Oil prices edged lower early Thursday.

Source link

backtoback

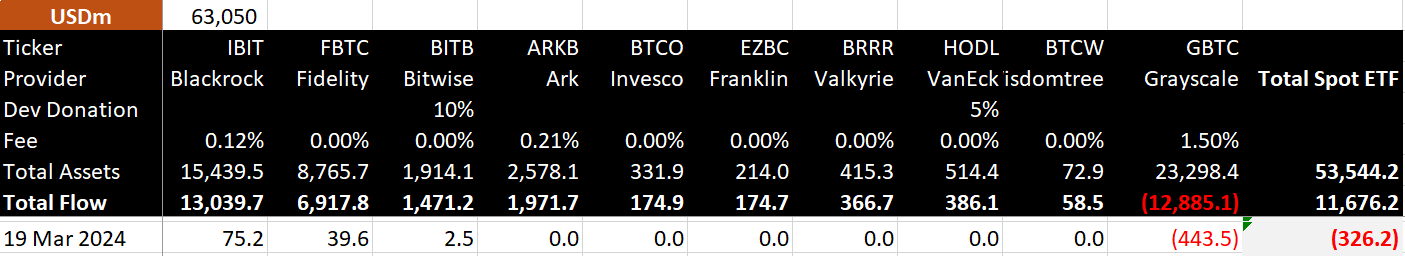

First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow

Bitcoin ETFs saw a second day of outflows on March 19, the first instances of back-to-back outflows since Jan 25. Net outflows totaled $362 million, with Grayscale accounting for all outflows at $443 million. Most funds saw no net movement, with BlackRock, Fidelity, and Bitwise seeing inflows, according to Bitmex Research.

BlackRock recorded just $75 million, Fidelity $39 million, and Bitwise $2.5 million in inflows on a rare poor performance day for the record-breaking Newborn Nine.

On a positive note, while Bitcoin fell approximately 9% on the day, the net outflows amounted to only 2.7% of total inflows since launch and 0.6% of total assets under management.

Further, $117 million was added to funds on a confidently ‘red’ day for Bitcoin. BlackRock, Fidelity, Bitwise, Ark Invest, Franklin Templeton, and Valkyrie are yet to post a single day of net outflows from their funds, regardless of volatility.

The lack of outflows from many funds can be seen as a bullish indicator, as authorized participants appear reluctant to sell Bitcoin even at prices above $60,000.

The post First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow appeared first on CryptoSlate.

Oil prices notch back-to-back gains after suspension of Red Sea shipments

Oil futures notched a second gain in a row Tuesday to settle at a more than two-week high as recent attacks on ships in the Red Sea stoked worries over potential supply disruptions.

Price action

-

West Texas Intermediate crude for January delivery

CL.1,

+1.53% CLF24,

+1.53%

gained 97 cents, or 1.3%, to settle at $73.44 a barrel on the New York Mercantile Exchange on the contract’s expiration day, marking the highest finish since Dec. 1, according to Dow Jones Market Data. February WTI crude

CLG24,

+1.85% ,

which became the front month at the end of the session, added $1.12, or 1.5%, to $73.94. -

February Brent crude

BRN00,

+0.06% BRNG24,

+0.06% ,

the global benchmark, rose $1.28, or 1.6%, to $79.23 a barrel on ICE Futures Europe, the highest finish since Nov. 30. -

January gasoline

RBF24,

+1.80%

tacked on 1.9% to $2.20 a gallon, while January heating oil

HOF24,

+2.03%

climbed nearly 1.7% to $2.72 a gallon. -

Natural gas for January delivery

NGF24,

+2.40%

settled at $2.49 per million British thermal units, down 0.4%.

Market drivers

Brent crude settled Tuesday at its lowest level since late November, while WTI crude ended at a more than two-week high, with the latest support for prices tied to Monday’s news that oil major BP PLC

BP,

BP,

said it was temporarily suspending shipments through the Red Sea.

Read more: Attacks in the Red Sea add to global shipping woes

Several shipping companies had previously announced they would pause shipments due to a series of drone and missile attacks by Houthi rebels, who largely control Yemen, since the start of the Israel-Hamas war.

The “longer-term impact on oil prices of Houthis’ attacks on oil tankers through the Red Sea is a complicated one, but the attacks do have immediate repercussions: delay in delivery of crude and higher shipping costs,” said Fawad Razaqzada, market analyst at City Index and FOREX.com, in emailed commentary.

Given that, “the oil price gains are justified,” he said in market commentary. Still, it’s “very difficult to say how long the gains will last for, or how much higher will prices go from here on, just on the back of this factor alone.”

Read The Year Ahead: Why oil may not see a return to $100 a barrel in 2024

Crude prices had risen modestly after the Oct. 7 Hamas attack on southern Israel on fears of a wider conflict, but soon gave up those gains to trade at roughly six-month lows early last week before seeing a modest bounce.

“As the holiday season approaches, a stable outcome for the region looks elusive,” said Stephen Innes, managing partner at SPI Asset Management, in market commentary. “The longer the war in Gaza rages on, the escalating humanitarian crisis may intensify political pressure on various actors, potentially leading to an expansion of the conflict.”

““The longer the war in Gaza rages on, the escalating humanitarian crisis may intensify political pressure on various actors, potentially leading to an expansion of the conflict.” ”

— Stephen Innes, SPI Asset Management

And “in the midst of rocket attacks and bombings, the fog of war increases the likelihood of unpredictable events and significant miscalculations, potentially resulting in further escalation,” said Innes.

U.S. stocks finished mixed on Monday ahead of the next major inflation update and a possible federal government shutdown later this week.

What happened

-

The Dow Jones Industrial Average

DJIA

finished up by 54.77 points, or 0.2%, at 34,337.87, its highest closing level since Sept. 20, according to Dow Jones Market Data. -

The S&P 500

SPX

closed down by 3.69 points, or almost 0.1%, at 4,411.55. -

The Nasdaq Composite

COMP

ended down by 30.36 points, or 0.2%, at 13,767.74.

On Friday, the Dow, S&P 500 and Nasdaq Composite had all climbed to score back-to-back weekly gains.

What drove markets

A cautious tone prevailed to start the new week as investors waited for the U.S. consumer-price-index report for October, due on Tuesday, which has the ability to underpin the recent bull run seen in U.S. stocks or to bring it to a halt.

The Dow Jones had jumped 5.8% over the two weeks that ended last Friday, helped by benchmark borrowing costs

BX:TMUBMUSD10Y

falling swiftly from 16-year highs on hopes inflation can ease further and that the Federal Reserve is done with interest-rate increases.

Treasury yields finished little changed on Monday, with the rate on the 10-year note at 4.631%, as investors and traders shifted into wait-and-see mode.

Read: Stock-market rally faces make-or-break moment. How to play U.S. October inflation data.

Economists expect core CPI growth — a measurement that strips out volatile items such as food and energy — to remain steady at 0.3% month over month, though Wall Street sees the likelihood of a higher-than-expected annual core rate of 4.2%.

See: This week’s October inflation data looms large on Washington’s economic radar

The producer-price report for October will be published on Wednesday. October retail-sales data is also on the docket this week and will offer further clues to the health of the consumer on Wednesday.

“We obviously have a big inflation data print tomorrow and think markets will generally get what they’re looking for, which is a slow decline in headline inflation,” said John Luke Tyner, a portfolio manager at Alabama-based Aptus Capital Advisors, which manages about $5 billion. “But there’s still a tug of war playing out, with markets getting ahead of the Fed and betting on inflation coming down faster than expected and on rate cuts occurring sooner rather than later.”

Meanwhile, worries over a dysfunctional government contributed to Moody’s Investors Service cutting its outlook on the U.S. sovereign credit rating to negative from stable late Friday.

While the decision by Moody’s is “important,” the possibility of a partial shutdown of the federal government this week is what’s leading to a “more jittery feel” in markets, Tyner said via phone on Monday.

Analysts see a 40% chance that a government shutdown will occur.

Also see: House Republicans look to pass two-step package to avoid partial government shutdown

“We don’t see the decision by Moody’s as having a large and immediate impact on the view the global investment markets hold for U.S. Treasurys,” said Brent Schutte, chief investment officer at Milwaukee-based Northwestern Mutual Wealth Management. “However, it’s important to remember that the country’s annual interest costs on servicing its debt are rising.”

With interest payments taking up more resources in the budget, “it is likely borrowing costs will become an issue that restricts future government spending,” Schutte wrote in weekly commentary distributed on Monday. “This could mean that we may see an erosion of the ultra favorable backdrop for risk-taking that has existed over much of the prior decade.”

Investors will also be keeping an eye out for reports from retailers, including Home Depot Inc.

HD,

on Tuesday, Target Corp.

TGT,

on Wednesday and Walmart Inc.

WMT,

on Thursday, as third-quarter earnings season comes to an end. Their comments on the health of the consumer may also play into thinking about the Fed.

Earnings Watch: Retail earnings begin this week. ‘It’s getting worse,’ an analyst says.

Through last Friday, 92% of S&P 500 companies had reported third-quarter results, according to FactSet. Of those that reported, 81% saw a positive surprise on earnings, while 61% reported a positive surprise on revenue. The year-over-year growth rate for the S&P 500 in the third quarter was on track to come in at 4.1%, according to FactSet, which if realized would mark the first quarter of positive year-over-year growth since the third quarter of last year.

The U.S. budget deficit narrowed in October, data showed on Monday.

Companies in focus

-

Shares of Dow component Boeing Co.

BA,

+4.01%

finished 4% higher after a flurry of news. Bloomberg reported Monday that the Chinese government is close to lifting a freeze on commercial sales of the U.S. company’s 737 Max aircraft. Elsewhere, long-haul carrier Emirates announced at the Dubai Airshow that it would buy $52 billion of the Boeing planes, and SunExpress, a joint venture between Turkish Airlines and Lufthansa

LHA,

+1.83% ,

said it would purchase 90 of the 737 Max jets. -

Shares of Nvidia Corp.

NVDA,

+0.59%

closed up by 0.6% after the company introduced its new artificial-intelligence chip. -

Collective Audience Inc. shares

CAUD,

-19.19%

ended 19.2% lower, weighed down by its blank-check merger with digital marketing business DLQ, which was a unit of Logiq.

Jamie Chisholm contributed.