Elvira Nabiullina, Governor of the Bank of Russia, stated that the current pilot test of the Russian digital ruble was “on track,” with several operations being tested, including opening wallets, and interactions with smart contracts. Nabiullina revealed that over 25,000 transactions were registered, and confirmed the pilot expansion later this year. Russian Digital Ruble Pilot […]

Elvira Nabiullina, Governor of the Bank of Russia, stated that the current pilot test of the Russian digital ruble was “on track,” with several operations being tested, including opening wallets, and interactions with smart contracts. Nabiullina revealed that over 25,000 transactions were registered, and confirmed the pilot expansion later this year. Russian Digital Ruble Pilot […]

Source link

25K

Bitcoin (BTC) ranged around the key $26,800 mark for a second day on Oct. 13 with a decision due in United States regulators’ battle with crypto investment giant Grayscale.

Bitcoin lurks between major liquidity clouds

Data from Cointelegraph Markets Pro and TradingView confirmed that the BTC price barely changed from the day prior, acting in a narrow corridor.

Bitcoin market analysts weighed potential catalysts, among these the U.S. Securities and Exchange Commission (SEC) choosing whether or not to appeal a court ruling over its refusal to allow a Bitcoin spot exchange-traded fund (ETF).

“Today is an important day with the SEC Appeal on the Grayscale ruling,” Michaël van de Poppe, founder and CEO of MN Trading, wrote in part of an X (formerly Twitter) post.

“If nothing happens, we might be seeing a case where Bitcoin reverses upwards in the coming weeks. I’m positioned long.”

Macro data prints were due to take a break following a series of releases throughout the week, which all showed inflation more persistent than market expectations had predicted.

Summarizing possible BTC price trajectory from here, popular trader and analyst Credible Crypto saw cause for modest optimism.

“We have a very clear and seemingly controlled ‘stairstep’ down on price here. Clear low timeframe breakdowns, retests, and continuation,” he explained alongside a chart.

“We are leaving behind equal lows right below us, so ideally I’d like to see these cleaned up before a reversal. Considering we have bids stacked above and below us, a push to the local highs into asks followed by a rejection and sweep of our lows into the waiting bids and local demand seems like the perfect way to form a reversal here. Let’s see how things develop.”

Fellow trader Daan Crypto Trades noted BTC/USD moving within a zone between two liquidity clouds, with a reaction more likely should the spot price reach either one.

#Bitcoin Liquidation Map

Big zones at $26.5K & $27K. Would expect some sort of ssqueeze to occur at those areas. pic.twitter.com/VW6YYPkMe4

— Daan Crypto Trades (@DaanCrypto) October 13, 2023

Trader and analyst Rekt Capital meanwhile placed a target of $25,000 on Bitcoin should bulls fail to reclaim exponential moving averages (EMAs) lost through the week.

Needs to reclaim at least one of these EMAs as support to avoid a drop into the $25k-$26k area$BTC #Crypto #Bitcoin pic.twitter.com/ywRkdM07uw

— Rekt Capital (@rektcapital) October 12, 2023

GBTC claws back more lost ground

Ahead of the appeal deadline, Grayscale’s flagship investment fund, the Grayscale Bitcoin Trust (GBTC), continued to outperform.

Related: Did SBF really use FTX traders’ Bitcoin to keep BTC price under $20K?

The focus of the legal proceedings, GBTC will end up as a spot ETF, Grayscale has said, with an early victory for the firm seeing its fortunes turn around through Q2.

On Oct. 11, GBTC hit its smallest discount to net asset value — the Bitcoin spot price — since December 2021.

The discount, technically a negative premium, reached -16.44% before dipping slightly lower, per data from monitoring resource CoinGlass.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Following the Fed interest rate pause announcement, the price of BTC broke major price support, raising concerns about a continued decline.

The Federal Reserve announced on Wednesday that it would maintain its interest rate at 5.25%, marking the first time since January 2022 that the rate would remain unchanged. According to the Fed, the inflation rate appears to be decreasing, and it wants to see whether previous rate increases were sufficient to slow price increases. However, it was hinted that the rate could rise if inflation does not appear to be declining and remains a concern.

At a press conference, Fed Chairman, Jerome Powell, stated:

“As we get closer and closer to our destination (the peak rate), it’s reasonable and common sense to go a little slower.”

The unemployment rate report also revealed that the final figures were above expectations. The Fed had predicted that the unemployment rate would fall to 4.1% from 4.5%. Nonetheless, the actual result was even lower, dropping to 3.7%, implying that the labor market is performing better than the Fed expected. The lower unemployment rate suggests that the economy’s current state can withstand higher interest rates without causing significant job losses.

Even with the interest rate pause, there are speculations that the rates may be raised twice before the end of the year, depending on how the economy nears its 2% inflation target. Powell also agrees that there may be a case for interest rates to rise later in the year, but only gradually.

BTC Price Plunges Further Following the Fed Interest Rate Pause

The interest rate news and many of the announcements that followed were positive for the United States dollar, making it strong against many currencies. Notably, the price of Bitcoin broke a major support level, raising concerns about a continued price decline.

Since April 14, the price of BTC has been below $31,000. This price represents the highest point it has reached this year after a long bearish market that persisted through most of 2022. Yesterday’s announcement finally caused it to break the $25,700 support level after more than five weeks of consolidating between $28,000 and $25,700.

The price of Bitcoin is now heading towards major support at $24,300. If this support does not hold, it may continue to decline towards the zone around $22,000, where the next major support level lies.

Given that Bitcoin’s price greatly influences market sentiment towards cryptocurrencies, the prices of other cryptos may also continue to drop if the bearish trend persists. Ethereum, for example, has also broken the $1770 support level and is currently moving towards the $1600 support level. Considering the price direction of major cryptocurrencies, individuals anticipating a major bull run may need to exercise a little more patience.

next

Bitcoin News, Cryptocurrency news, Market News, News

Temitope is a writer with more than four years of experience writing across various niches. He has a special interest in the fintech and blockchain spaces and enjoy writing articles in those areas. He holds bachelor’s and master’s degrees in linguistics. When not writing, he trades forex and plays video games.

You have successfully joined our subscriber list.

Why Bitcoin’s resistance to retesting the $25K support could be futile

Bitcoin has been trading in a narrow 3.4% range for the past three days after successfully defending the $25,500 support on June 10. In this time, investors’ attention has shifted to the macroeconomic area as the United States Federal Reserve will announce its interest rate decision on June 14.

Cryptocurrencies might work independently from the traditional finance markets, but the cost of capital impacts almost every investor. Back in May, the Fed raised its benchmark interest rate to 5–5.25%, the highest since 2007.

All eyes will be on Fed Chair Jerome Powell’s media speech 30 minutes after the rate announcement as markets are pricing in 94% odds of a pause at the June meeting, based on the CME FedWatch tool.

Crypto fears more than just an FOMC meeting

The upcoming Federal Open Market Committee meeting isn’t the only concern for the economy, as the U.S. Treasury is set to issue more than $850 billion in new bills between now and September.

Additional government debt issuance tends to cause higher yields and, thus, higher borrowing costs for companies and families. Considering the already-restrained credit market due to the recent banking crisis, odds are that gross domestic product growth will be severely compromised in the coming months.

According to on-chain analytics firm Glassnode, miners have been selling Bitcoin (BTC) since the start of June, potentially adding further pressure to the price. Among the potential triggers are reduced earnings from a cooldown in Ordinals activity and the mining hash rate reaching an all-time high.

Investors now question whether Bitcoin will test the $25,000 resistance, a level unseen since mid-March, and for this reason, they are closely monitoring Bitcoin futures contract premiums and the costs of hedging using BTC options.

Bitcoin derivatives show modest improvement

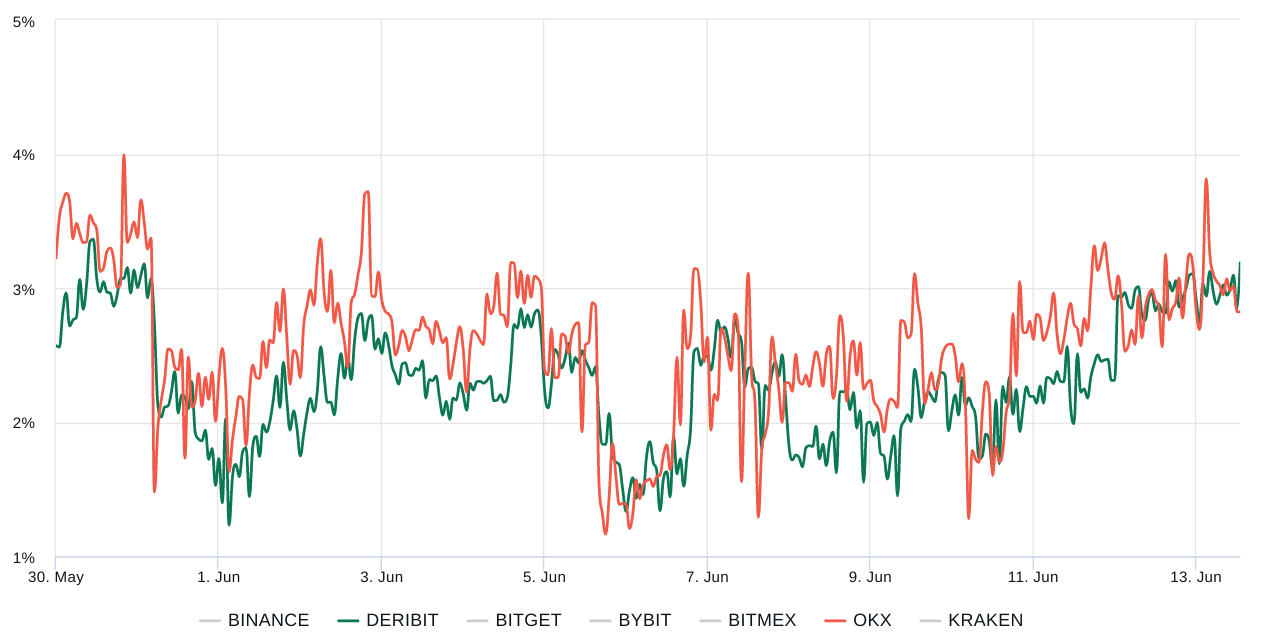

Bitcoin quarterly futures are popular among whales and arbitrage desks. However, these fixed-month contracts typically trade at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement.

As a result, BTC futures contracts in healthy markets should trade at a 5 to 10% annualized premium — a situation known as contango, which is not unique to crypto markets.

The demand for leveraged BTC longs has slightly increased, as the futures contract premium increased to 3% from 1.7% on June 10, although it is still far from the neutral 5% threshold.

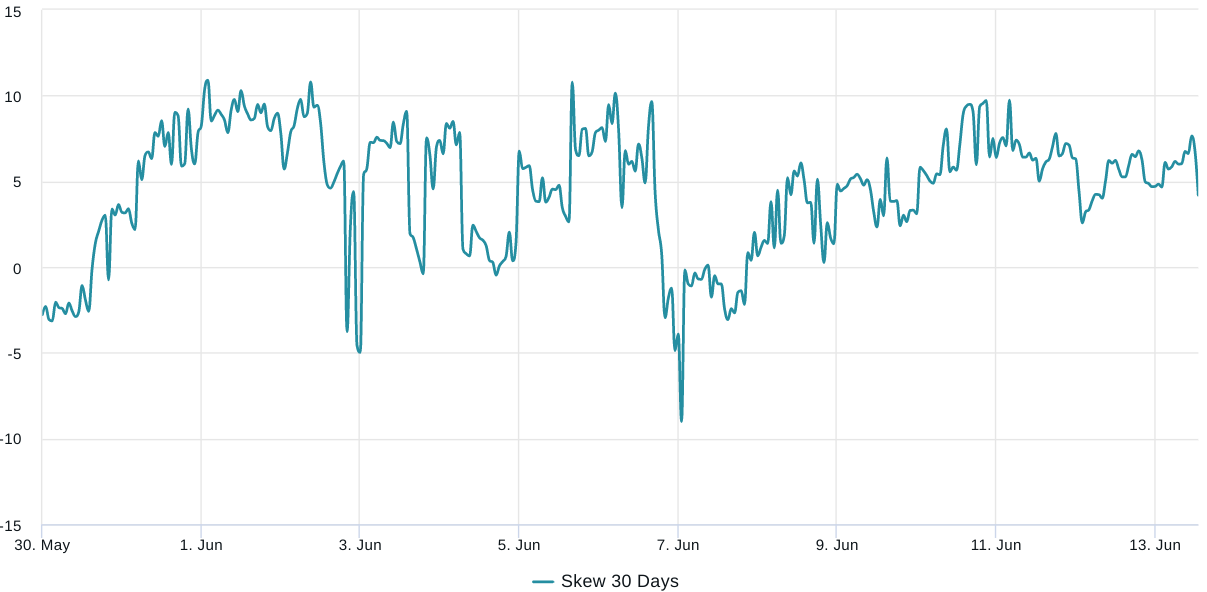

Traders should also analyze options markets to understand whether the recent correction has caused investors to become more optimistic. The 25% delta skew is a telling sign of when arbitrage desks and market makers overcharge for upside or downside protection.

In short, if traders anticipate a Bitcoin price drop, the skew metric will rise above 7%, and phases of excitement tend to have a negative 7% skew.

Related: Crypto fund outflows reach $417M over 8 weeks as investor caution persists

The 25% delta skew metric entered “fear” mode on June 10 as Bitcoin’s price faced a 4.5% correction. Currently at 4%, the indicator displays balanced pricing between protective puts and neutral-to-bullish call options.

The crypto bear trend looks set to continue

Normally, a 3% futures basis and a 6% delta skew would be considered bearish indicators, but that is not the case given the extreme amount of uncertainty regarding the economic conditions and the recent charges against Binance and Coinbase. The Securities and Exchange Commission (SEC) alleges those exchanges held unregistered offerings and sales of tokens and failed to register as brokers.

U.S. lawmakers have criticized the SEC for its heavy-handed approach to crypto enforcement. On June 12, Rep. Warren Davidson proposed a bill aimed at restructuring the SEC by firing Chair Gary Gensler and redistributing power between the commissioners.

The uncertain crypto regulatory environment remains a hurdle to attracting institutional investors. Furthermore, the recession risk for the U.S. economy limits the demand for risk-on assets such as Bitcoin, increasing the odds of the $25,000 support being tested.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.