A U.S. district judge has sided with the Securities and Exchange Commission (SEC) in a ruling that declares the trading of certain crypto assets on secondary markets to be securities transactions. This decision emerged from an insider trading case involving crypto exchange Coinbase’s former product manager Ishan Wahi, his brother Nikhil Wahi, and their friend […]

A U.S. district judge has sided with the Securities and Exchange Commission (SEC) in a ruling that declares the trading of certain crypto assets on secondary markets to be securities transactions. This decision emerged from an insider trading case involving crypto exchange Coinbase’s former product manager Ishan Wahi, his brother Nikhil Wahi, and their friend […]

Source link

backs

BitMEX Co-Founder Backs Solana Amidst Fears of Another US Bank Collapse

In a post on X, Arthur Hayes, the co-founder of the derivatives crypto exchange BitMEX, said it might be time for traders to double down on Solana (SOL) and altcoins in general. Hayes’s comments come at a time of heightened volatility in the broader crypto market, with Bitcoin (BTC) struggling to regain its footing and altcoins, including Ethereum (ETH), posting mixed results.

Time To Switch To Solana?

The co-founder noted that it could be time to get back on the Solana “train.” With this preview, Hayes is convinced that Solana and other altcoins could outperform Bitcoin in the days ahead.

The outlook could be anchored on the possibility of altcoins and Bitcoin rising in the coming sessions. Specifically, Hayes warns that a “few” major banks in the United States could “bite the dust.”

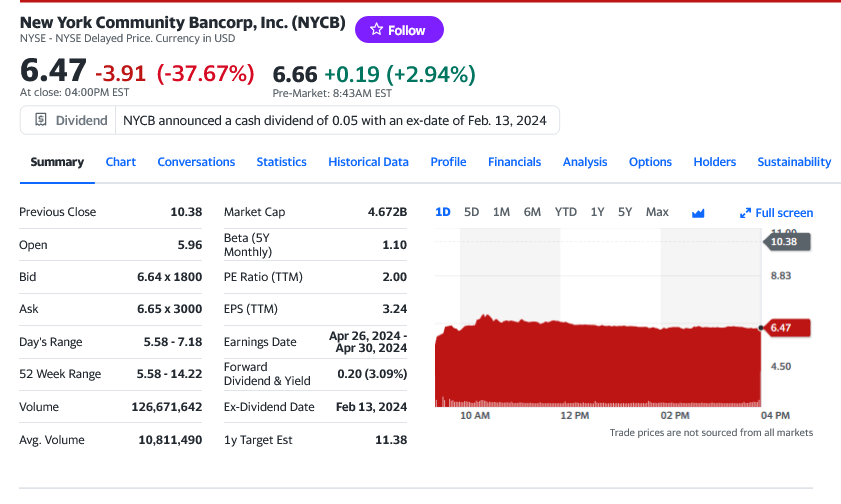

This comment also comes at a critical position in the United States banking landscape. On January 31, market analysts noted that NY Community Bancorp’s stock price plummeted 45% following a surprise quarterly loss and dividend reduction.

NY Community Bancorp is crucial in the United States regional banking sector. It also acquired assets from Signature Bank when it collapsed in March 2023.

Analysts say the bank’s decision to expand harmed its balance sheet. The acquisition of Signature Bank increased its regulatory capital requirements, impacting its dividends and provisions, as seen in its latest earnings report.

A Bank Crisis Is A Boon For Bitcoin, Altcoins

While Hayes’ comments are likely to fuel further speculation about the potential for another banking crisis in the United States, it is not immediately clear whether this might spark a crypto rally.

However, reading from past events, if indeed a major bank in the United States collapses and files for bankruptcy in the next few days, Bitcoin will likely rally. In March 2023, following the collapse of Signature Bank, among others, Bitcoin initiated a crypto rally that saw Ethereum and Solana record gains.

Considering the significant shift in Solana investor sentiment over the past few months, it is likely that SOL might snap back to trend. In that case, the altcoin might break above $125, extending 2023 gains.

When writing, SOL is pinned below $100 and under pressure. The local resistance is at $105. A break out might lift the coin towards $125 in a buy trend continuation pattern.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

(Bloomberg) — The US economy is set for an unexpected fiscal boost if lawmakers back a potential deal for $70 billion worth of tax breaks for businesses and families.

Most Read from Bloomberg

Congressional negotiators are locked in talks over renewing expired business tax breaks and boosting the child tax credit, evenly split between both. The proposal will need to pass through a Congress that is deeply divided over the nation’s fiscal trajectory, as some Republican lawmakers push for deep spending cuts as a condition for averting another government shutdown on Jan. 19 and Feb. 2, when temporary funding expires.

If passed, the tax breaks offer a double-edged sword for an economy that appears on course for a soft landing.

While the extra cash would boost consumer spending, it would also risk reigniting inflation pressures — complicating prospects for the Federal Reserve to lower interest rates this year, economists warned. Data for December show that inflation picked up at the end of 2023, fueled by services costs while a decline in goods prices petered out. The consumer price index increased 3.4% in the year through December, the most in three months. Prices for clothing and cars continue to increase.

Mickey Levy, a visiting scholar at the Hoover Institution, said the tax measures would add fuel to an economy that is already growing faster than estimates for its long run potential. The legacy of pandemic-era fiscal stimulus continues to juice growth, he said.

“There’s already substantial fiscal stimulus driving up economic activity,” he said.

Analysts say much will depend on the final details of any agreement and how the tax breaks will be structured. The draft deal would extend breaks through 2025.

The talks were still in flux as lawmakers left for the long weekend Friday. After halting progress earlier in the week, several potential roadblocks to a bipartisan agreement emerged, including differences over the state-and-local tax deduction cap, an expansion to the low-income housing tax credit and a more robust child tax credit.

If a deal does come together, money could start flowing to households as soon as March, said Marc Goldwein, senior policy director for the Committee for a Responsible Federal Budget, which advocates for reducing deficits and debt. He cautions the proposal will do little to encourage additional corporate investment.

Business Breaks

The proposed deal would revive tax breaks for research and development spending, boost the deductibility of investment, such as in equipment, and business loans. Lawmakers are discussing restricting benefits for foreign research investments in order to target the benefits to companies conducting such activities in the US.

“This is going to be a decent amount of fiscal cost with very little of it going to encourage new investment in a time when there are still inflation pressures,” Goldwein said.

Still, the plan could be a boon for President Joe Biden, whose poll numbers have slumped amid voter anxiety over the economy. Asked how the White House is weighing the potential inflationary impact of any proposal, Biden’s top economic adviser instead emphasized benefits of the bill.

“We are very much hoping that we can see a balanced package,” National Economic Council Director Lael Brainard said Thursday. “But what is critical for the president is that the child tax credit be extended and particularly be made available for low and moderate income families, because it is so powerful in reducing child poverty.”

Child Credit

The child tax credit boost on the table as of last week wouldn’t be nearly as much as the Covid-era version, which took the maximum credit from $2,000 to $3,600 per child. It’s also not fully refundable for those without tax burdens, nor would it be paid monthly. Those details could change, as many Democrats vow to block the current deal.

Nancy Vanden Houten, a lead economist at Oxford Economics, said the overall size of the tax package wouldn’t be enough to derail her view that the Fed will cut rates in May.

“The impact on the broader economy would be relatively small, and probably not enough to change our forecast for inflation and the Fed,” Houten said.

At the very least, the tax negotiations underscore that lawmakers remain a long way from entering an era of austerity even amid warnings from ratings firms and investors that the US fiscal trajectory is unsustainable.

Tax Season

Moody’s Investors Service in November warned it could downgrade the sovereign US rating because of wider budget deficits and political polarization. It lowered the outlook to negative from stable while affirming the grade at Aaa. Fitch Ratings downgraded the US in August.

If the tax proposal is agreed, negotiators are aiming for Congress to enact it before the Jan. 29 start of the annual tax-filing season.

“If it passes, it just becomes another shot in the arm for an economy that maybe does, or maybe doesn’t, need it,” said Owen Tedford, a senior research analyst at Beacon Policy Advisors LLC.

–With assistance from Erik Wasson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Bitcoin (BTC) has experienced little price movement this week and is up by only 0.25% in seven days, according to data from CoinMarketCap. Following the announcement on Wednesday that federal interest rates will remain at their current level, the premier cryptocurrency showed the expected reaction, maintaining its price above $27,000.

However, over the last two days, Bitcoin has witnessed a slight price decline of 2%. As the most-priced blockchain asset now hovers around $26,500, crypto analyst Captain Faibik has predicted an incoming bullish run, which may see BTC close out 2023 with impressive gains.

Analyst Says Bitcoin Is Poised For 30% Gain Soon

On Saturday, Captain Faibik shared on X (formerly Twitter) with his 65,000 followers a Bitcoin price forecast. Using data from Tradingview, the analyst stated that Bitcoin is currently experiencing a consolidation in a falling wedge stretching as far back as March 2023.

According to Faibik, the asset is also likely to remain in this wedge all through October, reaching as low as $23,000. Upon testing this price level, Faibik predicts Bitcoin could experience a price breakout and embark on a strong bullish run.

$BTC continues its Consolidation within the Wedge.

I anticipate Bitcoin staying within the wedge through October, Possibly testing the 23k area before an upside Breakout.

34,500 is Programmed in November. ✍️#Crypto #Bitcoin #BTC pic.twitter.com/gjMMZNGrAJ

— Captain Faibik (@CryptoFaibik) September 23, 2023

To explain, a falling wedge pattern is generally interpreted as a bullish signal. It usually suggests that a bearish trend is losing momentum, and a price reversal could soon occur.

If this pattern holds true in the present Bitcoin market, Captain Faibik predicts Bitcoin could start rising in November, attaining a price of $34,500 in January 2024. Such price gain would mark a 30% increase in Bitcoin’s current price.

As usual, there are no guarantees no this prediction as the crypto market is subject to various factors. Investors are advised to conduct proper personal research before making investment decisions.

Bitcoin Non-Whales Attain New Levels Of Market Supply

In other news, Bitcoin non-whales, defined generally as addresses holding under 100 BTC, have increased their total holdings in the BTC market.

According to data from Santiment, these wallet addresses have acquired 2.4% of BTC’s supply from October 2022 and now account for an all-time high value of 41.1% of Bitcoin’s available supply.

On the other hand, BTC whales, defined as addresses holding 100-100,000 BTC, have dumped 0.9% of BTC since early June and now account for 55.5% of BTC’s available supply, their lowest level of market dominance since May.

At the time of writing, BTC now trades at around $26,574, with a 0.07% decline in the last day. The token’s daily trading volume is also down by 29.95% and is valued at $9.17 billion. With a market cap of $517.19 billion, Bitcoin retains its spot as the largest cryptocurrency in the market.

BTC trading at $26,569 on the hourly chart | Source: BTCUSDT chart on Tradingview.com

Featured image from Investing News Network, chart from Tradingview

DraftKings top investor backs CoinScan to become ‘home page’ for crypto analytics

Crypto analytics platform CoinScan secured $6.3 million in a funding round that included Shalom MecKenzie, DraftKings’ largest private shareholder.

Per a Sept. 21 statement shared with CryptoSlate, CoinScan differs from other analytics platforms, providing free in-depth crypto charts alongside security features to give traders an edge in the market.

How CoinScan plans to revolutionize crypto analytics

CoinScan is set to bolster trader security by offering invaluable insights into crypto risks and rewards. The platform is rolling out a suite of protective features to combat scams, including a safety check, holder analysis, airdrop analysis, and social sentiment.

Furthermore, CoinScan aims to address the issues of price inconsistency and potential bias that plague some platforms. It intends to achieve this by providing in-depth charting insights and sourcing transparent data from diverse market channels.

CoinScan also introduces its pending transactions feature, allowing traders to preview a token’s price trajectory before confirming their transactions. Similarly, CoinScan’s market navigation page equips traders with the tools to compare and scrutinize similar tokens before investment decisions.

CoinScan’s CEO, Eliran Ouzan, underscores the platform’s mission of creating the crypto data solution they wished existed. He emphasizes the value of streamlining research and analysis processes to protect against scams, recognizing that nobody wants to spend excessive time navigating the intricacies of crypto data.

“We’re not just giving traders an edge, we’re introducing tools that allow new investors to enter the market with free, accessible, unbiased information that will allow them to succeed,” Ouzan added.

MecKenzie compared crypto to sports betting in his remarks and noted that users deserve tools that would provide risk and reward data. He added:

“CoinScan is introducing a hub of crypto information that users can finally trust for accurate, real-time insights. I see CoinScan as becoming the home page for anyone involved in the crypto industry.”

The post DraftKings top investor backs CoinScan to become ‘home page’ for crypto analytics appeared first on CryptoSlate.