It’s been a challenging second-quarter earnings season for several top-rated growth stocks, and more reports are on the way from the likes of Palantir Technologies (PLTR), Datadog (DDOG), Celsius (CELH) and Super Micro Computer (SMCI).

X

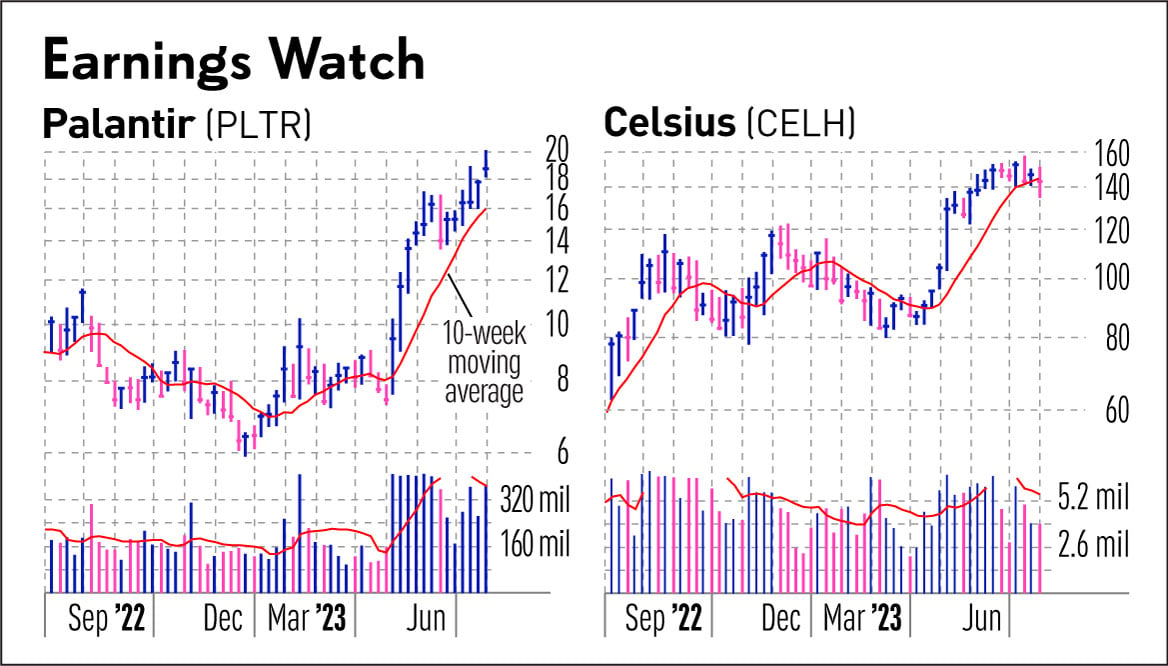

Palantir stock has been on a tear, thanks to strong prospects in the field of artificial intelligence.

Other top performers on the earnings calendar include Eli Lilly (LLY), Global-e Online (GLBE) and Trade Desk (TTD).

The stock market uptrend has come under pressure, partly due to a rising distribution day count for the Nasdaq composite and S&P 500. Several leading software stocks have come under selling pressure, including Dynatrace (DT) and HubSpot (HUBS), which reported strong results and gave bullish guidance. But investors sold both stocks harshly.

Palantir Stock

Palantir stock, one of many strong performers in the enterprise software group, gapped up more than 20% on May 9 as Wall Street cheered a Q1 report that showed accelerating growth from Q4. Adjusted profit soared 150% to 5 cents a share. Revenue increased 18% to $525.2 million, with commercial revenue up 26%. The latter was helped by a 50% jump in commercial customers to 155.

CEO Alex Karp said that demand for the company’s new artificial intelligence platform is “without precedent.”

According to Zacks, adjusted profit is expected to come in at 5 cents a share vs. a loss of 1 cent in the year-ago period. Revenue is seen rising 13% to $533.9 million. Results are due Monday after the close.

The data analytics software firm, which counts the U.S. Central Intelligence Agency as a customer, owns an Accumulation/Distribution Rating of A, helped by several above-average volume gains since its earnings gap higher in May.

High Expectations For Celsius, LLY

Celsius, an IBD Leaderboard stock, is waging a battle at its 10-week moving average ahead of its earnings report due Tuesday after the close.

In Q1, revenue surged 95% to $259 million, helped by a new distribution deal with Pepsi. In August 2022, PepsiCo (PEP) invested $550 million in Celsius for an 8.5% stake in the company.

Check out IBD’s new OptionsTrader app for options education, trade ideas and more! Download from the Apple App Store today.

Celsius gapped up on May 10 after the company reported a 344% surge in Q1 profit. For Q2, adjusted profit is expected to soar 150% to 30 cents a share, with revenue up 82% to $281.323 million.

Another high-quality name testing its 10-week line is Eli Lilly, which reports early Tuesday. Lilly’s Type 2 diabetes drug Mounjaro is currently being reviewed by the Food and Drug Administration for weight loss. Approval from the FDA is expected later this year or early next year.

In late June, Lilly reported strong midstage trial results for retatrutide, another experimental weight-loss drug. The trial showed that people lost, on average, about 24% of their body weight. A larger, phase 3 trial is expected to run until late 2025.

Results from Lilly are due Tuesday before the open. Adjusted profit is seen rising 58% to $1.98 a share, with revenue up 16% to $7.55 billion.

Options Trading Strategy

A basic options trading strategy around earnings — using call options — allows you to buy a stock at a predetermined price without taking a lot of risk. Here’s how the options trading strategy works and what a call option trade recently looked like for Palantir stock.

First, identify top-rated stocks with a bullish chart. Some might be setting up in sound early-stage bases. Others might have already broken out and are getting support at their 10-week lines for the first time. And a few might be trading tightly near highs and refusing to give up much ground. Avoid extended stocks that are too far past proper entry points.

In options trading, a call option is a bullish bet on a stock. Put options are bearish bets. One call option contract gives the holder the right to buy 100 shares of a stock at a specified price, known as the strike price.

Check Strike Prices

Once you’ve identified an earnings setup for a call option, check strike prices with your online trading platform, or at Cboe.com. Make sure the option is liquid, with a relatively tight spread between the bid and ask.

Look for a strike price just above the underlying stock price (out of the money) and check the premium. Ideally, the premium should not exceed 4% of the underlying stock price at the time. In some cases, an in-the-money strike price is OK as long as the premium isn’t too expensive.

Choose an expiration date that fits your risk objective, but keep in mind that time is money in the options market. Near-term expiration dates will have cheaper premiums than those further out. Buying time in the options market comes at a higher cost.

See Which Stocks Are In The Leaderboard Portfolio

This options trading strategy lets you capitalize on a bullish earnings report without taking too much risk. Risk is equal to the cost of the option. If the stock gaps down on earnings, the most you can lose is the amount paid for the contract.

Palantir Stock Option Trade

Palantir is extended now, but if it pulls back close to its last buy point of 17.16, it could make sense for a call option trade.

Here’s how a recent call option trade looked for Palantir, a very liquid name in the options trading market.

When Palantir stock traded around 18.70, a slightly out-of-the-money weekly call option with a 19 strike price (Aug. 11 expiration) came with a premium of around $1.90 per contract, or 10% of the underlying stock price at the time. It was a pricey trade at the time, well above the 4% threshold.

One contract gave the holder the right to buy 100 shares of Palantir stock at 19 per share. The most that could be lost was $190 — the amount paid for the 100-share contract.

When taking the premium paid into account, Palantir stock would have to rally past 20.90 for the trade to start making money (19 strike price plus $1.90 premium per contract).

A call option trade for Celsius was also on the pricey side. When shares traded around 144.50, a weekly call option with a 145 strike price (Aug. 11 expiration) offered a premium of around $9.25 per contract, or 6.4% of the stock price at the time.

Follow Ken Shreve on Twitter @IBD_KShreve for more stock market analysis and insight.

YOU MAY ALSO LIKE:

Best Growth Stocks To Buy And Watch

Catch The Next Big Winning Stock With MarketSmith

IBD Stock Of The Day: See How To Find, Track And Buy The Best Stocks

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Futures: What To Do After Market Skids; 5 Stocks Near Buy Points