People with obesity-related heart failure and diabetes can get substantial heart-health benefits from weight-loss drug Wegovy, even if they don’t shed many pounds on the medication, according to new research.

Source link

Benefits

Here’s How to Tell If You Qualify for Spousal Social Security Benefits

Social Security offers a vital financial safety net and a cornerstone in the foundation for a secure future for millions of Americans. What happens, though, if your employment history doesn’t support those plans?

If your spouse is eligible to receive retirement benefits, you may qualify for spousal benefits. You’ll need to check the rules and regulations from the Social Security Administration (SSA) to determine if you meet the requirements but can begin your research with the following summary of the major ways you can qualify for spousal benefits.

Image source: Getty Images.

Meeting the basic requirements

The good news is that you don’t necessarily need your own work history to receive spousal benefits. Ways to qualify include reaching age 62 or caring for a qualified disabled child under age 16. The child also must be eligible for benefits on your spouse’s Social Security record.

You also may be able to make a claim on an ex-spouse’s work record if you’re 62 or older, were married at least 10 years, divorced for at least two, and currently unmarried.

Some other caveats and what you can expect

There are a few additional factors to keep in mind. First, if you remarry after you become eligible for divorced spousal benefits, you’ll lose those benefits. (But you can reapply if you later become single again.) In any case, the amount of your spousal benefit will depend on your spouse’s earnings history and when you start collecting benefits.

Generally, you can receive up to 50% of your spouse’s full retirement benefit. However, if you start receiving benefits before your full retirement age, your benefit will be permanently reduced. The SSA offers an online tool for estimating your potential spousal benefit.

Develop your plan strategically

Knowing these eligibility requirements can help you and your spouse plan your retirement strategy. If you’re the lower earner in the marriage, you may want to delay taking your own retirement benefits until you reach your full retirement age to maximize your potential spousal benefit.

You can estimate your retirement benefit and investigate various claiming situations, including spousal benefits, using the SSA’s online benefits planner. The planner also is a good aid for understanding some of the complexities involved in making educated decisions about your retirement income.

Maximizing your income, together or not

Spousal benefits can be a significant source of income for retirees. By understanding the eligibility requirements and how different claiming strategies can affect your benefit amount, you and your spouse can work together to maximize your retirement income. The same goes for your ex-spouse.

For more detailed information on spousal benefits and claiming strategies, visit the Social Security Administration’s website. Consulting with a financial planning advisor who understands both Social Security and how your benefits will fit in with the eggs already in your nest is also a good idea.

Older adults with student debt at risk of losing some Social Security benefits

Martinprescott | E+ | Getty Images

Millions of older adults who are behind on their student loans could soon receive a smaller Social Security benefit.

That was the warning from Democratic lawmakers, including Sen. Elizabeth Warren, D-Mass., and Sen. Ron Wyden, D-Ore., in a recent letter to the Biden administration.

“When borrowers are in collections, on average their Social Security benefits are estimated to be reduced by $2,500 annually,” the lawmakers wrote on March 19. “This can be a devastating blow to those who rely on Social Security as their primary source of income.”

The U.S. government has extraordinary collection powers on federal debts and it can seize borrowers’ tax refunds, wages and retirement benefits. Social Security recipients can see up to 15% of their benefit reduced to pay back their defaulted student debt, which “can push beneficiaries closer to — or even into — poverty,” the lawmakers wrote.

After the pandemic-era pause on student loan payments expired in October of last year, the U.S. Department of Education said it wouldn’t resume its collection practices for 12 months.

However, the lawmakers wrote, “we are concerned that borrowers will face the extreme consequences associated with missed payments when protections expire in late 2024.”

They asked the Biden administration to provide a briefing on its efforts to address the issue by April 3.

More from Personal Finance:

FAFSA fiasco may cause drop in college enrollment, experts say

Harvard is back on top as the ultimate ‘dream’ school

More of the nation’s top colleges roll out no-loan policies

The U.S. Department of Education did not immediately respond to a request for comment.

The government’s collection practices with student loan borrowers, including the garnishment of wages and Social Security benefits, is an area under review, a source familiar with its plans told CNBC.

‘A morally bankrupt policy’

Outstanding student debt has been growing among older people. To that point, more than 3.5 million Americans aged 60 and older had student debt in 2023, a sixfold increase from 2004, according to the lawmakers.

Consumer advocates say the government’s collection actions are extreme.

“Many retirees need their Social Security benefits to survive,” said higher education expert Mark Kantrowitz.

Social Security benefits constitute nearly all income for one-third of recipients over the age of 65, the lawmakers said in their letter. The average check for retired workers is $1,907 this year, according to the Social Security Administration.

The garnishments mean older adults are often “forced to choose between skipping meals or rationing medicine,” Kantrowitz said. “It is a morally bankrupt policy.”

Don’t miss these stories from CNBC PRO:

I was forced to take Social Security retirement benefits at 62 instead of SSI. I’m 71 now. Did the agency make a mistake?

Dear MarketWatch,

Most Read from MarketWatch

Hopefully you can lessen my confusion. For several years before I reached 62, I was disabled and qualified for Supplemental Security Income. It helped immeasurably. When I turned 62, I was forced to enroll in Social Security and my SSI was taken away from me. I was given no choice whatsoever. Even though Social Security paid marginally more than SSI at the time, I would have preferred to remain on SSI until at least full retirement or age 70 if I was financially able to do so.

In the ensuing years of receiving Social Security at or very near the minimum level based upon what my earnings had been over my lifetime (I am 71 now), I kept hearing and reading articles about people who got to keep their disability (SSI) while also receiving full Social Security, at an amount of course based upon their age when they chose to enroll in Social Security.

When I reached Full Retirement Age (age 66) I tried to have my Social Security payments adjusted from what I was forced to accept at age 62, to what I qualified for at 66. Despite spending a lot of time and effort, not to mention the financial impact, I was never able to restore my full retirement payment from SS.

Can you help?

Dear Reader,

Social Security can be very confusing — you’re certainly not alone. And when there are different programs and benefits at play, it gets even more complex.

Social Security’s two main programs are for retirement and disability benefits, the latter of which is known as SSDI. Supplemental Security Income, known as SSI, is a separate benefit, available to people aged 65 or older, or a person with a disability or blindness, who has little or no income or resources. The main difference between the two: SSDI is tied to work history, whereas SSI is not.

You probably already know the intricacies, but here are the eligibility requirements for SSI, according to the Social Security Administration, for any readers unaware:

If you qualify for retirement benefits, then beginning at 62 — which is the earliest a beneficiary can claim for those benefits — you would have to file for other benefits you might be eligible for, according to disability law firm Peña & Bromberg. “In the case of a disabled individual with prior work credits who was denied SSDI but granted SSI, they will be required to file for retirement benefits at the earliest age of eligibility,” the firm said on its site.

Your situation may not have been ideal, but it’s also not unheard of.

“Unfortunately, not only do SSI payments not automatically convert to retirement payments, but the Social Security Administration can essentially force you to apply for early retirement benefits at 62, instead of waiting for your full retirement age,” according to law firm Harris Guidi Rosner. “This can happen if you did not qualify for SSDI benefits, but you did work enough years to qualify for a small retirement benefit.”

As for Social Security Disability Insurance, that benefit automatically switches to a retirement benefit upon Full Retirement Age. “The law does not allow a person to receive both retirement and disability benefits on one earnings record at the same time,” the SSA said. The amount will remain the same, though. Beneficiaries who also receive a reduced widow or widower’s benefit should contact the administration so it can make the proper adjustments, the agency said.

Still, if you think your benefits were calculated incorrectly, it doesn’t hurt to reach out to the Social Security Administration, even if it might take a long time. You could also request an appointment at a local Social Security office. You can call the agency at 1-800-772-1213 (the TTY number for people with hearing and speech impairments is 1-800-325-0778) Monday through Friday between 8 a.m. and 7 p.m. local time. The office locator is available on their site.

Most Read from MarketWatch

Social Security: Here’s How to See Exactly How Much You’ll Receive in Benefits When You Retire

Social Security benefits are a lifeline for millions of older adults. Roughly 90% of current retirees say they rely on their checks to some degree, according to a 2023 poll from Gallup, and of that group, close to 60% say their benefits are a major source of income.

If you’re going to be depending on Social Security to any extent, it’s often helpful to know how much you can expect to receive. This can give you a more realistic idea about how far your benefits will go, making it easier to see whether you’re saving enough to cover the rest of your expenses.

The good news is that it only takes a few minutes to see an estimate of your future benefit amount. And if it’s less than what you expected, there are a few simple ways to boost your monthly checks.

Image source: Getty Images.

How to check your future Social Security benefit

Perhaps the easiest way to see your future benefit amount is to check your statements online. If you haven’t already, you’ll first need to create a mySocialSecurity account. From there, you can see an estimate of your future benefit based on your real earnings throughout your career.

Keep in mind, however, that you have to qualify for benefits before you’ll see an estimate. If you haven’t worked and paid Social Security taxes for at least 10 years, you likely won’t be eligible for retirement benefits yet.

Also, this estimate is the amount you’ll receive at your full retirement age (FRA). Your FRA is the age at which you’ll receive 100% of your benefit based on your earnings history, and it’s age 67 for everyone born in 1960 or later.

Image source: The Motley Fool.

You can file before or after your FRA, but it will affect your benefit amount. By claiming as early as possible at age 62, your payments will be permanently reduced by up to 30%. Delay benefits past your FRA (up to age 70), and you’ll receive your full benefit plus a bonus of at least 24% per month.

Finally, if you still have many years left in your career, that could also affect your benefit amount — especially if your income changes dramatically between now and retirement.

Simple ways to boost your benefits

Delaying filing for Social Security is one of the most straightforward ways to increase your benefit amount. Again, waiting until age 70 to claim will boost your payments by at least 24%, which can amount to hundreds of dollars per month. There are a few other options, though, for increasing your benefits:

- Work for a full 35 years: The Social Security Administration calculates your benefit amount by taking an average of your wages over the 35 highest-earning years of your career. That number is then run through a complex formula and adjusted for inflation, and the result is the amount you’ll receive at your FRA. If you’ve worked fewer than 35 years by the time you begin claiming, you’ll have zeros added to your earnings average — which will bring down your benefit amount.

- Consider working for more than 35 years: Working more than 35 years can also increase your benefit, as you’re likely earning a higher income now than you were at the start of your career. Because only your highest-earning 35 years are included in your average, working longer now while you’re earning a higher salary can increase your earnings average and your benefit amount.

- Boost your income: The more you’re earning, the more you’ll receive in benefits — up to a point. The maximum taxable earnings limit is the highest income subject to Social Security taxes, and in 2024, that limit is $168,600 per year. While you don’t have to reach that limit, the closer you can get to it, the higher your benefit amount will be.

Small steps can go a long way toward earning larger Social Security checks. If you can’t work more than 35 years, delay benefits until age 70, or substantially increase your income, that’s OK. Maybe you can delay claiming by just one or two years, for example, or increase your income by a couple thousand dollars per year. Either one of those moves could still result in a bigger monthly benefit.

Social Security can make an enormous difference in retirement, so it’s wise to make the most of it. By checking your estimated benefit and maximizing your payments the best you can, you’ll be setting yourself up for a more financially secure retirement.

Grayscale Aims to Launch Mini Bitcoin Trust for Lower Fees and Tax Benefits

Grayscale has revealed the submission of an S-1 form to the U.S. Securities and Exchange Commission (SEC) for the launch of a new, smaller version of its popular Grayscale Bitcoin Trust (GBTC). This initiative is designed to provide shareholders with exposure to bitcoin, reduced fees and potential tax benefits. Grayscale Unveils Bitcoin Mini Trust With […]

Grayscale has revealed the submission of an S-1 form to the U.S. Securities and Exchange Commission (SEC) for the launch of a new, smaller version of its popular Grayscale Bitcoin Trust (GBTC). This initiative is designed to provide shareholders with exposure to bitcoin, reduced fees and potential tax benefits. Grayscale Unveils Bitcoin Mini Trust With […]

Source link

Alistair Berg | Digitalvision | Getty Images

A record 8.7% cost-of-living adjustment helped Social Security beneficiaries stave off the effects of inflation in 2023.

But as they file their federal returns this tax season, they may be surprised to find more of their benefit income has been taxed.

Capitol Hill lawmakers on both sides of the aisle have put forth proposals to eliminate those levies on benefit income altogether.

Rep. Angie Craig of Minnesota, who is championing a bill with fellow Democrats, calls the idea a “win-win.”

“It’s a tax cut for seniors and a way to ensure more Americans can depend on the Social Security benefits they’ve earned,” Craig said in a statement.

But experts say eliminating taxes on Social Security benefit income may be a tough ask as the program faces a funding shortfall.

COLAs go up, but tax thresholds stay the same

The 8.7% cost-of-living adjustment, or COLA, for 2023 — prompted by record high inflation — was the biggest annual increase in four decades. The Social Security Administration estimated it would put an extra $140 per month on average in beneficiaries’ monthly checks.

The year before — 2022 — the cost-of-living adjustment was 5.9%.

Both increases were substantially higher than the 2.6% average annual increase to benefits over the past 20 years due to record high increases in prices.

As inflation has started to subside, a 3.2% cost-of-living adjustment for 2024 has come closer to that average.

More from Smart Tax Planning:

Here’s a look at more tax-planning news.

But even as recent annual adjustments spiked, the thresholds at which Social Security benefits are taxed have stayed the same.

Up to 85% of Social Security benefit income may be taxed.

The levies are applied to combined income, or the sum of half your benefits and total adjusted gross income and nontaxable interest.

If your combined income as an individual tax filer is between $25,000 and $34,000 — or between $32,000 and $44,000 if married and filing jointly — you may pay taxes on up to 50% of your benefits.

If your combined income is more than $34,000 and you file individually — or if you’re married and file jointly and have more than $44,000 in combined income — up to 85% of your benefits may be taxed.

More may owe taxes on Social Security income

This year, some Social Security beneficiaries may see their benefits taxed for the first time, according to the Senior Citizens League. A 2023 survey from the nonpartisan senior group found 23% of respondents who had been receiving Social Security for three or more years paid taxes on their benefits for the first time that year.

That share may increase this tax season following the 8.7% cost-of-living increase in 2023, according to the group.

But just how much more beneficiaries will pay in taxes due to the “unusually large COLA” for 2023 depends on their personal circumstances, said Tim Steffen, a certified financial planner and the director of advanced planning at Baird.

“Whenever income is up, it’s reasonable to expect your tax liability to be as well, although that really depends on other income and deductions [you] might have between last year and this year, too,” Steffen said.

Over time, because Social Security’s combined income thresholds don’t change, more beneficiaries can expect to pay taxes on the money from their monthly checks.

“At a certain point in the future, essentially everyone will be paying taxes on their Social Security benefits,” said Emerson Sprick, associate director of economic policy at the Bipartisan Policy Center.

Proposals aim to eliminate ‘double tax’

Some lawmakers have decried a so-called “double tax” that those levies on benefits impose after beneficiaries paid into the system through payroll taxes.

“This is simply a way for Congress to obtain more revenue for the federal government at the expense of seniors who have already paid into Social Security,” Rep. Thomas Massie, R-Ky., who is sponsoring the Republican bill, said in a statement.

While both sides of the aisle have proposals to eliminate taxes on Social Security benefits, they differ on how to pay for it.

Craig’s proposal — called the You Earned It, You Keep It Act — would pay for the change with transfers from Treasury general funds and applying the Social Security payroll taxes to earnings over $250,000. Currently in 2024, the first $168,600 in employee wages is subject to the Social Security payroll tax.

The bill, which has seven Democratic co-sponsors, would help increase Social Security’s ability to make benefit payments on time and in full by 20 years, according to an analysis by the program’s chief actuary.

Massie’s proposal — called the Senior Citizens Tax Elimination Act — would pay for the cost of eliminating taxes on benefits through government fund transfers outside of the Social Security trust funds. The proposal, with 30 Republican co-sponsors, would not include any tax increases.

Not a ‘high probability of legislative success’

The idea of nixing taxes on Social Security benefits will likely be popular with the retirees who pay them. More than half of seniors — 58% — said the income thresholds for taxes on Social Security benefits should be updated to today’s dollars, according to a Senior Citizens League survey conducted last year.

But it may be tougher to get the change passed by lawmakers.

“They’re really popular messaging bills,” Sprick said. “But that doesn’t translate to a high probability of legislative success.”

Authorizing general fund transfers to shore up Social Security is “deeply unpopular” in Congress, Sprick said.

Social Security’s tax policies are already progressive, with just around 40% of beneficiaries owing levies on their benefit income, he noted.

Because of that, other changes to help the bottom 60% who do not owe taxes — such as providing higher income replacement for lower earners or a guaranteed level of minimum benefits — may better help those retirees, Sprick suggested.

Majamitrovic | E+ | Getty Images

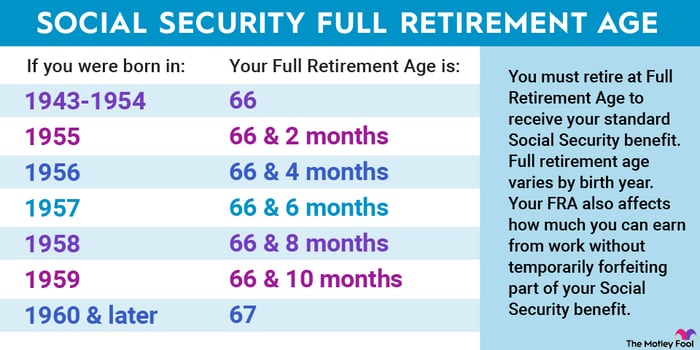

How to find your Social Security full retirement age

If you were born between 1943 and 1954, your full retirement age is 66.

If you were born in 1960 or later, your full retirement age is 67.

The full Social Security retirement age gradually increases from 66 to 67 for people born between those years.

Social Security full retirement age

| Year of birth | Social Security full retirement age |

|---|---|

| 1943-1954 | 66 |

| 1955 | 66 and two months |

| 1956 | 66 and four months |

| 1957 | 66 and six months |

| 1958 | 66 and eight months |

| 1959 | 66 and 10 months |

| 1960 and later | 67 |

Source: Social Security Administration

For some people, this can come as a surprise, because they may still confuse their Social Security full retirement age with the Medicare eligibility age of 65, according to Elsasser.

Others are familiar with their full retirement age because they have been seeing it on their Social Security statement over the years, he said.

Social Security statements can be accessed online by creating a My Social Security account.

How Medicare can trip up retirees in other ways

It’s not just the Medicare eligibility age that can trip up prospective Social Security retirement beneficiaries, Elsasser noted.

Retirees may be tempted to sign up for Social Security when they become eligible for Medicare at 65 so they do not have to write checks to cover their premiums. Those payments for Medicare Part B — which covers doctor’s visits, outpatient care and preventive services — are typically deducted directly from Social Security benefit checks.

But tying those decisions to each other will result in permanently reduced Social Security benefits, since that would be before full retirement age.

“You really should make those decisions independently of each other,” Elsasser said.

Of course, not everyone can or should delay claiming Social Security retirement benefits. The earliest eligibility age is 62, and experts say claiming then may make sense for individuals in some circumstances, such as if they have a poor health prognosis.

By waiting until full retirement age, you can receive up to 100% of the benefits you’ve earned.

If you delay claiming past your full retirement age and up to age 70, you stand to get an 8% benefit increase per year.

A better way to think about it is that each month you delay is worth two-thirds of 1%, Elsasser said. Therefore, even delays of small increments can help increase your monthly checks over your lifetime.

The full retirement age may be subject to go up again, depending on whether Congress decides to include that change to shore up Social Security’s funding woes.

However, such a change would likely affect only prospective retirees ages 55 and younger, Elsasser predicted, and isn’t necessarily a sure thing, as life expectancy in the U.S. is no longer accelerating.

I’m going to end up paying taxes on 85% of my Social Security benefits in retirement. What will my final check look like?

Dear MarketWatch,

Most Read from MarketWatch

I have been taking a look at my Social Security statements. If I wait to collect until age 67 (I’m currently 52), in theory I would be eligible to receive $3,000 per month. These calculations are based on my current situation, not factoring the deficit anticipated after 2034 when Social Security runs out of excess funds and can only pay about 80%.

I hope to be able to collect an annual income of around $75,000 per year from my 401(k), plus the $36,000 per year in Social Security. That puts me well above the tax-free zone and I expect to get to pay federal taxes on 85% of my Social Security. As a single-filer in Virginia, what can I expect my $3,000 per month Social Security income to look like ?

If you’re turning 65 this year and want to share your story, contact us at HelpMeRetire@marketwatch.com .

Dear Reader,

To answer your question involves a lot of variables, many of which are not yet known. You’re right that the $3,000 is based on your current situation, but that also means it’s dependent on nothing in your life changing, including your job or your income.

For those unaware, Social Security income can be taxed. If you’re filing as an individual, and your “combined income” (that’s your adjusted gross income, plus nontaxable interest and one-half of your Social Security benefits) is between $25,000 and $34,000, 50% of your benefit may be taxed. Anything above $34,000, and the taxable portion rises to 85%. For people who file a joint return, the range for the combined income (including your spouse’s) is $32,000 to $44,000. Anything above that, and 85% of benefits could be taxed. About four in 10 people who receive Social Security benefits pay federal income taxes, the Social Security Administration said on its website .

You are allowed to have federal taxes withheld from your benefits if you want to see less of a tax liability come tax season. That would also affect what you see in your Social Security check every month.

And keep in mind, this is separate from state taxes. Many states do not tax Social Security, but a handful do. In 2024, that list includes Colorado, Connecticut, Kansas, Minnesota, Montana, New Mexico, Rhode Island, Utah and Vermont, according to Nerdwallet .

Back to your question. It is very hard to know for sure what your Social Security benefit will look like, since you are 15 years out from when you plan to claim benefits. So much can change in that time, including tax brackets and the ranges for Social Security taxation, policy for the program and your own personal circumstances. Also, while the program is currently on track to run into financial issues by 2034, Congress has never let Social Security falter before, and there’s still time for it to be fixed.

Focus on your current saving s plan

While you’re waiting for more clarity regarding your Social Security income, you can focus on what you are already saving for the future, and how to be as tax-efficient as possible when you get to retirement. If you have most of your money in pre-tax accounts, like a traditional 401(k) plan or an IRA, you might want to take advantage of Roth accounts, said Marguerita Cheng, a certified financial planner and chief executive officer of Blue Ocean Global Wealth. This could be in the form of a Roth 401(k), if your company allows it (or a split between a traditional and Roth 401(k), if that’s an option). It could also be a Roth IRA. You can contribute directly to a Roth IRA, or convert some of your pre-existing funds into one.

You don’t have to jump on a Roth conversion now if you’re in a high tax bracket, or a tax bracket you expect is higher than it will be later on.

“This could be after retirement, but before beginning Social Security benefits,” said Seth Mullikin, a certified financial planner and founder of Lattice Financial. “It will also help reduce their RMDs as the Roth IRA is not subject to RMD rules.”

HSA accounts and delaying Social Security

Funding a Health Savings Account is another tax-advantageous strategy. “HSAs can reduce taxable income in retirement, which can affect Medicare premiums and the amount of Social Security benefits subject to federal income tax,” Cheng said. “In retirement, using the HSA (instead of your IRA) for medical is preferable because not only are HSAs funds not taxable, they don’t affect your provisional income. Provisional income is what determines how much of your Social Security is included in your taxable income.”

You may also decide you can delay your Social Security benefits until age 70, or closer to age 70 at least. The longer you delay your benefits up until that point, the more money you’d get in Social Security benefits. You’d also have less time potentially subject to taxation. Pushing back claiming could also reduce the amount of money subject to taxation, said Ashton Lawrence, a certified financial planner and director at Mariner Wealth Advisors. “By delaying benefits, pre-retirees can maximize their Social Security income while minimizing tax liabilities,” he said.

It’s great that you’re trying to be as specific as possible in your benefits, but know that you do have time — and that time can make all sorts of changes. Instead of trying to drill in on one specific number right now, keep an eye on how your personal circumstances (and the political ones around us) affect your Social Security, and prepare as best as you can for what you do have control over.

Most Read from MarketWatch

Crypto exchange Kraken started notifying affected XRP holders about the potential monetary benefits they could receive from the class action lawsuit against Ripple.

The exchange recently emerged victorious in the Zakinov v. Ripple Case. The exchange successfully intervened to protect its customers’ data from being shared without their consent.

Kraken Begins The Notification Process

Kraken, one of the largest crypto exchanges in the world, intervened in the Zakinov v. Ripple lawsuit, seeking to protect its customer’s privacy and data. The court ruling allowed Kraken to inform the affected users about the class action against Ripple, ultimately giving the customers the option to decide whether to participate in the lawsuit.

Kraken has now begun to notify eligible customers about the potential monetary benefits from the Zakinov v. Ripple lawsuit. The notification is aimed at Kraken users who purchased XRP during the previously established period, as the email stated:

Our records indicate that you have purchased XRP on Kraken between July 2, 2017 and June 30, 2023, which means that it might be within your rights to receive money or benefits that come from the lawsuit, depending on the outcome.

Yassin Mobarak, Dizer Capital Founder, was among the recipients, and he shared part of the email on X (formerly known as Twitter), expressing his surprise about the notification and the possibility of earning a profit from his XRP holdings through the class action lawsuit.

I always thought I would make money from my $XRP holdings, but not like this 😂

PS.

First I thought this was a scam email, but now I think it’s real. pic.twitter.com/4jhLuUSqEt— Yassin Mobarak 🪝 (@Dizer_YM) February 9, 2024

Mobarak expressed his initial disbelief in the email’s legitimacy, as recent phishing attacks exploited official email accounts of actors in the Web3 industry and exposed users to a massive and sophisticated phishing campaign.

The legitimacy of the emails was doubted by several Kraken customers who sought confirmation from the exchange’s official X account. Kraken’s support team confirmed the email as safe and authorized by the exchange.

Next Steps For XRP Holders

Following the notification, Kraken has updated its support page to provide customers with further details about the class action lawsuit.

The exchange addressed doubts such as who the affected parties are, clarifying that it “only applies to class members who purchased XRP within the United States during the relevant class period” and offering further information about the lawsuit:

The lawsuit also claims that persons or entities who purchased XRP during the class period (July 3, 2017, to June 30, 2023) have the right to recover (a) the consideration paid for the XRP, with interest, if they retained the XRP, less the current price of the XRP or upon tendering the XRP, or (b) damages if they sold the XRP at a loss.

Lastly, the exchange presented two options for the affected customers: do nothing or ask for an exclusion from the lawsuit.

As mentioned in the email you received, you have the option to either do nothing or exclude yourself. For more details, please visit the support article linked below.

Best,

Kraken Support 🐙— Kraken Support (@krakensupport) February 8, 2024

If the customer decides to do nothing, they will keep the possibility of getting the money or benefits from the lawsuit’s resolution. However, they automatically give up on any rights to sue Ripple separately in the future.

If they decide to be excluded from the class action and the potential benefits, XRP holders maintain the right to sue the defendant and must send a signed “Exclusion Request” statement by April 5, 2024.

XRP is trading at $0.52325 in the hourly chart. Source: XRPUSDT on TradingView.com

Featured image from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.