Aurora Cannabis Inc. led gains among Canadian cannabis stocks on Wednesday after an industry executive was named president of the Cannabis Council of Canada trade group.

Source link

Aurora

If You’d Invested $1,000 in Aurora Cannabis in 2018, This Is How Much You Would Have Today

It has been almost five years since Canada first legalized marijuana for recreational use. At the time, you may have been tempted to invest $1,000 into a top cannabis producer such as Aurora Cannabis (ACB 1.75%) to see how it might do in the future given the promising growth opportunities ahead. Unfortunately, to say that things haven’t gone well for Aurora — or many other Canadian producers — would be a huge understatement. Here’s just how bad things have been since then.

Shares of Aurora were trading at around $7 — before the reverse split

If you look up Aurora’s stock price on Sept. 4, 2018, some websites may say $81.60. That’s adjusted for the massive reverse stock split the company made in 2020, when it consolidated 12 shares into 1. The real price as of the close on that day was $6.80.

If you’d invested $1,000 at the time, that would have given you 147 shares of the pot producer. But with the stock price in a free fall in 2019 and the start of 2020, Aurora was struggling to keep its stock price above $1. That’s a key threshold it has to stay above to remain listed on the NYSE, the exchange where the stock was trading on at the time. In May 2020, in order to boost its share price, it consolidated its shares on a 12-for-1 basis. That means you would have received just 12.3 shares in return for your original 147 that you acquired.

On Monday the stock closed at $0.863, as it faces the prospect of another reverse stock split in its future. For now, you would still own 12.3 shares of the business. A stock split, even if it’s a reverse split, doesn’t alter the value of your investment. But generally, struggling stocks that have suffered significant declines often need to deploy reverse splits to keep their share prices up and maintain listing requirements. Split or not, Aurora investors have incurred deep losses.

At the stock’s current valuation, that original $1,000 investment would now be worth approximately $10.62. Your investment would literally be worth a few cups of coffee at this point.

Investors shouldn’t bet on a turnaround

Aurora has been working on slashing costs, as it has now achieved positive adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) for three straight quarters and expects to generate positive free cash flow by the end of next year.

But once the company starts to grow again, costs and overhead will increase, and there is the potential for the business’ financials to deteriorate again. Getting to breakeven is great, but investors also need to see a path for revenue and earnings growth. Focusing on small international cannabis markets isn’t likely to lead to a big pay off for investors. And unfortunately, its home Canadian market is ultra competitive, with too many producers and too many restrictions that weigh down cannabis companies.

Aurora needs more than positive adjusted EBITDA and positive free cash flow — it also needs to achieve that while growing its operations. The recent acquisition of Bevo Farms has boosted Aurora’s top line, but once that effect subsides, the company will once again be back to struggling to generate positive top-line growth.

ACB Revenue (Quarterly YoY Growth) data by YCharts.

Aurora’s stock may be cheap, but it still isn’t a good buy

Aurora Cannabis trades at less than its book value and a multiple of only 1.5 times revenue. It’s also down around 99% over the past five years. There’s no question its valuation is incredibly low, with its market cap around $330 million. But despite the company’s cost-cutting efforts, there’s still much more management would need to do to make this an investable business. Buying the stock might allow you to profit from short-term fluctuations due to various developments affecting the cannabis industry at large that aren’t necessarily specific to the company, but at that point, you’ve become a speculator rather than an investor.

For long-term investors, it’s hard to justify buying the stock. This is a business that still faces significant challenges ahead. The cannabis industry is risky enough as it is; there’s no reason to compound that risk by also investing in Aurora Cannabis.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Aurora Cannabis (ACB 16.57%) has perhaps been the most disappointing pot stock since Canada legalized adult recreational uses of marijuana back in 2018 — and that’s saying something. The company was initially seen as one of the frontrunners in the race to dominate this field, but things haven’t turned out so well.

But could Aurora Cannabis be on the verge of making a comeback? The company recently announced some news that has the market buzzing, not to mention there are some interesting industrywide developments. With all that going on, let’s find out whether investors should consider giving a second thought to the pot grower.

Benefitting from multiple tailwinds

On Sept. 8, Aurora Cannabis announced a move to reduce its debt and interest expense. The company said it had repurchased $9 million worth of convertible debt between mid-August and early September. Aurora Cannabis raised the money to do so by issuing 20.1 million new shares. This is part of the company’s goal to become free-cash-flow-positive next year — something that would be an achievement considering how poorly it has performed in recent years, both financially and on the stock market.

That’s not the only reason Aurora Cannabis has been on fire lately. The company is also benefiting from positive news on the regulatory front. The U.S. Department of Health and Human Services (HHS) recently recommended that marijuana be downgraded from a Schedule I controlled substance to Schedule III. If the agency in charge, the U.S. Drug Enforcement Administration (DEA), decides to follow this recommendation, things will get substantially easier for pot companies.

Schedule III substances are classified as less prone to dependence than those in the first or second category. For context, heroin is a Schedule I drug. Under the new HHS proposal, marijuana would also become recognized as having accepted medical use in the country — a potential game changer for the pot industry. Yes, cannabis would remain illegal at the federal level, but things would get substantially less stringent for Aurora Cannabis and its peers.

Finally, there is a bill making its way through the U.S. Senate right now that could give pot companies easier access to various banking services, which they currently lack due to the legal landscape surrounding marijuana in the country. These are all positive developments for Aurora Cannabis and the rest of the industry, but is that enough to buy the stock?

How long will this momentum last?

Let’s assume the DEA does reschedule cannabis as per the HHS’s recommendation, and lawmakers pass this new bill seeking to grant cannabis companies easier access to traditional means of funding. Even under this scenario, it’s not clear that Aurora Cannabis is a buy. Consider the company’s financial results. In its latest period — the first quarter of its fiscal year 2024, ended June 30 — Aurora Cannabis reported revenue of 75.1 million Canadian dollars (about $55.7 million), up 50% year over year.

That sounds great, at least until one realizes that much of that growth wasn’t organic and was instead due to an acquisition the company made in August 2022. This has been part of Aurora’s strategy for years. The company has sought to dominate the market by making a series of acquisitions. There is nothing wrong with this strategy in principle, but Aurora Cannabis hardly had the financial means to splurge on takeovers, so it often had to issue new shares, diluting existing shareholders in the process.

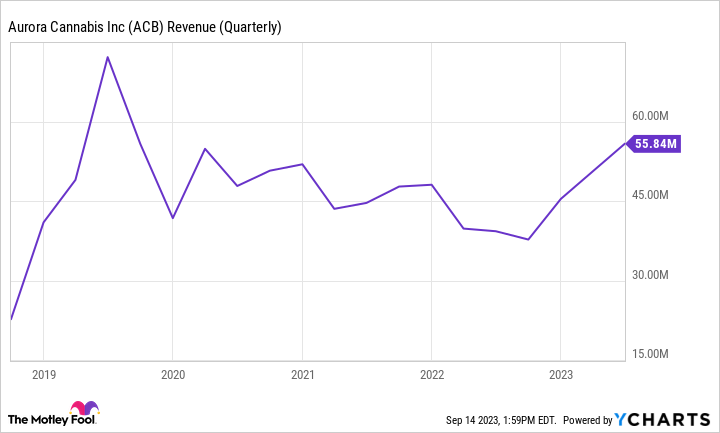

Perhaps that would have been fine if these acquisitions had panned out and the company’s financial results had increased substantially as a result, but that largely didn’t happen. Aurora Cannabis’ revenue growth has been unimpressive in the past five years after initially soaring once pot became legal in Canada.

Data source: YCharts

In fairness, that’s not entirely the company’s fault. The Canadian market had been difficult, with intense competition (including from illicit markets), stiff regulations to obtain cannabis licenses, and other challenges. That’s why there is no reason to think that Aurora Cannabis will suddenly turn things around even if the legal landscape substantially improves in the U.S. That will almost certainly attract plenty of new companies, and, based on the company’s history, I wouldn’t pick Aurora Cannabis to be one of the winners.

The company also remains unprofitable, although it has improved on this front in recent years and looks close to profitability.

Data source: YCharts

Aurora Cannabis may or may not become free-cash-flow-positive next year. In my view, it doesn’t matter. The company’s track record is too poor for that to somehow tip the scales in its favor. It should take much more than that for most investors to consider initiating a position. For now, it’s best to stay away and watch how things unfold from a safe distance.