As of April 15, 2024, bitcoin presents a mixed landscape of consolidation and subtle recovery hints, reflecting a crucial moment for potential bullish or bearish trends. Bitcoin Despite the current market indecisiveness indicated by the 1-hour chart, the 4-hour and daily charts suggest underlying movements that could influence future price actions. The 1-hour chart displays […]

As of April 15, 2024, bitcoin presents a mixed landscape of consolidation and subtle recovery hints, reflecting a crucial moment for potential bullish or bearish trends. Bitcoin Despite the current market indecisiveness indicated by the 1-hour chart, the 4-hour and daily charts suggest underlying movements that could influence future price actions. The 1-hour chart displays […]

Source link

analysis

Bitcoin Technical Analysis: BTC Eyes Previous Zeniths With Renewed Vigor

On April 8, 2024, bitcoin reached an impressive 24-hour peak of $72,573, marking a significant uptrend. With a 24-hour trading volume of $29.64 billion and a market capitalization soaring to $1.41 trillion, the cryptocurrency showcases strong market growth. Bitcoin Analyzing the daily chart, bitcoin (BTC) displays a bullish pattern with consistently higher lows and higher […]

On April 8, 2024, bitcoin reached an impressive 24-hour peak of $72,573, marking a significant uptrend. With a 24-hour trading volume of $29.64 billion and a market capitalization soaring to $1.41 trillion, the cryptocurrency showcases strong market growth. Bitcoin Analyzing the daily chart, bitcoin (BTC) displays a bullish pattern with consistently higher lows and higher […]

Source link

Bitcoin Technical Analysis: Price Consolidates Following Bearish Downturn

On Wednesday, bitcoin’s trade volume and overall value provided insights into its current technical situation. With a daily trading volume reaching $45.30 billion and a total market value of $1.29 trillion, the cryptocurrency’s liquidity and market breadth still stands strong. However, recent downturns have left traders wary. Currently, bitcoin has declined by 6% this week […]

On Wednesday, bitcoin’s trade volume and overall value provided insights into its current technical situation. With a daily trading volume reaching $45.30 billion and a total market value of $1.29 trillion, the cryptocurrency’s liquidity and market breadth still stands strong. However, recent downturns have left traders wary. Currently, bitcoin has declined by 6% this week […]

Source link

Bitcoin Technical Analysis: BTC Consolidation Points to Potential Shifts Ahead

On March 29, 2024, with a trading price of $70,075, and oscillating within a 24-hour range of $68,362 to $71,754, bitcoin’s current market behavior reveals significant consolidation and neutrality. Bitcoin Bitcoin’s 1-hour chart reveals recent volatility, with a significant bounce from a low of approximately $68,362, suggesting a strong support level. Conversely, the resistance near […]

On March 29, 2024, with a trading price of $70,075, and oscillating within a 24-hour range of $68,362 to $71,754, bitcoin’s current market behavior reveals significant consolidation and neutrality. Bitcoin Bitcoin’s 1-hour chart reveals recent volatility, with a significant bounce from a low of approximately $68,362, suggesting a strong support level. Conversely, the resistance near […]

Source link

Shiba Inu (SHIB), a popular memecoin, has experienced a notable decline. It dropped nearly 20% over the past week and continued a 13% fall in just the past 24 hours. This downturn occurs amid a broader bearish trend across the crypto landscape.

However, detailed on-chain analysis has uncovered specific factors contributing to SHIB’s sharp decline.

Whale Movements And Market Influence

Insights from IntoTheBlock have shed light on large transaction activities, often indicative of “whale” movements, which have seen a general decrease since March 5, further compounding the downward pressure on SHIB’s price.

The role of speculative trading in influencing SHIB’s market performance has also become increasingly apparent. Data pointing to the holding time of transacted coins suggests a shift towards short-term trading strategies among investors, possibly in pursuit of quick profits.

Such behaviors are underscored by a significant reduction in the average holding period of coins, from four weeks to just two months as of mid-March, accompanied by a transaction volume of 2.12 trillion SHIB.

This trend towards speculative trading has been a key driver behind the memecoin’s recent price movements, reflecting the broader dynamics within the cryptocurrency market.

The decrease in large transactions involving Shiba Inu signifies dwindling confidence among whales, whose actions can profoundly impact market direction.

The observed decline in whale activities aligns with a broader caution in the crypto market, where investors reevaluate their positions amid shifting market conditions.

Shiba Inu Bright Horizon

Despite the current downturn, Shiba Inu remains a focal point within the altcoin sector, buoyed by optimistic predictions from crypto analysts.

Michaël van de Poppe, a well-regarded figure in the crypto analysis community, has recently posited that altcoins, are set for significant rallies, potentially positioning Shiba Inu for a notable rebound as the market stabilizes.

There’s still around 40-60% market capitalization to gain for the #Altcoins.

That’s going to be a fun ride for the altcoins in the coming period. pic.twitter.com/qT0FRU4qpY

— Michaël van de Poppe (@CryptoMichNL) March 7, 2024

This sentiment is echoed by Shiba Inu’s co-founder, Shytoshi Kusama, who has expressed confidence in SHIB’s ability to lead in the next bull market, citing the project’s comprehensive plans, community support, and execution as key differentiators.

No. The community with the strongest tech, vision, plan, supporters, partners, and execution will. #SHIB But if you wanted some impressions why not say hi?

— Shytoshi Kusama™ (@ShytoshiKusama) March 6, 2024

Regardless, SHIB has continued its bearish trajectory, with a market price now sitting at $0.00002916 at the time of writing.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Fool.com contributor Parkev Tatevosian evaluates SkyWater Technologies (SKYT -4.69%) stock and lets you know whether investors should buy.

*Stock prices used were the afternoon prices of March 10, 2024. The video was published on March 12, 2024.

Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

Bitcoin Technical Analysis: BTC Bulls Regain Strength After Recent Pullback

In the last day, bitcoin exhibited a dynamic display, marked by significant fluctuations and upward movements across different periods. Upon hitting a peak at $69,210 per unit on Mar. 5, the cryptocurrency dipped below the $60,000 threshold, only to climb again on Wednesday, positioning itself in the $66,500 to $67,500 bracket. Bitcoin Over the course […]

In the last day, bitcoin exhibited a dynamic display, marked by significant fluctuations and upward movements across different periods. Upon hitting a peak at $69,210 per unit on Mar. 5, the cryptocurrency dipped below the $60,000 threshold, only to climb again on Wednesday, positioning itself in the $66,500 to $67,500 bracket. Bitcoin Over the course […]

Source link

Ethereum Technical Analysis: Bullish Market Sentiment Keeps ETH Above $3,500

Ethereum’s price experienced a turbulent trading session on March 4, 2024, with significant intraday fluctuations marking the landscape. Despite the short-term volatility, underlying indicators and moving averages suggest a strong bullish trend over the long term. Ethereum The last 24 hours saw ethereum’s (ETH) price swing from $3,411 to $3,537, encapsulating the volatile nature of […]

Ethereum’s price experienced a turbulent trading session on March 4, 2024, with significant intraday fluctuations marking the landscape. Despite the short-term volatility, underlying indicators and moving averages suggest a strong bullish trend over the long term. Ethereum The last 24 hours saw ethereum’s (ETH) price swing from $3,411 to $3,537, encapsulating the volatile nature of […]

Source link

Analysis challenges Bitcoin diminishing returns theory amid recent gains

Quick Take

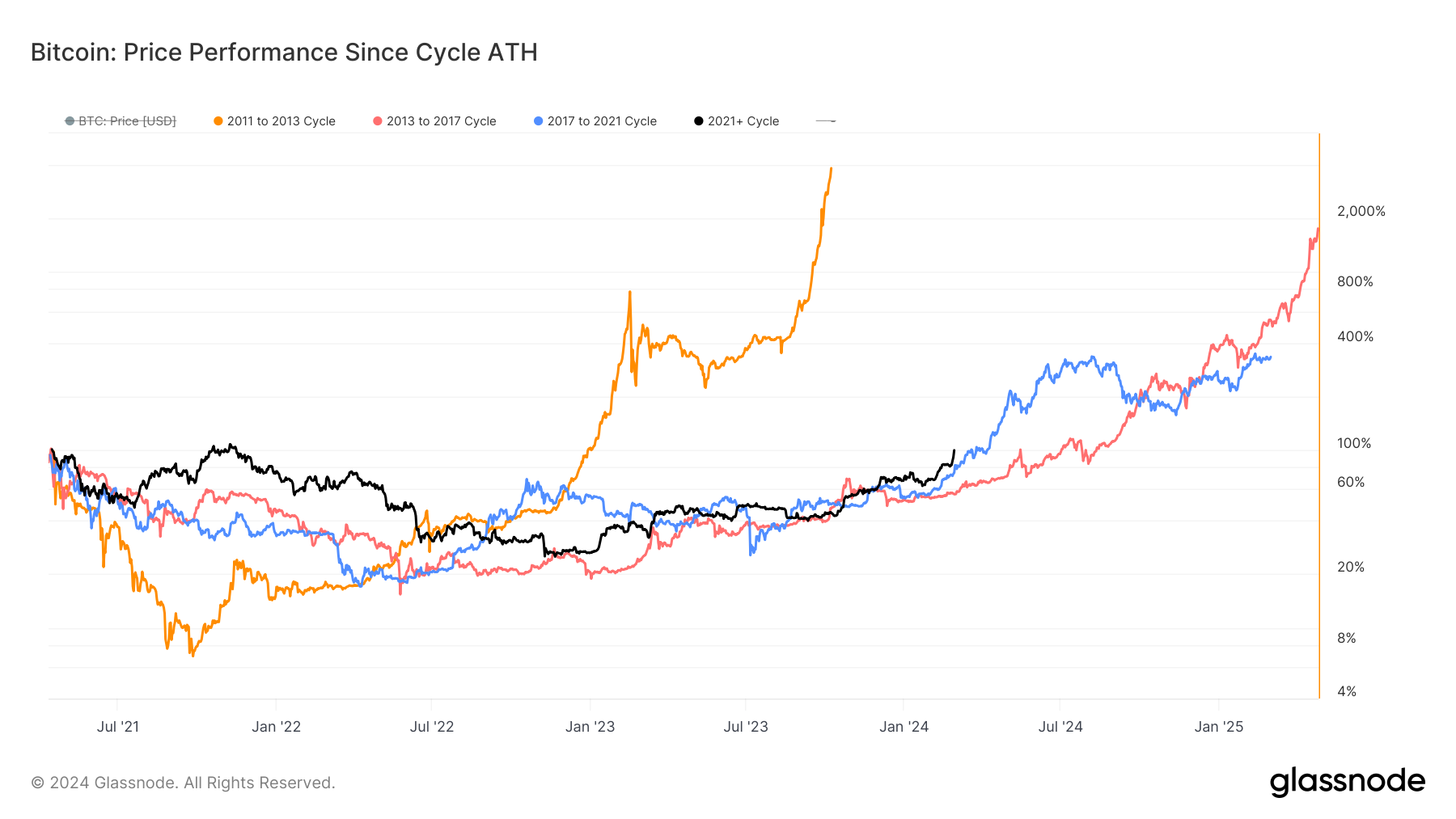

The diminishing returns theory, suggesting that Bitcoin will yield lesser returns with each cycle, is a subject of intense scrutiny. The examination of this theory from two points of view, the cycle low and the cycle all-time high, provides interesting insights.

In November 2022, Bitcoin’s cycle low occurred during the FTX collapse, dropping to roughly $15,500. Since then, Bitcoin has managed a staggering 287% appreciation, outpacing the returns of the 2015 to 2018 cycle (173%) and the 2018 to 2022 cycle (106%).

Considering the cycle from its all-time high, the bear market began shortly after the peak in April 2021, presenting a similar narrative.

We observe that Bitcoin has already hit its all-time high from April 2021 of roughly $63,000, a significant improvement compared to the previous cycles. At this juncture in the 2013 to 2017 cycle, Bitcoin needed roughly a 35% increase, and during the 2017 to 2021 cycle, a 20% increase was needed.

In conclusion, while this analysis doesn’t necessarily refute the diminishing returns theory, it highlights the strength of the current Bitcoin cycle.

The post Analysis challenges Bitcoin diminishing returns theory amid recent gains appeared first on CryptoSlate.

Bitcoin Technical Analysis: BTC Price Oscillation Reflects Crossroads and Market Indecision

Bitcoin’s value on Friday added another page to its unfolding story, registering just under $51,000, showing a modest decline from its 24-hour peak of $51,965 down to a trough of $50,877. Despite this dip, bitcoin’s 24-hour trading volume remains at $25.07 billion, highlighting the crypto asset’s persistent market vigor. Additionally, the leading digital currency’s market […]

Bitcoin’s value on Friday added another page to its unfolding story, registering just under $51,000, showing a modest decline from its 24-hour peak of $51,965 down to a trough of $50,877. Despite this dip, bitcoin’s 24-hour trading volume remains at $25.07 billion, highlighting the crypto asset’s persistent market vigor. Additionally, the leading digital currency’s market […]

Source link