In an unprecedented surge, global crypto investment products experienced a historic influx of $2.7 billion last week, signaling strong confidence among investors and propelling assets under management (AUM) back to December 2021 levels. Record $2.7 Billion Flows Into Crypto Investments in a Historic Week The record-breaking week saw digital asset investment vehicles garner inflows of […]

In an unprecedented surge, global crypto investment products experienced a historic influx of $2.7 billion last week, signaling strong confidence among investors and propelling assets under management (AUM) back to December 2021 levels. Record $2.7 Billion Flows Into Crypto Investments in a Historic Week The record-breaking week saw digital asset investment vehicles garner inflows of […]

Source link

CoinNews

As Bitcoin Hits New Highs, Nasdaq-Listed Miners Face Unexpected Declines

Despite bitcoin reaching another all-time peak on Monday, publicly traded mining stocks commenced the day with percentage declines. Stock linked to companies such as Marathon, Cleanspark, Riot, and various others have diminished in value compared to the U.S. dollar, even as bitcoin celebrates fresh price milestones. Mining Stocks Tumble on Nasdaq Nasdaq-listed bitcoin (BTC) miners […]

Despite bitcoin reaching another all-time peak on Monday, publicly traded mining stocks commenced the day with percentage declines. Stock linked to companies such as Marathon, Cleanspark, Riot, and various others have diminished in value compared to the U.S. dollar, even as bitcoin celebrates fresh price milestones. Mining Stocks Tumble on Nasdaq Nasdaq-listed bitcoin (BTC) miners […]

Source link

94 Million XRP Exits Binance As Bulls Reclaim Control, What’s Going On?

Crypto whale transaction tracker Whale Alerts has revealed various large XRP transactions in the last 24 hours as bullish momentum returns to the market. Interestingly, five of the large transactions in the past 24 hours have come from crypto exchange Binance, with the latest occurring in the past hour. In fact, 94 million tokens were recently transferred from Binance into unknown wallets, prompting investors to contemplate the reasons behind the transfers and possible outcomes.

Large Transactions From Binance

Data from Whale Alerts reveals that the transfers, worth over $57 million, were sent out of Binance in five transactions of 18 million XRP each. This huge transfer could signal big investors are buying the altcoin in droves, but the pattern of accumulation also points to the transactions being carried out by one entity.

The transfers occurred throughout Sunday, starting with a transfer of 18.76 million tokens worth $11.7 million from Binance into an unknown wallet. Subsequently, 18.4 million tokens, 19.2 million tokens, 18.8 million tokens, and 18.7 million tokens worth $11.26 million, $11.47 million, $11.19 million, and $11.69 million were sent into private wallets.

🚨 18,750,448 #XRP (11,698,918 USD) transferred from #Binance to unknown wallet

— Whale Alert (@whale_alert) March 11, 2024

Investors can only speculate as the identity of wallet addresses is mostly unknown. But shifts of this magnitude often foreshadow market sentiment. These enormous transactions in such a short time span negate a random pattern and suggest accumulation from the parties involved.

However, the transfers could have also been carried out by Binance itself, as on-chain data shows all recipient addresses were activated on the same day by the exchange. Furthermore, this pattern of 18 million XRP tokens departing Binance in each large transaction began on Friday. Essentially, the transfers could have been due to wallet maintenance or liquidity factors.

What’s Next For XRP?

XRP has majorly underperformed other large market-cap cryptocurrencies. At the time of writing, the token is trading at $0.6219 and is up by 18% in 30 days. For comparison, Bitcoin, Ethereum, and BNB are up by 49%, 58%, and 63% respectively in the same timeframe.

However, XRP enthusiasts continue to remain strong and anticipate a strong bullish run. According to attorney Bill Morgan, XRP is set to surpass its all-time high of $3.4 this cycle. Right now, XRP is showing other signs of building momentum, like a recent breakout above a long-term downtrend line.

A popular crypto analyst known as Ash Crypto noted that the altcoin is on the verge of a multi-year breakout. The last time this happened, XRP went on a surge throughout 2017 and 2018 to reach its current all-time high.

XRP MASSIVE BREAKOUT 🔥

XRP IS ON THE VERGE OF MULTI-

YEAR BREAKOUTONCE IT BREAKS OUT, THE PUMP

WILL BE HUGE !! pic.twitter.com/4UuwyMXHJU— Ash Crypto (@Ashcryptoreal) March 10, 2024

According to the analyst’s XRP chart, a repeat of this breakout would lead to a surge of epic proportions to $18.

Token price reaches $0.625 | Source: XRPUSD on Tradingview.com

Featured image from Coingape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin setting a new all-time high and breaking above $72,000 is a significant milestone for the market. Riding the wave of increased institutional interest in spot Bitcoin ETFs, it smashed through the $68,000 ceiling established in November 2021 after a brief correction to $59,000 and seems to be gearing up for more gains this week.

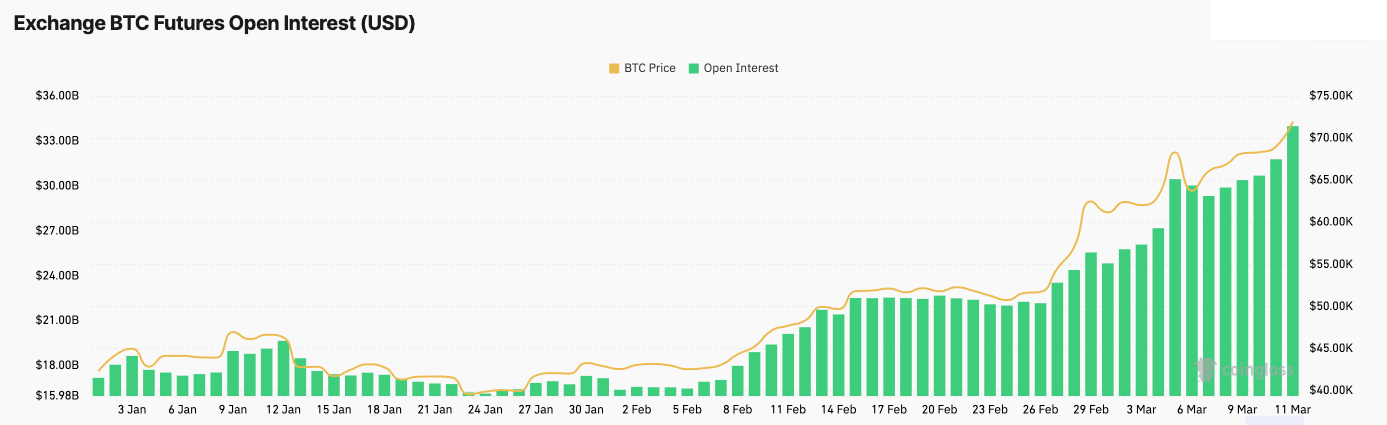

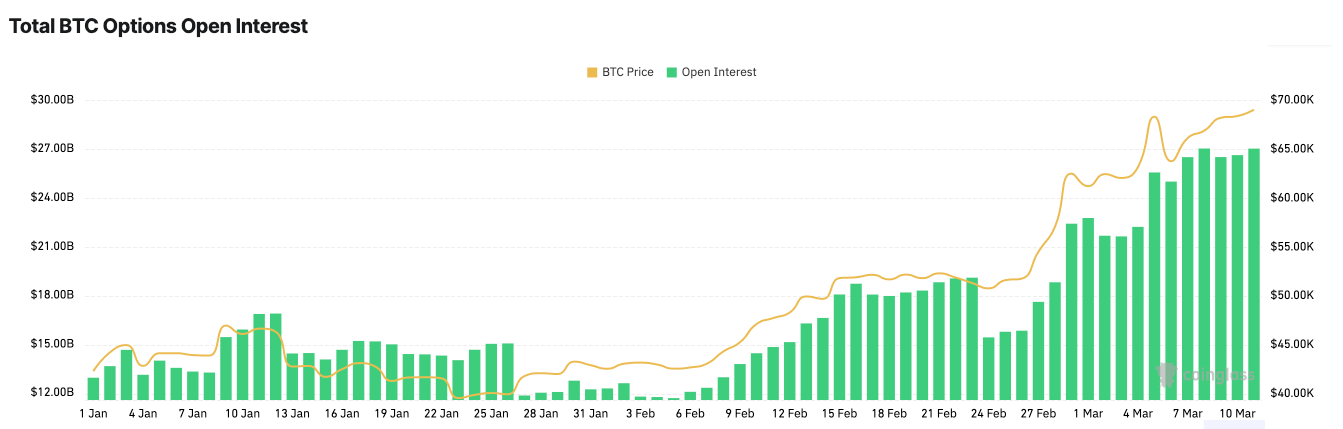

This week, the potential for more volatility is seen in the derivatives market, which peaked as Bitcoin touched $71,400. Since the beginning of the year, Bitcoin futures and options markets have seen unprecedented growth, with open interest reaching new highs on Mar. 11. Analyzing open interest is crucial for understanding market health and trader expectations. While spikes in open interest always follow price volatility, the intensity of the spikes can be a telling sign of just how leveraged the market is.

Futures open interest reached its all-time high of $33.48 billion in the early hours of Mar. 11 — almost double the $17.20 billion it posted on Jan. 1.

Options open interest reached their all-time high on Mar. 8 with $27.02 billion. A foothold seems to have been established at above $27 billion, with open interest remaining stable at $27.01 by Mar. 11. This is a significant increase from the $12.93 billion in open interest at the beginning of the year.

The growth in open interest shows a rapidly increasing appetite for derivatives. Futures and options provide traders with sophisticated strategies that allow them to hedge their positions and speculate on price movements.

The dominance of call options, with open interest and volume percentages consistently favoring calls over puts (61.66% vs. 38.34% for open interest and 59.43% vs. 40.57% for volume), shows an overwhelmingly bullish outlook among traders. This means that most of the market is speculating on further price increases.

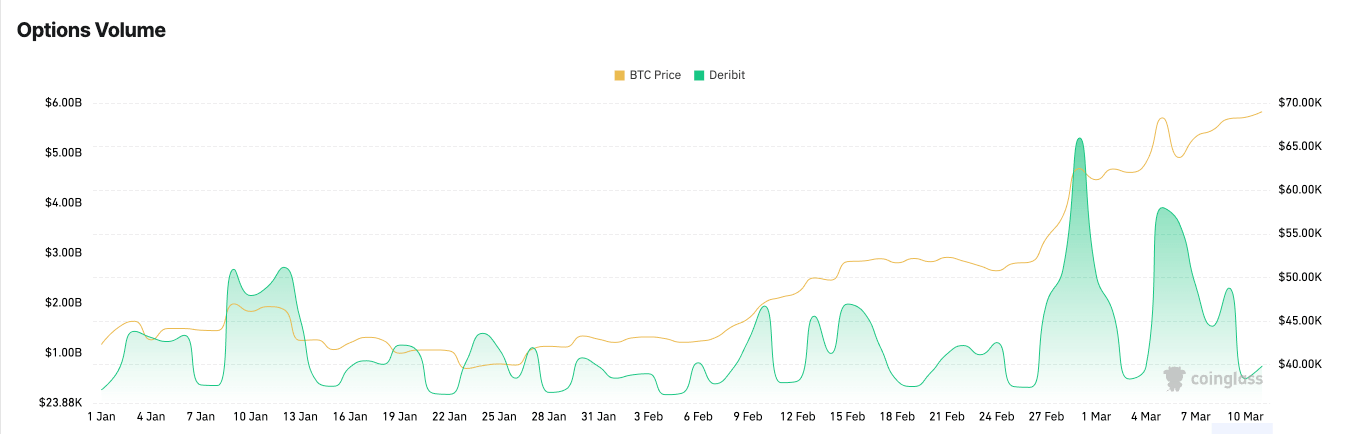

Significant spikes in options volume on Deribit around key dates show the derivative market’s reactive nature to Bitcoin’s price movements. Data from CoinGlass showed notable spikes in volume on Feb. 29 ($5.30 billion) and Mar. 5 ($3.91 billion), correlating with periods of intense price volatility.

Bitcoin breaking through important resistance levels played a pivotal role in this spike. Each resistance point crossed market new heights of market optimism and triggered increased trading activity as the market adjusted its positions to capitalize on the bullish momentum or protect against a potential downturn.

The rapid rise in interest in derivatives has led to the convergence of open interest in futures and options. While futures and options OI are yet to reach parity, the difference between the two is currently unprecedently low. Historically, futures open interest has been significantly higher than that of options, as futures provide a direct mechanism for hedging and speculation without the complexity of options strategies.

However, Bitcoin’s performance this year seems to have attracted many advanced traders looking for more versatile trading strategies than futures. Options are considered more sophisticated trading instruments, allowing traders to hedge their positions, speculate on price movements with limited downside risk, and generate income through strategies such as covered calls and protective puts. As investors become more knowledgeable and confident in using options, the demand for these instruments increases, leading to a rise in open interest.

Moreover, the current market conditions—high volatility and record prices—make options particularly appealing. Options can provide leverage similar to futures but with the added advantage of predetermined buyer risk. In a rapidly appreciating market, options allow investors to speculate on continued growth or protect against a potential downturn without committing as much capital as required for a futures position.

The balancing of open interest in futures and options also suggests that the market is at a crossroads, with investors divided in their outlook. While some may view the current price levels as sustainable and indicative of further growth, others might see it as overextended, warranting caution and using options for risk management.

The implications for future price movements are twofold. On the one hand, the robust derivatives activity indicates a healthy market with deep liquidity and sophisticated participants, potentially supporting further price increases. On the other hand, the high degree of leverage drastically increases the risks of market corrections — with tens of billions worth of derivatives on the line, even smaller drawdowns have the potential to turn into massive volatility.

The post Open interest reaches all-time high as Bitcoin touches $72k appeared first on CryptoSlate.

Bitcoin’s Hashrate Reaches 618 EH/s, Establishing a New 7-Day SMA Record in 2024

Bitcoin’s computing power has reached a new peak, ascending to 618 exahash per second (EH/s) as shown by the seven-day simple moving average. Currently, 56 entities are contributing at least 916.26 megahash per second (MH/s) to the network, with the mining pool Foundry USA at the forefront, delivering 204.41 EH/s. Bitcoin Edges Closer to Zettahash […]

Bitcoin’s computing power has reached a new peak, ascending to 618 exahash per second (EH/s) as shown by the seven-day simple moving average. Currently, 56 entities are contributing at least 916.26 megahash per second (MH/s) to the network, with the mining pool Foundry USA at the forefront, delivering 204.41 EH/s. Bitcoin Edges Closer to Zettahash […]

Source link

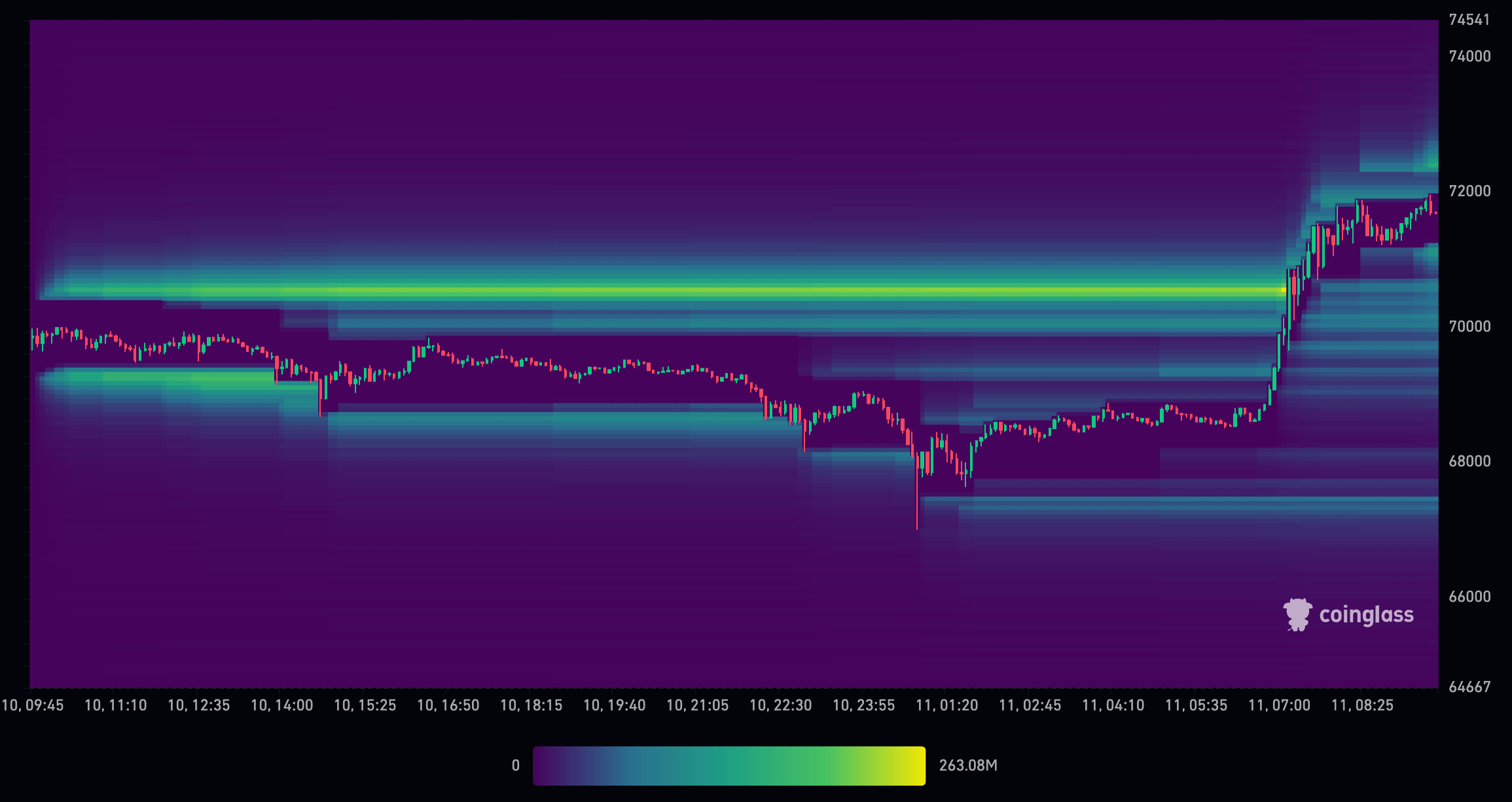

Record $1 Billion In Shorts Risk Liquidation If Bitcoin Hits This Price

The Bitcoin price is creeping up once again, rising to a new all-time high above $71,000 in the early hours of Monday. As the price surge continues, it has put a record number of shorts at risk, where a less than 10% move upward from here will see $1 billion in shorts liquidated.

$1 Billion In Shorts At Risk Of Liquidation

Crypto trader and analyst Ash Crypto took to X (formerly Twitter) to share a map that showed the number of short positions at risk as the price of Bitcoin rises. The map shared in the post showed that short liquidation leverage had risen above $1 billion.

These short leverage positions had been rising along with the price with a large number of crypto investors expecting the price to crash after pumping to a new all-time high. However, Bitcoin seems to have other plans in mind with its price surging close to $72,000 and increasing the risk of liquidations for these positions.

For these positions, Bitcoin reaching $75,000 would be detrimental to them. At this price level, over $1 billion worth of short positions will be liquidated. “$1,000,000,000 WORTH OF SHORTS WILL GET LIQUIDATED IF BTC HITS $75,000,” Ash Crypto revealed.

Will Bitcoin Stop Anytime Soon?

The Bitcoin price has seen a 10.33% increase in the last week and shows no signs of stopping soon. However, the debate of whether it continues upward or downward continues to wax strong as crypto analysts far and wide proffer their own predictions.

One crypto analyst know as MarcPMarkets suggests that the price of Bitcoin could hit resistance and then spiral back down if Bitcoin fails to properly clear the $70,000. But the analyst also explains that there is a possibility that the positive price action does continue if price does push above $71,500 and makes a close above it.

At the time of writing, Bitcoin is trading above $71,700, which shows it has cleared the level highlighted in the analyst. Now, what remains is to see if the cryptocurrency is able to make a daily close above $71,500, something that would be incredibly bullish for price. In this case, the BTC price could rise as high as $80,000 following this breakout.

The Bitcoin move over $71,000 has already had a significant impact on traders in the last day. Over $333 million has been lost by traders in one day. But interestingly, the majority of liquidations (64.29%) happen to be long positions, according to data from Coinglass.

BTC price reaches new ATH | Source: BTCUSD on Tradingview.com

Featured image from, chart from Tradingview.com Atlantic Council

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

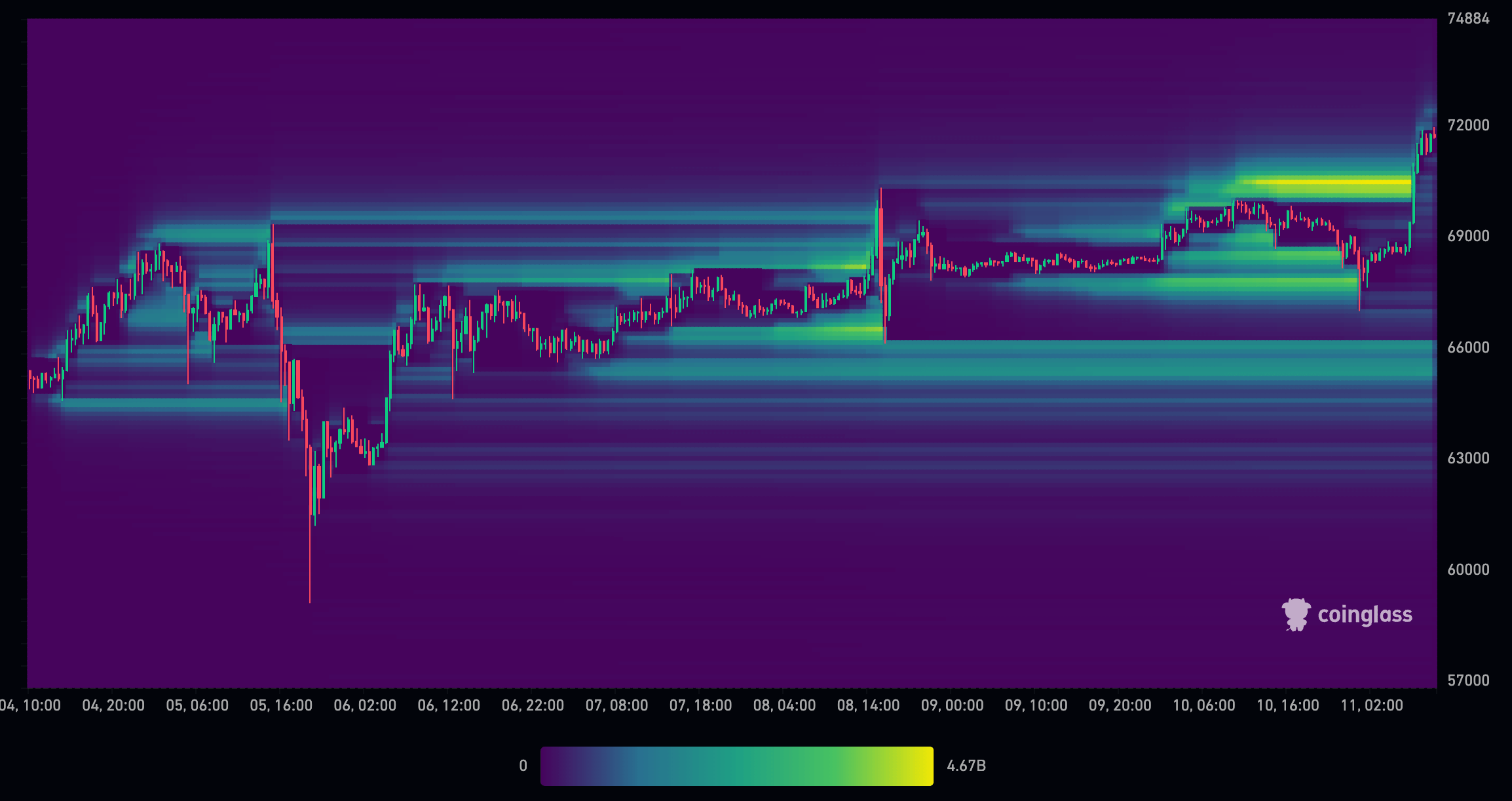

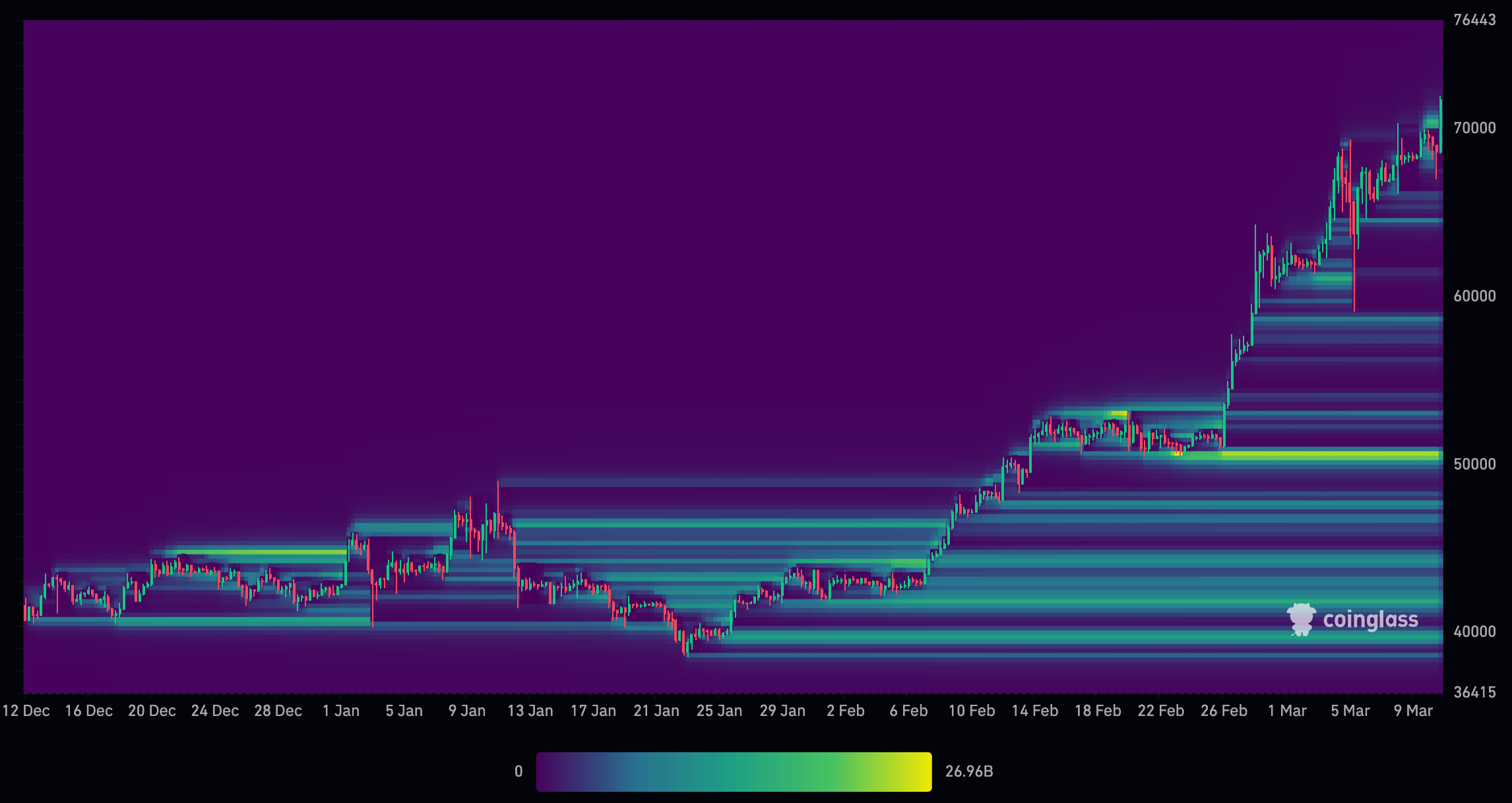

Recent data on Bitcoin liquidations and leverage levels indicates unique price discovery activity as longs and shorts have been swept from the market. Much of the leveraged positions were shaken out last week as Bitcoin saw volatile price actions around the US market open.

The liquidation chart from CoinGlass below highlights how trading activity on March 5 and 8 around 2.30 pm GMT (US market open) led to heavy liquidations of both long and short positions. A roughly 2% increase was followed by a decrease of over 10% on March 5, which swept the order books and flushed out all leverage down to $60,000.

The subsequent rapid V-shaped recovery saw further leverage positions created around $70,000 and $66,000. The market open on March 8 shook these out, leaving little to no leverage above $66,000.

As of March 11, the drop to $67,000, followed by a surge to new highs around $71,500, has again removed most leveraged positions above $66,000, setting a solid floor. The effect of such movements is that Bitcoin now has free reign for natural price discovery above $66,000.

Unlike the bull market of 2021, which was heavily influenced by highly leveraged positions, the current cycle appears to be shaking out leverage before it has the chance to cause significant volatility. Further, key institutional players and market makers may have a hand in clearing the route for Bitcoin’s price discovery through large-scale trading activities.

The role of market makers in price discovery

Market makers and, more recently, ETF-authorized participants heavily influence financial markets, conducting the flow of buy and sell orders with precision, and are responsible for providing liquidity, which is the lifeblood of any asset’s market. By quoting continuous bid and ask prices, they aim to profit from the spread, but their role extends far beyond mere profit generation.

During periods of high volatility, market makers engage in a strategic maneuver known as “sweeping” the order book. This involves placing many orders at varying price levels to probe the market’s depth and ascertain the true balance of supply and demand. This sweeping action is a probe into the market’s present state and a catalyst for price discovery, revealing the levels at which market participants are willing to transact in significant volumes.

The recent sweep of leverage from the Bitcoin market has profoundly impacted price conditions. With the removal of leveraged sell orders, the market has witnessed a reduction in downward pressure, allowing for a more organic price discovery process. This is characterized by a market less influenced by the amplified bets of leveraged traders and more by its participant’s genuine sentiment and valuations.

As the market adjusts to the new equilibrium free from the weight of leveraged positions, the price of Bitcoin is more likely to reflect its actual market value. This is not to say that the path will be linear or devoid of volatility; the crypto market is known for its rapid price swings. However, the current landscape suggests the conditions are ripe for a more sustained upward trend.

Leverage reduction and order book sweeping since December

A closer look at the market forces from December 2022 to March 2023 explains the route for further price discovery and a new $50,000 floor.

In December, the market witnessed substantial liquidations of leveraged positions, with many longs liquidated just above the $41,000 level and shorts liquidated around $45,000. As Bitcoin approached the ETF approval on January 11, many shorts were opened around the $45,000 level, which persisted as the price dropped to around $40,000. Interestingly, there were not many longs at this level, suggesting that the price was supported by holders and general price discovery rather than leveraged positions.

As Bitcoin rebounded from $40,000 and climbed toward $45,000 by early February, several shorts were liquidated along the way. As Bitcoin continued its upward trajectory, longs were positioned from $40,000 to $50,000. By the time Bitcoin reached $50,000, there were substantial leveraged positions, amounting to approximately $27 billion. However, as the price increased, the amount of leveraged positions above $50,000 diminished considerably.

The price action at the beginning of March saw Bitcoin surge to $70,000 and then plummet to $59,000 within a single candlestick, effectively wiping out nearly all leveraged positions in the market. Although there was some leverage around $70,000, the majority of leveraged positions are now concentrated below $50,000.

The liquidation of leveraged positions has led to a more transparent market structure, with a more balanced distribution of longs and shorts. This development could pave the way for a more organic price discovery process driven by genuine market demand rather than leveraged speculation.

The recent liquidations and reduction of leveraged positions in the Bitcoin market suggest a potential shift towards a more fundamentally driven market. With the majority of leveraged positions now concentrated at lower price levels, there is room for the market to experience upward pressure as genuine demand and adoption drive prices higher.

Removing excessive leverage has set the stage for a healthier market dynamic, where price discovery is guided by fundamental factors such as increasing mainstream acceptance, regulatory clarity, and technological advancements in the blockchain space.

The recent liquidations and leverage data provide a compelling case for a potential upward trend driven by organic price discovery.

Latest Alpha Market Report

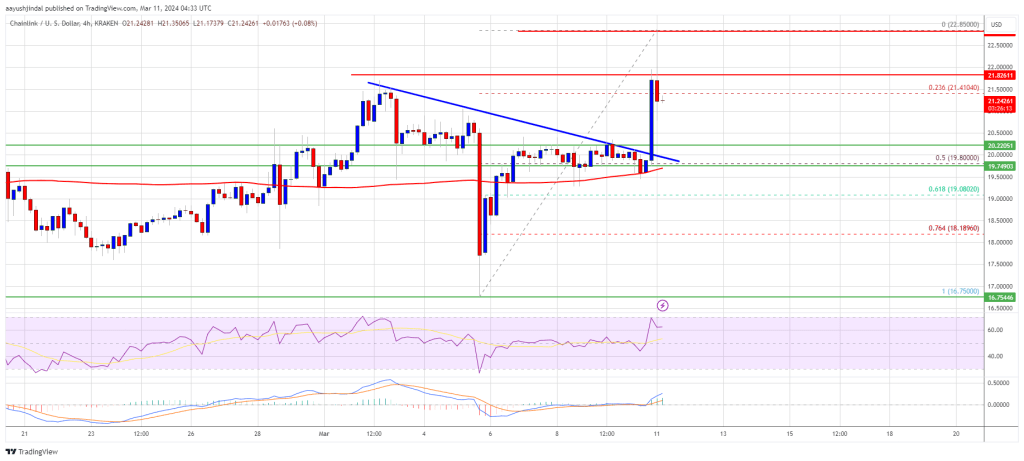

Chainlink’s LINK price is moving higher above the $20.00 resistance. The price is now up over 5% and might aim for a move toward the $25.00 resistance.

- Chainlink price is showing positive signs above $20.00 against the US dollar.

- The price is trading above the $20.50 level and the 100 simple moving average (4 hours).

- There was a break above a key bearish trend line with resistance near $20.00 on the 4-hour chart of the LINK/USD pair (data source from Kraken).

- The price could rally further if it clears the $22.00 resistance zone.

Chainlink (LINK) Price Eyes More Upsides

In the past few sessions, Chainlink bulls were able to send the price above a few key hurdles at $18.50. Earlier, LINK price formed a base above the $16.75 and started a fresh increase.

There was a break above a key bearish trend line with resistance near $20.00 on the 4-hour chart of the LINK/USD pair. The bulls pumped the pair above the $22.00 level. A new multi-month high was formed at $22.85 before the price started a downside correction.

There was a move below the $22.00 level. The price declined below the 23.6% Fib retracement level of the upward move from the $16.75 swing low to the $22.85 high.

LINK is now trading above the $20.50 level and the 100 simple moving average (4 hours). The price is up over 5% and outpacing both Bitcoin and Ethereum. If the bulls remain in action, the price could rise further. Immediate resistance is near the $21.80 level.

Source: LINKUSD on TradingView.com

The next major resistance is near the $22.00 zone. A clear break above $22.00 may possibly start a steady increase toward the $23.00 and $24.20 levels. The next major resistance is near the $24.80 level, above which the price could test $25.00.

Are Dips Limited?

If Chainlink’s price fails to climb above the $22.00 resistance level, there could be a downside correction. Initial support on the downside is near the $21.00 level.

The next major support is near the $20.00 level or the 50% Fib retracement level of the upward move from the $16.75 swing low to the $22.85 high, below which the price might test the $18.80 level. Any more losses could lead LINK toward the $17.65 level in the near term.

Technical Indicators

4 hours MACD – The MACD for LINK/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for LINK/USD is now above the 50 level.

Major Support Levels – $21.00 and $20.00.

Major Resistance Levels – $22.00 and $23.00.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

‘Wolf of All Streets’ Sees Start of Major Bull Run for Bitcoin and Broader Crypto Market — Warns of a ‘Huge Bubble’

Scott Melker, also known as the “Wolf of All Streets,” believes that we are at the start of a major bull run for both bitcoin and the broader crypto market. “We will likely see a huge bubble and that coins with no fundamental value will also skyrocket before it inevitably pops,” he warned, adding that […]

Scott Melker, also known as the “Wolf of All Streets,” believes that we are at the start of a major bull run for both bitcoin and the broader crypto market. “We will likely see a huge bubble and that coins with no fundamental value will also skyrocket before it inevitably pops,” he warned, adding that […]

Source link

The Tale of the Mysterious 2010 Bitcoin Whale: A Pattern of Consistent Liquidation Uncovered

Onchain analysts are focusing on the significant whale transactions occurring this month, revealing that 3,000 bitcoin from 2010 block rewards have been moved for the first time in nearly fourteen years. However, what many may not realize is that this sequence of block reward disbursements from 2010 isn’t a new activity for this particular whale, […]

Onchain analysts are focusing on the significant whale transactions occurring this month, revealing that 3,000 bitcoin from 2010 block rewards have been moved for the first time in nearly fourteen years. However, what many may not realize is that this sequence of block reward disbursements from 2010 isn’t a new activity for this particular whale, […]

Source link