The smart contracts platform Avalanche recently said it is collaborating with the Chinese payments giant Alipay to launch a Web3-enabled voucher program. The second phase will see the proof of concept being expanded to more than 100 million users from Southeast Asian countries. Web3-Enabled Vouchers Avalanche, a smart contracts platform, has said it is working […]

The smart contracts platform Avalanche recently said it is collaborating with the Chinese payments giant Alipay to launch a Web3-enabled voucher program. The second phase will see the proof of concept being expanded to more than 100 million users from Southeast Asian countries. Web3-Enabled Vouchers Avalanche, a smart contracts platform, has said it is working […]

Source link

avalanche

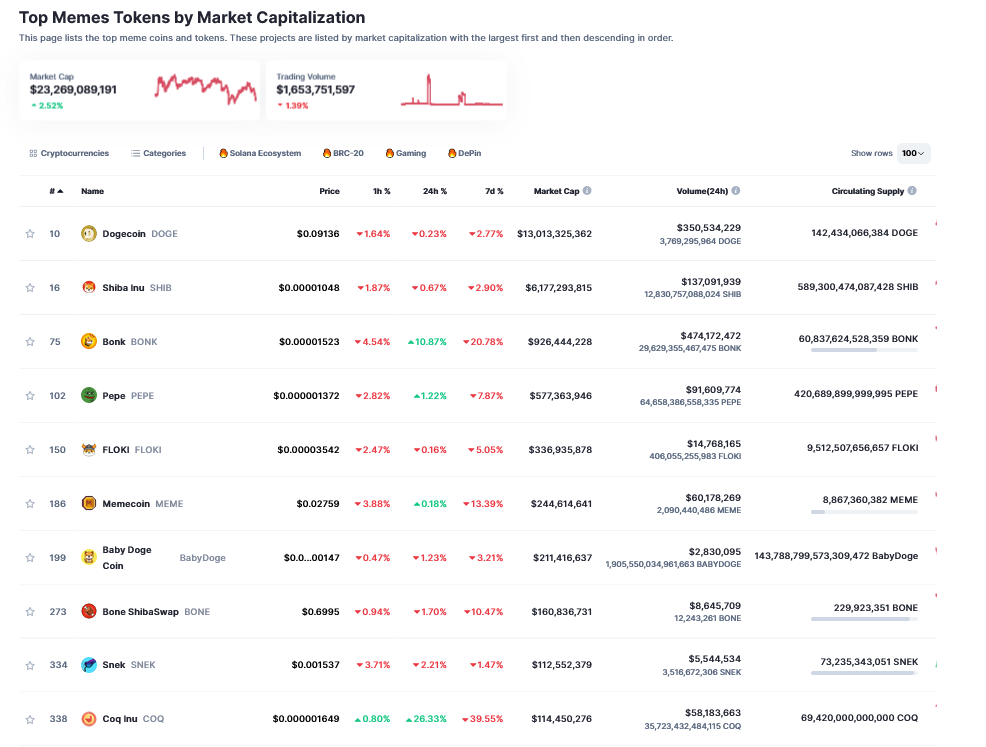

With altcoins finally catching up to Bitcoin, meme coins such as Dogecoin, BONK, and PEPE have been in the spotlight. This outperformance from these meme coins has pushed their standing in the crypto market further, putting them ahead of large competitors.

Dogecoin Rallies 50% To Reclaim 9th Spot From Avalanche

While Dogecoin did start out the week on a slow note, it picked up the pace on Wednesday after Bitcoin’s price rose to $64,000. This rally saw the DOGE price go from $0.09 to over $0.1 in a matter of hours, before the wipeout that sent Bitcoin below $60,000.

Once the market recovered, Dogecoin began to move up once again, and by Thursday, its price touched above $0.13. This is the highest that the price has been since 2022 and it gave its market cap enough boost to not only re-enter the top 10 cryptocurrencies by market cap. But also to reclaim the 9th spot from Avalanche.

Dogecoin’s price has risen 50% in the last week and pushed its market cap above $18.1 billion. Avalanche had been occupying the 9th spot on this list after rising from $10 to $40 in the last few months. However, its market cap of $16.64 billion falls behind DOGE, putting it in 10th place on the list.

It is interesting to note that a week ago, Dogecoin had completely fallen out of the top 10 cryptocurrencies after Tron’s TRX saw its market cap rise. This will end up being short-lived as TRX has fallen out of the top 10 and now sits at 11th position with a market cap of $12.6 billion.

BONK Beats Out PEPE

In addition to Dogecoin, BONK, another meme coin, has also seen impressive growth during the time. According to data from Coinmarketcap, the BONK price has risen 30% in the last day to cross the $0.00002 threshold.

This outperformance comes in light of a notable surge in the daily trading volume of the meme coin. Its volume saw a 135% increase in the last day to reach $955 million. This rapid rise in volume suggests a rapid increase in investor interest in the coin, leading to its gains.

BONK’s market rose to $1.81 billion as a result of this, which put it ahead of PEPE with a $1.22 billion market cap. BONK now holds the spot for the third-largest meme coin in the space behind Dogecoin and Shiba Inu.

However, on the weekly chart, PEPE is outperforming BONK with 148% gains compared to BONK’s 74% gains. Following behind PEPE is dogwifhat (WIF) which rose 142.6% in the last week to reach an $820 million market cap.

DOGE price rises to $0.129 | Source: DOGEUSD on Tradingview.com

Featured image from Gfinity Sports, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Avalanche, the blockchain platform poised for a major event in the month of love, is gearing up for a significant development. As February unfolds, the cryptocurrency market is anticipating the release of nearly $900 million worth of vested tokens from a diverse array of projects. This imminent influx into the market has sparked a wave of concerns among investors who are closely watching the unfolding scenario.

Projects involved in this token release include Avalanche (AVAX), Aptos (APT), The Sandbox (SAND), Optimism (OP), and SUI. Avalanche is strategically targeting strategic partners, team members, and an airdrop to maintain a balance between long-term commitment and potential short-term sell-offs.

Avalanche Braces For Major Token Release

Scheduled for release on February 22, Avalanche is set to unleash 9.5 million tokens valued at approximately $320 million. Similarly, Aptos is gearing up to release 24.8 million tokens worth around $233 million on February 11. The distribution strategy for Aptos aims to ensure market stability while fostering community involvement.

The impending release of these vested tokens has put the crypto community on high alert. Investors and analysts are closely monitoring the developments with a mix of excitement and caution. While anticipation surrounds the token releases, there is also a sense of vigilance as market participants evaluate how the surge in supply might impact project valuations and overall stability.

Avalanche currently trading at $35.76 on the daily chart: TradingView.com

Navigating A Potential Correction Phase: AVAX Price Analysis

Avalanche (AVAX) has recently caught the attention of the market with an impressive price performance, boasting a remarkable 470% increase after breaking through its bear market descending trendline on November 1.

Recent analyses suggest that AVAX is currently facing resistance at a descending trendline from the December high, which could lead to a price rejection and subsequent decrease.

If this correction signifies the commencement of a lasting bull phase for Avalanche, support levels around $20, aligning with the 0.5 to 0.618 Fibonacci retracement levels, may come into play. Following this correction phase, AVAX could potentially embark on a new uptrend, surpassing its all-time high.

Image source: DefiLlama

Meanwhile, AVAX has grown exponentially in the last year, and according to DeFiLlama data, it is now the sixth-largest DeFi chain. An artificial intelligence (AI) based price prediction model has predicted that the AVAX token’s price would soar by more than 500% from its present levels, reaching over $200 by the beginning of 2025.

Previous AVAX Unlock And Its Impact On The Market

It’s crucial to note that AVAX’s previous token unlock on November 23 did not cause significant price fluctuations. However, in the anticipation leading up to the unlock, the price experienced a 16% fall from nearly $23 on November 20 to $19 at the tokens’ release.

This historical precedent underscores the importance of closely monitoring market dynamics during token release events. Market participants should exercise caution and carefully consider the potential impact of these developments on their investment strategies.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The Avalanche (AVAX) network has gained prominence as a leading blockchain platform, providing users with a robust infrastructure for token transactions. It is a Layer 1 blockchain protocol that provides a high-performance platform for decentralized applications (dApps) and smart contracts.

Avalanche strives to provide users with a fast, secure, and scalable ecosystem for token transactions. It is a blockchain platform that aims to address the blockchain trilemma of scalability, security, and decentralization, thanks to its unique Proof of Stake (PoS) mechanism. Avalanche is commonly regarded as a viable alternative to Ethereum.

Avalanche serves as a leading light in the Web3 ecosystem by innovating a secure network that doesn’t compromise scalability or decentralization. The network possesses a remarkable characteristic in the form of its consensus protocol, referred to as Snow.

This protocol employs an innovative method known as “Snow consensus”, which enables the network to achieve nearly instantaneous transaction finality. Utilizing the “Snow consensus” method enables the network to achieve rapid confirmation times and efficient throughput by collectively validating transactions through a network of validators, overcoming the limitations of the blockchain trilemma. By addressing the challenges posed by the blockchain trilemma, Avalanche is actively working towards providing robust security and stability to the dynamic advancements in Web3.

This prominent network provides developers and investors with an advantageous blend of cost-effectiveness, high transaction speeds, dependability, and the scalability necessary for widespread acceptance. Avalanche’s commitment to sustainability and environmental consciousness further enhances its appeal. Consequently, it comes as no surprise that Avalanche has emerged as a prominent force in the Web3 ecosystem, commanding a significant presence.

How does Avalanche Work?

Avalanche’s platform sets itself apart from other blockchain projects through three fundamental design aspects: its distinctive integration of subnets, consensus mechanism and utilization of multiple built-in blockchains.

Subnetworks (subnets)

One capability that makes Avalanche innovative is Subnets, a game-changing technology that empowers developers to create projects on networks that they can design to fit their needs. Subnets are deeply customizable and inherit speed and security from Avalanche’s Primary Network.

Subnetworks, composed of groups of nodes, play a crucial role in achieving consensus on the chains within Avalanche’s platform. Each subnetwork is responsible for validating a specific set of blockchains. Additionally, all validators within a subnetwork must also validate Avalanche’s Primary Network.

It is also important to note that the Avalanche blockchain can reportedly process 4,500 transactions per second (depending on the subnet), a significant improvement over Ethereum’s less than 20. Avalanche’s native token is AVAX, which is used to secure the network and pay transaction fees.

Avalanche Consensus

Avalanche Consensus is a novel protocol that builds upon Proof of Stake (PoS) to achieve agreement among nodes in a blockchain network. When a user initiates a transaction, it is received by a validator node that randomly selects a subset of validators to check for consensus.

Through repeated sampling and communication, validators reach an agreement. Validator rewards are based on Proof of Uptime and Proof of Correctness, which consider staked tokens and adherence to software rules. Avalanche’s consensus resembles an avalanche, where a single transaction grows through repeated sampling and agreement.

Built-in Blockchains

Avalanche is built using three different blockchains in order to address the limitations of the blockchain trilemma. Digital assets can be moved across each of these chains to accomplish different functions within the ecosystem.

- i. The Exchange Chain (X-Chain) is the default blockchain on which assets are created and exchanged. This includes Avalanche’s native token, AVAX.

- ii. The Contract Chain (C-Chain) allows for the creation and execution of smart contracts. Because it is based on the Ethereum Virtual Machine, Avalanche’s smart contracts can take advantage of cross-chain interoperability.

- iii. The Platform Chain (P-Chain) coordinates validators and enables the creation and management of subnets.

Unique Features of Avalanche Network

The Avalanche ecosystem has experienced consistent growth, drawing the attention of a considerable number of projects, developers, and users. This expanding ecosystem fosters a dynamic and diverse trading environment, granting traders the opportunity to access an extensive range of assets and trading prospects. Participating in trading activities on the Avalanche network provides a multitude of significant advantages derived from the platform’s exceptional and unmatched features and capabilities. These include:

Enhanced Liquidity

The liquidity on the Avalanche network is strengthened as it continues to attract an expanding user base and an ever-growing assortment of projects. This heightened liquidity is important to traders, as it guarantees the presence of ample buyers and sellers within the market. Consequently, this diminishes slippage and fosters price stability, empowering traders to execute trades at their desired prices with minimal adverse effects.

Cross-chain Interoperability

Avalanche facilitates cross-chain interoperability through its support for the Ethereum Virtual Machine (EVM), enabling smooth interaction and compatibility with assets and decentralized applications (dApps), built on the Ethereum network.

This cross-chain interoperability broadens the horizons of trading opportunities, granting traders access to a wider selection of assets and the ability to leverage the liquidity present in other blockchain networks.

Security

Security is a top priority for the Avalanche network, and it implements robust Byzantine fault tolerance (BFT) mechanisms. These measures safeguard the network against malicious attacks and guarantee the integrity of transactions.

As a result, users can confidently participate in token transactions and interact with dApps on the Avalanche network, knowing that their security remains uncompromised.

Ecosystem Expansion

The expanding market depth on Avalanche empowers traders to broaden their asset selection, granting them access to a more extensive array of trading options. As adoption gains momentum, an increasing number of projects and tokens are introduced on the platform, enriching the diversity of available assets.

This diverse assortment of assets facilitates portfolio diversification and facilitates the exploration of various investment opportunities, accommodating a wide range of trading strategies and individual preferences. Avalanche works with a wide variety of Ethereum DApps and infrastructure projects, including Trader Joe and UniSwap.

How To Get Started On The Avalanche Network

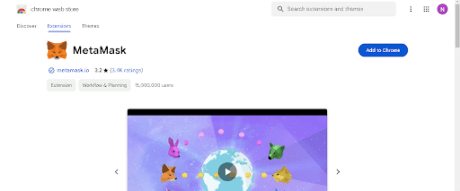

In order to engage in token transactions on the Avalanche (AVAX) network, users are advised to acquire a Metamask wallet. Metamask is a widely utilized browser extension wallet that facilitates interactions with blockchain networks such as Ethereum. It can be easily accessed and installed as an extension on popular web browsers like Google Chrome.

To add your Metamask Wallet to your browser as an extension, simply click on the ‘Add to Chrome’ icon located in the top right corner, as depicted below:

After you have installed and set up MetaMask, you can use it to manage your cryptocurrency wallets, interact with decentralized applications (DApps), and safely perform transactions on supported blockchains directly from your browser.

Remember to write down your seed phrase on paper and keep it in a secure place. Avoid storing it online or on your device.

Afterwards, you can add the Avalanche (AVAX) network to your Metamask wallet by following the instructions provided on the Metamask website here.

Trading On The Avalanche (AVAX) Network

In order to execute trades on the Avalanche Network, users will need to fund their wallet with AVAX tokens. AVAX is the native cryptocurrency for the Avalanche Network, and it functions as the primary medium of exchange for transactions, gas fees and liquidity provision on the platform. Hence, users should ensure a sufficient amount of AVAX tokens in their wallet to cover the cost of trading on the Avalanche network.

Users have the option to purchase AVAX on centralized exchanges like Binance. Once you have obtained AVAX, you can copy your wallet address from Metamask and proceed to send the AVAX tokens from Binance to your Metamask wallet.

You can also buy AVAX directly from your Metamask wallet. Click on the buy/sell button within Metamask to open the interface. Here, you can put how much AVAX token you intend to buy in terms of dollar amounts, pick your payment method, and then click “Buy”.

Kindly note that if you wish to buy cryptocurrencies directly within Metamask, you will need to provide information such as your country and state of residence. Rest assured, the process is quick and uncomplicated, typically taking just a minute to complete.

The arrival of your AVAX tokens in your wallet should take no more than a few minutes. Once they are successfully deposited, you are ready to commence trading tokens on the Avalanche network.

Now, it’s time to visit Trader Joe, and embark on your trading journey.

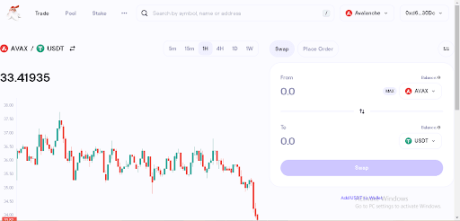

How To Trade Tokens On The Avalanche Network Using TraderJoe

Trader Joe is a decentralized exchange (DEX) on the Avalanche network. It allows users to trade tokens directly from their wallets using liquidity pools. Trader Joe prioritizes user control, security, and privacy while providing a user-friendly trading experience.

Make sure to be on the right Trader Joe website so as to protect your assets from malicious activities. The first step on the website is clicking on the “Connect Wallet” option at the top right corner, as shown in the image below:

Connect to the preferred wallet option (Metamask) as presented in the image below:

Once connected, switch Metamask to AVAX (no need to switch if you’re already on the AVAX network):

After connecting MetaMask to the Avalanche network, go to Trader Joe, and then you can start trading on the Avalanche (AVAX) network using Trader Joe.

Once you reach the Trader Joe interface, you can proceed by choosing your desired tokens. Since Trader Joe follows a token-to-token trading model, simply click on the “select token” button to pick the trading pair you wish to trade against. Users can search tokens by name, symbol or contact address:

Buying and Selling Tokens With The Metamask Wallet

Users of the Avalanche (AVAX) Network have the option to purchase and sell tokens directly through the Metamask extension wallet, which is already connected to the Avalanche network.

To proceed, ensure that you are connected to the Avalanche network and possess AVAX tokens for swapping and paying transaction fees. Next, locate the “Swap” button, illustrated below, and click on it. This action will redirect you to the Swap interface within Metamask.

Using the image above as a guide, you can also search for tokens using the name or the contract address, just like on Trader Joe. Input the amount of AVAX you want to swap, confirm that you have the correct token, and then click “Swap.”

Once the transaction is confirmed, the tokens you just bought will be sent to your wallet.

Tracking Token Prices on The Avalanche Network

Utilizing on-chain tools such as Dexscreener, users of the Avalanche network can access extensive market insights for specific tokens. These insights encompass crucial data like price information and contract details, equipping users with reliable and up-to-date information. By leveraging these insights, users can make informed trading decisions and engage in the market with confidence.

Dexscreener also allows Avalanche users can stay updated on token metrics and market dynamics, thereby improving their trading strategies and enhancing their overall trading experience. It provides valuable information such as price data, market cap, token supply, contract details, etc, that empowers users to make more informed decisions and navigate the market properly.

Dexscreener provides a range of beneficial features specifically designed for users on the Avalanche network. One standout feature is its advanced charting functionality, which offers real-time and historical price data for a diverse selection of tokens.

Through these charts, users can access valuable information about price trends, trading volumes, and other essential metrics. This empowers them to identify optimal entry and exit points for their trades with accuracy and certainty.

Conclusion

In conclusion, the Avalanche network provides a robust ecosystem for decentralized finance (DeFi) and token trading. With its fast transaction speeds, low fees, and high scalability, Avalanche offers an efficient and user-friendly platform for buying, selling, and trading tokens.

The network supports various decentralized exchanges, such as Trader Joe, and provides on-chain tools like Dexscreener to empower users with market insights. It is important for users to stay informed, exercise caution, and adapt to the evolving landscape of the Avalanche network to make the most of its features and opportunities.

Featured image from LinkedIn

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The Avalanche Foundation is expanding its support of meme coins. This move could further boost the popularity of Avalanche, a low-fee and high-throughput blockchain, and even support its native coin, AVAX.

Avalanche Foundation To Support Meme Coins

Taking to X on December 29, the foundation said it would continue its Culture Catalyst initiative to encourage meme coin activity, among others, including Real-World Assets (RWAs), non-fungible tokens (NFTs), and more. This campaign, they continue, aims to foster innovation and propel the adoption of blockchains by supporting the creation of “new forms of creativity, culture, and lifestyle.”

The Avalanche Foundation believes that meme coins have carved out a significant niche in crypto, representing the collective spirit and shared interests of diverse crypto communities. By recognizing and encouraging this culture, the foundation hopes to develop and expand the Avalanche ecosystem, attracting new users.

As they resume Culture Catalyst, the foundation will start by purchasing select Avalanche-based meme coins to create a collection. The selection process will be based on several critical criteria, including the number of holders, liquidity thresholds, project maturity, principles of a fair launch, and overall social sentiment.

This move is a significant step for the Avalanche Foundation, as it indicates a growing recognition of the potential of meme coins to drive innovation and growth. It is because meme coins have become increasingly popular in recent years, often attracting large communities and generating significant trading volume. According to CoinMarketCap data on December 29, meme coins have a cumulative market cap of over $23 billion.

Will AVAX And COQ Extend Gains In 2024?

The foundation’s support for meme coins could further boost the popularity of Avalanche, as it will bring more attention to AVAX, a coin used for paying network fees. Thus far, AVAX remains in an uptrend, adding nearly 400% from October 2023 lows. Though there has been a cool-off, buyers have the upper hand. With rising demand triggered by more meme coins deploying on Avalanche, AVAX prices will likely float even higher.

One of the Avalanche-based meme coins, COQ, is among the top 10 most liquid. According to DEX Tools data, there are over 34,000 COQ holders when writing. As of December 29, Dogecoin (DOGE) is the largest and most valuable meme coin, with over $13.2 billion in market cap. However, the launch and subsequent stellar performance of COQ propelled it to command a market cap of $114 million.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Avalanche Foundation’s memecoin acquisition plan prompts 200% rally in meme token prices

Several Avalanche-based memecoins are up more than 100% today after the blockchain network’s Foundation revealed plans to start buying this class of digital assets through its Culture Catalyst initiative.

Memecoin purchase goals

In a Dec. 29 post on social media platform X (formerly Twitter), Avalanche Foundation said it would purchase “select Avalanche-based meme coins to create a collection” that encourages the “culture and fun” symbolized by these assets.

The Foundation claimed memecoins “go beyond mere utility assets; they represent the collective spirit and shared interests of diverse crypto communities.”

However, the Foundation would not be purchasing just any kind of memecoin as it outlined strict selection criteria that will be applied to its potential acquisitions. It said:

“The selection process for this collection is based on several key criteria, including the number of holders, liquidity thresholds, project maturity, principles of a fair launch, and overall social sentiment, among other factors.”

The Foundation concluded that the move aligns with ongoing engagements across its ecosystem, involving non-fungible tokens, real-world assets, and other digital assets deployed on the blockchain network.

The Avalanche Foundation launched the Culture Catalyst initiative in March 2022 with $100 million in funding to empower creators, spark innovation, and propel the adoption of blockchains.

Avalanche-based memecoins rally

Several Avalanche-based memecoins prices have reacted positively to news of the Foundation’s intention.

Data from Coingecko shows that Coq Inu, Shibx, Husky, Landwolf on AVAX, and Bear gained as much as over 200% in the past 24 hours, most of which came after the news.

Generally, memecoins have historically faced skepticism from traditional blockchain enthusiasts due to their speculative nature and their perceived lack of utility. However, some of these assets, including Dogecoin, Shiba Inu, Bonk, and Pepe, have gone mainstream and have helped attract more people into the blockchain industry.

Thus, these assets play an integral yet unacknowledged role in the broader cryptocurrency industry.

Avalanche Foundation Expands Culture Catalyst Initiative to Embrace Meme Coins

For the planned investments in selected meme projects on the Avalanche network, the non-profit has outlined specific requirements for eligibility in the program.

Avalanche Foundation, the non-profit group overseeing the development of the Avalanche blockchain, has announced its intention to allocate a portion of the Culture Catalyst Funds to support meme coins.

According to a statement on X (formerly Twitter), the move is aimed at acknowledging the cultural and entertaining aspects symbolized by meme coins, with the foundation planning to acquire select Avalanche-based meme coins to build a curated collection.

From NFTs to Meme Coins

The non-profit organization initially rolled out the Culture Catalyst initiative in March 2022 with $100 million funding to propel the adoption of the crypto ecosystem.

At its launch, the program was designed to foster innovation in the non-fungible token (NFT) sector by supporting and empowering creators on the Avalanche protocol.

However, as revealed in a recent announcement on X, a portion of the funds will now be redirected towards targeted meme coins within the network.

The protocol claimed meme coins “go beyond mere utility assets” and stand as a representation of the “collective spirit and shared interests of diverse crypto communities.”

The Avalanche Foundation said the move aligns with its ongoing engagements across the Avalanche blockchain, involving non-fungible tokens, real-world assets, and various undisclosed tokens deployed on the Avalanche ecosystem.

The foundation believes that allocating a portion of the Culture Catalyst fund to selected meme tokens with promising potential will enrich the network’s portfolio, embracing a more comprehensive spectrum of possibilities. This step, according to the group, positions the protocol to accommodate the myriad new forms of creativity, culture, and lifestyle enabled by blockchain technology.

Last year, the Avalanche Foundation launched Culture Catalyst, a program aimed at empowering creators, sparking innovation, and propelling the adoption of blockchains. This initiative seeks to better position Avalanche to cultivate and support the many new forms of creativity,…

— Avalanche 🔺 (@avax) December 29, 2023

Unveiled Requirements for Investments in Meme Projects

For the planned investments in selected meme projects on the Avalanche network, the non-profit has outlined specific requirements for eligibility in the program.

According to the foundation, the selection process for the planned collection will be based on a number of factors, including liquidity thresholds, project maturity, principles of a fair launch, the number of holders, and overall social sentiment.

The non-profit said it is open to supporting diverse and culturally significant initiatives as long as it meets the selection criteria. The group prides itself as an adaptable and inclusive participant in the Web3 space.

next

Altcoin News, Cryptocurrency News, News

You have successfully joined our subscriber list.

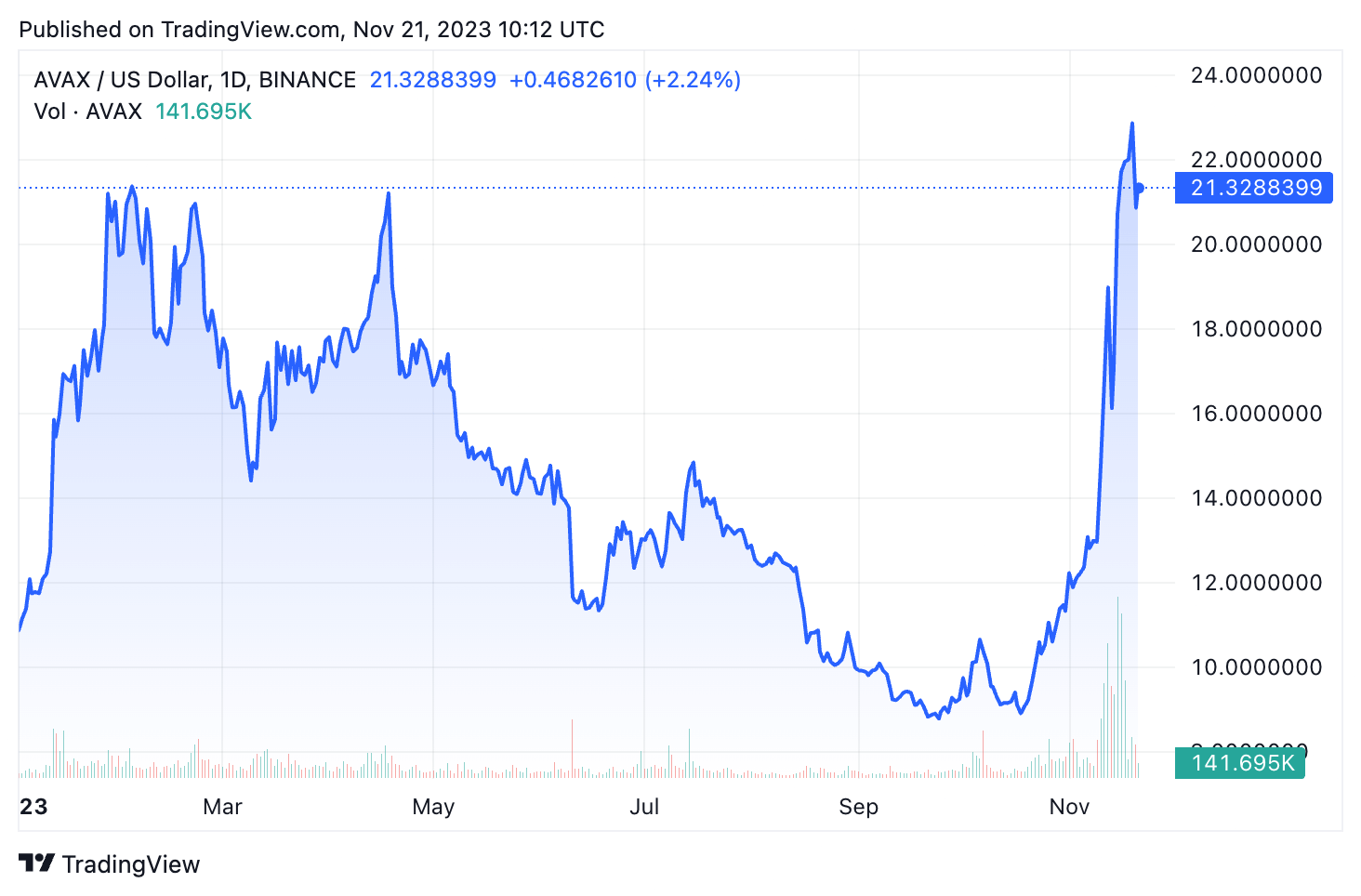

The price of Avalanche (AVAX) has been steadily rising leading up to the holiday season. Consequently, in just over two months, the altcoin has more than quintupled in value. In any case, the price of AVAX still has more potential than most other cryptocurrencies, which have seen rises of about 300% over the same time frame.

Investors and aficionados are keeping a careful eye on whether AVAX may reach this milestone before the end of the current year as the cryptocurrency makes steady progress toward the coveted $50 mark, a level it has not hit since May 2022.

AVAX Surges: From Resistance Break To $50 Anticipation

At the time of writing, AVAX was trading at $45.59, down 2.1% in the last seven days, but sustained a 6.7% rally in the last week, data from Coingecko shows. With a market valuation of more than $17 billion, the altcoin has become one of the largest in the business thanks to its continuous rise.

The value of the cryptocurrency has increased dramatically since October, when it was trading at a low of $8.50. With only two months to go, AVAX surged by more than 400%, setting a new annual high of $46.50 and sparking anticipation that it would hit $50 in the remaining days of the year.

AVAX achieved a major breakthrough by breaking away from a falling resistance trend line that had held for 750 days since its all-time high, which propelled this incredible ascension. This break free from the established trend line represented a significant technical advancement and was also a major factor in quickening the pace of AVAX’s price rise.

AVAX market cap currently at $16.563 billion. Chart: TradingView.com

AVAX’s solid run so far is attributable to a number of favorable factors driving the broader cryptocurrency market. Macroeconomically, the recent drop in inflation rates and signs of probable interest rate reductions by the Federal Reserve and other central banks in 2024 present a good climate for alternative assets like AVAX.

AVAX’s Potential Amid ETF Hope, Market Optimism

Moreover, there is hope that the US Securities and Exchange Commission (SEC) would approve a spot Bitcoin exchange-traded fund (ETF). If this happens, it may pave the way for the introduction of other cryptocurrency ETFs, such as those associated with Avalanche.

The crypto fear and greed index has risen to 75, signifying a favorable feeling, demonstrating the industry’s momentum. Historical data indicates that tokens like as AVAX have a tendency to perform well and remain resilient during times of market optimism, which may indicate additional upward movement in the present market environment.

Even with AVAX’s remarkable price surge, changes in Bitcoin’s price still have an impact. If Bitcoin falls for any reason, the price of Avalanche is probably going to follow.

#Avalanche $Avax 1w

On track! 👌 pic.twitter.com/pDM4hWzE7S

— FLASH (@THEFLASHTRADING) December 21, 2023

Meanwhile, crypto analysts on X believe that the trend is likely to go upward.

With a target price of $65, Flash has a bullish projection. His bullish view stems from a breakaway from a long-term trend and a move over a horizontal resistance zone.

Additionally, Bluntz Capital tweeted a bullish wave count that suggests the price of AVAX will finish the fifth and final wave close to $55.

Meanwhile, the price of AVAX stays above the weekly support level at $40 and advances into the resistance zone, which is located between $51 and $55. When compared to the current price of $45.49, this move would represent a gain of around 20%.

With momentum growing and significant changes expected in the cryptocurrency scene, Avalanche (AVAX) could experience a substantial % surge before a cooldown. The interplay of economic factors, regulations, and market sentiment creates an engaging story for both AVAX enthusiasts and investors.

Featured image from Shutterstock

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Avalanche has seen a significant increase in its market value this year. The token has grown substantially with impressive monthly, year-to-date (YTD), and yearly gains. AVAX’s price has surged by over 103% in the last 30 days alone, with a notable 77% increase over the past year.

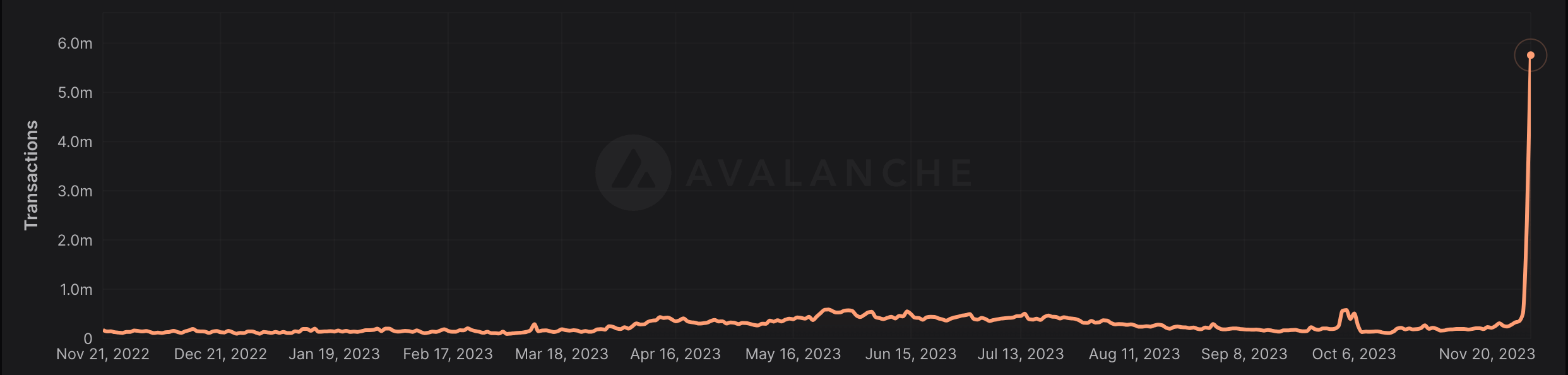

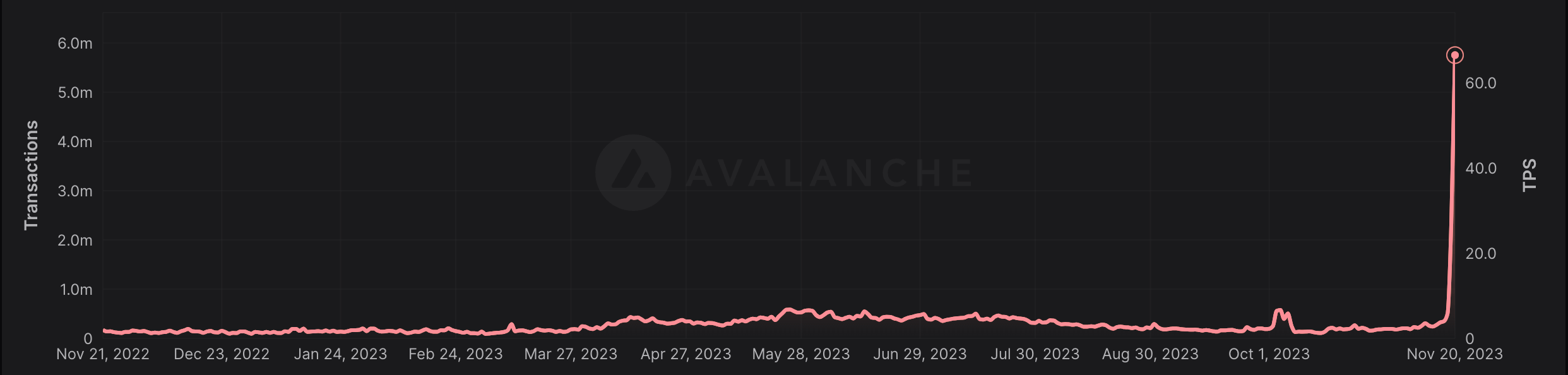

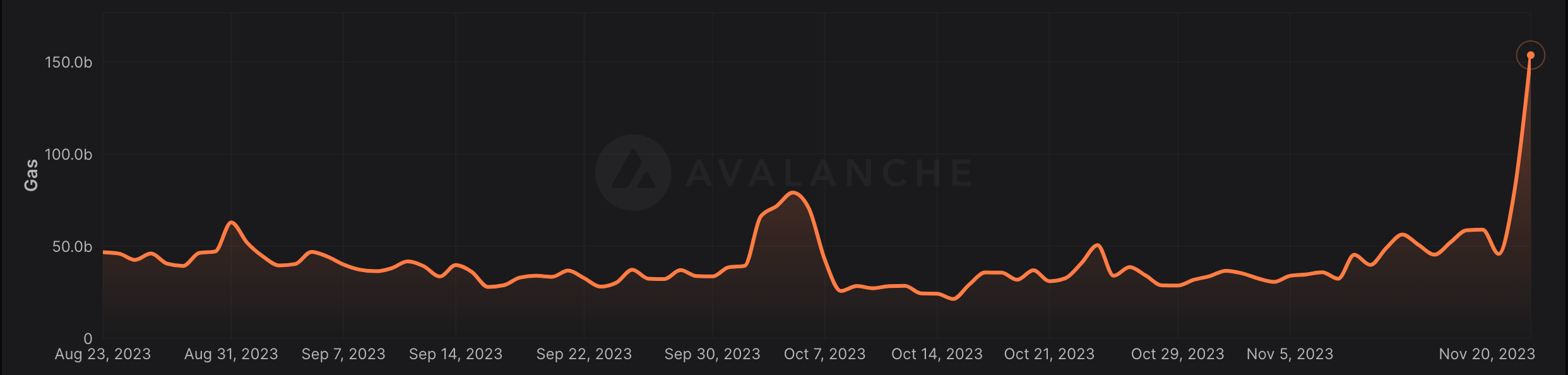

This price growth was accompanied by an even higher increase in usage and activity on the Avalanche network. The network experienced an unprecedented surge in daily transactions in November, a key indicator of network utilization and user engagement. From Nov. 1 to Nov. 20, daily transactions skyrocketed from 183,107 to 5,750,000, marking a 3,040% increase. This surge points to a growing interest and trust in the Avalanche platform among users and investors.

Alongside the rise in transaction count, there was a significant increase in the number of transactions per second (TPS) the network processed. This metric is a crucial gauge of a blockchain’s efficiency and scalability. The average TPS on Avalanche jumped from 2.24 on Nov. 1 to a peak of 66.61 on Nov. 20. This represents a remarkable ability of the network to handle increased throughput, showcasing its potential to support a high volume of transactions efficiently.

Another vital aspect to consider is gas usage, a measure of the computational effort required to execute operations on the network. Gas is essential to understand, as it reflects the network’s demand and the complexity of processing transactions. From Nov. 1 to 20, the gas used on Avalanche escalated significantly, from 36.7 million to 153.79 million, the second-highest level in the past year. This rise indicates not only increased activity but also possibly more complex transactions taking place on the network.

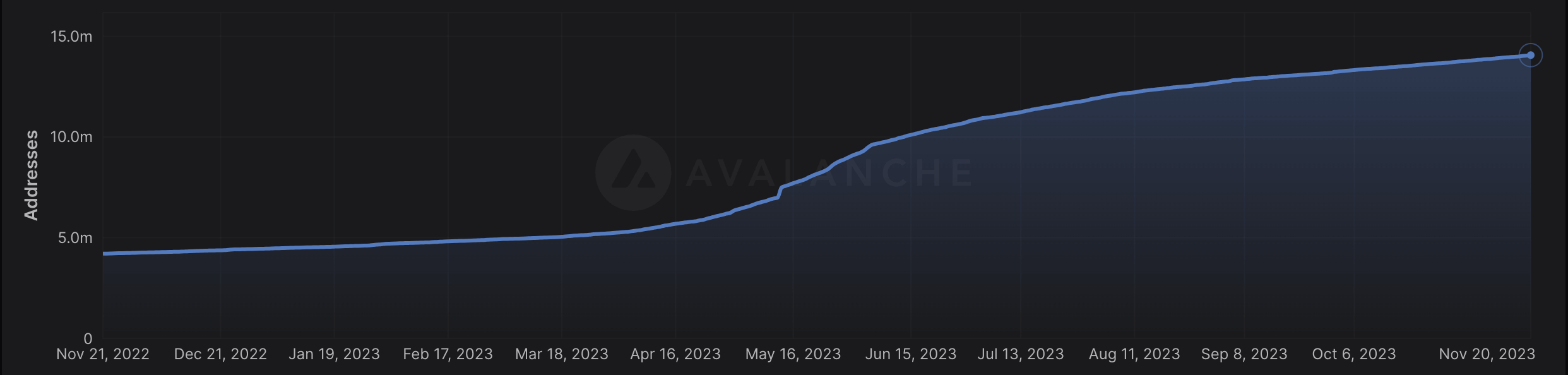

In addition to the surging transaction metrics, the total number of addresses on Avalanche also saw a noteworthy increase. This growth in addresses is indicative of the network’s expanding user base and adoption rate. The data shows a growth from 13.56 million addresses on Nov. 1 to 14.06 million on Nov. 20.

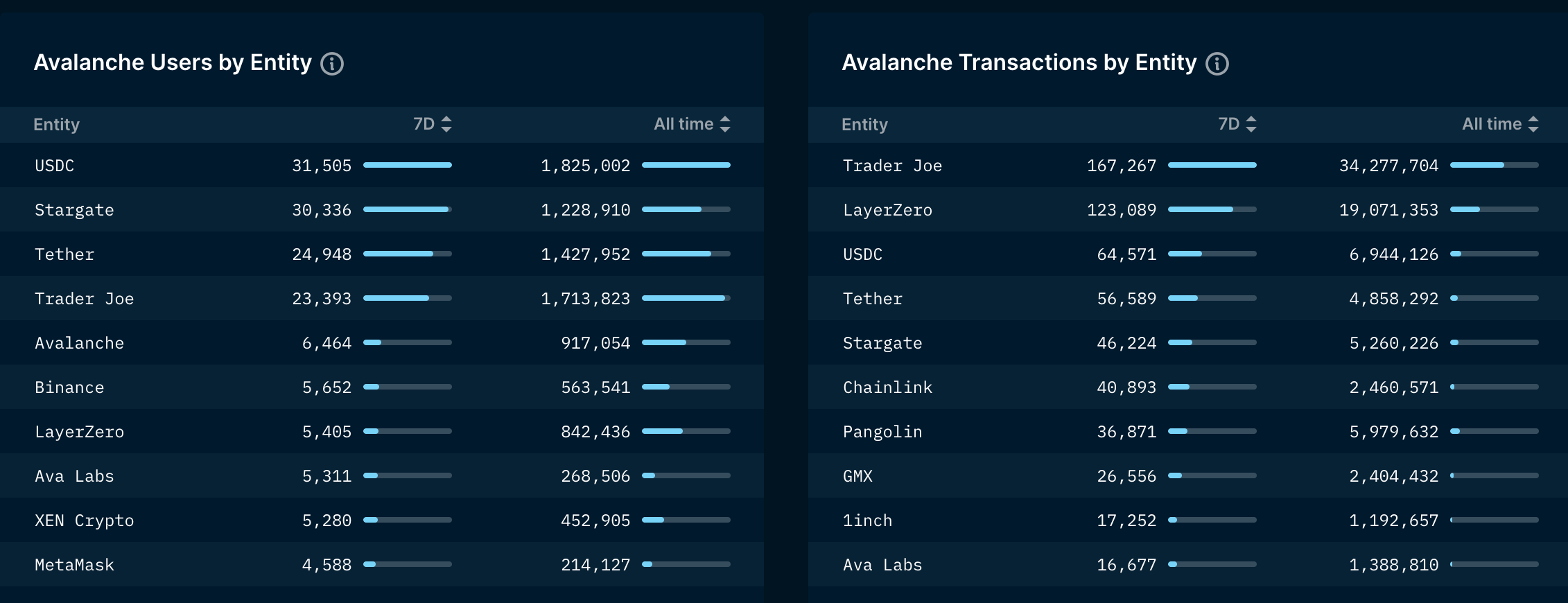

Focusing on specific entities within the Avalanche ecosystem, certain protocols have experienced heightened user interaction and transaction volume. For instance, USDC and Trader Joe have seen the highest number of users and transactions. Such entities play a pivotal role in the ecosystem, offering services ranging from stablecoin transactions to decentralized trading.

These developments and the surge in on-chain activity correlate with recent advancements and initiatives in the AVAX ecosystem. Strategic partnerships, technological enhancements, and expansions across various sectors likely drive this surge.

The post Transactions on Avalanche surge by 3,040% in November appeared first on CryptoSlate.

Bullish Sentiment Surrounds AVAX Price As Republic Adopts Avalanche Blockchain

Tech firm Republic has recently announced its mission to democratize private market investing, with the selection of Avalanche as the platform for launching its profit-sharing digital asset, the Republic Note (R/Note).

The R/Note is a revenue-sharing digital security that is backed by Republic’s private equity portfolio, which includes over 750 assets.

Republic And Avalanche Forge Partnership

According to Republic’s announcement, Avalanche was chosen for several key reasons. Firstly, its scalability and speed ensure that Republic Note holders can enjoy seamless and cost-effective transactions.

Notably, Avalanche has established partnerships with renowned brands like Amazon Web Services and Mastercard, highlighting its technical capabilities.

Additionally, Republic plans to launch a dedicated Subnet on Avalanche next year, offering a purpose-built network specifically designed for the Republic Note.

This will provide enhanced security, privacy, and regulatory compliance, creating a robust digital security environment.

Mission alignment between Republic and Ava Labs, the team behind Avalanche, is another crucial factor. Per the announcement, both entities share a commitment to fostering a more inclusive future for financial markets through tokenization.

Furthermore, Avalanche’s “eco-friendliness” sets it apart from other blockchains, consuming significantly less energy, per the announcement.

The pre-sale of Republic Notes has already attracted participation from thousands of individual retail investors, resulting in pre-sales exceeding $30 million. The public listing of the Republic Note is scheduled for December.

Optimism For AVAX Price

The partnership between Republic and Ava Labs is anticipated to have a positive impact on the AVAX price. The launch of the Republic Note on Avalanche’s platform establishes a strong foundation for expanding its reach to a global audience of investors.

Despite a 5% decline in the past 24 hours, AVAX has outperformed major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), with a 130% rally over the past 30 days, positioning itself as one of the industry’s top performers.

However, it is important to note that AVAX has recently undergone a correction, and its ability to surpass the $20.64 level will be crucial in determining its prospects amidst the ongoing bullish momentum.

Resistance levels at $21.59 and $22.74 have proven challenging for AVAX to breach and consolidate since February 2023.

Overall, the forthcoming launch of the Republic Note on Avalanche’s mainnet is a significant milestone in making the asset accessible to pre-sale participants who have contributed over $30 million.

It remains to be seen whether this partnership can further bolster AVAX’s price and reinforce the positive trend observed over the past 30 days, potentially driving AVAX to new yearly highs in 2023.

The collaboration between Republic and Ava Labs underscores their shared vision of democratizing access to private markets through tokenization.

Featured image from Shutterstock, chart from TradingView.com