Fisker tries to ward off bankruptcy talk, says it is still engaging with another carmaker to survive.

Source link

Bankruptcy

Email Shows Digital Currency Group and Gemini Explored Merger Before Genesis Bankruptcy

In an email found within the motion by Digital Currency Group (DCG) and Barry Silbert to dismiss the lawsuit initiated by the New York Attorney General, discussions of a potential merger between Gemini and Genesis were revealed before Genesis ultimately opted to declare bankruptcy. “Combined Gemini and Genesis would be a juggernaut and would be […]

In an email found within the motion by Digital Currency Group (DCG) and Barry Silbert to dismiss the lawsuit initiated by the New York Attorney General, discussions of a potential merger between Gemini and Genesis were revealed before Genesis ultimately opted to declare bankruptcy. “Combined Gemini and Genesis would be a juggernaut and would be […]

Source link

FTX to Sell Subsidiary Acquired for $10M to Coinlist for $500K Amid Bankruptcy Proceedings

FTX Trading Ltd. and its affiliates have announced a plan to sell a subsidiary it acquired for $10 million to Coinlist for $500,000, court documents filed on Feb. 9, 2024 show. The latest motion, filed in the United States Bankruptcy Court for the District of Delaware, details the proposed sale in order to maximize the […]

FTX Trading Ltd. and its affiliates have announced a plan to sell a subsidiary it acquired for $10 million to Coinlist for $500,000, court documents filed on Feb. 9, 2024 show. The latest motion, filed in the United States Bankruptcy Court for the District of Delaware, details the proposed sale in order to maximize the […]

Source link

Genesis’ bankruptcy plan faces pushback from parent company DCG over creditor payouts

Digital Currency Group (DCG), the parent company of the defunct crypto lender Genesis, has filed an objection against the approval of its subsidiary’s bankruptcy plan, which was created via a “clandestine approach.”

In a Feb. 5 court filing, DCG argued that Genesis’ plan aims to exceed legal obligations by overcompensating creditors. According to the firm, such action constitutes a breach of the bankruptcy code and reflects a lack of good faith.

The crypto company contends that the plan unfairly disadvantages it while eroding its fundamental economic and corporate governance privileges.

“The Debtors (Genesis), in concert with the UCC and Ad Hoc Group, have devised a cramdown plan that pays unsecured creditors hundreds of millions of dollars more than the full amount of their petition date claims—and which disproportionately favors a small controlling group of creditors over others—in violation of the Bankruptcy Code,” DCG added.

Consequently, DCG urged the court to dismiss the proposed plan, emphasizing its inability to endorse such “complex and convoluted Distribution Principles.”

Meanwhile, DCG pointed out that it was willing to “fully support a plan that provides a 100% recovery for creditors—par plus post-petition interest” if all of its concerns were met.

This is not the first time both companies have been involved in a face-off. Last year, Genesis took legal action against DCG to recoup a substantial loan exceeding $700 million, encompassing both fiat and cryptocurrency repayments slated for May 2023.

Despite DCG’s public assertion of settling the $700 million debt, a faction of the lender creditors have insisted that it remains obligated to the failed firm.

Genesis, alongside several cryptocurrency lending firms like Celsius, succumbed to the 2022 bear market turmoil. The company filed for bankruptcy in January 2023 following the suspension of withdrawals triggered by the FTX collapse in November 2022.

Since then, the lender has continued with its bankruptcy process and recently moved to liquidate $1.4 billion of its assets held in Grayscale Bitcoin Trust (GBTC), which recently converted to a spot exchange-traded fund (ETF).

A Carvana sign and signature vending machine in Tempe, Ariz.

Michael Wayland/CNBC

PHOENIX – As layoffs and cost cuts roil Wall Street, from retail and shipping to tech and media, embattled online used car sales giant Carvana says its own restructuring is in the rear view.

Carvana over the last 18 months aggressively restructured its operations and debt amid bankruptcy concerns to pivot from growth to cost-cutting. They were crucial moves for the company and its largest shareholders, including CEO and Chairman Ernie Garcia III and his father, Ernie Garcia II. The two control 88% of Carvana through special voting shares.

The efforts thus far have been successful, propelling Carvana’s stock last year from less than $5 per share to more than $55 to begin 2024 – marking a significant turnaround for the company, but still a far cry from the stock’s all-time high of more than $370 per share reached during the coronavirus pandemic in 2021. Shares closed Thursday at $42.53.

“We have every intention of continuing to make progress and don’t expect to return to a situation like that,” the younger Garcia told CNBC about the company’s dire circumstances. “I think the pressure of the last two years caused us to really focus on the most important things.”

The Tempe, Arizona-based company has taken $1.1 billion of annualized expenses out of the business; reduced headcounts by more than 4,000 people; and launched a new proprietary “Carli” software platform for end-to-end processing of vehicle reconditioning as well as other “AI,” or machine learning, systems for pricing and sales. The systems replaced previous processes that involved manually inputting data into separate systems or spreadsheets.

The result, Carvana hopes, is better footing to navigate an automotive industry that’s shifting and normalizing from a supply-constrained environment to one with less favorable pricing power for dealers.

Return to growth

Carvana has been a growth story since its initial public offering in 2017. It posted growing sales every year from its 2012 founding through 2022, when restructuring began.

The business concept of Carvana is simple: buy and sell used cars. But the process behind it is extremely complicated, labor-intensive and expensive.

Carvana puts each vehicle it intends to sell through a lengthy inspection, repair and sale preparation process. It ranges from fixing scratches, dents and other imperfections to engine and powertrain components. There’s also significant logistical costs and processes for delivering vehicles to consumers’ homes and the company’s signature car vending machines across the country.

A Ford F-150 is prepped for a painting booth at Carvana’s vehicle reconditing center outside Phoenix. The vehicle is wrapped so only the spot needed to be repainted is showing.

Michael Wayland / CNBC

In 2022, retail sales declined roughly 3%. Headed into the fourth quarter of last year, they were down a further 27%.

Carvana is currently in the “middle of step two” of a three-step restructuring that Garcia initially laid out to investors roughly a year ago.

Step 1: Drive the business to break even on an adjusted EBITDA basis. Step 2: Drive the business to significant positive unit economics, including positive free cash flow. Step 3: Return to growth.

“We’re trying to stay really focused on just building the business as best we can,” Garcia said during a rare, wide-ranging interview at a Carvana vehicle reconditioning center near Phoenix in mid-January.

The CEO, sitting under a “Don’t be a Richard” poster featuring former President Richard “Dick” Nixon (it’s one of Carvana’s six core values), says the company is largely done with taking fixed costs out of the business, but he believes there’s more room for reductions in variable costs to increase profits before returning to a growth-focused company again.

Wall Street largely agrees.

Carvana CEO and cofounder Ernie Garcia III

Screenshot

“We walked away confident that CVNA has room to further improve its cost structure and drive additional operational efficiencies. These efficiencies would come from three main areas: the further development of internal software, standardized processes, and improved training and career pathing,” said JPMorgan analyst Rajat Gupta in a December analyst note following an investor briefing and tour of a Carvana reconditioning center in Florida.

At the end of the third quarter, Carvana had $544 million in cash and cash equivalents on hand, up $228 million from the end of the previous year. The company reported total liquidity, including additional secured debt capacity and other factors, of $3.18 billion.

It recorded a record third-quarter gross profit per unit sold of $5,952, while cutting selling, general, and administrative expenses by more than $400 per unit sold compared to the prior quarter.

The company reports its fourth-quarter results on Feb. 22.

New era, new tech

At the center of much of Carvana’s cost reductions is new tech to optimize operations.

The company introduced Carli, a host of software “solutions” or apps for each part of reconditioning a vehicle. The suite of tools records inspections and reconditioning of inbound vehicles step by step, including price checks and benchmarking costs for parts and overall expenses per vehicle. It’s followed by other systems to assess market value and sales prices for each vehicle.

The systems helped contribute to $900 in cost savings per unit in retail reconditioning and inbound transport costs over past 12 months.

“We rolled Carli out across all sites. It’s a single, consistent, much more granular inventory management system,” said Doug Guan, Carvana senior director of inventory analytics, who formerly led expansion for Instacart. “That’s what we’ve been focused on for the last year and a half.”

Each vehicle that enters Carvana’s reconditioning center has a barcode sticker to assist in tracking the vehicle through its process as it prepares to be sold.

Michael Wayland / CNBC

Guan, who started at Carvana in 2020, is among a new group of hires from a variety of backgrounds that range from Silicon Valley tech startups to more traditional vehicle operations such as CarMax, Ford Motor and Nissan Motor.

Carvana’s offices, where it shares a campus with State Farm, feel a lot like a startup. On a floor housing customer support, music blares – the likes of Coldplay to Neil Diamond. A black-and-gold gong sits nearby to celebrate when costumer service reps, internally called “advocates,” assist customers in a sale, among other milestones.

Other than Carli, Carvana has built custom tools to support its inbound and outbound logistics activities that have driven down costs by about $200 per unit. These include mapping, route optimization, driver schedule management, and pickup/drop-off window availability, including same-day delivery, which the company recently launched in certain markets.

The customer care team has also recently begun piloting generative artificial intelligence for some requests, including automatically summarizing customer calls, training AI to act as an “advocate” and incorporate the company’s values: be brave; zag forward; don’t be a Richard; your next customer may be your mom; there are no sidelines; we’re all in this together.

A black-and-gold gong sits nearby to celebrate when costumer service reps, internally called “advocates,” assist customers in a sale, among other milestones.

Michael Wayland / CNBC

“Customer experience has been No. 1 at the heart of everything that we do, which I think after being here all these years, it’s amazing to say that still very, very true statement,” said Teresa Aragon, Carvana vice president of customer experience and the company’s first employee outside of its three cofounders.

In 2023, Carvana’s customer care team under Aragon handled 1.3 million calls and another 1.3 million chats and texts, according to stats posted on a bathroom flier called “Learning on the Loo” that the company confirmed.

The generative AI pilot, which is separate from Carli, has helped Carvana to reduce headcount in the department by 1,400 people while reducing processing times.

‘Never something that we considered’

Many investors are back on the Carvana bandwagon after the company managed through the last two years, but some concerns remain.

The Garcia family and its control of the company have been a target of some investors, including a lawsuit last year brought by two large North American pension funds that invested in Carvana alleging the Garcias ran a “pump-and-dump” scheme to enrich themselves. Its one of several lawsuits that have been brought against the the father-son duo in recent years, largely involving the family’s businesses.

In general, CEO Garcia said he attempts to use criticism as motivation in his “march” to lead Carvana, invoking a phrase he has regularly ended investor calls with for several years: “The march continues.”

Family ties

Carvana went public three years after spinning off from a Garcia-owned company called DriveTime, a private company owned by the elder Garcia, who remains the controlling shareholder of Carvana. DriveTime was formerly a bankrupt rental-car business known as Ugly Duckling that Garcia II, who pled guilty to bank fraud in 1990 in connection to Charles Keating’s Lincoln Savings & Loan scandal, grew into a dealership network.

Carvana has separated itself from the company but still shares many processes with DriveTime. The close link between Caravan and other Garcia-owned or -controlled companies has given some investors pause.

The Wall Street Journal in December 2021 detailed a network of Garcia companies that do business with DriveTime, Carvana or both.

Most notably, Carvana still relies on servicing and collections on automotive vehicle financing and shares revenues generated by the loans. The businesses also, at times, sell vehicles to one another and Carvana leases several facilities from DriveTime in addition to profit-sharing agreements.

For example, during 2022, 2021, and 2020, Carvana recognized $176 million, $186 million and $94 million, respectively, of commissions earned on vehicle service contracts, or VSC, also known as warranties, sold to its customers and administered by DriveTime.

Carvana sells such warranties or other service-related protections to customers, and DriveTime takes them over, giving Carvana a commission. It’s one of several multimillion-dollar transactions between the family-controlled companies.

The younger Garcia, who started Carvana while serving as treasurer at DriveTime, says completely separating from Drivetime is not a main priority at this time, as it utilizes already established systems such as the financing and servicing that aren’t core to Carvana’s operations.

Carvana’s march hasn’t always been in a straight line: The company was a darling stock of the coronavirus pandemic, as it was lightyears ahead of traditional auto retailers in selling vehicles online – a process that surged during the global health crisis and, in some states, became the only way businesses could operate due to stay-at-home orders.

But it couldn’t keep up with demand, pushing Carvana to invest billions in growth opportunities, including an acquisition of used car auction business ADESA.

Then the used vehicle market shifted and Carvana’s aggressive growth plans — which included buying thousands of vehicles from auctions and consumers at hefty premiums compared to traditional auto dealers to build inventory — became a major liability when prices declined.

Carvana’s debt grew, including the debt-funded ADESA deal, and its stock became the most shorted in the country as fears of bankruptcy and a creditor fight grew. The stock lost nearly all of its value in 2022, causing some to speculate bankruptcy may be ahead.

Garcia is adamant that he never believed bankruptcy would happen, saying “absolutely not” when asked about it. His confidence was fueled by a belief that the service Carvana offers – selling and buying used vehicles online and streamlining the tedious process of car purchasing is something consumers need and want.

He also said taking the company private – which scared some stakeholders and investors – was never a viable option: “I would say it was a thought in the sense that other people thought about it. It was never something that we considered,” Garcia said.

The inside of a Carvana sign vending machine in Tempe, Ariz.

Michael Wayland / CNBC

But Carvana’s debt load is still very much a factor.

A deal between Carvana and a group of investors who collectively owned $5.2 billion of its outstanding unsecured bonds reduced the used car retailer’s total debt outstanding by more than $1.2 billion but also kicked much of the debt to later this decade, at largely higher interest rates.

Marc Spizzirri, a senior managing director of B. Riley Advisory Services, said every restructuring is unique but in general companies need to take action quickly after taking on debt to ensure they don’t land in the same circumstances that drove the debt in the first place.

“They have to be able to service that debt,” said Spizzirri, a former franchised dealer. “It’s a classic pre-bankruptcy process and in [many companies’] minds that’s not an option for them … But they can’t keep repeating what they’ve done before.”

Carvana’s new notes will mature in 2028; the old notes, which carry interest rates ranging from just under 5% to more than 10%, are due between 2025 and 2030. The old and new notes make up roughly 78% of Carvana’s nearly $6 billion total debt.

For now, the march continues for Carvana.

Terraform Labs filed for bankruptcy to protect against potential SEC money judgment

Terraform Labs, the brains behind the Terra blockchain network, opted for bankruptcy protection as a strategic move against any “potential money judgment” that could be enforced by the U.S. Securities and Exchange Commission (SEC).

In a Jan. 30 court filing, Terraform Labs CEO Chris Amani explained that the company might need to close its business to meet the monetary penalties that could be imposed in favor of the financial regulator. This, in turn, would deprive the crypto company of its right to appeal and could have severe repercussions for holders of Terra-related tokens like Luna.

“Without the protection of chapter 11, the Debtor would likely have to liquidate after the trial and entry of final judgment, forfeiting its right to an appeal and causing disastrous consequences for the Debtor’s business, its approximately 60 employees, its creditors, and the hundreds of thousands of holders of Luna that depend on the Debtor to maintain the Terra Blockchain—the same token holders the SEC purports to protect,” Armani stated.

Last December, the SEC secured a favorable judgment from Judge Jed Rakoff, who ruled that Terraform Labs and its founder, Do Kwon, violated the Securities Act by offering and selling various securities tokens, including the failed algorithmic UST stablecoin, LUNA, wLUNA, and MIR.

However, the company has maintained that it disagrees with this ruling and revealed that it intends to file an appeal after the District Court enters its final judgment.

So, the Chapter 11 bankruptcy filing offers crucial legal protection, enabling Terraform Labs to potentially restructure its finances, continue operations, appeal the decision, and strive for long-term success.

Additionally, Amani emphasized that the company’s current focus is not profit generation. He clarified that Terraform Labs has reinvested all earnings into the business and the Terra blockchain ecosystem to foster growth.

“In fact, the Debtor does not currently operate to gain profits; all revenue earned is expected to be reinvested in the business and the Terra blockchain ecosystem,” Amani stated.

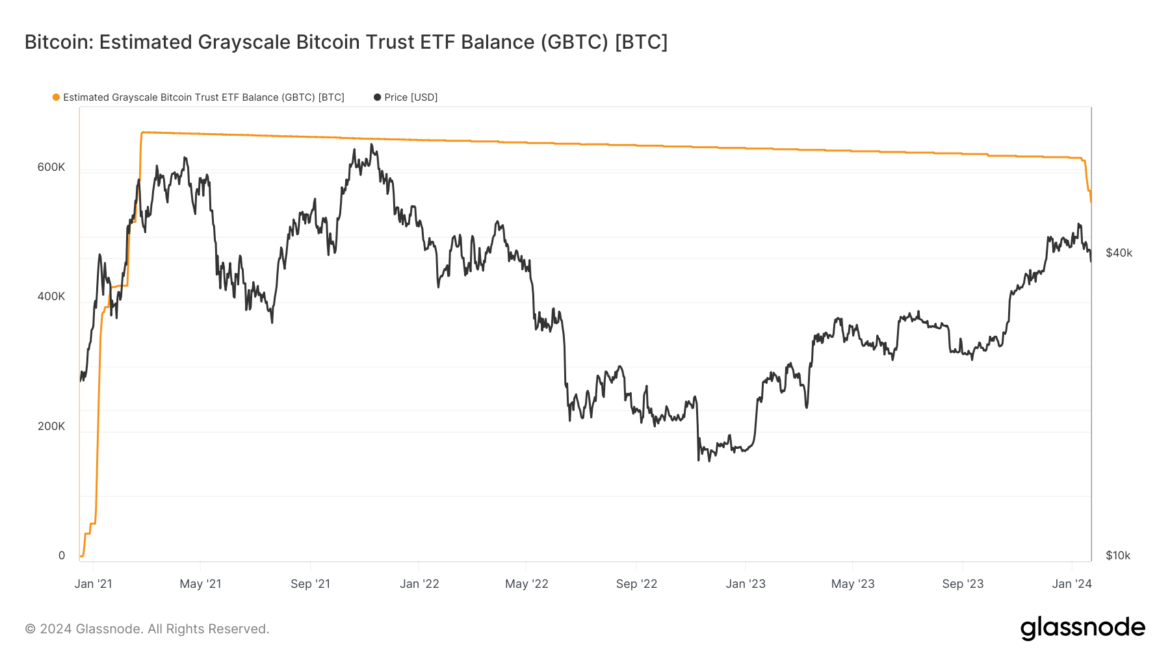

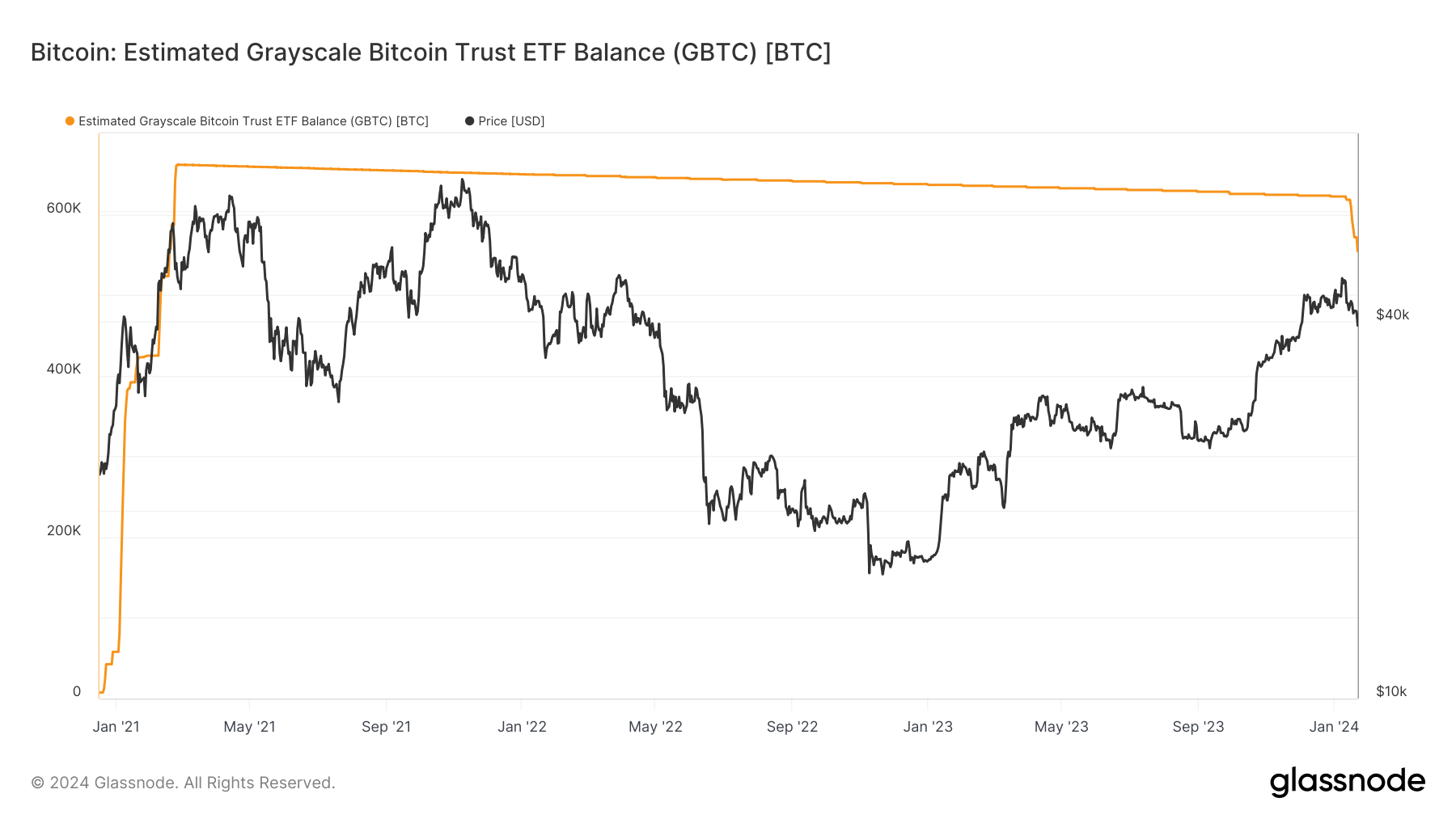

Grayscale Bitcoin Trust balance sees 12% reduction as FTX bankruptcy stirs $3.5 billion outflow

Quick Take

Recent data analysis from Glassnode reveals a substantial decrease in the balance of the Grayscale Bitcoin Trust ETF (GBTC), now estimated at around 553,000 Bitcoin, which is roughly 12% down from its high of 630,000 Bitcoin.

A key contributing factor to this decline appears to be the increasing outflows, which have been estimated at around $3.5 billion over its seven most recent trading days. These outflows are on the rise while the discount to the Net Asset Value (NAV) continues to close, currently roughly -0.11%, according to Y Charts. As this discount continues to narrow, the market may witness a further surge in GBTC selling.

Similarly, the digital asset exchange FTX reports significant sales nearing $1 billion, resulting from FTX’s bankruptcy estate offloading approximately 22 million shares, according to CoinDesk. Some of the outflows from GBTC have been redeemed into spot Bitcoin ETFs, roughly a third, according to Bloomberg analysts. However, it is noteworthy that about a third of the GBTC outflows ended up in USD, not in ETF vehicles, due to the FTX bankruptcy.

The post Grayscale Bitcoin Trust balance sees 12% reduction as FTX bankruptcy stirs $3.5 billion outflow appeared first on CryptoSlate.

Core Scientific wins court approval to enact reorganization plan, exit bankruptcy

The Bitcoin mining firm Core Scientific announced on Jan. 16 that it has obtained court approval to proceed with its reorganization plan.

Core Scientific noted that this reorganization plan will allow it to emerge from Chapter 11 bankruptcy proceedings in the coming days.

Adam Sullivan, Core Scientific’s CEO, said:

“Today’s plan confirmation is a defining moment in our reorganization; we’re poised to emerge by the end of this month as an even stronger company, with a highly motivated team that is aligned for success.”

Sullivan noted that demand for Bitcoin and “high-value compute” is rising and said that the company aims to create value for shareholders amidst that demand.

The press release added that the plan will see shareholders receive shares of Core Scientific’s new common stock and warrants, which constitute about 60% of the company’s new equity. The release also stated that Core Scientific’s existing debt is expected to be paid in full with the execution of the plan, marking a reduction of $1 billion from its debt balance before the reorganization plan.

Bloomberg suggested in a separate report that the plan will eliminate $400 million in debt from Core Scientific’s balance sheet. Bloomberg also indicated that the firm’s precise re-listing date on Nasdaq is Jan. 24, 2024.

Core Scientific was in bankruptcy for one year

Core Scientific filed for Chapter 11 bankruptcy in December 2022 but continued to operate throughout the bankruptcy process.

Notably, the company secured a multi-million dollar loan from BlackRock and other creditors shortly after its bankruptcy filing in order to continue its activities.

More recently, Core Scientific reached an expansion deal with Bitmain in September 2023. That agreement that saw Bitmain invest $54 million in Core Scientific and provide the company with 27,000 Bitcoin mining devices.

Core Scientific stock (CORZQ) is currently worth $1.18, down 14.49% today. The stock’s price is considerably higher than it was throughout most of 2023, but is considerably lower than its all-time high of $14.32 on Nov. 19, 2021.

Rudy Giuliani filed for Chapter 11 bankruptcy protection in New York on Thursday, citing debts that include a nearly $150 million recent civil judgment for defaming two Georgia election workers while serving as a lawyer for former President Donald Trump.

The filing by Giuliani came a day after a federal judge in Washington, D.C., ordered him to begin paying election workers Ruby Freeman and Shaye Moss monetary damages, and three days after they filed a new suit seeking to bar him from again defaming the mother and daughter.

The U.S. Bankruptcy Court in Manhattan filing legally pauses, for now, the $146 million defamation judgment against the former New York City mayor that resulted from a jury verdict last week.

Giuliani, while representing Trump in efforts to reverse his loss on the heels of the 2020 election, falsely accused Freeman and Moss of ballot fraud. The claims sparked death threats against them.

Their attorney, Michael Gottlieb, in a statement about Giuliani’s bankruptcy petition, said, “This maneuver is unsurprising, and it will not succeed in discharging Mr. Giuliani’s debt to Ruby Freeman and Shaye Moss.”

Giuliani’s filing estimates he has assets worth between $1 million and $10 million and estimated current liabilities of between $100 million and $500 million. A worksheet in the filing lists his current actual debts at $151.8 million.

While the defamation judgment is the lion’s share of that total, Giuliani also declared he has nearly $1 million in debt to the IRS and New York State Department of Taxation and Finance for unpaid taxes, and that he owes several million dollars in debts to various law firms.

Giuliani was sued in September by his former lawyer Robert Costello for $1.36 million in unpaid legal fees dating back to late 2019.

The list of nonsecured creditors in the new filing includes plaintiffs currently suing him, among them the Dominion and Smartmatic election machine companies, President Joe Biden’s son Hunter Biden, and former Giuliani employee Noelle Dunphy, who accuses him of sexual harassment and wage theft.

Filers use Chapter 11 of the Bankruptcy Code to reorganize their debts and come up with a plan to pay their creditors.

His bankruptcy lawyers in a statement Thursday said, “The filing should be a surprise to no one.”

“No person could have reasonably believed that Mayor Giuliani would be able to pay such a high punitive amount” from the defamation case, the attorneys, Heath Berger and Gary Fischoff said.

“Chapter 11 will afford Mayor Giuliani the opportunity and time to pursue an appeal, while providing transparency for his finances under the supervision of the bankruptcy court, to ensure all creditors are treated equally and fairly throughout the process,” the lawyers said.

In addition to serving two terms as New York mayor, Giuliani is a former Department of Justice official and former Manhattan U.S. Attorney.

Giuliani was in the final months of his mayoralty on Sept. 11, 2001, when a terror attack leveled the Twin Towers of the World Trade Center in lower Manhattan.

After being widely lauded for his leadership of the city on the heels of that attack, he made millions of dollars from consulting work and made a failed bid for the White House in 2008.

In recent years, Giuliani has been criticized, sued, and prosecuted for actions during his work as Trump’s lawyer. Since late 2020 he has made false claims that Trump lost to Biden only as a result of widespread ballot fraud.

Earlier this year, Giuliani, Trump, and 17 other people were charged in Georgia court with crimes related to an alleged conspiracy in their efforts to undo his defeat in that state in the 2020 election. Giuliani has pleaded not guilty in that case, as have Trump and most of the other defendants.

In July, the disciplinary board of the D.C. Bar Association recommended that Giuliani be stripped of his law license as a result of his false election fraud claims.

Giuliani’s law license in New York is suspended due to those claims.

— Additional reporting by CNBC’s Jim Forkin.

Don’t miss these stories from CNBC PRO: