In the last 12 days of April, the stablecoin sector expanded by $4.46 billion, reaching a current valuation of $155.86 billion. Additionally, the top five dollar-pegged cryptocurrencies experienced an increase in their supplies over the last 30 days. Top Dollar-Pegged Cryptos See Growth Amid April’s First 12 Days As of Friday, April 12, 2024, the […]

In the last 12 days of April, the stablecoin sector expanded by $4.46 billion, reaching a current valuation of $155.86 billion. Additionally, the top five dollar-pegged cryptocurrencies experienced an increase in their supplies over the last 30 days. Top Dollar-Pegged Cryptos See Growth Amid April’s First 12 Days As of Friday, April 12, 2024, the […]

Source link

Billion

U.S. President Joe Biden speaks about student loan debt forgiveness in the Roosevelt Room of the White House in Washington, D.C., on Aug. 24, 2022.

Evan Vucci | AP

Here is who benefits from this round of forgiveness

In this round of forgiveness, more than 206,000 borrowers will collectively get $3.6 billion in debt erased through the Biden administration’s new Saving on a Valuable Education, or SAVE, plan, due to the provision that allows for debt forgiveness after shorter periods than other income-driven repayment plans for those who originally took out small amounts for college.

More than 65,000 borrowers will have their loans canceled through fixes to the Department of Education’s income-driven repayment plans, and 4,600 borrowers are benefiting from the improvements to the government’s loan forgiveness program for public servants. Aid for these groups in this round of forgiveness amounts to $3.5 billion and $300 million, respectively.

Biden’s 2020 campaign promise to erase student debt was thwarted at the Supreme Court last June. The conservative justices ruled that Biden’s $400 billion loan cancellation plan was unconstitutional.

After that, the president directed the Department of Education to examine its existing authority to reduce and eliminate students’ debts. Mainly by improving current loan relief programs, the department has cleared the federal education loans of 4.3 million people, totaling $153 billion in aid, while Biden has been in office.

Relief is a result of fixes to federal student loan system

The Biden administration has been reviewing borrowers’ payment timelines and allowing them to get credit for periods that historically did not qualify, such as during certain deferments and forbearances.

It also rolled out a new income-driven repayment plan, the SAVE plan, in which borrowers with smaller loan balances can get debt forgiveness after as little as 10 years.

The Department of Education has been going over the accounts of borrowers pursuing Public Service Loan Forgiveness, too, trying to deliver more people relief under the program.

Previously, PSLF was famously complicated and excluded borrowers on technicalities, including their federal loan type, even if they were working a qualifying public service job. The Biden administration has loosened some of these rules.

The president also rolled out his wide-scale student loan forgiveness do-over plan earlier this week.

Quick Take

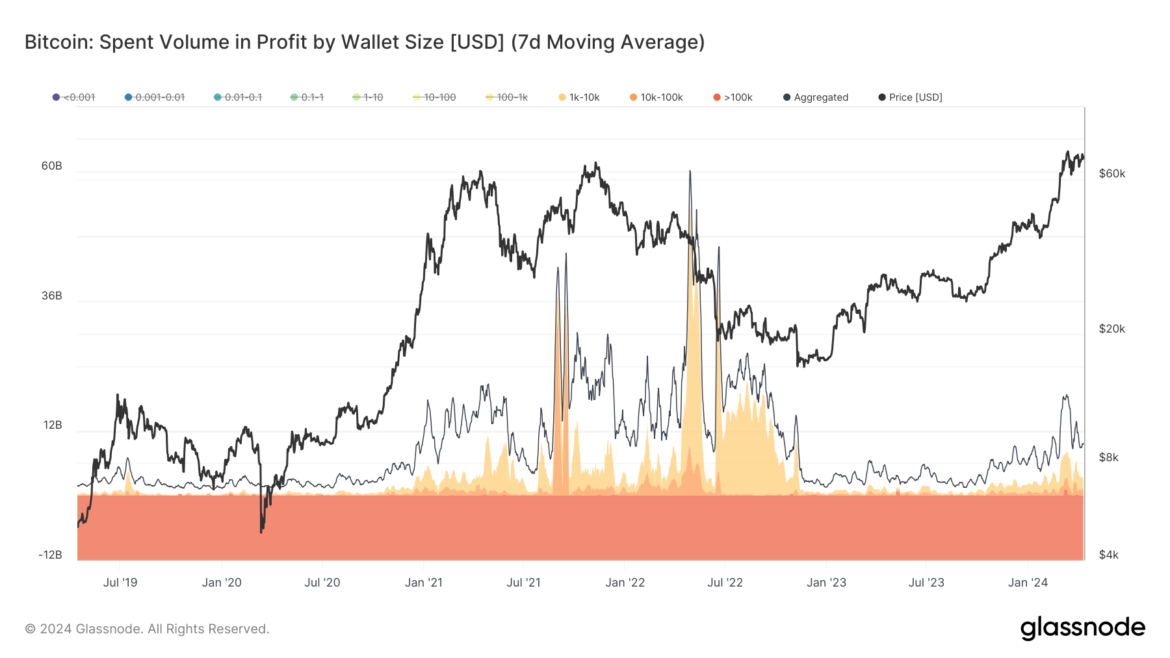

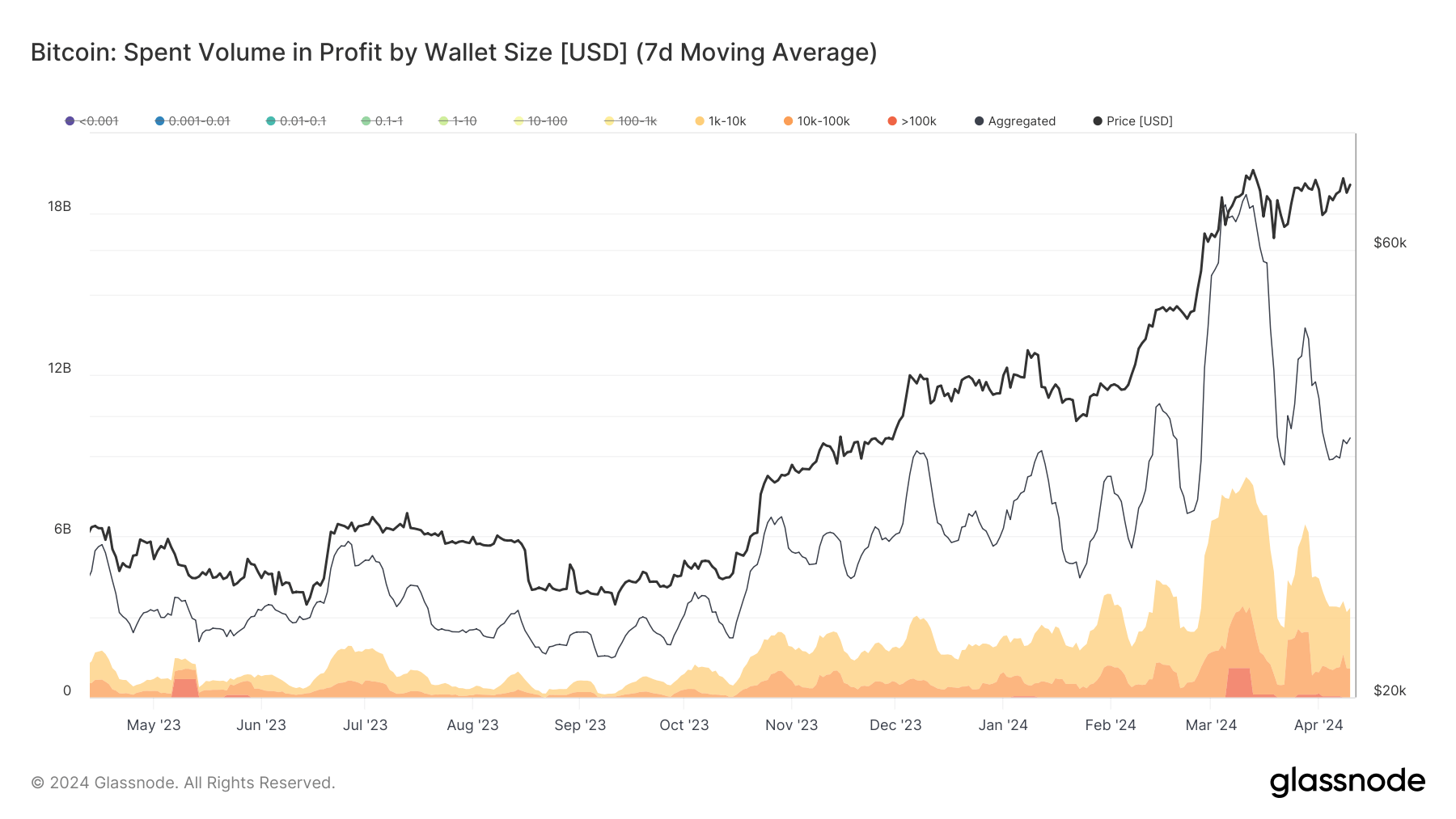

On March 14, Bitcoin reached its all-time high, followed by a significant drop to around $60,800. Data reveals that whales holding 1,000 or more Bitcoins offloaded approximately $8 billion worth of profits at the peak. Investors who hold 100,000 Bitcoin or more took profits for the first time since May 2023, when Bitcoin traded at roughly $27,500. Analyzing the spending pattern, they offloaded approximately $1 billion worth of profit each day from March 6 to March 12.

Comparing the March 2024 all-time high (ATH) of roughly $73,500 to the April and November 2021 ATHs of approximately $63,000 and $69,000, respectively, profit-taking levels were similar. However, the bear market that started in mid-2021 witnessed significantly higher profits in the second half of the year compared to the first, possibly influenced by investor concerns over the Federal Reserve’s first rate hike in 2022, prompted by headline inflation reaching around 5.5% in June 2021, according to Trading Economics.

In 2022, it was revealed that whales cashed out over $30 billion in profits on certain days despite Bitcoin being in a falling market. Historical data suggests that significant profit-taking by whales can often signal the beginning of a market correction or market tops.

The post Whale profit-taking reached $8 billion at Bitcoin’s record high appeared first on CryptoSlate.

Billionaire Bill Ackman Owns $1.9 Billion Worth of This Artificial Intelligence (AI) Stock Instead

Nvidia (NASDAQ: NVDA) is arguably the world’s most popular artificial intelligence (AI) stock, as evidenced by its 215% gain in the past year alone. It’s not a claim without merit, because the company’s revenue more than doubled in fiscal 2024 (which ended Jan. 28) on the back of its industry-leading AI data center chips.

But if investors want to know where the AI industry is headed next, it can be helpful to know where billionaires are putting their money. Bill Ackman, for example, manages a $10 billion stock portfolio for his hedge fund, Pershing Square Capital Management, and he doesn’t own Nvidia at all.

Instead, Ackman owns a $1.9 billion position in Google parent Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL). Not only has he made solid gains on that investment already, but the stock is also still cheap and could be poised for further upside thanks to the company’s AI initiatives.

Here’s why it’s not too late for investors to follow Ackman’s lead.

Microsoft created an opportunity for Ackman to buy Alphabet

It’s no coincidence Bill Ackman bought Alphabet stock in the first quarter of 2023 when Microsoft (NASDAQ: MSFT) announced its $10 billion investment in leading AI startup OpenAI. Microsoft quickly integrated OpenAI’s ChatGPT technology into its Bing search engine, in an attempt to disrupt Google’s 91% market share in the internet search industry.

Traditional search engines like Google typically make the user sift through web pages for the information they need, whereas Bing’s new chatbot interface can instantly provide a direct answer to almost any question. It’s a far more convenient experience. Alphabet stock plunged because investors feared the company fell way behind Microsoft on the AI front, but Ackman viewed that as a buying opportunity.

In a recent interview with David Rubenstein, Ackman said Alphabet’s valuation had fallen so much that he was getting a great deal on the company’s existing businesses, like search and YouTube, while getting its AI initiatives basically for free.

It’s interesting to note that Ackman felt Alphabet’s AI technology was neck-and-neck with OpenAI’s when he made the investment, even though Alphabet hadn’t launched its own AI chatbot yet.

Alphabet’s Gemini now outperforms OpenAI’s latest GPT-4 models

Shortly after Microsoft announced its OpenAI investment, Alphabet reminded investors it had been working on AI for years. After all, Google acquired AI startup DeepMind way back in 2014. That’s why it took only a few months to launch Google Bard, a chatbot designed to compete directly with ChatGPT.

The quality of a generative AI application comes down to the quality of the developer’s data, and since Google has been the window to the internet for decades, it arguably has more useful information with which to build AI applications than any other company.

Bard paved the way for Alphabet’s latest and greatest family of AI models called Gemini, which were launched in December. According to Alphabet, Gemini outperforms OpenAI’s most advanced GPT-4 models across most multimodal benchmarks. In other words, it’s capable of interpreting and generating text content, images, videos, and computer code more accurately.

Alphabet announced the release of Gemini 1.5, which is even more advanced, in February. The company says it’s far better at “in-context learning,” meaning it can learn new skills from users’ prompts without needing additional fine-tuning from developers. In one test, Alphabet gave Gemini 1.5 a grammar manual for a rare language called Kalamang — which has fewer than 200 speakers worldwide — and it could translate it at a similar level to human subjects who used the same learning material.

Gemini is now available as a standalone chatbot, but its technology is also woven into the traditional Google Search engine to feed users text-based responses in their search results. That reduces the amount of time users have to spend clicking through to third-party web pages for the information they need, striking a balance between traditional search and the chatbot experience.

Ackman is sitting on big gains, but Alphabet stock can still go higher

Ackman bought the bulk of Pershing Square’s Alphabet position in the first quarter of 2023, at an estimated average price of $96.56. That implies he’s sitting on a 60% gain based on the stock’s current price of $154.85. Ackman added to his holdings in the second and third quarters of 2023, and he’s sitting on a profit on those positions, too. But it isn’t too late for investors to follow his lead, because the stock is still relatively cheap.

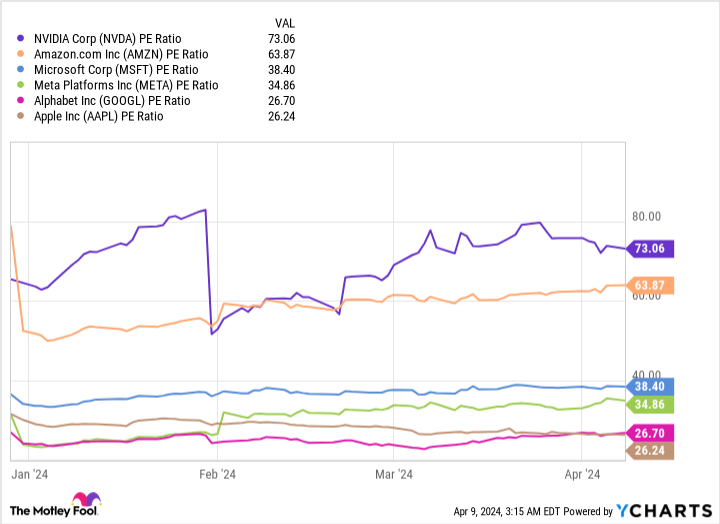

Alphabet generated a record $307.4 billion in revenue in 2023, with $5.80 in earnings per share (that is, profit). The latter places Alphabet stock at a price-to-earnings (P/E) ratio of 26.7. That means Alphabet is the second-cheapest stock among the six U.S. tech giants valued at $1 trillion or more:

The advertising dollars generated by Google Search still account for most of Alphabet’s revenue. However, Google Cloud is the company’s fastest-growing segment thanks to its growing portfolio of AI services. Businesses and developers can access the latest data center infrastructure and ready-made large language models, including Gemini, on Google Cloud to build their own AI applications.

Alphabet is also weaving Gemini into its other products, such as Google Docs and Gmail, offering a productivity boost to customers who can now use AI to rapidly craft content in those applications. Longer-term, Alphabet is reportedly negotiating with Apple to make Gemini the default AI chatbot on that company’s devices, including the iPhone. Details are scarce, but it could be an incredible opportunity, considering Apple has an installed base of more than 2.2 billion devices worldwide.

I think Ackman made a spectacular bet on Alphabet, and his $1.9 billion position is likely to continue to grow in value.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $522,969!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget Nvidia: Billionaire Bill Ackman Owns $1.9 Billion Worth of This Artificial Intelligence (AI) Stock Instead was originally published by The Motley Fool

Almost Half of Warren Buffett’s $369 Billion Portfolio Is Invested in Only 1 Stock

There’s no denying Warren Buffett’s remarkable track record. As the CEO of Berkshire Hathaway, he has done an amazing job compounding capital at high rates over multiple decades. This is why the average investor closely watches what the Oracle of Omaha owns.

Berkshire’s massive $369 billion portfolio has dozens of stocks. But Apple (NASDAQ: AAPL), which represents 41.4% of the overall portfolio, stands out as the single largest holding. The FAANG stock has soared 542% since the start of 2016 (as of April 2), which is around the time Buffett first started buying the business.

Before investors contemplate whether it’s a good idea to scoop up shares today, it’s important to understand the factors that first drew Buffett to Apple.

Apple’s wonderful qualities

Even in early 2016, Apple had one of the world’s strongest brands, boosted by its lineup of incredibly popular hardware products. This gave the company pricing power. Consumers want to continue paying up for new devices.

Buffett appreciates businesses that can consistently ask their customers to pay more without hurting demand. Another top Berkshire holding is Coca-Cola, which certainly fits this category.

Apple is a financial powerhouse. In fiscal 2015, the business posted an operating margin of 30%. And it generated $70 billion of free cash flow (FCF) that year.

This type of profitability continues today. Apple produced $100 billion of FCF in fiscal 2023. Management used this windfall to pay $15 billion in dividends and to repurchase $83 billion worth of outstanding stock.

In addition to strong financial performance, valuation is another top factor that Buffett looks at. During the first three months of 2016, Apple shares traded at an average price-to-earnings (P/E) ratio of 10.6. Given some of the sky-high valuations in the market today, this was an absolute steal for such a dominant company. Buffett took full advantage of the buying opportunity.

Should you buy Apple stock right now?

While Apple has obviously worked out as a tremendous investment for Berkshire and Buffett, investors shouldn’t just automatically buy the stock right now. I think it’s best to view the current situation with a fresh perspective.

If investors can agree on one thing today, it’s that Apple is no longer the screaming bargain that it was about eight years ago when Buffett first bought shares. In my opinion, this is an expensive stock right now, which makes sense given its impressive performance over the years.

Apple shares trade at a current P/E ratio of 26.3. To be fair, this has come down from the 32.3 it was less than four months ago. But it’s still pricey.

That’s because Apple certainly doesn’t have the same growth potential that it did several years ago. This is a far more mature enterprise today.

In fact, the business saw its sales decline slightly in fiscal 2023. And over the next three years, Wall Street analysts expect revenue and earnings per share to rise at annualized clips of 4.4% and 8.3%, respectively. Paying such a high valuation multiple doesn’t seem like a smart move considering these weak forecasts.

We can’t read his mind. However, I suspect Buffett still owns the stock because he doesn’t want to trigger a taxable event. Or maybe he simply wouldn’t know what to do with all the cash, a problem that Berkshire has already been dealing with.

Apple has been a huge winner historically. But based on where things stand today, it’s best to pass on the stock.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $539,230!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 4, 2024

Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Almost Half of Warren Buffett’s $369 Billion Portfolio Is Invested in Only 1 Stock was originally published by The Motley Fool

Solana’s stablecoin supply surges past $3 billion, USDC leads the charge

Stablecoin supply on the layer-1 blockchain network Solana has increased steadily since the beginning of the year, crossing the $3 billion mark during the past week.

Data from the blockchain analytical platform Artemis shows that the stablecoin supply on the network has increased by 55.72% in the last three months to reach $3.12 billion.

Notably, this number pales significantly against the balance on the network in 2022, when more than $6 billion worth of these assets were on the blockchain. However, it plummeted to as low as $1.4 billion during the bear market situation before embarking on the recent upward trend.

Meanwhile, stablecoin transfer volume on Solana surged by 164% to $1.4 trillion, reflecting the significant amount of activity the network has enjoyed.

USDC dominates

A breakdown of stablecoins on Solana shows Circle’s USD Coin’s (USDC) dominance, accounting for 73% of such assets on the network.

For context, Artemis data show that USDC accounted for a significant $63.69 billion of stablecoin transfer volume on April 2, overshadowing USDT’s $812.41 million. EURC completes the top three with less than $100,000 in volume.

USDC’s dominance on Solana can be directly linked to Circle’s launch of its Cross-Chain Transfer Protocol (CCTP) on the network on March 26.

Why Solana stablecoins balance is rising

Stablecoins play a crucial role as an intermediary between traditional fiat currencies and digital assets. An increasing stablecoin supply indicates heightened liquidity and is indicative of increased capital infusion.

Market observers have explained that this upsurge reflects the significant influx of capital into the network, coinciding with the frenzy surrounding memecoins and the expanding DeFi activity within the Solana ecosystem.

Over the past year, the Solana blockchain ecosystem has witnessed notable expansion despite its previous ties to Sam Bankman-Fried, the controversial founder of FTX. This growth has attracted a wave of new users and forged significant partnerships with major global financial entities, including Visa and Shopify.

The post Solana’s stablecoin supply surges past $3 billion, USDC leads the charge appeared first on CryptoSlate.

Bitcoin Miners’ Earnings Hit Record $2 Billion in March Ahead of Halving Event

In March, bitcoin miners amassed an unprecedented level of revenue not seen in the previous 12 months, hitting a high of $2.01 billion from rewards and transfer fees. Of this total, $85.81 million was earned from transaction fees over the past month. Historic Month for Bitcoin Miners — Income Peaks at $2 Billion As we […]

In March, bitcoin miners amassed an unprecedented level of revenue not seen in the previous 12 months, hitting a high of $2.01 billion from rewards and transfer fees. Of this total, $85.81 million was earned from transaction fees over the past month. Historic Month for Bitcoin Miners — Income Peaks at $2 Billion As we […]

Source link

Bitcoin Futures Open Interest Hits Record $37.55 Billion With CME Leading the Pack

On Friday, March 29, 2024, the combined open interest in bitcoin futures reached a new all-time peak of $37.55 billion. This uptick occurs amid buoyant bitcoin markets and a growing attraction from institutional investors. Bitcoin Futures Open Interest Reaches Unprecedented $37.55 Billion Since the close of 2023, interest in bitcoin (BTC) derivatives has escalated, reaching […]

On Friday, March 29, 2024, the combined open interest in bitcoin futures reached a new all-time peak of $37.55 billion. This uptick occurs amid buoyant bitcoin markets and a growing attraction from institutional investors. Bitcoin Futures Open Interest Reaches Unprecedented $37.55 Billion Since the close of 2023, interest in bitcoin (BTC) derivatives has escalated, reaching […]

Source link

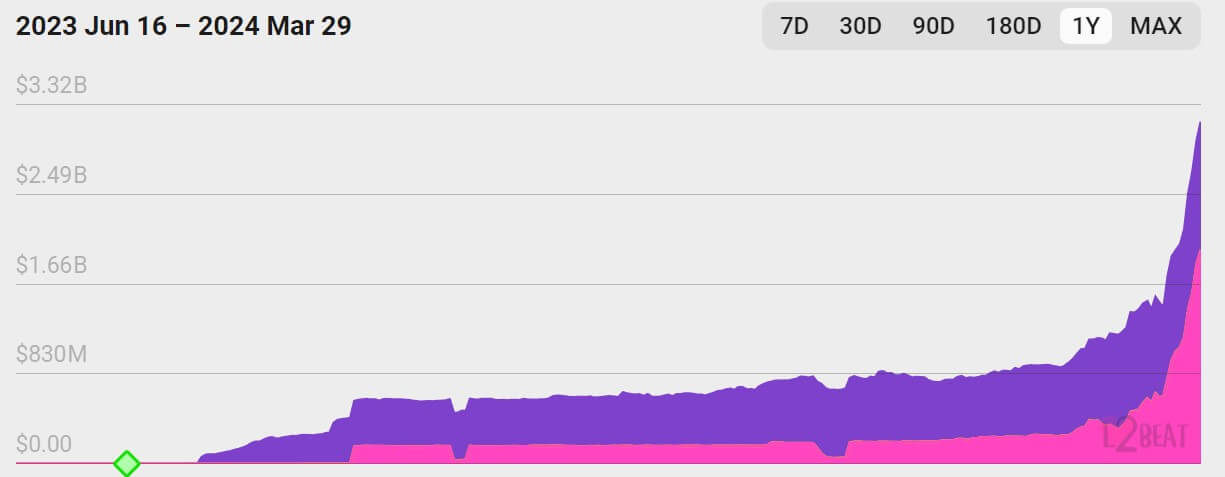

Base network TVL exceeds $3 billion, with daily users surpassing 5 million

The Ethereum layer-2 network, Base, has witnessed a remarkable surge in assets locked, soaring by approximately 200% over the last month to over $3 billion, according to L2beat data.

Key contributor Jesse Pollak disclosed that Base hit the $3 billion milestone five days after crossing the $2 billion threshold. Notably, the network took 203 days to reach its first billion mark and just 23 days to touch $2 billion.

Furthermore, on-chain data shows that the increased TVL is matched with an ever-expanding user base. According to the Dune analytics dashboard curated by Watermeloncrypto, Base’s daily active users have surpassed 5 million this week, with the network’s total revenue already exceeding $36 million.

Consequently, industry experts foresee Base’s growth catalyzing the entry of more firms into on-chain development. Ryan Watkins, the founder of Syncracy Capital, said:

“Imagine when Wall Street realizes Coinbase is printing $500M+ in annual revenue from an Ethereum rollup. Base may be the ultimate catalyst that gets enterprises building onchain.”

Why Base metrics are rising

The network’s exponential growth can be attributed to various factors, including the notable surge in meme coin activities and the advent of innovative products.

There has been a notable surge in memecoins traction on Base recently. Consequently, Base has experienced heightened liquidity and more favorable market sentiment as industry analysts speculated that the assets could spearhead the next adoption phase.

Notably, CryptoSlate reported that Base’s memecoins proliferation briefly spiked its network fees above that of rival layer-2 networks despite the introduction of the Dencun upgrade. To manage this surge, the network adjusted its gas fee target to 3.75 mgas/s, which gave it 50% more capacity.

Moreover, Base has witnessed a surge in crypto developers creating new products on the layer-2 solution, further fostering adoption and usage.

For context, Base recently welcomed one of the pioneer layer-3 networks, Degen, to its ecosystem on March 28. It said:

“L3s are appchains which deliver lightning-fast transactions because they settle on L2s like Base instead of connecting directly to Ethereum. A new onchain internet demands new models for scaling, and L3s utilize the power of L2s in new ways.”

Andrew Forte, the director of business development at Dappd, also highlighted Coinbase’s recent efforts to develop a native smart wallet that does not need seed phrases or private keys for the layer-2 solution. According to him, this wallet could help drive Coinbase’s vast user base to Base.

Coinbase plans to incentivize developers to contribute to the network through grants, allowing them to build freely and rewarding those who positively impact the ecosystem.

Pollak added:

“Gas grants will be upfront, with path to scaling. Builder grants will be primarily retroactive because we’ve observed that creates aligned incentives and a strong builder culture.”