According to the latest data, bitcoin has been trading above the $67,000 mark, with average network transaction fees experiencing a 288% increase from $3 to $11.64 since Feb. 25, 2024. Meanwhile, BTC has consistently stayed over the $60,000 level for eight straight days, elevating the daily value of one petahash per second (PH/s) of mining […]

According to the latest data, bitcoin has been trading above the $67,000 mark, with average network transaction fees experiencing a 288% increase from $3 to $11.64 since Feb. 25, 2024. Meanwhile, BTC has consistently stayed over the $60,000 level for eight straight days, elevating the daily value of one petahash per second (PH/s) of mining […]

Source link

CoinNews

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

The Nigerian Securities and Exchange Commission (SEC) has disclosed plans to introduce new regulations for crypto operators following recent challenges with Binance.

New regulations

The planned regulation would include licensing, registration, and screening guidelines for digital and virtual asset services providers (VASPs). In addition, the new guideline would ensure that malicious actors are not registered as operators within the Nigerian market.

A local media outlet, citing a Mar. 4 notice from the regulator, reported that the SEC expressed willingness to engage with “genuine” digital asset operators. The notice stated:

“The SEC has also developed a new AML/CFT/CPF AML/CFT/CPF onboarding manual for licensing/registration and on-going screening of Digital and VASP beneficial Owners to ensure that criminals are not registered as operators in the capital market. The SEC is ready to interface with genuine VASPs based on these clear rules and regulations.”

The Commission is also cooperating with the Central Bank of Nigeria to ensure additional rules are included in the upcoming regulations.

The Nigerian SEC has introduced several pro-crypto regulations to allow the industry to operate under its purview. Last year, the regulator said it would allow the tokenization of assets like equities, property, and debt within the jurisdiction.

Nigeria vs. Binance

This proposed regulation follows the Nigerian government’s issues with Binance, the largest crypto exchange by trading volume.

Over the past few weeks, the exchange has been accused of exacerbating Nigerian foreign exchange challenges by arbitrarily fixing the rates and profiting from the situation. As a result, the authorities blocked access to its official website and arrested two of its executives. In addition, the government is reportedly considering a $10 billion fine from the crypto platform.

In response, Binance discontinued all its services associated with the naira, the country’s national currency, while promising to cooperate with the authorities in their investigations.

The post Nigeria to tighten crypto regulation in wake of Binance disputes appeared first on CryptoSlate.

Quick Take

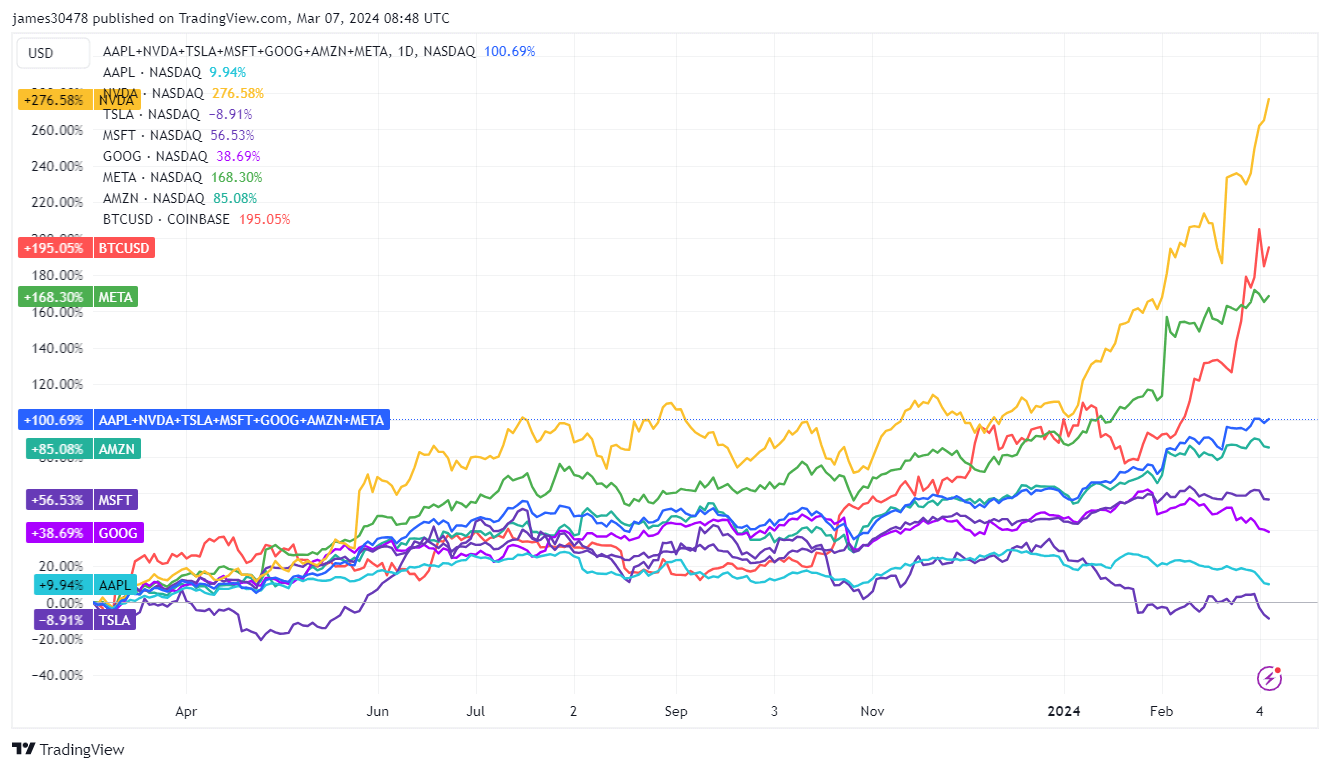

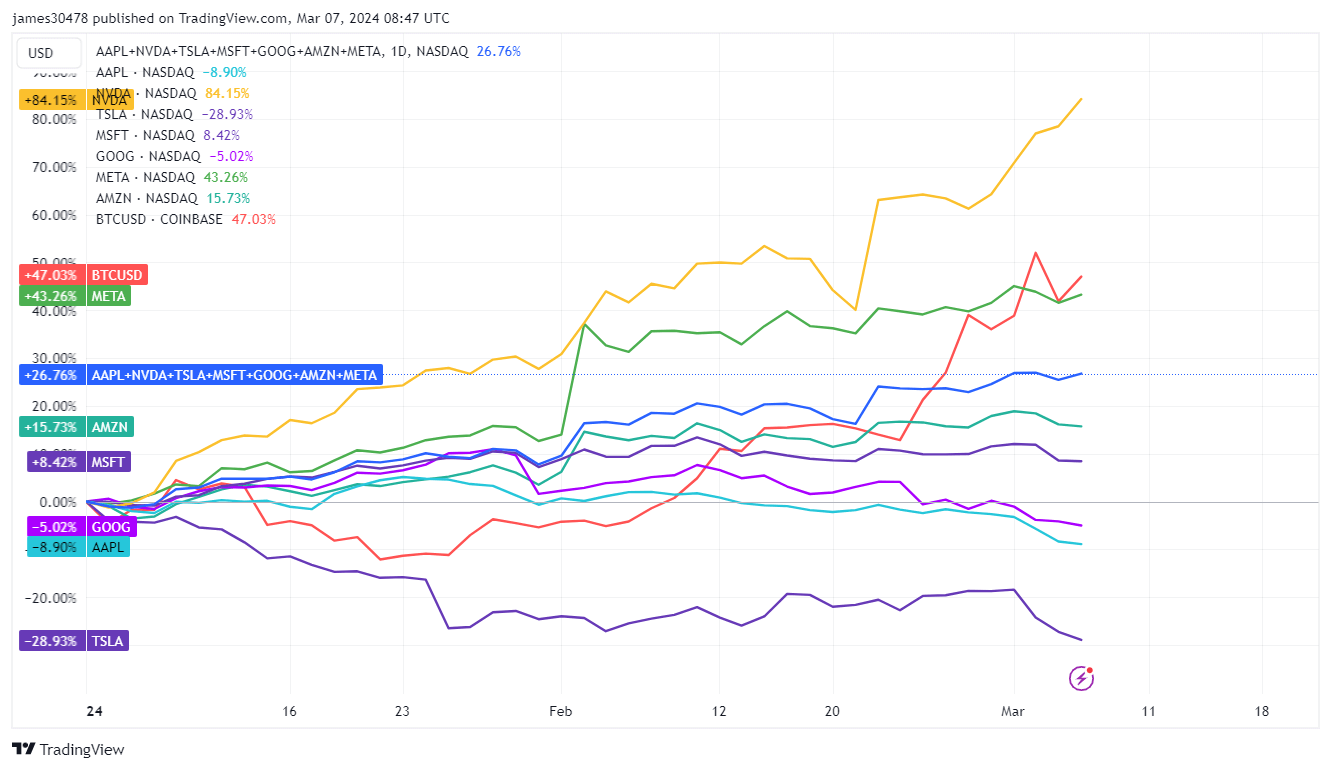

Comparing the performance of the ‘Magnificent 7’ tech stocks—Nvidia, Meta, Microsoft, Amazon, Google, Tesla, and Apple—to Bitcoin shows that the coveted group of assets is seeing significant competition from Bitcoin. A one-year comparison reveals Bitcoin’s superior performance, posting a 195% increase compared to the Mag 7’s average rise of 101%. Although the two were fairly correlated, Bitcoin’s surge since late February led to a noticeable decoupling.

Over the past year, Nvidia stands as the sole tech stock among its peers to have exceeded Bitcoin’s performance, achieving a remarkable increase of 277%.

Bitcoin, up 47% year-to-date (YTD), would be second only to Nvidia, which is up 84% since the beginning of the year. Three out of the seven tech stocks are showing negative YTD returns — Tesla is down 29%, while Apple and Google are down 9% and 5%, respectively.

Bitcoin’s performance nearly doubles the Mag 7 average of 27%. This leads to speculation on whether sustained BTC growth could trigger a financial shift from these tech stocks into Bitcoin.

The post Bitcoin’s 195% gain overshadows the tech sector’s ‘Magnificent 7’ appeared first on CryptoSlate.

US Judge Backs SEC: Trading of Certain Cryptocurrencies on Secondary Markets Are Securities Transactions

A U.S. district judge has sided with the Securities and Exchange Commission (SEC) in a ruling that declares the trading of certain crypto assets on secondary markets to be securities transactions. This decision emerged from an insider trading case involving crypto exchange Coinbase’s former product manager Ishan Wahi, his brother Nikhil Wahi, and their friend […]

A U.S. district judge has sided with the Securities and Exchange Commission (SEC) in a ruling that declares the trading of certain crypto assets on secondary markets to be securities transactions. This decision emerged from an insider trading case involving crypto exchange Coinbase’s former product manager Ishan Wahi, his brother Nikhil Wahi, and their friend […]

Source link

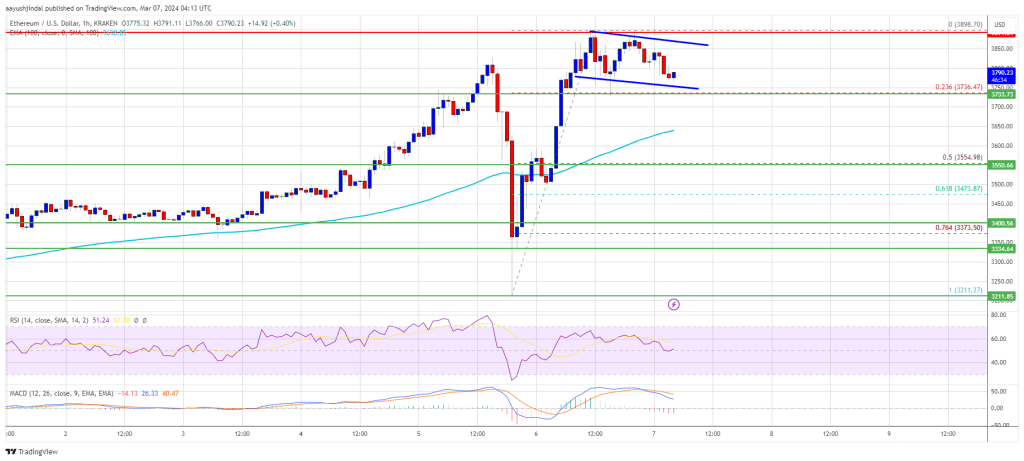

Ethereum price extended its increase toward $3,900. ETH is now consolidating gains and might aim for a move above the $4,000 resistance.

- Ethereum traded to a new multi-month high above $3,880.

- The price is trading above $3,700 and the 100-hourly Simple Moving Average.

- There is a short-term bullish flag pattern forming with resistance at $3,850 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could resume its increase if it clears the $3,850 resistance zone.

Ethereum Price Aims Higher

Ethereum price extended its rally above the $3,750 level, like Bitcoin. BTC failed to extend gains above the $69,200 zone, but ETH cleared the $3,850 level.

It traded to a new multi-month high above $3,880 and recently started a consolidation phase. There was a pullback below the $3,800 level. The price tested the 23.6% Fib retracement level of the recent wave from the $3,211 swing low to the $3,898 high.

Ethereum is now trading above $3,700 and the 100-hourly Simple Moving Average. Immediate resistance on the upside is near the $3,850 level. There is also a short-term bullish flag pattern forming with resistance at $3,850 on the hourly chart of ETH/USD.

Source: ETHUSD on TradingView.com

The first major resistance is near the $3,880 level. The next major resistance is near $3,920, above which the price might gain bullish momentum. The next stop for the bulls could be near the $4,000 level. If there is a move above the $4,000 resistance, Ether could even rally toward the $4,080 resistance. Any more gains might call for a test of $4,120.

Another Decline In ETH?

If Ethereum fails to clear the $3,850 resistance, it could start another downside correction. Initial support on the downside is near the $3,740 level.

The first major support is near the $3,650 zone. The next key support could be the $3,550 zone or the 50% Fib retracement level of the recent wave from the $3,211 swing low to the $3,898 high. A clear move below the $3,550 support might send the price toward $3,400. Any more losses might send the price toward the $3,320 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $3,650

Major Resistance Level – $3,850

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Vitalik Buterin’s ENS Address Trades $100K Worth of ETH for Stablecoins Amid Market Uptick

According to blockchain analytics, the Ethereum Name Service (ENS) domain “vitalik.eth” has engaged in a transaction of $100,000 worth of ether, converting it into an equal amount of stablecoins on the Base blockchain. The address, purportedly belonging to Ethereum’s co-founder Vitalik Buterin, currently possesses 955.58 ether, estimated at $3.64 million. ‘Vitalik.eth’ Wallet Makes Strategic $100K […]

According to blockchain analytics, the Ethereum Name Service (ENS) domain “vitalik.eth” has engaged in a transaction of $100,000 worth of ether, converting it into an equal amount of stablecoins on the Base blockchain. The address, purportedly belonging to Ethereum’s co-founder Vitalik Buterin, currently possesses 955.58 ether, estimated at $3.64 million. ‘Vitalik.eth’ Wallet Makes Strategic $100K […]

Source link

Gary Gensler compares Bitcoin’s latest all-time high to a ‘roller coaster ride’

SEC chair Gary Gensler cautioned investors to carefully consider the merits of each project after the market experienced extreme volatility following Bitcoin’s ascent to a new all-time high.

Gensler made the statements during an interview with Bloomberg on March 6 and likened the crypto market’s volatility to a roller coaster ride.

According to the SEC chair:

“[Cryptocurrency] is a highly speculative asset class. One could just look at the volatility of Bitcoin in the last few days. And I grew up loving roller coasters … but you really should be conscious, as the investing public, that this is a bit of a roller coaster ride on volatile assets.”

Continuing the metaphor, Gensler urged investors to consider the strength of each asset’s foundation as it reaches “the top of [the] hill.” He added that essential considerations include cash flows, use cases, and each asset’s potential status as a security.

Gensler’s comments come after Bitcoin briefly touched a new all-time high price of $69,324 on March 5 before falling 11% to $60,861 within hours, causing a bloody market rout.

However, the flagship asset and the overall market recovered most of the losses on March 6, with the flagship crypto trading at $65,834 as of press time.

ETH ETFs

When pressed to comment on the possible approval of spot Ethereum ETFs, Gensler said that the SEC has the filings before it and is reviewing them. He did not comment on specific applications.

The SEC has to decide whether to approve or reject VanEck’s spot Ethereum ETF application by the May 23 deadline, and many expect the regulator will simultaneously issue a decision regarding the other applications.

One Polymarket prediction market places May approval odds at 43%, while various experts, including executives at asset management firms, have placed approval odds close to 50%.

Gensler also declined to comment on whether the Ethereum token (ETH) is considered a security and if this would impact the approval of each pending ETF application. However, he said there are up to 20,000 crypto tokens, and many of them could be deemed securities because investors rely on the efforts of a group of entrepreneurs behind each project.

Gensler is known for his rigid stance toward crypto and his view that most tokens are securities that should be regulated by the SEC. Bitcoin remains the only asset he has confirmed as a commodity by the regulator and its chair.

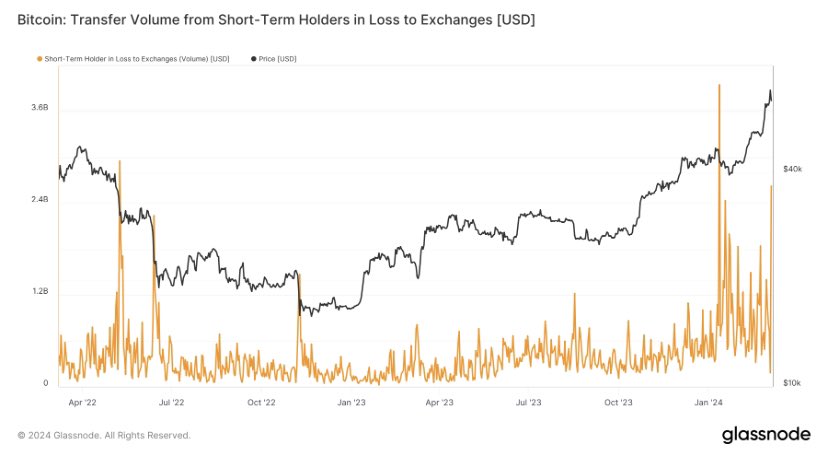

Bitcoin Short-Term Holders Panic Capitulate $2.6 Billion In BTC Crash

On-chain data shows that Bitcoin short-term holders have panic sold $2.6 billion worth of coins in the crash following the new all-time high.

Bitcoin Short-Term Holders Have Sent Huge Volume In Loss To Exchanges

As analyst James V. Straten explained in a new post on X, Bitcoin short-term holders have shown signs of capitulation during the latest drop in the cryptocurrency’s price.

The “short-term holders” (STHs) refer to the BTC investors who bought their coins within the past 155 days. The STHs make up one of the two main divisions of the market, the other one being the “long-term holders” (LTHs).

Statistically, the longer an investor holds onto their coins, the less likely they are to sell at any point. This means that the STHs, who are relatively new hands, generally sell quickly whenever an asset crash or rally occurs. The LTHs, on the other hand, usually show resilience, only selling at specific points.

One way to track whether either of these groups is selling is through the transfer volume they are sending to exchanges. First, here is a chart that shows the trend in the Bitcoin exchange inflow volume precisely for the STHs in loss:

The value of the metric appears to have shot up in recent days | Source: @jvs_btc on X

As displayed in the above graph, the Bitcoin STHs have transferred around $2.6 billion worth of coins in loss to exchanges in the past day, implying that some members of this cohort have capitulated.

This spike is huge, but it’s less than the loss-taking event that took place back during the price drawdown that followed the BTC spot exchange-traded fund (ETF) approval.

These loss sellers would be those who FOMO’d into the rally that took BTC to a new all-time high beyond the $69,000 level, but their conviction wasn’t strong enough that they were able to hold past the sharp crash that BTC observed shortly after.

The STHs aren’t the only ones who have exited the market in this latest price volatility; it would appear that the LTHs have also done some selling. The difference, however, is that these HODLers have made profits.

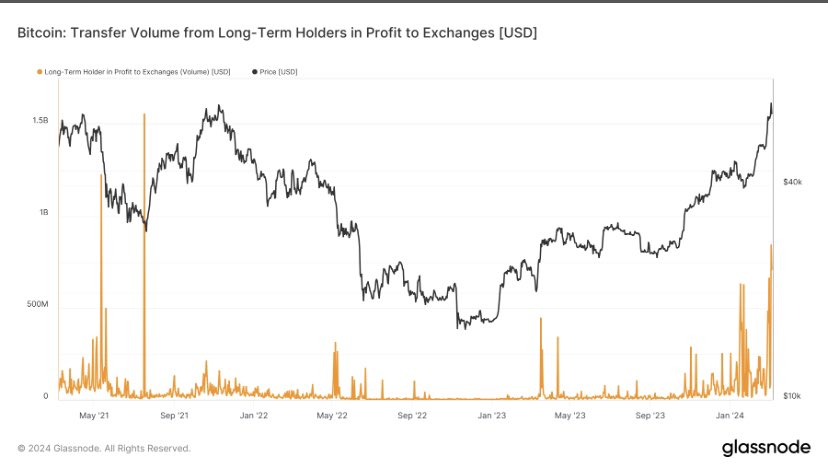

The chart below shows how the exchange transfer volume for the LTHs in profit has looked like recently.

Looks like the value of the metric has registered a sharp spike recently | Source: jvs_btc on X

The graph shows that the Bitcoin LTHs have participated in their largest profit-taking event since July 2021, transferring tokens worth $1.5 billion to exchanges.

Thus, it would appear that this recent volatility has shaken up the conviction of even some of the diamond hands, although these HODLers have at least still been rewarded with profits.

BTC Price

At the time of writing, Bitcoin is trading around the $65,800 mark, up 8% in the past week.

BTC has gone through a rollercoaster in the past couple of days | Source: BTCUSD on TradingView

Featured image from 愚木混株 cdd20 on Unsplash.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

After Bitcoin (BTC) recorded a new all-time high (ATH), Ethereum (ETH) rallied above $3,800 before the price crashed over 10%. The second-largest cryptocurrency has recovered from the dip and reached $3,900 momentarily for the first time in over two years.

Ethereum Recovers And Rallies to $3,900

On Thursday, Bitcoin reached a crucial milestone after breaking above $69,000 and recording a new all-time high (ATH). Before the euphoria was over, the flagship cryptocurrency’s price started to drop, trading as low as $60,000. Since then, BTC’s price has recovered to hover between the $66,000-$67,000 price range.

Fueled by the bullish sentiment, Ethereum rallied above $3,800 before suffering a considerable price drop. The ‘king of altcoins’ lost momentum and shredded about 12% of its price to trade at a price as low as $3,360, according to CoinMarketCap data.

After the dip was done, ETH started to show a recovery alongside Bitcoin. As reported by NewsBTC, a crucial resistance level to clear during this recovery was $3,600. Ethereum surpassed this support level and has maintained its price above the $3,800 range during the last 4 hours.

JUST IN: $3,900 $ETH

— Watcher.Guru (@WatcherGuru) March 6, 2024

Ethereum reached the $3,800 support level twice in the last 24 hours. This price range was not seen since January 2022, and the regained bullish momentum propelled the token’s price to a higher milestone.

Ethereum hit $3,900 for the first time since December of 2021. The biggest altcoin briefly soared to $3,901 before falling to the $3,850 price range.

At the time of writing, ETH is trading at $3,834, representing a 1.6% price drop in the last hour and a 2% increase from 24 hours ago. Similarly, the token exhibits green numbers on longer timeframes.

ETH price performance in the 4-hour chart. Source: ETHUSDT on TradingView.com

Ethereum’s price performance has surged almost 16% in the past week, 65% in the last month, and an impressive 145% in one year.

ETH’s market capitalization increased 1.55% to $459.7 million on the last day. Its daily trading volume has increased by 58%, with $52.16 billion in market activity in the previous 24 hours.

What’s Next For ETH’s Price?

Many analysts have forecasted that ETH’s rally is far from over. Analyst Altcoin Sherpa predicted that Ethereum could reach $4,000 when it breaks through the $3,000 price barrier.

Ethereum’s rally seems to be fueled not only by Bitcoin’s momentum but also by the general market dynamics. The date for the Dencun upgrade is approaching, and this update is expected to bring several technical improvements to Ethereum’s infrastructure,

Moreover, the possibility of Ether-based spot exchange-traded funds (ETF) being approved by the US Securities and Exchange Commission (SEC) in May has built expectations for Ether and the blockchain’s ecosystem.

Pseudonym trader Ash Crypto suggested to his Telegram subscribers that the price correction experienced after Bitcoin’s new ATH was not a “reason to panic.”

Message from Ash Crypto to his Telegram Subscribers. Source: Ash Crypto on Telegram

Related Reading: Ethereum Price Follows Bitcoin Surge, Why $4K Is Just A Matter of Time

The trader considers that the “late long flush to cut all the leverage” was expected and that a soon-to-come stabilization in BTC’s price will propel the run of ETH and all altcoins. Similarly, he announced the ‘incoming alt season’ after the price of ETH hit $3,900 and suggested that Ethereum’s next support level will be $4,200.

$ETH JUST MADE A NEW HIGH 🔥

$4,200 IS COMING NEXT !

GET READY FOR ALTSEASON pic.twitter.com/ZLirlerVDJ

— Ash Crypto (@Ashcryptoreal) March 6, 2024

Cover image from Unsplash, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.