) stablecoin across the globe, overtaking USDT on Ethereum since April 2021. The TRON network completed full decentralization in December 2021 and is now a community-governed DAO. Most recently in October 2022, TRON was designated as the national blockchain for the Commonwealth of Dominica, which marks the first time a major public blockchain partnered with a sovereign nation to develop its national blockchain infrastructure. On top of the government’s endorsement to issue Dominica Coin (“DMC”), a blockchain-based fan token to help promote Dominica’s global fanfare, seven existing TRON-based tokens – TRX, BTT, NFT, JST, USDD, USDT, TUSD, have been granted statutory status as authorized digital currency and medium of exchange in the country.

TRONNetwork | TRONDAO | Twitter | YouTube | Telegram | Discord | Reddit | GitHub | Medium | Forum

Media Contact

Hayward Wong

press@tron.network

The post TRON DAO Reveals Exciting Updates to Sponsor and Judge List for HackaTRON Season 6 appeared first on CryptoSlate.

In a new development, VeChain (VET) has announced the introduction of its latest No-Code Tokenized Asset Marketplace-as-a-Service platform (MaaS), fueling optimism within the community of an impendent price uptick.

The announcement also featured the collaboration of the MotoGP racing team Gresini Racing as its first enterprise client. By collaborating with Gresini Racing, an enormous fan base will be offered digital collectibles through the MaaS platform.

VeChain To Onboard A Rapid Tokenizing World

With the launch of its No-Code Tokenized Asset Marketplace (MaaS) platform, VeChain has made tremendous progress toward increasing mass adoption of blockchain technology. VeChain’s continuous goal to promote widespread blockchain technology adoption by removing technological hurdles is consistent with this user-friendly strategy.

Since its founding, VeChain has created several use cases powered by blockchain applications. These include product authentification, creating new digital communication channels, provenance and sustainability traceability, and others. This demonstrates its understanding of the tremendous potential that its technologies have for Web 3.

Given the rise in demand for tokenizing Real-World assets (RWAs) solutions, the introduction of MaaS seems appropriate. Furthermore, NFC functionality and support for “Phygitals,” or real-world physical assets with NFT/digital counterparts, will be added later in the platform.

Specifically, this innovation was created to significantly influence the digital asset market. It aims to provide enterprise and individual builders with an “easy-to-use white-label NFT platform for digital asset sales” and transfers that require little to no programming.

MaaS applications are diverse and address the increasing need for platforms that enable asset tokenization. Blackrock‘s latest application for a Real World Asset (RWA) tokenization fund highlighted this path. So far, the No-Code Tokenized Asset Marketplace-as-a-Service platform (MaaS) is expected to be fully operational later this year.

VET Is On A Downtrend

Despite the launch of MaaS, VeChain (VET) is witnessing a daily downtrend of nearly 2%. However, in the weekly timeframe, the crypto asset has increased by over 5%, suggesting an upward move.

As of the time of writing, VET was trading at $0.0440, with its market cap dropping by 2.78% in the past day. Meanwhile, its trading volume is down by about 24% in the last 24 hours.

In August 2018, during a downside trend in the cryptocurrency market, VET made its market debut. However, following the 2021 bull run, VET rose to the top, peaking at $0.281 before the cycle ended.

Featured image from Shutterstock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

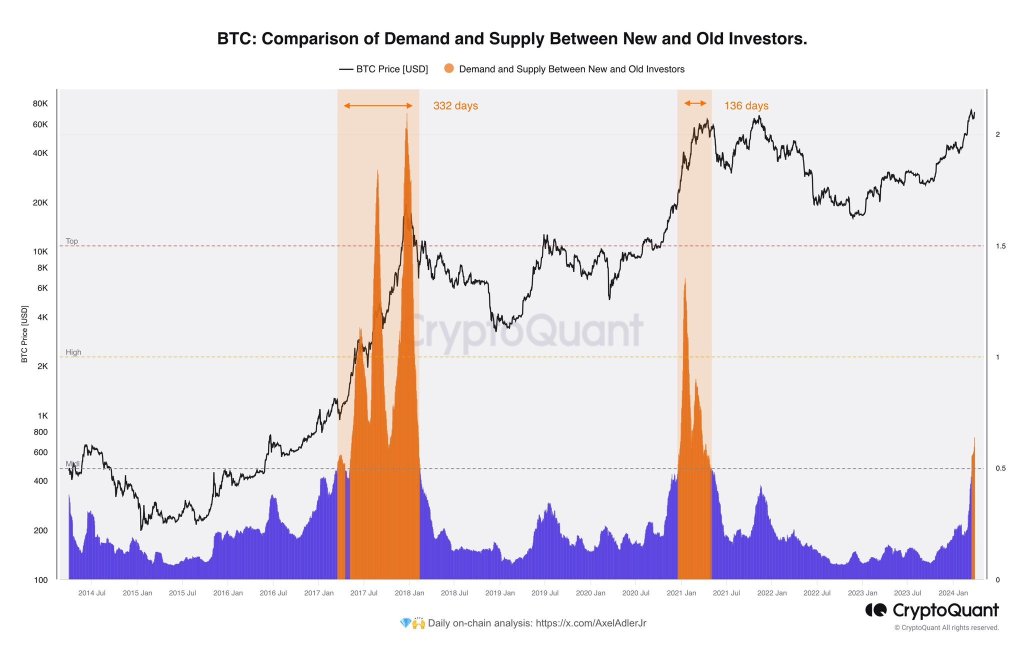

Are Old Bitcoin Whales Selling Or Mitigating Risks Using Spot BTC ETFs?

Ki Young Ju, the founder of CryptoQuant, a blockchain analytics firm, has noticed a curious trend. In a post on X, the founder shared a snapshot suggesting that Bitcoin “old whales” might be shifting their holdings to “new whales,” mainly traditional finance heavyweights like Fidelity and BlackRock.

The United States Securities and Exchange Commission (SEC) recently approved these new whales to list spot Bitcoin exchange-traded funds (ETFs) for all investors.

“Old Whales” Moving Coins: Selling Or Risk Mitigation?

While a definitive sell-off isn’t confirmed, commentators replying to the founder’s post believe these “old whales” could be mitigating risk. In their assessment, moving their Bitcoin stash from self-custody to a regulated investment vehicle like spot Bitcoin ETFs is a better measure of covering unexpected eventualities.

If this is the approach, then it could prove strategic. Bitcoin holders can transact without depending on a third party. Notably, this development coincides with a significant drop in BTC inventory on major exchanges like Coinbase and Binance, as well as at GBTC.

The decline has accelerated since the introduction of spot Bitcoin ETFs, hinting at a potential departure from exchanges. Meanwhile, the operators of GBTC are unwinding the product and converting it to a spot Bitcoin ETF following a court decision.

Will Spot BTC ETFs Gain Traction?

Even so, that “old whales” are moving their coins to centralized products like ETFs contradicts the core philosophy of BTC as a tool for financial self-sovereignty. Whether more users, mainly retailers, will choose to own spot Bitcoin ETF shares rather than the underlying coins directly remains to be seen.

Institutions might be obliged by law to use a regulated product if they need to be exposed to BTC. However, retailers can choose to buy directly from exchanges or mine. This freedom might lead to more retailers opting to buy BTC.

This trend emerges ahead of the highly anticipated Bitcoin halving. This event is set for mid-April 2024 and will further reduce BTC’s circulating supply, potentially driving higher prices. Before then, BTC prices are firm, steady above $70,000 at the time of writing.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Former FTX CEO Sam Bankman-Fried sentenced to 25 years in landmark fraud case

Sam Bankman-Fried, the former CEO of FTX, was sentenced to 25 years in jail today in a packed courtroom, marking a significant moment in the legal scrutiny of the crypto industry. He will be 57 years old when he is released. The sentencing, as detailed by Inner City Press, comes after a series of legal proceedings that shed light on the complexities and potential vulnerabilities within the digital asset space.

Bankman-Fried, dressed in a light brown jail uniform from MDC-Brooklyn, faced the judgment of Judge Lewis A. Kaplan, who, after considering the pre-sentence report and the guidelines disputes, delivered a sentence that reflects the gravity of the crimes committed. The courtroom, filled with prosecutors, defense lawyers, and an FBI agent, bore witness to the culmination of a case that has been closely followed by both the crypto community and the general public.

The legal proceedings highlighted the extensive financial losses incurred by investors, lenders, and customers, with Judge Kaplan rejecting the defense’s argument about the loss amount. The court found that investors lost $1.7 billion, lenders lost $1.3 billion, and customers faced an $8 billion shortfall. These figures underscore the scale of the fraud and the impact on the victims involved.

The defense had previously sought leniency, citing Bankman-Fried’s autism diagnosis and arguing for a reduced sentence of 63 to 78 months. However, the prosecution argued for a substantial prison term of 50 years.

Judge Kaplan’s decision to vary downward from the Guidelines range while still acknowledging the significant number of victims and the use of sophisticated means emphasizes the complexity of sentencing in cases involving emerging technologies and financial structures. The finding of obstruction of justice, including attempted witness tampering and perjury, further emphasized the deliberate actions taken by Bankman-Fried to mislead and defraud.

Human cost of FTX collapse

During the sentencing hearing, a poignant moment unfolded as victims were given the opportunity to address the court. One such victim, Sunil Kavuri, who traveled from London specifically for this purpose, shared his experiences and the impact of the FTX collapse on him and others. Kavuri highlighted the ongoing struggles faced by victims, challenging the narrative that the loss was zero and criticizing the handling of the bankruptcy estate. He pointed out the significant discrepancies in the valuation and sale of assets, including a token that significantly appreciated in value after being sold at a discount and the sale of Solana tokens at a 70% discount.

Kavuri’s testimony underscored the real and continuing harm suffered by those affected, including the tragic note that at least three individuals had committed suicide as a result of the fraud. Judge Kaplan acknowledged Kavuri’s points, reinforcing the gravity of the situation and the inaccuracies in claims that customers would be made whole. This victim’s statement added a deeply personal dimension to the proceedings, emphasizing the human cost of financial crimes and the need for accountability beyond the sentencing of Bankman-Fried.

SBF lawyer describes him as ‘misunderstood’

In a heartfelt defense of his client, Sam Bankman-Fried’s attorney, Mark Mukasey, presented a contrasting image of the former FTX CEO to the court. Mukasey argued that Bankman-Fried’s actions, while resulting in significant financial fallout, were not driven by the same malice or predatory intent that characterized other high-profile financial criminals, such as those who stole from Holocaust survivors. He emphasized that Bankman-Fried was not a “ruthless financial serial killer” but rather someone who made decisions based on mathematical calculations, not with the intention to cause personal pain.

Mukasey also relayed personal insights from Bankman-Fried’s mother, who described her son as misunderstood and not fitting the mold of a “greedy swindler.” According to Mukasey, Bankman-Fried did not abscond with funds but remained engaged until the end, with a genuine desire to see people repaid. This narrative was allowed to be presented in court partly due to Judge Kaplan’s decision to depart from the usual practice of enumerating the papers considered for sentencing, acknowledging the overwhelming volume of last-minute submissions from both the defense and the prosecution.

The defense’s portrayal of Bankman-Fried aimed to humanize him and differentiate his case from other financial frauds, suggesting that while the consequences of his actions were severe, his motivations were not inherently malicious. Mukasey’s statement also served as an acknowledgment of the victims’ suffering, expressing an understanding of their pain and a commitment to appeal, while maintaining respect for the jury’s verdict.

In a plea to the court, speaking directly Bankman-Fried admitted,

“I made a lot of mistakes. But that’s not how the story ended. Customers weren’t paid back. FTX didn’t survive that. Yeah, customers have been given conflicting claims. That’s caused a lot of damage. They could have been paid back.”

In a moment of candor, Sam Bankman-Fried expressed a somber reflection on his future, acknowledging the likelihood that his ability to contribute meaningfully to society may be irreparably diminished. He admitted to the court that his capacity to make an impact is severely limited by incarceration and that the length of his sentence, whether it be 5 or 40 years, is beyond his control. He stated,

“My useful life is probably over. I’ve long since given what I had to give. I can’t do it from prison.”

Bankman-Fried also addressed the perception of his actions, recognizing the stark contrast between his alleged intentions and how prosecutors, the court, and the media interpreted them. He also said he now expects customers to be repaid. He commented, “I think I failed at that. I’m not sure why, but I do think I did.” He also referred to a specific instance involving a text to the general counsel, which he claimed was an attempt to assist, though it was not viewed as such by others. Even on the day of his sentencing, Bankman-Fried continues to assert that he did not steal user funds maliciously.

However, in his judgment, Judge Kaplan asserted that he believed much of Bankman-Fried’s public rhetoric “was an act” designed to obtain power and influence.

According to Inner City Press, before the sentence was issued, the government argued,

“The defendant is not a monster but he committed gravely serious crimes that harmed many people – and he would consider doing it again. So, 40 to 50 years.”

In announcing the sentence, Judge Kaplan proclaimed that Bankman-Fried was nothing short of a “performer.”

“When not lying, he was evasive, hair splitting, trying to get the prosecutors to rephrase questions for him. I’ve been doing this job for close for 30 years. I’ve never seen a performance like that.”

His sentencing was reported by Inner City Press as follows,

“It is the judgment of the court that you are sentenced to 240 months then consecutive 60 [etc] for a total of 300 months [25 years].”

The implications of today’s sentencing extend beyond the immediate legal consequences for Bankman-Fried. They touch on broader questions about the regulation of digital assets, the protection of investors, and the future of digital asset markets. As the industry grapples with these challenges, the outcome of this case will likely influence discussions and decisions on how best to navigate the complex intersection of technology, finance, and law.

This article will be updated with additional details as they become available.

Mentioned in this article

Latest Alpha Market Report

Leading the downturn today, Fantom (FTM) contributes to the 2% drop in the crypto market after weeks of growth.

Fantom is one of those altcoins that followed the broader momentum of the market. The latest market data shows that the token is down 10% in the past 24 hours, but is still on the green in the bi-weekly timeframe at 14%. However, Fantom has a trick up its sleeve to curb this brewing bearishness potentially.

Fantom CEO Michael Kong Unveils Sonic Launch

Sonic is the brand-new technology that the Fantom has been developing in the past 2 years. According to their latest blog post, Sonic was able to surpass the network’s 200 transactions per second metric. Although 200 TPS was already impressive compared to Ethereum’s 12 TPS, the network was quickly congested, and user experience deteriorated.

Kong said in the blog post:

“Sonic will be used to create a new best-in-class shared sequencer for L1 and L2 chains, capable of processing over 180 million daily transactions with real, sub-second confirmation times, and serve as the foundation to relaunch Fantom as an entirely new community-centric brand.”

This brand-new tech will cover all parts of the Fantom network, from bridging to a stablecoin launch, Sonic has it all.

Sonic Labs will also gain a slice of the pie as the foundation ultimately adds grant programs alongside the network upgrades.

Bitcoin is now trading at $70.396. Chart: TradingView

“We will continue to significantly scale and accelerate our Sonic Labs grant program for developers who build unique and valuable applications and public goods in categories including gaming, DeFi, social media, streaming, and now distributed AI,” Kong added.

This will significantly increase the size of Fantom’s user base, boosting investor confidence, and giving more room for developers to innovate.

Furthermore, the advancements brought forth by Sonic Labs in covering all aspects of the Fantom network, from bridging to the launch of a stablecoin, are poised to have a notable impact on Fantom’s market dynamics.

By streamlining processes, enhancing interoperability, and introducing new functionalities, these developments are likely to enhance the network’s attractiveness to investors and users alike.

We are thrilled to announce the first of many angel investors that have joined our round!

Sam Kazemian (@samkazemian ) is the founder of @FraxFinance ✦, one of the largest DeFi protocols with over $1.6bn in assets such as sfrxETH and the FRAX stablecoin.

🌐 Frax is committed… pic.twitter.com/zSL1XFNHYR

— Fantom Foundation (@FantomFDN) March 27, 2024

The Fantom Foundation X account announced today that Frax Finance Founder Sam Kazemain is the first angel investor for Sonic, stating that Frax will deploy natively issued assets on Sonic on its eventual launch.

Short-Term Gains Slashed In Favor Of The Long-Term

Meanwhile, the bears have completely taken over the FTM market in the short to medium term. Investors in FTM could only hope that the broader market downturn will reverse in the coming weeks.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Miner Bitdeer Seeks $100 Million for Mining Capacity Expansion

Bitcoin miner Bitdeer is reportedly in discussions with private credit firms to secure $100 million in funding to expand its mining capacity. It is believed that the cryptocurrency miner has engaged a financial adviser to assist with the negotiations. Negotiations Between Bitdeer and Lenders Continue The cryptocurrency mining firm Bitdeer Technologies Group is reportedly seeking […]

Bitcoin miner Bitdeer is reportedly in discussions with private credit firms to secure $100 million in funding to expand its mining capacity. It is believed that the cryptocurrency miner has engaged a financial adviser to assist with the negotiations. Negotiations Between Bitdeer and Lenders Continue The cryptocurrency mining firm Bitdeer Technologies Group is reportedly seeking […]

Source link

Leonard Dorlochter, the co-founder of peaq, revealed that the layer-1 blockchain focused on decentralized physical infrastructure networks (DePINs) and Machine RWAs is gearing up for its mainnet launch and token offering in an exclusive statement to CryptoSlate.

“The mainnet launch will be a historic milestone for the project, the culmination of years’ worth of research and development, of collaborations with industry giants like Bosch.

Equally exciting is the fact that soon, we will begin to open peaq to the community through the upcoming token offering[…] these exciting events will take place over the next few weeks, they are closing in by the day.”

The announcement comes on the heels of peaq’s successful $15 million pre-launch funding round, led by Generative Ventures and Borderless Capital, with participation from a host of prominent Web3 investors. The substantial investment in peaq highlights the growing interest in the DePIN space, which Messari estimates could reach a market potential of $3.5 trillion by 2028.

While details about the token offering remain under wraps due to ongoing processes, Dorlochter confirmed that these events are set to unfold over the next few weeks. He also shared plans for a major campaign to support DePINs building on peaq, stating, “We are planning a major campaign to support the DePINs building on peaq and foster their adoption through a wide variety of gamified challenges with rewards to earn.”

peaq’s layer-1 blockchain is specifically designed to cater to the unique requirements of DePINs, offering crucial backend functions, a machine-centric economic model, and a supportive ecosystem. These features differentiate peaq from other networks, with the aim of positioning it as a leading player in the DePIN space.

The funding round follows a year of significant growth for peaq, which saw the onboarding of over 20 DePINs spanning various use cases, such as Silencio, ELOOP, and Wingbits. In 2023, peaq showcased its real-world applications through collaborations with industry leaders like Bosch and Fetch.ai, demonstrating the potential for DePINs to bridge the gap between Web3 and the physical world.

As the DePIN sector continues to gain traction, peaq’s upcoming mainnet launch and token offering hope to play a crucial role in driving the adoption and growth of decentralized physical infrastructure networks. The project’s focus on providing a robust, scalable, and interoperable platform for DePINs, coupled with its growing ecosystem and industry partnerships, positions it in the middle of a key narrative for this cycle.

🏡 Top IoT Crypto Assets

View All

Latest Alpha Market Report

Nigerian Central Bank Not in Charge of Crypto Regulation, Says Governor

According to the governor of the Central Bank of Nigeria, the Securities and Exchange Commission is responsible for regulating cryptocurrencies. However, the governor said the central bank will collaborate with law enforcement agencies and regulators overseeing the Nigerian crypto sector. The Central Bank’s Change of Heart In a surprise announcement, Yemi Cardoso, governor of the […]

According to the governor of the Central Bank of Nigeria, the Securities and Exchange Commission is responsible for regulating cryptocurrencies. However, the governor said the central bank will collaborate with law enforcement agencies and regulators overseeing the Nigerian crypto sector. The Central Bank’s Change of Heart In a surprise announcement, Yemi Cardoso, governor of the […]

Source link

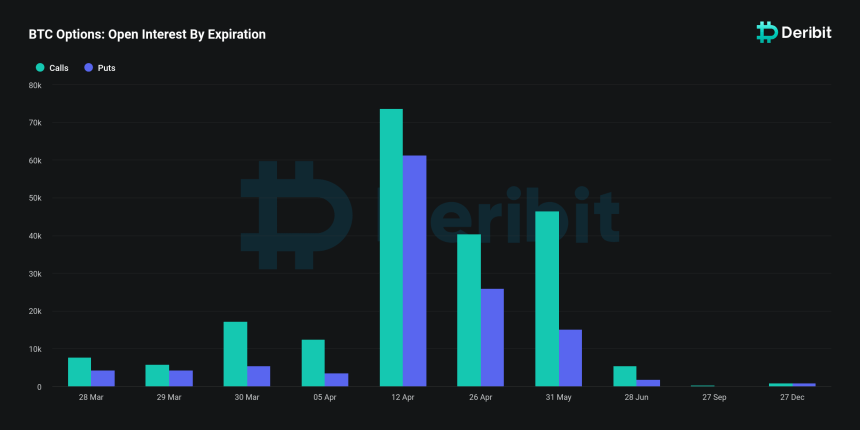

$9.5 Billion In Bitcoin Options Poised To Expire This Friday: Market Turbulence Ahead?

This Friday, the spotlight is turned to Deribit, the leading crypto derivatives exchange, as it gears up for a notable event in its trading history. Particularly, the exchange is poised to witness the expiration of over $9.5 billion in Bitcoin options open interest.

For context, Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not been settled or closed. It represents the number of contracts market participants hold at the end of each trading day.

This surge in open interest recorded by Deribit reflects increased market participation and signals heightened liquidity, marking a notable milestone in the crypto derivatives landscape.

Record-Breaking Open Interest

Notably, this event is significant in two ways: It underscores the growing interest in Bitcoin as an asset class and highlights the increasing “sophistication” of the cryptocurrency market. This is because Open interest can also serve as a critical indicator of market health and trader sentiment.

As such, the record levels of open interest set to expire on Deribit suggest a “vibrant” trading environment, with more investors engaging in complex financial instruments like options.

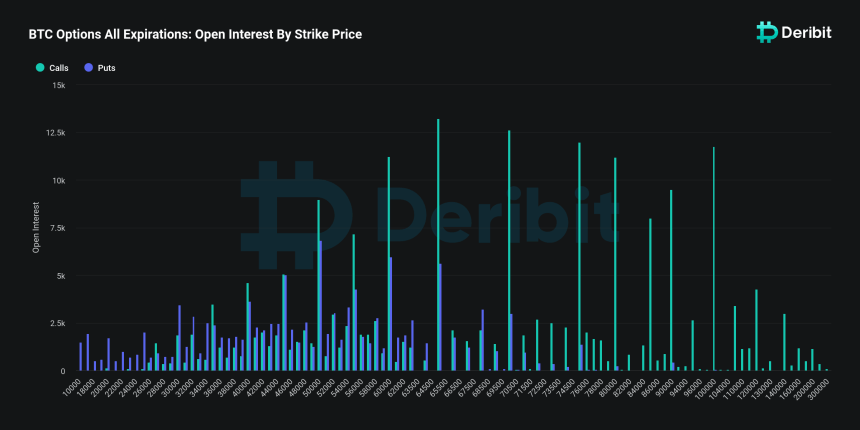

According to Deribit data, the exchange is set to host one of its largest option expiries ever, with $9.5 billion worth of Bitcoin options poised for expiry at the end of the month. This figure represents a substantial portion, approximately 40%, of the exchange’s total options open interest, which stands at $26.3 billion.

The magnitude of this expiry event eclipses previous months, with January and February end-of-month expiries totaling $3.74 billion and $3.72 billion, respectively. This trend indicates a large increase in market activity and investor engagement on the platform.

Implications Of The Bitcoin Expiry

The upcoming expiry has notable implications for the market, especially considering the current pricing dynamics of Bitcoin.

With Bitcoin’s spot price hovering below $70,000, an estimated $3.9 billion of the open interest is expected to expire “in the money,” according to Deribit analysts, presenting profitable opportunities for holders of these options contracts.

The “max pain” price, which represents the strike price at which the highest number of options would expire worthless, thereby causing the maximum financial loss to option holders, is identified at $50,000.

According to the analysts, this scenario suggests that a significant number of traders are positioned to benefit from the current market conditions, potentially leading to “increased buying activity” as these options are exercised.

Additionally, Deribit analysts speculate that the high level of “in-the-money expiries” could exert upward pressure on Bitcoin’s price or amplify market volatility. They added that as traders “hedge their positions” or “speculate on future price movements,” the market may witness a flurry of activity, impacting Bitcoin’s price trajectory in the short term.

This comes at a time when Bitcoin has experienced a slight retracement from its recent all-time high above $73,000, with the price adjusting to approximately $68,946, at the time of writing

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.