This weekend, many are intrigued by the potential outcomes following the cessation of the U.S. Federal Reserve’s Bank Term Funding Program (BTFP), launched amidst the significant banking collapses in March 2023. Some argue that the banking turmoil is far from over, suggesting it has merely been postponed, with institutions like New York Community Bancorp (NYCB) […]

This weekend, many are intrigued by the potential outcomes following the cessation of the U.S. Federal Reserve’s Bank Term Funding Program (BTFP), launched amidst the significant banking collapses in March 2023. Some argue that the banking turmoil is far from over, suggesting it has merely been postponed, with institutions like New York Community Bancorp (NYCB) […]

Source link

Banking

US banking groups lobby SEC for rule change to enter Bitcoin ETF market

Multiple US banking groups are seeking inclusion in the Bitcoin exchange-traded funds (ETFs) landscape, prompting a request for a rule change to facilitate their participation.

In a Feb. 14 letter to SEC Chair Gary Gensler, a coalition comprising the Bank Policy Institute, the American Bankers Association, the Securities Industry and Financial Markets Association, and the Financial Services Forum advocated their stance.

Crypto custodial

The coalition urged the SEC to reassess a regulation that made it expensive for traditional banks to offer crypto custody services. Current rules require these financial institutions to classify cryptocurrencies as liabilities on their balance sheets. Therefore, the banks must allocate assets equivalent to the crypto holdings to mitigate potential losses and adhere to the strict regulatory capital requirements.

The coalition contended that this rule hampered them from acting as custodians for the newly introduced Bitcoin ETFs, a role they commonly undertook for most other Exchange-Traded Products (ETPs). This limitation, the group argued, stemmed from factors such as the “Tier 1 capital ratio and other reserve and capital requirements.”

They added:

“If regulated banking organizations are effectively precluded from providing digital asset safeguarding services at scale, investors and customers, and ultimately the financial system, will be worse off, with the market limited to custody providers that do not afford their customers the legal and supervisory protections provided by federally-regulated banking organizations.”

The group further emphasized the need to mitigate the concentration risk of a single non-bank entity dominating the custodial services for these Bitcoin ETFs. According to the group, allowing prudentially regulated banks to offer custodial services for SEC-regulated ETFs, akin to qualified non-bank asset custodians, could address this concern.

Coinbase, the largest US-based crypto trading platform, is the unnamed non-bank entity mentioned in the letter. The exchange serves as the asset custodian for 8 of the ETF issuers.

Recommendations

The group urged the SEC to refine the definition of crypto outlined in Staff Accounting Bulletin 121 (SAB 121) to exclude traditional financial assets recorded or transferred on blockchain networks.

“SAB 121 makes no distinction between asset types and use cases, but instead generally states that crypto-assets pose certain technological, legal, and regulatory risks requiring on-balance sheet treatment,” they added.

Additionally, they proposed exempting banks from the on-balance sheet requirements while upholding disclosure obligations. This approach would enable banks to partake in select crypto activities while maintaining transparency for investors.

BEIJNG, CHINA – NOVEMBER 13: Illuminated skyscrapers stand at the central business district at sunset on November 13, 2023 in Beijing, China. (Photo by Gao Zehong/VCG via Getty Images)

Vcg | Visual China Group | Getty Images

The chief executive of the Institute of International Finance warned Tuesday that policymakers need to swiftly address record levels of global debt, describing the brewing crisis as a “huge fiscal problem.”

IIF CEO Tim Adams sounded the alarm on rising levels of debt while speaking to CNBC’s Silvia Amaro at the World Economic Forum in Davos, Switzerland.

His comments come at a time when the issue has largely been overshadowed at the WEF’s annual meeting, which runs through to Friday, with the rise of artificial intelligence and conflicts in the Middle East and Ukraine high on the forum’s agenda.

“We have a debt problem globally. We have the highest levels of debt in a nonwar period in modern history and it’s at the corporate, household, sovereign, sub-sovereign [levels],” Adams said.

“We have a huge fiscal problem everywhere, including the U.S. We’re running [a] deficit at 7% of GDP. We need sobriety and we need to focus on how we are going to get our fiscal house in order,” he added.

The global banking industry’s premier trade group said late last year that worldwide debt climbed to a record of $307.4 trillion in the third quarter of 2023, with a substantial increase in both high-income countries and emerging markets.

The IIF said it expected global debt to reach $310 trillion by the end of 2023, warning that elections in more than 50 countries and regions this year could usher in a shift toward populism that brings with it still-higher debt levels.

“I worry about geopolitics every day,” Adams said. “I think this will be a challenging year.”

Asked whether high levels of global public debt mattered at a time when major central banks are poised to cut interest rates, Adams replied: “It matters because of demographics. We have aging populations in so many parts of the world, from China to across Europe to the U.S. and Japan.”

“We need to build that capacity and deal with that huge debt overhang going forward. And this is in peacetime, so the question is how to do we do this quickly and in an intelligent fashion. But we all need to focus on the fiscal imbalances.”

Bank stocks surge after inflation report, regional banking ETF on pace for biggest gain since 2021

Exchange-traded funds that buy bank stocks were surging Tuesday after a reading on inflation was softer than Wall Street analysts expected.

Shares of the SPDR S&P Regional Banking ETF

KRE

were soaring 7.8% on Tuesday afternoon, on track for their largest percentage increase since January 2021, according to Dow Jones Market Data. The Invesco KBW Bank ETF

KBWB,

which holds major Wall Street banks, was up slightly more than 5%, putting it on pace for its biggest daily jump since November 2022.

U.S. bank stocks are jumping as U.S. Treasury yields tumble after fresh data Tuesday from the consumer-price-index showed headline inflation was flat in October. Regional banks had been hammered earlier this year on investor worries that elevated Treasury yields were pressuring their balance sheets, after Silicon Valley Bank collapsed in March.

While Treasury yields were falling Tuesday, they remain up so far this year in the wake of the Federal Reserve aggressively raising its benchmark interest rate to tame the hottest inflation in decades. The annual pace of inflation ran as hot as 9.1% in June 2022, as measured by the consumer-price index.

Inflation has fallen from its 2022 peak, with the consumer-price index showing further signs of easing in October. The rate of headline CPI data slowed year over year to 3.2%, from 3.7% in the 12 months through September, according to a report Tuesday from the Bureau of Labor Statistics. The Fed has been aiming to bring inflation down to its 2% target.

Meanwhile, the yield on the 10-year Treasury note

BX:TMUBMUSD10Y

was down about 17 basis points on Tuesday morning at around 4.45%, according to FactSet data, at last check.

The top three holdings of the SPDR S&P Regional Banking ETF on Nov. 13 were Truist Financial Corp.

TFC,

First Horizon Corp.

FHN,

and M&T Bank Corp.

MTB,

according to data on the website of State Street Global Advisors.

Invesco KBW Bank ETF’s biggest holdings on that same date included Goldman Sachs Group Inc.

GS,

JPMorgan Chase & Co.

JPM,

Wells Fargo & Co.

WFC,

Bank of America Corp.

BAC,

Morgan Stanley

MS,

and Citigroup Inc.

C,

portfolio data on Invesco’s website show.

Goldman shares were trading 3.7% higher on Tuesday, ranking among the best-performing stocks in the Dow Jones Industrial Average in the morning trading session, according to FactSet data, at last check.

The U.S. stock market was broadly seeing sharp gains Tuesday morning, with the Dow

DJIA

jumping more than 500 points, or 1.6%, while the S&P 500

SPX

climbed 2% and the Nasdaq Composite

COMP

advancing 2.3%, according to FactSet data, at last check.

Tuesday’s big gains for bank ETFs aren’t close to erasing losses seen so far this year.

SPDR S&P Regional Banking ETF remains down around 24% in 2023, while the Invesco KBW Bank ETF has slumped more than 18% year to date, according to FactSet data, at last check.

Japanese banking giant Nomura launches ETH fund via crypto unit Laser Digital

Japan’s largest investment bank, Nomura Holdings, is launching an Ethereum-based fund for institutional investors through its digital assets subsidiary Laser Digital Asset Management, according to a Nov. 9 press release.

The “Laser Digital Ethereum Adoption Fund SP” fund marks the second installment in a series of digital adoption investment solutions introduced by Laser Digital following the launch of the Laser Digital Bitcoin Adoption Fund in September.

Ethereum Adoption Fund

The new fund will primarily target long-only spot positions in Ethereum. It enhances yield through an innovative strategy that involves staking the ETH held by the fund. The fund is managed as a segregated portfolio within Laser Digital Funds SPC, a segregated portfolio company registered in the Cayman Islands.

Laser Digital has partnered with Komainu as custodian for the fund’s assets. The company also serves as the custodian for Laser Digital’s Bitcoin fund. Komainu is regulated under the U.K. Financial Conduct Authority and the Virtual Asset Regulatory Authority in Dubai.

Laser Digital Asset Management head and former Nomura Chief Scientist Officer Sebastian Guglietta said the company views Ethereum as the technological catalyst that will digitize the economy. He added that in the long run, exposure to Ethereum is crucial to capturing the structural technology trend of the web 3 economy.

Meanwhile, Laser Digital Asset Management head of distribution Fiona King said the fund will simplify investing in digital assets and provide a secure way for institutional investors to gain exposure to the industry as it is fully regulated.

ETH spikes amid positive news

Beyond the Nomura announcement, documents surfaced on Nov. 9 showing that BlackRock has registered an Ethereum-based exchange-traded fund (ETF) in the state of Delaware on the same day.

The ETF was registered under the name iShares Ethereum Trust. BlackRock similarly filed its Bitcoin ETF a week before applying with the SEC.

News of large traditional financial institutions diving into Ethereum has caused the token to rally and break past the $2000 resistance level. ETH was trading at $2,007 at press time — more than 5.8% over 24 hours, according to CryptoSlate data.

The European Banking Authority (EBA) — the European Union’s banking watchdog — has proposed a new set of guidelines for stablecoin issuers that will set minimum capital and liquidity requirements.

The new liquidity guidelines aim to ensure the stablecoin can be quickly redeemed even during turbulent market conditions to avoid the risk of bank runs and contagion in a crisis.

Under the proposed liquidity guidelines, stablecoin issuers must offer any stablecoin backed by a currency that is fully redeemable at par to investors. The official proposal by the EBA noted that the stablecoin liquidity guidelines will act as a liquidity stress test for stablecoin issuers.

The EBA believes the stress test will highlight any shortcomings and lack of liquidity for the stablecoin, which can help the authority to only approve fully-backed stablecoins with enough of a liquidity buffer. The guidelines state:

“The liquidity stress testing will help issuers of tokens to better manage their reserve of assets and generally their liquidity risk. Based on the outcome of the liquidity stress testing, the EBA or, where applicable, the relevant competent authority/supervisor, may decide to strengthen the liquidity requirements of the issuer.”

Once approved, the guidelines are set to come into effect from early 2024. After implementing the guidelines, the authorities will have the power to strengthen the liquidity requirements of the relevant issuer to cover those risks based on the outcome of the liquidity stress testing.

Related: Binance plans to delist stablecoins in Europe, citing MiCA compliance

The proposed liquidity rules are aimed at issuers of stablecoins, which can be non-bank institutions, requiring them to meet the same safeguards and avoid unfair capital or liquidity advantages over banks. Currently, the proposal is in the consultation phase, where the general public can give their input. The public consultation phase is open for three months until a public hearing is scheduled on Jan. 30, 2024.

Magazine: ‘AI has killed the industry’: EasyTranslate boss on adapting to change

Goldman Sachs Says Utilities and Consumer Staples Stocks Are Set to Outperform as the Presidential Election Approaches — Here Are 2 Names the Banking Giant Likes

Almost exactly a year from now, Americans will cast their ballots and vote for a President, doing so for the 60th time since 1788. The election process will kick off in earnest on January 15th when the Iowa Republican caucuses mark the official commencement of primary season.

Right on time, says Goldman Sachs’ Chief U.S. Equity Strategist David Kostin, investors have started asking how the 2024 election will impact the stock market.

Going by the history books, it’s not going to be a vintage year. In the 12 months heading into an election, since 1932, the S&P 500 has averaged a return of 7%, below the 9% average return seen in non-election years. In fact, recent performance has been even worse; since 1984, the S&P 500 has posted an average return of only 4% in the preceding 12 months of an election.

So, what should investors specifically focus on during the next year? “Profit growth is typically strong in election years while valuations move sideways,” Kostin noted. “Info Tech has usually been the worst performing sector in the year ahead of the election. Defensive sectors tend to perform best, led by Utilities and Consumer Staples.”

Against this backdrop, Goldman Sachs analysts have pinpointed two stocks in these defensive sectors worth examining closely. We’ve decided to give them a closer look and for a fuller view of their prospects we ran them through the TipRanks database. Here’s what we found.

Don’t miss

Sempra (SRE)

Starting with the Utilities sector, we’ll explore Sempra, an energy infrastructure company that ranks among the largest regulated providers of electricity and natural gas services in the United States. Sempra primarily serves approximately 40 million customers in Southern California and Texas.

The company’s operations are organized into distinct segments, which include San Diego Gas and Electric Company (SDG&E), Southern California Gas Company (SoCalGas), Sempra Texas Utilities, Sempra Mexico, and Sempra LNG. By the numbers, at the end of 2022, the company boasted of $79 billion in total assets while Sempra oversees a 20,000-strong workforce spread across its family of businesses.

The company only recently released its Q3 earnings report, showing mixed results. On the one hand, revenue fell by 8% year-over-year to $3.33 billion, while missing the Street’s forecast by $350 million. However, Sempra fared much better at the other end of the equation, with Q3 adj. earnings rising from $622 million in the year-ago period, or 0.98 per diluted share, to $685 million, or $1.08 per diluted share, thereby outpacing analyst expectations by $0.07.

On the back of the strong performance seen during the first 9 months of the year, for the full year, the company now expects adj. earnings to come in above or at the high-end of its guided range of $4.30 to $4.60 vs. Street expectations of $4.49.

Scanning these results, Goldman Sachs analyst Carly Davenport finds plenty to like about the latest display whilst noting the catalysts ahead.

“This quarter increased our conviction that SRE’s Texas utility Oncor is a material strength for the company. The reduction of regulatory lag, potential increase in capex, and a clear runway for organic load growth in the region all highlight why we have viewed Oncor as an underappreciated asset for SRE. We believe SRE has several key catalysts ahead, including the aforementioned capex raise, the conclusion of the California GRC (general rate case), and the announcement of FID for the Cameron expansion and Port Arthur Phase 2 in 2024. SRE continues to trade at a 0.7x discount to our coverage group on our 2025 numbers, which we view as unwarranted given these strengths,” Davenport opined.

These comments underpin Davenport’s Buy rating while her $89 price target suggests shares will climb 24% higher in the months ahead. (To watch Davenport’s track record, click here)

Overall, the analyst consensus rates SRE shares a Moderate Buy based on a mix of 6 Buys and 4 Holds. The forecast calls for one-year returns of 11%, considering the average target stands at $80.56. The company also pays a regular dividend. The latest div payout reached $0.59 per share, providing a ~3.25% yield.

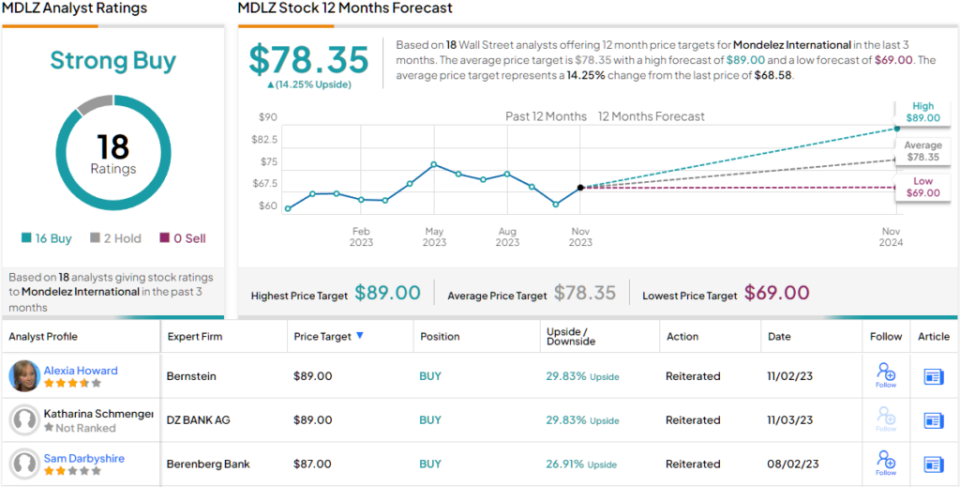

Mondelez International (MDLZ)

Let’s now turn to the Consumer Staples sector and check the details on global snack powerhouse Mondelez International. The company was created in 2012 when spun off from Kraft Foods and boasts a diverse range of iconic products, including Oreos, Cadbury, Toblerone, Ritz, and Trident, to name just a few. With a presence in more than 150 countries, Mondelez is one of the world’s biggest snack companies, claiming first global spot in biscuits (cookies and crackers) ands second in chocolate.

Last year, global net revenues reached around $31.5 billion, and the company appears on track to exceed that figure this year. In fact, in the recently released Q3 report, despite substantial reinvestment endeavors, the company bettered expectations on several fronts. Revenue reached $9.03 billion, representing a 16.4% YoY increase while beating the consensus estimate by $220 million. On the bottom-line, adj. EPS of $0.82 outdid the forecast by $0.04.

And looking ahead, the company delivered, too. Mondelez increased its FY23 organic net sales growth outlook from 12%+ beforehand to +14-15% vs. the consensus estimate of +13.8% and boosted the adj. EPS growth outlook to ~16% compared to the prior 12%.

Goldman Sachs analyst Jason English expects that strong performance to persist. “We continue to believe the company is well positioned to see widening fundamental outperformance versus Staples peers,” English said. “It is aggressively investing in both marketing and commercial activation with a long runway of distribution growth still ahead of it in markets such as Mexico, Brazil, China, India and other Southeast Asian markets. We expect this to sustain its momentum in the foreseeable future and reiterate our Buy rating in this context.”

That Buy rating is accompanied by an $82 price target, which makes room for one-year growth of 20%. (To watch English’s track record, click here)

Overall, Mondelez gets plenty of support on Wall Street. The stock claims a Strong Buy consensus rating, based on 16 Buys vs. just 2 Holds. Over the next year, shares are expected to appreciate by 14%, considering the average target stands at $78.35. Investors can also enjoy a dividend here. The latest payout stood at $0.42/share, and that offers a yield of ~2.45%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Fiat on-ramps, banking partners crucial for institutional Web3 adoption — European Blockchain Convention

Fiat payment rails and neobanking services are becoming a vital cog in driving mainstream adoption and acceptance of the wider cryptocurrency space, according to key industry figures at the intersection of traditional finance and Web3.

Executives from OpenPayd, Ramp Network and Damex unpacked the increasing importance of third-party payment rails and banking platforms in conversation with Cointelegraph during the recent European Blockchain Convention hosted in Barcelona.

OpenPayd CEO Iana Dimitrova outlined how their firm processes over 3 billion euros of monthly transaction volume and has issued over two million accounts, including several prominent cryptocurrency exchanges, including the likes of Crypto.com.

As Dimitrova explained, OpenPayd’s core offering is banking and payments infrastructure for various industries including the cryptocurrency space.

“The reality is that there is a growing level of mistrust on behalf of both regulators as well as traditional holders of access to payment rails, whether that’s SEPA or SWIFT, banks or systems that manage the payment rails insofar as the crypto world is concerned,” Dimitrova said.

The CEO added that fiat on-ramps and payment rails could bridge the gap by addressing concerns around identity and traceability, “ergo money laundering,” which she says remains a perception held by traditional financial institutions and regulators.

Samuel Rondot, the managing director of Damex, unpacked how the Gibraltar-based firm specializes in providing fiat on and off-ramps for “higher risk category clients,” including iGaming, Forex, family offices and hedge funds. The company typically converts large amounts of cryptocurrency to fiat and vice versa in euro, British pounds and United States dollars.

Damex’s clients deal with reputational issues with their bank accounts on an almost daily basis because they want to interact with the cryptocurrency ecosystem. Pondering why banks remain “allergic to crypto,” Rondot suggests that the problem comes from a misunderstanding “of the tool and the principle.”

Related: Crypto payment solution Ramp expands on-ramp service, adds support for 40 fiat currencies

This has led to the creation of services like OpenPayd and Ramp, which are beginning to fill the role of specialist actors that understand and facilitate Anti-Money Laundering and Know Your Customer processes and act as a third party, “shielding” traditional banks from directly dealing with cryptocurrency-related businesses.

“Let’s say you do a crypto-to-fiat payment with an OpenPayd IBAN. You then move this money toward your main bank account. It’s a completely different process, and the bank will not have a problem with that,” Rondot said.

The Damex exec highlighted the importance of these services in carrying out the necessary due diligence, mixed with the willingness to do business with crypto-related businesses, to allow fiat to flow between traditional finance and decentralized finance ecosystems.

Szymon Sypniewicz, the co-founder and CEO of Ramp Network, outlined how its services offer a single application programming interface (API) platform to the global fiat system. Ramp’s API and software development kit provide access to a regulatory-compliant tech setup that allows users to buy and sell cryptocurrencies worldwide.

As Sypniewicz explains, Ramp’s infrastructure allows crypto-related businesses to offer credit cards, debit cards, local payment methods and bank transfer functionality for users to acquire cryptocurrencies or pay for services:

“The aim here is to make the transition to crypto-enabled products so smooth and seamless that people would stop noticing that they are now interacting with an entirely new tech setup.”

When asked how difficult it is for crypto-native businesses to open bank accounts or access payment rails, all three highlight the gap between emerging and existing financial technologies as a continual pain point.

“I guess one of the main challenges that we see is that the banking technology of incumbent banks does not really correspond to the level of innovation, speed and agility that all of their products and customers require,” Dimitrova said.

She adds that is a prominent reason why infrastructure providers that can aggregate different payment rails, different banks and different channels exist.

“We can go to Szymon and give him a single API and allow him to get access to multiple countries, multiple jurisdictions, multiple currencies and have an equivalent level of service and experience across the board.”

Sypniewicz adds that the difficulty of crypto-firms getting banked comes down to how specialized they are. Platforms like Ramp effectively act as “regulatory technology specialists,” aggregating dozens of global banking and payment provider partners.

“All the regulations that you need to specialize in to be able to meet the requirements are fundamentally met by us. The end-user is able to take their crypto, and interact with your platform, wallet, NFT marketplace, or new-generation DeFi products.“

Compliance standards are another prerequisite for wider adoption and acceptance of crypto-native businesses. Sypniewicz, Dimitrova and Rondot agreed that the European Union’s Markets in Crypto-Assets (MiCA) framework will provide a common framework for Web3 and TradFi players to operate more easily.

Magazine: Slumdog billionaire: Incredible rags-to-riches tale of Polygon’s Sandeep Nailwal

J.P. Morgan Is Looking for the Silver Lining in the Current Market Headwinds — Here Are 2 Stocks the Banking Giant Likes Right Now

Market legend Warren Buffett has said of investing, “If you aren’t thinking about owning a stock for ten years, don’t even think about owning it for ten minutes.” Like most of his bon-mots, this quip embodies a basic fact about the stock markets: it’s a long-term game.

There are serious headwinds in the market today, ranging from worries over the persistently stubborn inflation and the Fed’s high-interest rate policy to a steadily worsening geopolitical situation, and investor sentiment is getting wobbly in response.

But covering the situation from the investment bank J.P. Morgan, global investment strategist Madison Faller sees a reason for investor optimism. Acknowledging the headwinds, she meets them head-on, describing these uncertain times as times of opportunity – if investors will play the long game.

In her words, “When markets are volatile, it can help to re-focus on what you want from your portfolio in the long run. The world is in transition – from pretty much any lens you look: the economy, policy, world order, technology and climate. Navigating that uncertainty can be overwhelming, but it can also be empowering… Despite the headwinds, a world in transition may offer an attractive entry point for long-term investors.”

We can follow Faller’s lead, and look for a bright side despite today’s market headwinds, taking a cue from the JPMorgan stock analysts. They’ve been pointing out two stocks they see primed for gains; we are talking returns of at least 40% over the next 12 months.

We ran them through the TipRanks database to see if there’s widespread agreement on the Street that these are both worth leaning into right now. Let’s take a closer look.

Don’t miss

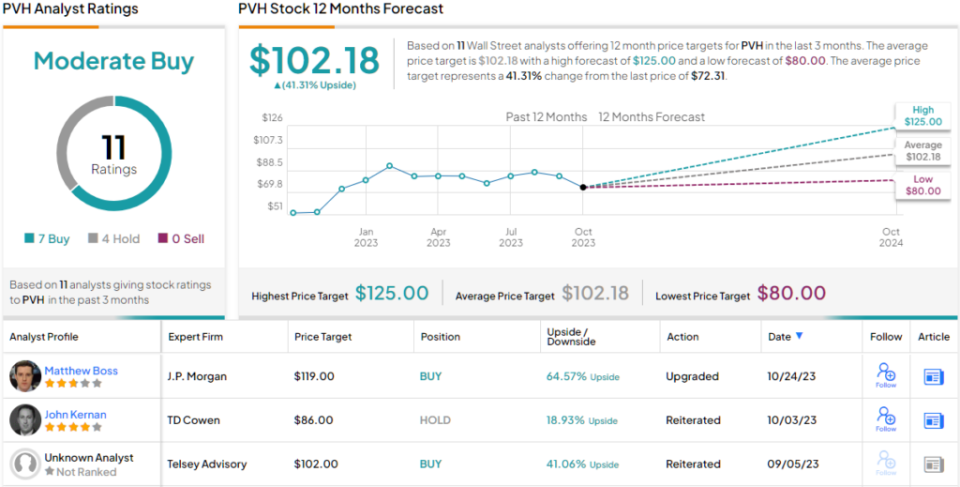

PVH Corporation (PVH)

We’ll start with PVH Corporation, a soft goods company and the owner of two of the fashion world’s best-known brand names: Calvin Klein and Tommy Hilfiger. Both are already giants in the industry, and PVH is always working to fine-tune the brands’ image and expand market share. The company’s goal is to make Calvin and Tommy the world’s most desirable lifestyle brands.

By the numbers, PVH has come a long way toward that goal. The company operates in more than 40 countries around the world and brought in nearly $9 billion in global revenue in the full year 2022. The company’s plan includes winning with its product, its customer engagement, and its digital marketing, and it does not shy away from using controversy to catch attention – as shown by its history of risqué ads for Calvin Klein.

PVH has been in business since the 1880s and today operates more than 1,000 clothing factories and approximately 6,000 retail locations. In its last quarterly financial release, for 2Q23, the company reported results described as ‘strong,’ with $2.2 billion in revenue. That was up 3.8% year-over-year and came in $20 million ahead of the forecast. The firm’s bottom-line figure, a non-GAAP EPS of $1.98, was 23 cents better than had been anticipated. For 2023 as a whole, PVH is guiding toward a revenue increase in the range of 3% to 4%. PVH’s results were supported by an 11% increase in the company’s ‘direct-to-consumer’ revenue.

In his coverage of PVH for JPMorgan, analyst Matthew Boss bases his upbeat view on the company’s demonstrated ability to deliver on its plans. He writes, “We rate PVH Overweight – with a multi-year brand ‘unlock’ underway in our view as mgmt focuses on driving increased desirability of the Calvin Klein and Tommy Hilfiger brands w/ incremental opportunity in N. America (brand whitespace & bolstered partnerships, increasing Hero product focus, and inventory reduction).”

These comments back up Boss’s Overweight (i.e. Buy), and is price target, now set at $119, implies a 64% upside by this time next year. (Watch Boss’s track record)

Overall, there are 11 recent analyst reviews on file for PVH, and their breakdown of 7 Buys and 4 Holds leads to a Moderate Buy consensus rating for the stock. The shares are trading at $72.31 with a $102.18 average price target, for a 41% upside potential in the coming year. (See PVH stock forecast)

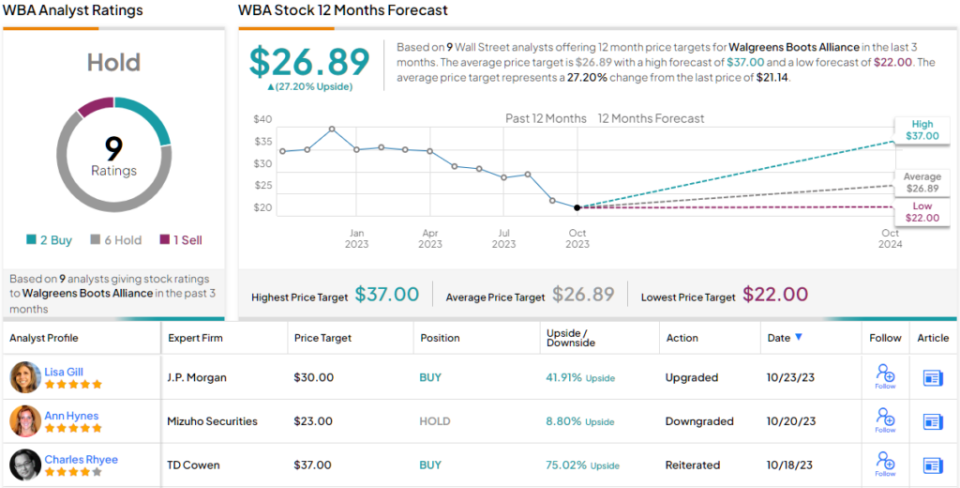

Walgreens Boots Alliance (WBA)

Now we’ll switch from clothing to the pharmacy industry, where the Illinois-based Walgreens Boots holding company is a major player in the retail pharmacy sector in both the US and the UK. The company name reflects its makeup; it is the owner of the US-based Walgreens chain and the UK-based Boots chain of retail pharmacy stores. In addition, the company owns several pharmaceutical manufacturing and distribution centers.

In all, Walgreen Boots has more than 13,000 retail locations across 9 countries, employing over 331,000 people – of whom more than 31,000 are pharmacists. The company’s largest presence is in the US, where it has 8,886 retail locations; there are another 3,989 locations in the international market.

This company has taken a hit in recent months due to the continued fading of the COVID pandemic emergency and related measures. In the firm’s recent report for fiscal 4Q23 and the full fiscal year 2023, the quarterly bottom line was down year-over-year and missed the forecast. The earnings figure, reported as 67 cents per share in non-GAAP measures, was down 18% from the year-ago period and was 2 cents below the estimates.

The earnings miss came even as Walgreens Boots reported a solid gain in revenue. Quarterly revenue, at $35.4 billion, was up more than 9% year-over-year and came in $580 million over the forecast. For the full fiscal year, which ended on August 31, the company’s top line rose ~5%, to $139.1 billion.

Walgreens Boots pays out a solid dividend to shareholders, and on October 26 declared the next payment, set to go out on December 12, at 48 cents per common share. This annualizes to $1.92 per share, and gives a yield of 9%. In an impressive metric that dividend-minded investors should note, Walgreens Boots, and its predecessor, Walgreens Co., has not missed a dividend payment in 91 years.

5-star analyst Lisa Gill covers this stock for JPMorgan, and her positive outlook is based on a combination of factors, including good risk-reward, improved management, and a favorable valuation.

“We see the new leadership team and FY24 guidance as creating a relatively favorable risk/reward balance. Our rating is predicated on an upgraded management team executing vs an achievable bar from trough results and a valuation that appears to more than incorporate the uncertainty of the current situation. While this does require that WBA executes on a proof-of-concept and shows consistency and credibility in its guide, we think that there is upside to the current range based on this as the company progresses through FY24 and clears some overhangs around debt and the dividend,” Gill opined.

Quantifying this stance, Gill rates WBA an Overweight (i.e. Buy), and sets a price target of $30 to point toward a ~42% upside for the next 12 months. (Watch Gill’s track record)

While Gill’s outlook is bullish, the consensus from the Street is more cautious. WBA shares have a Hold (i.e. Neutral) consensus rating, based on 9 recent analyst reviews that include 2 Buys, 6 Holds, and 1 Sell. However, the $26.89 average target price suggests a potential one-year upside of 27% from current levels. (See WBA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Bank of America Says Bullish Indicators Point to a Higher Stock Market — Here Are 2 Names the Banking Giant Likes

The markets have mostly been in a downtrend since midway through the summer, with a pensive mood driving the narrative. Concerns include higher oil prices, the prospect of interest rates remaining elevated for the time being, while worries about a recession are yet to abate.

However, a new note from Bank of America’s head of US equity & quantitative strategy, Savita Subramanian, sets out the bullish case for the final quarter of 2023.

“I see far more bullish indicators for mid and large-cap stocks than I do bearish,” Subramanian noted. “What I find interesting is that every day a new bearish narrative emerges.”

Those ‘bullish indicators’ include the opportunities remaining for those yet to reap the benefits of AI, a ‘renaissance’ for US manufacturing, and the fact that everyone is now getting bearish, which is usually a good sign that the markets are about to take off.

In fact, Subramanian thinks a recession has already been averted, and she recently raised her end-of-year target for the S&P 500 from 4,300 to 4,600, suggesting the index will add another 7.5% by the end of 2023.

So, which stocks should investors be loading up on in anticipation of the bull market’s resumption? The analysts at Bank of America have an idea about that too and have been pointing investors toward the names they think stand to gain against this backdrop. We decided to get the lowdown on a couple of their recent picks and ran them through the TipRanks database for a fuller view of their prospects. Here’s what we found.

Nutanix, Inc. (NTNX)

First up is Nutanix, a tech firm in the cloud software world. Nutanix works to solve the unique challenges of cloud software and has developed a platform to bring together public cloud simplicity and agility with private cloud performance and security, based on several sound pillars: unified management, one-click ops, and automated AI. At bottom, the company makes hybrid multi-cloud operations both simple and cost-effective for users.

Those users include an array of well-known names, including Vodafone, AAA, and Home Depot. Nutanix’s platform lets them – and all of its customers – conduct cloud operations smoothly, adding apps, deploying and managing new features, and improving storage, visualization, and networking.

Cloud computing is an expanding niche, and Nutanix has leveraged it for a turn to net profits in recent quarters. The last three quarterly reports all showed non-GAAP EPS coming in at a net profit, a switch from regular net losses, supported by rising revenues.

In the last quarter reported, for fiscal 4Q23, Nutanix had a top line of $494.2 million, up 28% year-over-year and 18% better than the forecasts. The company’s bottom line came in at 24 cents per share by non-GAAP measures, or 8 cents ahead of the forecast. In a metric that bodes well for Nutanix going forward, the company’s annual contract value (ACV) billings jumped 44% year-over-year in fiscal Q4, from $193.2 million to $278.7 million. Annual recurring revenue, or ARR, was up 30% year-over-year, rising from $1.2 billion to $1.56 billion.

Bank of America analyst Wamsi Mohan is impressed with Nutanix’s execution in recent months, writing, “We see fundamentals improving over the next few years including ACV billings, revenue, and operating margin. We see renewals driving a higher portion of ACV billings growth post F24, which can lead to more stable revenues, and expect operating leverage through lower cost of renewals. The new ‘GPT-in-a-Box’ offering, Cisco partnership and potential share gains are upside levers. We move to a Buy, from Neutral, as NTNX drives higher growth and profitability and more stable FCF.”

Mohan complements his upgraded Buy rating with a $50 price target that implies a one-year upside potential of 38%. (To watch Mohan’s track record, click here)

Overall, Nutanix has picked up a Strong Buy consensus rating from the Street’s analysts, based on 9 recent reviews that include 8 Buys and 1 Hold. The stock has a current trading price of $36.24 and an average price target of $44, suggesting ~22% gain on the one-year horizon. (See Nutanix stock forecast)

Fisker, Inc. (FSR)

The second stock we’ll look at is the brainchild of Henrik Fisker, the automotive design expert behind many of BMW’s luxury vehicles. Fisker started his eponymous car company in 2016, based in Los Angeles, to cash in on the coming electric vehicle (EV) boom. His company is designing and building the Fisker Ocean, a high-performance, all-electric SUV that entered full production earlier this year.

In its last production update, dated September 26, the Fisker company reported having made 900 customer deliveries this year and expects to deliver ‘several hundred’ more vehicles this week. These deliveries come from a total of 5,000 Fisker Oceans that have been built so far. The company expects to reach a milestone delivery pace of 300 vehicles per day to customers in the US and Europe later this year.

The switch to regular vehicle production and the jump in vehicle deliveries gave Fisker its first quarter of net positive automotive sales revenue. In the company’s 2Q23, it reported total revenue of $825,000, compared to just $10,000 one year earlier.

Realizing a positive revenue total, however modest, had an effect on Fisker’s earnings, and the company’s net loss, reported at 25 cents per share, was a noticeable improvement over the 2Q22 net loss of 36 cents per share. The 2Q23 figure came in 1 cent better than the estimates.

For Bank of America’s John Babcock, the key point here is that Fisker has started regular production and deliveries, which should lead to steadily increasing volume, revenue, and earnings heading into next year.

“FSR should see a sharp inflection in revenue, earnings and volume in 2024 with the ramp in production of the Ocean CUV. While this shouldn’t be a surprise to investors, the milestone on its own could serve as a key catalyst for the stock and particularly as the company has pushed back production targets due to supply chain issues. Ultimately, the ramp in volumes should get FSR to EBITDA breakeven in 2024 on revenues that we project will approach $3bn, up sharply from $1.2bn in 2023E and only $342k in 2022,” Babcock opined.

For Babcock, all of this points toward a Buy rating on the stock, and his price target, of $8, indicates his confidence in a 33% upside over the next few months. (To watch Babcock’s track record, click here)

All in all, Fisker’s 6 recent analyst reviews break down to 5 Buys and 1 Sell, giving this EV maker a Moderate Buy consensus rating. The stock’s average price target, now set at $10.20, implies a robust 70% gain by this time next year, from the current share price of $6. (See FSKR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.