Binance’s chief executive has shared his company’s future direction and areas of focus following its settlement with U.S. authorities, including the Department of Justice (DOJ). “We have moved past that as the company move into greater maturity,” he insisted, adding that the crypto firm is focusing on “sustainability.” ‘The Direction of Travel Is Very Clear’ […]

Binance’s chief executive has shared his company’s future direction and areas of focus following its settlement with U.S. authorities, including the Department of Justice (DOJ). “We have moved past that as the company move into greater maturity,” he insisted, adding that the crypto firm is focusing on “sustainability.” ‘The Direction of Travel Is Very Clear’ […]

Source link

Binance

Nigerian court orders Binance executive to remain in prison despite not guilty plea

A Nigerian High Court in Abuja ordered that the detained Binance executive Tigran Gambaryan be remanded in prison following the postponement of his bail hearing.

Gambaryan, a US citizen, pleaded not guilty to money laundering charges earlier today and will remain in custody until his bail hearing on April 18. The trial will commence on May 2, and in the interim, he will be held at Kuje Correctional Center, one of the largest prisons in the nation’s capital.

Today’s court appearance follows Gambaryan’s arrest over six weeks ago, along with another Binance executive, Nadeem Anjarwalla, regarding the exchange’s alleged involvement in worsening Nigeria’s foreign exchange woes. Anjarwalla escaped custody last month but is being tried in absentia.

Binance has yet to respond to CryptoSlate’s request for comment as of press time.

Why Gambaryan was remanded

Gambaryan faces multiple charges, including five counts of money laundering. His legal counsel contended that he shouldn’t bear responsibility for Binance’s actions, stressing his limited decision-making role within the exchange.

However, Judge Emeka Nwite dismissed this argument, citing Gambaryan’s prior representation of Binance in Nigeria. Notably, Binance said Gambaryan had previously facilitated a training session for Nigerian law enforcement agents on how to detect crypto frauds.

Furthermore, the judge highlighted Gambaryan and Anjarwalla’s affidavit affirming their presence in Nigeria since February, acting as representatives of the crypto exchange firm.

Consequently, the judge deemed Gambaryan’s refusal to acknowledge the charges on Binance’s behalf as unlawful.

The judge further rejected Gambaryan’s lawyer’s appeal to detain him under the prosecuting agency, the Economic and Financial Crimes Commission. The judge reportedly ruled that Gambaryan’ should be held at Kuje because there “have been Nigerians who had been convicted in the US and were detained in their prisons.”

The post Nigerian court orders Binance executive to remain in prison despite not guilty plea appeared first on CryptoSlate.

Dogecoin Whale Takes $52.3 Million In DOGE Off Binance, Sign Of Buying?

On-chain data shows a Dogecoin whale made a large withdrawal from Binance today, which may be bullish for the memecoin’s price.

A Large Amount Of Dogecoin Has Left The Binance Platform In The Past Day

According to data from the cryptocurrency transaction tracker service Whale Alert, a large transfer has been spotted on the Dogecoin blockchain during the past day.

In this move, the network has processed the movement of 304,588,737 DOGE, worth around $52.3 million when the transaction was executed. Given the large scale of the transfer, it’s likely that a whale entity was involved.

The whales are influential on the network due to the sheer number of tokens they carry in their wallets. As such, their moves can be worth keeping an eye on since they may cause noticeable fluctuations in the market.

How the market would be affected by the moves from these humongous entities depends on what they intend to do with those moves. Naturally, it’s impossible to say what an investor plans to do confidently.

The type of addresses involved in the transaction, however, can sometimes at least provide a hint about what the whale may have wanted to achieve with the move.

Below are the details of the latest Dogecoin whale transaction, which reveals its relevant addresses.

Looks like this massive move only required a negligible fee of $0.03 to be possible on the Dogecoin blockchain | Source: Whale Alert

As is visible, this Dogecoin transaction was executed from a wallet connected to the cryptocurrency exchange Binance. The destination of the move appears to have been a couple of unknown addresses.

An unknown address refers to a wallet not affiliated with any centralized entity like an exchange (the sender in this transfer is a “known” wallet as it’s attached to a central entity in Binance). Generally, such addresses are the investors’ personal, self-custodial wallets.

Transfers where coins move in the direction of exchanges to self-custodial entities are known as “exchange outflows.” Usually, investors make such moves when they plan to hold onto their coins long-term, as it’s safer to do so outside of these platforms, where the platforms control the wallets.

Exchange outflows can also sometimes be an indication that fresh buying is going on, as some investors like to immediately withdraw their purchases of these platforms.

Given the relatively massive scale of the Dogecoin exchange outflow in the current case, it can naturally be bullish news for investors if the whale is indeed accumulating here.

However, the scenario also exists where the whale has withdrawn to sell through the peer-to-peer (P2P) mode. In this case, the effect on the asset could be bearish instead.

DOGE Price

At the time of writing, Dogecoin is floating around $0.176, down 16% over the past week.

The price of the asset seems to have been going down recently | Source: Whale Alert

Featured image from Mike Doherty on Unsplash.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Nigerian Court Postpones Detained Binance Executive’s Tax Evasion Case to April 19

A Nigerian court has postponed the tax evasion case of the detained Binance executive to April 19, while the hearing for the cryptocurrency exchange itself is scheduled for April 8. The court also ordered that the executive Tigran Gambaryan be held in the custody of the Economic and Financial Crimes Commission. Tigran Gambaryan Accused of […]

A Nigerian court has postponed the tax evasion case of the detained Binance executive to April 19, while the hearing for the cryptocurrency exchange itself is scheduled for April 8. The court also ordered that the executive Tigran Gambaryan be held in the custody of the Economic and Financial Crimes Commission. Tigran Gambaryan Accused of […]

Source link

Bitcoin NFT Market Thrives, Franklin Templeton Remains Bullish, Binance Ends Support

Franklin Templeton’s digital assets division has released a note to its investors introducing Bitcoin-based non-fungible tokens (NFTs), highlighting a surge in activity within the Bitcoin ecosystem.

The asset manager attributes this increased momentum to various factors, including the emergence of Bitcoin (BTC) NFTs called Ordinals, the development of new fungible standards like BRC-20 and Runes, the growth of Bitcoin Layer 2 (L2s) solutions, and the expansion of decentralized finance (DeFi) applications built on the Bitcoin network.

Bitcoin Ordinals Shine

According to the Bitcoin ETF issuer’s report, activity in the Bitcoin NFT space is gaining momentum. In particular, Ordinals have seen a significant increase in trading volume over the past few months.

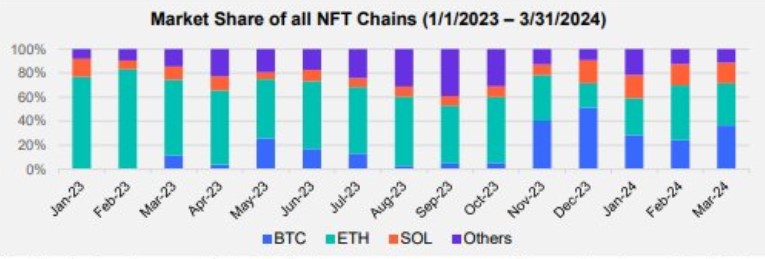

This growth is evident in Bitcoin’s dominance in terms of trading volume, which surpassed Ethereum (ETH) in December 2023, as shown in the accompanying chart.

In addition, several collections of Bitcoin Ordinals are emerging as dominant players in the NFT market, both in terms of trading volume and market capitalization.

These collections include NodeMonkes, Runestone, and Bitcoin Puppets, which have an aggregate market cap of $353 million, $339 million, and $168 million, respectively. They are the most notable collections.

In terms of trading volume over the past 30 days, the report shows that these three collections recorded trading volumes of $81 million, $85 million, and $38 million, respectively, over the past month.

The asset manager further claimed that what distinguishes BTC Ordinals from NFTs on other blockchains, such as Ethereum or Solana, is that they contain raw data recorded directly on the Bitcoin blockchain. This feature contributes to the attractiveness and growing popularity of Bitcoin Ordinals, as evidenced by market cap and trading volume figures.

Franklin Templeton, known for its involvement in the ETF market, was one of the issuers that launched a spot BTC ETF in the United States earlier this year. Its ETF, which trades under the ticker name “EZBC,” has seen total inflows of 281.8 million since its January 11 launch, according to BitMEX research data as of April 3.

Despite its zero-fee structure, Franklin Templeton’s ETF has seen a significant difference in flows compared to the leading players in the newly approved ETF market, such as Blackrock (IBIT) and Fidelity (FBTC), which have seen flows of over 14 billion and 7.7 billion, respectively.

Binance To Discontinue Support For BTC NFTs

In a recent blog post, crypto exchange Binance announced it would discontinue support for Bitcoin-based NFTs on its marketplace. Less than a year after their introduction, Binance will no longer facilitate airdrops, benefits, or utilities associated with BTC NFTs, citing a need to streamline its product offerings in the NFT space.

Binance states that users who own Bitcoin NFTs are advised to withdraw them from the Binance NFT marketplace via the Bitcoin network before May 18, 2024.

Effective April 18, 2024, users can no longer purchase, deposit, bid, or list NFTs via the BTC network on the Binance NFT Marketplace. Any existing listing orders affected by this change will be automatically canceled simultaneously.

Currently, BTC is trading at $68,300, up a modest 3% in the last 24 hours. It is approaching the significant milestone of $70,000, a level the cryptocurrency has struggled to maintain several times.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Crypto exchange Binance, currently facing criminal charges in Nigeria, notably lacked legal representation at its April 4 court hearing in the African nation.

Instead, the hearing was only attended by its compliance chief, Tigran Gambaryan, who the Nigerian government has detained since the end of February.

However, despite expectations for the proceedings to advance, the Nigerian High Court postponed the case until April 19.

As of press time, Binance has yet to respond to CryptoSlate’s request for comment.

Why was the case adjourned?

Last week, CryptoSlate reported that the authorities charged Binance and its executives with failing to register with relevant local agencies and avoiding tax responsibilities.

Additionally, the Nigerian government accused Binance of facilitating users who evade tax payments.

However, the government somehow failed to serve the case charges to the defendants despite having Gambaryan within their custody since February.

Chukwuka Ikwuazo, legal counsel for Gambaryan, argued that the arraignment should not proceed due to this lapse.

Binance’s case in Nigeria

In the past two months, Binance has faced ongoing disputes with the Nigerian government regarding its alleged involvement in worsening the country’s foreign exchange issues.

Despite Binance’s consistent denial of any wrongdoing, the Nigerian authorities, including the Federal Inland Revenue Services and Nigeria’s Economic and Financial Crimes Commission, have filed criminal complaints against it and its executives—Nadeem Anjarwalla and Gambaryan.

Anjarwalla, a UK citizen, evaded custody in March. He is currently being tried in absentia and the government has enlisted the help of Interpol to aid in his extradition.

Conversely, Binance has called for the release of Gambaryan, emphasizing that he does not make pivotal decisions within the company.

Notably, Gambaryan has also initiated legal actions against the Nigerian authorities, citing a violation of his fundamental human rights.

The post Binance executive remains detained as Nigerian court postpones case appeared first on CryptoSlate.

Binance NFT to Halt Bitcoin NFT Activities, Focus Shifts Away From BTC-Based Collectibles

In a recent announcement by Binance on April 4, 2024, the firm disclosed its decision to halt support for Bitcoin-based Ordinal non-fungible token (NFT) collectibles within its NFT marketplace. The directive from Binance calls for users of its NFT marketplace to withdraw their Ordinal inscriptions by May 18, 2024. Binance NFT Marketplace to End Ordinal […]

In a recent announcement by Binance on April 4, 2024, the firm disclosed its decision to halt support for Bitcoin-based Ordinal non-fungible token (NFT) collectibles within its NFT marketplace. The directive from Binance calls for users of its NFT marketplace to withdraw their Ordinal inscriptions by May 18, 2024. Binance NFT Marketplace to End Ordinal […]

Source link

Crypto exchange Binance said its non-fungible token (NFT) marketplace will discontinue support for Bitcoin NFTs by April 18, per an April 4 statement.

According to the exchange:

“Starting from 2024-04-18 06:00 (UTC), users will no longer be able to buy, deposit, bid on, or list NFTs on the Binance NFT Marketplace via the Bitcoin network. All impacted listing orders will be automatically canceled at 2024-04-18 06:00 (UTC).”

It added that its platform would stop supporting airdrops, benefits, or other utilities associated with the NFTs by April 10.

Notably, this decision is coming less than a year after the platform enabled support for these digital assets.

Why is Binance ending support for Bitcoin NFTs?

Binance explained that its decision was part of “ongoing efforts to streamline product offerings” in its NFT marketplace.

The firm did not comment on whether trading volumes or user demand affected its decision to end those services.

The exchange launched the NFT marketplace in 2021 amid the crypto market boom. While the marketplace enjoyed early successes due to its association with the exchange and football superstar Cristiano Ronaldo, the platform has struggled for considerable adoption compared to rivals like Blur.

Besides that, Binance is navigating regulatory issues across several jurisdictions, including the United States, where it agreed to pay a record fine of more than $4 billion and stop operating within the country.

These regulatory upheavals have prompted a rethink of the exchange’s operating style and the appointment of a seven-member board of directors led by Gabriel Abed, the former ambassador of Barbados to the UAE.

Bitcoin NFTs are thriving

Bitcoin-based NFTs have grown remarkably during the past year, fueled by the rising fascination with Ordinals.

Asset management firm Franklin Templeton pointed out that the innovations within Bitcoin’s ecosystem were primarily fueled by “Bitcoin NFTs, known as Ordinals, new fungible token standards such as BRC-20 and Runes, Bitcoin Layer 2s, and other Bitcoin DeFi primitives.”

Notably, data from CryptoSlam shows that Bitcoin’s NFT sales amounted to $6.37 million within the past 24 hours, marking the second-highest figure in the industry.

Mentioned in this article

Latest Alpha Market Report

The outlook for Binance Coin (BNB) has turned cloudy, with both futures market data and technical indicators flashing bearish signals. Based on our analysis of Coinglass data, negative funding rates and declining open interest in BNB futures contracts paint a picture of growing pessimism among traders.

A negative funding rate suggests that more traders are holding short positions, anticipating a decline in the price of the asset. This sentiment was confirmed on April 1st, when BNB’s funding rate dipped into negative territory at -0.012%.

Binance Coin Funding Rate And Open Interest Down

Further fueling the bearish narrative, BNB’s futures open interest has also witnessed a slight decline of 0.15%. Open interest reflects the total amount of outstanding futures contracts that haven’t been settled yet.

A decrease in open interest suggests traders are exiting their positions without opening new ones, potentially signaling waning confidence in the market.

Source: Coinglass

Funding rates are a crucial mechanism in perpetual futures contracts that keep the contract price aligned with the spot price. When the contract price trades higher than the spot price, long position holders pay a fee to shorts, resulting in positive funding rates.

Conversely, negative funding rates materialize when the contract price dips below the spot price, indicating that short sellers are currently paying fees to longs.

Source: Coinglass

More Traders Close Their Positions

As negative sentiments mount, this open interest is expected to plummet further. This would imply that more traders are closing their positions and not opening new ones, suggesting a potential price drop for BNB.

The bearish sentiment isn’t confined to the futures market. The Moving Average Convergence Divergence (MACD), another technical indicator, is suggesting a possible resurgence in selling pressure.

There’s an indication that the MACD line might cross below the signal line, typically interpreted as a bearish sign signaling the return of sellers to the market. It’s noteworthy that since March 18th, the MACD lines for BNB have been positioned for a downtrend.

BNB market cap currently at $87.9 billion. Chart: TradingView.com

BNB Price Retreat In The Offing?

Considering both the futures market and technical analysis, there’s a potential for a short-term decline in BNB’s price. However, it’s important to acknowledge that market sentiment can shift rapidly, and technical indicators aren’t infallible predictors of future price movements.

At the time of writing, BNB was trading at $587, up 6% in the last 24 hours, data from CoinMarketCap shows.

Meanwhile, a closer look at BNB’s technical indicators on the 24-hour chart reveals another trend.

The Directional Movement Index (DMI), used to gauge trend strength, displayed a bearish crossover where the negative directional index sits above the positive directional index. This positioning suggests that bearish momentum is currently dominating the market.

Analysts commonly interpret this particular crossover as an imperative signal prompting traders to consider exiting long positions and initiating short positions.

This strategic move aligns with the prevailing trend indicated by the DMI, reinforcing the notion of a prevailing bearish sentiment within the market ecosystem.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Detained Binance Executive Escapes Custody in Nigeria, Government to Request Interpol Assistance

A senior executive at Binance, who was detained by Nigerian authorities in late February, has since escaped from custody. The executive Nadeem Anjarwalla is believed to have left the country using a Kenyan passport. The Nigerian government confirmed Anjarwalla’s escape and said it would ask Interpol to issue an international arrest warrant. Binance Executive Departs […]

A senior executive at Binance, who was detained by Nigerian authorities in late February, has since escaped from custody. The executive Nadeem Anjarwalla is believed to have left the country using a Kenyan passport. The Nigerian government confirmed Anjarwalla’s escape and said it would ask Interpol to issue an international arrest warrant. Binance Executive Departs […]

Source link