PDD’s stock powered higher Wednesday, after the China-based e-commerce company and parent of fast-fashion platform Temu reported fourth-quarter earnings that rose well above expectations, citing signs of improving consumer spending.

Source link

Beat

With altcoins finally catching up to Bitcoin, meme coins such as Dogecoin, BONK, and PEPE have been in the spotlight. This outperformance from these meme coins has pushed their standing in the crypto market further, putting them ahead of large competitors.

Dogecoin Rallies 50% To Reclaim 9th Spot From Avalanche

While Dogecoin did start out the week on a slow note, it picked up the pace on Wednesday after Bitcoin’s price rose to $64,000. This rally saw the DOGE price go from $0.09 to over $0.1 in a matter of hours, before the wipeout that sent Bitcoin below $60,000.

Once the market recovered, Dogecoin began to move up once again, and by Thursday, its price touched above $0.13. This is the highest that the price has been since 2022 and it gave its market cap enough boost to not only re-enter the top 10 cryptocurrencies by market cap. But also to reclaim the 9th spot from Avalanche.

Dogecoin’s price has risen 50% in the last week and pushed its market cap above $18.1 billion. Avalanche had been occupying the 9th spot on this list after rising from $10 to $40 in the last few months. However, its market cap of $16.64 billion falls behind DOGE, putting it in 10th place on the list.

It is interesting to note that a week ago, Dogecoin had completely fallen out of the top 10 cryptocurrencies after Tron’s TRX saw its market cap rise. This will end up being short-lived as TRX has fallen out of the top 10 and now sits at 11th position with a market cap of $12.6 billion.

BONK Beats Out PEPE

In addition to Dogecoin, BONK, another meme coin, has also seen impressive growth during the time. According to data from Coinmarketcap, the BONK price has risen 30% in the last day to cross the $0.00002 threshold.

This outperformance comes in light of a notable surge in the daily trading volume of the meme coin. Its volume saw a 135% increase in the last day to reach $955 million. This rapid rise in volume suggests a rapid increase in investor interest in the coin, leading to its gains.

BONK’s market rose to $1.81 billion as a result of this, which put it ahead of PEPE with a $1.22 billion market cap. BONK now holds the spot for the third-largest meme coin in the space behind Dogecoin and Shiba Inu.

However, on the weekly chart, PEPE is outperforming BONK with 148% gains compared to BONK’s 74% gains. Following behind PEPE is dogwifhat (WIF) which rose 142.6% in the last week to reach an $820 million market cap.

DOGE price rises to $0.129 | Source: DOGEUSD on Tradingview.com

Featured image from Gfinity Sports, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Volatile market conditions create winners and losers, and Owens Corning‘s (OC -0.88%) latest move will put it in one of those two camps. Does it make sense to take on debt to buy a company in a declining market? That’s the question facing Owens Corning investors as they digest the agreement to acquire residential door company Masonite International (DOOR 0.03%). I think the answer is “yes,” and it’s based on the company’s history of cash generation.

Introducing Owens Corning

You don’t have to buy technology stocks to enjoy soaring returns, and Owens Corning is far from a high-tech company. The building and construction materials company operates three segments with a heavy focus on the residential housing market.

The roofing segment makes laminate and strip asphalt roofing shingles. Its demand is driven by residential repair and remodeling work, but it is also exposed to new housing construction and has highly variable sales caused by storms and extreme weather events.

The insulation segment helps improve building efficiency and heating/cooling in the home; its demand tends to follow housing starts and conditions in the housing market. Finally, the composites business has a mix of end markets including building and construction (keeping in the theme of housing exposure), and also reinforcements for wind energy, industrial, consumer products, and infrastructure.

The Masonite deal

Given Owens Corning’s heavy exposure to the U.S. housing market — 51% of its sales in 2022 went to the U.S. residential market in 2022, with the U.S. commercial and industrial market contributing a further 19% — the agreement to acquire door company Masonite makes sense as it should enable Owens Corning to generate cost savings from merging the two companies.

Image source: Getty Images.

For reference, Masonite generates 80% of its sales from the North American residential market, and Owens Corning expects to generate $125 million in cost synergies from the deal via sourcing/supply chain initiatives and shared selling, general, and administrative costs. Moreover, now customers can buy their roofing, insulation, and doors from one source.

In addition, management is undertaking a strategic review of its glass reinforcements business (as discussed above in the composites section), so don’t be surprised if it’s sold to increase the company’s focus on the housing market.

The details of the deal:

- A $3.9 billion acquisition, at a 38% premium to the share price before the announcement, with Owens Corning taking on $3 billion in debt financing.

- The debt will take Owens Corning to a net debt-to-earnings before interest, taxation, depreciation, and amortization (EBITDA) multiple of 2 to 3 times EBITDA, dropping to around 2 times at the end of 2024.

- The deal values Masonite at an enterprise value (market cap plus net debt) of 8.6 times adjusted EBITDA, or around 6.8 times adjusted EBITDA, including the assumed $125 million in synergies.

Three reasons the deal makes sense

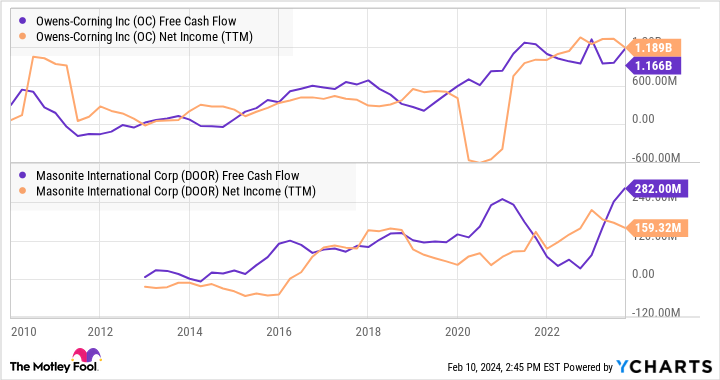

I think it’s an attractive deal. First, Owens Corning and, to a lesser extent, Masonite both have good track records of generating free cash flow (FCF), and FCF will be used to pay down debt.

OC Free Cash Flow data by YCharts

Second, while the U.S. housing market continues to face challenges due to the interest rate hikes over the last couple of years, it may start to bottom in 2024. To be clear, housing market forecasters like the Joint Center for Housing Studies at Harvard University forecast U.S. remodeling spending to decline from $481 billion in 2023 to $450 billion in 2024. However, they are also predicting that an inflection point in four-quarter trailing spending will occur in the third quarter of 2024. If that continues, then year-over-year remodeling spending could turn positive in 2025. In addition, recall that the deal will be completed in mid-2024, and it will take a while before the businesses are fully integrated.

Third, while the housing remodeling market is currently weak, this is often the best time to do such deals. Owens Corning’s management understands that its end markets are interest rate sensitive and, therefore, cyclical — and companies with good financial standing and cash flow generation often use such conditions to make strategic acquisitions in markets they are convinced will recover.

Image source: Getty Images.

A stock to buy?

The deal increases Owens Corning’s exposure to the U.S. housing market, and the possible sale of its glass reinforcement business will do so even more. Still, suppose you are bullish on the housing market’s long-term growth prospects and are willing to tolerate some near-term risk due to its current weakness. In that case, this looks like a good deal, particularly as the company’s excellent cash flow generation enables it to take on leverage to buy a strategic asset.

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends Owens Corning. The Motley Fool has a disclosure policy.

SoftBank shares extend their surge, pop more than 15% on earnings beat

SoftBank’s Vision Fund, the brainchild of the company’s founder Masayoshi Son, has faced a number of headwinds including a slump in technology stocks as a result of rising interest rates, a tough China market and geopolitics.

Kentaro Takahash | Bloomberg | Getty Images

Shares of SoftBank Group rose as much as 15.29% Friday morning, a day after the Japanese investment firm posted earnings that beat analysts’ expectations.

SoftBank’s on Thursday posted its first quarterly profit following four quarters of losses, thanks to big gains at its Vision Fund. For the December quarter, SoftBank’s net income was 950 billion Japanese yen ($6.36 billion), far exceeding LSEG estimates of 196.5 billion yen.

Its flagship tech investment arm the Vision Fund booked investment gains of 600.7 billion Japanese yen, continuing a recovery after record losses in the previous fiscal year.

On Wednesday, SoftBank-owned Arm, which designs chips for smartphones and a range of other devices, beat earnings estimates and offered a strong forecast as AI boom has been boosting sales.

This lifted SoftBank shares, which closed 11.06% higher at 7,350 yen on Thursday, according to LSEG data. They extended gains on Friday and were last trading at 8,090 yen.

Arm is among the beneficiaries of the AI boom that started last year on increased interest in generative AI after the launch of OpenAI’s ChatGPT in November 2022. Shares of the Nasdaq-listed Arm soared nearly 48% on Thursday.

“Arm is convincing more people it is leveraged into AI. This is going to be a very positive inflection point for the story on Softbank stock,” said Oliver Matthew, head of consumer Asia at CLSA, on CNBC’s “Squawk Box Asia” Friday.

SoftBank Group CFO Yoshimitsu Goto on Thursday said the firm has gone through a shift from an Alibaba-focused to an AI-focused portfolio.

SoftBank was known for its early bet on Chinese tech juggernaut Alibaba in 2000, but has cut its stake in Alibaba recently.

According to Goto, SoftBank’s stake in Alibaba had fallen to nearly zero by the end of the December quarter, down from 50% at the end of December 2019. Meanwhile, Arm’s share in SoftBank’s asset portfolio has risen from 9% to 32% in the same period.

– CNBC’s Vivien Soo contributed to this report.

Disney’s stock pops on big earnings beat, dividend, lower streaming losses

Walt Disney Co.’s stock popped 7% higher in after-hours trading Wednesday on stronger-than-expected quarterly earnings, deeper cuts, and a massive reduction in its streaming-business losses.

The company’s embattled board of directors approved a stock buyback of $3 billion — its first since 2018 — and declared a cash dividend of 45 cents a share payable July 25. The dividend program had been suspended during COVID. It also guided to a 20% increase in EPS for fiscal year 2024, to $4.60.

The entertainment giant also announced it is investing $1.5 billion for an equity stake in Epic Games Inc., the publisher of the massively popular videogame “Fortnite.”

Disney

DIS,

which is girding for an activist-investor confrontation at its annual shareholders meeting on April 3, reported fiscal first-quarter net income of $1.91 billion, or $1.04 a share. After adjusting for restructuring costs and other effects, Disney reported earnings of $1.22 cents a share.

Revenue was flat at $23.55 billion.

Analysts surveyed by FactSet had, on average, expected adjusted earnings of 99 cents a share on revenue of $23.7 billion.

“Just one year ago, we outlined an ambitious plan to return the Walt Disney Co. to a period of sustained growth and shareholder value creation,” Chief Executive Bob Iger said in a statement announcing the results. “Our strong performance this past quarter demonstrates we have turned the corner and entered a new era for our company, focused on fortifying ESPN for the future, building streaming into a profitable growth business, reinvigorating our film studios and turbocharging growth in our parks and experiences.”

In a wide-ranging interview with CNBC shortly after the results were disclosed, Iger said he is confident the company will find a successor for him when his contract expires at the end of 2026. He added Disney is on track to meet or exceed its $7.5 billion annualized savings target by the end of fiscal 2024.

Disney’s largest business segment, entertainment, generated $9.9 billion in revenue, down 7% from the same quarter a year ago.

Experiences hauled in $9.13 billion, an increase of 7% from $8.55 billion last year. Sports, which includes ESPN, generated $4.84 billion.

Disney+ reached 111.3 million subscribers, while substantially lowering the division’s quarterly loss of $138 million, compared with a loss of nearly $1 billion in the same quarter last year. Disney is locked in a streaming race with Netflix Inc.

NFLX,

Apple Inc.

AAPL,

Amazon.com Inc.

AMZN,

Warner Bros. Discovery Inc.

WBD,

Comcast Corp.

CMCSA,

and others. Disney Chief Financial Officer Hugh Johnston said a crackdown on password sharing in the coming months, following in the footsteps of Netflix.

It was also announced that the record-setting concert movie “Taylor Swift: The Eras Tour” will debut on Disney+ on March 15, with four additional songs not available in the theatrical or DVD release.

As the company celebrates its 100th anniversary, it faces a labyrinth of problems. While Iger attempts to turn a profit with the streaming business, he faces a showdown with activist investors.

In the latest twist Tuesday, investment firm Blackwells Capital implored shareholders to elect its three nominees to the board of directors and split Disney into three parts: sports, entertainment and resorts. Another activist investor, Trian Partners, has proposed two members to Disney’s board.

Read more: Disney activist Blackwells proposes splitting up company in proxy fight

Iger said he has not talked to the activists, and dismissed their actions as a “distraction.”

A Trian Partners spokesperson summed up Disney’s results as, “It’s déjà vu all over again. We saw this movie last year and we didn’t like the ending.”

Disney’s results come on the heels of a blockbuster partnership unveiled Tuesday. ESPN, Fox Corp.

FOX,

and Warner Bros. Discovery Inc.

WBD,

said they will create a joint venture sports streaming service, available as early as the fall, that will offer a sort of Hulu model for sports programming.

The joint venture marks a major milestone taking ESPN in the direction of the direct-to-consumer business, Iger told CNBC, and Disney continues to look for business partners for the service. He said pricing for the unnamed venture will be less than what it costs to buy each separate sports package.

Read more: Disney, Fox and Warner Bros. team up to launch new sports streaming service

ESPN will be available as a standalone streaming service in August 2025, according to Iger. It is likely to have integrated betting, stats and personalized data, he said during a conference call with analysts.

Shares of Disney have dropped 11% over the past year. The S&P 500

SPX

has climbed 21%.

Caterpillar’s stock surges toward a record after another big profit beat

Shares of Caterpillar Inc.

CAT,

shot up further into record territory Monday, after the maker of construction and mining equipment reported fourth-quarter profit that rose well above forecasts, with particular strength in its energy and transportation business.

And for the full-year, the company said sales reached the highest level in the company’s 98-year history, reflecting higher prices and increased volume.

The stock

CAT,

leaped 4.1% in premarket trading, after closing at record highs the past two sessions. The implied price gain was adding about 85 points to the price of the Dow Jones Industrial Average

DJIA,

while Dow futures

YM00,

were down 36 points, or 0.1%.

For the quarter to Dec. 31, net income climbed to $2.68 billion, or $5.28 a share, from $1.45 billion, or $2.79 a share, in the same period a year ago.

Excluding nonrecurring items, adjusted earnings per share of $5.23 beat the FactSet consensus of $4.76. That marked the fourth straight quarter adjusted EPS was a double-digit percentage above expectations.

Revenue grew 2.8% to $17.07 billion, just above the FactSet consensus of $17.06 billion, as higher prices and favorable currency translation offset lower sales volume.

Among the company’s business segments, construction industries sales fell 5% to $6.85 billion, just below expectations of $6.88 billion, and resource industries sales declined 6% to $3.44 billion, but were above expectations of $3.29 billion.

Meanwhile, energy and transportation sales jumped 12% to $6.82 billion to beat forecasts of $6.7 billion, amid strength in the oil and gas, power generation and transportation businesses.

Operating profit margin improved to 18.4% from 10.1%.

The company did not provide guidance for 2024 in the earnings press release. The post-earnings conference call with analysts was scheduled for 8:30 a.m. Eastern.

Caterpillar’s stock has soared 30.9% over the past three months through Friday, while the Dow has advanced 13.5%.

Microsoft earnings beat easily. Here’s why that may be met with a shrug.

Microsoft Corp. posted beats across the board with its latest results Tuesday afternoon, calling out momentum in the cloud and traction with artificial intelligence.

Microsoft’s

MSFT,

Azure and other cloud-services businesses posted revenue growth of 28% on a constant-currency basis in the fiscal second quarter, with that rate coming in ahead of the 27% growth that analysts tracked by FactSet were expecting.

What stood out to analysts was that AI services contributed 6 percentage points to Azure’s growth in the December quarter, up from 3 points in the September quarter. On the earnings call, UBS’s Karl Keirstead called the lift “extraordinary.”

Meanwhile, Microsoft’s management expects to see similar overall growth for Azure in the current quarter. “Growth will be driven by our Azure consumption business with continued strong contribution from AI,” Chief Financial Officer Amy Hood said on the earnings call.

Despite the upbeat results and AI commentary, however, shares of Microsoft slipped about 0.3% in after-hours trading following the call. Could the stock’s recent rally over the past three months (up 21%) and past 12 months (up 69%) have something to do with the muted response?

“AI is becoming a major story, but at this point it’s well-known and was priced into the stock,” David Russell, TradeStation’s global head of market strategy, said in an email.

See also: Alphabet’s stock dips because advertising was good, but not good enough

In his view, “traders could very well take profits and rotate to cyclicals, like financials and industrials, given the increasingly solid economic data,” meaning that Microsoft’s report “may be a sell-the-news event,” or at least one that makes investors shrug.

Overall, Microsoft recorded $62.0 billion in revenue for its fiscal second quarter, up from $52.7 billion a year earlier. Analysts were modeling $61.1 billion.

“By infusing AI across every layer of our tech stack, we’re winning new customers and helping drive new benefits and productivity gains across every sector,” Chief Executive Satya Nadella said in the company’s press release.

During the December quarter, Microsoft generated $19.2 billion in revenue from its productivity and business-processes segment, which houses Office. Analysts were modeling $18.6 billion.

Heading into Microsoft’s report, analysts were curious about the impact of AI on Microsoft’s software portfolio, especially after the company launched Copilot, an AI assistant for its Microsoft 365 product, late last year. The company didn’t offer too much detail on Tuesday’s call but hinted at traction.

“While it’s early days for the Microsoft 365 Copilot, we’re excited about the adoption to date and continue to expect revenue to grow over time,” Hood said on the call.

Intelligent-cloud revenue was up 20% to $25.9 billion, while the FactSet consensus was for $25.3 billion.

The More Personal Computing segment, which includes Xbox and Windows, saw revenue rise 19% to $16.9 billion and edging ahead of the consensus view, which was for $16.8 billion.

“A stronger-than-expected performance from Activision was offset by the weaker-than-expected console market,” Hood said.

Microsoft posted net income of $21.9 billion, or $2.93 a share, up from $16.4 billion, or $2.20, in the year-ago quarter. Earnings per share came in ahead of the consensus view, which was for $2.79.

See also: These 4 software stocks are ‘underloved.’ Here’s what could get them appreciated.

Johnson & Johnson’s earnings beat estimates with boost from medical-technology sales

Johnson & Johnson posted stronger-than-expected earnings for the fourth quarter early Tuesday and offered guidance that topped consensus estimates, but the news failed to prop up the stock, which fell 1.9%.

The company

JNJ,

which spun off its consumer-health operations into the separately listed Kenvue Inc.

KVUE,

last year to focus on innovative medicines and medical technology, posted net earnings of $4.132 billion, or $1.70 a share, for the fourth quarter, up from $3.227 billion, or $1.22 a share, in the year-earlier period.

Adjusted per-share earnings came to $2.29, just ahead of the $2.28 FactSet consensus.

Sales rose to $21.395 billion from $19.939 billion a year ago, also ahead of the $21.022 billion FactSet consensus.

By segment, sales at the company’s innovative-medicine business, which includes its COVID-19 vaccines, rose 4.8% to $13.722 billion, while sales at the medical-technology segment rose 13.3% to $7.673 billion.

Growth in innovative medicine was driven by cancer drugs Darzalex and Carvykti as well as psoriasis treatment Stelara, which was one of the 10 drugs selected in late August for the first round of Medicare drug-price negotiations under the Inflation Reduction Act.

That was partially offset by weakness in cancer drugs Zytiga and Imbruvica and immunology treatment Remicade.

In the medical-technology segment, growth was driven by electrophysiology products in interventional solutions, contact lenses in vision, wound-closure products in general surgery, and biosurgery in advanced surgery. The acquisition of Abiomed in 2022 contributed 4.7% of that segment’s growth.

Abiomed makes medical technology that supports circulation and oxygenation. It was acquired by Johnson & Johnson in a deal valued at $16.6 billion.

Johnson & Johnson said it’s now expecting 2024 adjusted earnings per share of $10.55 to $10.75 and sales of $87.8 billion to $88.6 billion. The FactSet consensus is for EPS of $10.68 and sales of $87.9 billion.

Separately, Chief Financial Officer Joseph Wolk told the Wall Street Journal that the company has tentatively agreed to pay about $700 million to settle a probe brought by more than 40 states into the marketing of talcum-based baby powder, which has been the subject of lawsuits by plaintiffs who claim that the powder caused cancer.

The agreement in principle with attorney general offices in most U.S. states is an “important step” for the New Brunswick, N.J.-based company as it tries to “reasonably put the matter behind us,” Wolk told the paper.

That settlement would address only a portion of the litigation, which involves more than 52,000 plaintiffs. Last year, Johnson & Johnson sought to settle the suits by paying at least $8.9 billion in a bankruptcy plan that would be filed by a subsidiary. The plan was rejected by a bankruptcy judge.

The stock has fallen 5% in the last 12 months, while the S&P 500

SPX,

has gained 20.7% in the same period.

JPMorgan Chase posts record yearly profit as 4th quarter earnings beat estimates

It was a record-breaking 2023 for JPMorgan Chase & Co. on the earnings front.

In its fourth-quarter earnings report Friday, JPMorgan

JPM,

said last year was its best year ever for full-year net income, which tipped the scales at $49.6 billion

The Wall Street bank’s fourth-quarter net-interest income of $24.2 billion also set a record, as did its full-year net-interest income of $90 billion, excluding markets.

JPMorgan’s fourth-quarter net income dropped to $9.3 billion, or $3.04 a share, from $11 billion, or $3.57 a share, in the year-ago period. The bank’s fourth-quarter adjusted profit beat analyst estimates, although its earnings were impacted by a $2.9 billion charge for the Federal Deposit Insurance Corp.’s special assessment related to last year’s failure of Silicon Valley Bank and other financial institutions.

Excluding one-time items such as the FDIC special assessment, fourth-quarter profit totaled $3.97 a share, well ahead of the FactSet consensus estimate of $3.35 a share.

The bank’s stock ended the session Friday with a drop of 0.7% after rising earlier in the day.

“[JPMorgan] really set the tone this quarter coming out with strong net-interest income,” David Wagner, a portfolio manager and equity analyst at Aptus Capital Advisors, said in an email to MarketWatch.

The bank’s overall results were “reassuring” as its scale “continues to make it differentiated,” Wagner said.

Reported revenue rose to $38.57 billion, from $34.55 billion in the same period last year. Managed revenue totaled $39.9 billion in the fourth quarter, which beat the analyst estimate of $39.73 billion in revenue.

“The U.S. economy continues to be resilient, with consumers still spending, and markets currently expect a soft landing,” JPMorgan Chief Executive Jamie Dimon said in a statement. “It is important to note that the economy is being fueled by large amounts of government deficit spending and past stimulus. This may lead inflation to be stickier and rates to be higher than markets expect.”

The bank is forecasting six interest-rate cuts by the U.S. Federal Reserve in 2024.

JPMorgan’s fourth-quarter net-interest income of $24.2 billion excluding markets beat the analyst estimate of $23 billion. Net-interest income reflects a bank’s profit on loans minus the money it pays out for interest on deposits.

Looking ahead, JPMorgan expects 2024 net-interest income excluding markets of about $88 billion. That forecast is stronger than the analyst estimate of $86.5 billion.

Dimon said the bank remains cautious in the face of wars in Ukraine and the Middle East, which have the potential to disrupt energy and food markets, migration, and military and economic relationships,

“in addition to their dreadful human cost.”

Breaking out some of its operating units, JPMorgan said its corporate- and investment-bank market revenue rose 2% to $5.8 billion, with fixed-income market revenue up by 8%, while equity-market revenue dropped by 8%.

In its commercial bank, gross investment-banking and markets revenue rose 32% to $924 million.

Assets under management rose 24% to $3.4 trillion.

Prior to Friday’s trading, JPMorgan’s stock had risen 1.3% in 2024, compared with a 0.2% increase by the S&P 500

SPX,

JPMorgan’s earnings came on a busy day for bank earnings, with Wells Fargo & Co.

WFC,

Citigroup Inc.

C,

and Bank of America Corp.

BAC,

all weighing in with their fourth-quarter results.

Also read: Bank of America’s stock slides 2% as earnings almost halve from a year ago

Also read: Wells Fargo’s stock falls as credit-loss provisions jump, profit was in line

Also read: Citigroup to cut 20,000 jobs by 2026 after ‘very disappointing’ quarter as it posts loss

3 Top Artificial Intelligence (AI) Stocks to Beat the Market in 2024

Investors have a lot to celebrate. The stock market will end 2023 near all-time highs after a fierce rebound that saw the Nasdaq Composite surge more than 40% this year, one of its best performances in decades.

It sets a high bar for 2024 as investors seek ways to continue the momentum. Three Fool.com contributors sifted through their top ideas to identify Amazon (AMZN -0.94%), Super Micro Computer (SMCI -2.47%), and SentinelOne (S -1.58%) as AI stocks with the right stuff to outperform a hot market in 2024.

Here is the investment pitch for each.

Amazon’s AI could be looking at a breakout year

Jake Lerch (Amazon): As of this writing, Amazon is up 83% year to date. It’s been an incredible year for the company, but I believe 2024 could be even better.

That’s because Amazon has only scratched the surface of its artificial intelligence (AI) potential. Indeed, in a recent interview with CNBC, CEO Andy Jassy said that “generative AI is going to change every customer experience.”

AI could prove to be an enormous competitive advantage for Amazon, which prides itself on anticipating customers’ wants and needs.

Take Alexa, Amazon’s signature virtual assistant. Jassy noted in the interview that, “if you’ve studied generative AI and you’re still scoffing, you’re really not paying attention. … We think we have a real opportunity to be the leader there, and we’re in the process of building a much more expansive large language model underneath Alexa that will make her both much more knowledgeable and much more conversational.”

In other words, get ready for a ChatGPT-like experience coming to an Alexa-enabled device near you soon. Need a new pair of shoes? Amazon wants you to talk with Alexa about the style you’re looking for, compare prices, and then buy — through an Amazon e-commerce partner, of course.

What’s more, Amazon already has a massive treasure trove for training large language models — its own data. With every search, review, or purchase, Amazon collects data that could be used to help it train and tailor its AI.

Amazon is something of a sleeping giant when it comes to AI. And 2024 could be the year that this goliath really springs to life.

The emergence of generative AI plays into the hands of this company

Will Healy (Super Micro): Super Micro Computer is not a household name for AI or tech investors. But it existed for more than 30 years and it began by selling motherboards.

Today, it’s best known for selling switches, servers, and solutions for storage and networking. However, it also offers combined hardware and software solutions that have become important amid the rise of generative AI.

Additionally, its rack-scale solutions support the cloud, metaverse, 5G, and edge infrastructure. Users may also like that Super Micro designs its products to save energy and minimize the impact on the environment. That growth helped it secure over 6 million square feet of manufacturing space and establish operations in more than 100 countries.

Thanks primarily to AI-driven interest, the AI stock is up more than 250% over the last year — outperforming powerhouse AI stocks such as Nvidia and Palantir.

There’s no guarantee Super Micro will repeat those results in 2024, and supply constraints and higher capital expenditures spending weighed on the financials. Its $2.1 billion in net sales for the first quarter of fiscal 2024 (ended Sept. 30) grew 14% yearly after revenue had surged 37% higher in fiscal 2023. Also, fiscal Q1 net income of $157 million fell short of the $184 million earned in the same year-ago quarter.

Still, with the AI-driven growth in the pipeline, that decline will probably amount to a temporary setback. The company forecasts net sales of $10 billion to $11 billion, which would mean 47% growth at the midpoint.

Moreover, Super Micro’s valuation significantly lags other AI giants despite the massive stock price gains. Its forward P/E ratio of 17 trails Nvidia’s forward earnings multiple of 40 and Palantir’s forward valuation of almost 71. That implied potential for multiple expansion and Super Micro’s positioning in the AI industry will likely mean the stock continues to march higher in 2024.

Wall Street hasn’t yet caught up to SentinelOne’s progress

Justin Pope (SentinelOne): Cybersecurity company SentinelOne went public at the height of the last bull market. The stock initially soared, then crashed as investors fled growth stocks due to rising interest rates. SentinelOne remains over 60% off its former high despite shares surging roughly 90% in 2023. But Wall Street could still be missing just how much SentinelOne progressed over these past 24 months.

The stock’s valuation peaked at a price-to-sales (P/S) ratio of over 106 but sits at just 14 today. Not only has the share price come down, but SentinelOne has been rapidly growing its business. Revenue has multiplied, and profit margins are racing higher:

S Revenue (TTM) data by YCharts

Notably, there are plenty of opportunities for SentinelOne to keep growing and become profitable over the long term. Artificial intelligence is the foundation of its core endpoint security product and is showing up in product expansions. Its Singularity Data Lake and Cloud Security products more than doubled sales year over year in Q3, and it’s begun rolling out Purple AI, a generative AI that can assist customers in using SentinelOne’s security products.

Analysts see SentinelOne’s revenue surpassing $1 billion over the next few years. Assuming profitability continues improving as revenue grows, the stock is a prime candidate to outgrow and outrun the broader market in 2024.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon and Nvidia. Justin Pope has positions in SentinelOne. Will Healy has positions in Palantir Technologies. The Motley Fool has positions in and recommends Amazon, Nvidia, and Palantir Technologies. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.