Corporate insiders are selling far more of their shares than buying.

Source link

Bearish

Cardano At Risk Of Crashing To $0.4 As Important Metrics Turn Bearish

Cardano (ADA) risks a significant price decline as several on-chain metrics paint a bearish sentiment for the crypto token. This coincides with a recent technical analysis by a crypto analyst, who predicted that ADA could drop to as low as $0.4.

ADA Sees Decline In Trading Volume

Data from the on-chain analytics platform Messari shows a decline in ADA’s trading volume from its recent peak. The crypto token recorded a daily trading volume of $1.53 billion on March 14 but has been on a steady decline since then, recording a daily trading volume of $445.83 million on April 10.

Furthermore, data from IntoTheBlock shows three other on-chain metrics signaling a bearish sentiment for the crypto token. The first is the ‘Net Network Growth,’ which has experienced a 0.17% increase in the past week. This metric measures the total number of ADA addresses, meaning more users have left the ecosystem than new ones have come this last week.

The second metric is the ‘In the Money,’ which has seen a 0.20% decline in the last seven days. This metric measures the number of ADA holders that are currently in profit at the crypto token’s price level. Meanwhile, large transactions on the Cardano network have also dropped lately, with a 2.60 decline. These large transactions refer to transactions that are over $100,000, suggesting that ADA whales are cooling off on investing in the crypto token.

These bearish on-chain metrics further strengthen crypto analyst Alan Santana’s analysis, in which he mentioned that ADA could drop between $0.4444 and $0.3450. Back then, he noted that ADA still had a bearish outlook from a technical analysis perspective, and this outlook would extend until ADA found a strong support level on the charts.

ADA’s Derivatives Market Also Shows Bearish Outlook

Data from Coinglass shows that the bears are also firmly in control of the ADA ecosystem. In the last 24 hours, $632,720 has been wiped out from ADA’s derivatives market, with long positions ($502,170) accounting for most of these liquidations.

Meanwhile, trading volume in ADA’s derivatives market has dropped by over 11%, suggesting a declining interest in the ADA token among crypto investors. Furthermore, the Options trading volume paints a more bearish picture, dropping by 92% in the last 24 hours.

At the time of writing, ADA is trading at around $0.59, up over 1% in the last 24 hours according to data from CoinMarketCap.

ADA price at $0.58 | Source: ADAUSDT on Tradingview.com

Featured image from The Independent, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Double or Nothing: Proshares Unveils BITU and SBIT ETFs for Bullish and Bearish Bitcoin Bets

On Tuesday, Proshares introduced two new offerings: the Ultra Bitcoin exchange-traded fund, sporting the ticker BITU, and the Ultrashort Bitcoin exchange-traded fund (ETF), known as SBIT. While BITU is designed to deliver two times the daily returns of bitcoin, SBIT is structured to produce double the inverse of bitcoin’s daily returns. Proshares Introduces Leveraged and […]

On Tuesday, Proshares introduced two new offerings: the Ultra Bitcoin exchange-traded fund, sporting the ticker BITU, and the Ultrashort Bitcoin exchange-traded fund (ETF), known as SBIT. While BITU is designed to deliver two times the daily returns of bitcoin, SBIT is structured to produce double the inverse of bitcoin’s daily returns. Proshares Introduces Leveraged and […]

Source link

Bitcoin Technical Analysis: Price Consolidates Following Bearish Downturn

On Wednesday, bitcoin’s trade volume and overall value provided insights into its current technical situation. With a daily trading volume reaching $45.30 billion and a total market value of $1.29 trillion, the cryptocurrency’s liquidity and market breadth still stands strong. However, recent downturns have left traders wary. Currently, bitcoin has declined by 6% this week […]

On Wednesday, bitcoin’s trade volume and overall value provided insights into its current technical situation. With a daily trading volume reaching $45.30 billion and a total market value of $1.29 trillion, the cryptocurrency’s liquidity and market breadth still stands strong. However, recent downturns have left traders wary. Currently, bitcoin has declined by 6% this week […]

Source link

Ethereum (ETH) showed a notable performance throughout March. The second largest cryptocurrency hit $4,000 twice and seemed ready for lift-off to a new all-time high (ATH) while the whole crypto market soared.

Quarter one (Q1) 2024 closed with important achievements for the crypto community. However, as Q2 started, Bitcoin began a correction that dragged Ethereum and the rest of the crypto market.

Are Ethereum Bulls In Problems?

The king of altcoins has registered red numbers for the past two days. ETH’s momentum recovery after the market slowdown was halted after the token followed BTC and the rest of the market.

On Monday, crypto analyst Ali Martinez expressed concerns about Ether’s future. He suggested investors should “always be prepared for the best and the worst” scenario.

Martinez deemed “breaching the $3,400 support level” as the most brutal scenario for the second-largest cryptocurrency. This move would confirm a bear pennant pattern that formed on the daily chart.

If confirmed, the bearish formation could trigger ETH’s price to face a “major correction,” according to the analyst. The correction could make Ether’s price dip to $2,800.

Martinez reaffirmed his analysis after Ethereum continued to dip in the early hours of Tuesday. After the token fell under the support level mentioned above, the analyst asserted that falling under $3,460 was a problem for the bulls.

#Ethereum dropping below $3,460 is a problem for the bulls! Given the lack of support, it increases the chances for a further $ETH correction toward $2,850 or lower. pic.twitter.com/dFpnpZtBVM

— Ali (@ali_charts) April 2, 2024

“Given the lack of support,” failing to regain this support zone could trigger further corrections for ETH that could go even lower than the previously forecasted $2,800.

According to the In/Out of the Money Around Price (IOMAP) chart shared by Martinez, Ethereum shows a potential price support between $2,846 and $2,905, with over 1.64 million ETH bought by 1.99 million addresses at this level.

Nonetheless, the chart also displays that an ETH rally could face resistance at $3,457 and $3,557.

ETH’s Follows Bitcoin’s Correction

Ethereum behaved no differently than the rest of the crypto market. Bitcoin’s correction saw its price drop from the $70,000 mark to hover between the $65,000-$64,000 price range.

The flagship cryptocurrency shredded 7.1% of its price in the last 24 hours. Similarly, Ethereum’s red numbers show a 7.4% drop from yesterday and a 7.5% decrease on Monday.

April fools shakeout to start the quarter.

Time to get to work. Let’s get this bread boys 🤝 pic.twitter.com/0458Qvrr4F

— Jelle (@CryptoJelleNL) April 1, 2024

In the weekly and monthly timeframes, the king of altcoins has decreased by 9.2% and 3.4%. However, its 3-month chart shows green numbers, with a positive 39.74% increase since 2024 started.

Despite the negative performance, Ethereum’s daily trading volume increased a remarkable 80.80%, with over $22.5 billion traded in the last 24 hours, suggesting a rise in market activity. At the time of writing, ETH was trading at $3,283.

Ethereum is trading at $3,238 in the one-day chart. Source: ETHUSDT on Tradingview.com

Featured Image from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Solana Whale Makes Massive 1,000,000 SOL Deposit To Binance, Bearish Sign?

On-chain data shows a Solana whale has just moved a massive SOL stack to Binance, which could prove to be bearish for the asset’s price.

Solana Whale Has Deposited 1 Million SOL To Binance Today

According to data from the cryptocurrency transaction tracker service Whale Alert, several large SOL transactions have occurred on the blockchain during the past day.

More specifically, six massive transfers have been spotted on the network. Out of these, two transactions were gigantic, with tokens worth $362 million and $498 million involved.

These extraordinary transfers, though, were both between unknown wallets. Addresses like these are those unattached to any known centralized exchange, so they are usually the users’ personal, self-custodial wallets.

Due to this, transfers between unknown wallets are generally hard to say anything about. Often, they can be as simple as the investor moving to a fresh wallet, which is naturally of no particular consequence for the wider market.

The other four whale transactions from the past day, however, did involve central entities on one end, so speculation around them can have a bit more ground to stand on.

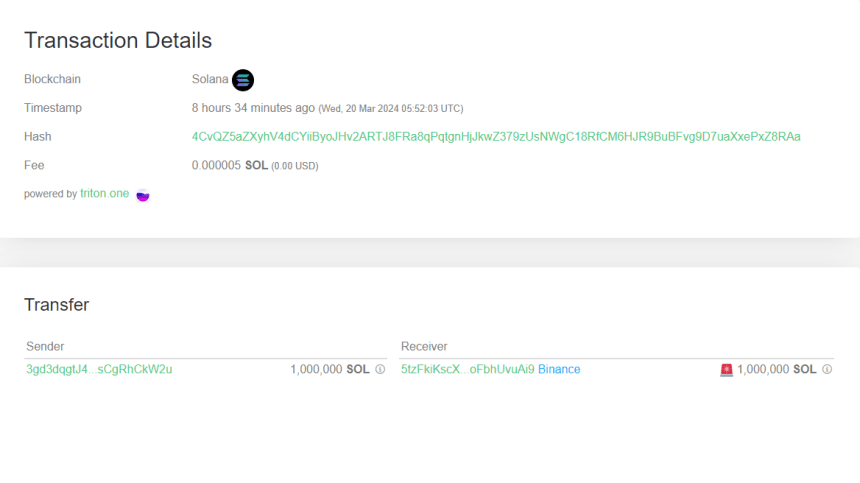

Out of these four, one transaction in particular stands out. In this move, a whale shifted 1 million SOL on the network, worth more than $166 million at the transfer time. Below are some additional details regarding this transfer.

Looks like this massive move only required a negligible fee of 0.000005 SOL to go through | Source: Whale Alert

As is visible, the receiver in the case of this transaction was a wallet affiliated with the cryptocurrency exchange Binance, implying that the whale transferred coins from their address to the platform.

Such transactions are known as exchange inflows. Users make these transfers when they want to use one of the exchange services, which can include selling.

As such, exchange inflows may sometimes be bearish for the cryptocurrency. In particular, massive inflows made by the whales can exert some visible fluctuations on the market.

Just like this huge SOL transfer, the other three transactions mentioned before were also exchange inflows. They were significantly smaller in scale, though, with their average value being $33.2 million.

Two of these transactions also went to Binance, while the third (and the latest) headed to Coinbase. Interestingly, the address pairs in these two Binance transfers were the same, hinting that the same whale may have been responsible for them.

With the four exchange inflows, Solana, worth $265.6 million, has now found its way to exchanges. This is clearly a notable amount, so it may impact the asset’s price.

There is no guarantee, however, that any of the whales involved made these transactions for selling; it’s possible that they made the moves for some other purpose that’s not directly relevant to the market.

Although Solana has been sliding off over the past few days, the possibility of these whales deciding to exit certainly exists.

SOL Price

Following the recent drawdown Solana has seen, the asset’s price has come down to the $174 level.

The price of the asset appears to have gone through some drawdown recently | Source: SOLUSD on TradingView

Featured image from Rod Long on Unsplash.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Dogecoin Adoption Rate Touches New ATH, But Why Is This AI Bearish On DOGE Price?

DOGE The Dogecoin network is on a roll after a particularly disappointing performance leading up to the end of January. Usage on the network is beginning to pick up once more after the price made its way above $0.08. New adoption saw the highest spikes, as almost 1 million new DOGE wallets were created in a 7-day period.

890,000 New Dogecoin Wallets In One Week

According to data from the on-chain analytics platform, IntoTheBlock, the number of new addresses created on the Dogecoin network spiked significantly in the last seven days of January. The total number of new addresses created during this one-week period came out to a total of 890,000. However, the most interesting part is the spike that took place between January 28 and 29.

In the screenshot shared by IntoTheBlock on X (formerly Twitter), we can see that the majority of new wallets creation happened in a single day. The daily wallet creation went from an average of 60,000 leading up to January 28, and by January 29, around 240,000 new wallets were created in a single day.

The next day would see a slight decline from these 2024 highs. But by January 31, the numbers picked up once more. During this time, another 200,000 DOGE wallets were created in a single day, accounting for one of the largest spikes in new wallets on the network.

IntoTheBlock offered a possible explanation for the spike in new wallets which could be related to an increased interest in Doginals. Doom, a highly anticipated project, was launched on the Dogecoin blockchain, contributing to the spike. The on-chain tracker also added that “the rumors of Xpayments could be driving new users to Dogecoin.”

DOGE bulls fail to hold $0.08 support | Source: DOGEUSDT on Tradingview.com

Machine Learning Algorithm Not Convinced On DOGE Price

Despite the increased interest in the Dogecoin network over the last week, the outlook for its native DOGE coin is still not favorable, according to the machine learning algorithm at CoinCodex. The algorithm has presented the likely movements of the DOGE price over the next few days to the next month, and they are far from bullish.

For the nearest term, the CoinCodex machine learning algorithm expects that there will be a small increase in price over the next five days, with an expected 1.54% rise. However, looking out in the long term, the algorithm expects a change in this positive momentum.

Over the next month, the AI expects that there will be an around 11.13% drop in price from the current levels. This would put the DOGE price at $0.071, pointing to the current sentiment toward the meme coin being rather bearish for now.

Nevertheless, Dogecoin is still holding on to its small gains of 0.7% over the last day, while maintaining its position as the 10th-largest cryptocurrency in the space with a market cap of $11.37 billion.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

XRP, the native cryptocurrency of the Ripple network, became a focal point in the face of the recent downturn in the broader market, facing the consequences of breaching a crucial support level and prompting uncertainties regarding its immediate outlook.

In tandem with Bitcoin’s descent below the $40,000 mark and Ethereum’s stumble beneath $2,200, XRP mirrored the trend, slipping below the pivotal $0.51 threshold for the first time since January 3.

XRP Vulnerability Sparks Differing Views

This abrupt breakdown laid bare the vulnerability of XRP’s current standing, triggering a wave of speculation about its potential trajectory in the near term.

Amid the market turbulence, analysts have offered a spectrum of conflicting predictions, leaving investors to navigate a complex landscape characterized by mixed signals.

The varying assessments of XRP’s future add an additional layer of uncertainty to an already tumultuous market environment, compelling investors to carefully weigh their options and stay attuned to the dynamic nature of cryptocurrency markets.

JD, a technical analyst, identified a long-term triangular pattern in XRP’s price chart. He predicts a potential further decline towards the lower trendline of this pattern, with the $0.28-$0.33 range identified as a potential “buy-the-dip” zone.

#XRP – May be creating “Hidden Bullish Divergence” on weekly (candle body close below red line would negate divergence)

A “wick” down the orange box is very possible. (Orange box been posted since November 2023!)

My personal DCA: 0.28 – 0.33 (HEAVILY!), 0.45, 0.51, 0.59

Don’t… pic.twitter.com/ipMsM0p7ZE

— JD 🇵🇭 (@jaydee_757) January 23, 2024

Ali Martinez, a veteran market observer, warned of a potentially steeper descent if XRP fails to hold above $0.55. Based on his Jan. 18 analysis, a breach of this level could trigger a significant drop, plummeting the token towards the $0.34 mark.

$XRP is currently grappling to maintain its footing at the crucial $0.55 support level. Should this support fail to hold, be prepared for a possible sell-off scenario that could see #XRP descending toward $0.34! pic.twitter.com/6oKObjpnnm

— Ali (@ali_charts) January 18, 2024

Alternatively, XRP Shark, another analyst, presented a more optimistic outlook. While acknowledging the possibility of a drop to the $0.35-$0.45 range, XRP Shark sees this as a potential buying opportunity and predicts a subsequent substantial recovery for the token.

Looking to load up a bit on XRP in the coming time between .35-.45 🍻 I personally think that will be the bottom area of this move down and a violent move to the upside is following. Invalidation below .30 cents (would be pretty bad to see it go past that level) 🍻 pic.twitter.com/OA0SbXOEOZ

— XRP_Shark (@XRP_Shark) January 22, 2024

At the time of writing, XRP was trading at $0.51, down 0.4% and 9.3% in the last 24 hours and seven days, respectively, according to data from Coingecko.

XRP Faces Critical $0.51 Threshold

The $0.51 threshold is one of the most important price zones for XRP because a retreat from this level could push the token below the psychological $0.50 level.

Ripple currently trading at $0.51 on the daily chart: TradingView.com

Despite the varied predictions, one consensus emerges: the short-term outlook for XRP appears bearish. With analysts anticipating further declines if crucial support levels are not held, investors should brace for potential volatility in the immediate future.

However, a closer look reveals glimmers of potential hope. Both XRP Shark and JD anticipate a future rebound for the token, albeit at different price points. This suggests that while the near-term may be turbulent, the longer-term prospects for XRP may not be devoid of promise.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bearish Bitcoin leads to tumble in crypto stocks, with Coinbase taking a hit

The shares of several U.S.-listed crypto companies experienced substantial declines in their values due to the significant market downturn today, Jan. 23.

Earlier today, Bitcoin’s price retraced more of the gains it made in anticipation of the U.S.-based spot exchange-traded fund (ETF) launches in the U.S. The flagship digital asset dropped below $39,000, marking its lowest value since early December, according to CryptoSlate’s data.

According to Yahoo Finance data, this market movement triggered a 5% decline in crypto exchange Coinbase shares and a 4% dip in business intelligence firm MicroStrategy’s shares during pre-market trading.

JPMorgan analysts downgraded Coinbase’s stock from Neutral to Underweight in response to the crypto market pressure and potential revenue shifts away from Coinbase due to newly launched ETFs.

The analysts explained that the exchange’s stock is valued “on a normalized earnings power at $80/share, suggesting a downside of 35% in its shares.”

Despite a remarkable 2023 performance (COIN +390% vs. SP500 +26%), the analysts foresee challenges for Coinbase this year.

“Cryptocurrency prices are already under pressure; with Bitcoin falling below $40k as of the writing of this note, we see greater potential for cryptocurrency ETF enthusiasm to further deflate, driving with it lower token prices, lower trading volume, and lower ancillary revenue opportunities for firms like Coinbase,” JPMorgan added.

Crypto miners’ stock decline

Bitcoin miners were not immune to the market decline as their stock value also fell.

Marathon Digital Holdings, a Nasdaq-listed bitcoin miner, witnessed a 3.19% pre-market decline, bringing its price to approximately $16.08.

Riot Platforms, another Bitcoin miner, saw a 2.45% decrease to $10.34, while Canada-based miner Hut 8 Corp experienced a 2.05% dip. In addition, CleanSpark recorded a 2.82% decline in pre-market prices.

Julio Moreno, CryptoQuant’s head of research, noted that BTC miners are currently feeling the pain from the flagship digital asset’s lower prices and fees.

“[BTC] prices are down 18% since ETF approval, total daily fees down 87% since mid-December (in BTC terms), and overall daily revenue down 38% also since mid-December (in USD terms),” Moreno explained.

The price of Bitcoin appears to be experiencing a bearish moment in the past few days now despite the approval of multiple Bitcoin Spot Exchange-Traded Funds (ETFs), which has raised speculations about the token’s future.

Bitcoin Could See Further Collapse

Bitcoinhyper, a cryptocurrency analyst, has offered his insights on the current state of Bitcoin. The analyst unveiled his predictions to the community during one of his YouTube videos.

According to him, BTC is currently undergoing a decline, which could potentially lead to a further collapse in price. In the beginning, Bitcoinhyper noted an upswing in the price of Bitcoin to $49,000 following the approval of BTC spot ETFs by the SEC.

However, the market did not react as anticipated, and there was a notable decline from the $49,000 price mark. “Unfortunately, we got a significant dump, and in rejection, from $49,000,” he stated.

The analyst highlighted that BTC was up for several days before the ETF approval, with experts anticipating the crypto would hit $50,000. Thus, in a surprising turn of events, the asset’s price witnessed a drop of about 16%.

In spite of the Bitcoin spot ETF approval, the market’s perception swiftly took an unpleasant shift. The correction took retail investors by surprise as they were unprepared since they had assumed that the price would rise.

With the crypto asset experiencing such a collapse in price, it is believed that the market will see a massive liquidation. Remarkably, during this decline, liquidations were not as large as anticipated.

Bitcoinhyper noted that during the decline, around $18.8 million in short positions were liquidated, which is less than expected. The news caused traders to become overconfident while ignoring the possibility of a correction.

No Positive Impact On BTC Price Despite Substantial Inflow

Reportedly, Bitcoin saw a whopping $1.18 billion inflow in digital assets funds worldwide following ETF approval. Despite the significant inflow of capital, the anticipated impact of boosting the price of BTC has not yet been realized.

On Monday, January 15, the price of BTC dropped below the support level of $42,000 as traders turned to Ethereum and other tokens. The approval of ETFs might be a “sell the news” moment, as BTC had dropped by 16% since the announcement.

As of now, it is crucial to observe that the market is becoming less enthusiastic about Bitcoin ETFs. A lot of people are now discussing the potential for an Ethereum ETF.

Currently, Bitcoin is trading at $42,951, indicating a decline of over 7% in the past seven days. Its trading volume is up by 3.86% in the last 24 hours, while its market cap is up by 0.75%, according to CoinMarketCap.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.