On March 5, 2024, at 10:03 a.m. (ET), bitcoin’s value eclipsed its previous lifetime peak against the U.S. dollar, ascending beyond the $69,000 threshold on Tuesday. This breakthrough in valuation marks a new all-time high (ATH), occurring 846 days since bitcoin last reached the $69,000 mark on Nov. 10, 2021. From Uncertainty to Uncharted Heights: […]

On March 5, 2024, at 10:03 a.m. (ET), bitcoin’s value eclipsed its previous lifetime peak against the U.S. dollar, ascending beyond the $69,000 threshold on Tuesday. This breakthrough in valuation marks a new all-time high (ATH), occurring 846 days since bitcoin last reached the $69,000 mark on Nov. 10, 2021. From Uncertainty to Uncharted Heights: […]

Source link

69K

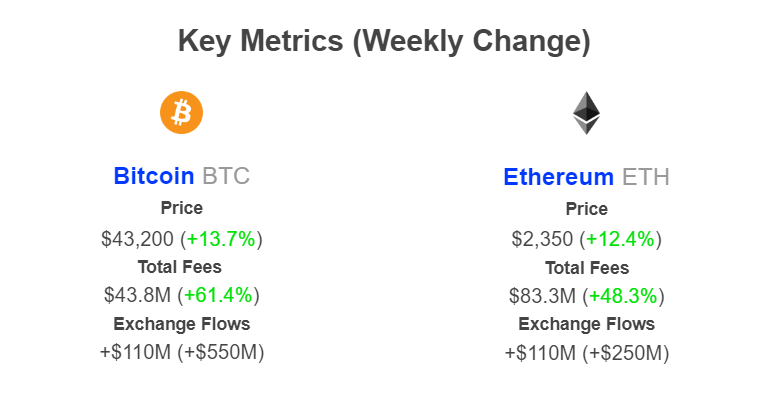

There is a spike in crypto on-chain activity if transaction fees lead. According to IntoTheBlock data on December 8, Bitcoin transaction fees are up by over 60%, while “gas” in Ethereum has climbed by nearly 50% in the past week.

Bitcoin And Ethereum Transaction Fees Rise By Double-Digits

This surge in activity can be pinned to multiple factors, mainly growing user interest and the ongoing crypto bull market. To illustrate, Bitcoin and Ethereum prices are trending at 2023 highs above $43,500 and $2,300 when writing.

Even so, the crypto community expects these coins to extend gains in the coming weeks and months, partly because of expected institutional capital, projected to be in their billions, flowing to the sphere.

According to IntoTheBlock data, cumulative fees collected in Bitcoin this week stand at $43.8 million, up 61%. On the other hand, $83.3 million in fees has been accrued from Ethereum.

Looking at the historical transaction fees trend, transacting on Ethereum, despite its relatively high transaction processing speeds (TPS), is more expensive than Bitcoin. This can be due to Ethereum’s role in decentralized finance (DeFi), non-fungible token (NFT) minting, and more. Bitcoin is a transactional layer and doesn’t inherently support smart contracts.

Usually, rising on-chain transaction fees are bullish for price and indicate that their respective ecosystem is thriving from increasing adoption. With transaction fees rising in the two leading blockchain ecosystems, more people want to interact with the project. Subsequently, this could support prices since BTC or ETH is used for paying transaction fees.

Will BTC Ease Past 2021 Highs Of $70,000?

As BTC is currently trading above $43,500 and ETH recently broke above $2,300, the possibility of these coins retesting and easing past their all-time highs of $70,000 and $4,800, respectively, cannot be discounted. One of the key drivers of the surge in on-chain activity is the ongoing bull market.

With crypto rising, more people are looking to position themselves, hoping to profit from further price appreciation. This wave of fear of missing out (FOMO) has pushed higher fees and prices.

The demand for liquid and SEC-recognized digital assets will likely increase once the Securities and Exchange Commission (SEC) goes ahead and authorizes the first Bitcoin ETF. This derivative product will allow institutions to invest in Bitcoin confidently through a regulated solution.

As the odds of the SEC approving this product rose from early Q4 2023, BTC and ETH prices started rising in sync. Still, how prices will react once the spot Bitcoin ETF is approved remains to be seen. Once the SEC green-lights a spot Bitcoin ETF, the crypto market will begin looking at Ethereum and whether the agency will approve a similar solution.

Feature image from Canva, chart from TradingView

The cryptocurrency’s historical trends indicate that significant gains often occur a year and a half after the bottom, suggesting a rapid price surge in the coming years.

A year after the crypto market saw the collapse of the now-defunct FTX Derivatives exchange and two years after Bitcoin (BTC) saw an all-time high of $69,044, the narrative of “Crypto is dead” has been unequivocally debunked.

Crypto Market: Post-FTX Collapse

The collapse of FTX was a turning point for the crypto market, leading to widespread skepticism and calls for its demise. However, the past year has seen a remarkable shift in sentiment. As highlighted in a recent blog post from Coinbase Global Inc (NASDAQ: COIN), institutional interest in cryptocurrencies has surged, with the filing of Exchange-Traded Funds (ETFs) and increased participation from financial titans.

Additionally, the user base for crypto assets has grown to an estimated 420 million globally, with 52 million in the United States alone. This growth far surpasses the adoption rates of electric vehicles and union memberships, signaling a profound shift in public perception.

Despite the difficulties posed by FTX’s demise, the crypto market has seen continued innovation driven by a dedicated developer community. Moreover, the technology behind cryptocurrencies, especially blockchain and Web3 projects, has evolved significantly.

Over half of the Fortune 100 companies have engaged in crypto-related initiatives, recognizing the importance of crypto investment for competitive advantage. Payment integration with mainstream services like PayPal and Visa has further bridged the gap between crypto and traditional finance.

The regulatory environment for cryptocurrencies has also seen substantial progress. Approximately 3% of the G20 and major financial hubs have either passed national crypto legislation or have legislation in progress.

Notably, the passing of MiCA, a unified framework for crypto across 27 countries in the European Union, is a significant step towards providing a clear regulatory environment. The increasing regulatory clarity has contributed to the legitimacy and acceptance of cryptocurrencies in mainstream financial markets.

Justice for Bad Actors

The crypto market in the past year witnessed a reckoning for individuals who engaged in unethical practices during the previous bull cycle. Notable figures like Sam Bankman-Fried, Alex Mashinsky, Do Kwon, and Su Zhu are facing consequences for their actions. Bankman-Fried’s conviction, in particular, serves as a symbolic moment in holding bad actors accountable.

As the crypto industry moves forward, it is crucial to remember the core principles of decentralization, self-custody, and the power of digital assets like Ethereum (ETH) and Bitcoin. The industry must remain vigilant against bad actors and uphold the principles of Decentralized Finance (DeFi).

The recent bullish crypto market sentiment, boosted by the prospect of regulated ETFs, points to a bright future. Looking ahead, Bitcoin is projected to enter an “acceleration phase,” with some analysts expecting prices to surpass the previous All-Time High (ATH) record of $69,044 by mid-2024.

The cryptocurrency’s historical trends indicate that significant gains often occur a year and a half after the bottom, suggesting a rapid price surge in the coming years.

next

Bitcoin News, Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.