Rich Dad Poor Dad author Robert Kiyosaki has urged investors to ditch the U.S. dollar and buy bitcoin alongside gold and silver. He warned that “baby boomers’ retirements are going broke as paper assets crash.” The famous author stressed: “I do not trust anything that can be printed.” Robert Kiyosaki’s Latest Warnings and Advice The […]

Rich Dad Poor Dad author Robert Kiyosaki has urged investors to ditch the U.S. dollar and buy bitcoin alongside gold and silver. He warned that “baby boomers’ retirements are going broke as paper assets crash.” The famous author stressed: “I do not trust anything that can be printed.” Robert Kiyosaki’s Latest Warnings and Advice The […]

Source link

assets

UK Judge Freezes Craig Wright’s Assets Worth $7M Amid Satoshi Nakamoto Identity Dispute

After Judge James Mellor in the U.K. rendered his decision in the notable lawsuit initiated by the Crypto Open Patent Alliance (COPA) against Craig Wright, he concluded that Wright did not embody the persona of the pseudonymous Satoshi Nakamoto. Subsequently, Mellor enforced a worldwide injunction on Wright’s holdings, freezing assets valued at £6.7 million (approximately […]

After Judge James Mellor in the U.K. rendered his decision in the notable lawsuit initiated by the Crypto Open Patent Alliance (COPA) against Craig Wright, he concluded that Wright did not embody the persona of the pseudonymous Satoshi Nakamoto. Subsequently, Mellor enforced a worldwide injunction on Wright’s holdings, freezing assets valued at £6.7 million (approximately […]

Source link

Labcorp inks $237.5M buyout of Opko’s reproductive, women’s health testing assets

Dive Brief:

-

Labcorp struck a deal Thursday to acquire clinical diagnostics, reproductive and women’s health testing assets from Bioreference Health, a subsidiary of Opko Health, for $237.5 million. Bioreference is retaining nationwide oncology and urology diagnostic services and all of its operations in New York and New Jersey.

-

The acquisition will give Labcorp control of parts of Bioreference, a loss-making Opko unit that laid off 252 people last year as part of a push to return to profitability in the next few years.

-

Labcorp has identified women’s health as one of four high-growth areas for its business.

Dive Insight:

Labcorp has established a “robust pipeline” of acquisition opportunities, leading it to recently increase its expectations for inorganic growth. While Bioreference will retain certain operations in New York and New Jersey, Labcorp is acquiring patient service centers and certain customer contracts and operating assets related to Bioreference’s reproductive and women’s health business.

The acquired assets generate about $100 million in annual revenue, according to the announcement.

“Today’s announcement appears to align well with [Labcorp’s] broader acquisition strategy of focusing on higher-growth testing areas as well as getting more involved in reproductive and women’s health. [Opko] disclosures further highlight that BioReference focuses primarily on larger metropolitan areas across the U.S.,” Evercore ISI analysts wrote in a note to investors.

Labcorp expanded its women’s health business by acquiring Ovia Health in 2021. On an earnings call in February, Labcorp CEO Adam Schechter pointed to a focus on women’s health and other higher-growth areas when an analyst asked why diagnostics earnings growth had outpaced the broader market.

Opko bought Bioreference for almost $1.5 billion in 2015, giving it control of the third-largest full service clinical laboratory in the U.S. The plan was to use Bioreference’s infrastructure to grow sales of Opko’s prostate cancer risk test, 4Kscore. However, Bioreference became a drag on the broader business as demand for COVID-19 testing fell, leading Opko to make cuts and scale back investments in the unit.

Bioreference narrowed its operating loss sequentially in the fourth quarter of 2023, reflecting efforts to cut spending and focus on opportunities in higher-value specialty segments such as oncology, women’s health and in urology. Opko president Elias Zerhouni told investors the goal was to “return this segment to profitability in the next few years” on an earnings call in February.

Opko CEO Phil Frost fielded a question about the potential to sell the diagnostic business on the call.

“At a particular point in time, if one approach seems advisable, we’ll certainly consider it seriously. I don’t want to be more specific than that right now,” Frost said. “But it’s clear that we have an asset on our books that is, at the moment, losing money, although we’re very optimistic about turning that around that has inherent value as an asset.”

This story was originally published on MedTech Dive. To receive daily news and insights, subscribe to our free daily MedTech Dive newsletter.

Zano Blockchain’s Hard Fork Facilitates Privacy Coin Creation, Introduces Confidential Assets

The Zano blockchain’s recently completed Zarcanum hard fork (HF4) will enable users and organizations to create custom tokenized assets that meet their specific needs. These custom tokenized assets or confidential assets, will be untraceable on the Zano blockchain. The team believes that without privacy and security, cryptocurrencies cannot achieve the much-hyped widespread adoption. Hosting Multiple […]

The Zano blockchain’s recently completed Zarcanum hard fork (HF4) will enable users and organizations to create custom tokenized assets that meet their specific needs. These custom tokenized assets or confidential assets, will be untraceable on the Zano blockchain. The team believes that without privacy and security, cryptocurrencies cannot achieve the much-hyped widespread adoption. Hosting Multiple […]

Source link

Nomura Bank launches Libre with Polygon for on-chain tokenization of alternative assets

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Russia Regulates Use of Digital Assets for International Settlements

Russia has integrated the use of digital assets as payment for international transactions in its legislation. President Vladimir Putin signed into law a document that describes using these assets as payment for international settlements, a use case not contemplated in any law, appointing the Central Bank of Russia as the overseer of these transactions. Russia […]

Russia has integrated the use of digital assets as payment for international transactions in its legislation. President Vladimir Putin signed into law a document that describes using these assets as payment for international settlements, a use case not contemplated in any law, appointing the Central Bank of Russia as the overseer of these transactions. Russia […]

Source link

Tokenized real world assets (RWA) redefined as personal property in landmark Iowa digital asset bill

A seemingly progressive digital asset bill has been approved by the Judiciary Committee in Iowa, introducing significant amendments to the Uniform Commercial Code, explicitly aiming to integrate digital assets and electronic records into commercial transactions. The bill, House File 2519, is titled “An act relating to commercial transactions, including control and transmission of electronic records and digital assets.”

As reported by the Committee on Judiciary monitored with TrackBill on Feb. 15, this legislation seeks to address the complexities and opportunities presented by digital assets within the legal framework of commerce. By offering a nuanced approach to the control and transmission of electronic records, the bill promises to enhance legal clarity and security in digital transactions, catering to the needs of the evolving digital economy.

House File 2519 clarifies the legal standing of digital assets by providing comprehensive definitions for terms like “controllable electronic record,” “digital asset,” and “smart contract.” This precision aims to reduce ambiguities and foster a more secure environment for digital commerce. However, the potential for variations in such definitions across state, federal, and international jurisdictions adds potential complexity for digital asset service providers.

Recognizing digital assets as personal property

However, the new definitions are a key aspect of this bill. The bill recognizes the legality of smart contracts from Article 12 of the 2022 “Uniform Commercial Code Amendments,” stipulating that a contract cannot be denied legal effect or enforceability solely because it is executed through distributed ledger technology or a smart contract. This ensures that smart contracts, which automatically execute the terms of a contract when certain conditions are met, have the same legal standing as traditional contracts.

Further, the bill also references provisions that facilitate recording real estate through electronic means from the 2022 Act. Specifically, it highlights a county’s ability to record a real estate conveyance if the evidence of conveyance adheres to the general requirements outlined in state law and is in a format that conforms to standards set by the electronic services system. The bill specifies that this system enables counties and the Iowa County Recorders Association to collaborate in implementing the county land record information system.

Building on these aspects of the 2022 Act, House File 2519 aims to amend and add to the legal framework surrounding digital assets, focusing on adjusting the definition of “digital asset.” The bill amends the definition by eliminating exceptions previously recognized under the Uniform Commercial Code (UCC). This means that certain electronic records previously excluded from being considered digital assets, such as electronic records representing an interest in specific physical or tangible property (chattel) or a lease of such property, are no longer excluded.

For example, suppose a business takes out a loan to purchase a piece of equipment, and the loan agreement also grants the lender a security interest in that equipment as collateral. In that case, the document detailing this arrangement can be considered chattel paper. If this document is created, signed, and stored electronically, it’s an electronic record evidencing chattel paper. This digital form is increasingly common in today’s digital and financial transactions, offering a more secure and efficient way to electronically manage and transfer interests in real-world assets (RWA).

The amendment simplifies the classification of digital assets, treating them simply as personal property rather than specifically as intangible personal property. This is a shift from the possible previous categorization that might have considered digital assets more narrowly as intangible personal property. This broader classification could have implications for how digital assets are treated in various legal and commercial contexts, providing a more straightforward approach to their classification.

Intangible personal property historically referred to rights and licenses, whereas tokenized RWAs related to real estate may be more appropriately treated as personal property akin to physical property.

These provisions reflect House File 2519’s approach to further integrating digital assets into Iowa’s commercial and legal frameworks. By amending the definition of digital assets and clarifying their classification, the bill aims to simplify and modernize the regulatory environment for digital assets, making it more conducive to the evolving digital economy. Additionally, by defining terms such as “electronic services system,” the bill provides legal clarity for the operation of digital asset systems and services within the state.

Protections and recognition of digital assets

Interestingly, the legislation outlines no-action protection for qualifying purchasers of controllable electronic records, asserting that filing a financing statement under Article 9 does not constitute notice of a property right claim in a controllable electronic record.

This provision in the legislation means that individuals who purchase controllable electronic records (such as digital assets or tokens) receive legal protection against claims challenging their ownership based solely on the absence of a financing statement. Essentially, even if no financing statement is filed to declare a security interest in a digital asset publicly, the purchaser’s rights to the asset are protected. This aims to streamline transactions by simplifying the proof of ownership and reducing the administrative burden on parties engaging in digital transactions.

The state creates distance on CBDCs with neutral legislation without endorsement.

The bill also explicitly states that its provisions should not be interpreted to support, endorse, create, or implement a national digital currency. This stance ensures that the legislation remains neutral regarding a centrally issued digital currency (CBDC) by a national government or central bank, focusing instead on the regulatory framework for digital assets without promoting or facilitating the establishment of a national digital currency.

The potential implications of House File 2519 on digital asset service providers and users include heightened regulatory oversight, increased legal and operational complexities, and a need for technological adjustments to meet the legal standards for control over digital assets. These challenges highlight the bill’s comprehensive attempt to adapt Iowa’s legal framework to the digital age, balancing innovation with legal clarity and consumer protection.

Ultimately, House File 2519 represents a step towards integrating digital assets into the state’s legal landscape, aiming to provide a more secure and clarified legal framework for digital transactions. While the bill’s detailed approach introduces specific regulatory and operational challenges, it also offers opportunities for enhancing the legal infrastructure supporting the digital economy.

Coinbase has lifted the freeze on Debt Box’s assets after discovering discrepancies in the Securities and Exchange Commission’s (SEC) representation of its case against the firm.

In a Feb. 13 post on social media platform X (formerly Twitter), Paul Grewal, Coinbase chief legal officer, highlighted the SEC’s flawed actions, saying the temporary restraining order (TRO) against Debt Box was “tainted by SEC’s misinterpretations” and criticized the regulatory body’s lack of immediate rectification upon acknowledging its deceptive stance.

According to Grewal, Coinbase challenged the SEC’s order because the regulator “sat silently” instead of “immediately pulling its order after admitting that it deceived the Court.” The exchange attempts to get an explanation from the authorities proved futile as it was met with “more silence.”

Consequently, Coinbase opted to unfreeze the assets, correcting the error while awaiting clarity from the SEC, which has remained silent.

“We have now righted that wrong by unfreezing the assets,” Grewal said.

Grewal furthered that the SEC’s move to dismiss the case without prejudice and mandatory training was insufficient redress for its actions.

SEC vs. Debt Box

The SEC’s pursuit of Debt Box has ignited a firestorm of critique regarding its handling of the emerging crypto industry.

Controversy flared when revelations surfaced about the SEC’s attorneys presenting false and misleading evidence in their bid for a TRO against DEBT Box. US District Judge Robert Shelby demanded explanations from the lawyers on why they shouldn’t face sanctions for their actions.

Following scrutiny, the SEC acknowledged its error and pledged to prevent such lapses. They sought the court’s acceptance of a motion to dismiss the action without prejudice as their sole penalty.

Yet, criticism of the SEC’s handling of the Debt Box case didn’t relent. Several crypto stakeholders and US lawmakers, including JD Vance, Thom Tillis, Bill Hagerty, Cynthia Lummis, and Katie Boyd Britt, condemned the regulator’s conduct as “unethical and unprofessional.”

“Regardless of whether Commission staff deliberately misrepresented evidence or unknowingly presented false information, this case suggests other enforcement cases brought by the Commission may be deserving of scrutiny. It is difficult to maintain confidence that other cases are not predicated upon dubious evidence, obfuscations, or outright misrepresentations,” the lawmakers wrote.

DeFi ecosystem rebounds to 18-month high of $60 billion in assets, signaling investor confidence resurgence

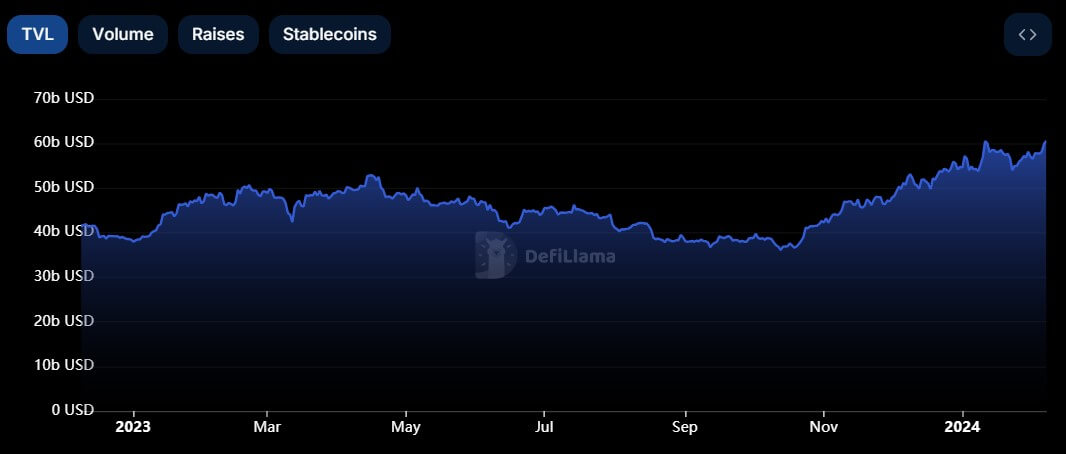

The decentralized finance (DeFi) ecosystem has hit a significant milestone as the total value of assets locked (TVL) surpassed $60 billion, marking a return to levels last seen in August 2022.

According to data from DeFiLlama, the sector surged by an impressive 68% to $60.72 billion from November 2023, when the TVL stood at around $36 billion.

The upward trajectory of a TVL signals robust investor confidence, with more users entrusting their assets to partake in decentralized financial activities.

Market analysts attribute this growth to the recent surge in crypto asset prices, fueled by buzz surrounding Bitcoin exchange-traded funds (ETFs). This rally, capturing the interest of both retail and institutional investors, propelled Bitcoin to nearly $50,000 and Ethereum, the leading DeFi blockchain network, above $2,000.

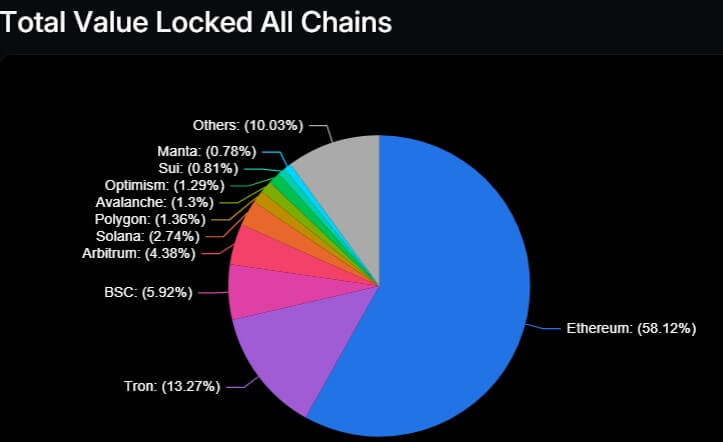

Ethereum leads

Ethereum remains the dominant force in DeFi, claiming over 58% of the market share across blockchains, boasting a TVL of $35.3 billion. Tron blockchain is second, commanding a 13% market share with a TVL of $8 billion.

Beyond Ethereum and Tron, other blockchain networks such as Solana, Binance Smart Chain, Polygon, and Arbitrum also wield considerable influence, hosting many projects and boasting substantial TVL figures.

Meanwhile, the emergence of the Sui blockchain is noteworthy as it has rapidly ascended the ranks in the DeFi space, securing a spot among the top 10 in TVL and surpassing well-established competitors like Cardano and Bitcoin.

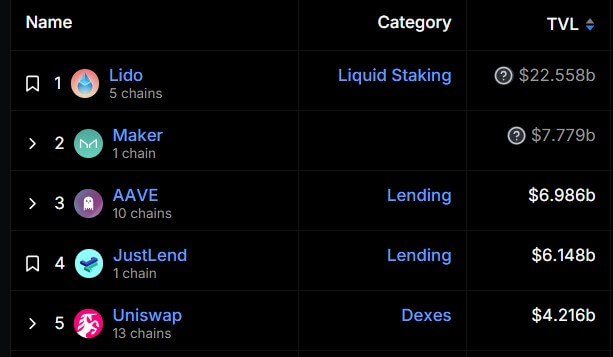

Lido dominate protocols

Lido Finance, a leading liquid staking protocol, commands a significant 37% market share, boasting a TVL of $22.58 billion.

Lido is poised to exceed 10 million ETH staked through its platform, operating across prominent blockchain networks such as Ethereum, Solana, Moonbeam, and Moonriver.

The other top five protocols include notable entities like the DAI stablecoin issuer Maker, lending platforms Aave and Justlend, and the decentralized exchange Uniswap. These protocols collectively hold TVLs of $7.7 billion, $6.98 billion, $6.14 billion, and $4.21 billion, respectively.

Trading resurgence

Concurrently, decentralized exchanges (DEXs) have experienced a surge in daily trading volumes, witnessing a 3.29% increase over the past week alone, facilitating trades worth approximately $22 billion, according to DeFillama data.

Furthermore, a Dune Analytics dashboard curated by rchen8 shows a resurgence in the sector’s user base, with more than 3 million users returning to previous highs. Over the past two months, the ecosystem has welcomed 3.6 million new addresses, pushing its total user count close to 50 million.