Ripple CEO Brad Garlinghouse believes that the U.S. Securities and Exchange Commission (SEC) will approve spot exchange-traded funds (ETFs) based on crypto tokens other than bitcoin. “I think it’s inevitable that there’ll be multiple ETFs around different tokens,” he stressed, noting that Ripple would welcome an XRP ETF. “In my opinion, it makes these markets […]

Ripple CEO Brad Garlinghouse believes that the U.S. Securities and Exchange Commission (SEC) will approve spot exchange-traded funds (ETFs) based on crypto tokens other than bitcoin. “I think it’s inevitable that there’ll be multiple ETFs around different tokens,” he stressed, noting that Ripple would welcome an XRP ETF. “In my opinion, it makes these markets […]

Source link

CoinNews

Ethereum Whale Buys $187 Million ETH In 3-Day Spree, Anticipating Further Surge

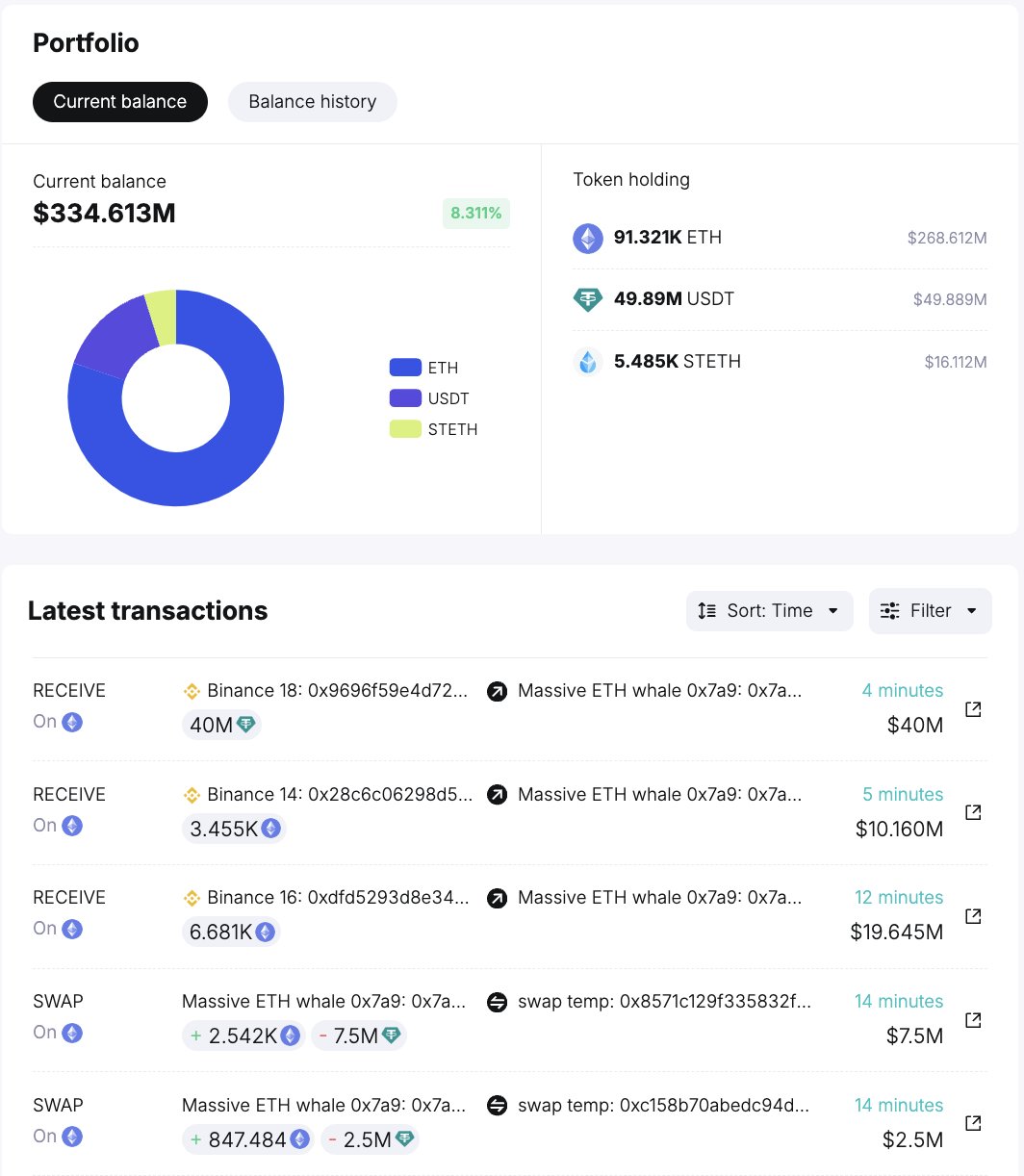

In recent on-chain data from Spot On Chain, an Ethereum whale appears to have engaged in significant accumulation activity, sparking interest and speculation within the ETH community.

According to the platform, the whale address in question has purchased a total of 64,501 ETH in the past three days, amounting to roughly $187 million at current market prices,

Ethereum Whale Accumulation

Spot On Chain reported that earlier today, the whale acquired approximately 13,526 ETH at an average price of $2,947 per ETH. This accumulation, valued at over $39 million, adds to the already substantial holdings of the whale, suggesting a bullish outlook on Ethereum’s future trajectory.

The platform’s data further reveals that the whale withdrew 10,136 ETH from Binance while purchasing 3,390 ETH from 1inch. These purchases have compounded the whale’s accumulation of ETH in the past three days to a total of 64,501 ETH.

Additionally, Spot On Chain highlights the withdrawal of an additional 40 million USDT from Binance, prompting speculation regarding its potential use for further Ethereum purchases.

According to the portfolio image above that Spot On Chain shared, the whale’s wallet holds a total of 91,321 ETH, in addition to approximately $49.8 million worth of USDT and 5,485 STETH. These assets, in total, are estimated to be $334 million.

Giant whale 0x7a9 allegedly bought 13,526 $ETH ($39.85M) at ~$2,947 again!

• withdrew 10,136 $ETH ($29.85M) from #Binance

• bought 3,390 $ETH with 10M $USDT #1inchOverall, the whale has bought 64,501 $ETH ($185.5M) in the past 3 days!

It also withdrew another 40M $USDT from… pic.twitter.com/ySbvIv2mux

— Spot On Chain (@spotonchain) February 21, 2024

Ethereum’s Price Action And Expert Sentiment

Ethereum has continued to showcase bullish momentum, trading up by nearly 6% over the past week. However, despite briefly surpassing the $3,000 mark, Ethereum has retraced slightly in the past 24 hours, trading around $2,900 at the time of writing.

This pullback has not dampened optimism within the crypto community, with many anticipating further upward movement. Industry experts have weighed in on Ethereum’s performance, with Stefan von Haenisch of OSL SG Pte in Singapore noting the cryptocurrency’s potential to outperform Bitcoin in the coming months.

Haenisch attributes this optimism partly to speculation surrounding the potential approval of spot Ethereum exchange-traded funds in the US. Michaël van de Poppe, CEO of MN Trading, echoes this sentiment, forecasting a potential surge for Ethereum to $3,800 to $4,500 shortly.

#Ethereum is on its way towards $3,800-4,500. pic.twitter.com/TfoBGloBsH

— Michaël van de Poppe (@CryptoMichNL) February 19, 2024

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

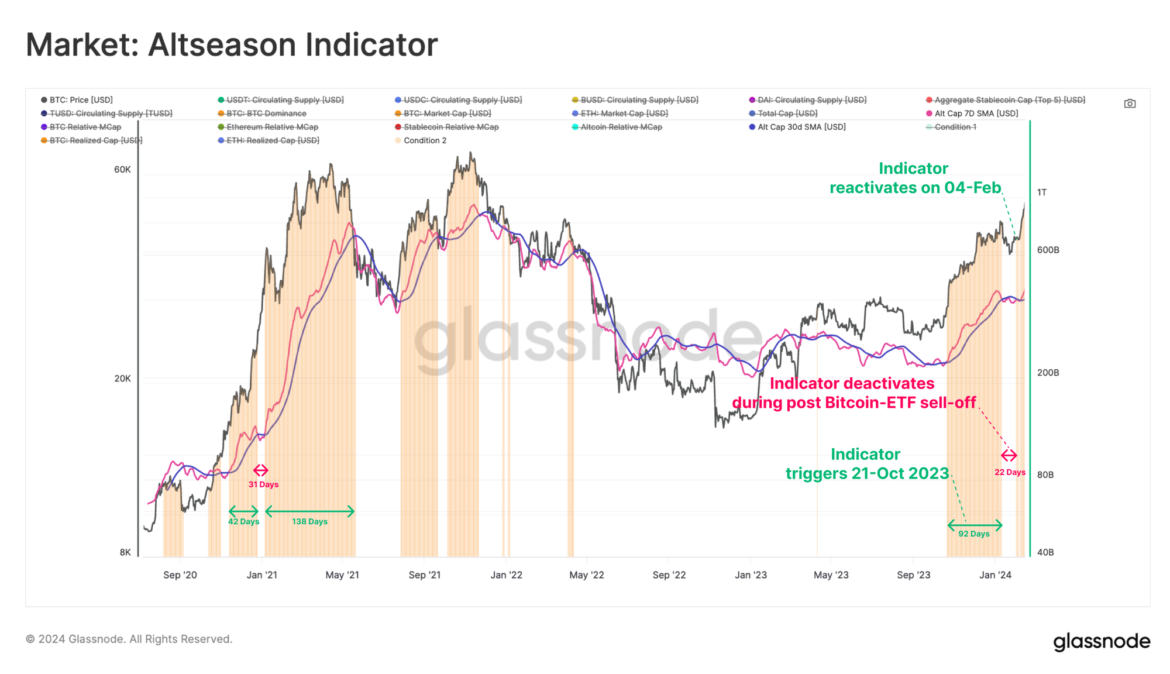

Here’s what the “Altseason Indicator” from the on-chain analytics firm Glassnode says regarding if an Altcoin season is currently going on or not.

What Altseason Indicator Says Regarding The Altcoin Season

In its latest weekly report, Glassnode has discussed what the Altcoin season status for the cryptocurrency market has looked like recently. To check whether the “altseason” is on, the analytics firm has devised its Altseason Indicator.

This metric judges if the investors are in a risk-on mode based on how capital rotations are occurring in the sector. There are two conditions the indicator checks for.

First, the Altseason Indicator looks at the capital netflows involving the three major asset classes in the sector: Bitcoin (BTC), Ethereum (ETH), and stablecoins.

For the former two assets, netflows are gauged using their “realized caps.” The realized cap is a capitalization model that calculates any asset’s total valuation by assuming that the real value of any token in circulation is the price at which it was last moved rather than the current spot price.

The last transfer for any coin was likely the last point at which it changed hands, so the price at the time of that transaction would be its current cost basis. As such, the realized cap sums up the cost basis of every holder in the sector.

Put another way, the realized cap measures the actual amount of capital the investors have put into the asset. Thus, changes in the metric would reflect the amount of capital flowing into or out of the asset.

For the stablecoins, net flows can be judged based on the supply or market cap alone, as the stables’ value remains tied to $1 at every point, so the magnitude of the market cap and realizes cap would be equal (both of these would also equal the supply, except for the unit).

For the Altcoin Season to be active, all three asset classes should have positive netflows. This is because capital generally enters the cryptocurrency sector through these coins and only then rotates into altcoins as investors’ appetite for risk rises.

The other condition the Altseason Indicator checks for is the momentum in the altcoin market cap itself. In particular, the metric confirms whether or not the altcoin market cap is currently over its 30-day simple moving average (SMA).

The data of the Altseason Indicator over the past few years | Source: Glassnode's The Week Onchain - Week 8, 2024

The chart shows that the Altseason Indicator first started flashing the risk-on signal in October of last year. However, the signal turned off when the market cooled off following the launch of the Bitcoin spot ETFs.

After staying off for 22 days this month, though, the Altseason Indicator seems to have been saying that the Altcoin season is back on.

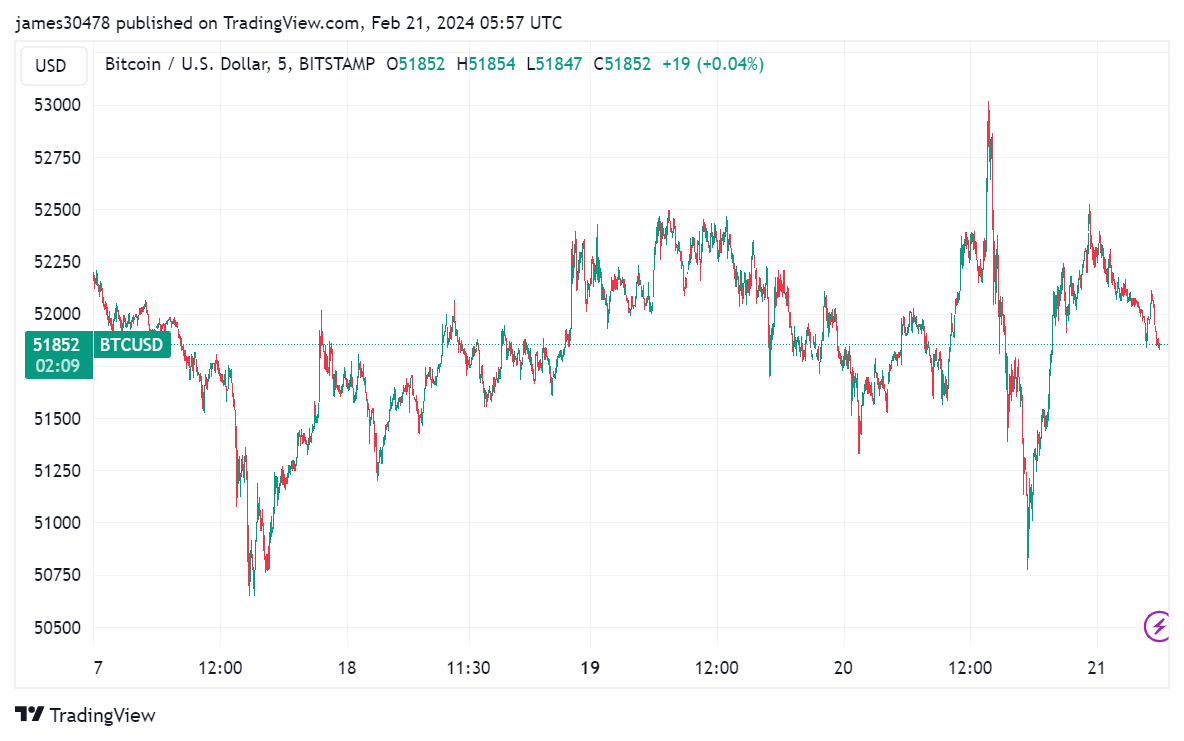

BTC Price

At the time of writing, Bitcoin is trading around the $50,900 level, down 1% in the past week.

Looks like the price of the asset has gone down over the past day | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Crypto Markets Experience Minor Setback as Major Coins Dip, While Select Tokens Buck the Trend

On Wednesday, the crypto market experienced a modest downturn, with a 1% decrease in its overall value across the board, as bitcoin and ethereum saw declines of 0.51% and 0.45%, respectively. Bitcoin momentarily reached the $53,000 mark the day prior, while ether soared past the $3,000 threshold on Tuesday, though both cryptocurrencies traded significantly lower […]

On Wednesday, the crypto market experienced a modest downturn, with a 1% decrease in its overall value across the board, as bitcoin and ethereum saw declines of 0.51% and 0.45%, respectively. Bitcoin momentarily reached the $53,000 mark the day prior, while ether soared past the $3,000 threshold on Tuesday, though both cryptocurrencies traded significantly lower […]

Source link

Quick Take

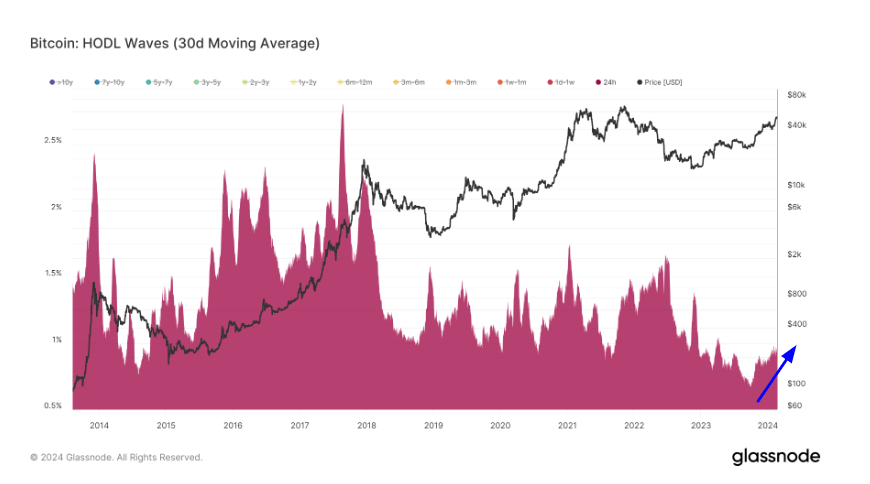

The recent surge in Bitcoin holdings among short-term holders (STHs), defined as investors who have held Bitcoin for less than 155 days, points to a noticeable increase. Since December, STHs have beefed up their Bitcoin portfolios by approximately 450,000 BTC. However, contrary to usual market behavior, soft indicators like Google trends suggest that we are not near market euphoria despite the aggressive accumulation from STHs.

This intriguing pattern is further illuminated by examining HODL waves, a metric representing different age bands of active supply. HODL waves for the extremely short-term speculation bands – 24 hours, one day to 1 week, and one week to one month – were at an all-time low in October 2023, just as Bitcoin embarked on its journey from $25,000 to $53,000.

Even though these cohorts have grown significantly, they still represent extremely low percentages compared to historical data. This points to a distinct lack of extreme short-term speculation.

Furthermore, these cohorts typically wield a much larger percentage supply at the peak of bull markets when speculation is highest. This particular data suggests there is substantial room for growth in this cycle.

The post Analysis of HODL waves reveals a speculative market at play appeared first on CryptoSlate.

The price of Avalanche’s AVAX token has dipped by 11% in the past week, bucking the bullish trend in the broader cryptocurrency market. This comes amidst a $365 million unlocking event that increased the token’s circulating supply by 2.6%. Experts suggest both short-term challenges and long-term opportunities for AVAX.

Unlocking Event Triggers AVAX Price Dip

Source: Token.Unlocks

Token.Unlocks data indicates that on Thursday, locked-up tokens valued at approximately $303 million will be released from vesting and put into circulation.

On February 15th, a significant unlocking event saw 9.5 million AVAX tokens, worth roughly $365 million, released from a vesting period. This influx of previously locked-up tokens coincided with a price decline for AVAX, which fell from $40.32 to its current price or nearly $37.

This aligns with historical trends, as a 2023 report by The Tie found that large unlocking events often lead to price drops within two weeks due to supply outpacing demand.

AVAX price in the red. Source: Coingecko

Analyst Opinions Diverge

Despite the recent dip, some analysts remain optimistic about AVAX’s future. The Tie’s report, while acknowledging the short-term price pressure, highlights the Avalanche network’s growing activity, fueled by popular NFT collections like Dreamheadz and Dokyoworld. The increased engagement within the NFT space is seen as a positive indicator for long-term adoption and potential price appreciation.

TSM’s @theblitzapp Subnet launched, where all premium subscriptions on the platform now flow on-chain, with more features to come later in Q1

— Avalanche 🔺 (@avax) February 5, 2024

Furthermore, analysts point to AVAX’s outperformance compared to specific peers like Celestia and Solana in recent days. This suggests some resilience in the face of the unlocking event and potential buying pressure despite the overall price dip. Some analysts even predict a possible climb to the $40 mark by the end of February, although this remains speculative.

Avalanche (AVAX) is currently trading at $36.95. Chart: TradingView.com

Market Sentiment And Broader Trends

It’s important to remember that the cryptocurrency market is inherently volatile, and AVAX’s price will be influenced by various factors beyond the unlocking event.

The overall market sentiment, regulatory changes, and broader economic trends can all play a significant role. Investors should conduct thorough research and consider their own risk tolerance before making any investment decisions.

AVAX price retreating today. Source: Coingecko

The recent unlocking event has undoubtedly impacted AVAX’s price in the short term. However, analysts remain divided on the token’s future trajectory. While some anticipate further price declines due to the increased supply, others highlight positive developments like the network’s growing NFT activity and potential for a rebound.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Technical Analysis: Oscillators and Averages Point to a Market at Crossroads

As bitcoin navigates through the volatile waves of the crypto market, its price on Feb. 21, 2024, reflects a complex interplay of market dynamics. Oscillating between $50,820 and $52,902 within a 24-hour frame, the leading digital currency continues to showcase significant trading activity. With a market capitalization over the $1 trillion mark, bitcoin traders are […]

As bitcoin navigates through the volatile waves of the crypto market, its price on Feb. 21, 2024, reflects a complex interplay of market dynamics. Oscillating between $50,820 and $52,902 within a 24-hour frame, the leading digital currency continues to showcase significant trading activity. With a market capitalization over the $1 trillion mark, bitcoin traders are […]

Source link

Amid tightening global crypto regulations, Backpack, a crypto exchange founded by former FTX executives, has broadened its reach to 11 US states, including California, Colorado, Indiana, Missouri, Wyoming, and others.

In a Feb. 21 announcement on the social media platform X (formerly Twitter), the company disclosed its availability to residents within the states above, with CEO Armani Ferrante outlining plans to consolidate the exchange’s presence in the US, saying:

“Today, we beginning our journey to bring Backpack Exchange into the USA. It’ll be slow. It’ll be steady. It’ll be hard. But it’ll be worth it. If we don’t support your state yet, hold on. We’ll get there. This is something that will take years to complete. But we’re committed to doing it right.”

The exchange, currently in its beta phase, facilitates spot trading activities and intends to diversify into derivatives, margin trading, and more as it secures additional licenses globally. It reportedly aims to offer non-custodial-based trading to differentiate itself from traditional crypto exchanges. On Feb. 18, the platform reported $1 billion in daily trading volume.

Backpack was co-founded by Can Sun, former general counsel at FTX, and Ferrante, previously a software developer at Alameda Research.

Sun played a pivotal role as a witness in Sam Bankman-Fried’s trial, revealing that he had no idea the former billionaire was misusing customers’ funds. Ferrante’s crypto infrastructure company, Coral, suffered a loss of $14.5 million due to FTX’s abrupt collapse. FTX Venture reportedly spearheaded a $20 million funding round for Coral mere weeks before the collapse.

Backpack’s licensing

The Backpack Exchange platform boasts multiple licenses across global jurisdictions, including the United Arab Emirates (UAE), Lithuania, Australia, and the United States.

The US Financial Crimes Enforcement Network’s records indicate its initial registration as a Money Services Business (MSB) in numerous US states. Furthermore, it’s duly registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) as a Digital Currency Exchange (DCE) provider.

In the UAE, it holds accreditation from the Dubai Virtual Assets Regulatory Authority (VARA) as a Virtual Asset Service Provider (VASP). Additionally, it’s registered as a Virtual Currency Exchange Operator and Deposit Virtual Currency Monetary Operator with the Lithuanian Financial Crime Investigation Service (FCIS).

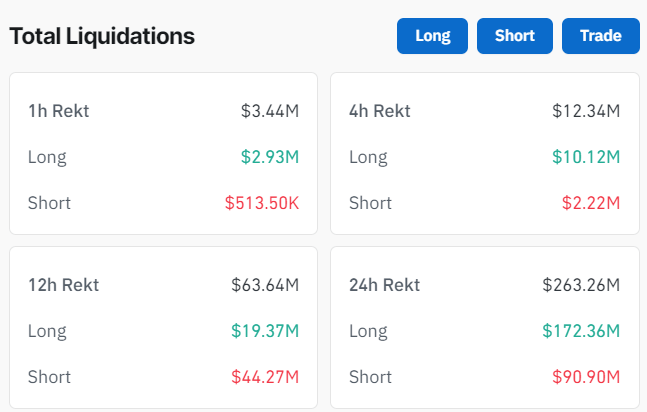

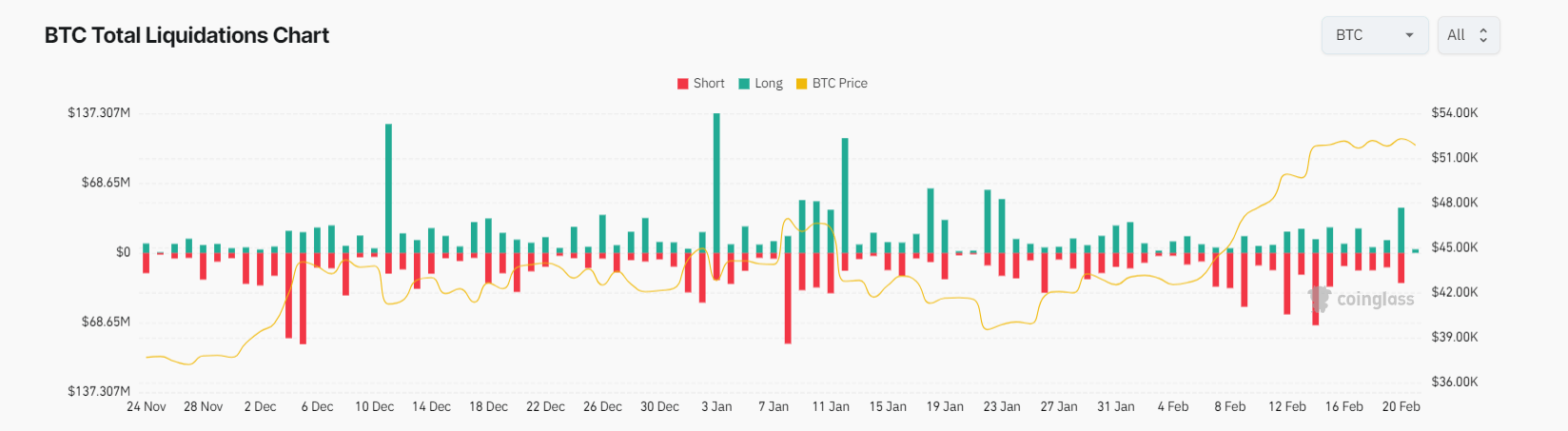

Quick Take

On Feb. 20, just before the US market opened, Bitcoin reached a yearly peak of $53,000, only to retreat into the $50k-$52k range shortly thereafter.

CryptoSlate reports indicate that approximately $1 billion worth of market liquidations were concentrated around Bitcoin’s $53,000 mark. Interestingly, during its short-lived surge to this value, Bitcoin experienced an estimated $70 million worth of these liquidations. While some of these liquidations happened during the rise, the majority are still impending.

In the broader digital asset market, Coinglass reported that the past 24 hours have seen an estimated $260 million in liquidations, with approximately $170 million from longs and $90 million from shorts. Bitcoin bore the brunt of these liquidations, accounting for around $70 million. While, Binance saw the majority of the liquidations from an exchange at approximately $117 million.

Out of Bitcoin’s $70 million liquidation, approximately $40 million was derived from long positions. This accounts for the largest long liquidation since Jan. 23, when Bitcoin was trading around the $40,000 mark.

The post Bitcoin’s climb to a yearly high triggers market shakeup appeared first on CryptoSlate.

Charles Hoskinson Signals Alert of Legacy Finance’s Creeping Influence in Crypto

In a video address, Charles Hoskinson casts a spotlight on the advance of traditional financial mechanisms into the realm of cryptocurrency, warning that the essence of digital currencies is at stake. Charles Hoskinson Warns of Crypto’s Creeping Centralization In a recent video titled “Legacy is Eating Crypto,” Charles Hoskinson, the co-founder of Ethereum and Cardano, […]

In a video address, Charles Hoskinson casts a spotlight on the advance of traditional financial mechanisms into the realm of cryptocurrency, warning that the essence of digital currencies is at stake. Charles Hoskinson Warns of Crypto’s Creeping Centralization In a recent video titled “Legacy is Eating Crypto,” Charles Hoskinson, the co-founder of Ethereum and Cardano, […]

Source link