Personal finance expert and best-selling author Dave Ramsey says he agrees with Berkshire Hathaway CEO Warren Buffett regarding bitcoin. Viewing the crypto as a currency whose value is based on “thin air,” Ramsey stressed: “I wouldn’t wish bitcoin investments on somebody I really dislike.” Dave Ramsey on Bitcoin: ‘It’s Still Thin Air’ Personal finance guru […]

Personal finance expert and best-selling author Dave Ramsey says he agrees with Berkshire Hathaway CEO Warren Buffett regarding bitcoin. Viewing the crypto as a currency whose value is based on “thin air,” Ramsey stressed: “I wouldn’t wish bitcoin investments on somebody I really dislike.” Dave Ramsey on Bitcoin: ‘It’s Still Thin Air’ Personal finance guru […]

Source link

based

CNBC’s Jim Cramer said Tuesday’s sell-off was a result of poor judgment on the part of shareholders.

“The market won’t bottom all at once — there will be some stocks that will bottom tomorrow — but I think this is a sell-off based on bad judgment, not bad earnings or a bad business environment,” he said. “And it will be cured by the departure of those bulls who got caught offsides, who’ll now be pulled from the lineup and sent back to the sidelines, where they can earn their 5% while they break form and do some much-needed homework.”

After a hotter-than-expected consumer price index, the Dow Jones Industrial Average lost 1.35% by the close, marking its worst session since March 2023 on a percentage basis. The S&P 500 declined 1.37% and the Nasdaq Composite slid 1.8%.

The overheated CPI number led to poor decision-making by shareholders, Cramer said, many of whom put too much faith in the idea that the Federal Reserve would be ready to cut interest rates in the spring.

Other bullish investors stirred up market froth, buying up many tech companies with unclear business plans, he said. An extreme example of this froth was the action behind semiconductor outfit Arm, whose post-earnings rally from last week extended into this week.

In theory, Cramer said investors would be wise to sell some stock here and then buy it back at lower levels, but admitted that plan is difficult to execute in practice.

“The market can’t advance on froth without terrible consequences,” he said. “We go to drain the froth and refresh, and that’s what today was, as those who don’t know anything about the economy or their stocks get cashiered out of the market.”

Jim Cramer’s Guide to Investing

Bitcoin ETF will now dwarf gold performance based on historical data

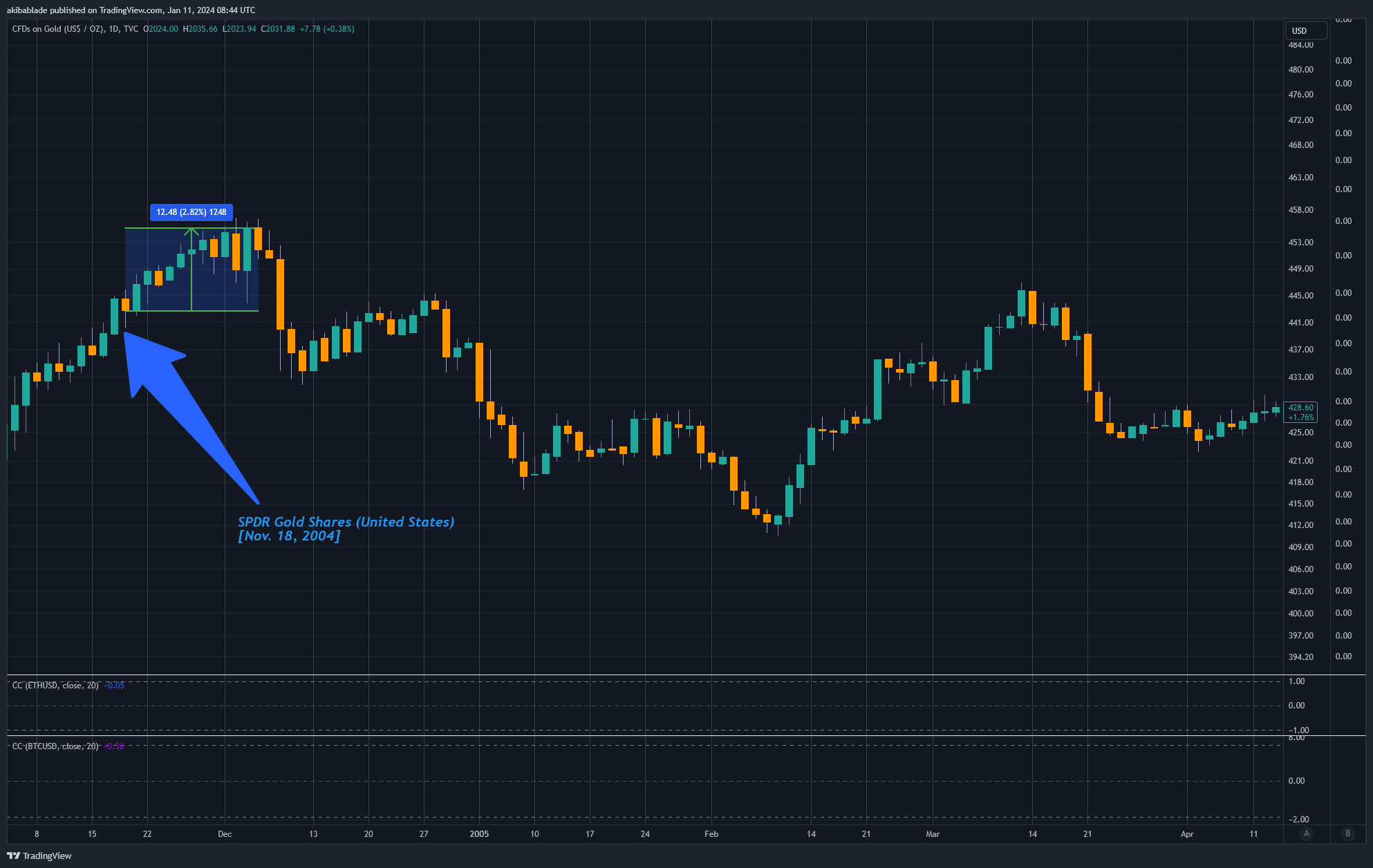

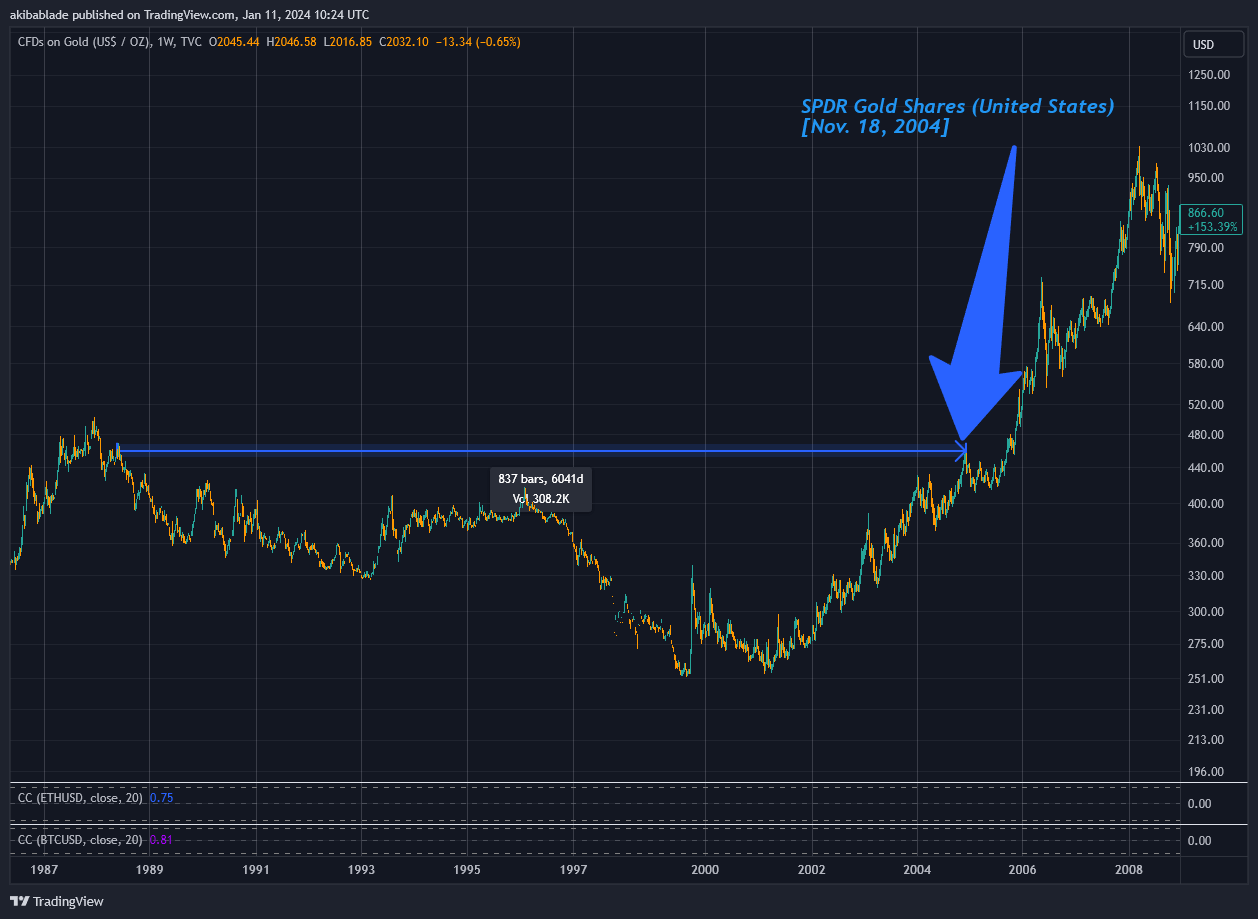

On a sure-to-be historic day for Bitcoin, I spent the morning looking back at historical data to see how impactful the first Gold ETF was at the time. We’ve seen plenty of analysts, including our own, talk about how Gold ETFs changed the landscape for the commodity, leading to outsized gains over the proceeding 20 years. Yet, what was it really like at the time? Did gold explode on day one, or did it take time? Let’s dig in.

First, let’s look at the timeline of the relevant exchange-traded products we will look at.

On Nov. 18, 2004, State Street Corporation launched SPDR Gold Shares (GLD), acquiring $114,920,000 in assets under management on launch and $1 billion in its first three trading days.

On Oct. 19, 2021, ProShares launched ProShares Bitcoin Strategy ETF (BITO), which had $570 million in inflows on day one, hitting $1 billion in assets the next day.

On Jan. 11, 2024, eleven spot Bitcoin ETFs will launch in the U.S. with $115.88 million under management via the sponsors’ seed funds. This means once they’ve taken $115 million in inflows, issuers like BlackRock, Ark, VanEck, and company will buy Bitcoin from the open market via Coinbase and Gemini, just like the rest of us.

Thus, before trading commences (removing Grayscale, which is converting its trust* into an ETF that already has $28.58 billion in AUM), the combined spot Bitcoin ETFs will have surpassed GLD’s day one trading. If we include Grayscale, spot Bitcoin ETFs have more assets under management than gold did for the first five years. GLD didn’t garner $29 billion in AUM until Feb. 12, 2009.

However, to be fair, it was no longer the only gold ETF by this point. BlackRock launched its iShares® COMEX® Gold Trust in 2005. Combined with GLD, gold ETFs reached an equivalent AUM around Feb. 10, 2009, with IAU obtaining $2 billion in assets by the end of Q1 2009.

By the end of 2009, three gold-backed ETFs were traded in the United States: ETFS Physical Swiss Gold Shares, SPDR Gold Shares, and iShares Comex Gold Trust.

| Company | Seed Investment ($M) |

|---|---|

| Bitwise | 20 |

| VanEck | 72.50 |

| Valkyrie | 0.52 |

| Franklin Templeton | 2.60 |

| WisdomTree | 4.95 |

| Invesco Galaxy | 4.85 |

| BlackRock | 10 |

| Ark | 0.46 |

| Grayscale | 2,858 |

How did GLD trade at launch?

The first gold ETF was launched in the U.S. on Nov. 18, 2004, and within 12 days, the price of gold was up just 2.82%.

This marked a sixteen-year high for gold, which had not reached $453 per ounce since May 1988. However, it was not at an all-time high. In fact, it would take another four years before that would occur.

Following the local high in Dec. 2004 at $453.40, gold went on a prolonged downward trajectory, with the price down 4% over the next six months. On its sixth-month birthday, GLD had acquired $2.4 billion in assets under management, with gold priced at $419.75.

However, things started to get much better for the flagship commodity. By Nov. 2004, on the anniversary of its launch, gold had risen to $485,85, up 8.15% since launch. Thus, gold was up less than Bitcoin after a year and could swing on a Gary Gensler tweet. Far from the earth-shattering impact many predict from the comparison to the gold ETF launch.

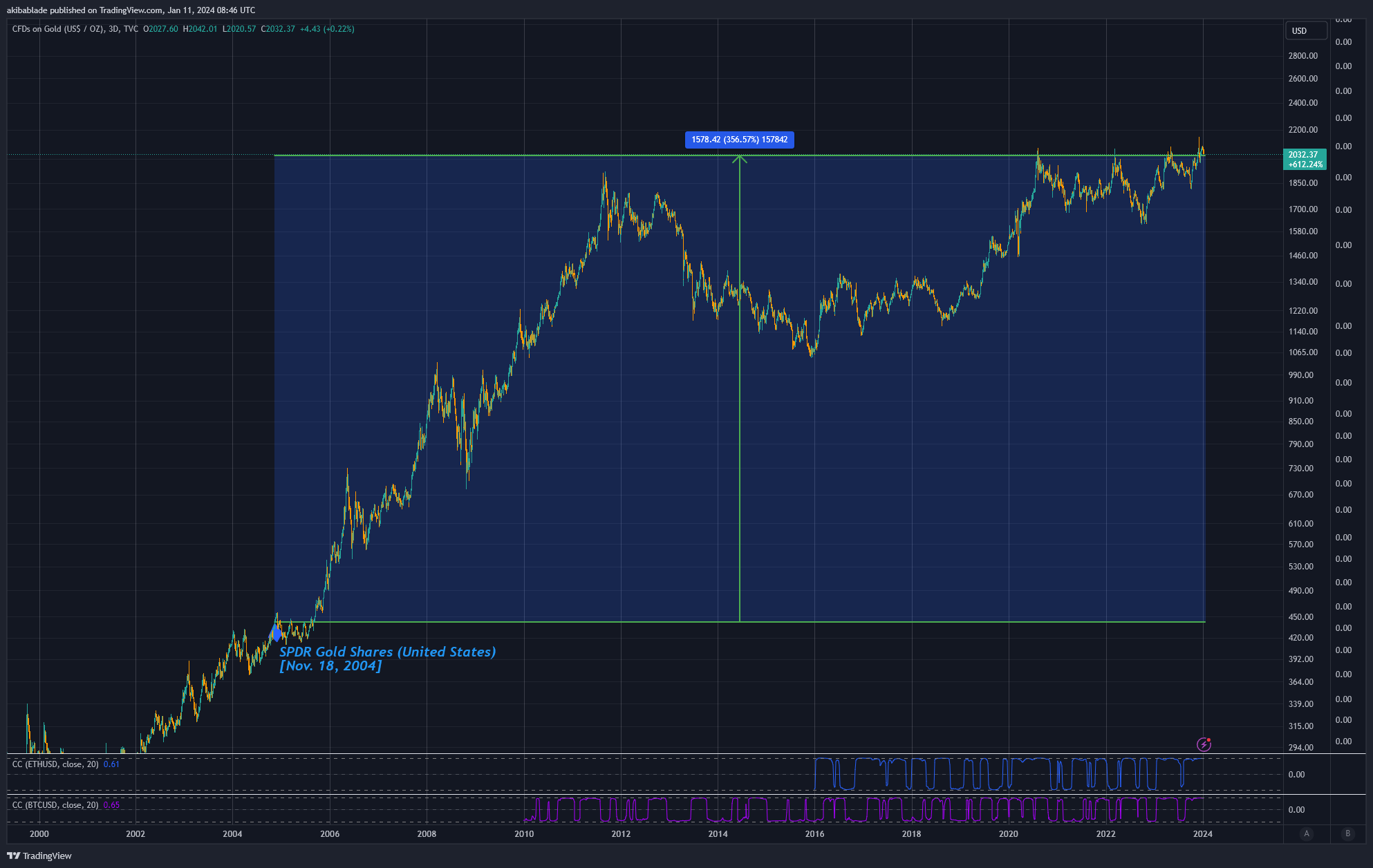

As GLD turned 2 on Nov. 18, 2006, gold was up to $620.50, an increase of around 40%.

Today, gold is priced at around $2,032 as of press time and a staggering 356%. However, that is on a nearly 20-year timeframe. By comparison, were Bitcoin priced at $210,000 on Jan. 11, 2044, how many investors would be happy with that return? Following gold’s trajectory, that’s the price point we’d be looking at.

However, gold and Bitcoin are like comparing apples with oranges. While we may discuss Bitcoin as digital gold, it is undoubtedly much more.

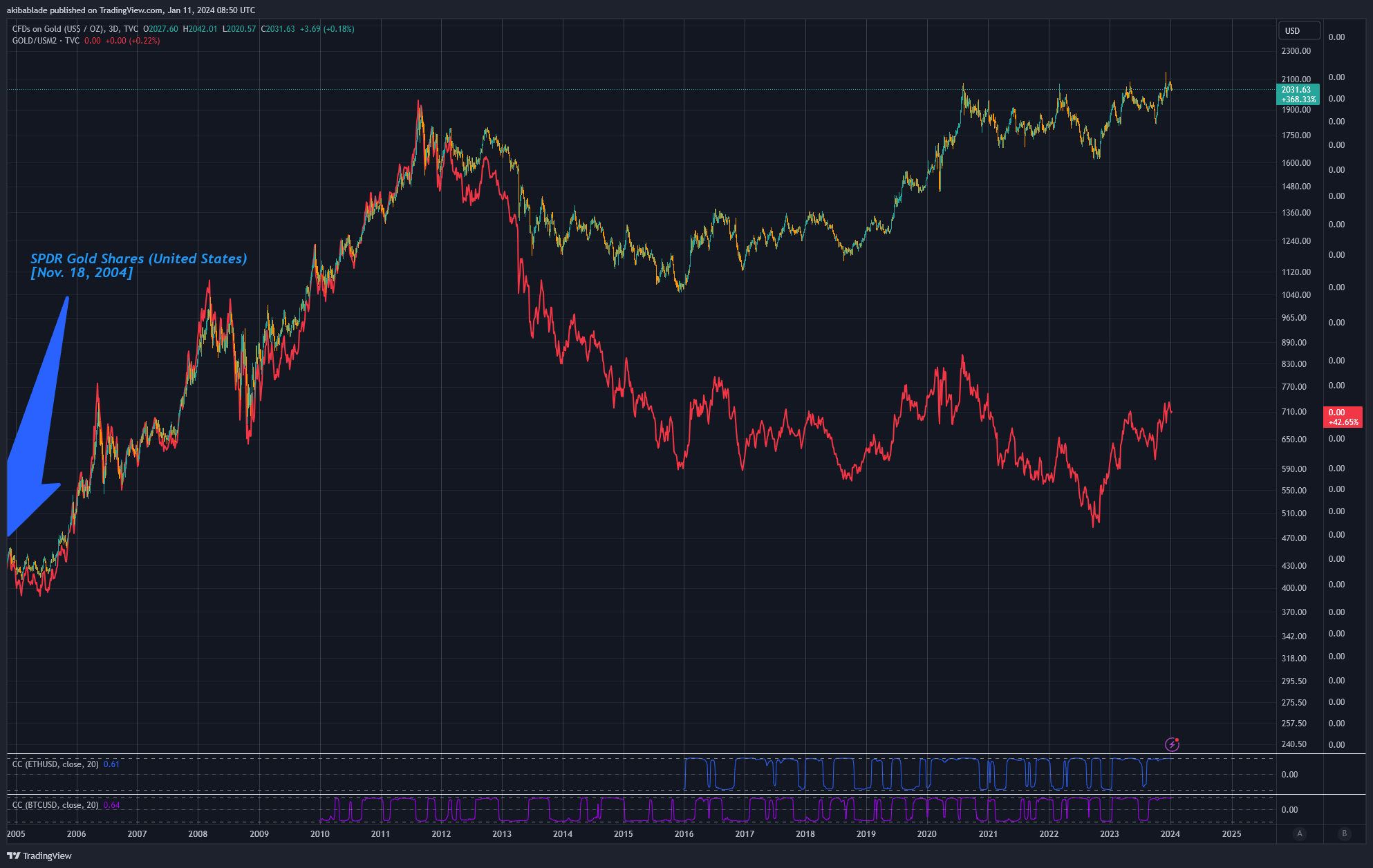

Let’s start by looking at gold in relation to the M2 money supply in the U.S. M2 is a broad measure of the money supply. It includes all components of M1 (notes and coins, checking accounts, other checkable deposits, traveler’s checks) plus savings deposits, small-denomination time deposits (time deposits in amounts of less than $100,000), and balances in retail money market funds.

M2 only excludes large deposits, institutional money market funds, short-term repurchase agreements, and other more considerable liquid assets, making it a relevant long-term metric to assess the spending power of the U.S. dollar.

When adjusted for the M2 supply, gold is up just 42%. Gold followed Gold/M2 pretty tightly from 2004 until 2012, and while the dollar price of gold continued to rise, Gold/M2 has been on a downtrend ever since.

Comparisons with Bitcoin

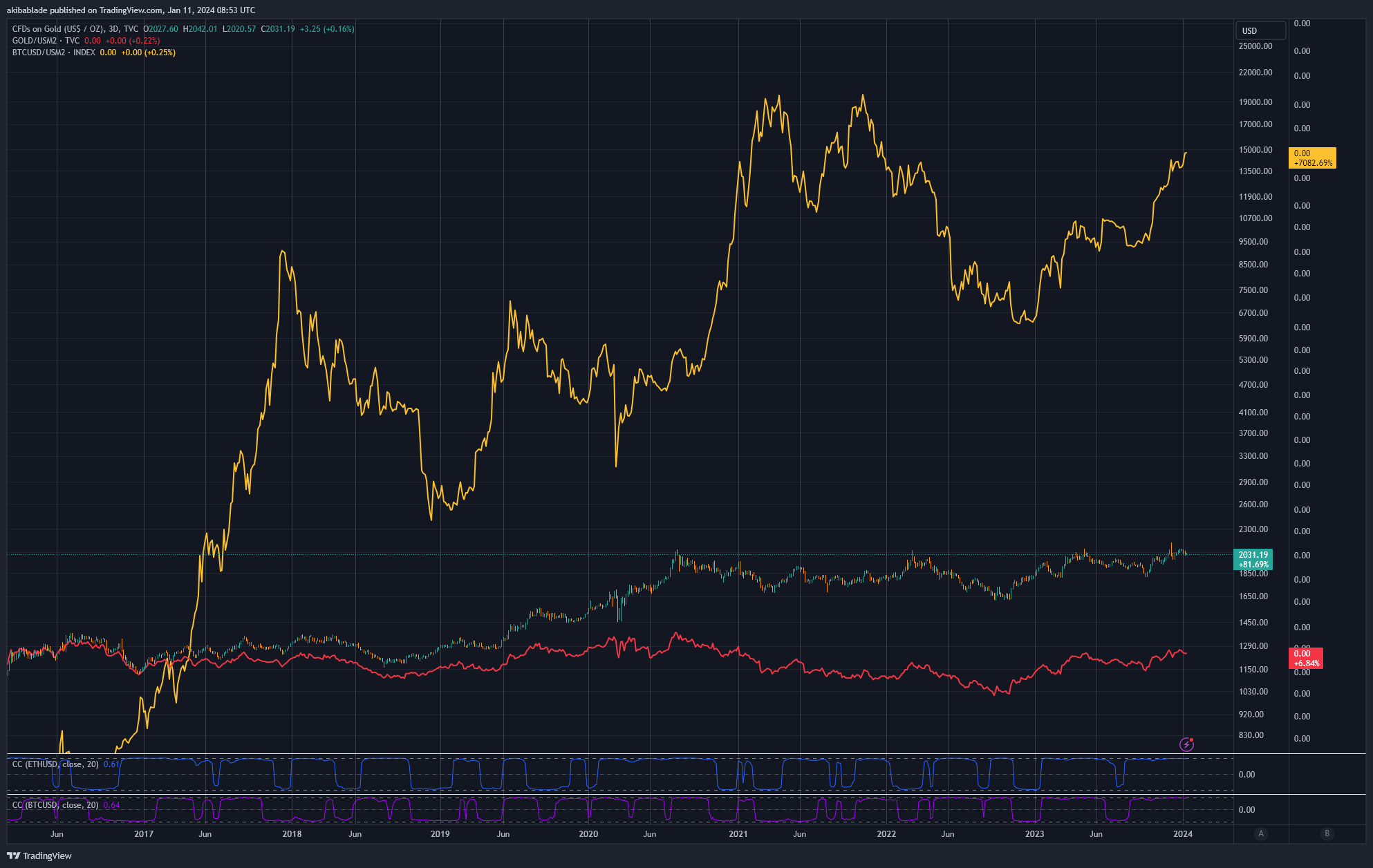

As we can’t compare Bitcoin over the same period as it was not launched until 2009, and its price discovery was highly volatile during its early days, I’ve used 2015 – 2024 in the chart below to compare Gold/M2 to Bitcoin/M2.

As you can see, Bitcoin has performed significantly better than gold (7,082%) over the past decade, even accounting for the 70% increase in the number of dollars included in the M2 supply.

However, not only has Bitcoin shown to increase even against dollar dilution, but it also has a fixed supply and tight market dynamics. Only 30% of all Bitcoin in circulation has been traded within the past 12 months.

Bitcoin’s supply is capped at 21 million coins, making it fundamentally scarce. This scarcity is a crucial driver of its value, akin to precious metals like gold. However, Bitcoin’s supply is predictably finite, unlike gold, where new reserves can be discovered and mined. The introduction of the spot Bitcoin ETFs is likely to amplify the scarcity effect.

As more investors buy into the ETF, a portion of Bitcoin’s limited supply will be locked up to back these investment products, reducing the available supply for regular trading on open markets. This decreased supply could lead to price appreciation, especially in the face of increasing demand (often spurred by easier access through financial products like ETFs). There is also a cyclical effect here whereby ETF issuers must fill baskets of shares with Bitcoin from the open market.

Moreover, the fact that 70% of the current circulating supply of Bitcoin hasn’t moved in over a year indicates a robust holding behavior among current Bitcoin owners. This holding pattern reduces the effective circulation of Bitcoin, further enhancing its scarcity.

When long-term holders hold a significant portion of an asset, any increase in demand, such as that generated by the launch of a new investment vehicle like the spot Bitcoin ETFs, can have a disproportionate effect on the price. There’s less supply available to meet this new demand.

This behavior contrasts with gold, where holding patterns are more diverse and include significant industrial and jewelry use, which can dampen the scarcity-driven price appreciation seen in assets like Bitcoin.

Thus, while gold has seen exceedingly solid gains over the past 20 years, comparing its ETF-fueled growth to Bitcoin may, in reality, be exceedingly underwhelming.

It’s important to note that demand for Bitcoin in relation to its scarcity still has to correlate to its demand at the asking price. It’s unlikely that Bitcoin will have the same demand at $1 million per coin as it would at $1 per coin, for instance. In my view, this is where the rubber meets the road; at what price does the demand for Bitcoin change?

Digging into the numbers – Bitcoin vs gold AUM

Yesterday, Bitcoin traded $52 billion across all exchanges at around $45,000 – $47,000.

Around 6.2 million BTC are in the market (they moved within the past 12 months). Glassnode estimates around 7.9 million coins have been lost or are unlikely to move any time soon. Given the current circulating supply of around 19.59 million, we can thus estimate a liquid pool of between 6.2 and 11.6 million coins available for purchase.

At today’s value, this equates to around $291 to $545 billion in liquid coins in the market, or around ten times the daily volume traded.

Thus, hypothetically, each of the 11 spot Bitcoin ETFs launching today would need to acquire around $49 billion in AUM to eat up the entire theoretical liquidity in the market.

As of Jan. 10, 2024, the top gold ETF, GLD, has an AUM of $56 billion. Assessing the overall top ETFs, SPY has $483 billion, and IVV has $396 billion.

The total value of assets under management for all gold ETFs in the U.S. is around $114 billion.

Thus, there is certainly room in the market for spot Bitcoin ETFs to acquire currently liquid coins, but it is still a tight market, and in less than 100 days, it will become even tighter.

When analysts compare the success of a spot gold launch 20 years ago with the potential for Bitcoin to follow suit, I think they may be drastically underestimating the differences between gold and ‘digital gold.’

Putting it into context, if BlackRock acquires the same AUM in Bitcoin as it has in gold (roughly $27 billion,) it would be 5% to 9% of all liquid Bitcoin on the market. Moreover, there are currently 2.35 million BTC on exchanges. So it would need to purchase 24% of exchange-listed Bitcoin… at current prices, that is.

Drawing on the parallels and contrasts between the historical impact of Gold ETFs and the potential influence of the upcoming spot Bitcoin ETFs, it becomes evident that while the success of Gold ETFs was significant, the unique attributes of Bitcoin, such as its fixed supply and prevailing holding patterns, could lead to an even more profound impact on the market, accentuating the potential for a transformative effect far beyond what was observed with gold.

Investment firm floats yield-bearing ETF based on MicroStrategy stock

A specialized exchange-traded fund (ETF) firm, YieldMax, has filed to launch the first yield-bearing ETF product based on shares in Michael Saylor’s Bitcoin holding company, MicroStrategy.

According to a Dec. 7 filing with the United States Securities and Exchange Commission (SEC), YieldMax has officially applied to launch its Option Income Strategy ETF based on shares in MicroStrategy, slated for release sometime in 2024.

If approved by the SEC, the ETF will trade under the ticker “MSTY” — just one letter off MicroStrategy’s preexisting ticker “MSTR.”

Yieldmax’s pending ETF utilizes a “synthetic covered call” strategy, which involves a mix of buying call options and selling put options to earn revenue. These proceeds are distributed to holders of the MSTY ETF as monthly payouts.

Notably, the ETF will never own any spot holdings of MicroStrategy shares, exclusively generating income by trading MSTR derivatives. To decrease potential losses, the fund limits its upside exposure to a 15% gain on the call options each month.

Yieldmax says the monthly yields generated by the ETF aren’t directly dependent on the growth of MicroStrategy shares, meaning that investors would still earn yields on the ETF even if MicroStrategy stocks were to take a significant hit.

Several commentators on X (formerly Twitter) questioned why someone would choose to invest in such an ETF instead of just buying the company stock or its options directly.

So first we trade the beta of SPX which is BTC, then we trade microstrategy which is the beta of BTC which is the beta of SPX, then we trade yieldmax which is beta of microstrategy which is beta of BTC, which is beta of SPX

Beta of beta of beta of beta, got it https://t.co/LrSXfbnP0X

— Marusha (@mattomattik) December 7, 2023

Yield-bearing ETFs are typically marketed to conservative investors looking to earn slightly above-average returns on the most volatile parts of the stock market. Because of the gain limits imposed by the fund managers, they are viewed as a cautious yet potentially more profitable way of generating passive income from big swings in stock prices.

YieldMax offers a roster of 18 similar ETF products for other major tech companies, including Tesla, Apple and Nvidia.

Related: Bitcoin’s huge rally has nuked $6B in shorts this year — S3 Partners

MicroStrategy shareholders have witnessed their fair share of outsized gains in 2023, with the price of the company’s shares growing more than 290% since Jan. 1, per TradingView data.

On Nov. 30, MicroStrategy co-founder Michael Saylor announced that the company acquired an additional 16,130 BTC for roughly $593.3 million — an average price of $36,785 per Bitcoin (BTC).

As of Nov. 29, MicroStrategy holds some 174,530 BTC worth roughly $7.6 billion at the time of publication.

Magazine: Lawmakers’ fear and doubt drives proposed crypto regulations in US-etf

Ethereum Could Decline To $1,700 Based On This Pattern, Analyst Explains

An analyst has explained how a pattern forming in the 3-day Ethereum chart could signal that a decline toward $1,700 may be coming.

Ethereum Has Recently Formed A TD Sequential Sell Setup

In a new post on X, analyst Ali talked about a sell signal that has taken shape in the ETH 3-day chart. The relevant technical indicator here is the “Tom Demark (TD) Sequential,” which is used to spot reversals in the price of any asset.

The metric is made up of two phases; a setup phase and a countdown phase. In the former, candles of the same polarity are counted up to nine following a reversal in the price. Once the ninth candle is hit, the indicator signals a probable top or bottom for the asset (depending on whether the trend until now was towards up or down).

Once the setup is completed, the 13-candle-long countdown phase begins. At the end of these 13 candles, a potential reversal once again takes place for the asset.

Ethereum has registered a sharp rally recently, but according to the analyst, the cryptocurrency has now finished with the setup phase of the indicator, implying that the asset could be heading towards a period of downtrend.

The below chart shows this pattern in the 3-day price of the coin:

Looks like the indicator is giving a sell signal at the moment | Source: @ali_charts on X

In the same chart, the analyst has drawn an ascending triangle pattern for Ethereum. “Ascending triangles” are made up of two lines: one parallel to the x-axis drawn through the highs in the price, while the other is made by connecting higher lows.

Generally, the price feels resistance at the upper line and support at the lower one. A break out of either of these lines suggests a continuation of the trend: bullish in the case of a surge above the former, while bearish in the case of the latter.

From the graph, it’s visible that Ethereum has recently been retesting the $2,000 to $2,150 zone, which happens to align with the resistance level of this ascending triangle.

Thus, it’s interesting that the ETH TD Sequential setup phase has finished just as the coin has encountered this line that it has been rejected from in the past.

“A pullback from this resistance level could lead to a dip toward the triangle’s hypotenuse at $1,700, setting the stage for a potential uptrend continuation,” explains Ali.

The analyst also notes, however, that the $2,150 level could be one to keep an eye on as if the asset can see a 3-day candlestick close above this level in the coming days, the bearish outlook could be nullified.

ETH Price

Ethereum had risen above $2,100 recently, but the coin has seen some pullback in the past day, a potential sign that the sell signal may already be in effect.

ETH has registered a drop during the past day | Source: ETHUSD on TradingView

Featured image from DrawKit Illustrations on Unsplash.com, charts from TradingView.com

An analyst has explained that a pattern in Grayscale Bitcoin Trust (GBTC) could suggest a potential 50% rise for BTC may be ahead.

Bitcoin & GBTC Have Seen A Decoupling In Recent Months

In a new post on X, analyst James V. Straten has discussed the correlation between GBTC and BTC that has been present over the years. The Grayscale Bitcoin Trust is an investment vehicle that holds Bitcoin and allows exposure to these holdings through its shares.

The chart below shows the trend in the percentage performance of Bitcoin and GBTC, as well as the correlation coefficient between them, over the past year.

Looks like the two assets have diverged recently | Source: @jimmyvs24 on X

The “correlation coefficient” here refers to a metric that tells us how tied the prices of any two assets are. When this metric has a positive value, the given commodities show positive correlations as they replicate each other’s moves. The closer the metric is to 1, the stronger this relationship is.

On the other hand, negative values imply the assets are responding to each other’s moves by moving in the opposite direction. The strongest negative correlation occurs at a value of -1.

Naturally, when the correlation coefficient is around zero, there isn’t any correlation between the commodities, as their prices move independently.

From the above graph, it’s apparent that Bitcoin and GBTC have often had a correlation coefficient close to 1, implying that there has been a robust positive correlation between the two.

There have been some temporary periods of deviation, mainly during drawdowns in the cryptocurrency’s price and other significant events like the SVB collapse. The correlation reverted to the norm soon after these, however.

Straten says this correlation is especially striking in a 5-year timeframe, where it becomes 100%. The analyst also notes, however, that the two assets have decoupled since June.

As is visible in the chart, GBTC has enjoyed some sharp uptrend recently, while BTC has been mostly flat. GBTC’s performance currently stands at +81% during the past year, while Bitcoin is up about 43%.

“GBTC will be the first to be approved for the spot ETF before Blackrock and others,” says Straten, referring to what British HODL, another analyst, said earlier. “Price action agrees with this. Irrespective of whether it’s late Q3 or early Q4, it’s a six-month window from now.”

Based on this, the analyst believes that either Bitcoin will have to close up the gap created between it and GBTC since June, which would mean a price jump of around 50%, or GBTC would have to come down towards BTC. Straten believes the latter scenario to be unlikely, however.

BTC Price

Bitcoin has declined over the past few days as its price has dropped to just $27,100.

BTC has been going down during the last few days | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com

The latest data from CoinMarketCap has indicated an unsettling calm in BTC/USD trading over the weekend, with the market experiencing an 11% decline in a span of just seven days.

Bitcoin (BTC) remains perched above the $26,000 mark, creating an air of uncertainty in the crypto market which has been recording a broad-based selloff in the past week. BTC’s price fell below $26,000 on Friday afternoon, following a brief rise above $27,000 that served to mitigate some of the steep losses seen earlier in the past week.

Analysts Remain Cautions on Bitcoin’s Price

Market observers, still shaken by the recent price drop, remained cautious about the future trajectory of Bitcoin’s price. Keith Alan, the co-founder of Material Indicators, a monitoring resource outfit, maintained a relatively conservative outlook amidst the uncertainty.

Alan expressed his thoughts on the X platform, predicting that Bitcoin’s price will eventually fall below $25,000 and retest support near the 2017 Bull Market Top, which was just under $20,000. However, Alan did not foresee a linear path to this outcome, explaining:

“I’m looking for a retest of $25,000 support to potentially create a double bottom and lay the groundwork for another upward rally. If this setup comes to fruition, a realistic range of $28,000 to $29,000 could be achieved.”

Alan also mentioned that if and when the retest of the $25,000 level occurs, his focus would then shift to the possibility of a series of lower lows.

Many shared the sentiment that if Bitcoin fails to find support at $25,000, then the $20,000 range would once again become a focal point for market participants. A well-known pseudonymous trader Skew commented on the potential scenario, noting:

“A break below $25,300 might signal a move towards $24,000 – $23,000, which could initiate a stronger buyback response. Alternatively, continued downward momentum could lead to a further drop to $20,000. In the most extreme case, Bitcoin might even dip below $20,000, presenting an opportunity for swing trading.”

Despite the prevalent pessimism, Skew predicted a short-term rally in intraday Bitcoin price movement around the weekly close, perhaps sending the price toward $28,500 if purchasing pressure becomes more pronounced.

Grayscale vs SEC Case Tempers Bitcoin’s Optimistic Outlook

The crypto market’s landscape remains uncertain and volatile, with traders and investors grappling with the ramifications of the recent price decline. Optimistic expectations have been tempered by the absence of positive developments stemming from the Grayscale vs the US Securities and Exchange Commission (SEC) court battle, which had the potential to influence Bitcoin’s price trajectory.

The legal tussle revolves around Grayscale’s desire to convert its $12 billion GBTC Bitcoin Trust into a spot Bitcoin Exchange-Traded Fund (ETF), a move that could significantly enhance its attractiveness to investors. Despite the attention, the regulator had previously rejected Grayscale’s application, prompting the investment manager to take legal action in an attempt to overturn the decision.

As Bitcoin’s price continues to experience fluctuations and market participants wait for clarity on the Grayscale vs SEC case, the broader crypto community remains vigilant, well aware of the potential implications of such legal battles on the market’s future.

next

Bitcoin News, Cryptocurrency News, Market News, News

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.

T. Rowe Price Says You Need This Much Saved For Retirement Based on Your Income

Retirement is a big milestone for many, and planning for retirement can constitute a large financial goal that takes years to reach. In fact, data from the Federal Reserve indicates that the majority of Americans only have $65,000 saved for retirement–far less than most experts recommend.

Investment giant T. Rowe Price has released an updated guide for retirement savers based on income level. Another well-known investment firm Fidelity Investments also has its own retirement savings guide, only with different numbers. So what do you do when the advice conflicts? Which benchmark guide should you follow?

A financial advisor could help you plan for retirement and select investments that align with your financial goals. Speak to a qualified advisor today.

T. Rowe Price Estimates Retirement Savings By Income Group

Planning for retirement can be intimidating, whether you’ve just begun working or you’re already approaching retirement. Given the power of compounding interest, saving as much as possible early on allows you to save even more over time. Yet with so many competing priorities in the present, sometimes retirement saving becomes less important and you may find yourself wondering if you’ve fallen behind.

T. Rowe Price calculates that the amount of money needed by age 65 depends heavily on your income. Thought Leadership Director Roger Young says that “higher earners will get a smaller portion of their income in retirement from Social Security, [so] they generally need more assets in relation to their income.”

As a result, most people looking to retire around age 65 should aim to save between seven and 13.5 times their pre-retirement gross income. The chart below shows how that breaks down by age group:

However, the range widens significantly as savers approach retirement. A married couple with two earners making $75,000 gross a year should have approximately five times their income saved for retirement by age 55, whereas a couple making $250,000 a year should save seven times their income by the same age. According to T. Rowe Price, this multiple factors in estimated government benefits that varies depending on income.

On the other hand, Fidelity recommends saving more at a younger age and catching up less as savers age. At age 30, the company advises earners to have one times their salary saved, two times by age 35, four times by 45 and reach seven times their salary by age 55. Fidelity assumes a relatively low real wage growth, at only 1.5% per year, so front-loading retirement savings would allow retirement savers to earn more through compounding returns.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

How Retirement Savers Can Take Advantage

For the average American, T. Rowe Price and Fidelity both arrive at a multiple of seven times your salary saved by age 55. But they rely on different assumptions that impact their retirement savings calculations.

T. Rowe Price assumes that, early on in a career, younger earners tend to save 6% of their paychecks for retirement, ramping up by 1% per year until they reach 15%. Fidelity assumes you’ll save 15% right from the start. The appropriate amount for you will depend on your level of disposable income and how much you can reasonably expect to save.

In fact, Federal Reserve data indicates that the average individual in the age 55-64 cohort has saved approximately $408,420 for retirement. However, the median savings for that age group is only $134,000. So while retirement savings goals are important for the future, some workers simply can’t afford to put away so much of their income.

If you’ve begun saving late or you’ve had to tap your retirement savings for unexpected expenses, it might even seem like seven times your salary is an unattainable goal. The 2020 Economic Well-Being of U.S. Households Survey found that 42% of non-retirees laid off in 2019 had no self-directed retirement savings, but it’s never too late to work on your financial goals.

Both T. Rowe Price and Fidelity find that 15% of income per year (including any employer contribution matches) is an ideal savings level for many people. Higher earners who will likely receive less in Social Security benefits should aim beyond 15%. A financial advisor could help you formulate a plan to reach your retirement goals faster if you need help.

Bottom Line

Investment firms T. Rowe Price and Fidelity Investments have released updated retirement savings benchmarks by income level. While both companies estimate that the average American should save seven times the annual salary by age 55, the actual amount saved will depend heavily on income and savings patterns. In general, experts recommend that retirement savers aim to save 15% of income per year over their working years in order to save enough for a comfortable retirement.

Retirement Planning Tips

-

Not sure what investments or strategies will set you up for a smooth retirement? For a solid, long-term financial plan, consider speaking with a qualified financial advisor. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Use SmartAsset’s free retirement calculator to get a good first estimate of how much money you’ll need to retire.

Photo credit: ©iStock.com/whyframestudio, SmartAsset, ©iStock.com/tagstock1

The post Approaching Retirement? T. Rowe Price Says You Need This Much Saved Based on Your Income appeared first on SmartAsset Blog.

Hong Kong based stablecoin FDUSD goes live on Binance with monthly audits

Hong Kong-based First Digital Group announced on July 26 that its stablecoin, First Digital USD (FDUSD), has been listed on Binance, the world’s largest cryptocurrency exchange by volume.

As one of Asia’s leading qualified custodians, First Digital Trust is part of the First Digital Group, which includes FD121, the entity under which FDUSD has been issued.

The FDUSD is backed 1:1 with “high-quality cash and cash equivalent reserves,” according to a press release, and it is redeemable 1:1 for an equal value in U.S. dollars. These reserves are held in regulated financial institutions’ segregated accounts and monitored and audited by independent third parties.

FDUSD aims to offer a “transparent, reliable, and trusted alternative” to conventional assets amid increasing volatility in the market.

Monthly attestations & stablecoin competition

On the news of the listing, a spokesperson for Binance told CryptoSlate, “Binance believes users benefit from more choices for products that fill an important financial need, and stablecoins have important use cases in the broader financial ecosystem.”

The spokesperson also confirmed that FDUSD will receive monthly audits from an independent accounting firm.

“[First Digital Trust] will be providing monthly attestation reports from an independent audit firm. Reserves of FDUSD are held by First Digital Trust Limited, a qualified custodian and registered trust company headquartered in Hong Kong.”

Further, Binance expects to see “increased competition in stablecoin offerings, including non-USD denominated projects” to meet market demands.

FDUSD Whitepaper

The FDUSD whitepaper emphasizes a commitment to fostering strong collaboration with regulatory authorities. It states that compliance with applicable regulations is a top priority and aims to actively engage with regulators to ensure understanding and adherence to evolving legislation. Compliance is noted as a guiding principle in navigating the regulatory environment.

First Digital, the parent company of the issuer FD121, is described as Asia’s leading multi-faceted trust partner bridging traditional and digital finance. It has over 3 decades of experience and provides services including structuring, custody, payroll, escrow, and administration.

The whitepaper further claims First Digital helps “future-proof” partners through innovative trustee services and expertise. It was also named an “Emerging Giant in Asia” by KPMG and HSBC in 2022.

FD121 Limited is a subsidiary of First Digital, specifically established to issue stablecoins allowing FDUSD to “leverage the resources, experience, and reputation” of the broader First Digital group.

Ultimately, FDUSD is designed as a programmable digital asset, offering efficiency enhancements by interacting directly with “financial smart contracts, escrow services, and insurance without intermediaries.” FD121 asserts that this feature reduces the cost of financial transactions and bolsters security.

Vincent Chok, CEO of First Digital Trust, commented,

“Recent events have shown that conventional assets are not immune to the risk and volatility posed by external events. FDUSD offers a transparent, reliable, and trusted alternative that provides the predictability corporates and investors are demanding.”

APAC crypto evolution

The listing of FDUSD on Binance follows a trend of growing acceptance of stablecoin in Asia, with Hong Kong, in particular, standing out due to its progressive approach to regulations.

This view is further supported by Circle, a leading USDC stablecoin provider, which recently underscored the potential role of the digital dollar, specifically USDC, in the APAC region, targeting the 74% of APAC trade invoicing processed in U.S. dollars.

In light of these developments, the listing of FDUSD represents an essential milestone in Hong Kong’s journey to position itself as a hub for crypto innovation and a test bed for crypto regulation. It also highlights the growing acceptance and importance of stablecoins in the digital economy.

FDUSD Listing information

The FDUSD listing went live at 16:00 HKT on July 26, 2023. According to the announcement, Binance will introduce a zero-maker fee limited-time promotion for FDUSD trading pairs on FDUSD/BNB, FDUSD/USDT, and FDUSD/BUSD spot trading pairs.

FDUSD is available on the Ethereum and BNB Chain, with planned support for an increasing number of blockchains.

As Hong Kong continues to position itself as a leading fintech and crypto innovation hub, the listing of FDUSD on Binance offers a glimpse of the potential of such offerings in shaping the global digital financial landscape.