Robert Kiyosaki expressed his stance on potentially investing more in Bitcoin if its price plummets to $200, as economist Harry Dent has forecasted. Cryptoquant data reveals that Bitcoin miners are selling off their holdings in anticipation of the network’s upcoming halving event, which is expected to impact their rewards. JPMorgan has speculated that the SEC […]

Robert Kiyosaki expressed his stance on potentially investing more in Bitcoin if its price plummets to $200, as economist Harry Dent has forecasted. Cryptoquant data reveals that Bitcoin miners are selling off their holdings in anticipation of the network’s upcoming halving event, which is expected to impact their rewards. JPMorgan has speculated that the SEC […]

Source link

ahead

Is Chipotle a Once-in-a-Generation Investment Opportunity Ahead of Its 50-for-1 Stock Split?

When its 2023 fourth-quarter financials were released almost two months ago, Chipotle Mexican Grill (NYSE: CMG) announced results that easily beat Wall Street estimates. But in more recent times, shareholders are excited about a new development.

On March 19, the Tex-Mex restaurant chain announced a massive 50-for-1 stock split. Since then, shares have climbed about 4% (as of April 2), and they are up 27% this year. There’s clearly strong investor interest in this stock right now, driving greater momentum.

Shareholders will vote on the stock split in June at the annual meeting. Does its pending approval make Chipotle a once-in-a-generation investment opportunity?

Cutting the burrito into smaller pieces

It’s critical to first understand what exactly a stock split is. Typically, if a business’s shares perform well, as has been the case with Chipotle, the price rises to an extremely high level. Executives want to reduce the price, so they announce a stock split. Lower nominal stock prices might be more enticing for smaller investors because they can acquire more whole shares, instead of having to buy fractional shares like some brokerages allow.

Should this get approved, every shareholder will receive 49 new shares of Chipotle stock for every single one they already own. Consequently, there will be 50 times more outstanding shares that trade at 1/50th the price.

However, at the end of the day, nothing changes with Chipotle at a fundamental level. A stock split will not change management’s strategy or alter revenue and earnings trajectories.

Is Chipotle stock a buy?

Now that we’ve established the specifics of Chipotle’s stock split, it’s time to turn our attention to the question of whether or not shares make for a smart buying opportunity right now. There are some important factors that we need to consider.

There’s no doubt that the company continues firing on all cylinders. Chipotle reported revenue and earnings per share growth of 14.3% and 38.4%, respectively, in 2023. These two headline figures are significantly higher than they were just five years ago. Chipotle’s results maintain strong financial performance despite ongoing macroeconomic uncertainty.

Key to the company’s strategy, unsurprisingly, is aggressively opening new restaurants. There are currently 3,437 Chipotle locations (as of Dec. 31, 2023), up by 250 from 12 months before. The success of the drive-through setups, known as Chipotlanes, is noteworthy. Management points out that these locations increase new restaurant sales, margins, and returns. They also help strengthen Chipotle’s digital presence.

Over the long term, executives believe there can be 7,000 stores in North America, roughly double today’s footprint. The hope is that these restaurants can generate $4 million in annual sales, up from $3 million in Q4. These forecasts certainly make bullish shareholders very happy.

But investors need to realize that just because a business is posting tremendous results and has bright growth prospects, it doesn’t necessarily mean the stock is a no-brainer buy. Valuation is the missing ingredient that must be closely scrutinized.

After shares have skyrocketed 311% in the past five years, Chipotle is extremely expensive today. The stock trades at a dizzying price-to-earnings ratio of 65.5. Even with impressive fundamentals and a lofty store opening target, the valuation is in nosebleed territory. There is literally no margin of safety for prospective investors, as Chipotle is priced for perfection right now.

Undergoing a significant 50-for-1 stock split definitely grabs the attention of investors. However, that doesn’t make Chipotle a once-in-a-generation investment opportunity. Investors shouldn’t buy the stock right now. Instead, they should wait for a major pullback before even considering adding the business to their portfolios.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $539,230!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 4, 2024

Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Is Chipotle a Once-in-a-Generation Investment Opportunity Ahead of Its 50-for-1 Stock Split? was originally published by The Motley Fool

Bitcoin Whales Maintain Positive Accumulation Behavior Ahead Of 2024 Halving: Santiment

Bitcoin began 2024 with a blast gaining by over 73% in the first quarter of the year to establish a new all-time high price of $73,750. And although BTC soon declined from this value following a turbulent price movement in the last month, its biggest stakeholders have shown a consistent accumulation trend throughout the first three months of 2024, indicating a high confidence in the asset’s profitability ahead of the upcoming halving event.

Bitcoin Whales Acquire $21.6 Billion BTC, Boost Market Dominance By 1.4% As Halving Nears

In an X post on Friday, blockchain analytics platform Santiment shared that Bitcoin whales are still maintaining the “right direction” in regard to their accumulation pattern. Santiment reported that these whales, which represent holders of 100-100,000 BTC, purchased a total of 319,310 BTC (valued at $21.6 billion) in the last three months.

This report also stated that a significant portion of the newly acquired tokens came from retail traders, i.e., holders of 0-100 BTC, who collectively offloaded 105,260 BTC, valued at $7.2 billion and 0.7% of BTC’s circulating supply, within the same time frame.

🐳↗️ #Bitcoin‘s key stakeholders with 100-100K $BTC have ACCUMULATED a collective 319,310 $BTC (around 1.4% of the supply) in the past 3 months. Many of these coins came from 0-100 $BTC wallets, which have DUMPED 105,260 $BTC (-0.7% of supply) in 3 months. https://t.co/6KKFgZzrPz… pic.twitter.com/kXyQrOIRGA

— Santiment (@santimentfeed) April 5, 2024

In general, BTC whales increased their market share by 1.4% in the last three months, which is interpreted as a rather positive sign ahead of the highly anticipated Bitcoin halving on April 19. For context, the Bitcoin halving, which occurs every four years, is a network-programmed event during which the amount of miners’ rewards on the Bitcoin blockchain is reduced by half.

Generally, the Bitcoin halving is regarded as a positive event that results in asset scarcity, thus driving up demand and market price in the long term. This notion may just remain true as Santiment describes the increased accumulation by BTC whales heading into the final weeks before the next halving as a bullish signal, indicating high confidence in the asset’s future valuation.

BTC Price Overview

According to data from CoinMarketCap, Bitcoin currently trades at $67,521, reflecting a decline of 0.01% and 3.51% in the last day and seven days, respectively. In tandem, the daily trading volume of the digital coin is also down by 6.80% and valued at $32.35 million.

However, BTC is up by 6.43% on its monthly chart adding to an impressive year-to-date increase of 140.65%. With a market cap of $1.33 trillion, the maiden cryptocurrency remains the largest digital asset in the world.

BTC trading at $67,504 on the daily chart | Source: BTCUSDT chart on Tradingview.com

BTC trading at $67,504 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Featured image from Watcher Guru, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

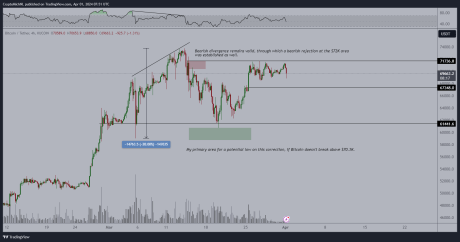

Once again, there is hope for Bitcoin (BTC) as Michael Van De Poppe, a cryptocurrency expert, has spotlighted the potential for the crypto asset’s price to reach a new all-time high before the highly anticipated Halving event commences.

One Final All-Time High For Bitcoin Before Halving

The price of Bitcoin is presently exhibiting new bearish activity, which might trigger negative sentiments in the market over the next few days. Despite the notable decline, Michael Van De Poppe is optimistic that BTC will attain a new height prior to Bitcoin Halving expected to occur this month’s end.

According to the analyst, the digital asset is currently in a consolidation zone. He further identified two distinct crucial levels within the lower timeframes such as the $67,000 threshold as a support level and the $71,700 mark as a final break out towards the peak.

It is worth noting that Michael Van De Poppe previously forecasted that Tuesday is probably when the real moves are expected to begin as Bitcoin consolidates. Thus, if the coin holds the $67,000 level, he will propose a one-last peak test ahead of the halving.

Poppe seems to be confident about his prediction now as he asserts that if one of the two aforementioned crucial levels develops, it will determine the direction of Bitcoin. Due to this, he believes BTC will experience one final pre-halving all-time high.

The post read:

Bitcoin is calmly consolidating. Crucial levels (lower timeframes): $67,000 to hold for support, $71,700 for a final breakout towards the ATH. If either of the two happens, probably direction is chosen. I think we will have one final ATH test before halving happens.

Following the recent decline, Poppe has issued a warning to the crypto community on how to interact with the price action. “You do not want to chase those massive green candles,” he stated.

He advocates entering the market when BTC‘s price is down by 15% to 40%. Additionally, he addressed those considering investing in altcoins, urging them to invest when altcoins are down by 25% to 60%.

Possible Triggers For The Correction

As of press time, Bitcoin’s price is trading at $65,843, demonstrating a decline of over 5% in the daily timeframe. Its trading volume has seen a significant uptick of 66% in the past day, while its market cap has decreased by 5%.

Since its peak of $73,000, achieved in early March, the price of Bitcoin has dropped by nearly 10%. One factor considered to have contributed to the retracement was the influx of funds into US Spot Bitcoin Exchange-Traded funds (ETFs), which has since started to calm down gradually.

Data from Wu Blockchain revealed that the products saw an overall net outflow of $85.84 million on Monday. BlackRock ETF IBIT recorded a net inflow of $165 million, while Grayscale ETF GBTC experienced a single-day net outflow of $302 million. Presently, the historical cumulative net inflow for the BTC spot ETFs is pegged at $12.04 billion.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Miners’ Earnings Hit Record $2 Billion in March Ahead of Halving Event

In March, bitcoin miners amassed an unprecedented level of revenue not seen in the previous 12 months, hitting a high of $2.01 billion from rewards and transfer fees. Of this total, $85.81 million was earned from transaction fees over the past month. Historic Month for Bitcoin Miners — Income Peaks at $2 Billion As we […]

In March, bitcoin miners amassed an unprecedented level of revenue not seen in the previous 12 months, hitting a high of $2.01 billion from rewards and transfer fees. Of this total, $85.81 million was earned from transaction fees over the past month. Historic Month for Bitcoin Miners — Income Peaks at $2 Billion As we […]

Source link

Bitcoin Technical Analysis: BTC Consolidation Points to Potential Shifts Ahead

On March 29, 2024, with a trading price of $70,075, and oscillating within a 24-hour range of $68,362 to $71,754, bitcoin’s current market behavior reveals significant consolidation and neutrality. Bitcoin Bitcoin’s 1-hour chart reveals recent volatility, with a significant bounce from a low of approximately $68,362, suggesting a strong support level. Conversely, the resistance near […]

On March 29, 2024, with a trading price of $70,075, and oscillating within a 24-hour range of $68,362 to $71,754, bitcoin’s current market behavior reveals significant consolidation and neutrality. Bitcoin Bitcoin’s 1-hour chart reveals recent volatility, with a significant bounce from a low of approximately $68,362, suggesting a strong support level. Conversely, the resistance near […]

Source link

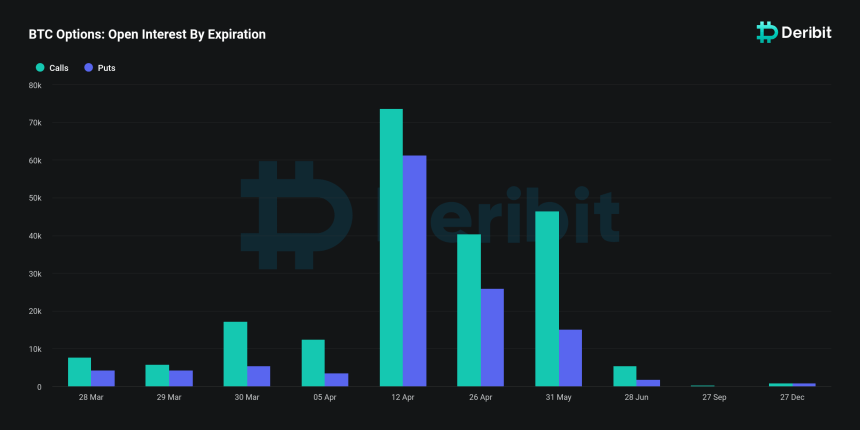

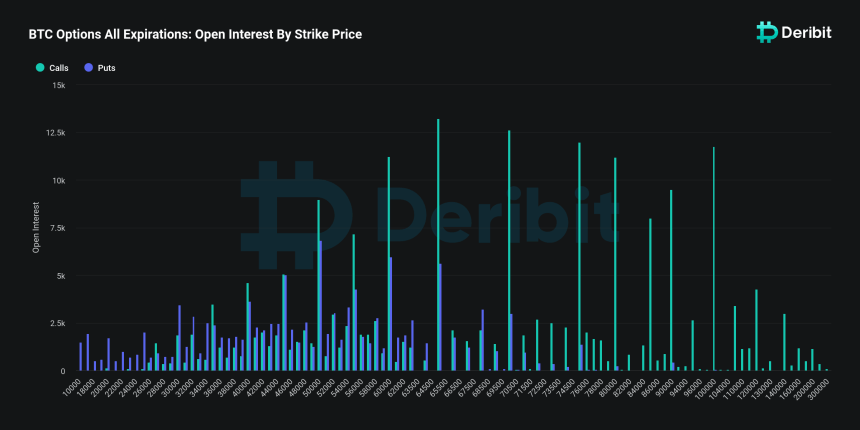

$9.5 Billion In Bitcoin Options Poised To Expire This Friday: Market Turbulence Ahead?

This Friday, the spotlight is turned to Deribit, the leading crypto derivatives exchange, as it gears up for a notable event in its trading history. Particularly, the exchange is poised to witness the expiration of over $9.5 billion in Bitcoin options open interest.

For context, Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not been settled or closed. It represents the number of contracts market participants hold at the end of each trading day.

This surge in open interest recorded by Deribit reflects increased market participation and signals heightened liquidity, marking a notable milestone in the crypto derivatives landscape.

Record-Breaking Open Interest

Notably, this event is significant in two ways: It underscores the growing interest in Bitcoin as an asset class and highlights the increasing “sophistication” of the cryptocurrency market. This is because Open interest can also serve as a critical indicator of market health and trader sentiment.

As such, the record levels of open interest set to expire on Deribit suggest a “vibrant” trading environment, with more investors engaging in complex financial instruments like options.

According to Deribit data, the exchange is set to host one of its largest option expiries ever, with $9.5 billion worth of Bitcoin options poised for expiry at the end of the month. This figure represents a substantial portion, approximately 40%, of the exchange’s total options open interest, which stands at $26.3 billion.

The magnitude of this expiry event eclipses previous months, with January and February end-of-month expiries totaling $3.74 billion and $3.72 billion, respectively. This trend indicates a large increase in market activity and investor engagement on the platform.

Implications Of The Bitcoin Expiry

The upcoming expiry has notable implications for the market, especially considering the current pricing dynamics of Bitcoin.

With Bitcoin’s spot price hovering below $70,000, an estimated $3.9 billion of the open interest is expected to expire “in the money,” according to Deribit analysts, presenting profitable opportunities for holders of these options contracts.

The “max pain” price, which represents the strike price at which the highest number of options would expire worthless, thereby causing the maximum financial loss to option holders, is identified at $50,000.

According to the analysts, this scenario suggests that a significant number of traders are positioned to benefit from the current market conditions, potentially leading to “increased buying activity” as these options are exercised.

Additionally, Deribit analysts speculate that the high level of “in-the-money expiries” could exert upward pressure on Bitcoin’s price or amplify market volatility. They added that as traders “hedge their positions” or “speculate on future price movements,” the market may witness a flurry of activity, impacting Bitcoin’s price trajectory in the short term.

This comes at a time when Bitcoin has experienced a slight retracement from its recent all-time high above $73,000, with the price adjusting to approximately $68,946, at the time of writing

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Listen back to Internet Computer community building on Bitcoin ahead of ICPCC24

The Internet Computer Protocol (ICP) appears to be ushering in a new era of decentralized cloud computing innovation, as evidenced by the vibrant ecosystem of developers and projects showcased in the recent CryptoSlate Twitter Space. Hosted by CryptoSlate’s Akiba, the space featured insightful dialogue with key figures from the ICP community, including Isaac from the ICP Code & State team, Max from Bitfinity, Kyle from The Swop, and Darren, an ICP content creator. Listen back to the recording on X.

As Isaac explained in the space, ICP is a decentralized cloud at its core, bridging the gap between Web2 and Web3. By providing decentralized website hosting with lightning-fast load times and enabling smart contracts to act as decentralized users on other blockchains, ICP is unlocking new possibilities for developers. The protocol’s advanced cryptography allows for the secure splitting of keys across nodes without ever reconstructing the full key, ensuring an unparalleled level of decentralization.

One of the most exciting aspects of ICP is its seamless integration with the Bitcoin blockchain. ICP smart contracts, or “canisters,” can function as decentralized users with their own Bitcoin addresses, paving the way for groundbreaking applications such as the first decentralized Bitcoin mining pool and gasless ordinal marketplaces. This integration makes it easier for developers to build sophisticated smart contracts and applications that leverage the power of Bitcoin while also providing a decentralized infrastructure layer to enhance other blockchains.

The ICP community is a testament to the protocol’s resilience, with a thriving ecosystem of developers and projects spanning various sectors, including DeFi, NFTs, gaming, and social media. After launching within the top 10 crypto projects in 2021, the ICP token fell over 90% amid controversial circumstances. However, the core ICP community continued to build through the bear market, and the fruits of their labors are now revealed.

Venture studios like Code State are actively supporting the ecosystem’s growth, while projects such as Bitfinity, The Swap, and numerous independent developers are pushing the boundaries of what’s possible with ICP.

The upcoming ICPCC24 conference is set to showcase the strength and diversity of the ICP ecosystem. This unique hybrid event, taking place on May 10, will feature a 9-hour main livestream with content from a wide array of ICP projects and ecosystem partners. Simultaneously, more than 25 in-person watch parties and meetups will be held worldwide, fostering a sense of community and collaboration.

Virtual and in-person attendees will have the opportunity to participate in interactive elements and unique airdrop opportunities, making ICPCC24 an unmissable event for anyone interested in the future of decentralized cloud smart contract technology.

Ahead of elections, candidates debate whether to ban TikTok or use it

TikTok Music has launched on Wednesday in Australia, Singapore and Mexico to a small group of users.

Jaap Arriens | Nurphoto | Getty Images

When Joe Biden joined TikTok on the eve of the Super Bowl last month, political scientist Maggie Macdonald was struck by what she called the “meta” nature of the president’s first post.

In the video, Biden poked fun at a conspiracy theory that he rigged the Super Bowl — in favor of the Kansas City Chiefs — to somehow help his reelection efforts.

“Yeah, I’m old, but I’m on TikTok, and I’m on this super online place talking about this super online concept,” Macdonald, an assistant political science professor at the University of Kentucky, said of the messaging and tone of Biden’s video.

While Biden’s debut on the wildly popular social media app came in a playful manner, his use of TikTok in this year’s reelection campaign is at the heart of a heated debate in Washington, D.C., about whether the service should even exist in the U.S. The app, owned by China’s ByteDance, is viewed as both an invaluable tool in trying to reach masses of young potential voters who are unplugged from mainstream media and an easy way, allegedly, for the Chinese government to spy on American consumers.

Members of the House Select Committee on the Chinese Communist Party introduced a bill this week that would require ByteDance to divest TikTok or face a U.S. ban, following earlier federal and state-led efforts that never came to fruition. On Thursday, the committee voted 50-0 to send the bill to the House floor.

Shortly after the committee advanced the bill, Rep. Troy Balderson, R-Ohio, called TikTok “a surveillance tool used by the Chinese Communist Party to spy on Americans and harvest highly personal data.”

TikTok CEO Shou Zi Chew has denied in Senate hearings any ties between the app and the CCP. In a statement to CNBC on Thursday, TikTok said, “The government is attempting to strip 170 million Americans of their Constitutional right to free expression,” an act that “will damage millions of businesses, deny artists an audience, and destroy the livelihoods of countless creators across the country.”

TikTok’s CEO Shou Zi Chew testifies during the Senate Judiciary Committee hearing on online child sexual exploitation, at the U.S. Capitol, in Washington, U.S., January 31, 2024.

Nathan Howard | Reuters

Since Biden’s playful intro post, his campaign’s TikTok account has notched over 222,000 followers and over 2.4 million likes. With eight months until the general election and a likely rematch of the 2020 contest, Biden narrowly trails Republican challenger Donald Trump in most national polls in what’s expected to be a tight battle to the end.

Biden’s age has shown up as a persistent concern in polling data, so experts say reaching out to younger audiences is key in trying to win over undecided young voters, and mobilize a traditional Democratic constituency whose members sometimes stay home on Election Day.

“It’s really important for him to have a presence, and for him to interact directly with voters, not just through creators and influencers,” said Aaron Earls, CEO of social media influencer firm Activate HQ, which specializes in political campaigns. “The turnout in 2020 was really significant with that younger audience and, everyone’s suggesting that maybe there will be a similar turnout with the younger audience again.”

During the State of the Union address Thursday evening, Biden’s campaign posted clips of the speech on TikTok, a sign that the president plans to stick with the app despite swirling concerns in Washington. But it’s a particularly convoluted matter for Biden because, should the bill pass the full House and the Senate, it would hit the president’s desk.

White House press secretary Karine Jean-Pierre told reporters on Thursday that, “This bill is important, we welcome this step.” She said the administration plans to “meet the American people where they are,” adding that, “It doesn’t mean that we’re not going to try to figure out how to protect our national security.”

Biden said on Friday that he will sign the bill if Congress passes it.

The Biden campaign didn’t immediately respond to a request for comment.

TikTok is trying to generate support from users following the House’s action on Thursday. On the app, users were greeted with a screenshot warning them that Congress was “planning a total ban of TikTok.” Multiple staffers and lawmakers told CNBC their offices were flooded with calls, mostly from kids.

TikTok goes to Washington

U.S. political campaigns more broadly are trying to figure out how best to utilize TikTok.

In recent cycles, Facebook has been the social media app of choice for campaigns because of its ability to narrowly target users with fundraising ads and informational posts. However, Apple’s 2021 iOS privacy update made it much harder to target audiences, raising the cost of ad campaigns across Meta’s platforms.

Additionally, Facebook has skewed older over the years, with younger groups gravitating to TikTok. The challenge for campaigns is that TikTok says it doesn’t allow for political ads or “content such as a video from a politician asking for donations, or a political party directing people to a donation page on their website.”

To date, major campaigns have relied on high-profile TikTok influencers to help rally support for specific issues. Last April, for instance, the White House said it was enlisting a squad of volunteer TikTok and Instagram influencers to help spread awareness of the Biden campaign.

Earls says it’s a strategy that’s long been employed in politics. TikTok just presents a new medium.

“That has historically been a tactic that’s happened since the Kennedy days, but just more in traditional media,” Earls said. “Like you’re going to get an endorsement from Marilyn Monroe or Joe DiMaggio or whatever.”

Political groups are scouring TikTok for influencers with positions that resonate with would-be voters, and are targeting certain swing states that could be critical in deciding an election. During the 2022 midterm elections, the Democratic National Committee and communications groups like Climate Power enlisted the help of TikTok and influencers to discuss issues like abortion rights and to mobilize voters.

Even with its growing popularity, TikTok remains a niche tool in politics.

Anupam Chander, a Georgetown University Law Center professor, released a study with some colleagues last year showing that fewer than 10% of members of the U.S. Congress have a “TikTok account from which they post content,” most likely because of the app’s connection to China. In total, the report said, 34 House members and seven senators had an official TikTok account.

Among major politicians using TikTok, an overwhelming majority are Democrats, the study showed. Some of Republicans’ resistance could tie back to Trump’s vow — which was ultimately unsuccessful — to ban TikTok during his administration.

Reaching ‘young Americans where they are’

One of the few high-profile Republicans now on the app is former presidential candidate Vivek Ramaswamy, who said during a primary debate that “part of how we win elections is reaching the next generation of young Americans where they are.”

As to whether Trump will use TikTok in his campaign, Earls said he wouldn’t be surprised to see it. The decision, he said, likely has less to do with China and is more about Trump’s connection to his own social media platform, Truth Social, where he posts with frequency.

“We’ve seen him do whatever it takes to win an election including trying to stop the peaceful transition of power,” Earls said. “He will do what he thinks will help him win so I suspect we’ll see his campaign join TikTok in the coming months depending upon how things develop with his ability to monetize Truth Social.”

The Trump campaign didn’t immediately respond to a request for comment.

Anish Mohanty, communications director for Gen-Z for Change, said his nonprofit advocacy group was originally called TikTok for Biden when it formed in 2020 as part of an effort “to defeat Donald Trump.” The group changed its name the following year, and now taps its network of hundreds of TikTok social media influencers to advocate for multiple progressive issues related to climate change, universal health care and for Biden to call for an immediate ceasefire in Gaza.

Given the many challenges Biden faces with younger groups, his mere presence on TikTok isn’t enough to win votes, Mohanty said, particularly if the president’s campaign is “just using it to post cringy memes about Trump.”

“Young people care about issues, that’s why young people are so unhappy with Biden over action on climate change, over the situation in Gaza,” Mohanty said. “Just because Biden is posting on TikTok, that’s not what’s going to pull young people over.”

Still, Macdonald sees a big opportunity for Biden.

“If you want to reach younger people who are very apathetic, they’re on TikTok,” said the University of Kentucky professor. “You have an incentive to reach them on TikTok, and it does seem that the Republican Party as a unit is just not doing it.”

WATCH: Denying a platform isn’t denying free speech.