In the opening fortnight of February, the stablecoin domain expanded by $1.7 billion, marking a significant rise. The value of the fiat token crypto market has once again risen witnessing an increase exceeding $2.5 billion over the past ten days. Specifically, three stablecoins have driven this upswing, with the stablecoin ethena usde at the forefront […]

In the opening fortnight of February, the stablecoin domain expanded by $1.7 billion, marking a significant rise. The value of the fiat token crypto market has once again risen witnessing an increase exceeding $2.5 billion over the past ten days. Specifically, three stablecoins have driven this upswing, with the stablecoin ethena usde at the forefront […]

Source link

CoinNews

Weekly NFT Sales Rise 17% With Bitcoin Climbing Back to Second in Volume

Based on the most recent international standings and weekly figures, sales of non-fungible tokens (NFTs) have surged by 17.66% in the past week, amassing slightly more than $306 million in sales. This uptick marks a jump from last week’s 16.8% rise in NFT sales, with the leading blockchains in terms of volume — Ethereum and […]

Based on the most recent international standings and weekly figures, sales of non-fungible tokens (NFTs) have surged by 17.66% in the past week, amassing slightly more than $306 million in sales. This uptick marks a jump from last week’s 16.8% rise in NFT sales, with the leading blockchains in terms of volume — Ethereum and […]

Source link

The cryptocurrency market witnessed a significant shift in momentum on February 23rd, as Uniswap native token, UNI, skyrocketed by an impressive 71%. This surge marks the token’s highest price point since March 2022, sending shockwaves through the crypto landscape and reigniting interest in the decentralized finance (DeFi) sector.

Source: Coingecko

Uniswap Proposes Fee-Sharing Feast For Stakers

The primary catalyst behind this astronomical rise appears to be a pivotal proposal unveiled by the Uniswap Foundation. This proposition advocates for the implementation of a novel fee-sharing mechanism, fundamentally altering the token’s utility and incentivizing long-term participation within the Uniswap ecosystem.

Under the proposed system, UNI holders who stake their tokens will be rewarded with a portion of the fees generated by the Uniswap protocol. This not only grants them a direct financial incentive but also empowers them to choose delegates who vote on governance proposals, shaping the future direction of Uniswap.

This revolutionary approach resonates with a broader trend of resurgent interest in DeFi. According to on-chain data provider Santiment, assets associated with decentralized lending, borrowing, and cryptocurrency exchange, like $COMP, $SUSHI, and $AAVE, have all experienced notable value increases, mirroring UNI’s upward trajectory.

Trade Volumes On A Roll

Further bolstering this trend, trading volumes across these protocols have also seen explosive growth. For instance, the COMP price jumped alongside a staggering 400% increase in trading volume, reaching over $175 million.

Similarly, SushiSwap (SUSHI) witnessed a 27% price surge coupled with a 153% increase in trading volume. This shift in investor focus is further underscored by a corresponding decline in the value of AI-related coins, indicating a potential capital rotation within the market.

UNI currently trading at $12.16 on the daily chart: TradingView.com

Uniswap v4 Upgrade On The Horizon: Efficiency And Customization Beckon

Adding fuel to the fire is the impending arrival of the highly anticipated Uniswap v4 upgrade, slated for release in Q3 2024. This transformative update promises to enhance the protocol’s efficiency and customizability, catering to the evolving needs of the DeFi space.

While the direct impact of v4 on the current price surge remains debatable, its potential to revolutionize the Uniswap experience undoubtedly contributes to the overall bullish sentiment surrounding UNI.

Beyond Uniswap: DeFi Dominance On The Rise?

The Uniswap fee-sharing proposal and upcoming v4 upgrade have not only revitalized the UNI token but also cast a spotlight on the broader DeFi landscape. Analysts predict that other DeFi protocols like Blur and Lido Finance could witness similar surges in the wake of Uniswap’s bold move.

This potential domino effect underscores the growing importance of DeFi within the cryptocurrency ecosystem, attracting investors seeking innovative financial solutions beyond traditional centralized systems.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Lejilex and Crypto Freedom Alliance of Texas Sue SEC for Unlawfully Targeting the Digital Asset Industry

Lejilex and the Crypto Freedom Alliance of Texas, a crypto nonprofit, have teamed up to introduce a complaint against the actions of the SEC towards actors in the digital asset industry in America. The complaint alleges that the SEC has no regulatory powers over these crypto companies, having usurped functions not given to it by […]

Lejilex and the Crypto Freedom Alliance of Texas, a crypto nonprofit, have teamed up to introduce a complaint against the actions of the SEC towards actors in the digital asset industry in America. The complaint alleges that the SEC has no regulatory powers over these crypto companies, having usurped functions not given to it by […]

Source link

Coinbase on Grayscale Ethereum Spot ETF Application: ‘ETH Is a Commodity, Not a Security’

Coinbase has answered the SEC request for comments on the proposed rule change to list the ETH Grayscale Fund as a spot ETF. Coinbase stated that ether was a commodity, and its status has been publicly recognized in a variety of circumstances by U.S. agencies and courts. Coinbase Supports Ethereum Grayscale Fund Conversion as a […]

Coinbase has answered the SEC request for comments on the proposed rule change to list the ETH Grayscale Fund as a spot ETF. Coinbase stated that ether was a commodity, and its status has been publicly recognized in a variety of circumstances by U.S. agencies and courts. Coinbase Supports Ethereum Grayscale Fund Conversion as a […]

Source link

Fluidkey Launches to Tackle the Transaction Privacy Issues on EVM Chains

Fluidkey has announced it has opened its Optimism-based alpha to more users, allowing them to test their private solutions. Fluidkey seeks to solve the transaction privacy problem in EVM chains by leveraging ENS and stealth addresses, allowing users to use a new self-custodial asset for each payment, and segregating these movements to avoid linkability. Fluidkey […]

Fluidkey has announced it has opened its Optimism-based alpha to more users, allowing them to test their private solutions. Fluidkey seeks to solve the transaction privacy problem in EVM chains by leveraging ENS and stealth addresses, allowing users to use a new self-custodial asset for each payment, and segregating these movements to avoid linkability. Fluidkey […]

Source link

Donald Trump Acknowledges Bitcoin’s Popularity — Says BTC Has Taken on ‘a Life of Its Own’ and ‘I Can Live With It’

U.S. presidential candidate and former President Donald Trump has acknowledged the growing popularity of bitcoin, stating that “a lot of people are doing it” and the crypto has taken on “a life of its own.” Trump further shared: “More and more I’m seeing people wanting to pay bitcoin and you’re seeing something that’s interesting so […]

U.S. presidential candidate and former President Donald Trump has acknowledged the growing popularity of bitcoin, stating that “a lot of people are doing it” and the crypto has taken on “a life of its own.” Trump further shared: “More and more I’m seeing people wanting to pay bitcoin and you’re seeing something that’s interesting so […]

Source link

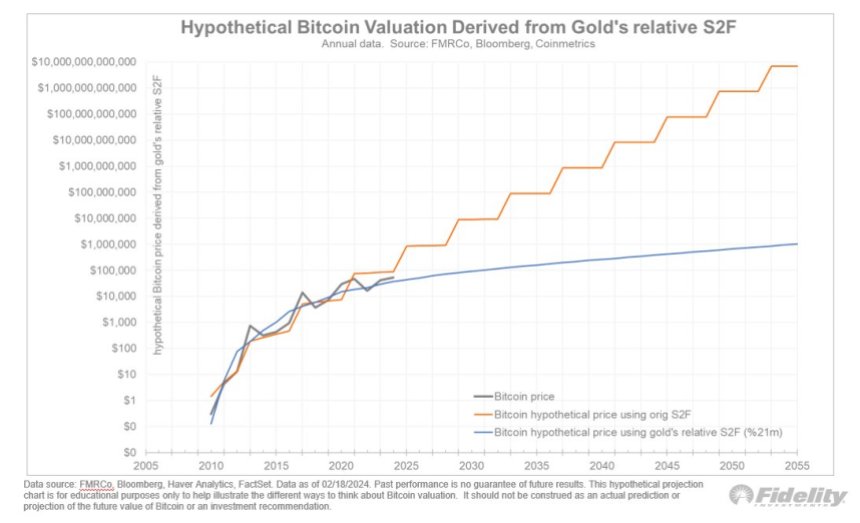

In recent years, the debate surrounding Bitcoin’s (BTC) potential market share relative to gold has garnered significant attention, as recently approved Bitcoin Exchange-Traded Funds (ETFs) can bring Bitcoin significantly closer to gold in key metrics.

Jurrien Timmer, Director of Global Macro at Fidelity Investments, has put forward an analysis that sheds light on this subject. By examining the value of “monetary gold” and Bitcoin’s market capitalization, as well as considering the impact of halvings on Bitcoin’s supply, Timmer presents insights into the future dynamics of these two assets.

Gold Vs Bitcoin

Timmer’s analysis begins by estimating the share of gold held by central banks and private investors for monetary purposes, excluding jewelry and industrial usage. While this estimation is not exact, based on data from the World Gold Council, Timmer suggests that monetary gold accounts for approximately 40% of the total above-ground gold.

Drawing upon his previous calculations, Timmer posits that Bitcoin has the potential to capture around a quarter of the monetary gold market, with monetary gold valued at around $6 trillion and Bitcoin’s market capitalization at $1 trillion.

Timmer further delves into the impact of Bitcoin halvings on its price. Historically, halvings have had a substantial effect on Bitcoin’s value. However, Timmer raises the hypothesis that diminishing returns may occur in the future as the incremental supply of new Bitcoin decreases.

By comparing the outstanding supply and incremental supply of Bitcoin with those of gold, Timmer demonstrates that the diminishing impact of the halvings is likely to be more pronounced in the future.

As the number of coins available for mining dwindles, the influence of each subsequent halving event on Bitcoin’s price may diminish. This insight prompts Timmer to explore alternative ways to project Bitcoin’s price trajectory.

BTC’s Price Projections

To account for the diminishing impact of halvings, Timmer introduces the concept of a modified Stock To Flow (S2F) curve. This curve is derived by overlaying an asymptotic supply curve, representing the percentage of coins mined relative to the final supply cap, onto the original S2F curve.

Timmer proposes using a regression formula incorporating PlanB’s original S2F curve and the asymptotic supply curve as independent variables. This modified S2F curve aligns more closely with the supply dynamics of gold, reflecting a scenario in which Bitcoin’s scarcity advantage continues, but its impact on price gradually diminishes over time.

Using the modified S2F model and considering the supply characteristics of gold, Timmer generates hypothetical price projections for Bitcoin that place the cryptocurrency at approximately $100,000 by the end of 2024.

According to Timmer, if Bitcoin were to capture a quarter of the monetary gold market, it would represent a remarkable shift in the global distribution of wealth, which would gradually drive up the cryptocurrency’s price over the coming years.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Never-before-seen Satoshi Nakamoto emails add several details to Bitcoin’s origin lore

Private email correspondence between the pseudonymous Bitcoin creator Satoshi Nakamoto and an early contributor to the project, Martii Malmi, has shed further light on the origin story of the flagship crypto and its creator’s earliest thoughts about the future.

The emails were shared as evidence by Malmi in the Crypto Open Patent Alliance (COPA) vs. Craig Wright trial as part of his testimony. The trial has been ongoing since the beginning of February and will determine whether Wright’s claims of creating Bitcoin have any substance.

Never before seen emails

One group of emails concerns early conversations between Nakamoto and Malmi, who contributed to the Bitcoin website and project code starting in 2009.

The emails provide insight into Nakamoto’s earliest expectations regarding Bitcoin and its future growth. Based on the emails, he was aware of the challenges Bitcoin could face regarding its legal status.

In one email, he wrote:

“There are a lot of things you can say on the sourceforge site that I can’t say on my own site … Even so, I’m uncomfortable with explicitly saying ‘consider it an investment’. That’s a dangerous thing to say and you should delete that bullet point. It’s OK if [Bitcoin users] come to that conclusion on their own, but we can’t pitch it as that.”

Whether cryptocurrencies and related offerings are investment contracts has been a critical point of contention between the industry and regulators, especially the US SEC.

After years of negative sentiment, Bitcoin has generally established itself as a commodity, with many considering it “digital gold.” This is primarily because it was initially issued through mining rather than investment contracts, although Bitcoin exchanges allowed users to purchase the crypto asset as early as 2010.

Incidentally, the emails describe the creation of one of the first Bitcoin exchanges. Nakamoto was looking for ideas for Bitcoin applications, and Malmi suggested a fiat-to-Bitcoin exchange.

Malmi went on to operate and register Bitcoinexchange.com, as was previously known. However, the latest emails show that Nakamoto had been a key advisor for the exchange.

Nakamoto advised Malmi to initially operate the exchange individually instead of creating an “eBay-type” or peer-to-peer exchange. He also dropped his plans to incorporate an auction system in favor of Malmi’s idea for a set exchange rate.

Furthermore, Nakamoto secured a donation of $3,600, of which $1,000 was allocated to support the exchange’s initial operations.

Other topics included anonymity, mining profits, fees

Nakamoto also created the early distinction between anonymous and pseudonymous — or partially anonymous — transactions. He anticipated controversy around transaction analysis, now a major business for firms like Chainalysis and Elliptic.

Nakamoto wrote at the time:

“I think we should de-emphasize the anonymous angle … we can’t give the impression [Bitcoin is] automatically anonymous. It’s possible to be pseudonymous, but … If someone digs through the transaction history and starts exposing information people thought was anonymous, the backlash will be much worse if we haven’t prepared expectations …”

Nakamoto and Malmi also discussed other topics, such as mining profits, power consumption, and Bitcoin’s potential environmental impact. In response to the environmental concerns, Nakamoto wrote:

“Ironic if we end up having to choose between economic liberty and conservation.”

He told Malmi that “unfortunately,” the proof-of-work consensus method was the only way to ensure that Bitcoin could “work” without a trusted third party. He added that it was “fundamental” in preventing double-spending.

Nakamoto did not seem fazed by the idea of significant energy being dedicated to the Bitcoin network. He wrote that even “if it did grow to consume significant energy,” it would not be as “wasteful” as the resources spent on “conventional banking activity.”

He further stated:

“The cost would be an order of magnitude less than the billions in banking fees that pay for all those brick and mortar buildings, skyscrapers and junk mail credit card offers.”

Nakamoto had also been acutely aware that electricity prices would affect mining profitability. His analysis at the time did not take into consideration how quickly the mining industry would evolve after the inception of ASIC devices. However, the emails show that he was mindful of the pace at which technology could develop over the coming years.

“The value of bitcoins would be relative to the electricity consumed to produce them … If you run a computational task 24/7, not letting it idle, it uses significantly more power … The extra wattage consumed goes straight to your power bill, and the value of the bitcoins you produce would be something less than that.”

Another topic discussed by the two developers included the possibility of using Bitcoin time-stamping data. Later, Nakamoto’s own Genesis Block transaction famously included a financial headline.

The emails also revealed discussions around Nakamoto’s decision to initially “hide the transaction fee setting” because he felt the ability to customize fees would confuse users. He predicted that adjustable fees would not be needed until the “far away future, if ever.”

Nakamoto’s prediction was partially correct — average Bitcoin transactions cost just cents before 2017, but the cost has risen significantly over the years, and transactions have regularly cost several dollars recently.

Emails could disprove Craig Wright’s claims

Critically, Malmi’s emails contradict some of the claims Wright has made over the years in his attempt to prove he is Nakamoto.

Wright said that Malmi first approached Nakamoto starting in February 2009. However, email records show that Malmi approached Nakamoto months later, in May 2009.

Another contradiction pointed out by Malmi was Wright misspelling Malmi’s first name in court, which would be uncharacteristic of Nakamoto, who had known him very well.

Yet another contradiction comes from the fact that Wright misidentified Malmi’s nationality even though emails contained a Finnish email address ending in .fi — and, in one case, Malmi’s full street address, including his country.

Wright also claimed in an earlier case that Malmi created the dark net marketplace Silk Road. This supposedly led Wright (as Nakamoto) to leave Bitcoin publicly in 2010.

In his witness statement, Malmi called these allegations “ridiculous and false.” He noted that Ross Ulbricht was convicted years ago for creating and operating the illegal dark web operation.

CryptoSlate previously covered email submissions between Nakamoto and Adam Back, which were filed as part of COPA’s broader efforts to disprove Wright’s claims in court.

Prominent digital asset financial services platform Matrixport has recently issued a bullish projection indicating a potential surge in Bitcoin’s (BTC) value. According to their analysis, Bitcoin may surpass its previously established two-year peak and climb to $63,000 by next month.

This bold prediction stems from a confluence of factors poised to exert significant influence on the trajectory of Bitcoin’s price in the coming weeks and months.

Rationale Behind Matrixport’s Optimistic Projection

The primary driver behind Matrixport’s optimistic outlook is the live trading of Bitcoin spot Exchange-Traded Funds (ETFs). According to the report, these spot ETFs have opened the doors for more investors to engage in crypto trading through conventional financial channels.

Additionally, with the increasing demand for these spot ETFs and the daily trading volumes reaching noteworthy levels, signaling growing investor interest in Bitcoin as an asset class, this could help propel the flagship crypto to trade above $60,000 by next month, according to the report.

[1/3] Bitcoin ETF Flow – Up to 22 Feb 2024

All data in. +$251.4m net flow on 22nd Feb. A strong day. pic.twitter.com/IdrCmgq5u8

— BitMEX Research (@BitMEXResearch) February 23, 2024

Furthermore, the impending Bitcoin halving event, scheduled for April 2024, is anticipated to catalyze further upward momentum in BTC prices. Bitcoin halvings result in a reduction in the rate of new BTC generation, and historically, this leads to a decrease in supply, typically driving up Bitcoin’s value.

Matrixport’s report also mentions the influence of macroeconomic factors on BTC’s price. The expectations of interest rate adjustments following the Federal Reserve’s Federal Open Market Committee (FOMC) gatherings are anticipated to have a significant impact.

Furthermore, the forthcoming uncertainty surrounding the US presidential elections may instigate market fluctuations, leading investors to turn to alternative assets such as Bitcoin to safeguard against potential shifts in economic policies.

Bitcoin Price Action And Expert Sentiments

Meanwhile, despite Bitcoin experiencing a nearly 10% surge over the past 14 days, the asset has witnessed quite a retracement in the previous week, declining by 2.2%. It’s worth noting that despite this setback, the cryptocurrency’s market capitalization remains above the $1 trillion mark.

An analyst known as Mags has expressed an overwhelmingly bullish sentiment toward Bitcoin, noting that the asset has “never been this bullish.” Mags city’s historical patterns and bullish technical signals reveal that BTC has recently closed a weekly candle above the 0.618 Fibonacci level, a rare occurrence in the cryptocurrency’s four-year cycle.

#Bitcoin has never been this bullish

For the first time ever, BTC is deviating from the 4 year cycle by closing a weekly candle above the 0.618 level before the halving event.

The best part about this deviation is it’s a bullish one, with the rise in demand among institutional… pic.twitter.com/F9xpTbEZ1d

— Mags (@thescalpingpro) February 22, 2024

However, Mike Novogratz, CEO of Galaxy Digital, has cautioned against potential downside risks, speculating on the possibility of a regulatory setback or market sentiment shift that could lower BTC prices to the $45,000-$42,000 range.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.