The smart contracts platform Avalanche recently said it is collaborating with the Chinese payments giant Alipay to launch a Web3-enabled voucher program. The second phase will see the proof of concept being expanded to more than 100 million users from Southeast Asian countries. Web3-Enabled Vouchers Avalanche, a smart contracts platform, has said it is working […]

The smart contracts platform Avalanche recently said it is collaborating with the Chinese payments giant Alipay to launch a Web3-enabled voucher program. The second phase will see the proof of concept being expanded to more than 100 million users from Southeast Asian countries. Web3-Enabled Vouchers Avalanche, a smart contracts platform, has said it is working […]

Source link

CoinNews

The U.S. Securities and Exchange Commission (SEC) has submitted its 2025 budget request, which will partly fund the securities watchdog’s efforts to regulate the crypto sector. “We’ve seen the Wild West of the crypto markets, rife with noncompliance,” SEC Chair Gary Gensler stressed. “As the cop on the beat, we must be able to meet […]

The U.S. Securities and Exchange Commission (SEC) has submitted its 2025 budget request, which will partly fund the securities watchdog’s efforts to regulate the crypto sector. “We’ve seen the Wild West of the crypto markets, rife with noncompliance,” SEC Chair Gary Gensler stressed. “As the cop on the beat, we must be able to meet […]

Source link

Solana Whale Makes Massive 1,000,000 SOL Deposit To Binance, Bearish Sign?

On-chain data shows a Solana whale has just moved a massive SOL stack to Binance, which could prove to be bearish for the asset’s price.

Solana Whale Has Deposited 1 Million SOL To Binance Today

According to data from the cryptocurrency transaction tracker service Whale Alert, several large SOL transactions have occurred on the blockchain during the past day.

More specifically, six massive transfers have been spotted on the network. Out of these, two transactions were gigantic, with tokens worth $362 million and $498 million involved.

These extraordinary transfers, though, were both between unknown wallets. Addresses like these are those unattached to any known centralized exchange, so they are usually the users’ personal, self-custodial wallets.

Due to this, transfers between unknown wallets are generally hard to say anything about. Often, they can be as simple as the investor moving to a fresh wallet, which is naturally of no particular consequence for the wider market.

The other four whale transactions from the past day, however, did involve central entities on one end, so speculation around them can have a bit more ground to stand on.

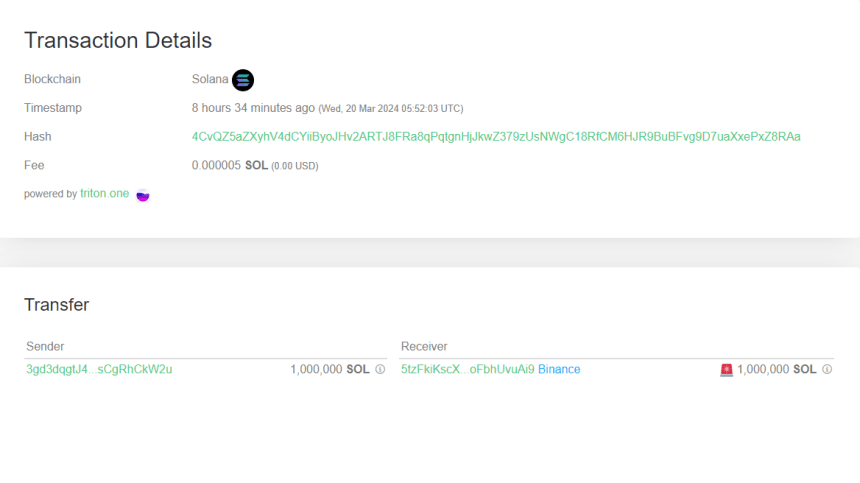

Out of these four, one transaction in particular stands out. In this move, a whale shifted 1 million SOL on the network, worth more than $166 million at the transfer time. Below are some additional details regarding this transfer.

Looks like this massive move only required a negligible fee of 0.000005 SOL to go through | Source: Whale Alert

As is visible, the receiver in the case of this transaction was a wallet affiliated with the cryptocurrency exchange Binance, implying that the whale transferred coins from their address to the platform.

Such transactions are known as exchange inflows. Users make these transfers when they want to use one of the exchange services, which can include selling.

As such, exchange inflows may sometimes be bearish for the cryptocurrency. In particular, massive inflows made by the whales can exert some visible fluctuations on the market.

Just like this huge SOL transfer, the other three transactions mentioned before were also exchange inflows. They were significantly smaller in scale, though, with their average value being $33.2 million.

Two of these transactions also went to Binance, while the third (and the latest) headed to Coinbase. Interestingly, the address pairs in these two Binance transfers were the same, hinting that the same whale may have been responsible for them.

With the four exchange inflows, Solana, worth $265.6 million, has now found its way to exchanges. This is clearly a notable amount, so it may impact the asset’s price.

There is no guarantee, however, that any of the whales involved made these transactions for selling; it’s possible that they made the moves for some other purpose that’s not directly relevant to the market.

Although Solana has been sliding off over the past few days, the possibility of these whales deciding to exit certainly exists.

SOL Price

Following the recent drawdown Solana has seen, the asset’s price has come down to the $174 level.

The price of the asset appears to have gone through some drawdown recently | Source: SOLUSD on TradingView

Featured image from Rod Long on Unsplash.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Sam Bankman-Fried’s Defense Challenges ‘Super-Villain’ Narrative in Sentencing Debate

In a detailed letter to Judge Lewis Kaplan, the legal representatives for Sam Bankman-Fried, the embattled founder of cryptocurrency exchange FTX, have vehemently argued against the government’s recommendation for a 50-year prison sentence, labeling it as a “medieval view of punishment.” Legal Team Contests Proposed 50-Year Sentence for Sam Bankman-Fried as Unjust and Excessive In […]

In a detailed letter to Judge Lewis Kaplan, the legal representatives for Sam Bankman-Fried, the embattled founder of cryptocurrency exchange FTX, have vehemently argued against the government’s recommendation for a 50-year prison sentence, labeling it as a “medieval view of punishment.” Legal Team Contests Proposed 50-Year Sentence for Sam Bankman-Fried as Unjust and Excessive In […]

Source link

Bitcoin remains under pressure when writing and is within a bearish formation following sharp losses on March 19. While prices tank, one analyst on X thinks this retracement aligns with historical performance, especially as the network prepares to slash miner rewards in April 2024.

Bitcoin Retracement Similar To Pre-Halving Cool-Off Of 2020

Based on the analyst’s assessment, BTC is currently down roughly 18% from its recent swing high. This retracement is at the same level as the ballpark 19% decline observed before the previous halving event in 2020.

It’s worth noting that Bitcoin has historically corrected lower after posting fresh highs before halving. Afterward, the coin rallies to fresh all-time highs following halving, driven by a decrease in supply. In this cycle, BTC soared to a new all-time high of $73,800 in the first two weeks of March before cooling off to spot rate, a deviation from the usual trend.

As the Bitcoin network gears up for the halving event in mid-April 2024, it’s crucial to note the potential market implications. Some market observers speculate that the current drop could offer entries for investors looking to accumulate at a lower price in anticipation of future price gains.

From the Bitcoin candlestick arrangement in the daily chart, the least resistance path appears southwards. Specifically, following the dip on March 19, the coin remains in a bearish breakout pattern, finding strong rejections from the middle Bollinger Band (BB) or the 20-day moving average. The BB is a technical indicator for gauging volatility.

Will The Federal Reserve Revive BTC Demand?

Currently, Bitcoin is steady. Even so, only time will tell whether prices will recover, breaking above the $70,000 level in the days leading up to the halving event in less than a month. Further losses from spot rates mean the dip before halving and after the pre-halving rally was much sharper than in 2020.

As history clearly shows, halving is an important event in Bitcoin. It has repeatedly proven to be a major price catalyst for Bitcoin, as seen in the last bull cycle when prices rose to roughly $70,000.

Accordingly, the coming days will shape how Bitcoin prices evolve in the medium to long term. One key driver of crypto and BTC valuation will be fundamental events, especially pronouncements from the United States Federal Reserve (Fed). The central bank will relay its decision on interest rates on March 20. Earlier in 2022, when interest rates were hiked, prices tanked.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Celsius looks to recover $2 billion withdrawn by 2% of accounts during its collapse

Bankrupt crypto lender Celsius Network is seeking the return of over $2 billion withdrawn by major customers shortly before its bankruptcy declaration in July 2022, according to a release shared with CryptoSlate.

The initiative, led by a committee appointed during the company’s Chapter 11 proceedings, is part of the firm’s restructuring efforts and targets individuals who extracted large sums from the crypto platform to mitigate potential legal confrontations and ensure the remaining assets are distributed fairly among creditors.

Favorable rate

The efforts are specifically aimed at accounts that withdrew more than $100,000 during the critical period leading up to the company’s bankruptcy filing. Such a collective action intends to replenish the funds available to repay the creditors left behind.

The withdrawals have raised concerns due to their preferential nature, as they benefited a small percentage of users at the cost of the wider Celsius customer base.

The committee said it is prepared to contact these customers directly, offering them an opportunity to settle at a “favorable rate” to avoid potential litigation.

A Litigation Administrator appointed by Celsius will focus on a select group of customers who collectively withdrew more than $2 billion from the platform during the 90 days leading up to its bankruptcy filing, a period now referred to as the Preference Period.

2% of accounts

This move is set to impact only about 2% of Celsius users, who are responsible for withdrawing approximately 40% of the platform’s assets within the 90 days preceding the bankruptcy declaration.

Celsius bankruptcy filings show the firm held around $6 billion in assets before its collapse — with a user base comprising 1.7 million registered and 300,000 active users, each with account balances exceeding $100.

The legal framework of bankruptcy law enables entities like Celsius to reclaim funds dispensed just before filing for bankruptcy, irrespective of the recipients’ innocence. This provision aims to ensure fair treatment for all creditors, preventing those who withdrew funds prematurely from gaining an advantage over those who did not.

Cam Crews, a member of the Litigation Oversight Committee (LOC), an independent committee the Bankruptcy Court approved to oversee the Litigation Administrator’s efforts and other related activities, emphasized the settlement offer’s intention.

Crews said:

“This offer aims to correct the imbalances caused in the days before our bankruptcy filing. It presents an opportunity for those who disproportionately benefited to contribute to the relief of the creditors who were most affected.”

The settlement strategy aims to simplify the recovery process and offers a practical alternative to the potential complexities of litigation. Account holders who opt for the settlement can return a part of the assets they withdrew, which have since increased in value, rather than the original amount.

Mentioned in this article

Latest Alpha Market Report

PRESS RELEASE. Solama, a new meme coin developed on the Solana network, will soon get listed on one more centralized crypto exchange: HTX (formerly known as Huobi Global). The announcement was made on March 18, 2024, on Solama’s official X (Twitter) account. Growth Has No Boundaries Solama, one of the most promising Solana-based meme coins […]

PRESS RELEASE. Solama, a new meme coin developed on the Solana network, will soon get listed on one more centralized crypto exchange: HTX (formerly known as Huobi Global). The announcement was made on March 18, 2024, on Solama’s official X (Twitter) account. Growth Has No Boundaries Solama, one of the most promising Solana-based meme coins […]

Source link

Despite concerns about the XRP price performance in this market cycle, this crypto expert has elaborated on why he believes the crypto token will still record significant gains. He even predicts that XRP could rise to as high as $10.

Why XRP Price Could Rise To As High As $10

Nick, the founder of Web3Alert, mentioned in an X (formerly Twitter) post that his price range for XRP in this market cycle is between $5 and $10. According to him, this is possible considering that there are predictions that ETH will rise to between $7,500 and $10,000 and Bitcoin will rise to between $100,000 and $150,000.

Nick noted that the XRP price rising to between $5 and $10 would put its market cap at $500 billion and 1 trillion, respectively. That puts the crypto token’s market cap in a similar category to that of Bitcoin and Ethereum, which could be valued as high as $2.9 trillion and $1.2 trillion if their price predictions are fully actualized.

In other words, Nick argues that XRP hitting these prices is not farfetched since there is still much room for growth for the two largest crypto tokens by market cap, Bitcoin and Ethereum. As those two tokens continue to increase in price, he expects XRP to follow suit. Interestingly, he opined that his XRP prediction is “conservative,” suggesting XRP could go way higher.

Following Nick’s assertion, another X user remarked that comparing XRP to Bitcoin and Ethereum seemed out of place since BTC and ETH’s price prediction is just a 2x, unlike XRP, which will need to see a 10x in its price to hit those targets. Nick responded that this simply shows that XRP is undervalued and presents a great ROI opportunity in this cycle.

The Belief In XRP’s Potential

Nick joins a list of crypto analysts who have expressed optimism about XRP’s potential in this market cycle despite its underperformance to start this bull run. Crypto expert Zach Rector also recently shared his belief and gave reasons why XRP is still bound to perform well in this bull market.

Although he didn’t give any price prediction, he alluded to XRP’s fundamentals as one reason why he holds this belief. Meanwhile, technical analysts like Egrag Crypto have also made bullish price predictions for XRP heading into this market cycle. Egrag has even gone as far as suggesting that the XRP price could rise to as high as $27 at the peak of this bull run.

At the time of writing, the XRP price is trading at around $0.58, down over 3% in the last 24 hours, according to data from CoinMarketCap.

Token price retests $0.6 | Source: XRPUSDT on Tradingview.com

Featured image from Coingape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Sybil attack concerns spark controversy for EtherFi airdropped ETHFI token

Liquid restaking platform EtherFi’s ETHFI token has faced considerable struggles since its airdrop, partly due to one of its early investors selling their airdropped tokens.

Blockchain analytical firm Nansen reported how Arrington XRP Capital, one of EtherFi’s investors, allegedly may have gamed EtherFi’s airdrop process for personal profit.

Arrington ‘sybils’ EtherFi

Nansen’s findings reveal that Arrington XRP Capital staked 5,000 ETH across ten separate wallets, each containing 500 ETH. This move allowed the firm to claim the ETHFI airdrop from ten separate wallets, amassing 200,498 ETHFI tokens.

Subsequently, all the airdropped tokens were transferred to the Binance crypto exchange, suggesting the firm might have divested its holdings.

Such maneuvers, known as Sybil attacks, are usually frowned upon in the industry as they enable individuals to manipulate a network by utilizing multiple identities and potentially circumventing vesting schedules.

Several community members, including blockchain sleuth ZachXBT, immediately voiced concerns about Arrington XRP Capital’s actions while highlighting the unfair advantages the project gained.

Since the March 18 airdrop, ETHFI’s price has faced considerable sell-pressure, declining by more than 32% within the last three days to as low as $2.83 before rebounding to $3.24 as of press time, according to CoinMarketCap data.

EtherFi and Arrington defend action.

EtherFi’s team defended Arrington’s action, asserting that the investment firm duly informed it about the multiple wallet staking strategy.

According to EtherFi, Arrington belonged to the top-tier staker category, with a linear distribution model in place. Consequently, the multiple wallets did not equate to the firm garnering additional points.

The project added:

“These assets, including the ETHFI tokens is a very small percentage of their position and it’s part of their liquid fund which is actively traded, and that is the reason the assets were moved to Binance.”

Despite this explanation, some community members remained skeptical, suggesting that Arrington’s maneuver might have been a means to bypass the three-month vesting period applicable to wallets holding over 25,000 ETHFI tokens.

In response, EtherFi stated that Arrington was unaware of the vesting period, as the decision was made shortly before the airdrop.

Meanwhile, Arrington Capital also denied Sybil attacking EtherFi, saying:

“This was not a sybil attack and did not take advantage of the protocol’s distribution methodology. Because each account was over a minimum threshold in value, the airdrop distribution was linear. This means that the total number of ETHFI tokens airdropped to our wallets is the same as if all the eETH was in one wallet.”

It further explained that it only sold a small percentage of its ETHFI allocation, amounting to just $700,000, representing a tiny percentage of its overall position in the project.

Mentioned in this article

Latest Alpha Market Report

Zone, a Nigerian payment fintech startup that leverages the blockchain, recently raised $8.5 million in a seed funding round. An undisclosed portion of the funds will be allocated to cover costs associated with the trial of Zone’s cross-border payment capabilities in 2025. Zone to Expand Its Payment Infrastructure Zone, a blockchain-based Nigerian payments startup, has […]

Zone, a Nigerian payment fintech startup that leverages the blockchain, recently raised $8.5 million in a seed funding round. An undisclosed portion of the funds will be allocated to cover costs associated with the trial of Zone’s cross-border payment capabilities in 2025. Zone to Expand Its Payment Infrastructure Zone, a blockchain-based Nigerian payments startup, has […]

Source link