The growth stock party has returned in late 2023. Space flight start-up Rocket Lab (RKLB -10.83%) has joined in, with shares up 20% in the last month alone. It has been a volatile year for the company, which is trying to build a vertically integrated rocket launching business to compete with private leader SpaceX in the fast-growing space economy. At one point shares of Rocket Lab were up over 100% year to date (YTD), and they’re now up 37% so far in 2023. But if we look at a multiyear timeline, the stock is off over 75% from all-time highs, putting many investors in the red.

Down 75% from all-time highs, is 2024 finally going to be the year Rocket Lab stock turns the corner? Let’s see if now is the time to buy Rocket Lab while the is stock trading at a discounted price.

Steadily growing its space flight services

Rocket Lab has ambitious plans. It wants to become one of the backbones of the fast-growing space economy, helping companies launch items such as satellites into orbit (and eventually to the moon and beyond). Some analysts expect the space economy to hit $1 trillion by 2030, providing Rocket Lab with a monstrous opportunity if it can hit its product goals.

To start out, Rocket Lab began launching a set of smaller rockets for customers, nicknamed the Electron. The company is closing in on 50 launches for the product line, which has a 300kg payload that companies can purchase. Last quarter the company posted $21.3 million in launch revenue with 27% gross margins. As it aims to increase the launch frequency of the Electron rocket, we should see revenue and margins for the segment continue to climb higher.

On top of launch vehicles, Rocket Lab has worked organically and through acquisitions to vertically integrate launch services for its customers. These include things like the Photon space capsule, radio systems, and software for satellite customers. Last quarter the Space Systems segment generated $46.3 million in revenue for Rocket Lab. As one of the few companies consistently launching rockets into space, Rocket Lab has a competitive advantage over other space economy companies because it can bundle all its services together.

The key will be the Neutron rocket

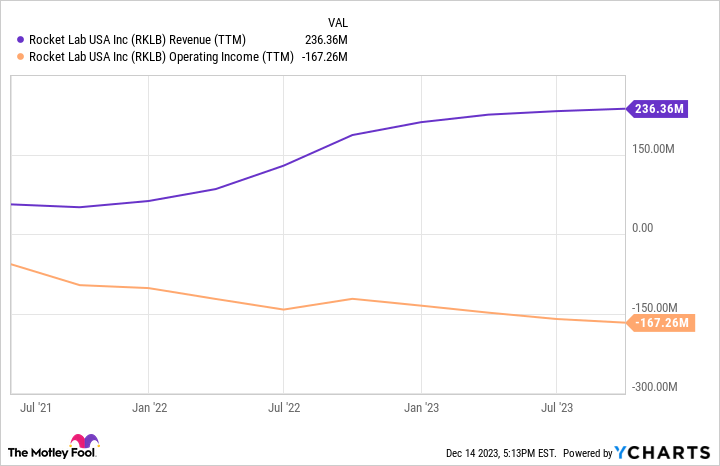

Rocket Lab has steadily grown its revenue, hitting $236 million over the past 12 months. But the company is still small for a space economy business, and is posting $167 million in operating losses every year. The company needs to achieve a huge jump in revenue — and quickly — in order to hit break-even profitability.

Luckily, it may have a trick up its sleeve: the Neutron rocket. Coming in 2024, this larger rocket will see a 43x increase in payload compared to the Electron rocket, hitting 13,000kg. Revenue per launch generally goes up the more payload is on a vehicle, meaning that Rocket Lab could see a double-digit increase in revenue per launch for the Neutron compared to the Electron.

Right now, Rocket Lab’s launch revenue is sitting at close to $100 million a year. If that can 10x once the Neutron rocket becomes fully operational, investors could start to see the launch business hit $1 billion within a few years’ time. Of course, there is a risk that the Neutron rocket gets pushed back or struggles to achieve consistent launches (it has never launched before). But you can’t deny there is a lot of potential for this new product from Rocket Lab.

Don’t forget the Space Systems segment either. More launch payloads mean more revenue potential from the other services Rocket Lab offers customers. If things go right, Rocket Lab could be a multibillion-dollar revenue business within a few years.

RKLB Revenue (TTM) data by YCharts

But is the stock a buy?

After its December rally, Rocket Lab now trades at a market cap of $2.5 billion. It is hard to value the business given all the uncertainty with the Neutron rocket. Yes, there is a ton of potential here, but there is also a lot of risk. Rocket Lab is burning a lot of cash right now, and only has around $250 million left on the balance sheet.

If Rocket Lab gets the Neutron rocket consistently launching for commercial customers, this stock is likely to go much higher in a few years. The business will likely be doing billions in sales and generating a profit. But there is also a chance the business fails, or at least struggles mightily, if the Neutron project hits major roadblocks.

So what’s an investor to do? Fans of this business don’t necessarily need to avoid the stock. You just need to make sure you size your position to account for the large spectrum of potential outcomes. Make Rocket Lab a small enough position in your portfolio so you won’t kick yourself if the stock goes to zero, but large enough so if it does become a multi-bagger the gains are meaningful.