“His portfolio is still down from the April slump when everybody else’s accounts have gone up.”

Source link

Finance

From left, Sen. Susan Collins, R-Maine, and Sen. Lisa Murkowski, R-Alaska, talk as they arrive for a vote in the U.S. Capitol on Wednesday, April 30, 2025.

Bill Clark | Cq-roll Call, Inc. | Getty Images

Republican Sens. Susan Collins and Lisa Murkowski are joining Democrats to back a new bill that would exempt millions of U.S. small businesses from President Donald Trump’s tariffs on Canadian goods.

The two-page bill, titled the “Creating Access to Necessary American-Canadian Duty Adjustments Act” — which shortens to the CANADA Act — comes as Trump threatens to slap a blanket 35% tariff on Canadian imports starting Aug. 1.

The tariff threat is the president’s latest salvo in an on-again, off-again trade war with America’s longtime economic and political ally, which is the largest export partner for nearly three dozen U.S. states.

“Imposing tariffs on Canada, Maine’s closest trading partner, threatens jobs, drives up costs, and hurts small businesses that have long relied on cross-border cooperation and exchange,” Collins said in a statement in support of the new bill.

Murkowski in her own statement said, “I’ve heard loud and clear from small businesses in Alaska: tariffs are forcing prices to rise and making it difficult to plan long-term.”

“I’m hopeful this legislation sends a clear message to the administration that we want to continue this strong partnership by alleviating the effects of these tariffs on our small businesses,” she said.

The legislation introduced by Sen. Peter Welch, D-Vt., is cosponsored by five other Democrats including Senate Minority Leader Chuck Schumer of New York and Oregon’s Ron Wyden, the Senate Finance Committee’s ranking member.

The bill targets the tariffs that Trump first announced on Feb. 1, a 25% blanket duty on Canadian goods imported to the United States and a 10% tariff on Canadian energy imports.

If enacted, the legislation would make those tariffs inapplicable “with respect to goods imported by or for the use of small business concerns” as defined under federal law.

The White House did not immediately respond when CNBC requested a comment on the bill and asked if Trump would consider signing it, should it make it to his desk.

In a phone interview with CNBC on Wednesday, Welch said that other U.S. tariffs targeting Canada — including Trump’s threatened 35% duty — will “all be on the table.”

The impact of Trump’s tariffs goes beyond concerns that they will ultimately raise prices on U.S. consumers, Welch said.

“Vermonters really love Canadians, and are very upset about what has happened to the relationships that many of our businesses have built up over the years,” the senator said.

Likewise, Canada “understandably is furious and hurt by the way they’ve been treated” by the U.S., and that has affected Vermont’s hospitality industry, he added.

Canadian travel to Vermont — and the U.S. in general — is reportedly down sharply so far this year.

Trump said he imposed the Feb. 1 tariffs in response to Canada’s alleged failure to stop the flow of drugs and crime over the U.S. northern border. But he quickly issued a 30-day pause on those tariffs, after then-Canadian Prime Minister Justin Trudeau vowed to take steps to address Trump’s concerns.

In a March 2 executive order, Trump further amended the Canada tariffs by delaying the end of the so-called de minimis trade exemption, a carve out which allowed low-value goods shipments to enter the U.S. duty free.

Read more CNBC politics coverage

The Canada tariffs — alongside 25% duties on Mexican goods and a total 20% import tax on China — nevertheless took effect on March 4, prompting retaliation from Ottawa.

One day later, Trump granted a monthlong tariff pause for major U.S. automakers whose cars comply with the trilateral North American trade pact known as USMCA.

The day after that, Trump issued temporary tariff exemptions for USMCA-compliant imports from Canada and Mexico. That covered about 38% of goods entering the U.S. from Canada, the White House said at the time.

Canada was excluded from Trump’s April 2 “liberation day” tariffs, which imposed a near-global 10% duty and significantly higher rates on dozens of individual countries. But Ottawa has continued to grapple with U.S. blanket tariffs on its imports of steel and aluminum and autos.

Nvidia’s stock outpaced Apple’s in 2024 and could continue to do so next year.

It’s been nearly impossible to escape coverage on Nvidia (NVDA -6.62%) over the last year, as its stock has been on a historic bull run, soaring 762% since the start of 2023. The chipmaker’s rise dwarfed the growth of many of the most prominent tech companies, including Apple (AAPL -2.53%), which saw its stock increase by 80% in the same period.

The disparity between the companies’ stock growth is significant, considering Apple is the world’s most valuable company with a market cap of $3.5 trillion. Nvidia’s rally has seen it become the first chipmaker to achieve a market cap above $3 trillion, putting it third on the list of most valuable companies (after Microsoft, which is in second).

Nvidia’s swift rise saw it temporarily overtake Apple in market cap earlier this year, but it didn’t last. However, the chipmaker’s consistent ability to outpace Apple in growth suggests it’s a matter of when, not if, Nvidia will one day be worth more than Apple. Meanwhile, the company’s dominance in the chip market and lead over its competitors indicates that day might not be very far away.

So, will Nvidia be worth more than Apple by 2025? Let’s assess.

Nvidia is in a far better financial position than its rivals

Nvidia’s recent rally was primarily driven by its dominance in artificial intelligence (AI). The company’s graphics processing units (GPUs) are the preferred hardware for developers worldwide, with Nvidia now responsible for an estimated 70% to 95% of the AI chip market.

The company’s success in the industry has seen its earnings skyrocket over the last year, even while rivals like Advanced Micro Devices and Intel launched competing products.

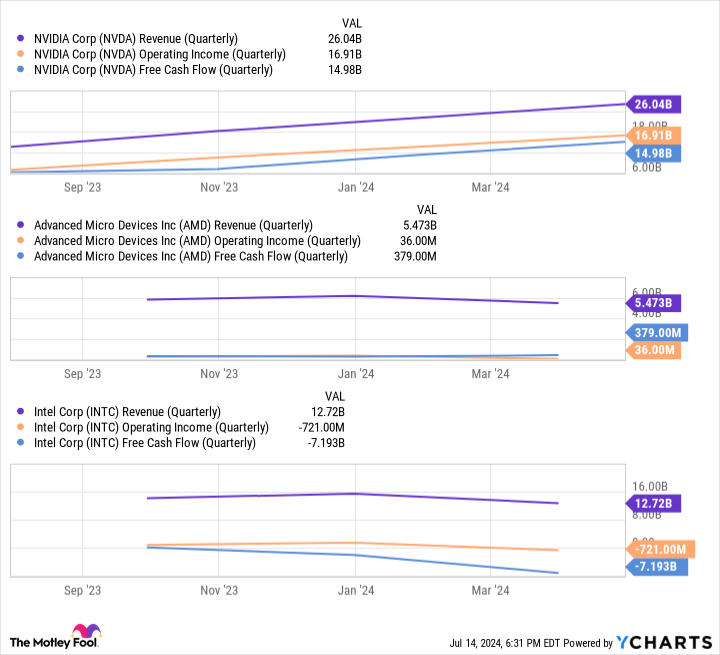

Data by YCharts

Nvidia has taken a massive financial leap Nvidia over its competitors in the last 12 months, with far more revenue, operating income, and free cash flow. The figures suggest Nvidia is far better equipped than AMD and Intel to continue reinvesting in its technology and stay ahead in AI.

Comparatively, Apple’s AI competitors are in similar financial positions to the iPhone maker. Microsoft and Alphabet are investing heavily in the generative technology, even pulling ahead of Apple since the start of 2023, and have the financial resources to do so. As a result, Apple will likely continue to face fiercer competition in AI than Nvidia, which could mean slower earnings and stock growth as it develops in the sector.

Data by YCharts

Additionally, Nvidia’s more established position in AI means it’s already enjoying major gains from selling its hardware to the industry. At the same time, it remains to be seen if Apple will, in fact, attract consumers to the soon-to-be-launched AI features in its iPhones, Macs, and iPads.

Market trends suggest it’ll be challenging for rivals to overcome Nvidia

Past chip trends indicate it will be an uphill battle for Nvidia’s competitors to chip away at its leading market share in AI. For instance, Nvidia’s share of the discrete desktop GPU market has grown from 65% in 2014 to 88% this year. The company’s position has risen despite AMD’s investment in the sector, with AMD’s share falling from 35% to 12% in the same period.

A similar example has occurred with central processing units (CPUs). Since 2017, AMD’s CPU market share has risen from 18% to 33%. While Intel’s position in the industry has declined since then, it has held onto its majority market share, which was 64% as of the first quarter of 2024.

Historical trends in the chip market show that once a company takes a dominant position, it can be nearly impossible for a competitor to steal the top spot. As a result, Nvidia will likely retain its dominance in AI GPUs for years, especially as it continues widening the financial gap to its peers.

Meanwhile, in the first six weeks of 2024, Apple’s iPhone sales tumbled 24% in China, while domestic rival Huawei’s smartphone sales soared 64%. Apple has responded to the market shift by introducing heavy discounts on its iPhones. However, the situation suggests Apple’s dominance in some regions could be more fickle than previously thought.

Nvidia’s business has exploded since the start of 2023 and has shown no signs of slowing. Apple has delivered solid stock growth more recently, hitting a new high in its share price this year. However, Nvidia’s lead in AI and more extensive financial resources than its competitors indicate it could surpass Apple in 2025.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Vanguard ETF That Could Soar 41.5% in the Remainder of 2024, According to a Select Wall Street Analyst

Small-cap stocks might be a great place to invest for the rest of 2024 if interest rates fall as expected.

Wall Street doesn’t always get things right, but Tom Lee from Fundstrat Global Advisors is one analyst with a hot hand right now. He predicted the S&P 500 index would close above 4,750 in 2023, and it ended the year at 4,769. He also entered 2024 with an S&P index target of 5,200, which was the highest on Wall Street at the time, and the index blew past that level within the first three months.

Lee also predicted the Russell 2000 could soar 50% in 2024. This index is home to approximately 2,000 of the smallest listed stocks in the U.S., with the largest company in the index worth just $53 billion. Lee cites valuations and the potential for lower interest rates as key reasons for his prediction.

The Russell 2000 had a sluggish first half of 2024, so it will have to climb 41.5% between now and the end of the year to meet Lee’s forecast. The Vanguard Russell 2000 ETF (VTWO -0.63%) closely tracks the performance of the index, so it’s a simple way for investors to capture that gain if he turns out to be right.

The Vanguard Russell 2000 ETF is a great way to invest in small caps

Thanks to the meteoric rise of trillion-dollar giants like Nvidia, technology is the largest sector in the S&P 500, with a weighting of 30%. The Russell 2000 is a little more balanced — the industrial sector has the largest weighting at 19%, followed by healthcare at 15.2% and financials at 14.8%.

The top-10 holdings in the Vanguard Russell 2000 ETF make up just 5.2% of its total value, so its performance isn’t beholden to a mere handful of stocks:

|

Stock |

Vanguard Russell 2000 ETF Portfolio Weighting |

|---|---|

|

1. Super Micro Computer |

1.50% |

|

2. MicroStrategy |

0.85% |

|

3. Comfort Systems USA |

0.44% |

|

4. Onto Innovation |

0.40% |

|

5. Carvana |

0.39% |

|

6. Elf Beauty |

0.38% |

|

7. Fabrinet |

0.33% |

|

8. Scientific Games |

0.32% |

|

9. Weatherford International |

0.32% |

|

10. Abercrombie & Fitch |

0.32% |

Data source: Vanguard. Portfolio weightings are accurate as of May 31, 2024 and are subject to change.

Super Micro stock is up a whopping 218% this year so far. Investors are bullish on the company’s role in artificial intelligence (AI), which includes selling networking, server, and storage equipment for the data center.

MicroStrategy stock is also having a great year with a 103% gain. It offers a portfolio of software products designed to help businesses extract more value from their data using AI. But the company is also a proxy for Bitcoin, given that it holds around $12.5 billion worth of the cryptocurrency.

Carvana stock also roared back to life this year with a 178% return, but it’s still down 62% from its all-time high, which was set during the tech frenzy of 2021. The company sells used cars online with a focus on automation using its vending-machine style buildings.

Elf Beauty and Abercrombie & Fitch are further examples of consumer companies putting up strong numbers this year.

Small companies should benefit from lower interest rates

According to the CME Group‘s FedWatch tracker, the U.S. Federal Reserve will cut interest rates three times before the end of the year (in September, November, and December). In that environment, risk-free assets, like cash deposits and bonds, will be less attractive. This often pushes investors into stocks, instead. That’s good news for the overall market but especially positive for small caps.

Small companies often borrow money to fuel growth and typically have more floating-rate debt, which is very sensitive to changes in monetary policy. In contrast, the tech giants that dominate the S&P 500 are sitting on billions of dollars in cash. Apple, for example, just announced a $110 billion stock-buyback program, which basically means the company makes so much money that it can’t find a better use for it internally.

Lower interest rates will drive down borrowing costs for small caps, which means they can take on more debt and potentially drive faster growth. Plus, smaller interest payments will be a direct tailwind for each company’s earnings.

Lee cites valuations as another reason the Russell 2000 could soar. The index trades at a price-to-earnings (P/E) ratio of 16.9 (excluding companies with negative earnings). The S&P 500 trades at a P/E ratio of 24.3, which makes the Russell look quite attractive by comparison.

Of course, the S&P 500 trades at a premium because of the quality of its constituents. Investors will always pay a higher valuation for stocks like Microsoft, Apple, and Nvidia because they’re secure organizations with track records of success spanning decades. But if lower rates boost small-cap earnings, the valuation gap could narrow.

Image source: Getty Images.

Will Lee be right?

Here’s where things get tricky. Going all the way back to 1988, the Russell 2000 has never recorded an annual gain of 50%. In fact, it consistently underperformed the S&P 500, on average.

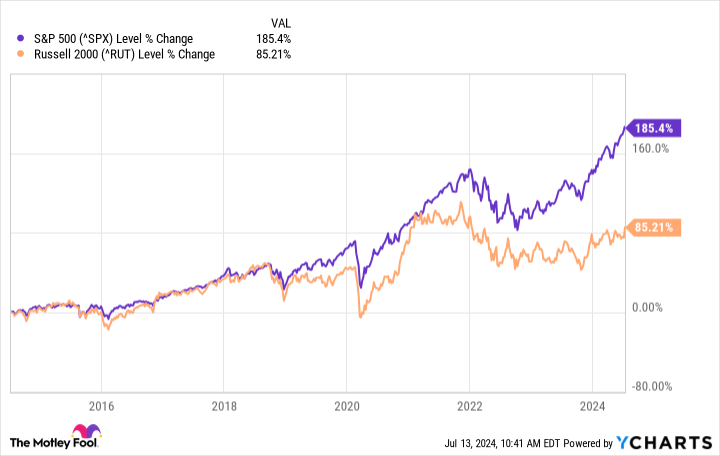

The federal funds rate was below 1% for most of the last decade, yet the Russell 2000 was up just 85% over that period, compared to a 185% gain in the S&P 500:

Plus, the Vanguard Russell 2000 ETF has delivered a compound annual return of 9.9% since its inception in 2010, sharply lagging the 14.5% average annual return of the Vanguard S&P 500 ETF. That 4.6% differential substantially impacted returns when compounded over the last 14 years:

|

Starting Balance (2010) |

Compound Annual Return |

Balance In 2024 |

|---|---|---|

|

$10,000 |

9.9% (Russell 2000 ETF) |

$37,734 |

|

$10,000 |

14.5% (S&P 500 ETF) |

$66,651 |

Calculations and chart by author.

While it’s entirely possible for the Russell 2000 to deliver a positive return in the remainder of 2024, history suggests it’s extremely unlikely to climb 41.5% to end the year with a 50% gain. With that said, small caps might be a good place for investors to park their money when interest rates begin to fall, so adding the Vanguard Russell 2000 ETF to a balanced portfolio isn’t a bad idea.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bitcoin, Microsoft, Nvidia, Vanguard S&P 500 ETF, and e.l.f. Beauty. The Motley Fool recommends CME Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

San Francisco downtown is ‘ghost town:’ mayoral candidate Mark Farrell

With San Francisco facing record high commercial vacancies, one mayoral candidate has a plan to reshape the city’s business district and surrounding areas.

Democrat Mark Farrell, former interim mayor, is proposing a 20-year vision to revitalize San Francisco’s downtown in a bid to help the city bounce back from challenges exacerbated by the pandemic. His plan includes a new park at Embarcadero Plaza and mixed-use buildings that provide more housing options.

He’s also proposing tax incentives for businesses that relocate to the area, and for those that mandate workers return to the office four days a week. The goal is to incentivize industries beyond technology.

“As I’ve traveled around the world and in our own country over the past few years for work, other downtowns and other cities have recovered from Covid,” Farrell told CNBC in an interview. “Unfortunately, our city now ranks dead last in economic recovery post-Covid. And that, to me, is an embarrassment and it needs to change.”

Commercial real estate vacancies in San Francisco hit a fresh high of 34.5% in the second quarter, according to a report last week from Cushman & Wakefield, up from 5% before the pandemic. Manhattan’s vacancy rate for the quarter was 23.6%. Farrell’s goal is to cut San Francisco’s vacancy rate in half by the end of a first term.

A key piece of Farrell’s plan involves getting workers back into the city. Many of San Francisco’s top employers, including Salesforce, Uber and Visa, have embraced hybrid work, with staffers coming in, at best, three days a week. On top of that, the tech industry has been battered by layoffs over the past two years, removing thousands of people from payrolls.

Under Farrell’s proposal, business that relocate downtown would receive a gross receipts tax incentive, as would companies that compel employees to come to the office four days a week. Such mandates have seen pushback in some cities, most recently in Philadelphia, where unionized city workers lost a bid to extend further an in-person work deadline.

“Right now, if you come downtown, the issue is, is the lack of people; it’s a shell of what it used to be,” Farrell said. The incentives are designed to make sure “employees come back to work multiple days a week in the office to create that vibrancy that will really bring the future of downtown forward,” he said.

Public safety is a major concern, as certain parts of downtown San Francisco are rife with drug use and homeless encampments. Farrell is calling for an increase in police staffing, adding that safety and street conditions impact every neighborhood, beyond San Francisco’s downtown core.

On Tuesday, Elon Musk said he’s moving the headquarters for X, formerly known as Twitter, to Austin, Texas, from San Francisco. X had already been looking to sublease most of its building in the city, and Musk posted on X on Tuesday, “Have had enough of dodging gangs of violent drug addicts just to get in and out of the building.”

Conferences and tourism have also been slow to return to the city since the shutdowns that began in early 2020. The park at Embarcadero Plaza would be part of a plan to bring some of that back, Farrell said. He envisions a clean and open park outside of the Ferry Building to draw in workers, residents and tourists. He likened it to Mission Dolores Park, a San Francisco landmark.

An image commissioned by Mayoral Candidate Mark Farrell’s campaign to show its plans for a new “world class” park on the Embarcadero in the future.

Courtesy: Farrell for Mayor Commissioned from Gensler

For housing, Farrell’s plan includes “aggressive tax-increment financing” and local incentives to drive faster housing development as well as conversion of commercial buildings to residential. Farrell is also seeking to increase height limits in neighborhoods including the Financial District, SoMA and Mission Bay to create “tens of thousands” of new units and residents, and encourage more housing in places like Union Square, which recently lost major tenants including Macy’s and Nordstrom.

Farrell said the idea is akin to New York’s Hudson Yards, which opened before the pandemic. That project was criticized for its hefty price tag, but has since turned into a success story with lower office vacancies than other Manhattan neighborhoods. Farrell said his proposal promises to be a revenue generator for the city but that it needs anchor projects.

“Right now the problem is downtown,” Farrell said. “We don’t have people working here. And it is a ghost town. And what that translates into is a loss of sales tax revenue, property tax revenue that is decreasing in major ways when buildings are selling for 10 or 20 cents on the dollar. At the end of the day, those resulting commercial property taxes are putting a massive hole in our budget here in San Francisco.”

Farrell is just one of a number of well-known local candidates, including sitting Mayor London Breed, philanthropist Daniel Lurie and Board of Supervisors President Aaron Peskin. According to the city government’s website, 13 people have qualified for the November mayoral election.

— CNBC’s Ari Levy and Jordan Novet contributed to this report.

Don’t miss these insights from CNBC PRO

Federal Reserve Bank Chair Jerome Powell speaks during a House Financial Services Committee hearing on the Federal Reserve’s Semi-Annual Monetary Policy Report at the U.S. Capitol on July 10, 2024 in Washington, DC.

Bonnie Cash | Getty Images

Traders are now 100% certain the Federal Reserve will cut interest rates by September.

There are now 93.3% odds that the Fed’s target range for the federal funds rate, its key rate, will be lowered by a quarter percentage point to 5% to 5.25% in September from the current 5.25% to 5.50%, according to the CME FedWatch tool. And there are 6.7% odds that the rate will be a half percentage point lower in September, accounting for some traders believing the central bank will cut at its meeting at the end of July and again in September, says the tool. Taken together, you get the 100% odds.

The catalyst for the change in odds was the consumer price index update for June announced last week, which showed a 0.1% decrease from the prior month. That put the annual inflation rate at 3%, the lowest in three years. Odds that rates would be cut in September were about 70% a month ago.

The CME FedWatch Tool computes the probabilities based on trading in fed funds futures contracts at the exchange, where traders are placing their bets on the level of the effective fed funds rate in 30-day increments. Simply put, this is a reflection of where traders are putting their money. Actual real-life probability of rates remaining where they are today in September are not zero percent, but what this means is that no traders out there are willing to put actual money on the line to bet on that.

Fed Chairman Jerome Powell’s recent hints have also cemented traders’ belief that the central bank will act by September. On Monday, Powell said the Fed wouldn’t wait for inflation to get all the way to its 2% target rate before it began cutting, because of the lag effects of tightening.

The Fed is looking for “greater confidence” that inflation will return to the 2% level, he said.

“What increases that confidence in that is more good inflation data, and lately here we have been getting some of that,” added Powell.

The Fed next decides on interest rates on July 31 and again on Sept 18. It doesn’t meet on rates in August.

Don’t miss these insights from CNBC PRO

Between fundraising, legislating, and engaging in a number of other responsibilities, the politicians who serve in Washington, D.C., are busy. Many of them, however, find enough time to buy and sell stocks. And because many politicians demonstrate an uncanny ability to outperform the market, ordinary investors are keen to know the stock trades of senators and representatives.

Rep. Marjorie Taylor Greene, a Republican from Georgia who sits on the Oversight and Reform Committee and the Homeland Security Committee, recently submitted regulatory filings that acknowledged six recent stock purchases in late June: ASML (NASDAQ: ASML), Costco Wholesale (NASDAQ: COST), CrowdStrike (NASDAQ: CRWD), Lululemon Athletica (NASDAQ: LULU), Nestle (OTC: NSRGY), and NextEra Energy (NYSE: NEE). Although the exact value of each transaction wasn’t reported, all six trades were valued between $1,001 and $15,000.

The deets on Greene’s newest holdings

Although Greene didn’t provide any commentary regarding the thinking behind her stock purchases, there are some clear reasons that could’ve motivated her decision making. Consistent with the market’s overwhelming interest in artificial intelligence (AI) stocks, two of Greene’s recent picks have significant AI exposure. ASML manufactures equipment that semiconductor manufacturers require for making microchips. Encouraging news broke prior to Green’s purchase that Taiwan Semiconductor Manufacturing would be purchasing ASML’s extreme ultraviolet lithography (EUV) machine earlier than expected. Providing sophisticated cloud-based cybersecurity solutions, CrowdStrike helps customers — with help from AI — protect various devices such as laptops, mobile devices, and those connected on the Internet of Things. The company recently reported strong results for its fiscal first quarter of 2025, ended April 30, including year-over-year diluted earnings-per-share (EPS) and free-cash-flow increases of 63% and 42%, respectively.

Stretching out to the world of retail apparel, Greene scooped up shares of activewear powerhouse Lululemon. Shares of Lululemon had plunged 33% from the start of the year to June 23, the day before Greene clicked the buy button. It’s likely that the company’s auspicious outlook for 2024 played a pivotal role in her decision-making. In its release of its financial results for its first quarter of fiscal 2024, ended April 28, management forecast top-line year-over-year growth of 11% to 12% for 2024, and diluted EPS to rise from 17% to 19%.

Warehouse club superstar Costco also made its way onto Green’s buy list. In early June, Costco reported sales in May had risen 6.4% compared to May 2023. And the growth didn’t just occur for one month. The company also noted that revenue in the first 39 weeks of fiscal 2024 had climbed 5.4% compared to the same period last year.

Evidently, Greene also recognized a tasty opportunity with Nestle stock. Perhaps it was management’s outlook for 2024 — guidance that it reaffirmed during a business update in April — that Greene found appetizing. In addition to organic sales rising 4%, management projected EPS growth between 6% and 10% for 2024. Or maybe it was Greene’s hunger for passive income that was the source of motivation. Currently, Nestle stock offers a forward dividend yield of 3.1%.

Lastly, Greene chose to power her portfolio with NextEra Energy, a renewable energy powerhouse that performed exceptionally well in the first half of 2024. And while the company’s future isn’t guaranteed, a look at the company’s past suggests that it has a history of growth — a trend that it can certainly extend in the future. Over the past 20 years, for example, NextEra Energy has achieved compound annual growth rates (CAGRs) of 9% and 8% for adjusted EPS and operating cash flow, respectively. During the same period, the company maintained focus on rewarding shareholders, hiking its dividend at a 10% CAGR.

Should you make the same buys?

As savvy investors know, monitoring politicians’ stock picks is a smart strategy. Rushing to copy the stock moves that politicians just made, however? Not so much. That being said, ASML and CrowdStrike are two excellent options for tech-focused investors who want to lean into AI and are certainly worth further investigation. Similarly, Lululemon and Costco are two premier consumer-focused companies that can bolster one’s portfolio.

Nestle, on the other hand, has a history of underperforming the market, and it doesn’t seem like there’s a catalyst to change that in the near future. For those looking to supplement their passive income, moreover, there are much more compelling options than Nestle. NextEra Energy, for instance, is a compelling dividend stock and with it trading at 11.6 times operating cash flow, a discount to its five-year average cash-flow valuation of 15.8, today seems like an especially good time to take a close look at it.

Should you invest $1,000 in CrowdStrike right now?

Before you buy stock in CrowdStrike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Costco Wholesale, CrowdStrike, Lululemon Athletica, NextEra Energy, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Nestlé. The Motley Fool has a disclosure policy.

Marjorie Taylor Greene Just Loaded Up on Stocks: 6 Companies She Just Bought was originally published by The Motley Fool

Want to Collect $1,000 in Safe Monthly Dividend Income? Invest $121,000 Into the Following 3 Ultra-High-Yield Dividend Stocks.

For more than a century, Wall Street has been a bona fide wealth-creating machine. Although other asset classes have delivered nominal gains for investors, including housing, gold, and Treasury bonds, no other asset class comes remotely close to the average annual rate of return that stocks have generated over the last 100 years.

While there is no shortage of strategies that can make long-term investors richer on Wall Street, few match the return potential of buying and holding high-quality dividend stocks.

Last year, the investment advisors at Hartford Funds released a lengthy report (“The Power of Dividends: Past, Present, and Future”) examining the many ways dividend stocks have outperformed their non-paying counterparts over many decades. In particular, a collaboration with Ned Davis Research revealed a marked disparity in average annual returns.

Whereas non-payers produced a modest 4.27% annual rate of return over the last half-century, and did so while being 18% more volatile than the broad-based S&P 500, researchers found that dividend payers averaged a 9.17% annual return over the last 50 years, with 6% less volatility than the benchmark index.

The biggest challenge for income seekers is simply avoiding yield traps — i.e., companies with struggling/failing operating models whose yields have been artificially inflated by a plunging share price. Previous studies have shown that investment risk and yield tend to correlate.

However, not all ultra-high-yield dividend stocks are created equally. When I say “ultra-high-yield,” I’m talking about dividend stocks sporting yields that are four or more times higher than the average yield of the S&P 500 (1.3%, as of July 12). Top-notch and trustworthy ultra-high-yield income stocks do exist, and sometimes they dole out their dividends on a monthly basis!

If you want to collect $1,000 in safe monthly dividend income, simply invest $121,000 (split equally, three ways) into the following three ultra-high-yield monthly payers, which are averaging a 9.92% yield.

Realty Income: 5.66% yield

The first high-octane dividend stock that can help deliver $1,000 in monthly income to investors with a beginning investment of $121,000 (split equally across three stocks) is the premier retail real estate investment trust (REIT), Realty Income (NYSE: O). This is a company that’s increased its dividend in each of the last 107 quarters.

Although recessionary concerns persist, and have been fueled by the first meaningful decline in U.S. M2 money supply since the Great Depression, Realty Income’s commercial real estate (CRE) portfolio offers a number of well-defined competitive advantages.

To start with, approximately 90% of the company’s 15,485-property CRE portfolio is “resilient to economic downturns and/or isolated from e-commerce pressures,” according to the company. Realty Income predominantly owns stand-alone retail locations in industries that supply basic need goods and services. No matter how well or poorly the U.S. or global economy are performing, consumers are still going to visit grocery chains, dollar stores, drug stores, and automotive service stations. Being mindful of which companies and industries it leases to has resulted in predictable funds from operation (FFO).

To add to this point, Realty Income tends to land lengthy leases with brand-name, time-tested businesses. Whereas the median S&P 500 REIT has had a 94.2% occupancy rate since the start of this century, Realty Income has done 400 basis points better, with a 98.2% occupancy rate. This demonstrates why the company’s FFO and dividend growth are so predictable.

However, Realty Income isn’t satisfied being dominant in just the retail REIT landscape. In recent years, management has been expanding the company’s reach into new channels, including gaming and data centers. Moving beyond retail should further fortify Realty Income’s FFO.

The cherry on the sundae for income seekers is that Realty Income’s stock is historically inexpensive. Shares can be picked up for 12.4 times forecast cash flow in 2025, which represents a 28% discount to its average multiple to cash flow over the trailing-five-year period.

PennantPark Floating Rate Capital: 10.31% yield

A second super safe ultra-high-yield monthly payer that can help you bring home $1,000 in monthly income from a starting investment of $121,000 that’s been split three ways is business development company (BDC) PennantPark Floating Rate Capital (NYSE: PFLT). PennantPark modestly increased its monthly payout twice in 2023 and is currently yielding north of 10%.

BDCs invest in the equity (common and preferred stock) or debt of what’s known as “middle-market companies.” These are typically unproven small and microcap businesses. As of the end of March, roughly $1.29 billion of PennantPark’s approximately $1.48 billion portfolio was tied up in debt securities, which makes it a primarily debt-focused BDC.

There are three smart reasons PennantPark’s management team chose to focus on loans. First off, middle market companies often have limited access to traditional credit and lending markets. When they are able to borrow, it’s typically at a rate that’s well above the market average. Not surprisingly, PennantPark’s weighted-average yield on debt investments of 12.3% is well above average.

Secondly, as the company’s name gives away, the entirety of PennantPark Floating Rate Capital’s debt-investment portfolio sports variables rates. This is to say that the company’s yield on its debt investments ebbs and flows with the Federal Reserve’s monetary policy. The most-aggressive rate-hiking cycle since the early 1980s has resulted in a 510-basis-point increase in its weighted-average yield on debt investments since September 2021. The longer the nation’s central bank does nothing with its federal funds target rate, the more lucrative it’ll be for the company.

The third reason focusing on high-yielding debt securities makes sense for PennantPark is because it has a couple of ways to protect its principal investment. On top of maintaining a reasonably low average investment size of $10.1 million, including its equity investments, 99.98% of the company’s debt securities are first-lien secured loans. In the event that one of the company’s borrowers seeks bankruptcy protection, first-lien secured debtholders are first in line for repayment.

At less than 10 times forward-year earnings per share, PennantPark remains a bargain among monthly dividend payers.

AGNC Investment: 13.78% yield

The third safe, ultra-high-yield dividend stock that can allow you to collect $1,000 each month from an initial investment of $121,000 that’s split three ways is mortgage REIT AGNC Investment (NASDAQ: AGNC). AGNC has averaged a double-digit yield in 13 of the last 14 years, which means its nearly 14% yield isn’t out of the ordinary.

Mortgage REITs are businesses that aim to borrow at low, short-term lending rates, and use this capital to purchase higher-yielding long-term assets, such as mortgage-backed securities (MBS). The difference between the average yield mortgage REITs net on the assets they own, less their average borrowing rate, is known as “net interest margin.” The higher their net interest margin, usually the more profitable the mortgage REIT.

For as long as I can remember, mortgage REITs like AGNC have been almost universally disliked by Wall Street. These are interest-sensitive businesses that have been hurt by the Fed’s rapid changes in monetary policy, as well as the longest yield-curve inversion of the modern era. However, history has shown that when things seem their grimmest for mortgage REITs is precisely when they make for a fantastic buy.

For instance, the Treasury yield curve historically slopes up and to the right. This is to say that bonds maturing 30 years from now are going to offer higher yields than Treasury bills maturing in a year or less. When the yield curve eventually normalizes, AGNC Investment should enjoy a widening of its net interest margin.

Furthermore, it shouldn’t be overlooked that the nation’s central bank is no longer purchasing MBSs. Not having to compete against the Fed for higher-yielding MBSs should be a positive for AGNC’s average yield on its owned assets.

Lastly, AGNC’s investment team relies almost exclusively on agency assets. “Agency” securities, which comprised all but $1.1 billion of AGNC’s $63.3 billion investment portfolio, as of March 31, are backed by the federal government in the unlikely event of a default. This added protection is what allows AGNC to lever its investments and sustain its outsized dividend.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Sean Williams has positions in PennantPark Floating Rate Capital. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.

Want to Collect $1,000 in Safe Monthly Dividend Income? Invest $121,000 Into the Following 3 Ultra-High-Yield Dividend Stocks. was originally published by The Motley Fool