Quick Take

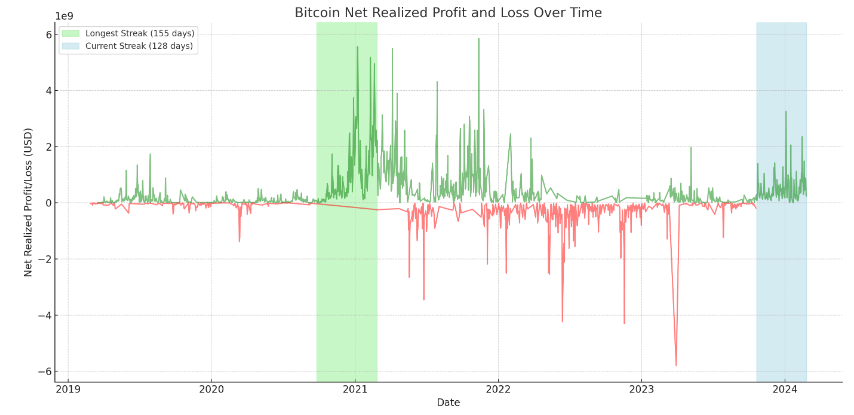

Net realized profit-taking for Bitcoin has witnessed an unbroken streak of 128 days, starting from Oct. 20, 2023, until Feb. 25, 2024. This period saw Bitcoin’s price catapult from below $30,000 to $50,000, providing lucrative opportunities for investors.

Defined by Glassnode, the net realized profit/loss represents the cumulative profit or loss from all coin transactions. It is calculated by deducting the realized loss from the realized profit.

This is not the first time such a trend has been noted. Looking back over the past five years, we find an even more extended period of consecutive net profit-taking: a staggering 155-day run from September 2020 to Feb. 26, 2021, during the significant bull run of 2021.

Interestingly, the frequency of profit-taking has dipped considerably in recent weeks as Bitcoin’s price has stabilized above $50,000. Notably, when Bitcoin’s price crossed significant milestones at $40,000 and $50,000, we noticed an intense surge in profit taking.

However, a contrast emerges when comparing the current trend with the 2021 bull run. The 2021 bull run witnessed multiple days where the profit-taking figures reached staggering heights of over $4 to $5 billion. In contrast, the highest profit-taking in 2024 peaked at $3.2 billion in a single day. This indicates a notably subdued level of profit-taking activities in the current year when compared to the intense trading during the 2021 bull run.

The post Bitcoin investors realize net profits for 128 consecutive days appeared first on CryptoSlate.

The rapid proliferation of artificial intelligence (AI) models in recent years is contributing to the escalating problem of personal data harvesting, or “grabbing,” by major tech companies, Calanthia Mei, the co-founder of the data marketplace Masa, has argued. Mei, a Web3 builder and investor, asserts that this personal data harvesting frequently occurs without the consent […]

The rapid proliferation of artificial intelligence (AI) models in recent years is contributing to the escalating problem of personal data harvesting, or “grabbing,” by major tech companies, Calanthia Mei, the co-founder of the data marketplace Masa, has argued. Mei, a Web3 builder and investor, asserts that this personal data harvesting frequently occurs without the consent […]

In its latest annual report, Riot Platforms, the publicly-listed bitcoin mining firm, outlines several significant risks that could impact its operations, including troubles in the broader crypto economy, potential decreases in onchain transaction fees, and the anticipated bitcoin halving event in April 2024. The company emphasizes the halving event’s potential to reduce mining rewards as […]

In its latest annual report, Riot Platforms, the publicly-listed bitcoin mining firm, outlines several significant risks that could impact its operations, including troubles in the broader crypto economy, potential decreases in onchain transaction fees, and the anticipated bitcoin halving event in April 2024. The company emphasizes the halving event’s potential to reduce mining rewards as […]

Just recently, the 45th President of the United States, Donald Trump, has expressed a neutral stance towards bitcoin, stating he could live with it “one way or the other.” Meanwhile, Trump’s holdings in crypto assets have seen a significant increase in value. A substantial portion of his digital wealth is currently in a digital currency […]

Just recently, the 45th President of the United States, Donald Trump, has expressed a neutral stance towards bitcoin, stating he could live with it “one way or the other.” Meanwhile, Trump’s holdings in crypto assets have seen a significant increase in value. A substantial portion of his digital wealth is currently in a digital currency […]

The start of every year presents an opportunity for new beginnings. Many people set out with ambitions to hit the gym, exercise regularly, or walk more instead of driving. Sadly, it’s estimated that it takes the average American just seven weeks to lose motivation and abandon their New Year’s health goals. The following is an […]

The start of every year presents an opportunity for new beginnings. Many people set out with ambitions to hit the gym, exercise regularly, or walk more instead of driving. Sadly, it’s estimated that it takes the average American just seven weeks to lose motivation and abandon their New Year’s health goals. The following is an […]

The European Central Bank (ECB) has published a blog post claiming that “bitcoin has failed to fulfill its original promise to become a global decentralized digital currency.” The ECB economists who authored the post added that bitcoin’s fair value is still zero and bitcoin transactions are “still inconvenient, slow, and costly.” Moreover, they asserted that […]

The European Central Bank (ECB) has published a blog post claiming that “bitcoin has failed to fulfill its original promise to become a global decentralized digital currency.” The ECB economists who authored the post added that bitcoin’s fair value is still zero and bitcoin transactions are “still inconvenient, slow, and costly.” Moreover, they asserted that […]

Rich Dad Poor Dad author Robert Kiyosaki has explained what he will do if the price of bitcoin crashes. The famous author has been recommending bitcoin alongside gold and silver for quite some time, and he recently increased his bitcoin holdings following the approval of U.S. spot bitcoin exchange-traded funds (ETFs). Robert Kiyosaki: ‘Sale’ Is […]

Rich Dad Poor Dad author Robert Kiyosaki has explained what he will do if the price of bitcoin crashes. The famous author has been recommending bitcoin alongside gold and silver for quite some time, and he recently increased his bitcoin holdings following the approval of U.S. spot bitcoin exchange-traded funds (ETFs). Robert Kiyosaki: ‘Sale’ Is […]

Microstrategy’s executive chairman, Michael Saylor, sees bitcoin as “the strongest asset.” He believes that capital is going to keep flowing from other asset classes, such as gold and real estate, into bitcoin because the cryptocurrency is “technically superior to those asset classes.” He emphasized that bitcoin is an exit strategy and Microstrategy has no plan […]

Microstrategy’s executive chairman, Michael Saylor, sees bitcoin as “the strongest asset.” He believes that capital is going to keep flowing from other asset classes, such as gold and real estate, into bitcoin because the cryptocurrency is “technically superior to those asset classes.” He emphasized that bitcoin is an exit strategy and Microstrategy has no plan […]