Binance has announced a competition through its crypto derivatives arm, Binance Futures, offering participants the chance to win a Tesla Model Y. According to the crypto exchange, the contest will unfold over four weekly challenges spanning from Feb. 18 to Mar. 17, 2024. Binance Futures Unveils Tesla Model Y Challenge and Daily Crypto Rewards Beginning […]

Binance has announced a competition through its crypto derivatives arm, Binance Futures, offering participants the chance to win a Tesla Model Y. According to the crypto exchange, the contest will unfold over four weekly challenges spanning from Feb. 18 to Mar. 17, 2024. Binance Futures Unveils Tesla Model Y Challenge and Daily Crypto Rewards Beginning […]

Source link

Binances

Binance’s CZ seeks to avoid jail time, refutes DOJ’s flight risk claim

Changpeng ‘CZ’ Zhao, the founder and former CEO of Binance, is contesting the U.S. Department of Justice (DOJ) motion to restrict his travel before sentencing, asserting he doesn’t pose a flight risk.

On Nov. 23, CryptoSlate reported that the DOJ moved to prevent CZ from leaving the U.S., arguing that the Binance founder posed a flight risk because of his substantial wealth and family connections in the UAE.

‘No flight risk’

However, CZ’s legal team rebuts this claim, highlighting U.S. Magistrate Judge Brian A. Tsuchida’s prior decision to grant bail and voluntarily permit CZ to return to the UAE.

“As Judge Tsuchida concluded, based on a complete record, [that] Mr. Zhao presents no risk of flight, having voluntarily come before the Court to accept responsibility and plead guilty, and the government’s motion should be denied.”

They emphasize CZ’s commitment to accepting responsibility for his actions and his lack of criminal history. Additionally, they assert that his guilty plea underlines his intent to cooperate with the court.

Besides that, the filing highlights that CZ’s voluntary appearance was pivotal in resolving the government’s case against Binance. The defense further argues against the government’s contention regarding the lack of an extradition treaty between the U.S. and the UAE, citing inconsistencies in similar bail cases involving foreign defendants.

‘No jail time’

Regarding sentencing, CZ’s legal team has hinted at advocating for no jail time for their client.

Instead, they argue that CZ might be “eligible to serve half of any term of imprisonment in a non-jail setting, such as home detention or community confinement.” The lawyers plan to draw on precedents for similar offenses that could support their client’s release.

The U.S. government indicates a potential maximum 18-month prison term in line with federal guidelines for CZ’s case.

Binance’s $4.3-billion settlement with the United States was the final hurdle before the country’s securities regulator approves spot Bitcoin (BTC) exchange-traded funds (ETFs), many industry watchers claim.

The settlement involved Binance agreeing to Justice Department and Treasury compliance monitors for up to five years, allowing the agencies sweeping powers to keep the exchange in line with Anti-Money Laundering and sanctions rules, among other things.

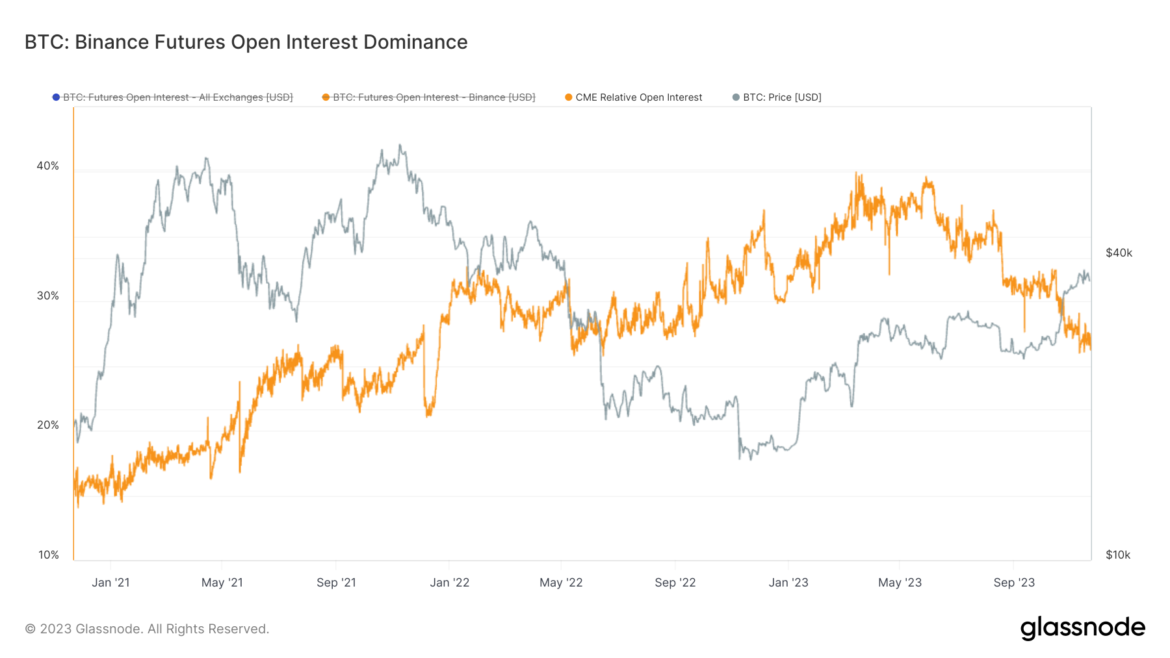

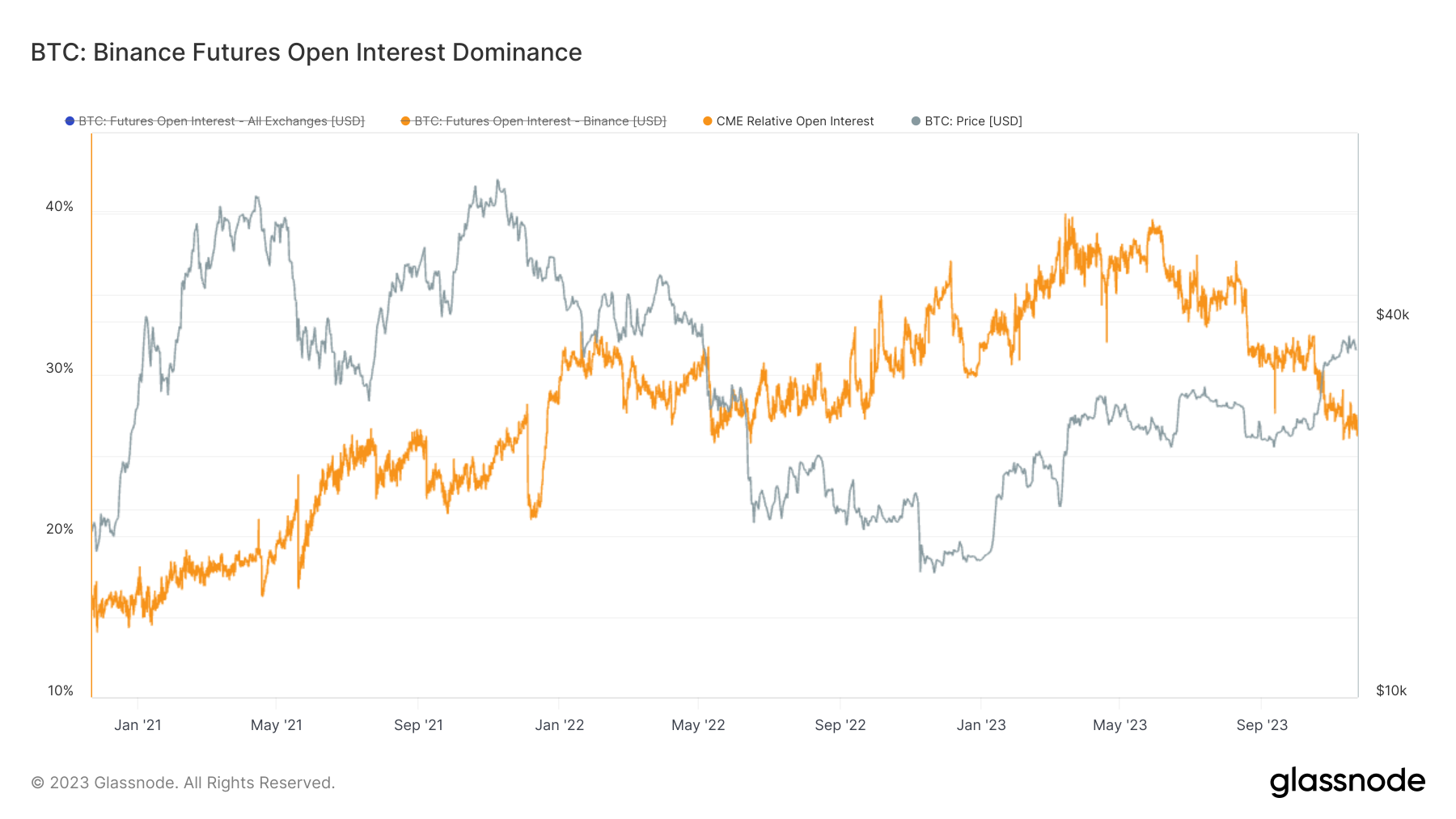

The U.S. Securities and Exchange Commission has cited market manipulation when denying spot Bitcoin ETFs, and Binance’s market dominance had to take a hit before BlackRock’s spot BTC ETF application would be approved, according to a June X (Twitter) post by Travis Kling, chief investment officer of Ikigai Asset Management.

“There is no chance, and I mean zero, that this ETF is approved with Binance in its current position of market dominance,” Kling wrote. “If this ETF is approved, Binance is either gone entirely or their role in price discovery is massively diminished.”

Ok here we go. https://t.co/fJ7c3MpaTy

— Travis Kling (@Travis_Kling) November 21, 2023

Kling’s prediction sparked others to consider how closely BlackRock works with the U.S. government to obtain a favorable position in the spot Bitcoin ETF market. YouTuber Colin Talks Crypto said it was suspect that Binance’s settlement happened “right before a Bitcoin ETF comes out.”

“Is it a way for BlackRock to acquire a massive amounts [sic] of BTC for cheap?” he asked. “Is it a way to remove competition from U.S. markets right before the ETFs go live?”

Does it seem fishy to anyone else that #Binance is being found guilty of money laundering right before a #Bitcoin #ETF comes out?

Is there any connection?

For example:

• Is it a way for BlackRock to acquire a massive amounts of BTC for cheap/free?

• Is it a way to remove…— Colin Talks Crypto (@ColinTCrypto) November 21, 2023

Others noted that BlackRock and its rival Vanguard together own 11.5% of Binance’s top competitor, Coinbase, and speculated that the action against Binance may have been planned.

BlackRock met with the SEC on Nov. 20 and presented how it could use an in-kind or in-cash redemption model for its spot BTC ETF, the iShares Bitcoin Trust.

Binance/DOJ settlement and SEC Spot #Bitcoin ETF approvals are mutuals.

— Andrew (@AP_Abacus) November 20, 2023

Grayscale also met with the securities regulator on the same day, discussing its bid to list a spot Bitcoin ETF. Fidelity, WisdomTree, Invesco Galaxy, Valkyrie, VanEck and Bitwise also await the SEC’s approval of their spot Bitcoin funds.

Related: Binance CEO CZ’s downfall is ‘the end of an era’ — Charles Hoskinson

Mike Novogratz, CEO of digital asset investment firm Galaxy Digital, said the Binance settlement is “super bullish” for the cryptocurrency industry.

Not everyone sees the point in guessing if the Binance news will lead to spot BTC ETF approvals.

In a note to Cointelegraph, Piper Alderman partner Michael Bacina suggested it is best to let the speculation run its course.

Magazine: Deposit risk: What do crypto exchanges really do with your money?

Binance’s market dominance wanes with regulatory woes and futures market shifts

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Bitcoin Price Plunge Due to Binance’s Settlement Could Be ‘Buy Dips’ – Here’s Why

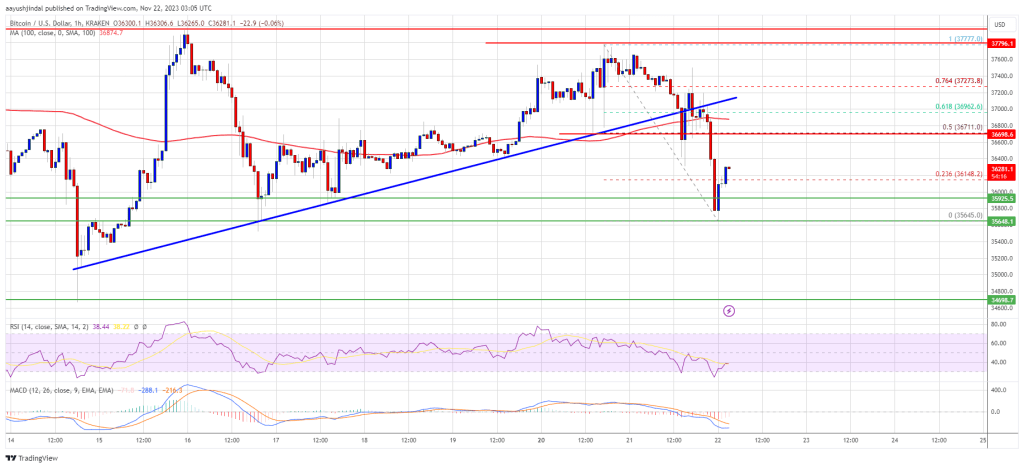

Bitcoin price declined over 4% and traded below the $36,500 support. BTC is still holding the key $35,650 support zone and dips might attract buyers.

- Bitcoin started a fresh decline after reports of Binance’s settlement and CZ stepping down.

- The price is trading below $37,000 and the 100 hourly Simple moving average.

- There was a break below a key bullish trend line with support near $36,980 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could struggle in the short term, but dips might be attractive to the bulls.

Bitcoin Price Takes Hit

Bitcoin price failed to continue higher above the $37,800 resistance zone. BTC formed a short-term top and started a fresh decline after reports of Binance’s settlement and CZ stepping down.

There was a sharp decline below the $37,000 level. There was a break below a key bullish trend line with support near $36,980 on the hourly chart of the BTC/USD pair. The pair even broke the $36,500 support zone. Finally, it spiked below the $36,000 level.

A low is formed near $35,645 and the price is now consolidating losses. It recovered above the 23.6% Fib retracement level of the downward move from the $37,777 swing high to the $35,645 low.

Bitcoin is now trading below $37,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $36,500 level. The main resistance is now forming near the $36,700 level or the 50% Fib retracement level of the downward move from the $37,777 swing high to the $35,645 low.

Source: BTCUSD on TradingView.com

A close above the $36,700 resistance might start a decent increase. The next key resistance could be near $37,000. A clear move above the $37,000 resistance could send the price further higher toward the $37,500 level. In the stated case, it could even test the $37,800 resistance.

More Losses In BTC?

If Bitcoin fails to rise above the $36,700 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $36,000 level.

The next major support is $35,650. If there is a move below $35,650, there is a risk of more downsides. In the stated case, the price could drop toward the $34,700 support in the near term. The next key support or target could be $34,200.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $36,000, followed by $35,650.

Major Resistance Levels – $36,500, $36,700, and $37,000.

Binance’s new chapter begins with hefty fines and compliance commitments

Binance issued a statement on Nov. 21 regarding its resolution of investigations from the U.S. Department of Justice (DOJ) and other agencies.

There, Binance stated that it is pleased to announce the resolution and admitted to past wrongdoing. The crypto exchange company said:

“When Binance first launched, it did not have compliance controls adequate for the company that it was quickly becoming … Binance made misguided decisions along the way. Today, Binance takes responsibility for this past chapter.”

The company said that the current resolutions acknowledge its role in “historical, criminal compliance violations” and allow it to “turn the page.”

Binance emphasized that the U.S. agencies do not allege that it misappropriated user funds or engaged in market manipulation. In that regard, it mentioned its other promises, such as its 1:1 backing of user assets, its commitment to allowing 100% withdrawals at all times, and transparency around its own crypto addresses.

The company also highlighted its recent restructuring efforts and past additions to compliance leadership. It noted that it will appoint its Global Head of Regional Markets, to the role of CEO, in line a statement from former CEO Changpeng Zhao today.

Binance addresses KYC/AML concerns

In a statement, the DOJ said that Binance violated financial laws including the Bank Secrecy Act (BSA) and failed to register as a money transmitting business.

The DOJ said Binance was required to register with FinCEN as a money services business and create an effective anti-money laundering (AML) policy but did not do so. Elsewhere, it said that Binance did not implement comprehensive know-your-customer (KYC) procedures: it neglected monitoring, never reported suspicious activities to FinCEN, and at times supported users who only provided an email address.

Binance appeared to acknowledge those issues, noting that it has recently expanded its anti-money laundering (AML) tools and capabilities. It also called itself one of the first major exchanges outside of the U.S. with mandatory KYC for all users.

International access to Binance also an issue

The DOJ additionally said that Binance violated the International Emergency Economic Powers Act (IEEPA) and described various violations around international transaction restrictions. The agency said that Binance failed to implement controls stopping users from transacting with sanctioned users and users in sanctioned areas.

The DOJ added that Binance did not fully block U.S. customers in 2019 in compliance with the law. Binance instead focused on retaining high-value VIP customers and providing those users with ways to circumvent restrictions.

Binance once again seemed to address those complaints in its statement. Binance said that it “takes sanctions compliance seriously,” maintains a standalone sanctions team, enforces KYC and IP blocks, and uses third-party tools to monitor transactions in real time. Furthermore, the company said that it has teams staffed with more than 70 members to engage with law enforcement and share information.

Binance has pleaded guilty: its statements address oversight in the relevant areas without contesting specific allegations. The firm has also agreed to pay over $4 billion in fines, retain an appointed monitor for three years, and improve compliance.

Binance’s UK subsidiary withdraws FCA registration as European exodus continues

Binance said in a June 19 email shared with CryptoSlate that the exchange’s United Kingdom subsidiary, Binance Markets Limited (BML), has canceled its registration with the country’s Financial Conduct Authority (FCA).

Binance has no authorized entity in the UK

According to the spokesperson, BML held various FCA permissions for activities it never carried out or offered in the U.K. It added:

“As these permissions were unlikely to be required in the future, Binance Markets Limited decided that it would be prudent to cancel them in line with the FCA’s recommendations to keep these updated.”

The regulator’s website confirmed that the firm was “no longer authorized” as of May 30. FCA stated:

“This firm can no longer provide regulated activities and products but previously was authorized by the FCA and/or PRA.”

The FCA’s website further shows that Binance no longer has an authorized entity in the U.K.

Meanwhile, BML’s registration cancellation did not impact Binance since it had never operated in the country. The spokesperson said:

“This decision has no impact on Binance.com, which does not own or operate any crypto services in the UK and is only available to UK consumers on a reverse solicitation basis.”

In 2021, the FCA warned that Binance was prohibited from conducting business in the U.K. The regulator also expressed concerns about a partnership deal the exchange entered into in 2022.

European exodus

The latest withdrawal from the U.K. continues Binance’s spate of deregistration from various European markets.

Last week, Binance exited two European countries, Netherlands and Cyprus.

The exchange failed to secure registration as a virtual asset service provider (VASP) in the Netherlands. At the same time, it left Cyprus as part of its efforts to focus on its larger market in other European countries like France.

Binance’s sub-regional manager for growth in the U.K. and Europe, Ilir Laro, said the firm already has five regulated entities in France, Italy, Spain, Poland, and Sweden. Laro added:

“As MiCA kicks into force in 2024/5, we are moving focus to getting ready which means some consolidating in order to passport throughout Europe.”

The post Binance’s UK subsidiary withdraws FCA registration as European exodus continues appeared first on CryptoSlate.