Quick Take

Long-term holders (LTHs) are defined by Glassnode as investors holding Bitcoin (BTC) for 155 days or more. Renowned for their astute investment strategies, LTHs typically accumulate BTC during bear markets and sell during bull runs to generate profits.

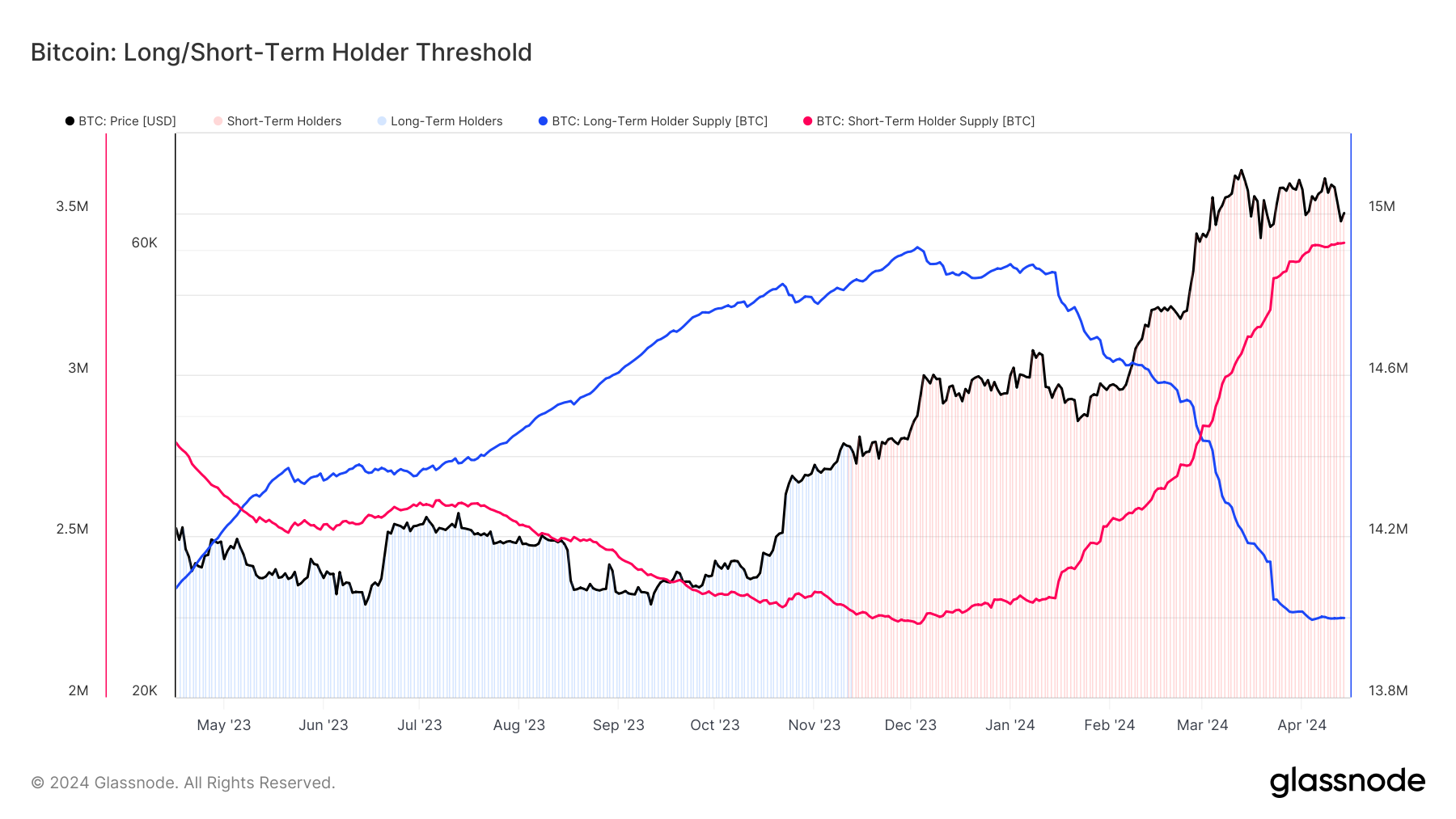

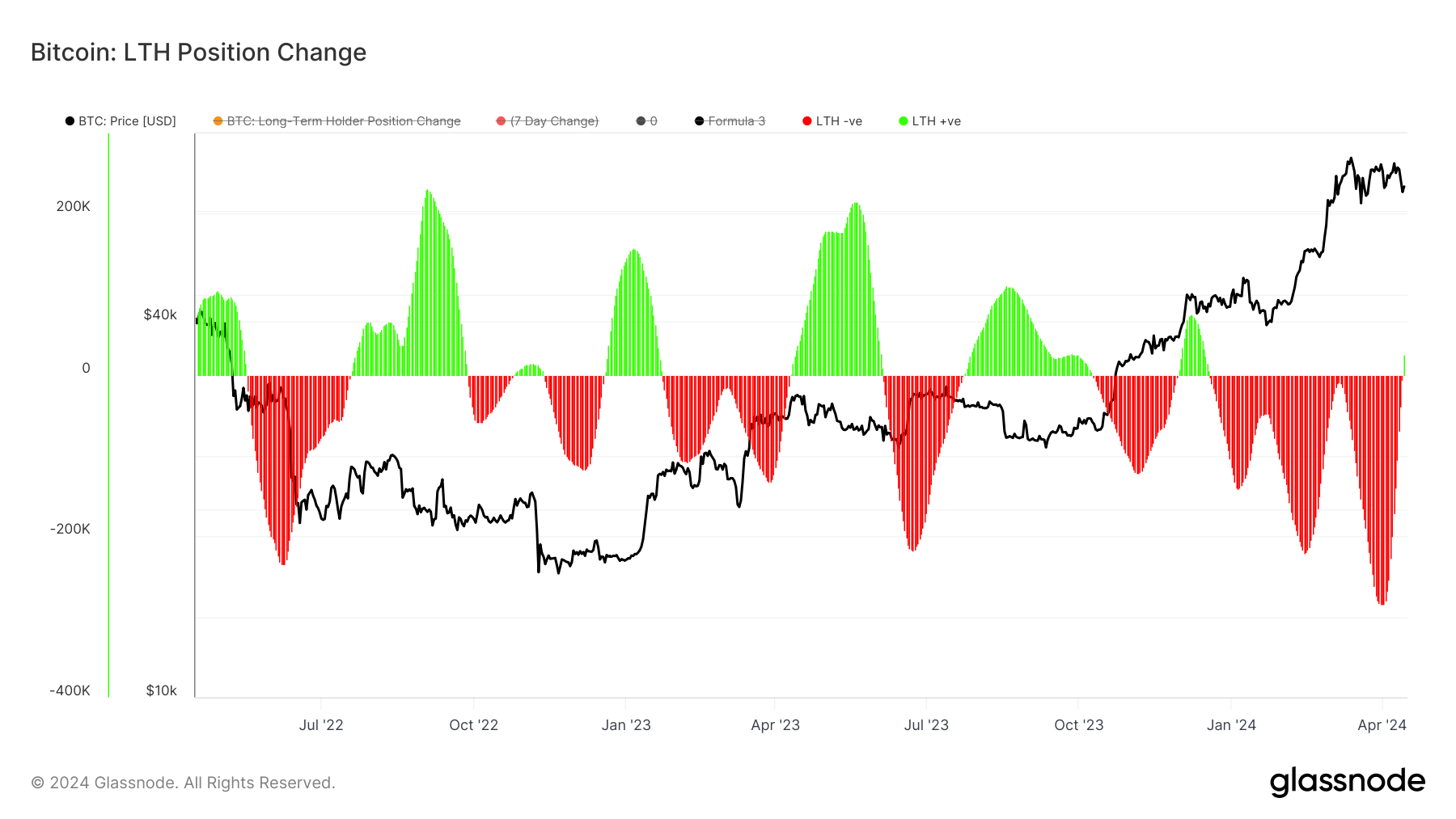

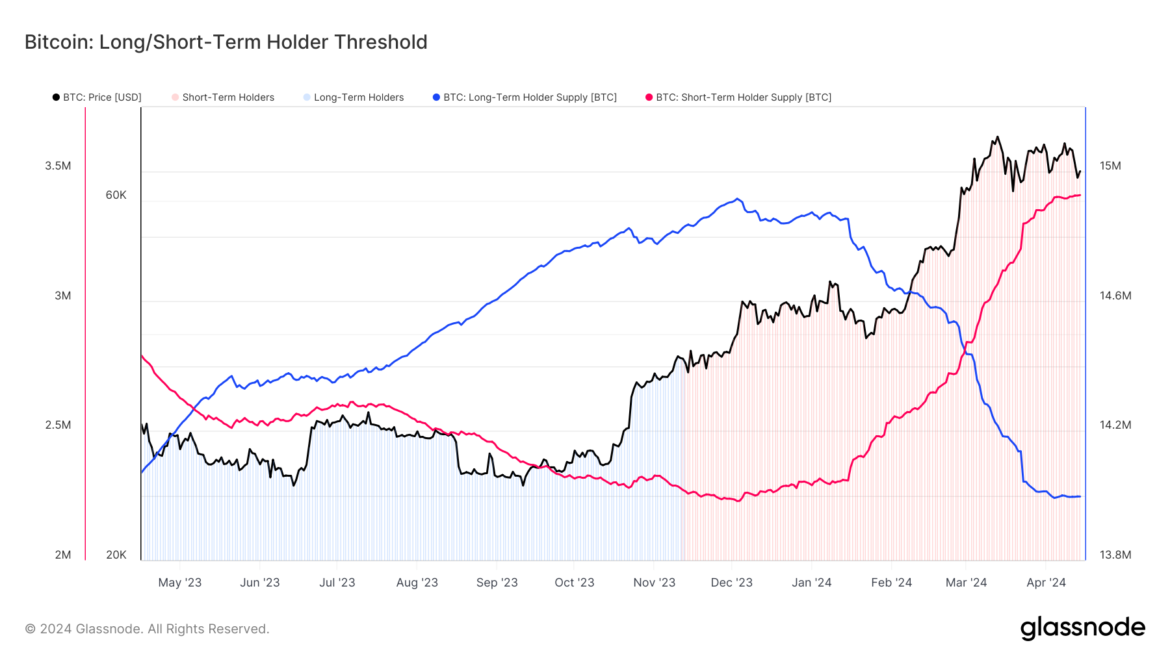

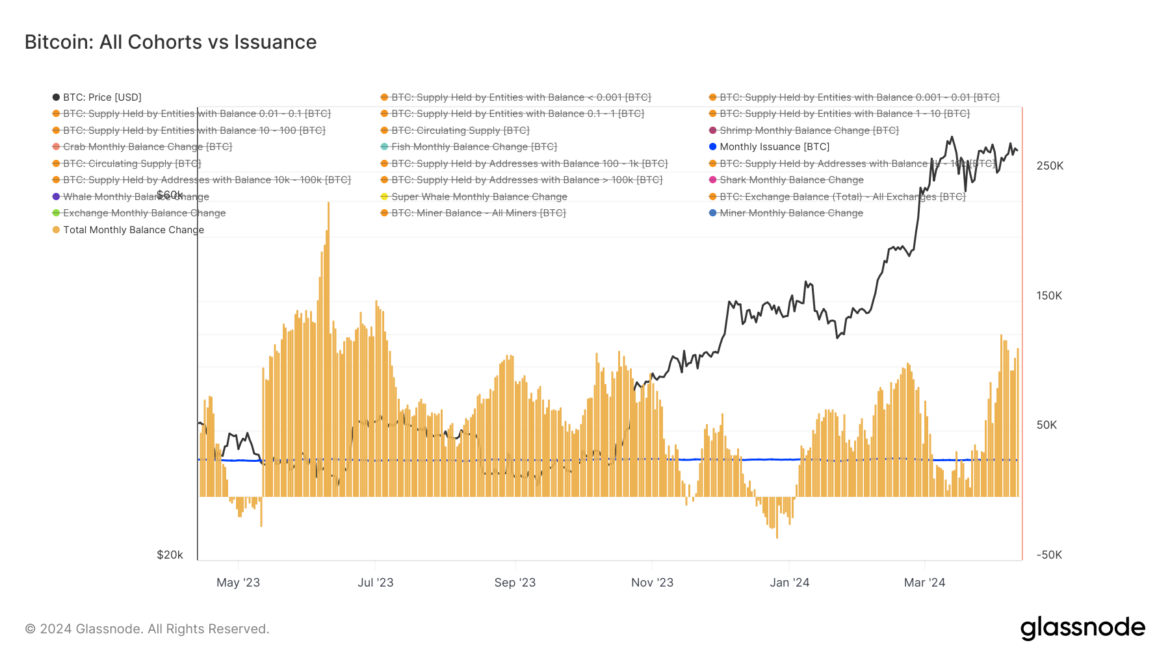

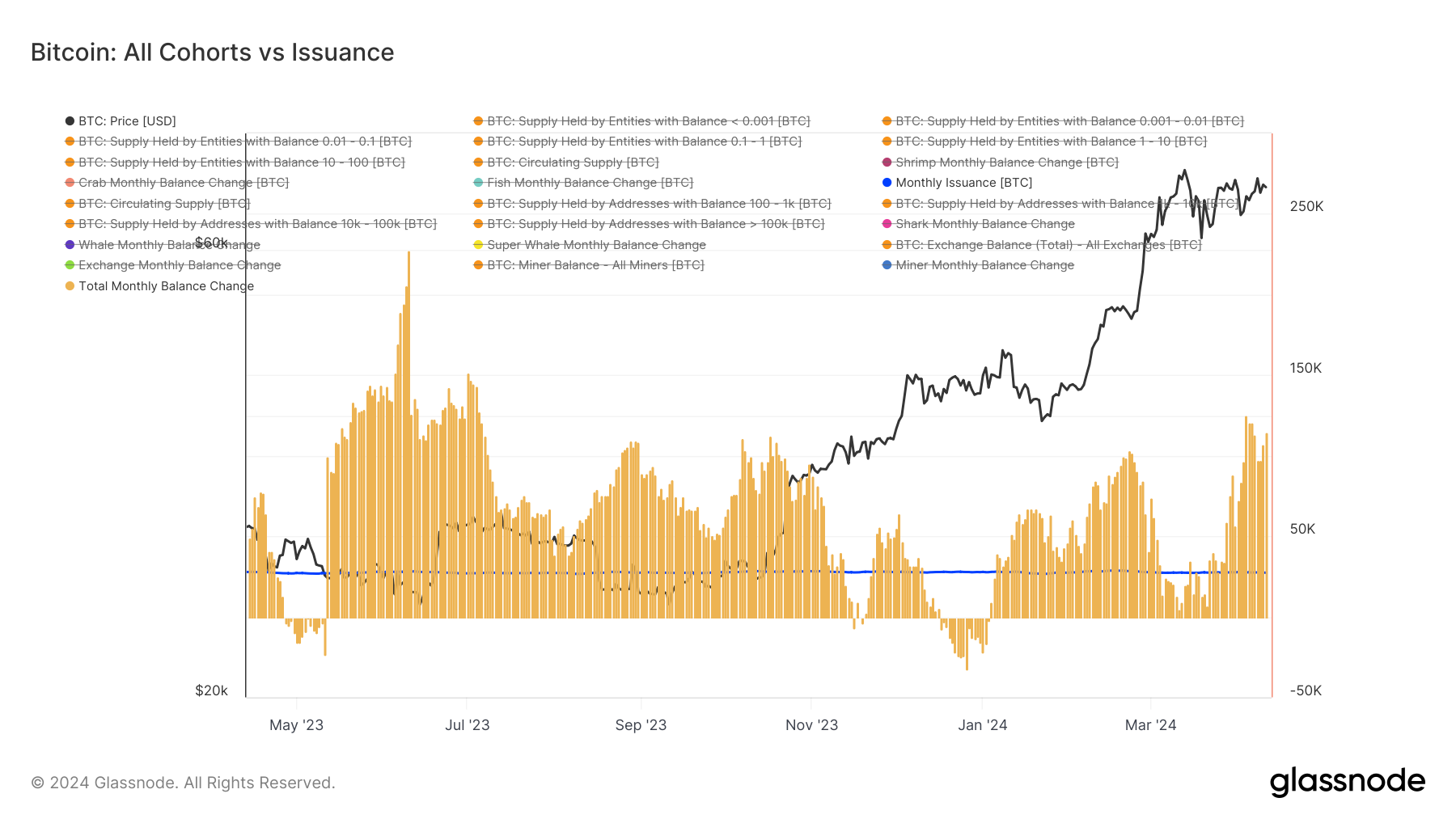

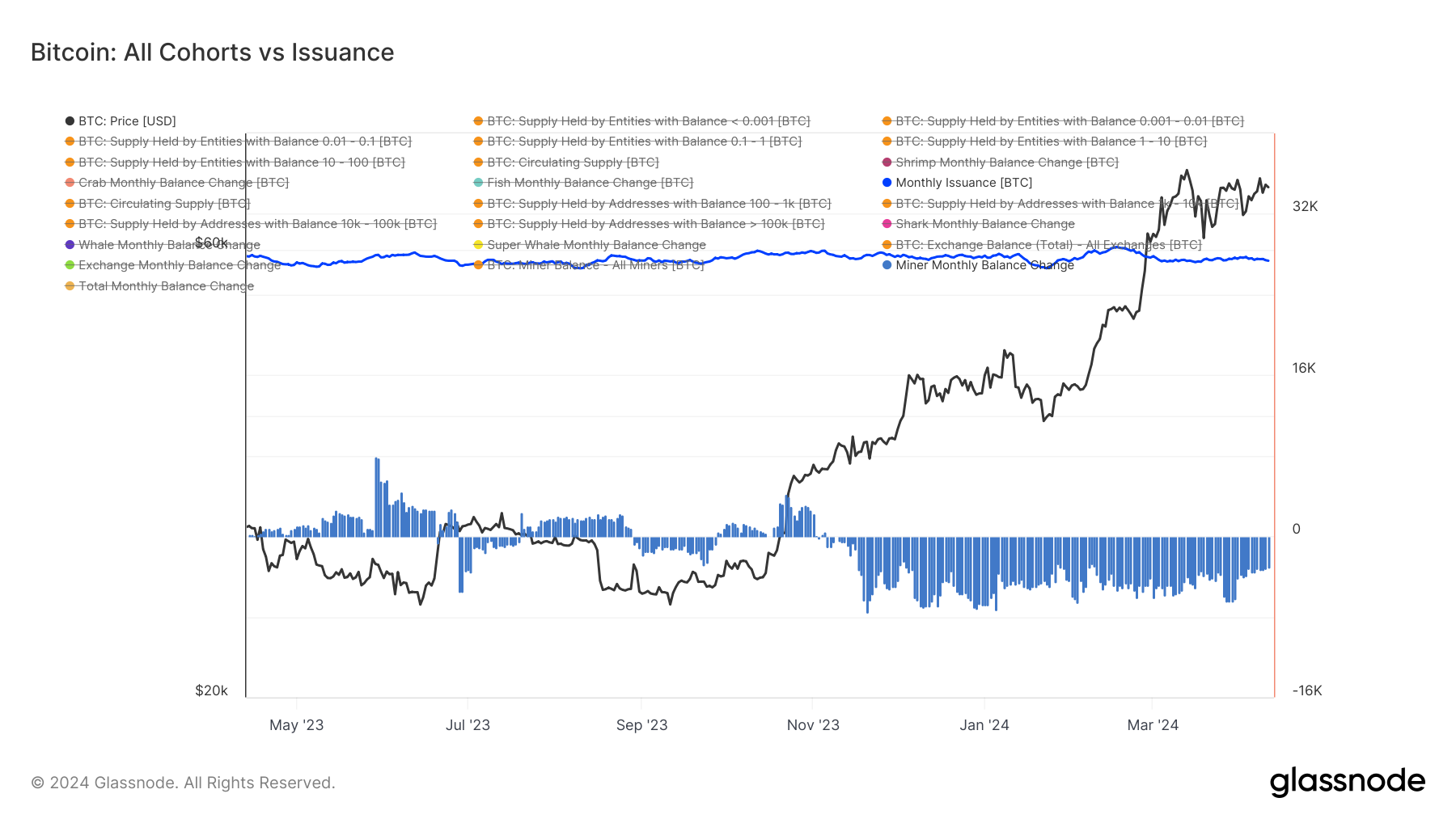

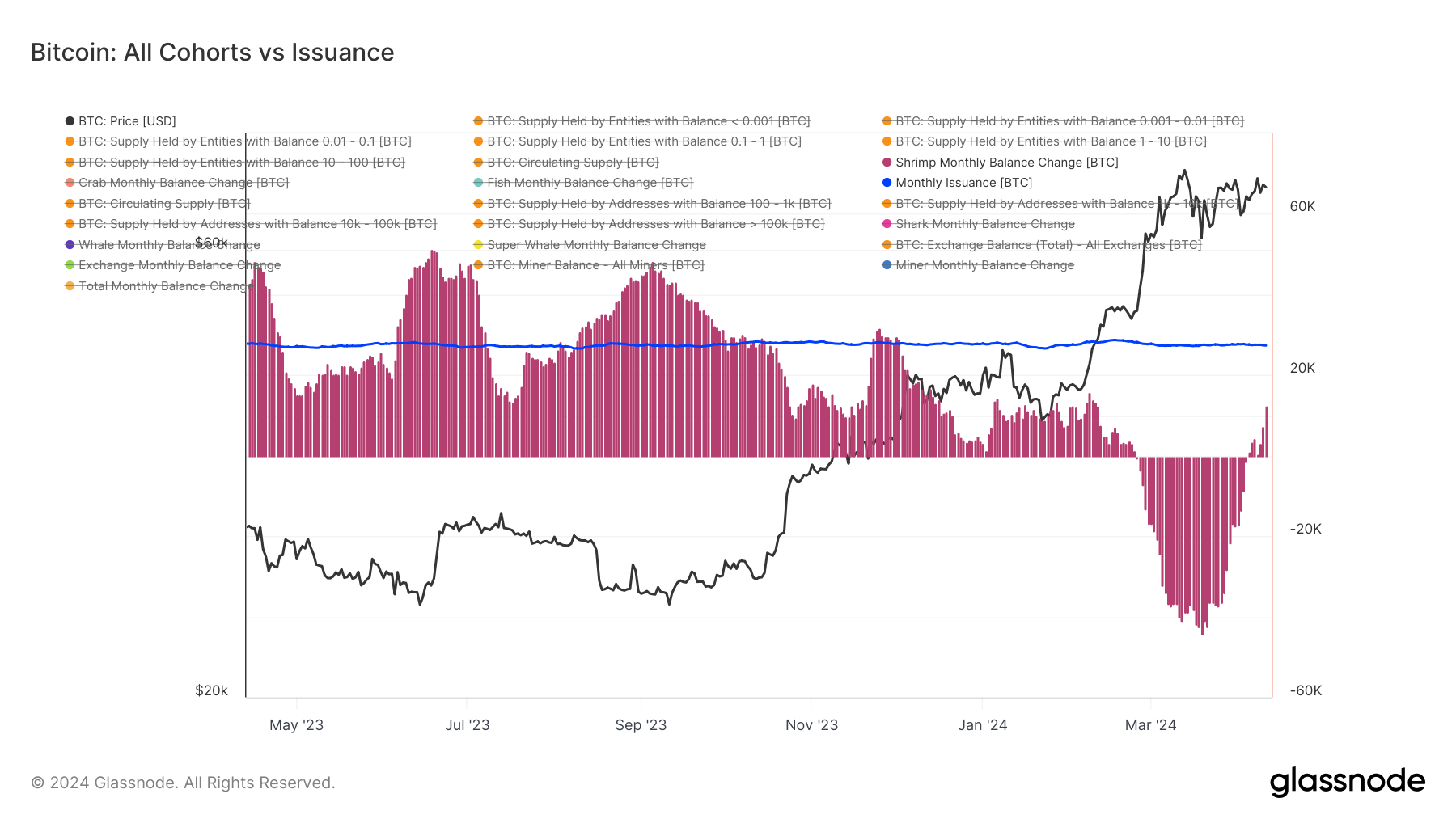

Glassnode data shows that since December, LTHs have offloaded around 1 million BTC; however, the recent GBTC sell-off has impacted Bitcoin’s long-term holder metrics. Excluding GBTC holdings, this accounts for roughly 700,000 Bitcoin sold by LTHs.

In contrast, short-term holders (STHs), those holding BTC for less than 155 days, persist in accumulating. During the period in which LTHs sold 1 million BTC, STHs have purchased approximately 1.2 million BTC, according to Glassnode data. While STHs have tapered their acquisition pace in the last 14 days, they remain active buyers. The interaction between LTHs and STHs indicates a promising outlook for short-term Bitcoin prices, with reduced sell pressure from LTHs.

As we can now discern from the data, because it takes 155 days to observe an LTH purchase, LTHs have capitalized on the opportunity amid the price surge from $25,000 in October 2023. Using a 14-day moving average, the LTH supply has experienced a slight increase, indicating accumulation. Currently, LTHs collectively hold approximately 14 million coins.

The post Bitcoin’s long-term holders shift to accumulation appeared first on CryptoSlate.

Onchain data indicates that a single custodian now manages the coinbase addresses for at least nine prominent mining pools, which collectively account for 47% of Bitcoin’s total hashrate. The analysis shows that substantial miners’ rewards from pools like F2pool, Antpool, Binance Pool, and Braiins are being funneled to this particular custodian. Onchain Data Reveals Single […]

Onchain data indicates that a single custodian now manages the coinbase addresses for at least nine prominent mining pools, which collectively account for 47% of Bitcoin’s total hashrate. The analysis shows that substantial miners’ rewards from pools like F2pool, Antpool, Binance Pool, and Braiins are being funneled to this particular custodian. Onchain Data Reveals Single […]

Based on current metrics, the Bitcoin blockchain is set to undergo another difficulty adjustment before the halving, with an anticipated increase of 1.2% to 2.16% around April 11, 2024. Following this adjustment, there will be 1,344 blocks remaining until the reward is halved. Estimated Increase in Difficulty Precedes Halving In April, bitcoin (BTC) miners face […]

Based on current metrics, the Bitcoin blockchain is set to undergo another difficulty adjustment before the halving, with an anticipated increase of 1.2% to 2.16% around April 11, 2024. Following this adjustment, there will be 1,344 blocks remaining until the reward is halved. Estimated Increase in Difficulty Precedes Halving In April, bitcoin (BTC) miners face […]

On March 1, a well-known colossal whale holding bitcoins from 2010 activated 2,000 dormant bitcoins across 40 transactions in a single block. Just four days afterward, on March 5, this entity once more made waves by transferring 1,000 bitcoins originating from the same year. For the third instance in March, this entity has returned, reallocating […]

On March 1, a well-known colossal whale holding bitcoins from 2010 activated 2,000 dormant bitcoins across 40 transactions in a single block. Just four days afterward, on March 5, this entity once more made waves by transferring 1,000 bitcoins originating from the same year. For the third instance in March, this entity has returned, reallocating […]