JPMorgan has cautioned investors that the price of bitcoin could fall to $42,000 after the halving event in April. The global investment bank’s analysts explained that $42K is the level they “envisage bitcoin prices drifting towards once bitcoin-halving-induced euphoria subsides after April.” The bank also recently stated that the bitcoin halving and the next major […]

JPMorgan has cautioned investors that the price of bitcoin could fall to $42,000 after the halving event in April. The global investment bank’s analysts explained that $42K is the level they “envisage bitcoin prices drifting towards once bitcoin-halving-induced euphoria subsides after April.” The bank also recently stated that the bitcoin halving and the next major […]

Source link

42K

Despite ETF rotation fears, mining stocks recover as Bitcoin crosses $42k

Bitcoin regained the psychologically important $40,000 level during the weekend after spending last week struggling to surpass $39,500. As of press time, it stands at just above $42,000, showing solid resilience at this level. This recovery positively affected the broader crypto market and the performance of public Bitcoin mining companies.

Despite being listed and traded on stock exchanges like Nasdaq, public Bitcoin mining companies are susceptible to changes in Bitcoin’s spot price and other developments in the crypto market. As most TradFi investors involved with the stocks see them as a proxy for trading and owning Bitcoin, increases in Bitcoin’s price automatically translate into increases in the stock value of these companies. Conversely, a decrease in the price of BTC leads to a reduction in revenues, adversely affecting their stock performance.

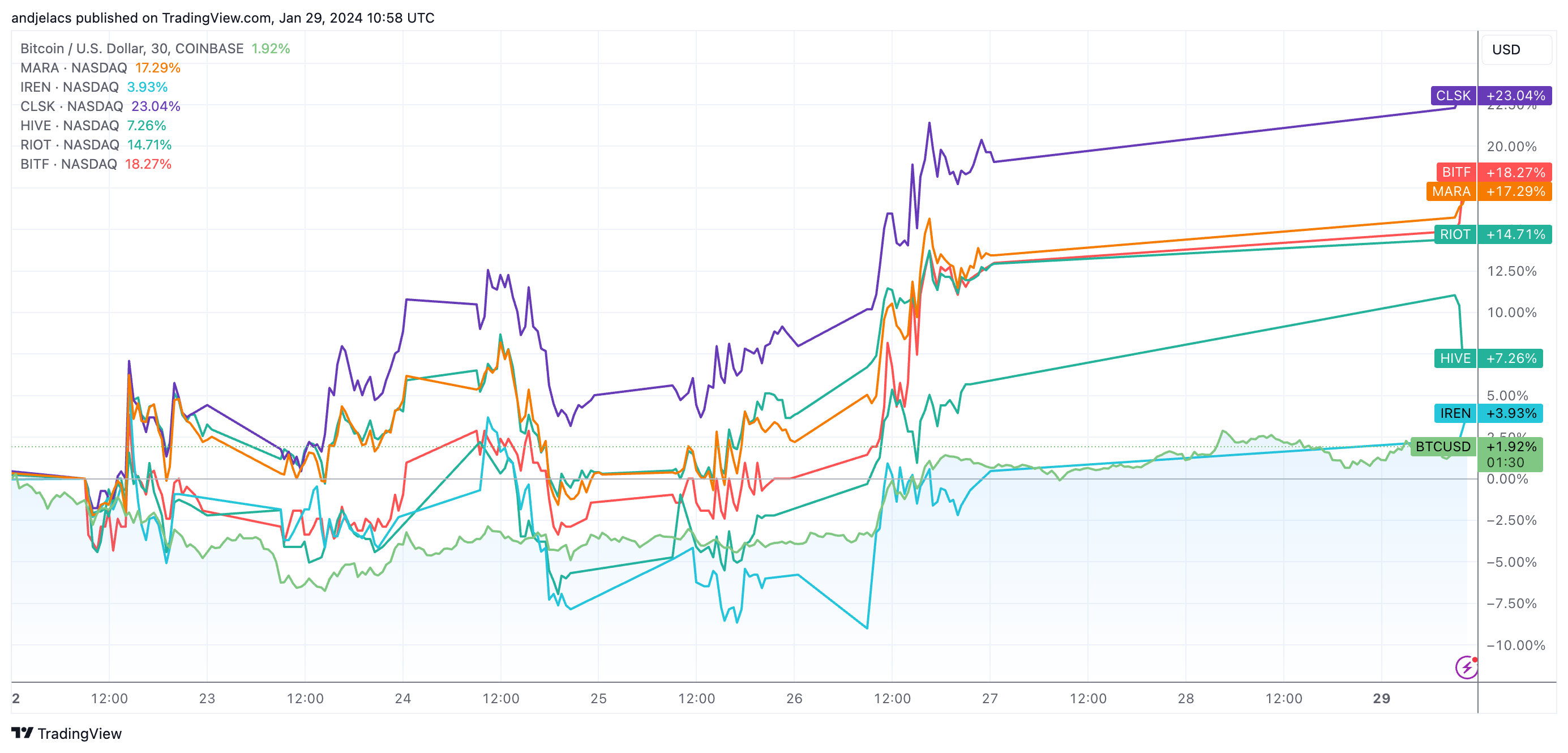

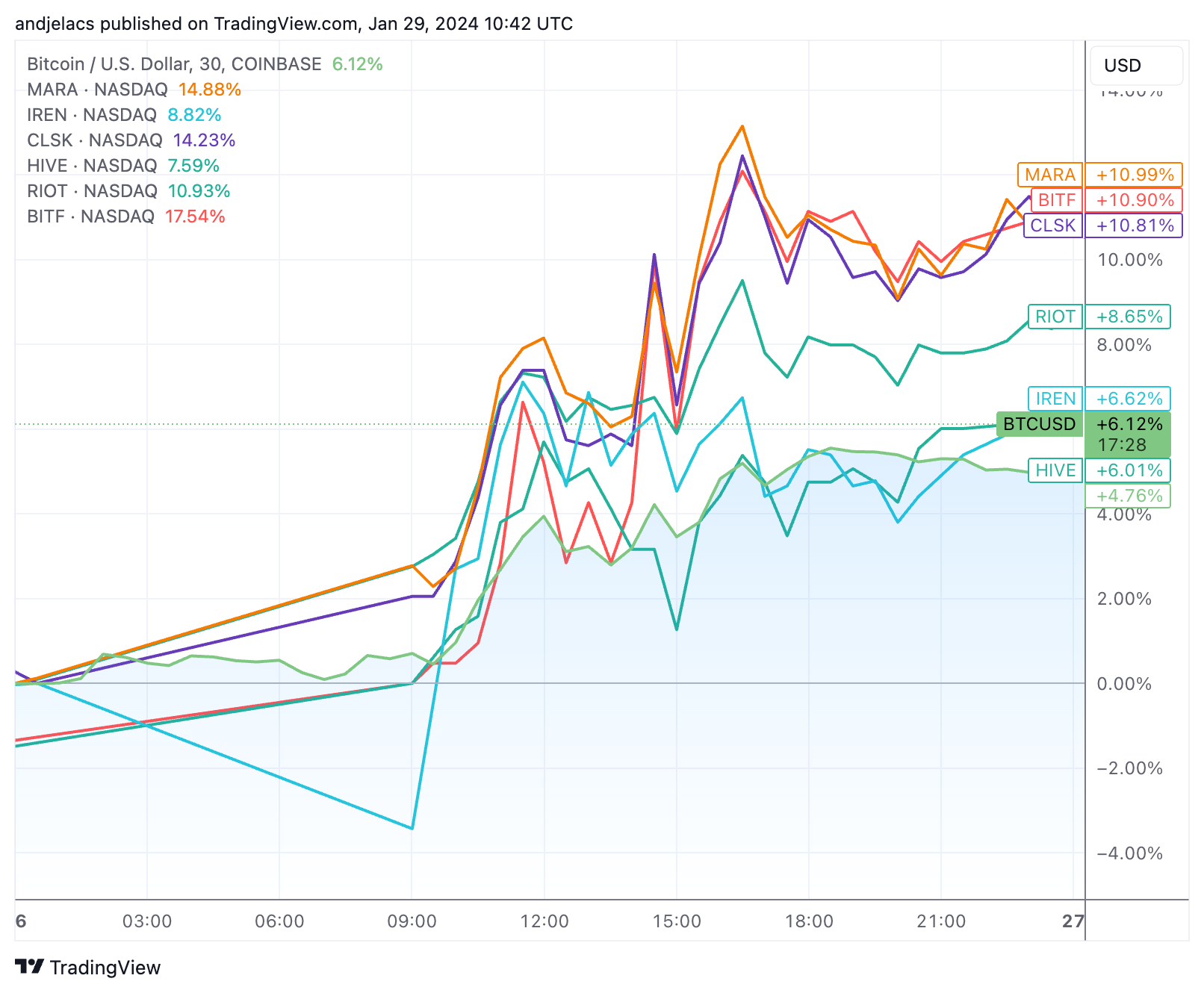

After experiencing a sharp slump in the first two weeks of January, public miners seem to have recovered most of their losses. Between Jan. 22 and Jan. 29, CleanSpark (CLSK) led the pack with a 23% increase, with Bitfarms (BITF) close behind with 18.27%. Marathon Digital (MARA), Riot (RIOT), and Hive (HIVE) grew by 17.29%, 14.71%, and 7.26%, respectively, with Iris Energy (IREN) posting the slightest growth of 3.93% during the period.

This upward trend was extremely pronounced on Friday, Jan. 26, when almost all of the mentioned stocks outperformed Bitcoin’s growth of 6.12%, with MARA, BITF, and CLSK all showing increases of over 10.80%.

On Jan. 29, as of press time, there has been a lack of response from Bitcoin mining stocks to Bitcoin’s price movement. This lag is due to the different trading hours between the crypto market, which operates 24/7, and traditional stock exchanges like Nasdaq, which operates only on weekdays and where most of the mining stocks are listed. This discrepancy often results in a delayed reaction in mining stock prices to Bitcoin’s weekend price movements. Given Bitcoin’s rise past $42,000 over the weekend, we could see further growth in mining stocks as the market opens on Jan. 29 and adjusts to the development in the coming week. Stocks such as RIOT, MARA, and CLSK are up 3%, 3.9%, and 4.2%, respectively, so far in pre-market trading.

The performance of these stocks also reflects the slightly increased miner revenue, which was volatile last week but showed an overall positive uptrend. According to data from Glassnode, the total daily USD revenue paid to miners fluctuated between $39 million and $47 million, following Bitcoin’s price volatility. Miner revenue is a critical benchmark for assessing the health and performance of mining stocks, and revenue increases are one of the most significant factors pushing stock prices up.

The post Despite ETF rotation fears, mining stocks recover as Bitcoin crosses $42k appeared first on CryptoSlate.

Bitcoin Price Faces Uphill Task, Risk of Additional Losses Below $42K Looms

Bitcoin price is still struggling below the $43,250 resistance zone. BTC remains at risk of more downsides if it stays below $43,500 for a long time.

- Bitcoin price is still trading in a range from the $41,500 zone.

- The price is trading below $43,250 and the 100 hourly Simple moving average.

- There was a break below a key rising channel with support near $42,880 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is now at risk of more downsides below the $41,500 support zone.

Bitcoin Price Turns Red

Bitcoin price started a consolidation phase from the $41,500 zone. BTC recovered a few points, but the bears were active near the $43,250 and $43,500 levels.

The last swing high was near $43,568 before the price started a fresh decline. There was a clear move below the $43,000 level. Besides, there was a break below a key rising channel with support near $42,880 on the hourly chart of the BTC/USD pair.

Bitcoin is now trading below $43,250 and the 100 hourly Simple moving average. It is again attempting a recovery wave above the $42,500 level.

On the upside, the price is facing resistance near the $42,800 level. It is close to the 50% Fib retracement level of the recent decline from the $43,568 swing high to the $42,190 low. The first major resistance is $43,000. The main resistance is now forming near the $43,250 level.

Source: BTCUSD on TradingView.com

The 76.4% Fib retracement level of the recent decline from the $43,568 swing high to the $42,190 low is also near $43,250. A clear move above the $43,250 resistance could send the price toward the $44,000 resistance. The next resistance is now forming near the $44,250 level. A close above the $44,250 level could push the price further higher. The next major resistance sits at $45,000.

More Losses In BTC?

If Bitcoin fails to rise above the $43,250 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $42,120 level.

The next major support is $41,450. If there is a close below $41,450, the price could gain bearish momentum. In the stated case, the price could drop toward the $40,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $42,120, followed by $41,450.

Major Resistance Levels – $43,000, $43,250, and $44,000.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin dips below $42k, liquidates majority of long positions across exchanges

Bitcoin (BTC) fell below $42,000 for the second time over the weekend after failing to break above $43,100 amid subdued trading volumes after the ETF hype at the end of last week.

As of press time, BTC was trading at $41,870 on most of the large exchanges. The price is still above the key support level of $40,250; however, sell pressure continues to mount before the Asian markets open for trading.

The flagship crypto experienced $23.68 million in liquidations over the past 24 hours, roughly 85% of which were longs — equating to $20.11 million, according to CoinGlass data.

The liquidations largely affected traders on prominent exchanges, with Binance and OKX bearing the brunt, witnessing liquidations of $7.51 million and $5.26 million, respectively.

Sell the news

The approval and launch of spot Bitcoin ETFs initially led to a surge in Bitcoin’s price, reaching around $49,000. However, following the excitement, there has been a notable downturn in the price, partly due to market reactions typical of “sell the news” events.

This kind of market behavior often occurs when there is a build-up of anticipation for an event (like the launch of ETFs), followed by a quick sell-off after the actual event.

From a technical analysis perspective, Bitcoin was showing signs of buyer exhaustion and increased selling pressure. Analysts observing indicators like the Exponential Moving Average (EMA) noted that Bitcoin was trading at key resistance levels, suggesting a potential price correction.

These technical signals can often lead to a self-fulfilling prophecy as traders and investors react to them.

ETF issuers buying the dip

Meanwhile, the ETF issuers have reportedly bought 23,000 BTC amid the downturn, with BlackRock accounting for 11,500 Bitcoin. It is unclear whether the interest in these products will continue to gain traction or if the weekend lull is a precursor to the coming days.

Experts believe that if these institutions continue scooping up Bitcoin at similar levels, it will likely lead to a supply crunch within a few months and could push the price to new highs.

However, the market has been wary of outflows from Grayscale’s GBTC ETF, whose holders have been underwater since 2022 and are likely looking for an opportunity to sell as they are made whole.

At the time of press, Bitcoin is ranked #1 by market cap and the BTC price is down 2.04% over the past 24 hours. BTC has a market capitalization of $822.13 billion with a 24-hour trading volume of $17.72 billion. Learn more about BTC ›

Market summary

At the time of press, the global cryptocurrency market is valued at at $1.65 trillion with a 24-hour volume of $48.87 billion. Bitcoin dominance is currently at 49.71%. Learn more ›

Buy the dip, sell the rip? BTC price levels to watch as Bitcoin taps $42K

Bitcoin (BTC) faces an uphill struggle to reignite its uptrend after its biggest one-day losses of 2023.

The largest cryptocurrency continues to claw back lost ground after falling to lows of $40,200 after the Dec. 10 weekly close, the latest data from Cointelegraph Markets Pro and TradingView shows.

With BTC price action taking a break from relentless gains — one which many argue was overdue — new key support and resistance levels are coming into play.

The coming days are already set to offer plenty of potential volatility triggers. United States macro data releases begin on Dec. 12, with the Federal Reserve interest rate decision and commentary from Chair Jerome Powell following a day later.

The stage is set for a showdown that may involve more than crypto markets.

Cointelegraph takes a look at some of the popular BTC price lines in the sand now on the radar for traders and analysts as Bitcoin narrowly preserves the $40,000 mark.

Bollinger Bands: BTC bounced “where it was supposed to”

While painful for late longs, the 7.5% BTC price dip which followed the weekly close offered a form of reset for frantic crypto markets.

#Bitcoin has now dropped 7.5% today, which would be the single biggest 1-day drop in 2023.

It has overtaken the drop in March during the banking collapse; -6.2%, bottomed out at $20,000.

Also dropped -7.2% in August when Bitcoin bottomed out at $26,000. pic.twitter.com/WFYiyURO3J

— James Van Straten (@jimmyvs24) December 11, 2023

This was needed, consensus agrees, as unchecked upside typically results in a violent reaction the longer it continues.

“Very overextended, so a pullback was due,” John Bollinger, creator of the Bollinger Bands volatility indicator, argued in a reaction on X (formerly Twitter).

“Stopped right were it was supposed to. That doesn’t happen too often. Now we look to see if support can hold.”

Bollinger referred to Bollinger Bands data, with an accompanying chart showing, among other things, the forcefulness of the latest upside within the context of broader recent BTC price strength.

On daily timeframes, the dip took Bitcoin straight to the middle band within the Bollinger channel, making the correction something of a textbook move and cause for optimism going forward.

The air is getting a bit thin up here, but all we see as of now are signs of strength. We are outside both the daily and weekly BBs with no divergences. The last controlling formation was the 2 bar reversal at the middle BB completed on 21 Nov. $BTCUSDhttps://t.co/B4ZU3vpTvV

— John Bollinger (@bbands) December 5, 2023

Meanwhile, Bollinger warned of increasingly constrictive conditions the week prior, which could be a warning over a local top in advance.

Large Bitcoin buyers may play “buy the dip, sell the rip”

Looking at the behavior of large-volume traders, some commentators see encouraging signs after the open interest flush at the hands of the dip.

Uploading a print of BTC/USDT order book liquidity on the largest global exchange Binance overnight, trading resource Material Indicators revealed a new band of support at $38,500.

While lower than both $40,000 and this week’s bottom, Material Indicators suggested that “institutional sized” bids could now be returning — but there could be a caveat.

Accompanying analysis concluded that “it’s not yet clear whether they are legitimately starting to accumulate at these levels or just buying dips and selling rips.”

“After all, we have a Fed Rate Hike decision coming this week and # JPow’s speeches are typically good for some volatility,” it added.

Continuing on Dec. 12, popular trader Skew likewise considered the odds of manipulation among larger players.

“Seeing a bit of change in the mindset of large spot players whom were actively chasing price before,” he told X followers about the Binance order book.

“Current mindset seems to be buy the dip & sell the rip till bid depth & liquidity improves for large capital to return.”

Skew put the key BTC price areas to watch at $38,000–$40,000 and $44,000–$45,000, respectively.

Analyst: Bitcoin will greet yearly close in “new range”

In terms of major support, popular trader Ali additionally noted the range around $38,000 as a formidable barrier against major downside.

Related: Price analysis 12/11: SPX, DXY, BTC, ETH, BNB, XRP, SOL, ADA, DOGE, AVAX

“In case of a deeper correction, Bitcoin finds solid support between $37,150 and $38,360. This zone is backed by 1.52 million addresses holding 534,000 $BTC,” he showed alongside data.

“Also, watch out for two resistance walls that could keep the BTC uptrend at bay: one at $43,850 and another at $46,400.”

Michaël van de Poppe, founder and CEO of MN Trading, meanwhile flagged a floor zone slightly lower at $36,500.

Bitcoin, he believes, should end 2023 in a “new range.”

Crucial levels to hold for #Bitcoin are, on higher timeframes, $36,500-38,000.

With this correction, we’ll see bounces coming from $39,500-40,000 back to the $42K+ mark.#Bitcoin is likely going to create a new range before the end of the year. pic.twitter.com/bmQIREzEW8

— Michaël van de Poppe (@CryptoMichNL) December 11, 2023

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin breaks $42k with market cap outstripping Tesla and Berkshire Hathaway

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Don’t Change The Channel! Why Bitcoin Could Target $42K If Uptrend Holds

Bitcoin, the world’s largest cryptocurrency by market cap, has traded at or near $30K per coin for the better part of 2023.

Throughout the year, an uptrend channel has formed that is currently still holding. If support remains unbroken, it could propel BTCUSD to the top of the parallel channel which is currently located at or around $42K per coin.

A Bitcoin Price Channel For Your Viewing Pleasure

2023 might not have featured the same painful drawdowns in Bitcoin and other cryptocurrencies as 2022 did, but the market is still doling out suffering in the form of boring, sideways price action, and crypto winter PTSD.

Although BTCUSD has mostly been ranging around the $30,000 level for months now, it has overall remained in an uptrend. Uptrends are defined as a series of higher highs and higher lows.

Oftentimes, these uptrends are supported by drawing a trend line below intraday troughs. Depending on the price action, occasionally a parallel channel will form, providing both support and resistance on either end, keeping an uptrend from moving upward too quickly despite the general trajectory.

Such a parallel uptrend channel has formed in Bitcoin, and if the upward-sloping support trend line continues to stay solid and intact, a move to the top of the channel is likely.

Will the channel hold or break down? | BTCUSD on TradingView.com

Tune In To Find Out What Happens Next In Crypto

The channel began to form in late 2022, acting first as an upward-sloping support line that broke down during the FTX collapse. Bitcoin price then meandered sideways until a new, parallel upward-sloping support carried it higher. With the previous support now acting as resistance, it created the upper boundary of the parallel channel that price is now ping-ponging back and forth within.

If the current uptrend structure holds this latest selloff, a push to the upper resistance boundary is possible. As time ticks by, this upper boundary will reach $42K within the next week or two. If Bitcoin does indeed make a run for the upper boundary, this price is within striking distance by early August.

On the other hand, if the channel breaks down, it could be a sign the uptrend is over and short-lived. Failure to produce a meaningful rally could tell the market that the downtrend has resumed, and new lows are ahead.