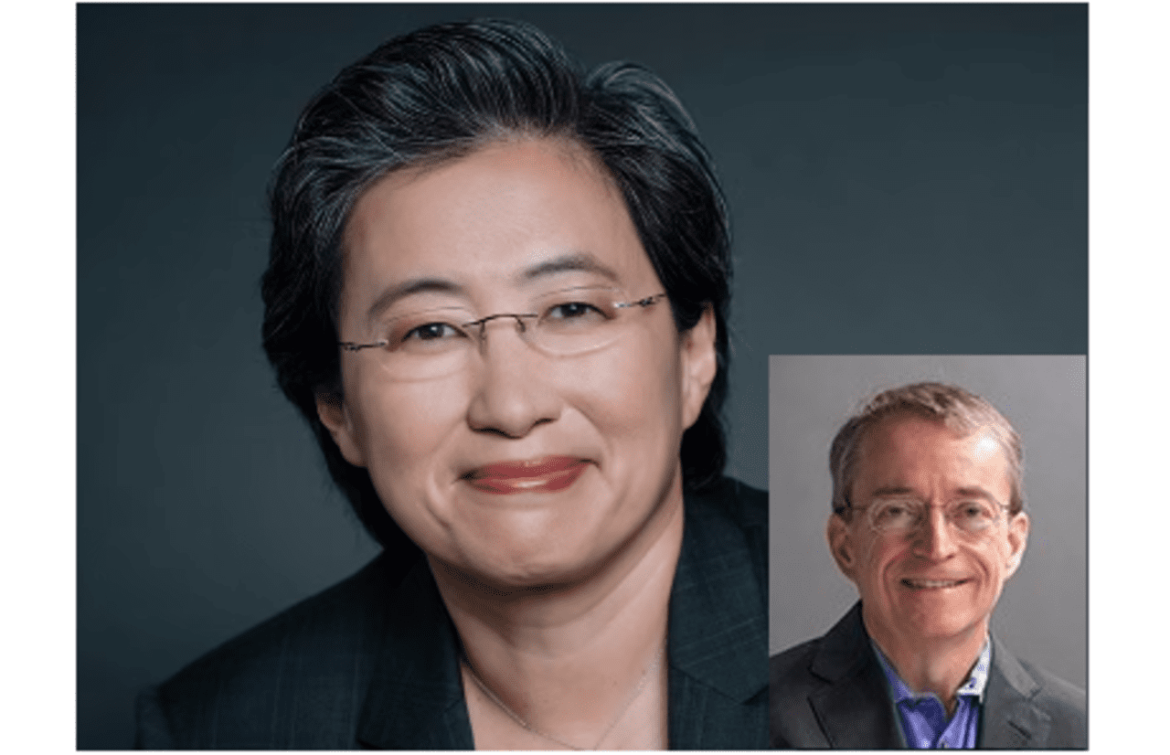

Intel Chief Executive Pat Gelsinger got a big bump in compensation in 2023, but it still amounted to just over half what Lisa Su made as CEO of rival Advanced Micro Devices.

Source link

AMD

China blocks use of Intel and AMD chips in government computers, FT reports

(Reuters) -China has introduced guidelines to phase out U.S. microprocessors from Intel and AMD from government personal computers and servers, the Financial Times reported on Sunday.

The procurement guidance also seeks to sideline Microsoft’s Windows operating system and foreign-made database software in favour of domestic options, the report said.

Government agencies above the township level have been told to include criteria requiring “safe and reliable” processors and operating systems when making purchases, the newspaper said.

China’s industry ministry in late December issued a statement with three separate lists of CPUs, operating systems and centralised database deemed “safe and reliable” for three years after the publication date, all from Chinese companies, Reuters checks showed.

The State Council Information Office, which handles media queries for the council, China’s cabinet, did not immediately respond to a faxed request for comment.

Intel and AMD did not immediately respond to Reuters request for comment.

The U.S. has been aiming to boost domestic semiconductor output and reduce reliance on China and Taiwan with the Biden administration’s 2022 CHIPS and Science Act.

It is designed to bolster U.S. semiconductors and contains financial aid for domestic production with subsidies for production of advanced chips.

(Reporting by Akanksha Khushi in Bengaluru; Editing by Christian Schmollinger, William Mallard and Lincoln Feast.)

Super Micro Computer (NASDAQ: SMCI), more commonly known as Supermicro, has seen its stock skyrocket by 2,220% over the past three years. That stunning rally was fueled by the rapid expansion of the artificial intelligence (AI) market, which drove data center operators to purchase more of its high-performance AI servers.

A lot of Supermicro’s growth can be directly attributed to Nvidia (NASDAQ: NVDA), which provides the high-end GPUs that process complex machine learning and AI tasks. Nvidia worked closely with Supermicro to design a new line of servers and workstations that fully supported its H100 GPUs, and that tight relationship enabled Supermicro to carve out a high-growth niche with its AI servers in the heavily commoditized market for pre-built servers.

Yet Supermicro’s dependence on Nvidia is a double-edged sword. It struggled to secure a steady supply of Nvidia’s GPUs in early 2023, and its two largest competitors — Hewlett Packard Enterprise and Dell Technologies — have also been working with Nvidia to design new AI servers. In its latest 10-K filing, Supermicro admitted that it doesn’t hold any long-term agreements with Nvidia or its other suppliers that actually lock them in as exclusive partners.

That’s why AMD‘s (NASDAQ: AMD) recent expansion into the data center GPU market might be great news for Supermicro.

Why AMD could catch up to Nvidia in the AI race

AMD only controlled about 17% of the discrete GPU market last year, according to Jon Peddie Research, putting it in a distant second place behind Nvidia with its 80% share. AMD’s share mainly consists of gaming GPUs for PCs, but it has been expanding its reach into the data center market with its Instinct GPUs for processing AI tasks.

AMD rolled out its first batch of Instinct GPUs (the MI6, MI8, and MI25) in 2017. It launched its newest MI300 Instinct GPUs, which are manufactured using TSMC‘s 5nm and 6nm process nodes, in late 2023. By several industry benchmarks, AMD’s high-end MI300X actually beat Nvidia’s H100 in terms of raw processing power and memory usage.

That’s a bright red flag for Nvidia, since the H100, which faces ongoing supply chain constraints, still costs about four times as much as the MI300. Nvidia claims the H100 still beats the MI300 when it’s running optimized software, but that slight difference probably won’t justify its premium price tag for cost-conscious data center operators.

That’s why it wasn’t surprising when AMD’s CEO Lisa Su recently said the MI300 was on track to be the “fastest revenue ramp of any product” in the company’s history. Su also estimates that AMD’s Epyc CPUs have claimed 25% of the server CPU market at the expense of Intel‘s (NASDAQ: INTC) market-leading Xeons. Between the growth of those two businesses and the expansion of its programmable chip business (from Xilinx), AMD has more data center bundling options than Nvidia.

Cozying up to AMD

Supermicro already works closely with AMD to design servers for its Epyc CPUs and Instinct GPUs. In November, Supermicro CEO Charles Liang predicted that AMD’s MI300 GPUs, Nvidia’s latest GPUs, and Intel’s Gaudi AI accelerator chips would all “gain broad adoption and expand our share in the accelerated compute market.” In January, Liang predicted that ongoing diversification would “more than double the size” of the company’s AI portfolio.

If Supermicro sells more AMD-powered AI servers, it could reduce its long-term dependence on Nvidia and insulate itself from any future supply chain constraints. Competitive pressure from AMD could also drive Nvidia to lower its GPU prices, which would boost Supermicro’s gross margins by reducing its component costs.

A well-balanced play on the AI market

Supermicro already generates about half of its revenue from its AI servers, and Bank of America believes it could expand its share of the dedicated AI server market from 10% today to 17% over the next three years.

That’s why analysts expect its revenue to grow at a compound annual rate of 42% from its fiscal 2023 (which ended in June) through its fiscal 2026. That’s a stunning growth rate for a stock that trades at just 3 times this year’s sales.

That low valuation already makes Supermicro an attractive long-term play on the AI market, but its gradual diversification away from Nvidia with AMD-powered servers might make it a more balanced play on the AI market than either chipmaker.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Leo Sun has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Bank of America, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and Super Micro Computer and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Forget Nvidia: AMD Could Be Super Micro Computer’s New Best Friend was originally published by The Motley Fool

Semiconductor stocks outperformed the broader market by a wide margin in 2023, which is evident from the 66% gain clocked by the PHLX Semiconductor Sector index as compared to the 24% gain of the S&P 500 index as of Dec. 27.

Booming demand for artificial intelligence (AI) chips played a key role in driving the impressive surge in semiconductor stocks this year. Not surprisingly, prominent semiconductor companies such as Nvidia (NVDA) and Advanced Micro Devices (AMD -0.91%) have delivered healthy gains to shareholders in 2023.

The good part is that these semiconductor giants’ stocks could continue soaring in 2024 thanks to the emergence of a new catalyst.

The PC market is set to rebound in 2024

Sales of personal computers (PCs) have been declining every quarter since the beginning of 2022. That market experienced a sharp surge in demand in 2020 and 2021 thanks to the coronavirus pandemic, which led many consumers to buy new PCs as they shifted to doing more learning, working, and playing at home. However, that demand disappeared in 2022 and the market is estimated to have declined further in 2023.

The good news: 2024 may be the year when PC sales rise again. Market research firm IDC is predicting a 3.4% increase in PC shipments in the new year, while Canalys is forecasting a jump of 8%.

Both firms assert that the growth will be fueled by the advent of AI-enabled PCs, an aging installed base of existing computers, and the looming necessity for users to upgrade to Windows 11 as Microsoft is set to end support for Windows 10 in October 2025. What’s more, IDC is expecting the PC market to clock a compound annual growth rate of 3.1% through 2027.

A turnaround in PC sales would be great news for Nvidia and AMD as both companies supply chips for PCs and rely on this space for significant chunks of their top lines.

Nvidia and AMD would benefit

People install Nvidia’s graphics cards in PCs to power graphics-intensive tasks such as game-playing, 3D rendering, and video editing. Nvidia has a market share of more than 80% in discrete graphics cards and it’s already witnessing a nice recovery in sales of its PC graphics cards as manufacturers restock their inventories in anticipation of a recovery in demand.

In its fiscal 2024 second quarter, which ended July 30, Nvidia’s gaming revenue increased 22% year over year to $2.5 billion. This was followed by a year-over-year increase of 81% in the following quarter. Gaming accounted for nearly 16% of Nvidia’s revenue in the most recent quarter and the gaming business’s impressive momentum of late is likely to complement the AI-fueled growth of its data center business and lead to impressive growth in 2024.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts.

What’s more, Nvidia management said during the November conference call with analysts that “generative AI is quickly emerging as the new killer app for high-performance PCs.” The chipmaker is looking to target this market with a new platform that’s going to significantly increase the speed of AI inference workloads on PCs, which could lead to a jump in the adoption of its graphics cards.

AMD has also witnessed a sharp turnaround in its PC-focused business, which includes central processing units (CPUs) used in desktops, laptops, and workstations. The chipmaker’s revenue from this segment was up 42% year over year to $1.5 billion in the third quarter, and accounted for 26% of its top line.

AMD management said in an October conference call with analysts that sales of its Ryzen AI PC processors “grew significantly in the quarter as inventory levels in the PC market normalized and demand began returning to seasonal patterns.” CEO Lisa Su also added that AMD has launched more than 50 new notebook designs powered by the Ryzen AI processors, which are equipped with an on-chip AI accelerator to tackle AI workloads.

Even more exciting, AMD says that it is “working closely with Microsoft on the next generation of Windows that will take advantage of our on-chip AI Engine to enable the biggest advances in the Windows user experience in more than 20 years.” AMD seems set to ride the wave of recovery in PC sales, especially considering that it has been grabbing a bigger share of this market.

Analysts are expecting AMD’s revenue to increase 17% next year to $24 billion, but the company’s growing footprint in the AI data center chip space and a recovery in the PC market could help it deliver a stronger revenue jump. This, in turn, could send shares of AMD higher, which is why investors may want to load up on this semiconductor stock right away.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

Advanced Micro Devices

Advanced Micro Devices

AMD

$3.35

2.81%

3%

IBD Stock Analysis

- Stock trying to break out from tiny handle

Composite Rating

![]()

Industry Group Ranking

![]()

Emerging Pattern

![]()

Cup with Handle

* Not real-time data. All data shown was captured at

10:59AM EST on

11/22/2023.

Advanced Micro Devices (AMD) is the IBD Stock of the Day for Wednesday, as AMD stock is attempting a breakout from a small handle. AMD shares have gained more than 90% this year as the chipmaker positions itself in the growing artificial intelligence market.

X

The Santa Clara, Calif.-based AMD competes with Intel (INTC) in making central processing units, or CPUs, for personal computers and servers. But the firm is also a challenger to Nvidia (NVDA) in the market for graphics processing units, or GPUs, for PCs, gaming consoles and data centers.

AMD is targeting the white-hot market for AI chips sparked by the rapid expansion of generative AI applications, an arena dominated by Nvidia. An upcoming event will officially launch new AI chips that AMD detailed earlier this year.

On the stock market today, AMD stock rose 2.8% to close at 122.51.

is up 3.5% at 123.29 in recent action. Shares have gained more than 20% since the firm’s Oct. 31 earnings report, forming a cup-with-handle base with a 122.11 buy point.

AMD Stock: Sales, Earnings Top Estimates

In its recent Q3 report, AMD said it earned an adjusted 70 cents per share on sales of $5.8 billion in the September quarter. Analysts polled by FactSet had expected AMD earnings of 68 cents a share on sales of $5.7 billion. Sales and earnings both rose 4% year over year.

The third-quarter report broke a streak of three quarters with year over year earnings declines for AMD.

Meanwhile, AMD’s guided for $6.1 billion in sales for the current quarter, short of analysts expectations of $6.39 billion. But the disappointment was tempered by AMD’s prediction of more than $2 billion in 2024 sales for its MI300 AI accelerators.

Unveiled in June, the MI300 accelerator is designed to compete against the advanced H100 chips sold by generative artificial intelligence market leader Nvidia. The product will officially launch Dec. 6.

“In the fourth quarter, we expect to see strong growth in data center and continued momentum in client, partially offset by lower sales in the gaming segment and additional softening of demand in the embedded markets,” Chief Financial Officer Jean Hu said in the Oct. 31 news release.

AI Push

The 2024 sales projection “supports the view that AMD is well-positioned to participate in the large and growing Gen AI compute market,” wrote Goldman Sachs analyst Toshiya Hari in a Nov. 1 client note.

Meanwhile, NVDA’s booming business selling chips for generative AI has powered its stock to 230% gains this year, the best performance in the S&P 500. On Tuesday, Nvidia reported earnings that easily topped Wall Street’s lofty expectations. But NVDA stock was down about 2% in recent action.

A potential catalyst for AMD stock is coming up early next month. AMD is hosting an event on Dec. 6 called “Advancing AI” to officially launch its MI300 accelerators. The event will also “highlight the company’s growing momentum with AI hardware and software partners,” AMD said in a news release.

AMD Stock: Technical Ratings

AMD ranks third among 37 stocks in IBD’s fabless semiconductor industry group, according to IBD Stock Checkup. NVDA is the top stock in the group.

Further, AMD stock has an IBD Relative Strength Rating of 94 out of 99. The Relative Strength Rating shows how a stock’s price performance stacks up against all other stocks over the last 52 weeks. The best growth stocks typically have RS Ratings of at least 80.

AMD stock carries an IBD Composite Rating of 91 out of 99. IBD’s Composite Rating combines five separate proprietary ratings into one rating. The best growth stocks have a Composite Rating of 90 or better.

Further, AMD stock is on the IBD Tech Leaders list.

YOU MAY ALSO LIKE:

See Stocks On The List Of Leaders Near A Buy Point

Find Winning Stocks With MarketSmith Pattern Recognition & Custom Screens

Opinion: How Microsoft’s new chip for AI could disrupt Nvidia, AMD and Intel

Microsoft earlier this week took the wraps off one of the more important reveals in the chip market in a long time. Microsoft MSFT now has both a custom-designed AI processing chip and a custom Arm-based CPU to add its growing stable of products to help it vertically integrate its services and solutions.

The star of the show is the new Azure Maia 100 AI accelerator chip. This chip is built for both training and inference (creating the models and then utilizing them for work) and has been collaborated on with OpenAI, the AI…

AMD hopes to generate about $400 million in sales from its graphics processing units for AI workloads in the fourth quarter2023, which will result in a rise to $2 billion in fiscal 2024.

American semiconductor company Advanced Micro Devices Inc (NASDAQ: AMD) has reported its financial results for Q3 of 2023. The company showed strong performance, beating analysts’ expectations. However, for Q4 2023, the forecast is not that bright, as AMD is expecting its sales to slow down.

AMD Q3 2023: Highlights

For the third quarter, AMD generated a revenue of $5.8 billion, while the forecast was $5.7 billion, and adjusted earnings per share of $0.70, versus 68 cents expected. Further, AMD reported a gross margin of 47%, operating income of $224 million, net income of $299 million, and diluted earnings per share of $0.18.

The revenue for the quarter has grown by 4% year over year, the growth has been driven by record server CPU revenue and strong Ryzen 7000 series PC processor sales. When releasing Ryzen, the company was responding to a strong customer demand for this processor, and it paid off. Based on the demand, the company expanded its AMD Ryzen processor lineup, delivering more performance and capabilities for enthusiasts, gamers, and creators.

AMD CEO Dr Lisa Su commented:

“We delivered strong revenue and earnings growth driven by demand for our Ryzen 7000 series PC processors and record server processor sales. Our data centre business is on a significant growth trajectory based on the strength of our EPYC CPU portfolio and the ramp of Instinct MI300 accelerator shipments to support multiple deployments with hyper-scale, enterprise and AI customers.”

Speaking of the AMD units separately, the Data Center division generated $1.6 billion in revenue, Client segment revenue totaled $1.5 billion – up 42% year-over-year driven due to higher Ryzen mobile processor sales, Gaming unit revenue was $1.5 billion, and Embedded segment delivered $1.2 billion.

During the AMD earnings call, Dr Lisa Su highlighted AI acquisition deals closed by the company in the third quarter and mentioned improvements in AMD’s AI software suite. In particular, AMD completed the acquisitions of an open-source AI software startup Nod.ai, and an AI software leader Mipsology. Besides, the company launched a list of new products including the AMD Alveo™ UL3524 accelerator card for AI-enabled trading strategies, the Radeon RX 7800 XT and Radeon RX 7700 XT graphics cards for higher performance and better user experience, and more.

Q4 Guidance

Despite great performance in the third quarter, AMD is very moderate about Q4 results. The company’s revenue forecast for the fourth quarter of 2023 is approximately $6.1 billion, which represents year-over-year growth of approximately 9% and sequential growth of approximately 5%. Non-GAAP gross margin is expected to be approximately 51.5%. Meanwhile, LSEG analysts are expecting a revenue of $6.37 billion for the chip-maker.

AMD CEO also hopes to generate about $400 million in sales from its graphics processing units for AI workloads in the fourth quarter alone, which will result in a rise to $2 billion in fiscal 2024.

Dr Lisa Su said:

“The way to think about it is, in the fourth quarter, we said revenue would be approximately $400 million, and that’s mostly HPC. As we go into the first quarter, we actually expect revenue to be approximately similar in that $400 million range, and that will be mostly AI, so with a very small piece being HPC.”

Following the earnings report, AMD closed the session 2.41% up yesterday, at $98.50. AMD’s market cap totals $155.4 billion, years-to-date, AMD shares are 52.08% up.

next

Business News, Market News, News, Stocks, Technology News

Darya is a crypto enthusiast who strongly believes in the future of blockchain. Being a hospitality professional, she is interested in finding the ways blockchain can change different industries and bring our life to a different level.

You have successfully joined our subscriber list.

Apple Headlines Earnings Calendar With Chip Titan AMD, Health Giant Amgen

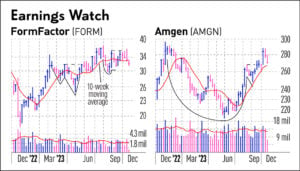

Apple (AAPL) headlines earnings next week, along with several chip companies. Fellow Dow Jones Industrial Average component Amgen (AMGN) is also a notable name on the earnings calendar with results due Tuesday.

X

Chip companies Advanced Micro Devices (AMD), Axcelis Technologies (ACLS), FormFactor (FORM) and Microchip Technology (MCHP) dot next week’s earnings calendar as well.

AMD stock is below its 50-and 200-day lines but continues to hold a Relative Strength Rating of 92. The stock has come off the year’s high of 132.83, but still has an impressive 47% gain year to date. The maker of graphic processors, visualization technologies and advanced AI-capable chips coveted by data centers and cloud platform providers ranks fourth in the fabless semiconductor group.

AMD reports its third-quarter results Tuesday after market close. The company gave sales guidance of $5.7 billion for the third quarter, in line with FactSet analysts’ target.

The stock market remains in correction. A strong report from Dow giant Microsoft (MSFT) has not been enough to offset warning signs from Meta (META) and Google parent Alphabet (GOOGL) as Treasury yields hover near multiyear highs.

Apple Stock Ahead Of Earnings

Amid the market weakness, Apple faces tepid sales from iPhone 15 handsets, which went on sale Sept. 12 as it headed toward fiscal Q4 earnings. But a product launch Monday could skew things in the stock’s favor ahead of earnings. Analysts expect a new iMac desktop computer featuring the M3 processor chip. The Cupertino, Calif., behemoth also raised prices for some of its subscription-based services recently, such as Apple TV and Apple News.

The iPhone maker has seen service revenue hit all-time highs for two quarters in a row after it crossed an installed base of 2 billion active users in its fiscal first quarter, which ended last December. In its third quarter, service revenue surged as paid subscriptions crossed 1 billion.

Apple stock has been turned away from its 50-day moving average twice since September and is now breaking the 200-day line, according to IBD MarketSmith chart analysis. The company is set to report its results on Thursday after the close.

Analysts polled by FactSet expect sales to decline slightly from the prior year to $89.3 billion, but they see earnings per share picking up 8% to $1.39, accelerating from a 5% increase in the June-ended quarter.

Analysts polled by FactSet expect sales to decline slightly from the prior year to $89.3 billion, but they see earnings per share picking up 8% to $1.39, accelerating from a 5% increase in the June-ended quarter.

Dow Jones health care component Amgen reports on Tuesday before the open.

FactSet analysts see sales of $6.9 billion, up 4%, with earnings per share of $4.68, nearly flat from a year ago. Amgen stock has been pulling back but fell below a cup-with-handle entry at 268.24, and the 50-day line, Friday. The Dow Jones leader has a portfolio and pipeline of cancer treatments.

Computer peripherals and hardware provider Super Micro Computer (SMCI) is also up next week on Wednesday with microcontroller device maker Microchip Technology reporting Thursday.

Options Trading Strategy

A basic options trading strategy around earnings — using call options — allows you to buy a stock at a predetermined price without taking a lot of risk. Here’s how the options trading strategy works and what a call option trade recently looked like for Amgen, a noteworthy stock in the current earnings calendar.

First, identify top-rated stocks with a relatively good chart. With the market in correction, those are not that easy to find. But some might be setting up, showing signs of forming early-stage bases. Others already might have broken out and may be getting support at their 10-week lines after a strong shakeout.

And a few might be trading tightly near highs and refusing to give up much ground. That would be an encouraging sign of limited overhead supply.

A call option is a bullish bet on a stock. Put options are bearish bets. One call option contract gives the holder the right to buy 100 shares of a stock at a specified price, known as the strike price and expires on a particular date in the future.

Once you’ve identified an earnings setup for a call option, check strike prices with your online trading platform, or at cboe.com. Make sure the option is liquid, with a relatively tight spread between the bid and ask.

Look for a strike price just above the underlying stock price — that’s out of the money — and check the premium. Ideally, the premium should not exceed 4% of the underlying stock price at the time. In some cases, an in-the-money or at-the-money strike price is OK as long as the premium isn’t too expensive.

See Which Stocks Are In The Leaderboard Model Portfolio

Choose an expiration date that fits your risk objective. But keep in mind that time is money in the options market. Near-term expiration dates will have cheaper premiums than those further out. Buying time in the options market comes at a higher cost.

Amgen Call Option

A call option for Amgen with a strike price of 262.50 and a Nov. 10 expiration date cost $6.45 per contract Friday. Based on the underlying price of the stock of 262.21, the premium was 2.5% of the stock price.

One contract gave the holder the right to buy 100 shares of AMGN stock at 262.50 per share. The most that investors could lose was $645 — the amount paid for the 100-share contract.

Keep in mind this is not a trade for a small portfolio. If the option is exercised, buying 100 shares of AMGN would cost $26,250.

Another tradable option in the chip sector might be FormFactor (FORM), which reports on Wednesday after the close. FormFactor provides semiconductor testing and measurement tools.

An out-of-the-money call option with a strike price of 35 and Nov. 17 expiration cost $1.03 Friday, which is 3.1% of the underlying stock price when FORM was trading at 32.76.

Bear in mind that this is not as liquid a name as Amgen. To break even, FORM stock would have to climb to 36.03 (strike price of 35 plus $1.03 premium per contract).

Please follow VRamakrishnan on X/Twitter for more news on the stock market today.

YOU MAY ALSO LIKE:

Top Growth Stocks To Buy And Watch

Learn How To Time The Market With IBD’s ETF Market Strategy

Find The Best Long-Term Investments With IBD Long-Term Leaders

MarketSmith: Research, Charts, Data And Coaching All In One Place

Here’s the Average Social Security Benefit for Retirees Aged 62 to 70

2 Stock-Split Artificial Intelligence (AI) Stocks to Buy Hand-Over Fist in October

1 Growth Stock Down 13% to Buy Right Now

A Stock Market Rally Is Coming: 2 Magnificent Growth Stocks to Buy Before They Soar 51% and 62%, According to Wall Street

The longstanding partnership between Microsoft and AMD has been a strategic alliance that has shaped the tech industry in various ways.

A recent report has revealed that shares of Advanced Micro Devices Inc (NASDAQ: AMD) rose nearly 5% on Thursday following comments from Kevin Scott, the Chief Technology Officer of Microsoft Corp (NASDAQ: MSFT) about the chipmaker’s efforts to strengthen its position in AI, an arena long dominated by Nvidia Corp (NASDAQ: NVDA).

With AMD’s stock up approximately 60% this year, investors are keeping a close eye on this tech powerhouse.

Microsoft’s Endorsement

“They’re making increasingly compelling GPU offerings that I think are going to become more and more important to the marketplace in the coming years,” Scott says while speaking at the Code Conference in Dana Point, California, on Wednesday.

This endorsement from a tech giant like Microsoft lends credibility to AMD’s AI initiatives and suggests that the company may be on the cusp of a breakthrough. Notably, AMD has been diligently working to bolster its presence in the AI sector.

In June, the company announced its intention to begin sampling the MI300X chip during the third quarter of the year. Unlike traditional GPUs, these chips were meticulously designed with AI models in mind, reflecting AMD’s commitment to delivering tailored solutions for the AI market.

Meanwhile, Nvidia has long been synonymous with AI prowess. The company’s GPUs have been instrumental in powering AI workloads, driving Nvidia’s meteoric rise. So far this year, Nvidia’s shares have nearly tripled, an impressive feat that further cements its position as an industry leader.

The surge in demand for AI applications, particularly those reliant on deep learning models, has created a need for exceptionally powerful GPUs. Nvidia’s GPUs have risen to meet this challenge, and the company is confidently forecasting a staggering 170% year-over-year revenue growth in the current quarter, highlighting the immense demand for its products.

The Strong Microsoft-AMD Partnership

The longstanding partnership between Microsoft and AMD has been a strategic alliance that has shaped the tech industry in various ways. For years, Microsoft has relied on AMD’s cutting-edge technology to power various aspects of its business.

This partnership extends beyond conventional computing devices to encompass cloud services and gaming consoles. Notably, Microsoft has offered AMD GPUs to its Azure cloud customers, recognizing the value of AMD’s graphics processing units in handling diverse workloads, including AI and machine learning tasks.

Moreover, AMD chips have found their way into Microsoft’s computers and Xbox gaming consoles, further cementing this collaborative relationship. In May, AMD made headlines by announcing that Microsoft had begun offering a cloud networking service, drawing upon AMD’s Pensando products.

This development underscores AMD’s increasing relevance in the data center and cloud computing space, where the demand for high-performance chips is insatiable. Microsoft’s utilization of AMD’s Pensando products demonstrates its confidence in AMD’s capabilities to deliver innovative solutions for its cloud offerings.

next

Business News, Market News, News, Stocks, Wall Street

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.