According to blockchain analytics, the Ethereum Name Service (ENS) domain “vitalik.eth” has engaged in a transaction of $100,000 worth of ether, converting it into an equal amount of stablecoins on the Base blockchain. The address, purportedly belonging to Ethereum’s co-founder Vitalik Buterin, currently possesses 955.58 ether, estimated at $3.64 million. ‘Vitalik.eth’ Wallet Makes Strategic $100K […]

According to blockchain analytics, the Ethereum Name Service (ENS) domain “vitalik.eth” has engaged in a transaction of $100,000 worth of ether, converting it into an equal amount of stablecoins on the Base blockchain. The address, purportedly belonging to Ethereum’s co-founder Vitalik Buterin, currently possesses 955.58 ether, estimated at $3.64 million. ‘Vitalik.eth’ Wallet Makes Strategic $100K […]

Source link

100K

The COVID-19 pandemic, rampant inflation and regional conflicts directly influenced Bitcoin’s (BTC) drop in value over the past two years. However, 2024 promises to be a resurgent period, according to Blockstream CEO Adam Back.

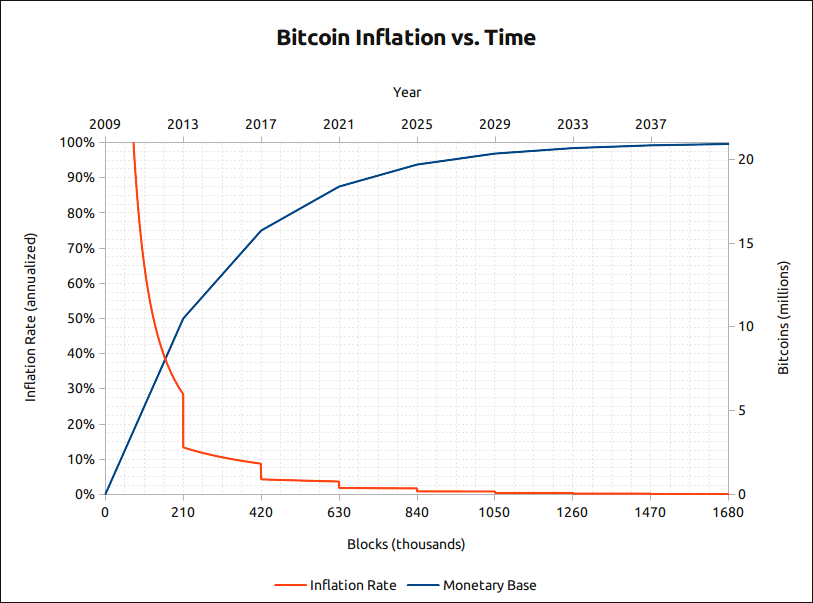

The cryptographer, who pioneered the proof-of-work algorithm applied in Bitcoin’s protocol, tells Cointelegraph that the preeminent cryptocurrency is trailing below the historical price trend line of previous mining reward halving events.

“Biblical” events hurt Bitcoin

Back weighed in on the potential price action of Bitcoin as the next halving approaches, which will see Bitcoin miners’ block reward reduced from 6.25 BTC to 3.125 BTC. Block reward halvings are programmatically hardwired into Bitcoin’s code, taking place after every 210,000 blocks.

Back says that the overlaid averages of the previous market cycles and halvings indicate that Bitcoin’s relative value is trailing behind widely accepted projections. Multiple events have played a role in driving the price of BTC down, which has also been seen across traditional financial markets:

“The last few years were like biblical pestilence and plague. There was COVID-19, quantitative easing and wars affecting power prices. Inflation running up people, companies are going bankrupt.”

The impact has keenly affected markets and portfolio management, according to Back. Investment managers have had to manage risk and losses over the past few years, which has necessitated the sale of more liquid assets.

“They have to come up with cash, and sometimes they’ll sell the good stuff because it’s liquid and Bitcoin is super liquid. It used to happen with gold, and I think that’s a factor for Bitcoin in the last couple of years,” Back explains.

Bitcoin would have hit $100,000 already

As 2023 comes to a close, many of these macro events that Back cited have wound down, while more industry-specific failures have also been resolved. This has been reflected in Bitcoin’s recent price surge from Nov. 2023 onwards.

“The wave of the contagion, the companies that went bankrupt because they were exposed to Three Arrows Capital, Celsius, BlockFi and FTX — that’s mostly done. We don’t think there are many more big surprises in store,” Back said.

Related: Blockstream targets continued Bitcoin miner surplus with Series 2 BASIC Note

The Blockstream CEO previously predicted that Bitcoin would hit $100,000 in the next market cycle and referred back to this point. He believes BTC would have hit this mark already if not for the macro factors highlighted before.

Back also referred to the Bitcoin “stock-to-flow” model created by pseudonymous former institutional investor PlanB as a reference point for the potential upside for Bitcoin in 2024.

If you want to know more about bitcoin Stock-to-Flow:

* This is the original 2019 article:https://t.co/n5P5uMCKHT

* Or watch this YouTube video: pic.twitter.com/Qp8SjqtXIB— PlanB (@100trillionUSD) December 5, 2023

Back explains that PlanB’s model and heuristics suggest that savvy Bitcoin investors historically bought BTC six months before a halving event and sold into significant surges in price that have occurred in the 18 months following the drop in mining rewards:

“People thought it was a bit of a crazy assertion that we might get to $100,000 pre-halving because I said it when the price was around $20,000.”

He adds that Bitcoin’s price hitting $44,000 multiple times in Dec. 2023 suggests that his prior prediction might not be so far-fetched.

The Bitcoin ETF effect

Prominent investors and market analysts have also highlighted the effect of the potential approval of several spot Bitcoin exchange-traded fund (ETF) applications by the United States Securities and Exchange Commission (SEC).

People asking me if we changed odds. No, we still holding line at 90% odds of approval by Jan 10 (aka this cycle), the same odds we’ve had for months (before it was cool/safe). What we watching for now: more amended/final filings to roll in and clarity on in-kind vs cash creates https://t.co/uiWgfxOfzz

— Eric Balchunas (@EricBalchunas) November 29, 2023

Senior ETF analysts Eric Balchunas and James Seyffart have touted these applications to get the green light in early 2024. Galaxy Digital’s co-founder Michael Novogratz has also predicted mass inflows of institutional investment into the BTC-backed products, a point echoed by Back:

“I think Bitcoin could get to $100,000 even before the ETF and before the halving. But I certainly think the ETF shouldn’t be undervalued in its influence.”

A key reason cited by the Bitcoin advocate is that whole segments of traditional markets, including major fund managers like BlackRock and Fidelity, are simply not allowed to invest directly into assets like Bitcoin.

Related: Bitcoin ETFs will drive institutional adoption in 2024 — Galaxy Digital’s Mike Novogratz

“If they’re managing a mutual fund, they have rules, either externally imposed or as part of their fund, that they can only buy things like public stocks and ETFs. They can’t buy into startups, they can’t buy precious metals physically. They can’t do any of that stuff,” Back said.

This remains a pertinent reason why a spot Bitcoin ETF could drive significant capital inflows into the space. Back adds that the investment vehicle opens access to Bitcoin exposure for many types of funds, particularly in the U.S., that are more inclined to do so through Fidelity or BlackRock than with a cryptocurrency exchange.

Magazine: ‘Elegant and ass-backward’: Jameson Lopp’s first impression of Bitcoin

Global investment management firm VanEck‘s 2024 predictions for crypto suggest a transformative year ahead for the sector, highlighting pivotal events and trends set to redefine the digital asset landscape from economic fluctuations to groundbreaking technological advancements.

The forecasts are based on analysis beyond just the crypto sector, looking at economic trends, technological developments, and regulatory dynamics. From the anticipated U.S. recession’s intertwining with the launch of spot Bitcoin ETFs, aiming to bolster Bitcoin’s resilience above $30,000, to the fourth Bitcoin halving poised to elevate its market value, these predictions spotlight pivotal moments in crypto’s journey.

Further, VanEck’s outlook predicts Ethereum to retain its position beneath Bitcoin’s market dominance while simultaneously outshining major tech stocks and facing competition from other smart contract platforms. The NFT market, which will be fueled by both Ethereum and Bitcoin in 2024, is expected to scale new heights, reshaping the landscape of digital collectibles. Meanwhile, the stablecoin realm, particularly with USDC, anticipates unprecedented growth.

The predictions also highlight the potential shift in exchange supremacy, with Binance’s leading spot trading position challenged by emergent rivals. Additionally, DEXs are projected to claim a significant slice of the spot trading market. A breakthrough is anticipated for blockchain-based gaming, with a game surpassing one million daily active users, marking a milestone in mainstream acceptance.

Robbie Ferguson, Co-Founder and President of Immutable, told CryptoSlate,

“Recognition from VanEck, one of the world’s top 10 ETF issuers, is exceptional validation of the work we’ve been doing for web3 games since we built the first decentralized game on any blockchain in 2017[…] This endorsement further validates our platform strategy, and relentless focus on an exceptional end player experience.”

Furthermore, Solana’s ascent to a top-three blockchain position, along with the rise of DePi networks like Hivemapper and Helium, anticipates broad diversification within the blockchain ecosystem.

Finally, a pivotal area highlighted by VanEck is the integration of Know Your Customer (KYC) protocols in decentralized finance (DeFi), expected to usher in a new era of institutional participation. This, along with new corporate accounting treatments for crypto holdings, signals a shift towards mainstream and institutional adoption of cryptocurrencies.

VanEck predicts spot Bitcoin ETF will be approved in Q1.

In 2024, VanEck predicts the U.S. economy to enter a recession amidst slowing economic momentum and cooling inflation. This downturn, marked by 19 months of consecutive decline in leading indicators, weak commodity markets, and increasing corporate bankruptcies, sets a challenging backdrop. Yet, in this economic landscape, the debut of the first U.S. spot Bitcoin ETFs will be approved in Q1.

VanEck forecasts that these ETFs will attract substantial investment, drawing a parallel with the early success of the SPDR Gold Shares (GLD) ETF launched in 2004. The GLD ETF experienced rapid inflows, capturing a notable fraction of the gold market within its first quarter. Applying these metrics to Bitcoin, adjusted for the current era’s higher money supply, the prediction is a striking initial influx of around $1B, potentially reaching $2.4B within a quarter for Bitcoin ETFs.

This significant capital flow into Bitcoin ETFs reflects a deeper shift in the financial landscape. With the U.S. Federal Reserve’s M2 money supply considerably higher than during the GLD launch, the potential for Bitcoin ETF inflows is magnified, leading to an estimated $40.4B over the first two years. This surge is partly driven by a predicted preference for Bitcoin as a form of ‘hard money’ amidst concerns over sovereign debt levels and inflation, positioning it as an alternative to gold among investors.

Furthermore, the expected lower transaction costs of these ETFs, compared to current retail trading fees, suggest a potential for broader market adoption. Such cost efficiencies historically have catalyzed the widespread acceptance of new technologies and could similarly propel Bitcoin ETFs into the financial mainstream. Despite the looming recession and potential market volatility, these developments indicate a robust demand for Bitcoin, potentially sustaining its price above $30k in the early phase of 2024.

Impact of the Bitcoin halving and new Bitcoin ATH.

VanEck predicts that the fourth Bitcoin halving event, scheduled for April, will unfold smoothly without major disruptions. This halving is likely to lead to the disconnection of unprofitable miners, shifting the landscape towards those with more efficient, low-cost power solutions. Despite the initial adjustment period, where the market might experience some consolidation, Bitcoin’s value is projected to rise. VanEck predicts that following the halving, Bitcoin’s price could surpass the $48k mark, aligning with the technical pattern observed in April 2022. This uptrend is expected despite some miners potentially underperforming compared to Bitcoin’s price, with low-cost miners like CLSK and RIOT predicted to outshine others. The post-halving period might also see significant growth for at least one publicly traded miner.

The second half of 2024 could bring even more dramatic developments for Bitcoin. Amid a backdrop of global political shifts and an increase in global voting participation, Bitcoin is anticipated to scale new heights. This period of heightened political activity and potential changes in regulatory landscapes, particularly following a significant U.S. presidential election, sets the stage for Bitcoin to potentially achieve an all-time high. VanEck speculates that by Nov. 2024, Bitcoin could hit a new peak in value, potentially reaching $100k by the year’s end. This scenario, marked by a departure from certain regulatory stances, could lead to a landmark moment for Bitcoin and its perception in the global financial system.

The Flippening won’t happen, but DeFi will rise.

Ethereum is set to make significant strides but will not surpass Bitcoin in market dominance. Ethereum’s performance is expected to outshine even the largest tech stocks, but it will not achieve the long-speculated “flippening” to overtake Bitcoin. Bitcoin’s clearer regulatory status and its appeal due to its energy-intensive mining process are anticipated to draw increased interest from state-backed entities in regions such as Latin America, the Middle East, and Asia. Notably, Argentina might join the ranks of countries like El Salvador and the UAE in state-level Bitcoin mining support, focusing on utilizing stranded methane and gas resources.

Simultaneously, Ethereum’s Layer 2 solutions are poised for substantial growth following the implementation of EIP-4844, which promises to enhance scalability and reduce transaction fees. This upgrade is expected to catalyze a consolidation within the Ethereum network, with two to three Layer 2 chains emerging as dominant players. These leading chains could potentially surpass Ethereum in monthly decentralized exchange (DEX) volume and total value locked (TVL). This shift is likely due to the reduced transaction costs enabling more efficient trading and arbitrage opportunities. By the fourth quarter of 2024, these Ethereum Layer 2 chains collectively might double Ethereum’s current DEX volume and exponentially increase transaction numbers, signaling a significant evolution in Ethereum’s ecosystem.

In total, VanEck made 15 predictions for crypto in 2024, listed below:

- U.S. Recession Arrival and Debut of Spot Bitcoin ETFs

- Uneventful Fourth Bitcoin Halving

- Bitcoin’s All-Time High in Q4 of 2024

- Ethereum’s Market Position Behind Bitcoin in 2024

- Dominance of ETH Layer 2s Post-EIP-4844

- NFT Activity Peaks to New Heights

- Binance Relinquishes Top Position in Spot Trading

- Stablecoin Market Cap Hits Record High with USDC Market Share Recovery

- Decentralized Exchanges Attain Record Spot Trading Market Share

- Bitcoin Yield Opportunities Driven by Remittances and Smart Contract Platforms

- Emergence of a Leading Blockchain Game

- Solana Outperforms Ethereum with Resurging DeFi TVL

- Meaningful Adoption of DePin Networks

- Corporate Crypto Holdings Boosted by New Accounting Standards

- DeFi’s Reconciliation with KYC Regulations

The full report from VanEck is available on the firm’s website.

13.15 GMT: Updated to include comment from Immutable.

Blockstream CEO Adam Back said on social media that he believes Bitcoin (BTC) will likely hit $100,000 before its next halving, causing a blend of excitement and skepticism within the cryptocurrency community.

Back also believes that Bitcoin could potentially reach between $750,000 to $1 million per token under a bullish scenario. While some enthusiasts align with Back’s bullish outlook, others criticize what they see as speculative guessing in an unpredictable market.

$100K BTC

The conversation began with a tweet from Bitcoin analyst and author Vijay Boyapati, asking if Bitcoin could hit an all-time high (ATH) before the halving. Back boldly responded with an affirmative, saying:

“That’s what I’ve been saying, my bet is $100k before the halving.”

Back’s prediction goes against the flagship crypto’s historic price trend, which has never broken above a previous cycle’s all-time high before the halving. In the past two cycles, BTC price began its breakout movements months after the halving as supply and demand settled at new levels.

Bitcoin’s current all-time high is roughly $69,000, and many believe that a monumental move above the previous high is unlikely.

However, some in the community argue that the next bull run will entail vast amounts of institutional money as spot exchange-traded funds (ETFs) related to Bitcoin finally secure regulatory approval in the U.S.

One X (formerly Twitter) user pointed out that the most recent bear cycle took BTC below its previous all-time high — something that had also been unprecedented until last year.

Many community members echoed Back’s sentiment of a bull run magnitudes greater than any that have come before due to factors like institutional investors and the mainstream acceptance of Bitcoin. Additionally, the flagship crypto enjoys a regulatory status akin to commodities like gold, even in the U.S., where watchdogs have been cracking down on the industry.

Optimistic speculation

While Back’s predictions align with optimistic market sentiments and the historical tendency for Bitcoin to surge post-halving, some community members are wary — calling the prediction optimistic speculation at best.

Critics of his statement pointed out the inherent uncertainty of cryptocurrency markets, emphasizing that even expert opinions should be taken with caution. They argued that making high-stakes predictions can be misleading, especially for less experienced investors who might interpret them as guarantees.

Meanwhile, some argued that the unprecedented move would not be a positive one, with some making parodical claims of Bitcoin falling to $3,000 in the coming years.

The debate reflects the broader dichotomy within the cryptocurrency community: a clash between cautious realism and optimistic speculation. As the halving nears, these divergent views underscore the unpredictable nature of the market.

Whether Bitcoin reaches the $100k mark pre-halving as Back predicts remains to be seen, but the discussion it has spurred is a testament to the dynamic and ever-evolving narrative of Bitcoin and the wider cryptocurrency landscape.

‘Enjoy sub-$40K Bitcoin’ — PlanB stresses $100K average BTC price from 2024

Bitcoin (BTC) buyers should enjoy the chance to add to their stack below $40,000, says one of the crypto industry’s household names.

In a post on X (formerly Twitter) on Nov. 24, PlanB, creator of the stock-to-flow family of BTC price models, hinted that current levels would not be around long.

PlanB: Time is ticking on $40,000 resistance

Bitcoin is destined to go much higher than its recent 18-month highs, PlanB believes, and time is ticking to increase BTC exposure below $40,000.

Known for his optimistic takes on long-term BTC price growth, PlanB used realized price data to support the case for bulls.

Realized price is Bitcoin’s realized cap — the sum total price at which all BTC last moved — divided by the current supply. It is currently at just below $21,000.

Bitcoin bear market bottoms are characterized by the spot price dipping below the realized price, while bull markets begin once the spot crosses the two-year and five-month realized price levels. These refer to the realized price of coins that last moved within the last two years or the last five months — “younger” coins.

BTC/USD is now once again above all three realized price iterations.

“Enjoy sub-$40k bitcoin … while it lasts,” PlanB commented on an accompanying chart.

Asked whether the market should expect lower levels from here, PlanB would not be drawn, saying that he simply expected an average BTC price of at least $100,000 between 2024 and 2028 — Bitcoin’s next halving cycle.

Bitcoin hodlers bet on six figures

Related: Bitcoin to $1M post-ETF approval? BTC price predictions diverge wildly

As Cointelegraph reported, these are coalescing around an area with $130,000 as its focus for the end of 2025.

The halving itself, meanwhile, due in April 2024, should produce a return to around $46,000, further analysis says.

Earlier this month, PlanB described Bitcoin as being in a “pre-bull market” phase, with the real launch yet to come.

IMO bitcoin is currently in pre-bull market (yellow) and on track towards a full blown bull market (red, after halving unless earlier ETF approval).

Note I changed colors and stage names again, to better align with S2F model:

pre-bull

bull market

pre-bear

bear market pic.twitter.com/tmayjteVWv— PlanB (@100trillionUSD) November 19, 2023

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Immutable to offer studios up to $100k to build web3 games in partnership with Amazon AWS

In a potentially significant step towards mainstream blockchain-enabled gaming adoption, Immutable, the blockchain gaming platform, secured a strategic partnership with Amazon Web Services (AWS), according to the company’s recent announcement.

By joining forces with AWS, Immutable aims to leverage Amazon’s expansive network of game studio leads, thereby facilitating successful deal closures. In turn, game developers and studios will gain access to a comprehensive platform and ecosystem in web3 gaming.

Some promising games built on the Immutable X layer-2 blockchain include Gods Unchained, Guild of Guardians, Illuvium, Ember Sword, Blankos Block Party, Planet Quest, and GreenPark Sports. The company has also had extensive partnerships with top media companies such as Warner Bros to offer other blockchain-enabled interactive experiences.

Immutable offering AWS credits for web3 games.

Immutable’s inclusion in Amazon’s ISV Accelerate Program is vital to this partnership, a co-selling initiative for organizations offering software solutions that operate on or integrate with AWS. This program enables Immutable to tap into AWS’s expert resources, strategically aimed at securing prospective customers and closing deals with prominent global game studios.

Further, Immutable will provide game studios with up to $100,000 in AWS cloud credits to help cover the costs of using AWS cloud services for the studios.

“Immutable is able to provide AWS cloud credits to game studios through AWS Activate, which offers Immutable customers up to $100k to cover cloud services.”

This strategic alignment positions Immutable at a unique vantage point to transform the gaming landscape. The platform’s ecosystem, already bustling with game studios and players, is further bolstered with the necessary infrastructure components and ecosystem partners to create a secure and dependable environment.

Immutable and AWS’s partnership is seemingly underpinned by a shared belief that blockchain technology can revolutionize the gaming industry by melding top-tier gaming technology with true digital asset ownership.

“We are also working on go-to-market programs to accelerate the onboarding of game studios to web3 and drive digital ownership to millions of gamers globally.”

Immutable’s ongoing collaboration with AWS, rooted in security, performance, proximity to users, and elasticity for developer environments, has created a serverless architecture, enabling the platform to scale effectively amid rapid growth.

Furthermore, Immutable has reported the ability to handle a tenfold increase in partnered games, signifying a marked improvement in the customer experience, anchored by increased security and over 99% uptime.

John Kearney, Head of Startups at Amazon Web Services, Australia and New Zealand, noted,

“Today, web3 gaming is one of the fastest-growing sub-sectors of the blockchain industry and is already enjoyed by millions of gamers worldwide.”

He added that AWS is “supercharging Immutable’s development by onboarding new game studios and providing them with resources through our flagship AWS Activate startup program and AWS’s ISV Accelerate Program, which give them the tools to accelerate their global launch.”

Looking forward: Immutable and Amazon.

Moving forward, Immutable plans to continue investing in its infrastructure, built on AWS, to support its upcoming offerings, such as Immutable zkEVM, effectively. With Ethereum compatibility, Immutable zkEVM aims to expand offerings and support to partners, enabling more developers to build web3 games without learning a new programming language.

Immutable is positioning itself as a one-stop-shop for game developers, providing all the necessary tools to build a successful web3 game. From player experience enhancements like Immutable Passport for instant wallet onboarding to revenue engines like Immutable Global Orderbook & Marketplace Network for maximizing asset distribution, Immutable offers a suite of integrated products for platform services hosted on AWS.

Friend.tech denies report that database of over 100K users was leaked

The team behind the viral decentralized social media platform Friend.tech has refuted a report that claimed that the personal information of more than 100,000 of its users was leaked.

The now-amended report, first posted by The Block, suggested that data posted by Banteg, a pseudonymous developer for Yearn Finance, was “leaked” information.

The Friend.tech team, however, clarified that the information came from scraping its public API.

“It’s like saying someone hacked you by looking at your public Twitter feed,” the official Friend.tech account argued.

This is just someone scraping our public API that shows the association between public wallet addresses and public Twitter usernames.

It’s like saying someone hacked you by looking at your public Twitter feed.

Irresponsible reporting from @TheBlock_ and @vishal4c https://t.co/GIXOWazqBk

— friend.tech (@friendtech) August 21, 2023

The post also received input from X’s (formerly known as Twitter) Community Notes contributors.

“The underlying data is public and anybody can work it out reading a block explorer: if you buy a share, 5% goes to the creator’s wallet and he will have needed to fund his wallet. The database only scraps that public info,” the community note reads.

Banteg originally published a repository of the publicly available scraped data, containing details of users on the Friend.tech platform on GitHub.

101,183 people has given friend tech access to posting as them, leaked db indicateshttps://t.co/yYYDqzUoON

— banteg (@bantg) August 21, 2023

This data included wallet addresses on Base, linked to the corresponding Twitter usernames for more than 101,000 users.

“101,183 people have given friend.tech access to post as them, leaked db (database) indicates,” Banteg wrote.

Banteg also gave criticism to the inaccurate interpretation of their initial post.

Meanwhile, X users also joined in to poke fun at the situation, with one user, Satsdart, posting a link to the Ethereum block explorer, humorously claiming that he had discovered “a leaked database showing ALL transactions on eth.”

i just found a leaked database showing ALL transactions on eth look guys https://t.co/4rrC6sBYJM

— satsdart (@satsdart) August 21, 2023

Notably, Banteg’s release of the data followed a post from blockchain analytics service Spot On Chain which found that Friend.tech’s API revealed specific sets of information not immediately available to everyday users of the app.

Related: ‘I give it six to eight weeks’ — Critics warn Friend.tech hype won’t last

2. The API of @friendtech also leaks the information

You can check the wallet generated by FriendTech by this API:https://t.co/uqb7V0FxLi

Just replace “0x317931c6b64f6058f688c7d62e84e1491a319dff” with the address you see on the contract. pic.twitter.com/mGrRax4Jd6

— Spot On Chain (@spotonchain) August 21, 2023

The most prominent example was that wallets created by certain users can be viewed through the API.

When asked how this information could be used, Spot On Chain said it could be used to game the system by allowing bots to near-immediately purchase shares of big accounts as soon as they signed up to Friend.tech.

“A lot of bots have already taken advantage of this, it monitors the contract, finds the big KOL, and buys shares before others,” wrote Spot On Chain.

Since its beta launch on Aug. 11, Friend.tech has seen its users engage in over 934,000 unique transactions and trade a staggering volume of 34,320 Ether (ETH) — $57,101,116 at current prices.

Magazine: Blockchain games aren’t really decentralized… but that’s about to change

I’m inheriting $100K. Is a 5.5% CD a good rate? Where do I invest for zero risk?

I’ll be inheriting about $100,000 very soon. It all depends on when probate is settled. I’ve never had this kind of money before, or access to this kind of money, so I know nothing about investing. I am only interested in zero risk. I saw a billboard for a bank that has a 13-month certificate of deposit for 5.5%.

Is that a good interest rate, or an average one?

I don’t even know what my savings account pays, since I usually have about $2,000 deposited in it, and based on that low amount, the interest is basically negligible. For that CD, I’d be perfectly happy to earn $5,000 a year on it, but are there more lucrative zero-risk options?

Also, do I report the interest on my tax return?

Soon To Be $100,000 Richer

Dear Richer,

Some people have lost that amount in stocks. Others dream of having a net worth of $100,000. And some folks earn $100,000 a year but bemoan the fact that their partner does not also earn a six-figure salary. Yours is a good story: You are grateful, you want to plan ahead and you are already thinking of the tax implications of your investments.

And so congratulations on your windfall, and condolences if you have lost someone close to you. You are fortunate to be in a position to have such a cash cushion. Whether or not you are just starting out in your career — and depending on where you live in the U.S. — this money could also help you with a down payment on a property, allowing you to get a foot on the property ladder.

But as to your initial question: Is 5.5% a good rate or an average rate? The answer is, both. The return on CDs has more than doubled over the last 12 months, and rates are currently in the 5%-plus range, particularly for high-yield, online accounts. Some have no minimum deposit restrictions or else have minimums of a couple of thousand dollars, while others have $25,000 minimum deposits.

“Competition among financial institutions provides investors with a broad menu of choices when it comes to CDs,” according to Ken Tumin, founder of DepositAccounts.com, which tracks rates. “Banks and credit unions are battling it out for deposits, so they offer savers plenty of different CD maturities at very competitive yields.”

Do you have to report the interest you earn from CDs to the Internal Revenue Service? Yes. Here’s a longer answer: A CD is basically a time-limited savings account — and the interest you earn on your CD should be reported as taxable income, unless the money is stored in a tax-advantaged account like an IRA CD.

Implications for taxes — and beyond

With interest rates so high, prices still elevated and the stock market continuing its unpredictable seesaw act, making money off your cash is an increasingly popular option for savers and investors alike. In addition to CDs, other zero- or close to zero-risk options include high-yield savings accounts, checking accounts and short-term Treasury debt. Money-market funds are also extremely low risk.

I recently wrote a story about how to invest $100,000. I suggested companies with a higher return on equity, lower leverage and more consistent earning profiles. Investing a small portion in the stock market can also help you learn about compounding — that is, earning money on your initial investment and on your investment’s return. But they all carry risk.

You can do a lot with $100,000. This woman from Texas wrote to me five years ago. She was living at the poverty line and inherited $150,000, which was the most money she would likely ever see in her lifetime. Her story continues to inspire me, and she has maintained a long correspondence with me and MarketWatch readers over the last five years.

The money, she said, was a “life changer.” She paid off her car, bought a “tiny home” and deposited $70,000 in a high-yield online savings account. She topped up her retirement portfolio and invested $30,000 into emerging markets. She maxed out her IRA and invested $10,000 between very safe dividend stocks and exchange-traded funds. She also spent $7,000 on dental work in Mexico.

Earlier this year, she updated MarketWatch readers on her life in her third letter: “My tiny house has been one of the greatest decisions I’ve ever made, and has truly changed my whole mindset on what makes me happy.” Her final words? “Investing is truly empowering. I didn’t know that before, but I know it now, and I wish it for many more Americans.”

Whatever you decide to do with your $100,000, I wish the same for you.

“This money could also help you with a down payment on a property, allowing you to get a foot on the property ladder.”

MarketWatch illustration

Readers write to me with all sorts of dilemmas.

By emailing your questions, you agree to have them published anonymously on MarketWatch. By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

The Moneyist regrets he cannot reply to questions individually.

More from Quentin Fottrell:

My wife and I want to retire to the Philippines. We have $193K in savings and $280K in investments, and own a $365K home. Can we do it?

My husband ran away to another state, bought a home and opened credit cards. Am I responsible if he defaults?

My wife and I are turning 50. We have $800K in our 401(k)s and IRAs. Should we withdraw $100K to buy our dream home for retirement?

Can a Nursing Home ‘Take Our IRA?’ My Wife and I Are Elderly. We Have a $100K IRA and a Trust to Protect Our Assets.

My wife and I are elderly. I have an individual retirement account (IRA) worth about $100,000, and we have a trust set up through our children to protect our assets. If one or both of us have to go into a nursing home, can they take our IRA? What do we need to do to protect it?

-Dawn

Long-term care (LTC), which may include nursing home stays, is expensive and can quickly suck up savings you may have intended for something else.

How do you prevent that from happening? The specific answer depends on variables you didn’t reveal. But in my experience, when people talk about “protecting” assets from LTC costs, they often have Medicaid in mind. So what does that look like? (And if you need more help planning for long-term care costs, consider working with a financial advisor).

Qualifying for Long-Term Care Through Medicaid

Medicaid is often viewed as a “safer” option for long-term care for the simple reason that it is less expensive and therefore less likely to drain your assets. But Medicaid eligibility is governed by strict income and asset limits. While those limits vary by state, having a $100,000 IRA will likely disqualify you from Medicaid coverage.

So now you are faced with a paradox: The assets you want to save by means of cheap healthcare are an obstacle to getting cheap care in the first place.

It is at this point that an estate attorney or well-meaning friend might suggest you rearrange your assets in such a way as to exempt them from the eligibility limits. The idea is to make yourself less wealthy on paper to qualify for Medicaid without actually giving away your assets.

If this sounds tricky, that’s because it often is. For one thing, many states use a five-year lookback period when determining Medicaid eligibility. This means that if you do any fancy asset-shuffling in the five years before applying, your efforts will have been in vain. (And if you need help determining whether you’re eligible for Medicaid, consider matching with a financial advisor.)

3 Ways to Protect Your Assets from Medicaid

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

If you’re willing to plan ahead and do your homework, there are a few options for relocating your assets so that you can potentially qualify for Medicaid.

-

Annuities: Any money you put into a “Medicaid-compliant” annuity will not count against your asset limit and will be exempt from the lookback period, as well. The catch – and it’s a big one – is that the money is totally locked up, except for whatever periodic payment you receive from the annuity. And that payment will count against the income eligibility limit.

-

Home equity: In most cases, any equity you have in your primary residence will not count against the Medicaid asset limit. So you could protect your assets by putting them toward your mortgage or even upgrading your home. But the lookback period also applies here, and in some states, the government may claim part of your home equity to recoup care costs after your death.

-

Trusts: You mentioned having a trust already set up, but there is a type of trust designed specifically for this situation. Putting your money into a Medicaid asset protection trust (MAPT) effectively hands it over to someone else, so it is technically no longer yours and does not count against your Medicaid eligibility. Just remember that the handoff must be completed five years before you go on Medicaid.

As you may notice, the common problem with these methods is that they drastically restrict what you can do with your assets. And by taking away your financial independence, to some extent they leave you poor in reality – not just on paper. (And if you need help executing one of these strategies, consider matching with a financial advisor.)

That may be preferable to the alternatives, but it depends on another variable: Why do you want to protect your assets from long-term care expenses, including nursing home costs, in the first place?

Is Cheap Care Worth it?

The options discussed above often make the most sense as estate planning measures. If you do not expect to use your assets yourself and are instead concerned about preserving them for your heirs, perhaps it does not matter if they get locked up in a trust, an annuity or your home equity.

But there is still an elephant in the room. Remember that these asset-protection techniques will ultimately leave you with cheap healthcare and long-term care. And that may impact your access to care and its overall quality.

Ask yourself this: What are you trying to “protect” your money for? Is it worth all the hoop-jumping and the risk of mediocre care in your twilight years? It may be if you want to leave a sizable inheritance behind or save assets for your spouse. (And if you need more help with estate planning, consider working with a financial advisor.)

Next Steps

A middle-ground solution be the best course of action. Something like LTC insurance or an “aging-in-place” strategy may not completely protect your assets from long-term care costs. But such an option could reduce those costs while still providing the care that preserves your quality of life.

Remember, the point of saving money is ultimately for your well-being and that of your loved ones – not just to save it for its own sake.

Tips for Finding a Financial Advisor

-

Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Consider a few advisors before settling on one. It’s important to make sure you find someone you trust to manage your money. As you consider your options, these are the questions you should ask an advisor to ensure you make the right choice.

Graham Miller, CFP® is a SmartAsset financial planning columnist and answers reader questions on personal finance topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Graham is not a participant in the SmartAdvisor Match platform. Find more money insights from Graham at the Wiegand Financial blog.

Photo credit: ©iStock.com/shapecharge, ©iStock.com/Ridofranz

The post Ask an Advisor: Can a Nursing Home ‘Take Our IRA?’ My Wife and I Are Elderly. We Have a $100K IRA and a Trust to Protect Our Assets. appeared first on SmartAsset Blog.

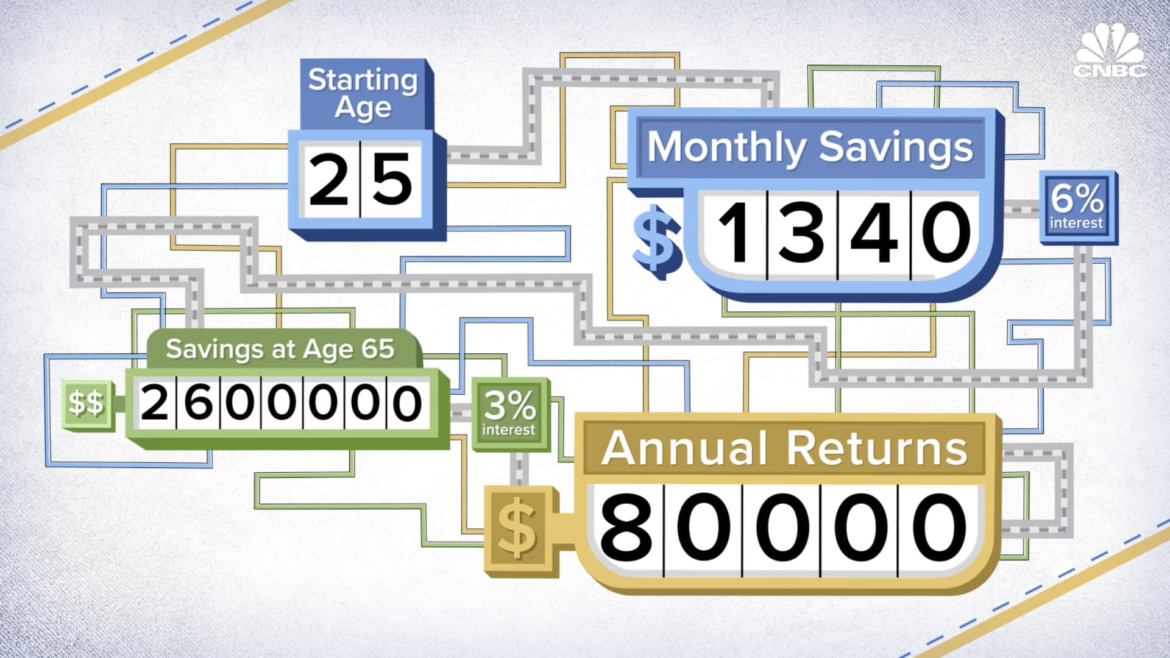

Savings you need to earn $80K, $90K, $100K in interest for retirement

While the thought of funding your retirement adequately might be daunting, if you start planning now, you’ll certainly be thankful later. It’s never too early to start thinking about retirement and it might not be as difficult as you think.

Retirement usually entails replacing your annual salary from a workplace with other income sources to maintain your current lifestyle. While Social Security may cover part of your budget, there are understandably reasons to be concerned about how much you could receive from Social Security by the time you retire. The rest of your money will most likely need to come from your savings and investments.

CNBC crunched the numbers, and we can tell you how much you need to save now to get $80,000, $90,000 and $100,000 every year in retirement, without taking a bite out of your principal.

More from The New Road to Retirement:

Here’s a look at more retirement news.

First, there are some ground rules. The numbers assume you will retire at age 65 and that you currently have no money in savings.

Financial advisors typically recommend the mix of investments in your portfolio shift gradually to become more conservative as you approach retirement. But even in retirement, you’ll likely still have a mix of stocks and bonds, as well as cash. For investing, we assume a conservative annual 6% return when you are working and an even more conservative 3% rate during your “interest-only” retirement.

We also do not factor in inflation, taxes or any additional income you may get from Social Security or your 401(k) investment plan.

We have a full breakdown of how much you need to save now if your goal is to get to $80,000, $90,000 or $100,000 every year in retirement.

Watch the video above to learn more.