U.S. spot bitcoin exchange-traded funds (ETFs) experienced another round of net withdrawals, documenting a $19.4 million decrease. The holdings of GBTC diminished from 322,697.17 bitcoins to 318,451.70. U.S. Spot Bitcoin ETF Landscape: Outflows Continue to Persist On April 8, 2024, the U.S. spot bitcoin ETFs saw a substantial $223.8 million in outflows, and on April […]

U.S. spot bitcoin exchange-traded funds (ETFs) experienced another round of net withdrawals, documenting a $19.4 million decrease. The holdings of GBTC diminished from 322,697.17 bitcoins to 318,451.70. U.S. Spot Bitcoin ETF Landscape: Outflows Continue to Persist On April 8, 2024, the U.S. spot bitcoin ETFs saw a substantial $223.8 million in outflows, and on April […]

Source link

bitcoin

Spot Bitcoin ETFs in Hong Kong could mark a regional first with April listings

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Historical patterns in Bitcoin fees surface amid the halving countdown

Quick Take

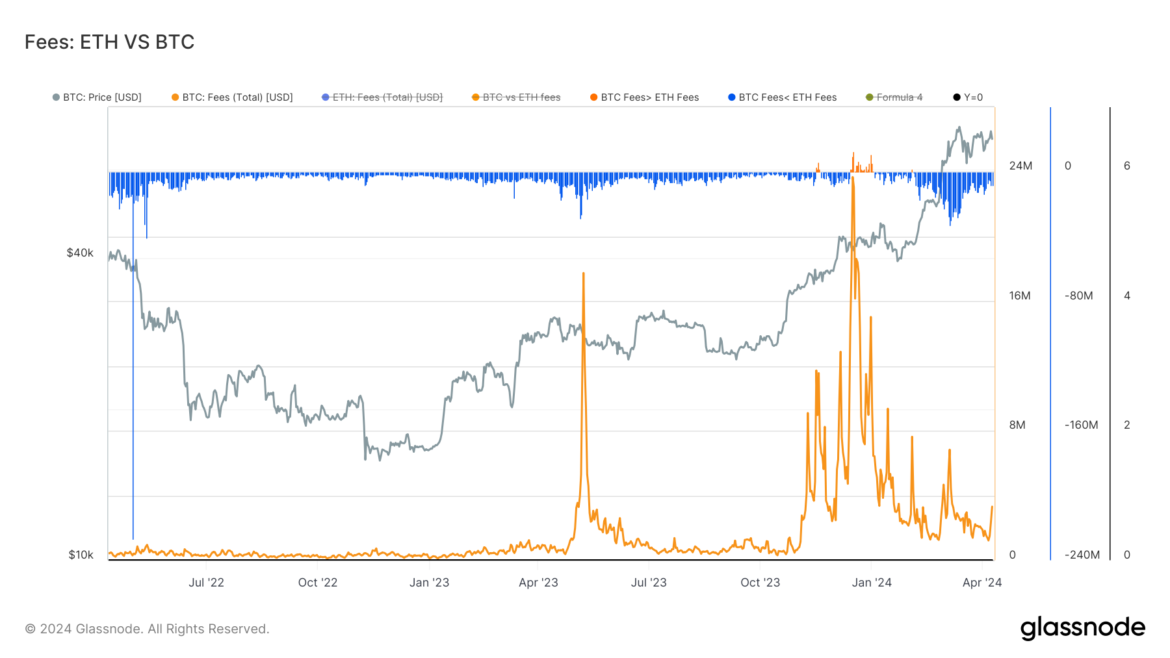

Data from Glassnode show that Bitcoin (BTC) transaction fees in 2024 have exhibited a general downward trend, but not without intermittent spikes. Contrasting with 2023, the average transaction fees in BTC have escalated, now settling between $1 million to $2 million per day, a marked increase from the previous year’s $500k average. Notably, inscriptions, particularly prevalent from November through December 2023, fueled significant fee spikes, surpassing Ethereum fees for the last two weeks of December and briefly on Feb. 3. However, Ethereum has since retained its dominance.

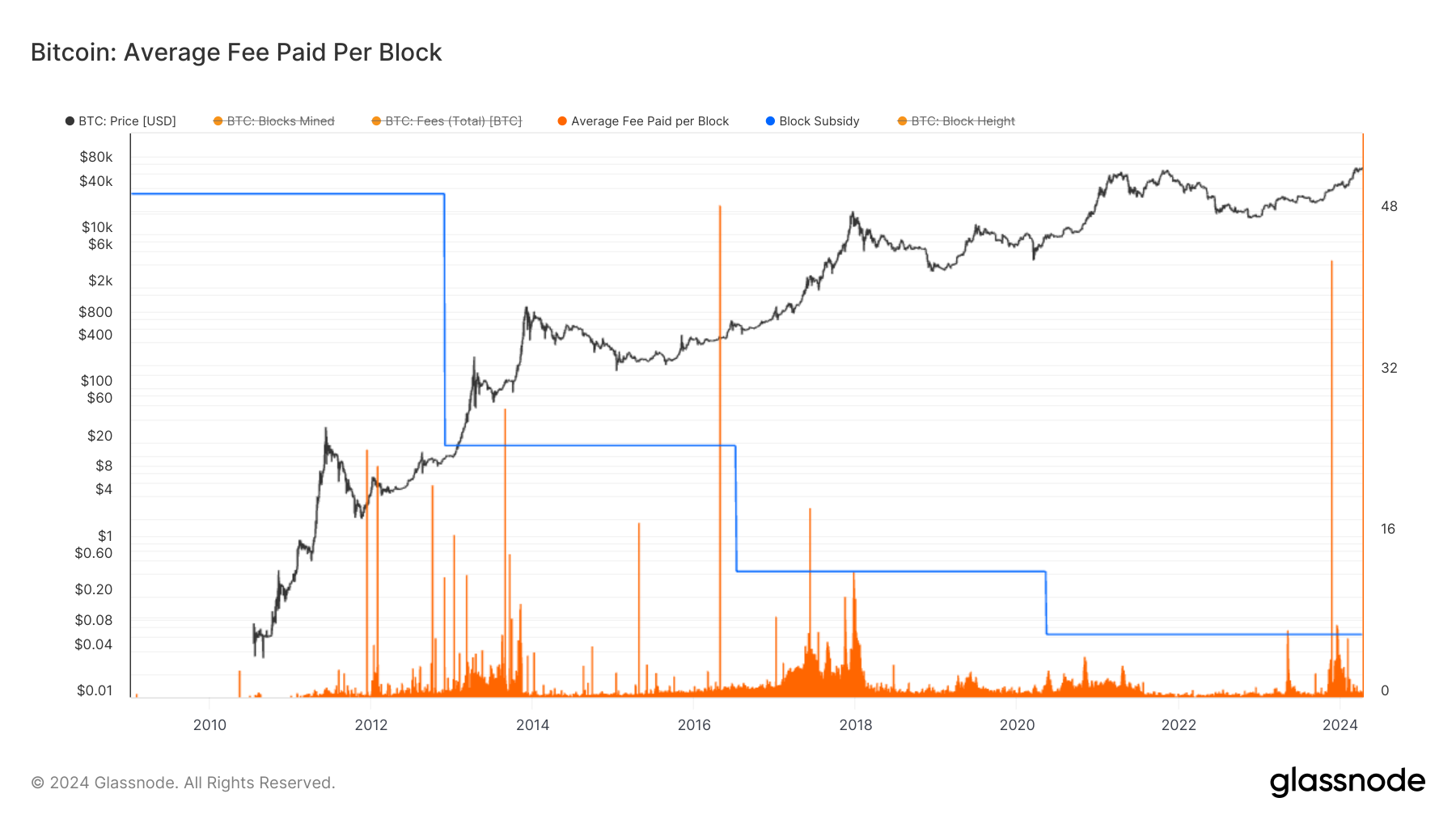

Presently, the average fee per block stands at approximately 0.40 BTC, remaining close to cycle lows, having recently risen from 0.10 BTC. This trend reflects patterns observed before previous halvings, characterized by low fees leading up to the event and a subsequent surge in fees during ensuing bull markets. Remarkably, throughout Bitcoin’s history, including three occurrences in 2023, the average fee paid per block has exceeded the block subsidy six times, according to Glassnode.

As the halving approaches within 10 days, historical trends indicate that Bitcoin’s post-halving surge could align with a resurgence in fees.

The post Historical patterns in Bitcoin fees surface amid the halving countdown appeared first on CryptoSlate.

The Bitcoin price has seen a notable fluctuation, briefly surpassing $72,500 on Monday before dipping below the $70,000 threshold on Tuesday. This movement can be attributed to a risk-off sentiment among investors, largely in anticipation of the latest US Consumer Price Index (CPI) figures today. Following a low of $68,200 on Tuesday, Bitcoin managed a slight recovery, stabilizing above $69,400 at the time of reporting.

Concurrently, the Hong Kong Securities and Futures Commission (SFC) has updated its registry of virtual asset management funds early on April 10. Notably, the SFC is poised to announce the inaugural list of four Bitcoin spot Exchange Traded Funds (ETFs) on April 15, as reported by Tencent News. This announcement marks a significant milestone, setting the stage for the ETFs’ launch on the Hong Kong Stock Exchange by the end of April. Despite the magnitude of this news, the immediate market reaction has been muted.

Hong Kong To Launch Spot Bitcoin ETFs By End Of April

According to a Tencent News report, Harvest International Asset Management and Huaxia Funds (Hong Kong) Limited have been officially approved to manage virtual assets, signaling their entry into the cryptocurrency sector in Hong Kong. This development is significant as it introduces mainland China’s leading public fund companies into Hong Kong’s virtual assets industry. Currently, there are 18 funds in Hong Kong authorized to manage cryptocurrency assets, with Harvest International and Huaxia Fund being among the first public funds to venture into this space.

Harvest International emerged as the pioneer in submitting a proposal for a spot Bitcoin ETF in Hong Kong as of January 26. Following this initial submission, both companies have now secured the necessary qualifications to issue cryptocurrency-related fund products, including Bitcoin spot ETFs. This move enables retail investors to access these products through the Hong Kong Stock Exchange.

The urgency to update the virtual asset management funds list stems from the SFC’s plan to unveil the first batch of Bitcoin spot ETFs by April 15. The initial batch was anticipated to include Huaxia Fund, Bosera Fund, and Value Partners Financial, alongside Harvest International. However, Bosera and Value Partners were notably absent from the updated list due to their lack of an independent responsible officer (RO) qualified in cryptocurrency asset management. These funds are reportedly collaborating with Hashkey Capital and VSFG, both qualified crypto asset management organizations.

In preparation for the ETF launch, some applicants, including Huaxia Fund, have been rapidly assembling dedicated teams and submitting their applications by early March. Huaxia’s swift approval by the SFC, achieved in just two weeks, underscores the rapid pace of development in this area. The application process for a Bitcoin spot ETF in Hong Kong involves extensive collaboration with over 20 institutions, including custodian banks and market makers.

Following the SFC’s approval, the Hong Kong Stock Exchange is expected to spend approximately two weeks preparing for the ETF launch. Notably, this move opens up the crypto sector to Chinese retail investors, coming three months after the US SEC’s approval of the first batch of Bitcoin spot ETFs on January 11.

At press time, BTC traded at $69,484.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

As the Bitcoin (BTC) “Halving” approaches, expectations increase about how the flagship cryptocurrency will perform. Bitcoin (BTC) is recovering momentum after facing a significant correction in the first few days of Q2, and some analysts are forecasting new heights for the number one cryptocurrency soon.

Are The Odds In The Bulls Or Bears Favor?

Bitcoin had its best quarterly close during Q1, 2024. Despite BTC’s stellar performance, as Q2 started, the market was dragged by the leading cryptocurrency’s price correction.

Since then, Bitcoin has been steadily recovering, testing the $70,000 resistance level over the weekend. As the week started, BTC appeared to have regained support above the $70,000 level.

Crypto analyst Ali Martinez seems to think that Bitcoin’s performance so far reflects a positive sentiment from investors. In an X post, Martinez shared a chart that paints an optimistic picture, at least for now.

When you compare support (1.4 million addresses holding 893,000 $BTC between $68,220 and $70,325) with resistance (474,000 addresses holding 285,000 #BTC between $70,760 and $71,200), the odds appear to favor the #Bitcoin bulls! pic.twitter.com/pceCyGa8mb

— Ali (@ali_charts) April 9, 2024

According to Martinez’s post, the In/Out of the Money Around Price (IOMAP) indicator seems favorable to the bulls. Per the chart, the addresses holding BTC at the support level massively outnumber those holding Bitcoin at the resistance level.

The chart suggests that Bitcoin is at “stable support” as 474,000 addresses hold 285,000 BTC between $70,760 and $71,200. Meanwhile, 1.4 million addresses hold the flagship cryptocurrency between $68,220 and $70,325.

When compared, the addresses and BTC held at the support level nearly triple those in the resistance zone. To the analyst, bulls are the current victors as “odds appear to favor” them.

Analyst Forecast Bitcoin To 90,000 Soon

Captain Faibik, another crypto analyst, also seems to perceive more bullish momentum for Bitcoin. In an X post, the analyst suggests that BTC’s “bullish pennant upside break is confirmed on the daily chart.”

Per the chart, the flagship cryptocurrency’s price started a consolidation period in early March, forming a pennant pattern. This pattern saw an upside breakout after Monday’s daily candle closed above the $70,000 price range.

Due to this breakout, the analyst forecasts a surge to the $88,000-$90,000 price range this month.

$BTC Bullish Pennant Upside Breakout is Confirmed on the Daily timeframe Chart.. ✅

Now, Send Bitcoin to the 88-90k this Month. 📈🚀#Crypto #BTC #Bitcoin pic.twitter.com/ok2DGPXsAb

— Captain Faibik (@CryptoFaibik) April 9, 2024

At the time of writing, Bitcoin remains above the $70,000 support level, only 5% below its most recent all-time high (ATH) price of $73,373. Despite the positive resistance, BTC’s price performance shows a slight decrease of 2.3% from yesterday.

Similarly, its daily trading volume and market capitalization have mildly dropped. According to CoinMarketCap data, BTC’s daily trading volume is down by 6%, while its market cap of $1.38 trillion represents a 2.1% decrease.

Nonetheless, Bitcoin remains 8.4% above its price seven days ago, trading at $70,378. Further bullish sentiment, fueled by the upcoming “Halving” event, could help the largest cryptocurrency by market capitalization consolidate its support above the current levels.

Bitcoin sits above the $70,000 support level in the 1-day chart. Source: BTCUSDT on Tradingview

Featured Image from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

From days to months: How Bitcoin holder behavior predicts price peaks

Quick Take

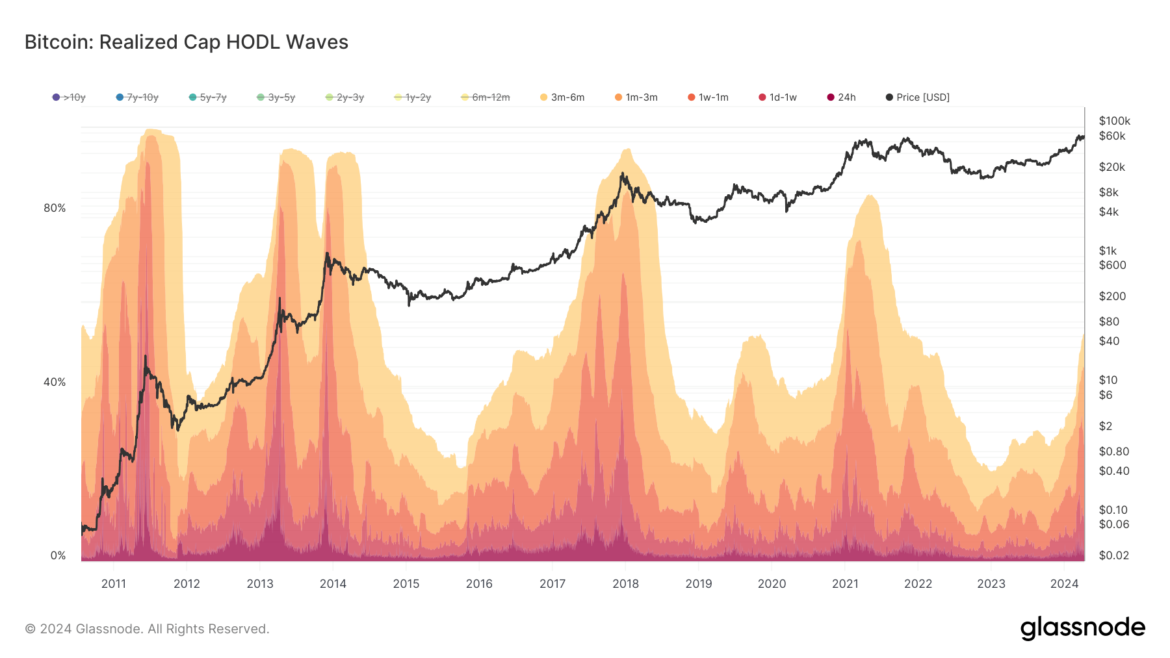

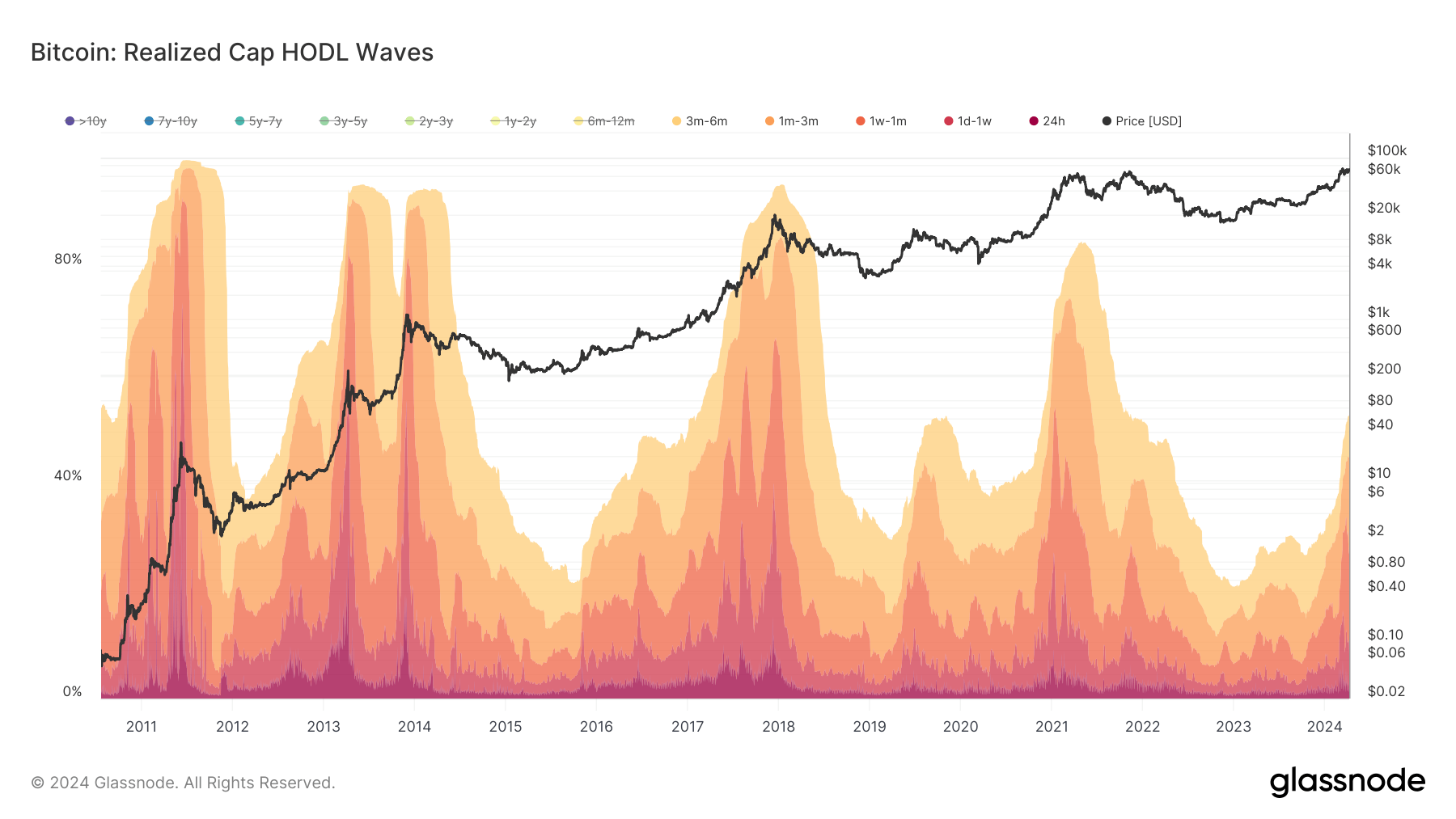

Bitcoin’s price cycles are often influenced by the behavior of short-term holders (STHs), defined as investors who have held the digital asset for less than 155 days. According to Glassnode data, during market peaks, STHs typically possess 80% or more of the Bitcoin supply, with the prevailing cohort transitioning from shorter to longer holding periods in each subsequent cycle.

Data from Glassnode shows that at the peak in 2011, STHs commanded 96% of the supply, primarily comprising holders of one-day to one-week durations. By the 2013 peak, 90% of the supply was held by STHs, predominantly those holding for one-day to one-week periods. Moving to the 2017 peak, STHs still dominated over 90% of the supply, but the principal cohort shifted to one-week to one-month holders, indicating a slightly maturing market.

In March 2021, at the peak, 85% of the supply was held by STHs, with the predominant group being holders of one-month to three-month durations, according to Glassnode.

Currently, with Bitcoin hovering near all-time highs, STHs control 54% of the supply, which suggests potential for further growth. The gradual transition in dominant STH groups from shorter to longer durations implies an evolving market maturity.

The post From days to months: How Bitcoin holder behavior predicts price peaks appeared first on CryptoSlate.

Japanese Firm Metaplanet to Add $659M in Bitcoin to Its Treasury, Shares Soar 90% in Response

According to the latest figures, Metaplanet, a company listed on the Japanese stock exchange, witnessed its share price soar by nearly 90% in just one day. This significant jump came on the heels of the company’s announcement regarding its intention to incorporate 1 billion yen in bitcoin into its balance sheet. Metaplanet Joins Forces With […]

According to the latest figures, Metaplanet, a company listed on the Japanese stock exchange, witnessed its share price soar by nearly 90% in just one day. This significant jump came on the heels of the company’s announcement regarding its intention to incorporate 1 billion yen in bitcoin into its balance sheet. Metaplanet Joins Forces With […]

Source link

Bitcoin and crypto are no longer seen as a fleeting “fad” among consumers — the majority now consider them an integral part of the financial system, Reuters reported on April 8, citing a Deutsche Bank survey.

The survey gathered responses from 3,600 individuals and revealed a slow yet noticeable shift in consumer attitudes towards bitcoin and cryptocurrencies, balancing cautious skepticism with a cautiously optimistic outlook for their future in the financial market.

‘Important asset class’

According to the survey, 52% of respondents believe crypto will become an “important asset class and method of payment” in March, compared to less than 40% of respondents in September 2023.

Meanwhile, detractors have fallen to record lows, and only 1% of the respondents still hold the belief that Bitcoin “will eventually fade away” — versus 20% last year.

On the other hand, respondents who believe crypto will become the “dominant payment method” fell to 5% from 20% in the previous year.

Central bank digital currencies (CBDCs) were also part of the survey, with 15% of respondents saying they would become mainstream, while crypto would maintain a minor role in the financial system.

Additionally, about 25% of respondents believe crypto is “here to stay, but will never become mainstream.”

Price expectations

Despite growing positivity toward Bitcoin, a significant minority expect lower Bitcoin prices by the end of the year.

Roughly 30% of respondents believe Bitcoin’s price will fall below $20,000 by year-end — down from 35% in February and 36% in January.

Meanwhile, 25% believe the flagship crypto will be valued between $20,000 and $75,000 by the end of the year, and only 10% believe Bitcoin’s price will surpass $75,000.

Bitcoin recently achieved a three-week high on April 8 after weeks of trading in the red as traders took profits after it hit a new all-time high at $73,794 in March. The recovery aligns with growing enthusiasm for spot Bitcoin ETFs and the prospect of interest rate cuts.

Analysts at Deutsche Bank anticipate that the upcoming Bitcoin halving, regulatory developments, expected rate cuts, and speculation about the SEC’s approval of spot Ethereum ETFs will continue to drive the market higher in the coming weeks.

The post Only 1% of consumers still think Bitcoin is a passing ‘fad’ appeared first on CryptoSlate.

Major cryptocurrencies rallied to new highs thanks to multiple tailwinds.

Several major cryptocurrencies started the week on a high note today amid a confluence of positive catalysts, including potential short squeezes, technical trading tailwinds, and — perhaps most surprising — geopolitical tailwinds from leading Chinese money management firms.

When all was said and done, as of the close of Monday’s regular session, the price of Ethereum (ETH -0.27%) was up 9.1%, Bitcoin (BTC -2.04%) had rallied 3.8%, and Dogecoin (DOGE -3.82%) gained a little over 2%.

On a possible crypto short squeeze, technical tailwinds

According to Coinglass data this morning, the digital asset market has seen more than $176 million in liquidations over the past 24 hours, the vast majority of which (around $124 million, or 72%) came from liquidations of open short positions.

As the price of major cryptocurrencies has rallied in recent weeks — spurred by a combination of factors, including strong inflows into Bitcoin ETFs, an upcoming Bitcoin halving event, and expectations for the possible approval for the first spot Ethereum exchange-traded funds (ETFs) — it appears that short-sellers are effectively being forced to close their bearish positions. The resulting surge in buying demand can cause a so-called short squeeze, sending digital asset prices even higher in the process.

Meanwhile, technical trading patterns may also be playing a role. According to the widely followed Bitcoin analyst TechDev on social media platform X, the price of Bitcoin appears to be consolidating above key technical levels and trading averages that have historically preceded significant rallies for the world’s most prominent cryptocurrency.

Is China entering the Bitcoin ETF market?

If that wasn’t enough, Chinese financial news site Securities Times reported on Monday that multiple China-based financial giants, including Harvest Fund and Southern Fund, have submitted applications through Hong Kong subsidiaries for their own spot Bitcoin ETFs. Those applications are currently awaiting regulatory approval.

This news is particularly significant, given China’s previous public hostility against Bitcoin. In 2021, China’s top regulators even banned crypto trading and mining, sending the price of Bitcoin plunging at the time. It became evident in recent years, however, that China’s ban on crypto wasn’t absolute, and crypto trading and mining has reportedly continued to thrive in the country. If China is indeed softening its stance, it would serve as only the latest significant validation for the global adoption of Bitcoin and other cryptocurrencies.

The U.S. Securities and Exchange Commission (SEC) only approved the world’s first 13 Bitcoin ETFs in January 2024. The historic approvals served as arguably the most prominent validation yet of cryptocurrencies as a legitimate investment asset class. Because ETFs can be bought and sold throughout the normal trading day via nearly any online brokerage — in contrast to requiring investors to set up separate crypto trading accounts with a crypto-specific firm — they’re a much more accessible investment medium for anyone considering making cryptocurrencies a meaningful part of their portfolio.

Bitcoin ETFs have experienced enormous inflows since then; late last month, for instance, the ARK 21 Shares Bitcoin ETF (NYSEMKT: ARKB) registered net inflows of more than $200 million, becoming the third Bitcoin ETF in the U.S. to cross the $200 million mark this year.

For perspective, China’s Harvest Fund and Southern Fund manage over $230 billion and $280 billion in total assets, respectively. So, if their Bitcoin ETF applications pass regulatory muster through their Hong Kong subsidiaries, and the mainland Chinese government continues to opt for a more cautious approach with indirect approval, it could signal a massive positive shift toward more pervasive crypto adoption over the long term from the world’s second-largest economy.

That certainly doesn’t guarantee that Bitcoin, Ethereum, and Dogecoin will continue this incredible rally indefinitely. But as cryptocurrencies, in general, continue to enjoy greater adoption on a global scale, it’s hardly surprising to see the prices of the most prominent digital assets continuing to reach new highs.

Steve Symington has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin and Ethereum. The Motley Fool has a disclosure policy.

Crypto Expert Reveals What To Expect For Bitcoin, Dogecoin, And XRP In 12-16 Months

Crypto expert Ash Crypto has outlined his price predictions for several crypto tokens, including Bitcoin (BTC), Dogecoin (DOGE), and XRP, heading into this bull run. He also suggested that these price levels could be attained in the next 12 to 16 months.

How High Will Bitcoin, Dogecoin, And XRP Rise?

Ash Crypto predicted in an X (formerly Twitter) that BTC would rise between $100,000 and $250,000 by 2025. This prediction aligns with those made by other notable crypto analysts. One of them is Skybridge Capital CEO Anthony Scaramucci, who predicted in January that Bitcoin would rise to $170,000 18 months after the Bitcoin Halving.

Source: X

Meanwhile, some other crypto analysts will argue that Bitcoin hitting $100,000 could even happen this year rather than 2025. This includes Tom Dunleavy, the Chief Investment Officer (CIO) at MV Capital, who claims that Bitcoin will rise to $100,000 by the end of this year. Tom Lee, Managing Partner and Head of Research at Fundstrat Global Advisors, also predicted that Bitcoin would rise to as high as $150,000 this year.

Regarding his price target for DOGE, Ash Crypto predicted that the meme coin would rise to $1 in the next 12 to 16 months. This prediction is also a common sentiment shared by several other crypto analysts and members of the crypto community. Specifically, crypto analyst DonAlt once mentioned that “it isn’t too unlikely for Dogecoin to go to $1,” while crypto analyst Altcoin Sherpa stated that DOGE could do “something silly like go to $1 this cycle eventually.”

Ash Crypto also shared his price target for XRP, stating that the crypto token could rise between $3 and $5. This price prediction, however, seems conservative, considering other predictions that crypto analysts have made for the XRP token.

Crypto analyst CrediBULL Crypto recently mentioned that XRP could rise to as high as $20 in this market cycle. Meanwhile, Crypto analyst Egrag Crypto has repeatedly stated that XRP hitting $27 is possible.

Undervalued Altcoins Make The List

Crypto expert Michaël van de Poppe recently included Chainlink (LINK), Celestia (TIA), and Polkadot (DOT) in a list of ten crypto tokens he believes are undervalued. Interestingly, these three altcoins also made their way into Ash Crypto’s list of coins, for which he outlined price targets.

For LINK, Ash Crypto predicted that the crypto token could rise to between $250 and $500 by next year. LINK’s rise to such levels would undoubtedly be massive, considering it currently trades at around $17. Ash Crypto also predicted a parabolic surge in TIA and DOT’s prices, as he believes they could rise to as high as $150 and $120, respectively.

DOGE price rises above $0.2 resistance | Source: DOGEUSDT on Tradingview.com

Featured image from CoinGape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.