The House Financial Services Committee of the U.S. Congress has advanced a resolution that seeks to disavow SEC SAB 121, a bulletin that leaves banks and financial institutions out of the cryptocurrency custody provider market. However, the resolution, advanced with bipartisan support, is unlikely to be passed at a vote on the House floor, according […]

The House Financial Services Committee of the U.S. Congress has advanced a resolution that seeks to disavow SEC SAB 121, a bulletin that leaves banks and financial institutions out of the cryptocurrency custody provider market. However, the resolution, advanced with bipartisan support, is unlikely to be passed at a vote on the House floor, according […]

Source link

advances

South Africa advances financial inclusion with crypto and digital payment reforms

South Africa announced plans to weave digital payments and crypto into its financial fabric to boost the economy for marginalized groups.

The announcement was made in the country’s 2024 budget and underlines the government’s drive to build a digital economy through active collaborations between public and private sectors to enhance financial innovation.

The budget targets enhancing access to digital payments for people in townships and rural areas who predominantly handle cash. Initiatives will provide local merchants with the infrastructure needed for digital transactions, like internet connectivity and point-of-sale systems.

Starting with a pilot in Gauteng, these efforts seek to broaden the acceptance and use of digital payments among both consumers and businesses.

Regulatory Standards

South Africa intends to legitimize crypto payments and make them an intrinsic part of the local economy over the coming years, starting with a regulatory framework for the sector. The country made crypto an official financial product in 2022, akin to company shares or debt.

The Intergovernmental Fintech Working Group (IFWG) will start issuing comprehensive guidelines in 2024 that will focus on “stablecoins” and their practical applications. This effort will complete a thorough review of the stablecoin environment domestically and create regulatory recommendations that align with global standards.

In 2023, the Financial Sector Conduct Authority (FSCA) and the Financial Intelligence Centre (FIC) started to register crypto asset service providers, following changes to the FIC Act that align with FATF recommendations. The FSCA’s classification of crypto as a financial product now requires service providers to obtain a license, ensuring they meet strict operational standards.

The government is reviewing the extension of the FIC Act’s mandate, which currently requires reporting cash transactions over R49,999, to include crypto transactions. The move aims to use such data in fighting crime.

Additionally, the government intends to explore tokenization and how blockchain technology can represent assets, with the publication of policy and regulatory implications planned for December 2024.

The South African central bank has been considering the development of a central bank digital currency (CBDC) for a number of years. However, the regulator has yet to announce any significant progress in the area.

Supporting financial inclusion

The National Treasury and the Reserve Bank, together with international partners, are rolling out four pilot projects focused on digital payments to aid small and informal businesses.

These projects aim to digitize community transactions, informal worker payments, and cross-border remittances to facilitate finance for small traders engaging in cross-border commerce. Each initiative addresses specific hurdles, from cutting remittance costs to implementing digital tipping for low-income workers.

These efforts highlight South Africa’s determination to be at the forefront of financial digitalization and inclusion, using technology to strengthen its economy and uplift its people. By integrating crypto and emphasizing a solid regulatory framework, the country shows a progressive approach that ensures innovation goes hand in hand with consumer protection and financial integrity.

Bitcoin advances as gold and markets show resilience amid geopolitical unrest

Quick Take

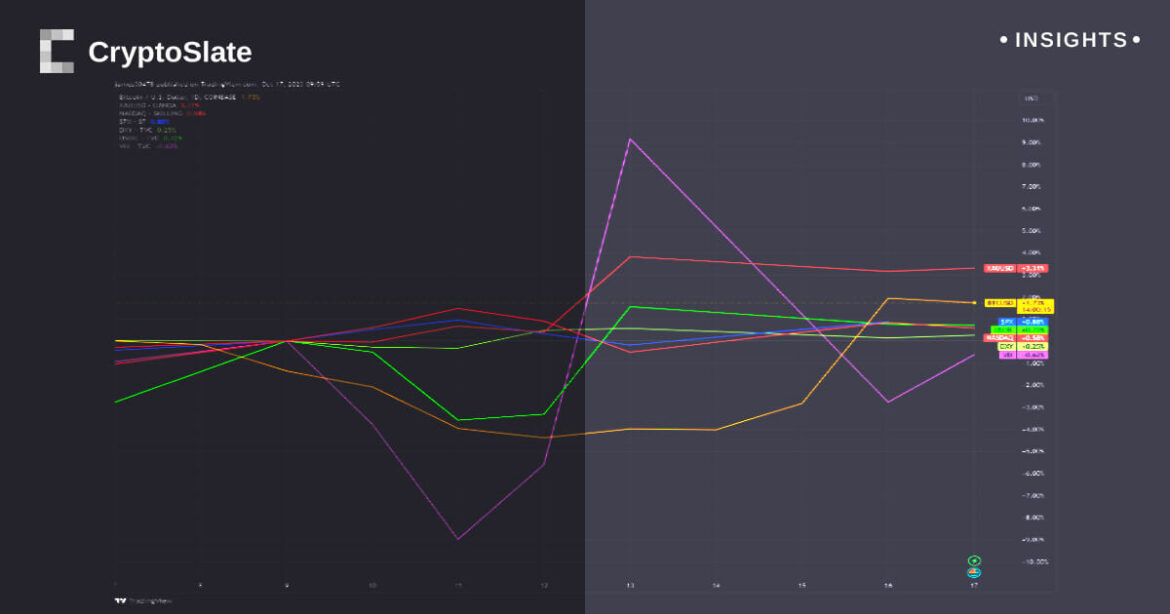

The recent conflict in the Middle East has surprisingly not destabilized the financial markets, as one might expect. Instead, data analysis reveals a slight increase across various financial assets. Gold, historically considered a safe haven during volatile periods, experienced a 3.31% hike. Bitcoin, the leading cryptocurrency, has also increased by 1.74% since the start of the war.

The SPX, Nasdaq, and DXY indices rose by 0.88%, 0.57%, and 0.27%, respectively, evidence of sustained market confidence. WTI Crude Oil, however, exhibited noticeable volatility, plunging from $90 to $82 per barrel before the war, regaining some ground to hover around $86. The Volatility Index (VIX) presented a similar scenario, jumping to 20 on Oct. 13 and then receding to just above 17 yesterday, Oct. 16.

The high volatility of traditional financial assets like WTI Crude Oil might indicate a potential ripple effect on Bitcoin and other cryptocurrencies.

The post Bitcoin advances as gold and markets show resilience amid geopolitical unrest appeared first on CryptoSlate.

Senators make headway on clawing back pay from failed banks’ CEOs, as key committee advances bill

U.S. lawmakers made further progress Wednesday in a bipartisan push to take back pay from executives at failed banks, as the Senate Banking Committee advanced a bill that would permit regulators to claw back compensation received in the two years before a failure.

The measure — dubbed the Recoup Act — was rolled out last week by the committee’s chairman, Democratic Sen. Sherrod Brown of Ohio, and Republican Sen. Tim Scott of South Carolina, a presidential candidate. It was backed by the Senate Banking Committee in a 21-2 vote on Wednesday.

Ahead of Wednesday’s vote, Capital Alpha Partners analyst Ian Katz suggested in a note that the bill’s backers had “some negotiating left to do with Sen. Elizabeth Warren,” as the Massachusetts Democrat “has pushed for a harsher bill.”

The Brown-Scott measure then ended up getting amended, and Warren voted for it, describing the bill as a “reasonable compromise.”

Warren’s bill, called the Failed Bank Executives Clawback Act, would require that regulators take back all or part of the compensation that execs received in the three years before their bank’s failure. It had drawn support from Republicans such as Ohio Sen. J.D. Vance and Missouri Sen. Josh Hawley.

See: Elizabeth Warren, J.D. Vance team up to claw back failed banker pay

The Recoup Act’s prospects in the Republican-run House aren’t clear, but President Joe Biden has expressed support for clawbacks. He urged Congress in a March speech to make it easier for regulators to take back compensation from execs after the failures of Silicon Valley Bank

SIVBQ,

and New York’s Signature Bank

SBNY,

A bill aimed at bankers’ pay has a chance of becoming law, but it isn’t likely to rock the sector

KBE,

according to Capital Alpha’s Katz.

“While this is headline-grabbing legislation and has the potential to pass both chambers of Congress and become law, we don’t expect it to change much in the way banks operate, since no bank executive goes into the job expecting his/her bank to fail,” the analyst said.

Now read: Justice Department to weigh updating banking competition rules

Digital euro proposal set for debate as EU advances AI restrictions legislation

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.