Quick Take

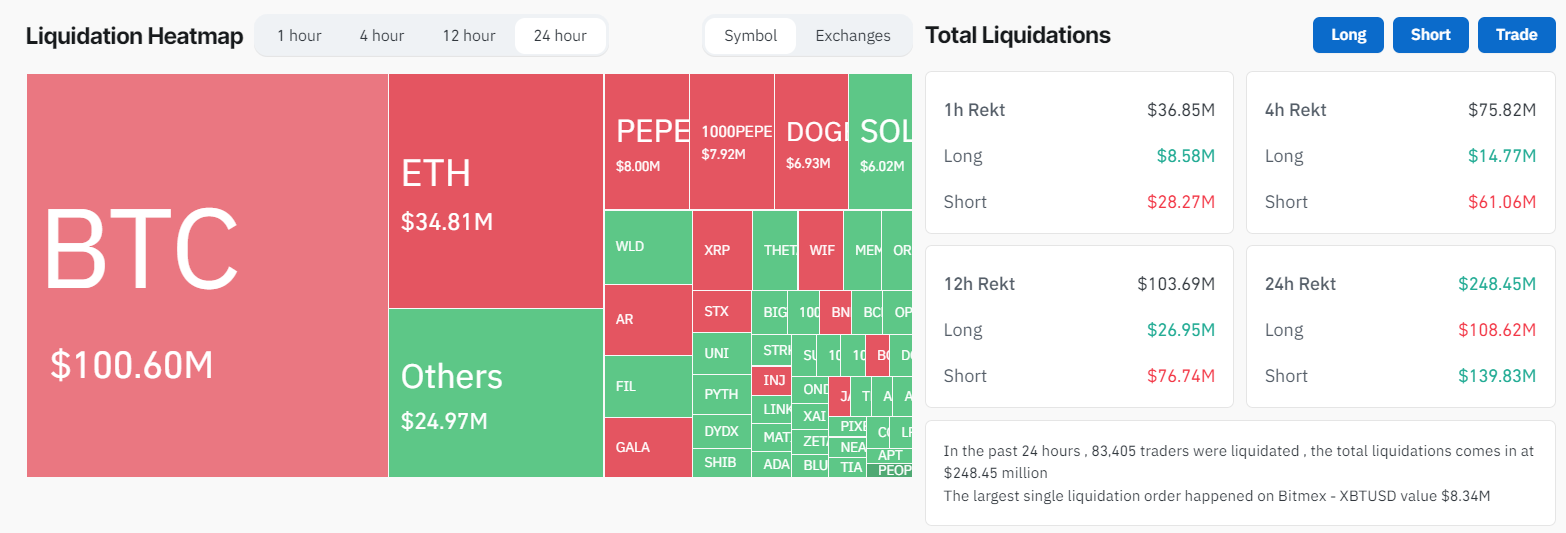

Bitcoin is currently demonstrating a robust market performance, bulldozing its way towards the $60,000 benchmark, up from its daily start of around $57,000. In the preceding 24 hours, a significant wave of liquidations hit the digital asset market, amounting to approximately $250 million. The liquidations depict a slight bias towards shorts, with an estimated worth of $140 million, according to Coinglass.

Coinglass data shows that in the same timeframe, Bitcoin experienced $100 million worth of liquidations, majorly shorts accounting for $70 million.

Simultaneously, the Exchange Traded Fund (ETF) inflows marked their third-best performance day, underlining the growing interest of institutional investors in this digital asset. A noteworthy mention is BlackRock, which recorded a record-breaking single-day performance with net inflows of $520 million.

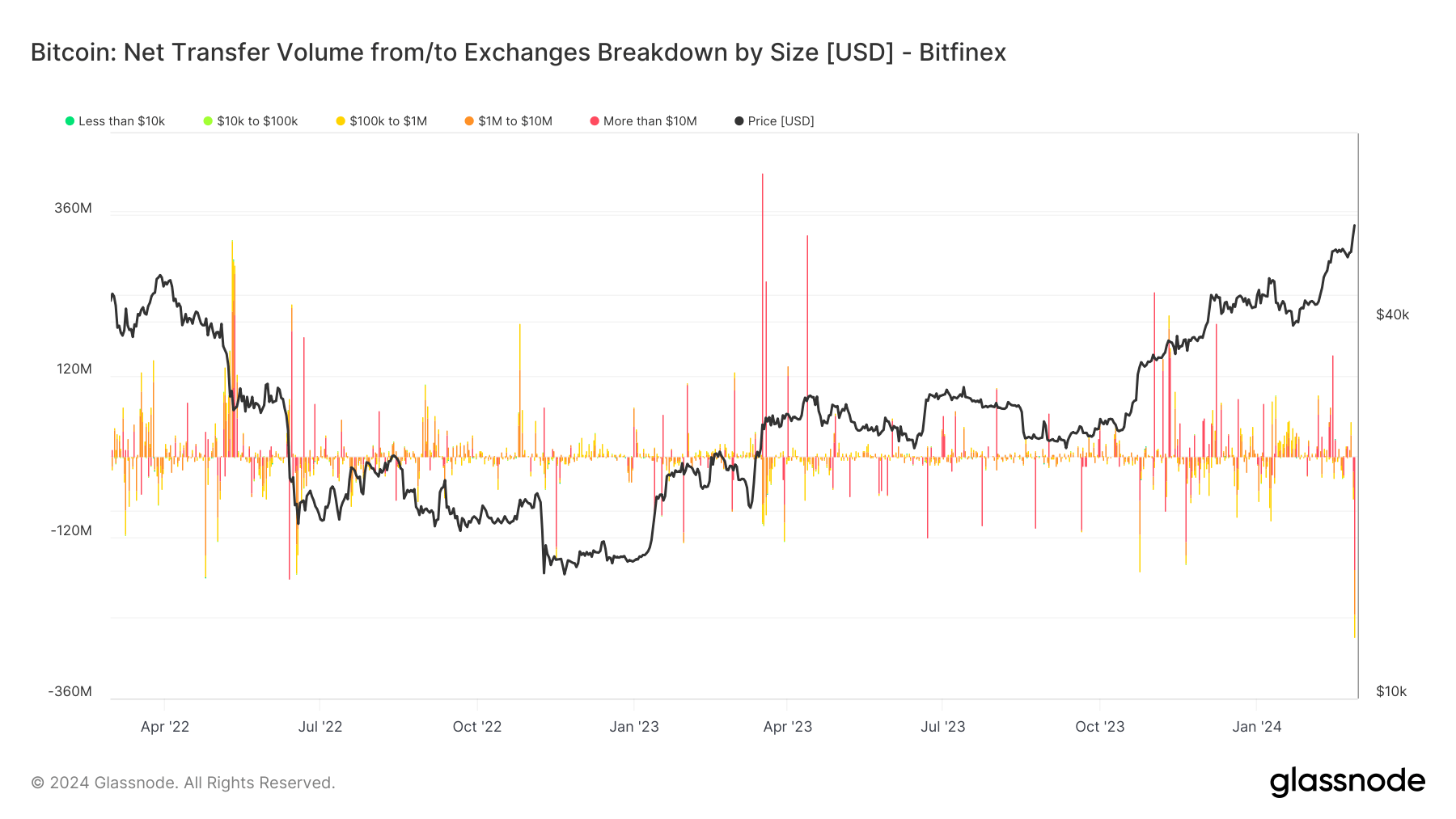

The day further witnessed the largest Bitcoin withdrawal from Bitfinex since 2021, exceeding $240 million. This substantial offloading, estimated to be the equivalent of 5,000 Bitcoins, was primarily attributed to large whale activities.

The post Whale transactions and ETF records fuel Bitcoin’s push toward $60,000 appeared first on CryptoSlate.

Veteran trader Peter Brandt has provided an update on his bitcoin price prediction. He explained that the price target for “the current bull market cycle” scheduled to end in Aug/Sep next year has been raised from $120,000 to $200,000. Peter Brandt on Bitcoin Bull Market Cycle Peter Brandt provided an update on his bitcoin price […]

Veteran trader Peter Brandt has provided an update on his bitcoin price prediction. He explained that the price target for “the current bull market cycle” scheduled to end in Aug/Sep next year has been raised from $120,000 to $200,000. Peter Brandt on Bitcoin Bull Market Cycle Peter Brandt provided an update on his bitcoin price […]

Uniswap Labs has unveiled a collection of new features designed to refine the trading journey for users of its decentralized exchange (dex). This collection encompasses the Uniswap browser extension, limit orders for precise trading strategies, and advanced data and insights for making well-informed choices. Uniswap Labs explained on Tuesday that the expansion aims to make […]

Uniswap Labs has unveiled a collection of new features designed to refine the trading journey for users of its decentralized exchange (dex). This collection encompasses the Uniswap browser extension, limit orders for precise trading strategies, and advanced data and insights for making well-informed choices. Uniswap Labs explained on Tuesday that the expansion aims to make […]

Bitcoin’s value has been on an impressive rise over the past month, and by the start of the week, the leading digital currency surpassed the $57,000 range for the first time since Nov. 2021. This upward trend in value has stimulated bitcoin-based derivatives, causing open interest in bitcoin futures to hit an unprecedented level, exceeding […]

Bitcoin’s value has been on an impressive rise over the past month, and by the start of the week, the leading digital currency surpassed the $57,000 range for the first time since Nov. 2021. This upward trend in value has stimulated bitcoin-based derivatives, causing open interest in bitcoin futures to hit an unprecedented level, exceeding […]

Cross Finance is a next-generation digital ecosystem of cutting-edge payment solutions, bridging the worlds of banking and blockchain. CrossFi seamlessly integrates these two pivotal segments of the global economy into a unified ecosystem, offering unparalleled scalability and processing speed of up to 1 million transactions per second through the core of the CrossFi Chain—a modular […]

Cross Finance is a next-generation digital ecosystem of cutting-edge payment solutions, bridging the worlds of banking and blockchain. CrossFi seamlessly integrates these two pivotal segments of the global economy into a unified ecosystem, offering unparalleled scalability and processing speed of up to 1 million transactions per second through the core of the CrossFi Chain—a modular […]