ceτi AI, a pioneering decentralized artificial intelligence infrastructure provider, is thrilled to announce the successful launch of its CETI token. Founded by a team of visionaries led by Dennis Jarvis (formerly of Bitcoin.com and Apple), ceτi AI is on a mission to democratize access to AI by building a globally distributed, high-performance, intelligent, and scalable […]

ceτi AI, a pioneering decentralized artificial intelligence infrastructure provider, is thrilled to announce the successful launch of its CETI token. Founded by a team of visionaries led by Dennis Jarvis (formerly of Bitcoin.com and Apple), ceτi AI is on a mission to democratize access to AI by building a globally distributed, high-performance, intelligent, and scalable […]

Source link

CoinNews

Cosmos DeFi boosted as ‘rivals’ Osmosis and Astroport collaborate on programmable liquidity pools

Cosmos-based decentralized exchange Astroport is set to deploy its passive concentrated liquidity (PCL) pools on Osmosis, the largest Cosmos-based DEX by volume, following successful governance votes on both platforms. This move marks an alignment between two of the most active DEXes in the Cosmos ecosystem, aiming to improve the overall trading experience and capital efficiency for users.

PCL pools, which aim to provide the benefits of concentrated liquidity without requiring active management, will be offered alongside Osmosis’s existing “supercharged liquidity” pools. Astroport’s pools utilize an advanced repegging algorithm that automatically concentrates liquidity around the exponential moving average of ongoing trades. As Astroport core dev Andre Sardo explained,

“With PCL pools, you go and LP in a pool, and you can leave your tokens there for days, months or years, and have it automatically adjust to market conditions. Impermanent loss gets minimized, and fees get maximized.

And because your liquidity is passive, it’s truly programmable or composable. It can be tapped by apps and vaults and aggregators anywhere in the Cosmos.”

The deployment of Astroport’s PCL pools on Osmosis is expected to benefit both protocols. Standard PCL pool fees will flow back to xASTRO stakers, while all trades routed through Astroport’s PCL pools on Osmosis will generate a 0.1% fee for Osmosis, to be split between the Osmosis community pool and the OSMO staking pool. This move is anticipated to expand Astroport’s reach, grow its global trading volume and fee generation, and attract more passive liquidity to Osmosis.

Sunny Aggarwal, Co-Founder of Osmosis Labs, predicted the move could lead to record volumes within the first month.

“Competition is good, but aligning for the benefit of the greater community is even better — so it’s very exciting to see Astroport and Osmosis joining forces here… Only time will tell, but I predict that the Astroport deployment on Osmosis will become one of the biggest by volume within a month or so of the launch.”

While supercharged liquidity and PCL pools may appear to be competitors, the teams believe they are better viewed as complementary offerings catering to different types of LPs. Supercharged liquidity pools are best optimized by professional market makers and active LPs who run their own algorithms and programmatically readjust their liquidity to match market conditions. In contrast, PCL pools cater to more casual LPs who prefer a “deposit and chill” approach, according to the teams, allowing the pool’s algorithm to concentrate their liquidity automatically.

According to Jose Maria Macedo, Founder and CEO of Delphi Labs, this alignment between Astroport and Osmosis is a significant development in the Cosmos ecosystem. Macedo stated,

“It’s two massive DEXes that outsiders look at as rivals coming together and assimilating. And they’re doing it in ways that benefit both protocols. They’re leaning into their strengths and combining to improve liquidity for the entire Cosmos ecosystem.”

Further, Astroport core developer Donovan Solms highlighted the portability of Astroport’s codebase, comparing it to a “magic suitcase” that can be deployed on any Cosmos chain. Solms explained,

“We can go wherever there’s a need for liquidity in the Cosmos. And thanks to IBC, each deployment is interconnected. It’s part of a bigger whole, which is this backend layer of truly passive, truly infinite liquidity.”

Preparations for the deployment are underway, with PCL pools expected to go live on Osmosis in the coming weeks. This historic alignment between Astroport and Osmosis is poised to improve capital efficiency for those who swap or have trades routed through Osmosis while also potentially “defragmenting” liquidity spread across other automated market makers throughout the Cosmos ecosystem.

Mentioned in this article

Latest Alpha Market Report

TRON integrated with Amazon Web Services to Accelerate Blockchain Adoption

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

The smart contract platform, Monad Labs is in talks to raise over $200 million via a funding round that is likely to be led by venture capital firm Paradigm. A successful funding round will see Monad Labs’ valuation rocket to $3 billion. Monad Labs Building Platform to Challenge Ethereum Monad Labs, a smart contract platform, […]

The smart contract platform, Monad Labs is in talks to raise over $200 million via a funding round that is likely to be led by venture capital firm Paradigm. A successful funding round will see Monad Labs’ valuation rocket to $3 billion. Monad Labs Building Platform to Challenge Ethereum Monad Labs, a smart contract platform, […]

Source link

South Korea Preparing Tax System to Avoid Cryptocurrency Tax Evasion

The National Tax Service in South Korea is preparing to launch a virtual asset tax system to help analyze the information received from cryptocurrency holders to avoid cryptocurrency tax evasion. Local sources reported that the agency had contracted the services of a third-party company to help in this task, and it is scheduled to be […]

The National Tax Service in South Korea is preparing to launch a virtual asset tax system to help analyze the information received from cryptocurrency holders to avoid cryptocurrency tax evasion. Local sources reported that the agency had contracted the services of a third-party company to help in this task, and it is scheduled to be […]

Source link

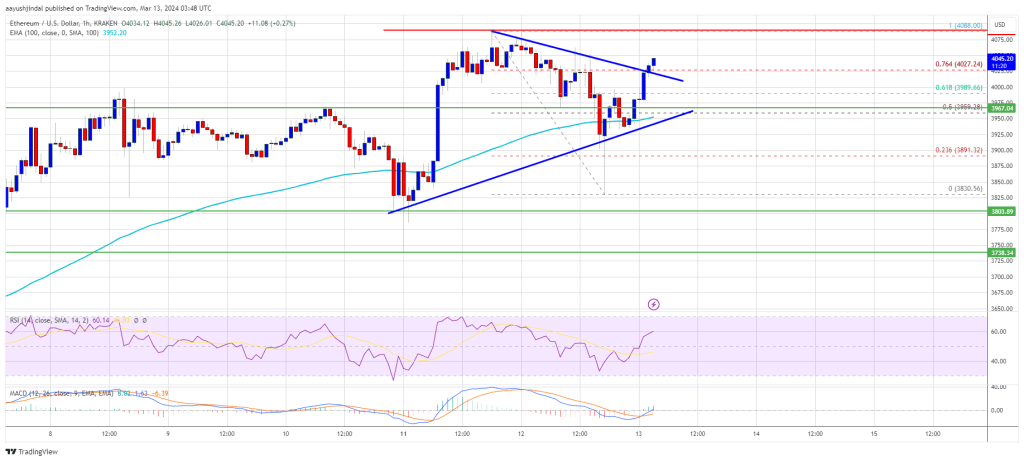

Ethereum price is consolidating near the $4,000 zone. ETH is again moving higher as the bulls seem to be aiming for a move above the $4,200 level.

- Ethereum traded to a new multi-month high above $4,080 before correcting lower.

- The price is trading above $4,000 and the 100-hourly Simple Moving Average.

- There was a break above a key contracting triangle with resistance at $4,025 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could resume its increase if it clears the $4,085 resistance zone.

Ethereum Price Regains Strength

Ethereum price spiked above the $4,000 resistance zone, like Bitcoin. ETH traded to a new multi-month high above $4,050 before there was a downside correction.

The price declined below the $4,000 level, but the bulls were active near the $3,850 zone. A low was formed at $3,830 and the price is now rising. There was a move above the $4,000 resistance. The price cleared the 50% Fib retracement level of the recent decline from the $4,088 swing high to the $3,830 low.

Ethereum price is now trading above $4,000 and the 100-hourly Simple Moving Average. There was a break above a key contracting triangle with resistance at $4,025 on the hourly chart of ETH/USD.

It is now showing positive signs above the 76.4% Fib retracement level of the recent decline from the $4,088 swing high to the $3,830 low. If the pair stays above the $4,020 level, it could attempt another increase. Immediate resistance on the upside is near the $4,085 level.

Source: ETHUSD on TradingView.com

The first major resistance is near the $4,120 level. The next major resistance is near $4,150, above which the price might gain bullish momentum. In the stated case, Ether could rally toward the $4,280 level. If there is a move above the $4,280 resistance, Ethereum could even rise toward the $4,350 resistance. Any more gains might call for a test of $4,500.

Are Dips Limited In ETH?

If Ethereum fails to clear the $4,085 resistance, it could start a downside correction. Initial support on the downside is near the $4,020 level.

The first major support is near the $3,965 zone or 100 hourly SMA. The next key support could be the $3,880 zone. A clear move below the $3,880 support might send the price toward $3,830. Any more losses might send the price toward the $3,740 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $3,965

Major Resistance Level – $4,085

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Coinbase looks to raise $1 billion via bond offering amid bullish market trend

Coinbase announced plans to launch a $1 billion bond offering to raise funds for its growth and expansion, according to a March 12 filing.

The bonds, designated as unsecured convertible senior notes, are set to mature in 2030, offering investors the option to convert their holdings into Coinbase shares or cash at that time. The offer also includes a 30-day option to buy an additional $150 million principal amount of notes to cover over-allotments.

The strategy is seen as a savvy maneuver to capitalize on the crypto market’s positive momentum while safeguarding shareholder value.

Coinbase has also introduced “negotiated capped call transactions” as part of the bond offering. This measure is designed to mitigate the dilutive impact on shareholders when the debt is converted into equity.

The proceeds from the bond offering are earmarked for a variety of uses, including debt repayment, funding for the capped call transactions, and potential acquisitions, indicating Coinbase’s ambitious agenda for growth and consolidation within the crypto economy.

Coinbase stock surging with crypto

This announcement comes on the heels of a significant upsurge in the value of Bitcoin, which recently hit a record high, crossing the $73,000 mark.

The bullish trend in the crypto market has been paralleled by a 48% increase in Coinbase’s stock price this year to levels last seen in December 2021 — a rally that has prompted some Wall Street analysts to revise their previously cautious outlooks on the company’s stock.

Financial giants like Raymond James and Goldman Sachs have shifted from bearish to more optimistic views, buoyed by the sector’s robust performance.

As of press time, COIN was trading at $256.14, up 11.91% over the past week and 82.45% over the previous month.

Coinbase previously offered $1.25 billion in senior convertible notes in May 2021, which instead took place following a market crash related to the collapse of the TerraUSD stablecoin. The firm has regularly repurchased its outstanding debt.

The post Coinbase looks to raise $1 billion via bond offering amid bullish market trend appeared first on CryptoSlate.

NEAR, the native token of the Layer 1 (L1) public blockchain NEAR Protocol, has substantially risen during this bull run after registering remarkable gains since the end of 2023.

As the price of Bitcoin continues to soar, NEAR has recorded an over 130% price surge in the past month, and analysts forecast that the bullish momentum isn’t over yet.

Analyst Foresees NEAR’s Next Leg Up Coming Soon

At the end of 2023, the NEAR token showed a remarkable performance by doubling its price in mid-December. Since then, the crypto market has been propelled to heights like those seen during the last bull run.

NEAR continued its growth alongside the market, and crypto analyst Altcoin Sherpa considers that the gains for the token are far from over.

$NEAR: Consolidation for the next leg up soon IMO. #NEAR pic.twitter.com/pII6Uanwaz

— Altcoin Sherpa (@AltcoinSherpa) March 12, 2024

In an X (former Twitter) post, the analyst shared a chart showing NEAR’s performance in the last few days. This performance displays the token has oscillated between two levels since yesterday.

NEAR hovered between the $6.7- $7.17 price range for the past 24 hours, Altcoin Sherpa’s chart shows. As the analyst highlights, this is the “consolidation for the next leg up” coming soon.

Previously, Sherpa warned about the $6.9 price level being a “danger area approaching.” However, the token broke that resistance level over the weekend.

Moreover, crypto trader and analyst Rekt Capital shared a chart showing that NEAR revisited its multi-year macro downtrend. Breaking above it would further fuel the bullish momentum that could drive the price to revisit its all-time high (ATH) resistance area of $20.

Finally – Near Protocol has revisited its multi-year Macro Downtrend

Now #NEAR will try to break this to further build on its current bullish momentum

Breaking this Macro Downtrend would likely see price revisit the old All Time High resistance area

#BTC #NEARprotocol… pic.twitter.com/wboVljOJsc

— Rekt Capital (@rektcapital) March 11, 2024

Are $10 Coming Soon?

NEAR has been closely following Bitcoin’s price performance during the past week. As the chart below shows, in the last 24 hours, the token’s price has closely followed the trajectory of the flagship cryptocurrency.

BTC and NEAR’s performance in the last 24 hours. Source: CoinGecko.com

At writing time, NEAR is trading at $7.3, a 4.2% surge in the past hour. The token registered a stellar 67.8% and 83.1% price surge in the weekly and bi-weekly timeframe.

Crypto trader Doctor Profit foresees NEAR to reach $10 soon, as his previous prediction of the token reaching this price by the end of the year seems closer than expected.

That the token’s price of $3 was easily doubled in a matter of days. This suggests to the analyst that NEAR’s next goal of $10 will come very soon.

As optimistic predictions continue, the token’s market cap of $7.74 billion shows a 7.7% growth in the last day. By this metric, NEAR is inside the top 20 largest cryptocurrencies, currently being the 19th, according to CoinMarketCap data.

However, the daily trading volume has dropped 20% in the last 24 hours, with $993.5 million traded. This hints at a recent decline in market activity despite the positive performance and community support.

NEAR is trading at $7.39 in the hourly chart. Source: NEARUSDT on TradingView.com

Feature image from Unsplash.com, Chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

As Bitcoin Soars, Peter Schiff Offers Gold as the Prudent Alternative

With bitcoin climbing over 50% in the past month, the notable gold aficionado and economist Peter Schiff has thrown shade at the market’s recent rally. Schiff argues that this uptick in value is nothing but “speculative mania” and advises folks to funnel their risky investments into gold instead. Schiff Warns of Speculative Mania in Bitcoin, […]

With bitcoin climbing over 50% in the past month, the notable gold aficionado and economist Peter Schiff has thrown shade at the market’s recent rally. Schiff argues that this uptick in value is nothing but “speculative mania” and advises folks to funnel their risky investments into gold instead. Schiff Warns of Speculative Mania in Bitcoin, […]

Source link

Grayscale introduces ‘mini’ Bitcoin ETF to alleviate investor tax burdens and curb outflows

Grayscale, the issuer of the world’s largest Bitcoin exchange-traded fund (ETF), has applied for a smaller version of its popular Grayscale Bitcoin Trust (GBTC) ETF under the “BTC” ticker, according to a Mar. 12 filing with the US Securities and Exchange Commission (SEC).

Grayscale said:

“This would be net-positive for existing GBTC investors, who would benefit from a lower blended fee with the same exposure to Bitcoin, spanning ownership of shares of both GBTC and BTC.”

If approved, the proposed ETF will debut a cost-effective iteration of its GBTC ETF. It will be seeded through an undisclosed percentage of GBTC, and shareholders of the current GBTC will seamlessly transition to holding shares in both GBTC and BTC, ensuring no taxable implications.

The proposed ETF will be listed on the New York Stock Exchange, operating independently from Grayscale’s GBTC fund.

Why did Grayscale file for a ‘mini’ ETF?

James Seyffart, an ETF analyst at Bloomberg, explained Grayscale’s maneuver as a savvy move to compete against rivals without compromising on fees for its profitable GBTC investment offering.

Besides that, Seyffart pointed out that the new trust could offer GBTC investors tax-free exposure to the flagship digital asset. He said:

“[The Mini ETF] definitely helps out long term GBTC holders — particularly the taxable ones who were sorta stuck with potential capital gains tax hits. Not a full solution. But way more helpful than launching a standalone product from scratch.”

Furthermore, introducing a miniature version could prevent customers from migrating to more cost-effective alternatives.

GBTC, since its inception in January, has witnessed outflows exceeding $11 billion. This trend is primarily attributed to its high fees of 1.5%, notably higher than competitors charging 0.3% or even less.

Eric Balchunas, Bloomberg senior ETF analyst, opined:

“This way, [Grayscale] can keep some of that juicy 1.5% assets while placating a bit of investors with this treat. Also, BTC then gives something competitive for their salespeople to have when talking to advisors who probably find a 1.5% fee an instant dealbreaker.”

The post Grayscale introduces ‘mini’ Bitcoin ETF to alleviate investor tax burdens and curb outflows appeared first on CryptoSlate.