NSA whistleblower Edward Snowden has warned that the National Security Agency (NSA) is on the verge of significantly expanding its surveillance capabilities through a new bill amending Section 702 of the Foreign Intelligence Surveillance Act (FISA), potentially allowing the government to compel a wide array of businesses and individuals to assist in NSA surveillance operations. […]

NSA whistleblower Edward Snowden has warned that the National Security Agency (NSA) is on the verge of significantly expanding its surveillance capabilities through a new bill amending Section 702 of the Foreign Intelligence Surveillance Act (FISA), potentially allowing the government to compel a wide array of businesses and individuals to assist in NSA surveillance operations. […]

Source link

alarm

Florida Governor Ron Desantis’ Raises Alarm By Calling Citizens Insurance ‘Not-Solvent’ As An ‘Explosive’ Hurricane Season Is Predicted

In Florida, homeowners are grappling with insurance rates that are nearly three times the national average, a situation that has prompted concerns at both the state and federal levels.

The average cost of home insurance in the Sunshine State has soared to approximately $6,000 annually, significantly outpacing the national average of about $1,700. This surge in premiums is attributed to a 102% increase over the past three years, according to the Insurance Information Institute.

Gov. Ron DeSantis has been particularly vocal about the challenges plaguing Florida’s insurance market, highlighting the state’s reliance on Citizens Property Insurance Corp. as a key issue. Established by the Florida legislature as a not-for-profit insurer of last resort, Citizens has come under scrutiny for its financial solvency. DeSantis’s assertion that the corporation is “not solvent” raises alarms over its capacity to manage claims after major storms, potentially necessitating a government bailout.

Don’t Miss:

The insurance crisis is multidimensional, with Florida’s vulnerability to hurricanes and severe weather playing a significant role. Regulatory and financial hurdles within the state’s insurance industry exacerbate the problem, leaving homeowners facing exorbitant premiums and, in some cases, the inability to secure insurance coverage. The situation has caught the attention of U.S. Sen. Sheldon Whitehouse, who has sought detailed financial information from Citizens in light of DeSantis’s remarks. Whitehouse’s concerns underscore the potential implications for federal resources and the national economy.

Efforts to mitigate the crisis have included legislative attempts to reform the insurance market. These efforts aim to stabilize premiums and ensure the solvency of insurers like Citizens. However, the impact of these measures remains uncertain as homeowners continue to confront the challenges of affordability and availability of insurance coverage.

Trending:

Citizens CEO Tim Cerio has countered claims of financial instability, asserting the corporation’s strong financial condition. He clarified that, should Citizens deplete its resources, Florida law mandates levying a special surcharge on Floridians rather than seeking federal financial assistance. This approach, however, means that a hurricane impacting one part of Florida could lead to increased insurance costs for homeowners throughout the state, according to Jake Holehouse, president of HH Insurance.

Adding to the concern, AccuWeather’s forecast for an “explosive 2024 hurricane season” intensifies the urgency to address Florida’s insurance market challenges. With predictions of an extremely active season, fueled by factors such as the potential development of La Niña and record-warm sea surface temperatures, the stability and preparedness of Florida’s insurance indiustry are more critical than ever.

As Florida faces the prospect of an unprecedented hurricane season, the dialogue between state officials, insurance industry leaders and federal representatives underscores the complex interplay of environmental, financial and regulatory factors driving the state’s insurance crisis. The path forward requires a concerted effort to devise sustainable solutions that protect homeowners while ensuring the financial health of insurers like Citizens Property Insurance Corp.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Florida Governor Ron Desantis’ Raises Alarm By Calling Citizens Insurance ‘Not-Solvent’ As An ‘Explosive’ Hurricane Season Is Predicted originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dogecoin Influencer Sounds Critical Warning Alarm For Scams Targeting The Community

Dogecoin influencer Mishaboar has issued a vital warning to members of the Dogecoin (DOGE) community. This warning could prove timely as meme coin-related scams look to be on the rise in the crypto community.

Beware Of Fake Dogecoin Airdrops

Mishaboar warned community members in an X (formerly Twitter) post to be “extremely careful,” stating that there are several fake airdrops targeting the Dogecoin tag and other popular meme coins. The influencer also added that some of these scams are also deployed using the tags of popular AI tokens.

These scammers are said to promise airdrops to community members with the aim of solely stealing the tokens of unsuspecting users in the process. It is not surprising that these schemes are perpetuated using the tags of popular meme and AI tokens, as these categories of crypto tokens are two of the leading narratives for this bull cycle.

Therefore, using these token tags is likely to help these scammers gain more reach and attract more users. Mishaboar’s warning is no doubt crucial, especially for newbies in the crypto space who could easily fall prey to these scams in the bid to earn ‘airdrops’ that could give them more leverage entering into the bull run.

As part of his warning, the influencer advised his followers to report any account they suspected to be a scam. Mishaboar also noted that some of these accounts have a huge following and might seem legitimate, but users shouldn’t be deceived. Accounts with a significant following always tend to look more legit. That’s why these crypto users have to be extra vigilant.

Mishaboar is known to be very particular about the safety of crypto users. When the ‘MyDogeWallet’ Hack occurred, he advised members of the crypto community to enable two-factor authentication (2FA) on their X accounts using an authenticator application or a physical security key.

Shiba Inu Community Also Faced Similar Scams

At the beginning of the year, Shiba Inu scam detector platform Susbarium drew the SHIB community’s attention to scams that were targeted at obtaining people’s identities and stealing their crypto holdings. Back then, Susbarium warned that one of the scams involved fake accounts promoting fake TREAT tokens to unsuspecting investors.

Like Mishaboar, Susbarium urged users to enable 2FA on all their crypto accounts. They also proposed using hardware wallets to help community members securely store their crypto tokens. Some scam accounts clone or impersonate official accounts, so the scam detector advised to be wary of unsolicited messages they might receive from these impersonators.

DOGE price at $0.17 | Source: DOGEUSD on Tradingview.com

Featured image from Securities.io, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

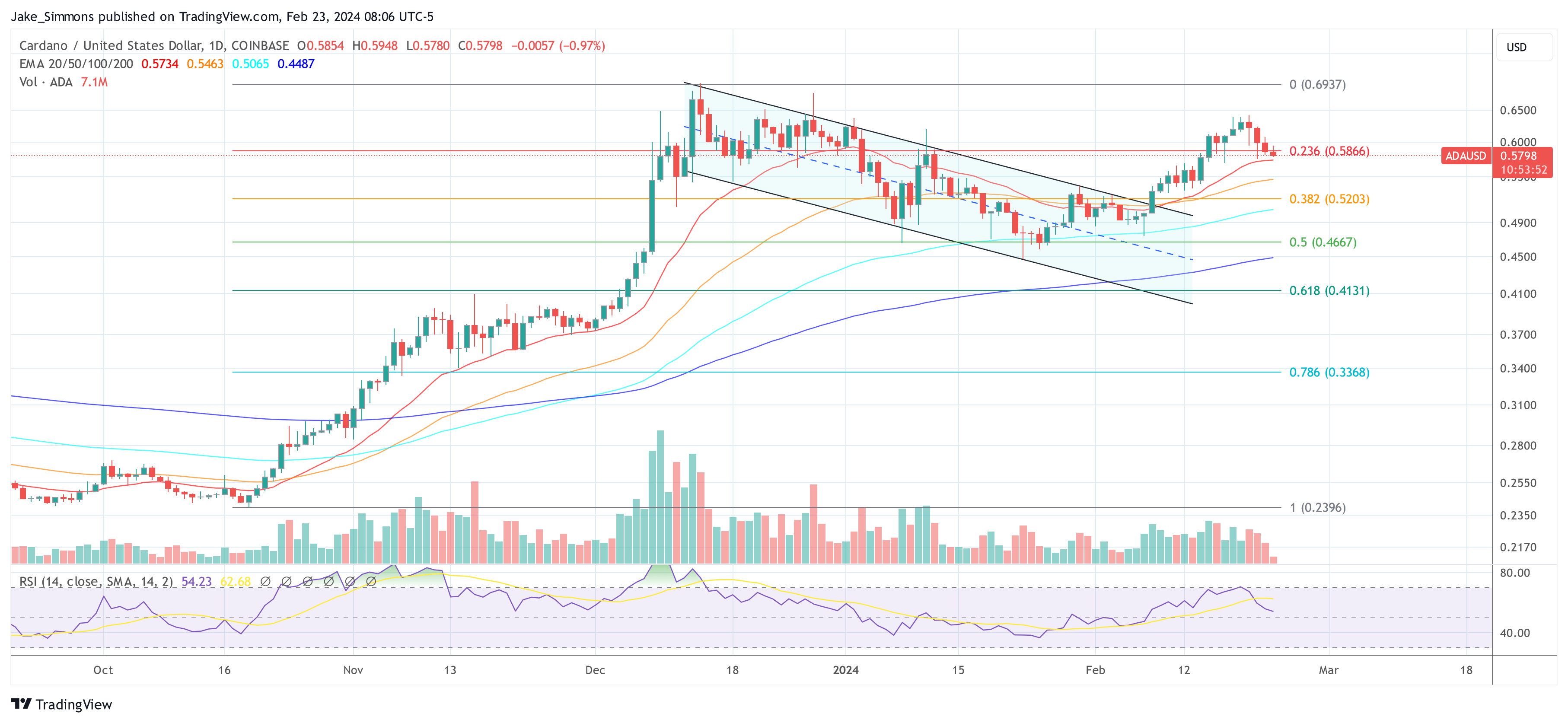

In a recent technical analysis by crypto analyst Ali Martinez, known on social media as @ali_charts, a potential sell signal has been identified on the three-day chart for Cardano (ADA) against the US dollar. This analysis, shared on X on February 23, suggests caution among ADA traders due to the appearance of a bearish signal from the TD Sequential indicator.

Martinez’s chart showcases the TD Sequential indicator presenting a ‘9’ signal, a classic sell indication that suggests the current trend may be exhausted and a reversal could be imminent. This signal is highlighted on the candlestick that has been forming over the last three days, marked by a red rectangle surrounding a green candlestick.

The ‘9’ setup, traditionally seen as a sign to take profits or to prepare for a trend change, implies that ADA’s recent upward momentum may face a setback. The analysis further notes that this is not the first instance of such a signal appearing on Cardano’s chart.

Previous occurrences of the TD Sequential ‘9’ sell signal were followed by price corrections for ADA. Traders may be particularly vigilant now, as the chart indicates that the last two signals of this nature were succeeded by downward price action. Martinez remarked:

The TD Sequential indicator shows a sell signal on the #Cardano 3-day chart. It’s important to note that the last two times this indicator signaled bearish, ADA experienced a price correction!

How Low Could Cardano (ADA) Price Retrace?

As of February 23, 13:06 UTC, the ADA/USD pair shows a complex interplay between bullish and bearish signals on the daily time frame. The chart presents a constricted pattern following a descent from a local high.

The ADA price is currently trading at $0.5790. Importantly, the price is above the 20-day Exponential Moving Average (EMA) at $0.5733, the 50-day EMA at $0.5462, the 100-day EMA at $0.5065 and notably, the 200-day EMA at $0.4487. The positioning above these EMAs can be a sign of an underlying bullish sentiment in the market.

The Fibonacci retracement levels, drawn from the peak to the trough of the recent move, highlight significant levels of potential support and resistance. The 0.236 level at $0.5866 is immediately overhead, acting as a minor resistance level. The 0.382 level at $0.5203 and the 0.5 level at $0.4667 are key support zones to watch if a bearish reversal occurs.

A break below these levels could signal a deeper retracement towards the 0.618 level at $0.4131 or even the 0.786 level at $0.3368. However, the most crucial support at the moment is the 20-day EMA which could forebode a changing trend.

Notably, the volume has been relatively consistent, with a slight decrease in trading volume accompanying the recent price consolidation. This could indicate a lack of conviction among traders. Confirming this, the Relative Strength Index (RSI) is at 54, indicating neither overbought nor oversold conditions. The RSI trend is neutral, providing no clear directional bias at the moment.

In conclusion, while there are hints of bearishness, there are still good arguments to be bullish on Cardano and not wait for a larger correction. However, if the price does not hold above several key EMAs on the daily chart, the trend change could be confirmed.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

George Soros’s Former Co-Founder Sounds Economic Alarm Saying, ‘The Next Problem Has To Be The Worst In My Lifetime’ — Waiting For Right Time To Go Short

The Quantum Fund’s historical performance is most often associated with Co-Founder George Soros. The fund achieved an average annual return of 30% from 1970-2000.

Perhaps Soros’s most famous bet came against the pound in 1992 when it netted his fund about $1 billion in one trade, considered by some to be the greatest currency trade of all time.

However, Soros didn’t start the Quantum Fund alone. Instead, he founded it alongside another now-famous investor, Jim Rogers. While Rogers left the fund in 1980 to “retire” and travel around the world on his motorcycle to search for international investment ideas, eventually turning his travel experiences into a best-selling book called “Investment Biker,” he continued to share his thoughts on the market.

Don’t Miss:

Seemingly, the best thing he can say about stocks at the moment is that it’s not the right time to short them … yet.

In a recent interview, Rogers shared that the world essentially is in an everything bubble, telling Soar Financially, “Bonds are a bubble, property in many countries is a bubble, stocks are getting ready for a bubble.”

Even with his bearish conviction, he points out that he’s “not shorting yet because often at the end there’s a blowoff and things get really crazy.”

To play out his thesis as he waits for his planned short, Rogers is happy to sit in hard assets such as gold and silver, explaining “everybody should have some silver and gold under the bed.”

Trending: Copy and paste Mark Cuban’s startup investment strategy according to his colorful portfolio.

Investors who don’t want the stress of storing the actual physical metal in their possession could consider an exchange-traded fund (ETF) such as the SPDR Gold Trust (NYSE:GLD) or the iShares Silver Trust (NYSE:SLV).

It should be noted, however, that Rogers has not been accurate with his predictions in recent years.

In 2011, he shared that there was a 100% chance of a crisis worse than in 2008. If investors heeded his advice then and never got back into a market-tracking index fund such as the SPDR S&P 500 ETF Trust (NYSE:SPY) they would have missed out on about 290% returns. Of course, these impressive returns came despite there being wars, a pandemic, flash crashes and inflation scares.

As the old expression goes, even a broken clock is right twice a day. However, to completely dismiss the advice of one of the world’s most legendary investors might not end up looking wise if Rogers is right about a serious crash being around the corner — especially if it is the worst in his lifetime, given how much he’s seen in his 81 years.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article George Soros’s Former Co-Founder Sounds Economic Alarm Saying, ‘The Next Problem Has To Be The Worst In My Lifetime’ — Waiting For Right Time To Go Short originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BEIJNG, CHINA – NOVEMBER 13: Illuminated skyscrapers stand at the central business district at sunset on November 13, 2023 in Beijing, China. (Photo by Gao Zehong/VCG via Getty Images)

Vcg | Visual China Group | Getty Images

The chief executive of the Institute of International Finance warned Tuesday that policymakers need to swiftly address record levels of global debt, describing the brewing crisis as a “huge fiscal problem.”

IIF CEO Tim Adams sounded the alarm on rising levels of debt while speaking to CNBC’s Silvia Amaro at the World Economic Forum in Davos, Switzerland.

His comments come at a time when the issue has largely been overshadowed at the WEF’s annual meeting, which runs through to Friday, with the rise of artificial intelligence and conflicts in the Middle East and Ukraine high on the forum’s agenda.

“We have a debt problem globally. We have the highest levels of debt in a nonwar period in modern history and it’s at the corporate, household, sovereign, sub-sovereign [levels],” Adams said.

“We have a huge fiscal problem everywhere, including the U.S. We’re running [a] deficit at 7% of GDP. We need sobriety and we need to focus on how we are going to get our fiscal house in order,” he added.

The global banking industry’s premier trade group said late last year that worldwide debt climbed to a record of $307.4 trillion in the third quarter of 2023, with a substantial increase in both high-income countries and emerging markets.

The IIF said it expected global debt to reach $310 trillion by the end of 2023, warning that elections in more than 50 countries and regions this year could usher in a shift toward populism that brings with it still-higher debt levels.

“I worry about geopolitics every day,” Adams said. “I think this will be a challenging year.”

Asked whether high levels of global public debt mattered at a time when major central banks are poised to cut interest rates, Adams replied: “It matters because of demographics. We have aging populations in so many parts of the world, from China to across Europe to the U.S. and Japan.”

“We need to build that capacity and deal with that huge debt overhang going forward. And this is in peacetime, so the question is how to do we do this quickly and in an intelligent fashion. But we all need to focus on the fiscal imbalances.”

‘Big Short’ investor Michael Burry rang the recession alarm, bet against the S&P 500, and scooped up bargains in 2023

-

Michael Burry issued dire warnings, took short positions, and pounced on bargains in 2023.

-

The investor predicted inflation and recession, and bet against the S&P 500 and microchip stocks.

-

Here are “The Big Short” star’s three big highlights of the year.

Between his bleak forecasts for the stock market and economy, his bets against the S&P 500 and microchip stocks, and his bargain hunting during the regional-banking crisis, Michael Burry had an eventful 2023.

The investor is best known for predicting and profiting from the mid-2000s housing bubble, after his massive bet was immortalized in the book and movie “The Big Short.” He also placed eye-catching bets against Elon Musk’s Tesla and Cathie Wood’s flagship Ark fund in 2021, and bought into GameStop long before it became a meme stock.

Here are Burry’s three highlights of 2023:

1. Doom and gloom

Burry started the year in classic style with a slew of grim predictions.

“Inflation peaked. But it is not the last peak of this cycle,” he posted on X in early January. “We are likely to see CPI lower, possibly negative in 2H 2023, and the US in recession by any definition.”

“Fed will cut and government will stimulate,” he continued. “And we will have another inflation spike. It’s not hard.”

Burry proved to be right that inflation would drop by the second half of this year; it has fallen from over 9% at its peak last summer to below 4% in recent months. However, a recession hasn’t materialized so far with US GDP growing by an annualized 5.2% in the third quarter. Inflation hasn’t resurged either, and the Federal Reserve is yet to cut interest rates after raising them to 5% to curb price growth.

The Scion Asset Management boss shared a few worrying charts over the next few weeks, including one comparing the S&P 500’s trajectory at the time to its ill-fated rally during the dot-com crash in the early 2000s.

He sent alarm bells ringing at the end of January when he posted a single word: “Sell.” Burry has been cautioning investors about the current market for a few years now; he bemoaned the “greatest speculative bubble of all time in all things” and predicted the “mother of all crashes” in 2021.

He also issued a warning in February to Bed, Bath & Beyond shareholders that the stock was headed for disaster. The homewares retailer filed for bankruptcy in April, and its shares were delisted from the Nasdaq in May.

Burry appeared to backtrack on his advice to cash out in a March post that read, “I was wrong to say sell.” However, he seemed to strike a mocking tone in a follow-up tweet: “Going back to the 1920s, there has been no BTFD generation like you. Congratulations,” he wrote, using the acronym for “buy the f****** dip.”

2. Bank woes and bargains

Burry weighed in during the regional-banking crisis in March, which saw Silicon Valley Bank, Signature Bank, and Silvergate Capital all fail as customers yanked their deposits. He compared the lenders’ mistakes to the errors made during the dot-com and housing bubbles.

“2000, 2008, 2023, it is always the same,” he posted. “People full of hubris and greed take stupid risks, and fail.”

Even so, Burry correctly predicted the chaos would end swiftly and didn’t pose a serious threat to the wider economy.

The value investor capitalized on market jitters in the first quarter, buying up shares of beaten-down banks including First Republic and PacWest. He spotted other bargains in the second quarter, when he purchased a bunch of energy, commodity, and shipping stocks including Coterra Energy and Sibanye Stillwater.

Burry boosted a few of those positions in the third quarter, including Euronav and Star Bulk Carriers. Yet he also slashed his stock portfolio from 33 holdings to 13 in the period, more than halving its total value (excluding options) from $111 million to $44 million.

3. Short stuff

Burry’s most striking moves of 2023 were on the short side. He purchased bearish put options on two exchange-traded funds that respectively tracked the S&P 500 and Nasdaq-100 in the second quarter. Those positions represented wagers with a notional value of $1.6 billion against those stock indices.

“That is a big position even for a big fund,” Gerry Fowler, UBS’ head of European equity strategy and global derivative strategy, told Business Insider at the time. Even if Burry only paid a tiny fraction of $1.6 billion for the hedges, “the exposure he is using shows a significant amount of leverage,” Fowler said.

The Scion chief made waves again with his third-quarter maneuvers. While he closed out his previous shorts, he bought puts on 100,000 shares of Blackrock’s iShares Semiconductor ETF with a notional value of $47 million. The ETF counts Nvidia, the graphics-chip stock that has tripled in value this year on the back of AI excitement, as its third-biggest holding.

Portfolio disclosures don’t show the days on which trades were made or closed out, but neither of Burry’s bets appears to have paid off. The S&P 500 and Nasdaq both rose between the start of April and the end of September, and the microchip ETF has climbed to a near-record high.

Will Burry speak up again?

Burry rarely talks to the press and hasn’t posted on X since April, meaning there’s almost no context around his moves this year. His followers will be hoping he resumes commenting on markets and the economy in the new year — not just because his posts are frequently colorful, insightful, and prophetic, but also because the current outlook for investors is deeply uncertain.

Read the original article on Business Insider

Top Wall Street bull sounds the alarm on one of the biggest risks for the stock market in 2024

-

Wall Street’s top bull highlighted two big risks that could upend the stock market in 2024.

-

Fundstrat’s Tom Lee said a hard landing in the economy and a parabolic melt-up in the stock market are risks to watch.

-

“If we have a parabolic move in December and we end up at S&P 5000 by December 31, you’ve pulled forward a lot of the gains for 2024,” Lee said.

One of Wall Street’s biggest bulls highlighted the two big risks that could derail the stock market next year.

Fundstrat’s Tom Lee, who has one of the highest S&P 500 price target for 2024 at 5,200, told CNBC on Thursday that a hard landing in the economy and frothy trading action could lead to a volatile stock market next year.

Lee said that he expects the US economy to continue to grow in 2024, with PMI’s likely to turn higher in part because of the Federal Reserve signaling that it will shift from hawkish interest rate hikes to dovish interest rate cuts in 2024.

But a hard landing in the economy could still materialize if other countries don’t rebound from their current economic slump.

“You need a global turn, so China and Europe have to emerge from this stagnation, and if [they] don’t maybe we talk about a hard landing,” Lee said.

China in particular has been suffering from economic malaise since the government eased COVID-19 restrictions. A combination of high youth unemployment, challenging demographics, and a crumbling real estate market has put pressure on the second largest economy in the world.

The second risk to Lee’s bullish view is a melt-up in the stock market between now and the end of December.

“The second [risk] is if we have a parabolic move in December and we end up at S&P 5000 by December 31, you’ve pulled forward a lot of the gains for 2024, so the first half [of 2024] could be pretty bad,” Lee said.

The S&P 500 traded at 4,717 on Friday, about 5% away from 5,000.

Since October 27, the S&P 500 has surged 14%, the Nasdaq 100 is up 17%, and the Russell 2000 is up 22%. Meanwhile, the Dow Jones Industrial Average surged to an all-time high this week, while all of the other major indexes are within spitting distance of a new record high.

Such sharp moves higher in the stock market in such a short period of time could lead to a local top that requires months of consolidation before further gains can be had, and that’s the exact worry on Lee’s mind.

Read the original article on Business Insider

In a significant blow to the decentralized finance (DeFi) sector, the Sushi DeFi protocol has fallen victim to its second exploit this year.

The protocol’s Chief Technology Officer (CTO), Matthew Lilley, has issued a stark warning to users, advising them to refrain from using any decentralized applications (dApps) until further notice.

Sushi And Zapper Frontends Compromised

The latest breach has prompted concerns about the security and integrity of the Sushi DeFi protocol and other associated dApps. According to Lilley, a widely-used web3 connector has been compromised, allowing malicious code injection that affects numerous dApps.

Specifically, dApps that use the LedgerHQ/connect-kit, a dApp that allows users to connect other dApps to their Ledger hardware wallets, are considered vulnerable. Notably, Lilley’s warning underscores the severity of the situation, emphasizing that this is not an isolated attack, but a large-scale assault targeting multiple dApps.

Further investigation by security experts has revealed a potential supply chain attack on the ledger connect kit. The attacker allegedly successfully injected a wallet-draining payload into the popular Node Package Manager (NPM), impacting several prominent dApps, including Hey and others.

Additionally, it has been discovered that the Zapper and Sushi frontends have been hijacked, exacerbating the scope of the breach.

Slowmist, a module of Ledger, further confirmed that their system was hijacked and tampered with during the supply chain attack. This compromised the integrity of the ledgerhq/connect-kit library, which is relied upon by many dApps.

As a result, users are urged to exercise caution when conducting any dApp-related operations and to scrutinize requests for wallet information that may appear unexpected.

Malicious Connect Kit Neutralized?

In an official statement, Ledger has confirmed the identification and removal of a malicious version of the Ledger Connect Kit. The company assures users that their Ledger devices and Ledger Live remain uncompromised.

The company stated that a genuine version of the Connect Kit is currently being pushed to replace the malicious file. Ledger advises users to refrain from interacting with any dApps at the moment for their safety.

The company pledges to provide updates as the situation develops, ensuring users stay informed about the ongoing efforts to address the security breach.

SUSHI’s Uptrend Threatened By Exploit Fallout

In light of recent events affecting the Sushi DeFi protocol, its native token, SUSHI, has experienced a decline of over 4% within the past hour, reaching a low of $1.590.

Before the exploit, SUSHI had been exhibiting a notable uptrend structure on its 1-day chart, marked by higher highs and higher lows. However, with the loss of its crucial support level at $1.961, there is a potential invalidation of the previously established uptrend.

The uncertainty surrounding the protocol’s native token raises the possibility of further downside in SUSHI’s price action. If a sustained downtrend continues, the next significant support level for SUSHI is located at $1.084.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Price Briefly Spikes towards $30K Following False Alarm on Spot ETF Approval Leading to High Liquidations

While experts forecast the US SEC will approve a spot Bitcoin ETF within the next six months, the BlackRock’s officials confirmed that it has not received a green light on its application.

Bitcoin (BTC) price experienced heightened volatility on Monday, which briefly pushed the mothercoin towards $30k. However, Bitcoin price had since stabilized around $28.2k on Tuesday, but notable damage had already been done to leverage traders. According to market aggregate data provided by Coinglass, more than $111 million was liquidated from the Bitcoin market in the past 24 hours. Notably, the heightened Bitcoin’s volatility was caused by a piece of fake news perpetrated by Cointelegraph that the United States Securities and Exchanges Commission (SEC) had approved the BlackRock Inc’s (NYSE: BLK) iShares spot Bitcoin Exchange Traded Fund (ETF).

The fake news was quickly debunked due to the lack of evidence to support the ointelegraph claims. Additionally, BlackRock confirmed that its spot Bitcoin ETF application is still under review by the SEC. Nonetheless, crypto traders continued to ride the wave, which has seen Bitcoin’s daily average traded volume spike more than double in the past 24 hours to about $28 billion.

Bitcoin Gets a Slight Taste of Spot ETF Approval

As Bitcoin price struggled to rally beyond $28k, the claims of a spot ETF approval saw FOMO traders long the instrument within short periods. According to the latest market data provided through TradingView, Bitcoin’s dominance gained about 1.4 percent in the past five days over the altcoin market to about 51.66 percent. Notably, crypto traders are eagerly awaiting a spot ETF approval in the United States as it will open up floodgates of new money from institutional investors seeking to hedge against high fiat inflation.

The US SEC is currently reviewing a dozen of spot ETF applications and market experts believe the agency could approve all of them at once to avoid giving any fund manager a head start. Moreover, the SEC did not appeal the Grayscale Investments’ ruling which significantly raised the chances of a spot ETF approval.

“Given the pressure the SEC has faced from the courts and the US House Financial Services Committee, it is a question of when, not if, these approvals get the green light. When these approvals happen, it will open up new possibilities for a number of sovereign, pension funds, IRAs, and 401k as well as other institutions who, before this point, may not have had access to digital asset investment opportunities,” said Philippe Bekhazi, the Chief Executive Officer at XBTO Global.

Nonetheless, a former computer intelligence consultant who is popularly known for leaking classified documents belonging to the United States National Security Agency (NSA), Edward Snowden, recently noted during the Bitcoin Amsterdam 2033 conference that a spot ETF approval will lead to more regulatory scrutiny to a path on economic freedom.

next

Bitcoin News, Cryptocurrency News, Funds & ETFs, Market News, News

Let’s talk crypto, Metaverse, NFTs, CeDeFi, and Stocks, and focus on multi-chain as the future of blockchain technology.

Let us all WIN!

You have successfully joined our subscriber list.

Subscribe to our telegram channel.

Join