In the last 12 days of April, the stablecoin sector expanded by $4.46 billion, reaching a current valuation of $155.86 billion. Additionally, the top five dollar-pegged cryptocurrencies experienced an increase in their supplies over the last 30 days. Top Dollar-Pegged Cryptos See Growth Amid April’s First 12 Days As of Friday, April 12, 2024, the […]

In the last 12 days of April, the stablecoin sector expanded by $4.46 billion, reaching a current valuation of $155.86 billion. Additionally, the top five dollar-pegged cryptocurrencies experienced an increase in their supplies over the last 30 days. Top Dollar-Pegged Cryptos See Growth Amid April’s First 12 Days As of Friday, April 12, 2024, the […]

Source link

CoinNews

Bitcoin’s correction at the start of Q2 dragged down the Altcoins market, and a “gloomy” sentiment appears to surround investors despite Q1 2024 registering one of the best performances for the crypto market. As prices recover momentum, traders and analysts suggest a brighter future might be around the corner.

Altcoins Next Stop: Altseason?

On Friday, some traders shared optimistic forecasts for altcoins. According to investor Crypto Jelle, the altcoin market cap chart “looks primed to go on a massive rally in the coming months.”

The investor highlights the similarities between the altcoin’s performance during the previous bull runs. Per the chart, after 2018’s all-time high (ATH) of $474.5 billion, the altcoin market consolidated under the resistance zone in “preparation” for the next bull run.

Altcoins market cap sitting at $1.15 trillion. Source: CryptoJelle on X

During the 2020-2021 bull market, altcoins’ market cap broke out and consolidated around a new support zone before continuing its upward trajectory to its last ATH of $1.7 trillion.

As the investor highlighted, altcoins’ performance looks like that of the previous bull run. They are seemingly consolidating after a breakout from the resistance zone. If history were to repeat itself, then altcoins could “remind everyone what they’re capable of.”

Another trader and analyst, Titan of Crypto, shared a similar prediction to Jelle’s. According to the analysts, he’s seen crypto community members believing that “there’ll never be another altseason.”

To those in doubt, the trader suggests they “zoom out” to get a broader perspective on where the market is in the cycle. Per his chart, which excludes Ether (ETH), altcoins are at the “2 bullish monthly candles followed by consolidation” phase.

Run up prediction for altcoins, excluding ETH. Source: Titan Of Crypto on X.

The chart also suggests that the subsequent run-up could surpass the $1.13 trillion ATH and soar to a market cap of $3.25 trillion in the coming months. To the analyst, the “#Altseason2024 is inevitable.”

Predictions Are Up, Why Is The Sentiment Down?

Across different platforms, the sentiment seems to lean towards “negative” despite the optimistic forecasts. Follis, content creator and founder of Chroma Trading shared his experience on X this Thursday.

According to the post, “sentiment at the moment is some of the worst” he’s seen during his years in the crypto community. Moreover, he considers “engagement is dead” as “everyone is quiet” across X, Discord, and Twitch.

Sentiment at the moment is some of the worst I’ve seen in my 3y in crypto

Twitter, twitch, discord – everyone is quiet, engagement is dead$BTC only -6% from ath but lots of alts down -40% or more. No real bid to be found for a month or more, except on random rotations &…

— フ ォ リ ス (@follis_) April 11, 2024

The post opened a discussion as to what could be the reason. Follis suggested a combination of “over-leveraged top longers” and “traders who expected price to go up indefinitely.”

Another user weighed in, suggesting traders lost significant money buying high and selling low on Solana and Base memecoins.

Top crypto trader Ansem joined the discussion, disagreeing with the “depressing” take on the current market. The trader pointed out that BTC was at $70,000 and ETH at $3,500 at the time of his post. These prices represent a 129.8% and 82.5% increase in the past year.

Similarly, he highlighted the performance of SOL compared to the bear market bottom and the remarkable performance of memecoins in the past six months. Many users agreed that drawdowns are usual during market cycles and ultimately suggested looking at the bigger picture.

Altcoins market cap is at $1.15 trillion. Source: TOTAL2 on Tradingview

Featured Image from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Solana developers have released a new version of the validator client software to address persistent congestion issues and are urging validators to upgrade immediately.

Anza, a spinoff of Solana Labs, spearheaded the development with the release of version 1.18.11 aimed at mitigating network congestion.

Validator clients, essential in proof-of-stake blockchains like Solana, verify transactions to ensure compliance with network rules and confirm the sender’s fund sufficiency before appending new blocks to the blockchain.

Recently, spam transactions have significantly slowed processing times and increased transaction drop rates on Solana, which uniquely processes transactions directly without a mempool, adding complexity to its congestion issues.

Anza initially deployed the updated software version 1.18.11 on a devnet, and they are now calling for testnet validators to test the effectiveness of these fixes. Anza tweeted on April 12:

“The v1.18.11 release is now deployed to devnet, recommended for use on testnet. Please upgrade ASAP to help us start analyzing the effects of the proposed congestion fixes.”

In response to the congestion, Solana developers are also exploring strategies to enhance network efficiency. These include optimizing computing unit usage, implementing priority fees to improve user experiences, and developing a stake-weighted Quality-of-Service (QoS) system to prioritize transactions more efficiently.

External analyses have highlighted the negative impact of congestion on Solana’s operational performance. The network serves as a significant hub for DeFi activities, which has escalated the congestion problem with increased demand, leading to record-high trading volumes on decentralized exchanges in March.

Austin Federa, Head of Strategy at the Solana Foundation, recently addressed the root causes of these issues in a tweet:

“The issues stem from an implementation of the QUIC protocol and can be attributed to a known issue that suddenly got much worse due to unprecedented demand.”

Teams from Anza, Firedancer, Jito, and other core contributors are actively working to strengthen Solana’s networking stack in response to this demand. Federa remains optimistic about overcoming these challenges, drawing parallels to similar obstacles the network faced in early 2022.

As these developments unfold, the upcoming weeks will be critical in assessing whether the implemented fixes will restore Solana’s efficiency and reliability.

Mentioned in this article

Digital Renaissance: Global Market of Artification Brings Rubens and Rembrandt Artworks to Global Blockchain Show

PRESS RELEASE. Dubai, April 12, 2024: The Global Blockchain Show is pleased to announce Global Market of Artification (GMA) as its diamond sponsor at the upcoming two-day conference, set to take place at the Grand Hyatt, Dubai. Artworks by renowned masters like Rubens and Rembrandt will be featured at the event. With the inclusion of […]

PRESS RELEASE. Dubai, April 12, 2024: The Global Blockchain Show is pleased to announce Global Market of Artification (GMA) as its diamond sponsor at the upcoming two-day conference, set to take place at the Grand Hyatt, Dubai. Artworks by renowned masters like Rubens and Rembrandt will be featured at the event. With the inclusion of […]

Source link

Ethereum Pectra upgrade promises major wallet improvements with EIP 3074 integration

Ethereum developers are currently deliberating the Pectra upgrade, which is poised to enhance various facets of the blockchain’s functionality.

Tim Beiko, the Ethereum Foundation‘s protocol support lead, confirmed the development, revealing that the developers have agreed to include Ethereum Improvement Proposals (EIP) 3074 in the network’s slated overhaul.

EIP 3074

EIP 3074 is a pivotal advancement within Ethereum’s ecosystem and was introduced by Lightclients in 2020. The proposal has garnered widespread support from the crypto community as it aims to enhance the user experience (UX) of Ethereum wallets.

Fundamentally, EIP 3074 enables conventional crypto wallets like MetaMask to function akin to smart contracts.

This upgrade facilitates various functionalities, including transaction bundling, streamlining the signing process to a single step, and sponsored transactions. The latter feature empowers wallets to delegate funds for others to utilize, offering a more versatile and efficient transaction framework.

Trading a new token on a DEX such as Uniswap will now only require one signature from a user’s wallet as opposed to having to approve the new token and then sign the transaction to purchase.

Crypto community reacts

The announcement of the impending upgrade has sparked various reactions within the crypto community.

Georgios Konstantopoulous, Paradigm’s CTO, highlighted the update’s potential to enhance wallet usability tenfold, noting Reth’s successful implementation and testing.

Echoing this sentiment, Hayden Adams, the mind behind Uniswap, lauded the upgrade as a significant boost to Ethereum’s user experience. He added:

“Industry should make an effort to create compatibility for 4337 wallets to interact with 3074 contracts (much like eip1271 has created compatibility between safes and EOAs today).”

However, EVM developer Alex Watts cautioned against solely focusing on user experience improvements, emphasizing the broader implications for application and mechanism design.

Despite the optimism, concerns linger among some community members regarding the EIP 3074 upgrade.

Ansgar Dietrich, an Ethereum Researcher involved in the proposal’s inception, expressed ambivalence, reflecting on the lengthy journey to its impending mainnet integration and questioning its alignment with the evolving account abstraction roadmap.

Similarly, 0xngmi, the pseudonymous developer of DeFiLlama, raised apprehensions about the upgrade potentially enabling the complete depletion of addresses, encompassing tokens, NFTs, and other DeFi assets.

Mentioned in this article

On-chain data suggests Dogecoin is no longer the dominant meme coin in terms of its weekly active trader count. Here are the coins above it.

Dogecoin Has Been Surpassed In Trader Count By Other Memecoins

According to data from the market intelligence platform IntoTheBlock, DOG and DEGEN are the two assets that have managed to surpass the original meme-based cryptocurrency in terms of weekly trader count.

A “trader” here refers to an investor who has been holding onto their coins since less than 30 days ago. These investors generally tend to move their coins often, as they play the role of active traders in the market. They are certainly not the HODLers of the sector.

When the number of these traders goes up for any asset, it means that some fresh interest is potentially coming into the coin. Price actions like rallies are only sustainable when they have an ever-increasing fuel coming in, so the trader count going up can perhaps be a bullish indication in this direction.

On the other hand, the metric going down implies traders either are losing interest in the cryptocurrency or have decided to hold onto it in the long term, thus maturing past the 30-day threshold. Whatever the case be, though, a drawdown in the indicator does suggest a lack of new hands coming into the market.

Now, here is a chart that shows the trend in the number of traders for the various meme coins in the sector:

The data for the number of traders for meme-based tokens over the past couple of years | Source: IntoTheBlock on X

As displayed in the chart, Dogecoin (in blue) has consistently remained number one in terms of the number of traders, which only makes sense as DOGE has generally been the most popular meme coin, as its market cap would indicate.

Hype and excitement are usually the number one driver for attracting users to a cryptocurrency. It would appear, though, that DOGE has recently been falling off in this metric.

“While DOGE has long dominated almost every metric in the memecoin market, it seems to be losing some of its dominance,” says the analytics firm. The interest behind the coin may thus not be at the same level anymore.

As for which meme coins have overtaken the cryptocurrency so far, IntoTheBlock notes, “DEGEN currently leads with 129k active traders, followed by DOG with 126k.”

Given this high interest in these memecoins, it’s possible they may be likely to go through some volatility in the near future as all these traders make moves at once.

In theory, this volatility can take these coins in either direction, but as the intelligence platform explains, “a strong increase in traders usually coincides with bullish momentum.”

DOGE Price

Dogecoin had slipped below the $0.17 level last week, but the coin has since bounced back as it’s now trading just under $0.20.

Looks like the price of the memecoin has gone stale since its recovery push | Source: DOGEUSD on TradingView

Featured image from Kanchanara on Unsplash.com, IntoTheBlock.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Quick Take

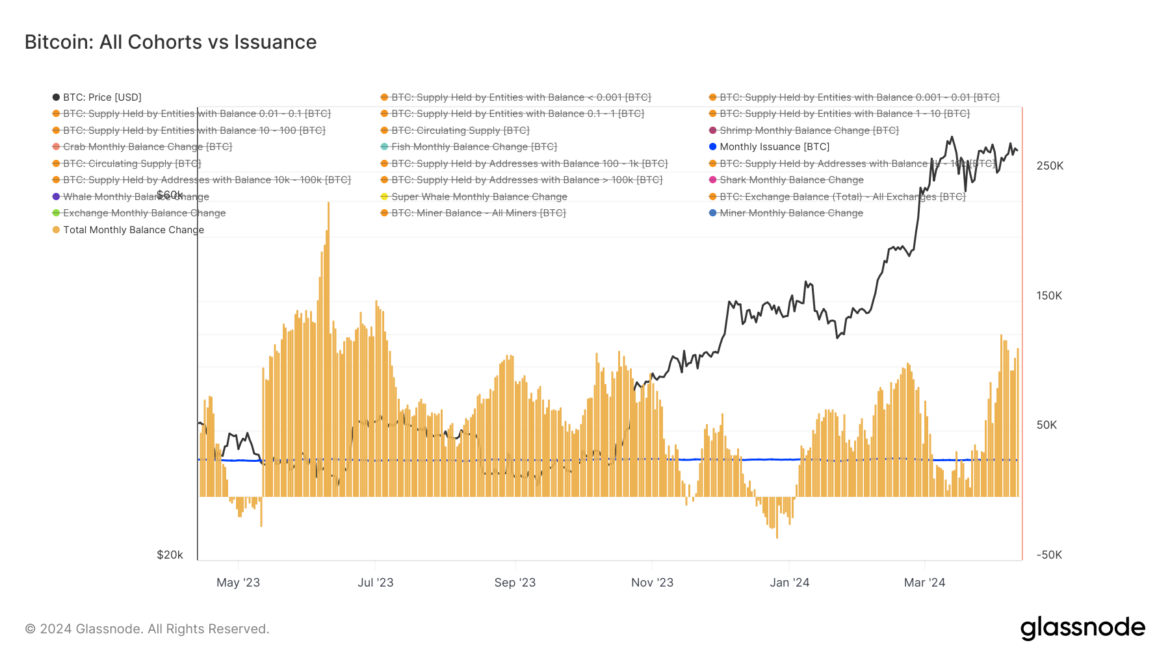

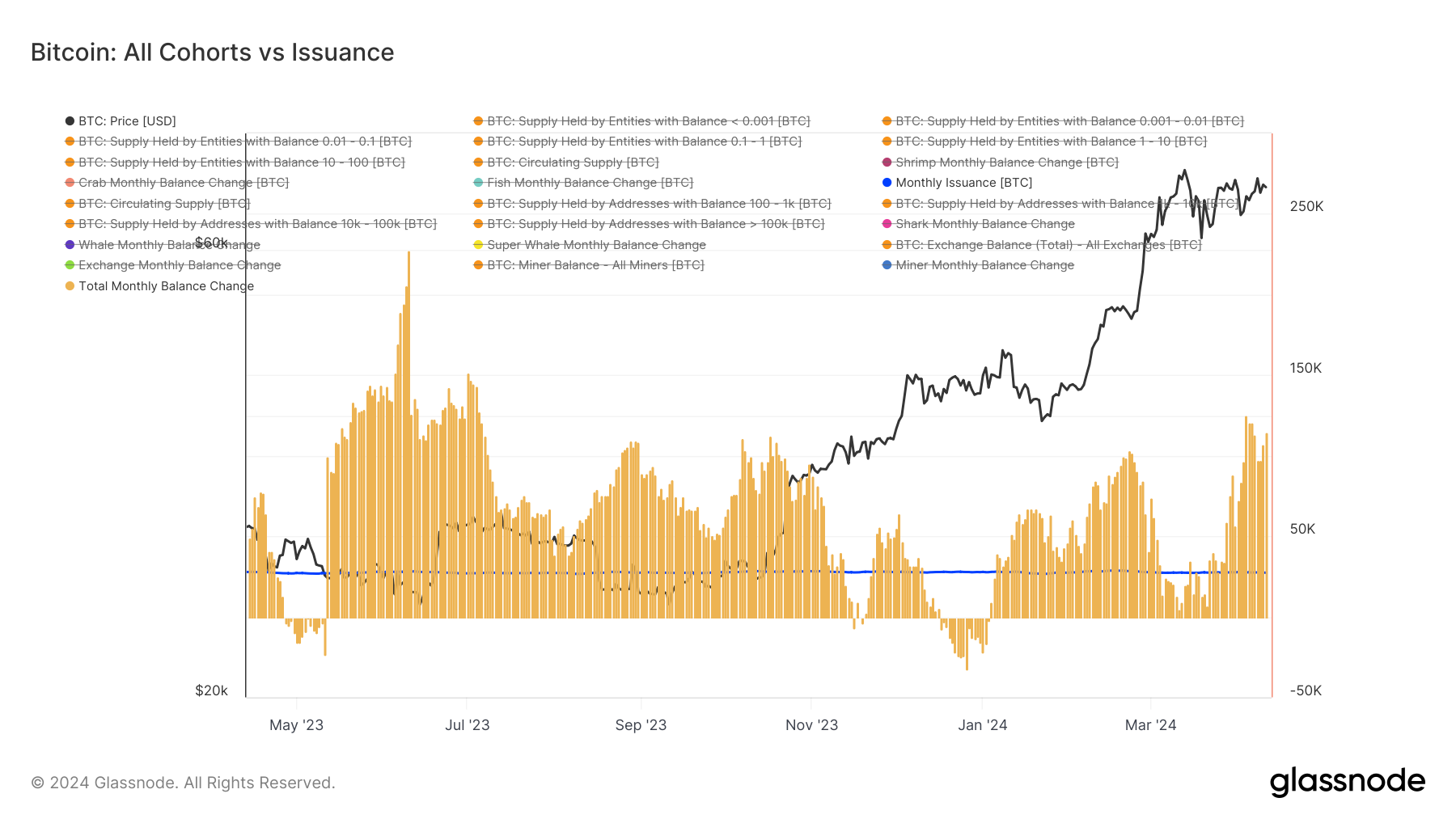

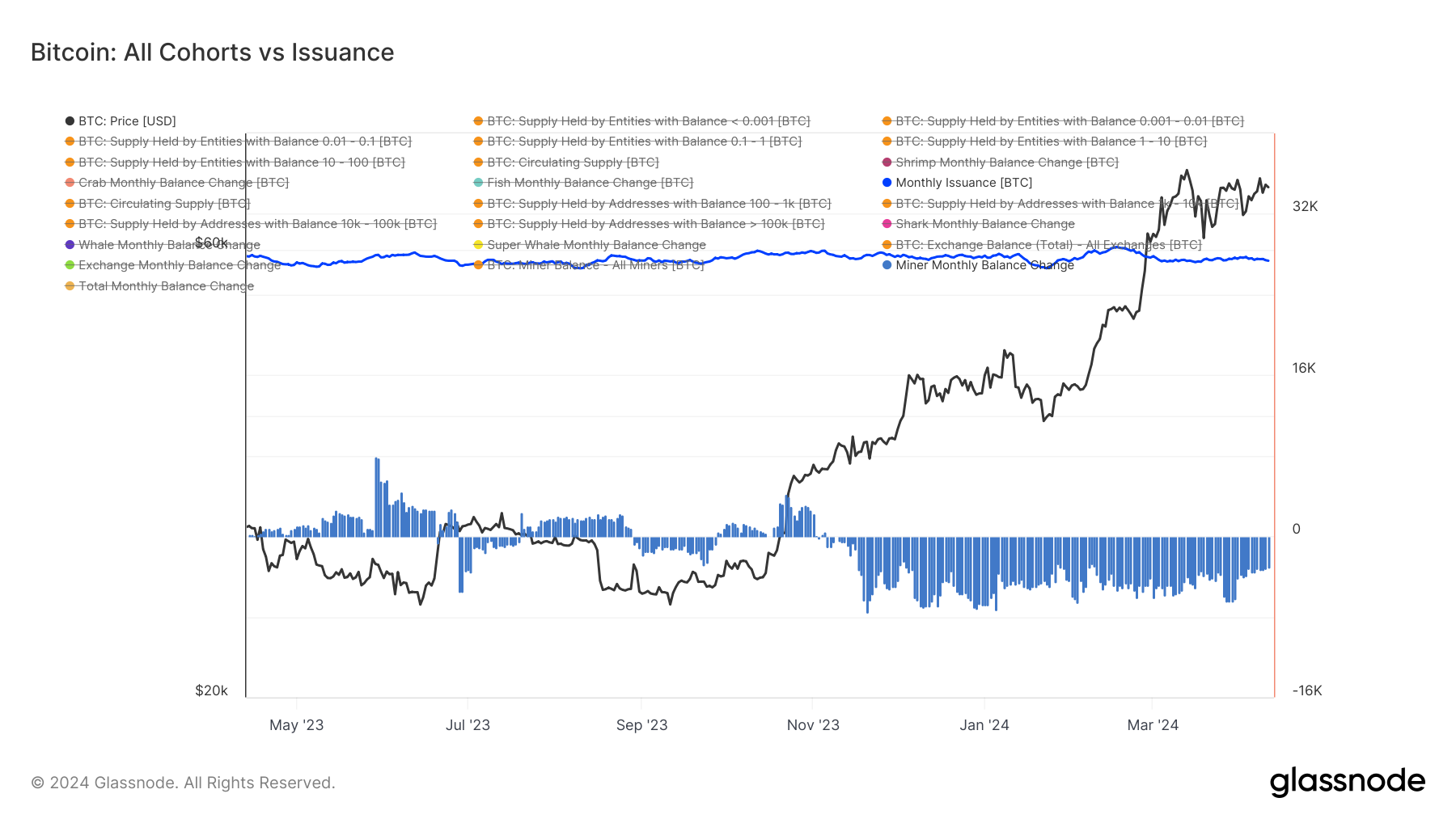

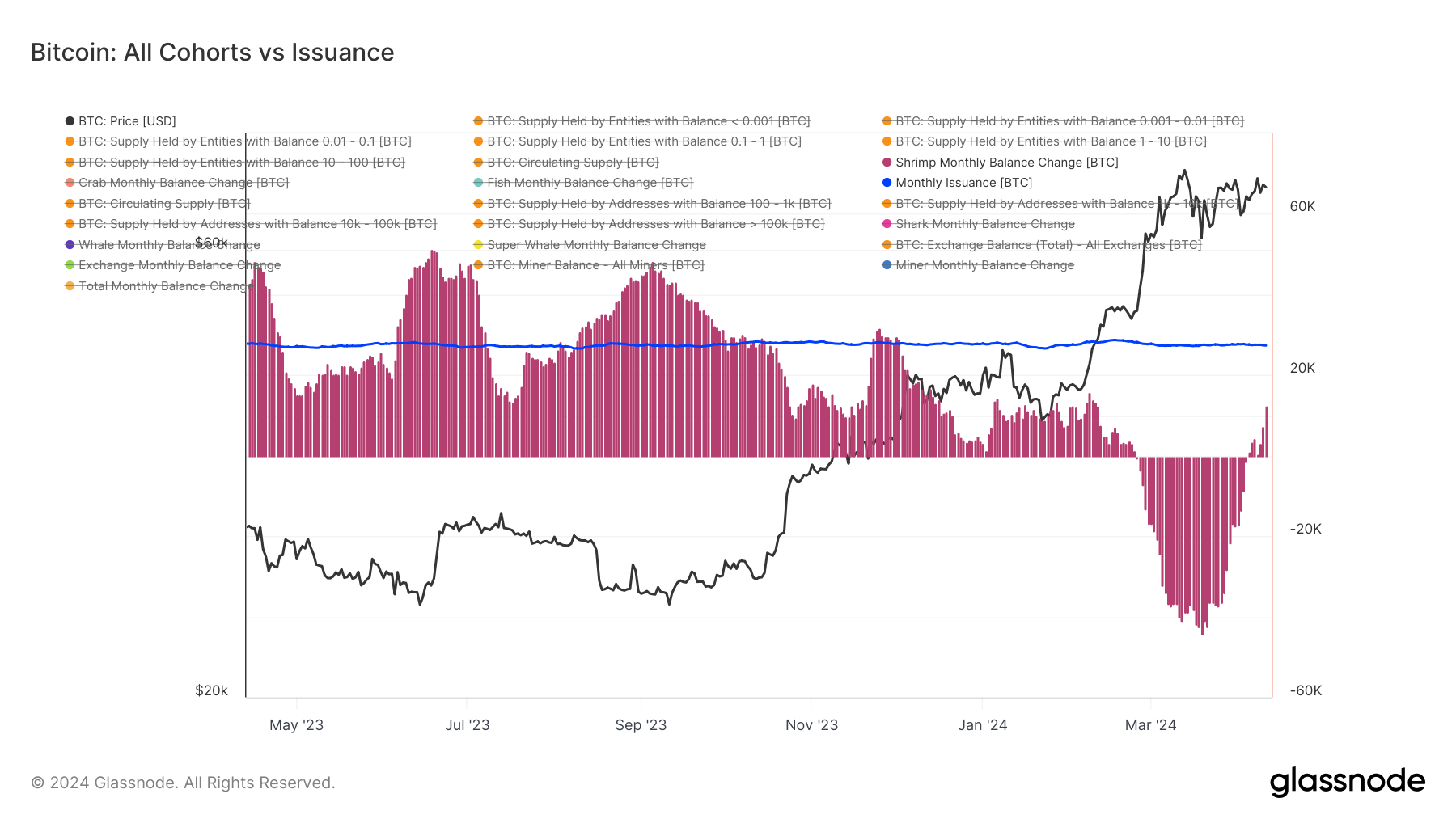

The aggregate accumulation by various Bitcoin cohorts, ranging from shrimps (holding less than one BTC) to super whales (10,000+ BTC), has surpassed the monthly issuance, painting a bullish picture for the future of BTC.

We are rapidly approaching the next Bitcoin (BTC) halving, with the event now just days away. Currently, around 900 BTC are mined daily, amounting to approximately 27,000 BTC per month. Amid this data, Glassnode reveals an astonishing accumulation of 115,000 BTC over the past 30 days, marking one of the most bullish periods in a year.

Interestingly, while miners have been continuously distributing since the end of 2023, shrimps are now accumulating for the first time since February, with a strong accumulation of roughly 12,500 BTC over the past 30 days.

As the halving looms closer, the monthly issuance is set to be cut in half to 13,500 BTC. This reduction in supply, coupled with the increasing demand outpacing the monthly issuance, sets the stage for an exciting Q2.

The post Bitcoin’s looming halving event prompts massive accumulation appeared first on CryptoSlate.

Cleanspark to Upgrade Mining Fleet With 100,000 S21 Pro Bitcoin Miners From Bitmain

The publicly traded bitcoin mining company Cleanspark has exercised its option to acquire 100,000 bitcoin mining machines from Bitmain. The firm initially secured the option last year, and the agreement has now been enhanced to include the latest S21 Pro model from Bitmain, which offers 15 joules per terahash (J/T). Bitmain and Cleanspark Seal Deal […]

The publicly traded bitcoin mining company Cleanspark has exercised its option to acquire 100,000 bitcoin mining machines from Bitmain. The firm initially secured the option last year, and the agreement has now been enhanced to include the latest S21 Pro model from Bitmain, which offers 15 joules per terahash (J/T). Bitmain and Cleanspark Seal Deal […]

Source link

Bitcoin is now hovering around the $70,000 threshold after a notable recovery it witnessed a few days ago. Due to the recent momentum, crypto enthusiasts are becoming less pessimistic about the digital asset’s growth prior to the halving event. With the fast approaching much-anticipated Bitcoin Halving, Rekt Capital, a well-recognized cryptocurrency analyst and aficionado, has offered his market insights mapping out three distinct stages of the event for investors.

3 Distinct Aspects Of The Bitcoin Halving

Rekt Capital’s analysis delves into Bitcoin‘s movement before and after the halving takes place, which is expected to happen this month. In the seven days leading up to the occurrence, the crypto analyst underscored three stages to observe for a successful outcome.

These three phases include the final pre-halving retrace, the re-accumulation phase, and the parabolic uptrend phase. Emphasizing on the first aspect, Rekt Capital noted that the pre-halving retrace is documented in the books and has already manifested.

During this period, Bitcoin experienced an 18% pullback compared to 2016 and 2020’s retracement of 38% and 19%, respectively. The expert believes that the concluded pre-halving Retrace was the last chance to purchase a deal during the pre-halving phase.

Following the conclusion of the retrace, Rekt Capital has confirmed the development has laid the groundwork for the Re-accumulation range. It is important to note that the aforementioned range occurs a few weeks ahead of the halving, and it ends with a breakout from it a few weeks later.

Specifically, the period could last for several weeks and up to 150 days or five months. Given the manifestation of the range, sideways movement through the halving and beyond is the major purpose of BTC.

Thus, the analyst has stressed the need to be patient around this phase, as many investors get frustrated, bored, and disappointed here because their Bitcoin investments lack significant returns. As a result, they lose confidence and get shaken out of the market before the event.

BTC’s Post-Halving Rally Might Mirror Previous Trend

As for the parabolic uptrend, Rekt Capital claims the phase will begin when Bitcoin breaks out from the re-accumulation range. He further stated that the price of BTC tends to grow more quickly and enters a parabolic upsurge during this stage.

According to the expert, this area has typically lasted about a year or a little more, particularly around 385 days in the past. However, with the possible accelerated cycle that is currently in development, the period could be halved within this bull market cycle.

Rekt Capital’s key perspectives came amidst Bitcoin demonstrating strength to revisit its current all-time high of $73,000. BTC has managed to amass gains of more than 6% in the past few days.

It recovered to the $70,000 level after plunging as low as $67,000 on Wednesday and is getting close to $71,000. At the time of writing, BTC was trading at $70,854, indicating over 6% increase in the past week.

Its market capitalization is up by 1% and its trading volume has plummeted by more than 21% over the past day. Given the current trend in the coin market, BTC could be in a position to see even bigger gains in the months to come.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin holds steady against economic headwinds, outshining Ethereum

Quick Take

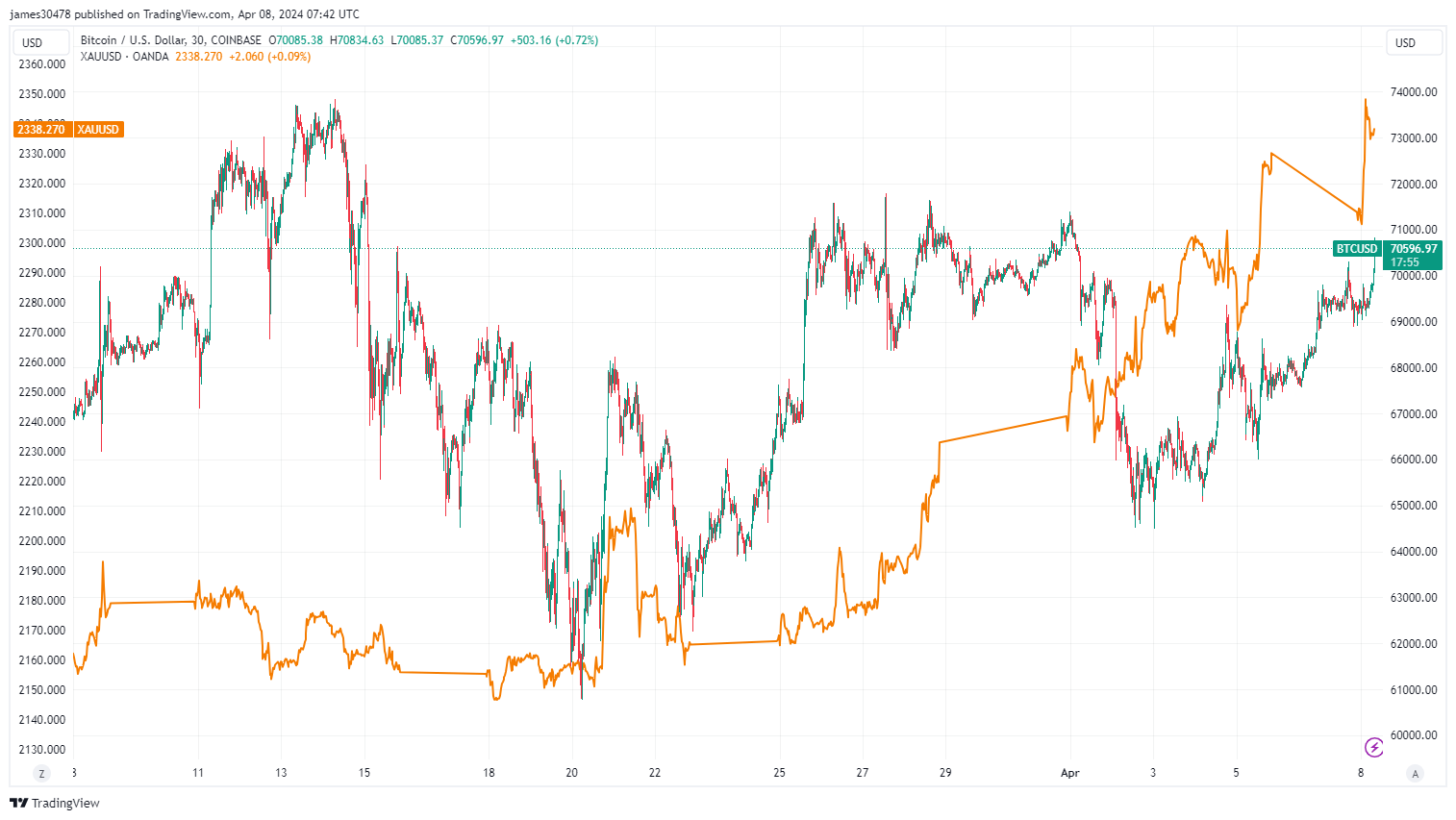

In the midst of economic uncertainty, Bitcoin continues to dance around the crucial $70,000 level, demonstrating its resilience despite the DXY index steadily climbing towards 106 and US yields on the rise. As investors seek safe-haven assets, many are looking to gold for guidance, hoping that Bitcoin, often referred to as “digital gold,” will follow suit.

Despite a slight dip at the beginning of April, Bitcoin’s dominance in the digital asset market remains strong, currently at 54.6%, just below the cycle highs of 55.2%. This growth in dominance, up 6% year-to-date, indicates that investors, on aggregate, are favoring Bitcoin over other digital assets.

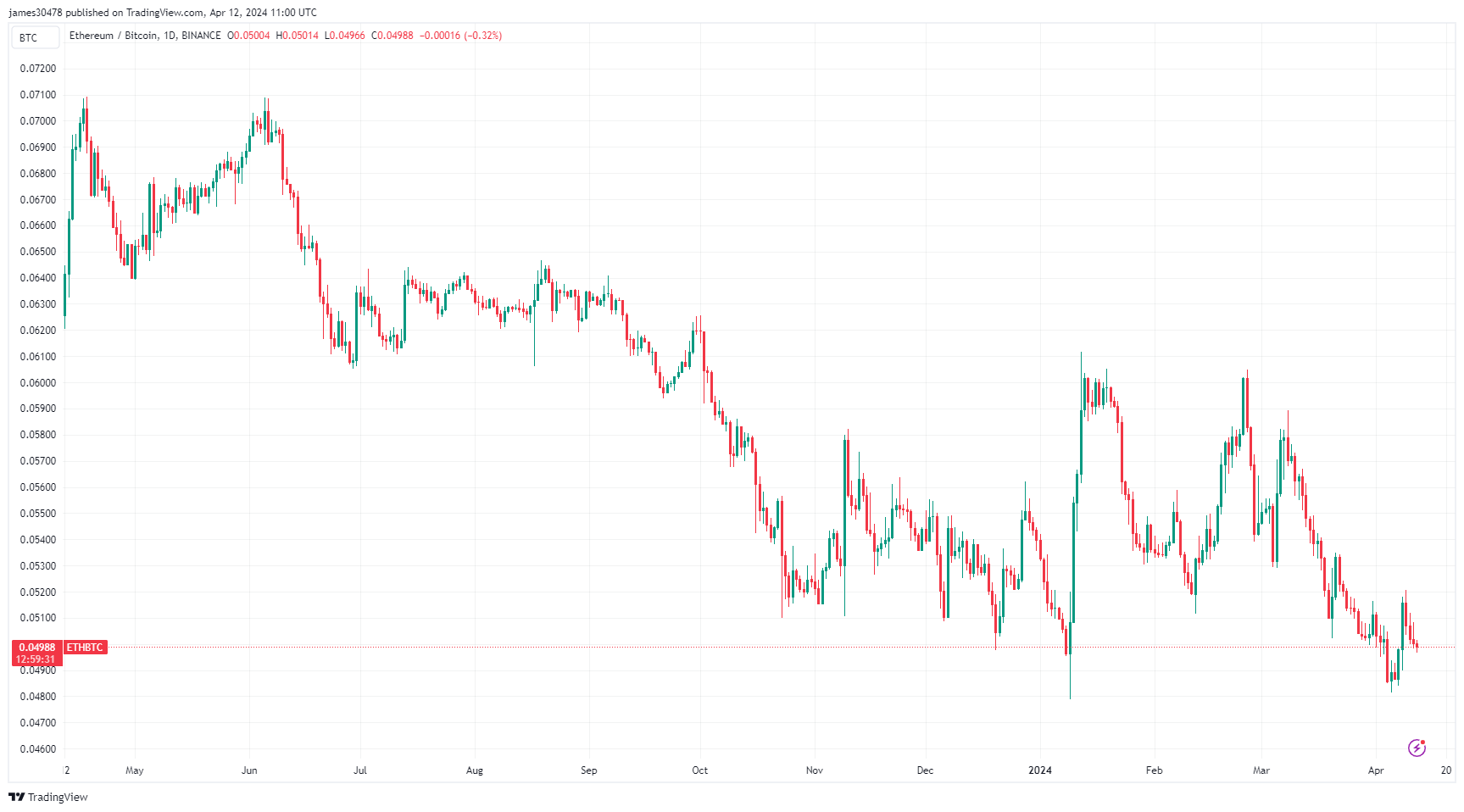

Another noteworthy trend is the ETH/BTC ratio, which remains below the critical 0.05 threshold, suggesting that Bitcoin is outperforming Ethereum. The ETH/BTC ratio has declined by 6% year-to-date and 20% over the past year. As the DXY index continues to surge, market observers are keeping a close eye on Bitcoin and gold, anticipating that they may continue to hold their ground or even follow the upward trend, providing a potential hedge against economic instability.

The post Bitcoin holds steady against economic headwinds, outshining Ethereum appeared first on CryptoSlate.