In a series of insightful emails between Martti Malmi and Satoshi Nakamoto, the foundational discussions shaping the early development of Bitcoin are revealed. These exchanges offer a rare glimpse into the critical thinking and technical challenges overcome in the cryptocurrency’s infancy. Blueprints of a Digital Revolution: Nakamoto’s Conversations With Sirius The dialogue initiated in May […]

In a series of insightful emails between Martti Malmi and Satoshi Nakamoto, the foundational discussions shaping the early development of Bitcoin are revealed. These exchanges offer a rare glimpse into the critical thinking and technical challenges overcome in the cryptocurrency’s infancy. Blueprints of a Digital Revolution: Nakamoto’s Conversations With Sirius The dialogue initiated in May […]

Source link

CoinNews

AI Token SingularityNET (AGIX) has recently observed a rally of 128% as on-chain data shows activity-related metrics have heated up for the coin.

SingularityNET Has Seen Sharp Growth In Volume & Whale Activity

In a new post on X, the on-chain analytics firm Santiment has talked about how SingularityNET has fared in its underlying metrics, with its market cap more than doubling in its latest rally.

In particular, the analytics firm has shared data for four of the AI token’s indicators. The chart below shows their trend over the past month.

All of these metrics seem to have blown up in recent days | Source: Santiment on X

The first indicator on the chart is the “Transaction Volume,” which keeps track of the total amount of AGIX (in USD) involved in network transfers every day.

This metric tells us about the amount of activity the users on the blockchain are displaying currently. The graph shows that this metric has climbed as SingularityNET has gone through its rally.

Generally, many traders must continue participating in the market for any rally to be sustainable. As the transaction volume has been rising, this is clearly what has been going on. If the volume shows any signs of cooling off, though, that’s when the coin might slow down.

The second metric of interest here is the “Whale Transaction Count,” which measures the total number of transactions on the SingularityNET blockchain worth at least $1 million in value.

Only the whales can make transfers so large, so this metric can provide hints about the current activity level of these humongous holders. As the chart shows, this metric has also been high recently, implying that the current transaction volume isn’t just because of smaller hands showing interest in the asset but also from these titans.

AGIX’s adoption also appears to be proceeding swiftly as the “Total Amount of Holders” metric has also been climbing up recently. This indicator keeps track of the number of addresses on the network carrying a non-zero balance.

Adoption is naturally a constructive sign for any cryptocurrency, as a large user base can provide a stronger foundation for sustainable moves to occur in the future. This constant influx of users would also contribute to the uptrend in the Transaction Volume.

Finally, Santiment has listed the “Social Dominance” in the chart, which, in short, tells us about the portion of social media talks around the top 100 cryptocurrencies that SingularityNET alone is contributing.

It would appear that the coin’s mindshare on social media has also skyrocketed with its price surge. This metric may be one to keep an eye on, as excessive hype has historically been something that has led rallies to top out.

AGIX Price

SingularityNET is trading around the $0.76 level after its incredible run over the past week.

Looks like the price of the asset has sharply gone up over the last few days | Source: AGIXUSD on TradingView

Featured image from Shutterstock.com, Santiment.net, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Crypto Analysts Are Giga-Bullish On XRP Price, Set Multiple Price Targets

Crypto analysts are currently optimistic about the XRP price trajectory in the coming months, setting different price targets, with some of them more bullish than others. XRP, like most top cryptocurrencies, is always subject to price predictions from analysts as the entire crypto market continues to anticipate the resumption of a market-wide rally.

Consequently, experts on social media are calling for some pretty wild price targets for XRP if the bull run kicks back into gear. Other market factors, like the possibility of an XRP ETF, are also bound to come into play in the quest for a price rally.

Crypto Analysts Remain Bullish On XRP Despite Price Consolidation

XRP has been on price decline since the beginning of the year. At the time of writing, the XRP price is trading at $0.5375, down 14% from the $0.625 level in early January. Notably, price movement recently went on a surge at the beginning of February as the broader cryptocurrency market witnessed inflows spearheaded by Bitcoin. As a result, XRP climbed to the $0.57 price level on February 15.

Despite the ongoing consolidation and lackluster price action, crypto analyst EGRAG CRYPTO has predicted a $1.4 XRP price target in the coming months. The analyst, known for his strong positive stance on XRP, made this prediction while looking at the wicking, ranging, consolidation, and bullish stages of XRP.

According to a color-coded price chart shared on social media by EGRAG, XRP is currently in the wicking stage. XRP recently closed above a long-term support level of $0.5141 at the top end of the red flag stage. Consequently, we could see XRP passing through into the bullish stage and $1.4 in the coming months.

It’s worth noting that the $1.4 price point coincides with a 1.618 Fib extension from $0.3536. EGRAG had noted in the past that XRP reaching $1.4 would set the stage for a progression to $5.

Dark Defender, another crypto analyst, used the wave strategy to predict various bullish price points. According to a social media post, XRP could continue the current downturn until it reaches the end point of a wave 2 correction between $0.5198 and $0.5066. Subsequent waves 3, 4, and 5 formations would then see XRP tearing past $0.6649, $0.7707, and $0.9191.

Analyst Dr. Profit also noted the potential of inflows rushing into XRP in the next 30 to 60 days. The analyst divulged that he bought 500,000 recently while calling XRP the “next shining bull.”

In the spirit of bullish countenance, a popular Bitcoin day trader recently disclosed that his father sold his house for $800,000 and allocated the proceeds to purchase XRP. Although this might seem very daring and unbelievable, it emphasizes the vast amount of optimism among some XRP investors.

XRP rises to $0.53 | Source: XRPUSD on Tradingview.com

Featured image from CryptoRankl, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Filecoin (FIL) has been among the top gainers during the current market rally. Throughout February, FIL has shown a formidable performance fueled by the bullish momentum and its partnership with a major blockchain.

This performance has analysts and important crypto actors predicting a potential bullish run around the corner for the decentralized storage network’s native token.

Should Filecoin Investors Get Ready For A Bull Run?

Pseudonym analyst and trader Crypto Breakout highlighted that FIL broke through a crucial resistance in the 3-day timeframe, signaling that the “bulls return with force.” The chart shared by the analyst illustrates a downtrend pattern in FIL’s price since 2022.

Two years ago, as the chart below shows, the token traded at $11 before facing a pullback that shredded about 70% of the token’s value in the following months. By February 2023, the token recovered and broke through the $9 resistance level before repeating a similar downtrend.

FIL's downtrend pattern since 2022. Source: Crypto Breakout on CoinMarketCap

Since 2023, the price has remained well below this level, only breaking through the $8 support zone once at the very beginning of 2024. Throughout January, FIL’s price had a turbulent performance, falling around 40%.

The price has picked up the crypto market uptrend, and, as the analyst highlights, it has been gaining positive momentum. The 3-day time frame shows that FIL has been following an upward trend that led to the token breaking through the crucial $8 support zone this Friday.

As the post suggests, this break out of the downtrend could signal FIL’s “beginning of an epic bullish rally” and that investors should “get ready for exciting moves ahead.”

Renowned crypto analyst Ali Martinez made a similar prediction. Earlier this week, Martinez highlighted Filecoin moving within a parallel channel on the 3-day chart. He suggested a successful breakthrough from the $8.50 barrier could catapult the token’s price to $25.5.

Artur Hayes Predicts $100 As FIL Continues To Rise

After the token’s recent surge, BitMEX co-founder Arthur Hayes shared his FIL prediction. On an X (former Twitter) post, Hayes forecasted that FIL’s price would rally to $100, also calling the arrival of the bull market.

Welcome to the bull market. May all things AI related levitate. $FIL = $100

Yachtzee 😘😘😘😘 pic.twitter.com/oggCeY8IGc

— Arthur Hayes (@CryptoHayes) February 23, 2024

Filecoin, a decentralized storage network, recently integrated with Ethereum’s rival Solana to make its blockchain history more accessible and usable. According to the announcement, the integration is a significant move away from centralized storage solutions, which seek to improve reliability and scalability in the Solana blockchain.

This move has considerably fueled the ongoing upward momentum for FIL. The token has shown a considerable performance in recent weeks, with FIL increasing 53.9% in the last two weeks and 67.7% in 30 days.

The token trades at $8.19 at writing time, representing a 9.6% surge in 24 hours and 39.0% in the last seven days. FIL is currently the 25th largest cryptocurrency by market capitalization, at $4.2 billion, a 12.38% increase from yesterday. Its trading activity also saw a recent rise, with its daily trading volume at $895.2 million, 44% more than the day before.

FIL performance in the 1-day chart. Source: FILUSDT on TradingView.com

Featured image from Unsplash.com, Chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

CoinMarketCap launches ‘Oscars of Crypto’ to celebrate industry accomplishments

CoinMarketCap has announced the launch of the inaugural CMC Crypto Awards to recognize the accomplishments of networks, people, and technology in the crypto industry.

The awards are scheduled to take place between Feb. 21 and March 6.

The selection of winners will rely on CoinMarketCap data, insights from expert panels, and community votes, with the winners announced on the last day of the event.

CoinMarketCap CEO Rush Luton said:

“Our intention is for the CMC Crypto Awards to become the most recognized annual celebration of Crypto and Web3. Think of it as the ‘Oscars Of Crypto’, an entertaining way to bring the whole industry together and celebrate the people and projects that are driving the industry forward.”

CoinMarketCap plans to award excellence across eight distinct categories within the crypto sphere.

The nominees

The first award is the coveted title of Crypto of the Year, which aims to recognize groundbreaking innovation and enduring impact on the industry. The nominees are Ripple, Solana, Chainlink, Ethereum, and Toncoin.

In the Crypto Leader of the Year category, CoinMarketCap is looking to honor visionaries who combat fear, uncertainty, and doubt (FUD), propelling technological advancements, adoption, and regulatory progress worldwide.

Nominees include former Binance CEO Changpeng Zhao, Coinbase CEO Brian Armstrong, Messari CEO Ryan Selkis, Ethereum co-founder Vitalik Buterin, and Hong Kong’s Securities and Futures Commission (SFC) CEO Julia Leung.

The Meme Coin of the Year category aims to recognize humor and community engagement in the industry, the nominees include Pepe, Milady, Memecoin, Bonk, and Ordinals.

The Most Innovative DeFi award will honor protocols that have contributed uniquely to the evolving landscape. The nominated projects are Uniswap, Unibot, EigenLayer, MakerDAO, and Friend.Tech.

The Most Innovative L1, L2, Cross-Chain Project award will be given to networks that have demonstrated considerable scalability, security, and interoperability advancements. The nominees include Arbitrum, Aptos, Axelar, ZKSync, and Celestia.

CoinMarketCap also wants to acknowledge the significant contributions of social media influencers for enriching the crypto discourse and advancing the community. Nominees include Lookonchain, ZachXBT, CryptosRUs, Wendy O, and The DeFi Edge.

Lastly, the Bridge Builder of the Year category aims to celebrate established brands that have embraced Web3 to enhance customer value.

Nominees for this award include BlackRock for championing a Bitcoin ETF, PayPal for its PYUSD stablecoin, Reddit for gamified avatars simplifying Web3 access, Starbucks for Web3 loyalty programs, and Nike for blending fashion, sport, gaming, and Web3 through strategic partnerships.

Vibrant Finance leverages Neon EVM for groundbreaking DeFi exchange innovation

Decentralized exchange (DEX) Vibrant Finance has launched on Neon EVM, a Solana-based platform, marking its foray into the non-Ethereum DeFi landscape, according to a Feb. 23 press release.

The DEX utilizes the Discretized-Liquidity Automated Market Maker (DL-AMM) model to overcome existing limitations within traditional DeFi exchanges.

Vibrant Finance CEO Jimmy Yin expressed enthusiasm about this deployment on Neon, emphasizing its potential to bridge Ethereum’s vibrant DeFi ecosystem with Solana’s robust liquidity and transactional efficiency.

“With our latest deployment on Neon EVM, we aim to make liquidity more efficient and foster cooperation between chains and ecosystems,” Yin remarked.

The DL-AMM model, renowned for offering discrete liquidity for each price movement, facilitates precise liquidity allocation at specific fixed prices. This innovative approach addresses challenges in DeFi exchanges and optimizes liquidity management for users. Additionally, it introduces advanced trading features such as limit orders, enriching the trading experience for users.

Vibrant Finance is supported by iZumi, a multi-chain DeFi protocol that provides DEX-as-a-Service (DaaS).

Neon EVM growing ecosystem

Neon EVM facilitates scaling Ethereum decentralized applications (dApp) on Solana, making it an ideal choice for Vibrant Finance to expand beyond Ethereum.

Neon essentially simplifies the deployment of EVM-compatible dApps with minimal code adjustments. The platform operates as a smart contract on Solana and processes requests through public PRC endpoints.

Several DeFi protocols, including deBridge and MeredianFi, have integrated with Neon, showcasing its growing success in the industry, primarily on the back of Ethereum and Solana’s rising prominence.

DeFillama data shows that Ethereum is the largest DeFi blockchain, with $45.87 billion in total value locked (TVL) on the network, while Solana’s TVL recently climbed above the $2 billion mark.

GAIMIN Announces the World’s First L2 Gaming Blockchain on BNB Chain

GAIMIN, the world’s leading provider of DePIN (Decentralised Physical Infrastructure Networks) today announces the world’s first L2 blockchain focused on delivering Web3 technology and services to the gaming industry. The incorporation of Web3 technologies, such as blockchain, crypto currency based economies and owner retained NFTs within the gaming industry has been slow to develop, primarily […]

GAIMIN, the world’s leading provider of DePIN (Decentralised Physical Infrastructure Networks) today announces the world’s first L2 blockchain focused on delivering Web3 technology and services to the gaming industry. The incorporation of Web3 technologies, such as blockchain, crypto currency based economies and owner retained NFTs within the gaming industry has been slow to develop, primarily […]

Source link

Decentralized exchange (DEX) Uniswap’s native token UNI climbed 60% on Feb. 23 to a two-year high of $12.48 following a governance proposal to introduce a fee reward mechanism for holders.

The token has since given up some of its gains and was trading at $11 as of press time — up 48% on a daily basis, according to CryptoSlate data.

UNI was last trading at these price levels in January 2022.

The primary driver behind the price rise is a new proposal to overhaul the DEX’s governance system. It aims to tackle the crucial issue of low engagement and “stale” delegation by directly incentivizing active participation.

Active governance

According to the proposal, Uniswap currently faces a troubling reality: despite its governance system holding the reins of the protocol’s future, participation remains sluggish.

Less than 10% of UNI tokens, the lifeblood of voting, are actively used, and a significant portion of existing delegation stands idle, failing to contribute to crucial decisions. The lack of engagement poses a potential threat to Uniswap’s long-term stability.

The proposal wants to solve this issue by creating a compelling incentive for token holders that involves linking UNI token delegation and staking to a share of the protocol’s fee revenue. This creates a direct connection between active participation and potential rewards, aiming to foster a more engaged community and attract new delegates.

The mechanism will be implemented via two new smart contracts that are meticulously designed to automate protocol fee collection and distribute them fairly to stakers based on their delegated UNI tokens.

The proposal lays out every detail of these contracts, including security audits and code descriptions, to remain fully transparent with the community.

Voting scheduled

The community has reacted positively to the development, and the surge in UNI’s value indicates a buying frenzy ahead of the voting snapshot.

After open discussion and refinement on the Uniswap forum, the community will hold two votes to determine whether it should be adopted — a snapshot vote on March 1 and an on-chain vote on March 8.

If successful, the community will then have the final say on activating the fee mechanism through a separate vote. This ensures every voice is heard and allows for further deliberation before taking the final step.

This proposal’s potential ramifications extend beyond Uniswap itself. Should it be implemented successfully, it could become a reference point for other decentralized protocols seeking to enhance active participation and responsible governance practices.

However, careful evaluation is necessary to understand the potential effects on liquidity and trade execution, as acknowledged within the proposal itself.

The proposal mirrors Osmosis DEX’s recent prop 651, which introduced similar incentives for token holders. The protocol has generated and distributed a little over $4 million in taker fees to OSMO stakers.

Osmosis Lead Llama Emperor Osmo told CryptoSlate:

“The recently suggested changes within Uniswap only help to cement that Osmosis governance acted with the sustainability and long-term viability of the Osmosis DEX in mind. Similar to what Prop 651 did for Osmosis, Uniswap aims to transform its UNI token from a governance-only token to one with a legitimate value accrual mechanism.”

Uniswap Market Data

At the time of press 7:51 pm UTC on Feb. 24, 2024, Uniswap is ranked #16 by market cap and the price is up 2.14% over the past 24 hours. Uniswap has a market capitalization of $6.68 billion with a 24-hour trading volume of $1.53 billion. Learn more about Uniswap ›

Crypto Market Summary

At the time of press 7:51 pm UTC on Feb. 24, 2024, the total crypto market is valued at at $1.98 trillion with a 24-hour volume of $50.3 billion. Bitcoin dominance is currently at 51.21%. Learn more about the crypto market ›

CardanoGPT (CGI) Token Skyrockets Amid AI Crypto Frenzy, Urging Investors to Seize the Opportunity

PRESS RELEASE. In an electrifying surge that has captured the attention of the cryptocurrency world, CardanoGPT (CGI) witnessed a remarkable 40% increase in value within just 24 hours, following the unveiling of OpenAI’s groundbreaking Sora and a significant profit jump for Nvidia, a company that produces chips that most AI companies use. This surge positions […]

PRESS RELEASE. In an electrifying surge that has captured the attention of the cryptocurrency world, CardanoGPT (CGI) witnessed a remarkable 40% increase in value within just 24 hours, following the unveiling of OpenAI’s groundbreaking Sora and a significant profit jump for Nvidia, a company that produces chips that most AI companies use. This surge positions […]

Source link

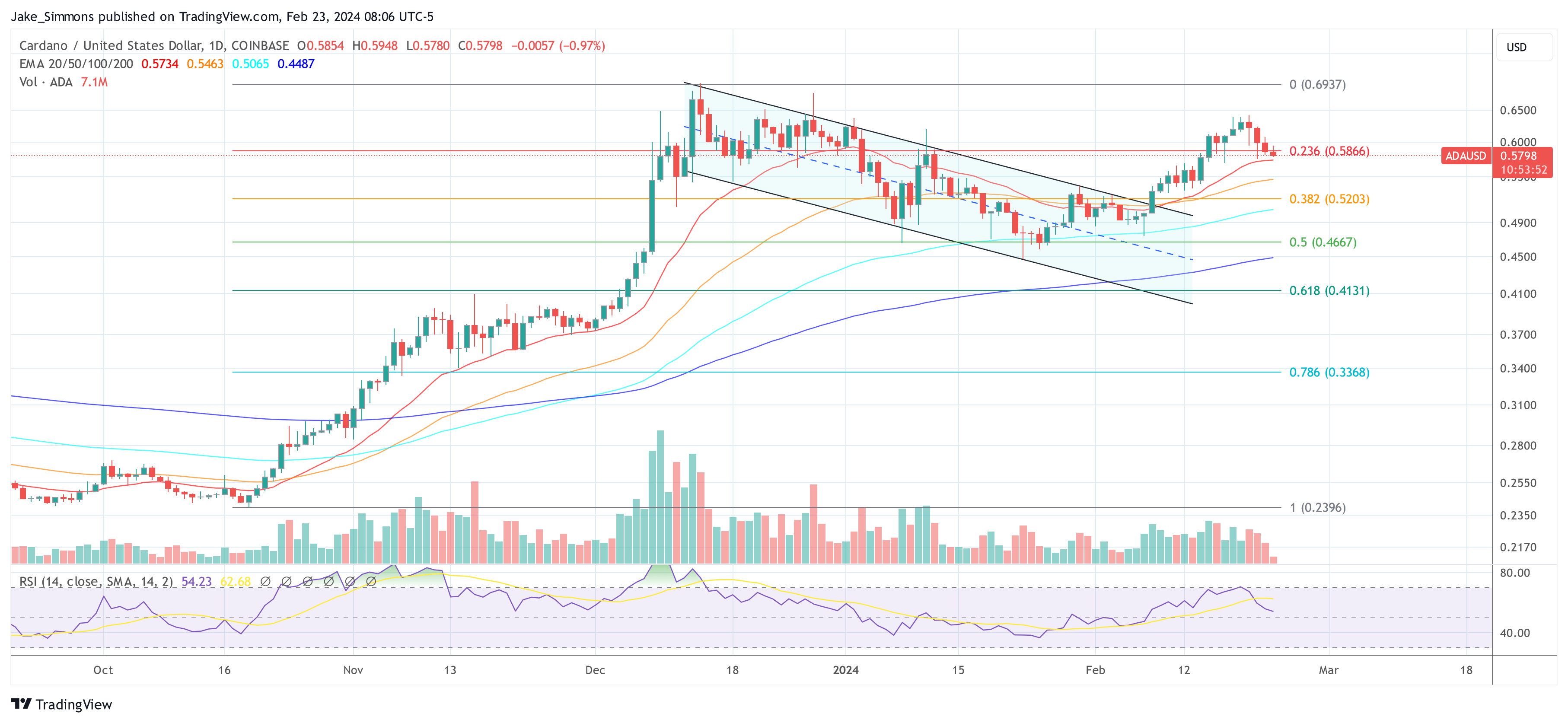

In a recent technical analysis by crypto analyst Ali Martinez, known on social media as @ali_charts, a potential sell signal has been identified on the three-day chart for Cardano (ADA) against the US dollar. This analysis, shared on X on February 23, suggests caution among ADA traders due to the appearance of a bearish signal from the TD Sequential indicator.

Martinez’s chart showcases the TD Sequential indicator presenting a ‘9’ signal, a classic sell indication that suggests the current trend may be exhausted and a reversal could be imminent. This signal is highlighted on the candlestick that has been forming over the last three days, marked by a red rectangle surrounding a green candlestick.

The ‘9’ setup, traditionally seen as a sign to take profits or to prepare for a trend change, implies that ADA’s recent upward momentum may face a setback. The analysis further notes that this is not the first instance of such a signal appearing on Cardano’s chart.

Previous occurrences of the TD Sequential ‘9’ sell signal were followed by price corrections for ADA. Traders may be particularly vigilant now, as the chart indicates that the last two signals of this nature were succeeded by downward price action. Martinez remarked:

The TD Sequential indicator shows a sell signal on the #Cardano 3-day chart. It’s important to note that the last two times this indicator signaled bearish, ADA experienced a price correction!

How Low Could Cardano (ADA) Price Retrace?

As of February 23, 13:06 UTC, the ADA/USD pair shows a complex interplay between bullish and bearish signals on the daily time frame. The chart presents a constricted pattern following a descent from a local high.

The ADA price is currently trading at $0.5790. Importantly, the price is above the 20-day Exponential Moving Average (EMA) at $0.5733, the 50-day EMA at $0.5462, the 100-day EMA at $0.5065 and notably, the 200-day EMA at $0.4487. The positioning above these EMAs can be a sign of an underlying bullish sentiment in the market.

The Fibonacci retracement levels, drawn from the peak to the trough of the recent move, highlight significant levels of potential support and resistance. The 0.236 level at $0.5866 is immediately overhead, acting as a minor resistance level. The 0.382 level at $0.5203 and the 0.5 level at $0.4667 are key support zones to watch if a bearish reversal occurs.

A break below these levels could signal a deeper retracement towards the 0.618 level at $0.4131 or even the 0.786 level at $0.3368. However, the most crucial support at the moment is the 20-day EMA which could forebode a changing trend.

Notably, the volume has been relatively consistent, with a slight decrease in trading volume accompanying the recent price consolidation. This could indicate a lack of conviction among traders. Confirming this, the Relative Strength Index (RSI) is at 54, indicating neither overbought nor oversold conditions. The RSI trend is neutral, providing no clear directional bias at the moment.

In conclusion, while there are hints of bearishness, there are still good arguments to be bullish on Cardano and not wait for a larger correction. However, if the price does not hold above several key EMAs on the daily chart, the trend change could be confirmed.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.