A misinterpreted announcement by the HBAR Foundation suggested that Blackrock’s ICS US Treasury Fund was tokenized on the Hedera blockchain in partnership with Archax and Ownera, leading to a significant misunderstanding and a 96% increase in the HBAR token price within 24 hours. However, Blackrock had no direct involvement in the tokenization process, as clarified […]

A misinterpreted announcement by the HBAR Foundation suggested that Blackrock’s ICS US Treasury Fund was tokenized on the Hedera blockchain in partnership with Archax and Ownera, leading to a significant misunderstanding and a 96% increase in the HBAR token price within 24 hours. However, Blackrock had no direct involvement in the tokenization process, as clarified […]

Source link

BlackRock

BlackRock tokenized BUIDL fund now convertible to USDC 24/7 via Circle integration

Circle, the issuer of USDC, announced a new smart contract functionality that allows holders of the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) to transfer their shares to Circle for USDC. As reported by Circle, this smart contract provides BUIDL investors with a near-instant, 24/7 off-ramp, leveraging the core benefits of tokenized assets: speed, transparency, and efficiency.

Jeremy Allaire, Co-founder and CEO of Circle, emphasized this development’s significance, stating,

“Tokenization of real-world assets is a rapidly emerging product category. Tokenizing assets is but one important dimension of solving investor pain points. USDC enables investors to move out of tokenized assets at speed, lowering costs and removing friction.

We’re thrilled to provide this functionality to BUIDL investors and deliver the core benefits of blockchain transactions via USDC availability to investors.”

BlackRock’s BUIDL fund, officially named the BlackRock USD Institutional Digital Liquidity Fund, represents a significant foray by the world’s largest asset manager into the realm of blockchain and digital assets. Launched in partnership with Coinbase, BUIDL is a blockchain-based investment fund designed to offer US dollar yields through tokenization, marking a notable step in integrating traditional finance with blockchain technology. The fund leverages US$100 million in USDC stablecoin transactions and is supported by a consortium of firms, including Anchorage Digital Bank NA, BitGo, Fireblocks, and Coinbase.

BlackRock’s BUIDL attracted $240 million in its first week of operations. Arkham Intel’s real-time data suggests that BUIDL’s Ethereum address has a balance above $100 million, primarily consisting of USDC that seeded the fund, with a small portion coming from community donations.

BlackRock launched the fund on the Ethereum blockchain on March 19, as indicated in a regulatory filing, with a public announcement on March 20 stating that the fund tokenizes assets in the form of the BUIDL token. The fund invests 100% of its assets in cash, US Treasury bills, and repurchase agreements, making it the “first tokenized fund issued on a public blockchain,” according to BlackRock.

Circle’s smart contract functionality enables the frictionless transfer of BUIDL shares for USDC on the secondary market. It provides a trusted and transparent method for users looking to sell their BUIDL shares while remaining holders of digital dollars. This development marks a significant step towards the tokenization of financial markets, offering a glimpse into the future of global finance while providing a secure, efficient, and compliant way for institutional investors to engage with digital assets.

The post BlackRock tokenized BUIDL fund now convertible to USDC 24/7 via Circle integration appeared first on CryptoSlate.

10 US Bitcoin ETFs Amass Over 519,000 BTC, With Blackrock Leading at 50.81%

The latest data reveals that Blackrock’s spot bitcoin exchange-traded fund (ETF) has increased its bitcoin portfolio, now encompassing 263,937.48 bitcoins valued at $17.88 billion. Spot Bitcoin ETF Reserves Reach New Heights Several U.S. spot bitcoin ETFs have bolstered their bitcoin (BTC) holdings, bringing the total for ten ETFs, excluding Grayscale’s Bitcoin Trust (GBTC), to 519,440.22 […]

The latest data reveals that Blackrock’s spot bitcoin exchange-traded fund (ETF) has increased its bitcoin portfolio, now encompassing 263,937.48 bitcoins valued at $17.88 billion. Spot Bitcoin ETF Reserves Reach New Heights Several U.S. spot bitcoin ETFs have bolstered their bitcoin (BTC) holdings, bringing the total for ten ETFs, excluding Grayscale’s Bitcoin Trust (GBTC), to 519,440.22 […]

Source link

People With Emergency Savings Are 70% More Likely to Invest for Retirement, According to BlackRock CEO. 3 Ways to Build Your Nest Egg Now

Saving for retirement can feel like an uphill battle, especially when you’re juggling day-to-day expenses and trying to keep your head above water.

But BlackRock CEO Larry Fink shares an action that can kick-start your journey: building an emergency fund. In his annual letter to investors, he points out that people with emergency savings are 70% more likely to invest for retirement.

So, if you’re seeking to tackle your daily finances while saving for retirement, here are three tips to kick-start your journey.

Image source: Getty Images.

1. Zero in on your emergency fund goals

Fink highlights research that shows 40% of Americans would have trouble coming up with $400 for sudden expenses, such as an urgent car repair. If you’re struggling to manage current expenses, the chances are slim that you’ll be able to tuck away money for retirement.

The good news is that you don’t have to save a lump sum at once. You can beef up your emergency fund over time by saving small amounts from every paycheck. Set up a recurring transfer, say $25, from your checking account to a savings account each payday to get the ball rolling.

If you’re able to increase your savings rate every quarter, you’ll be able to reach your goals faster. As a general rule, you should aim to have at least three to six months worth of bills stashed away in an emergency fund. So, if your essential living expenses total $1,500 each month, you can work toward your first milestone of saving $4,500.

2. Keep tabs on your money

You may be able to stretch your paycheck further by tracking where your money is going.

While you’re probably aware of your fixed monthly costs, like rent or mortgage and car payments, it’s the smaller everyday expenses that can pile up and nibble away at your wallet. Consider tweaking your daily spending habits, such as cutting back on coffee runs or snack purchases, if they don’t add value to your life. You may also be able to unlock potential savings by reassessing your subscription services and negotiating bills.

If trimming your expenses doesn’t move the needle, you might want to tackle income goals, too. See if you can score a raise or bonus at your current job or pick up a side gig that can bring in extra money. Every extra dollar you earn can be funneled into your emergency fund to help you hit your goals faster.

3. Pump up your retirement savings

Once you’ve tucked away money in an emergency fund, it becomes easier to focus on long-term savings goals, like retirement. Fink shares that his parents were able to build a sizable nest egg by prioritizing retirement savings and investing.

One way to boost your retirement savings is by taking advantage of employer-sponsored retirement plans like a 401(k). While a traditional 401(k) is often praised for its tax benefits, the cherry on top could be receiving free money from your employer through matching contributions. For instance, if your employer matches dollar-for-dollar up to 6% of your salary and you earn $100,000 annually, setting aside $6,000 in your 401(k) could instantly double your retirement savings with the employer match.

You can also look into individual retirement accounts, which offer greater flexibility compared to a 401(k). If you meet the income limits for contributing to a Roth IRA, you can unlock tax-free income during retirement. With a Roth IRA, you contribute after-tax dollars and have the freedom to invest in your favorite assets, including individual stocks. Additionally, depending on how much income you’re bringing in, you might be able to snag a Saver’s Credit worth up to $2,000 for contributing to a qualified retirement account such as a Roth IRA or 401(k) this year.

If your day-to-day finances have been getting in the way of your retirement savings, you could make a few adjustments this year to turn your financial situation around. Start by beefing up your emergency fund, and then gradually ramp up your retirement savings. The more you sock away for retirement today and plan ahead for your future, the better your odds of living a comfortable retirement.

Blackrock CEO Larry Fink ‘Very Bullish’ on Bitcoin — Hails IBIT ‘the Fastest Growing ETF’ Ever

The CEO of Blackrock, the world’s largest asset manager, Larry Fink, says he is “very bullish on the long-term viability of Bitcoin.” Noting that he is “pleasantly surprised” by the demand for Blackrock’s spot bitcoin exchange-traded fund (ETF), he emphasized that the Ishares Bitcoin Trust (IBIT) is “the fastest growing ETF in the history of […]

The CEO of Blackrock, the world’s largest asset manager, Larry Fink, says he is “very bullish on the long-term viability of Bitcoin.” Noting that he is “pleasantly surprised” by the demand for Blackrock’s spot bitcoin exchange-traded fund (ETF), he emphasized that the Ishares Bitcoin Trust (IBIT) is “the fastest growing ETF in the history of […]

Source link

Quick Take

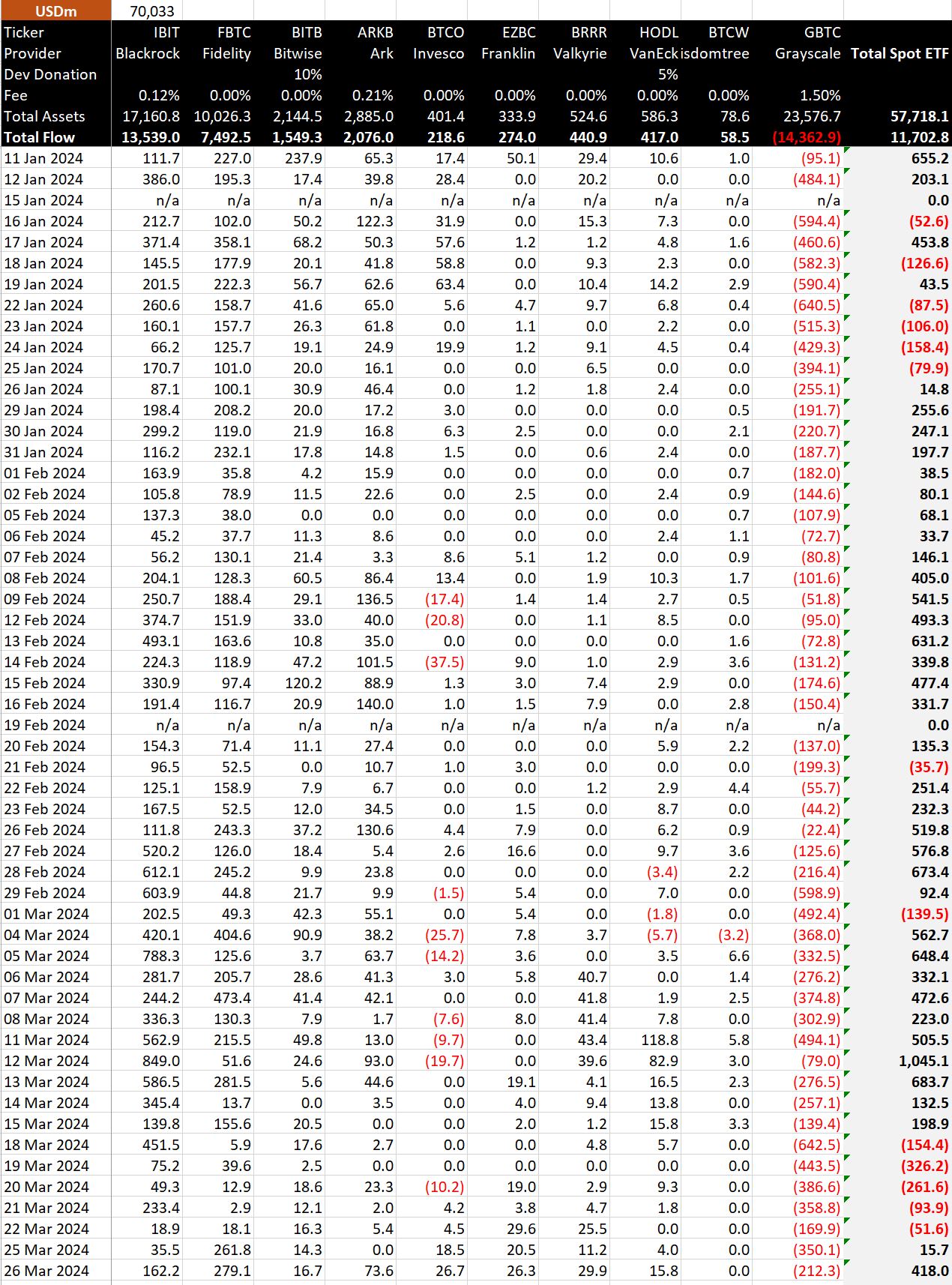

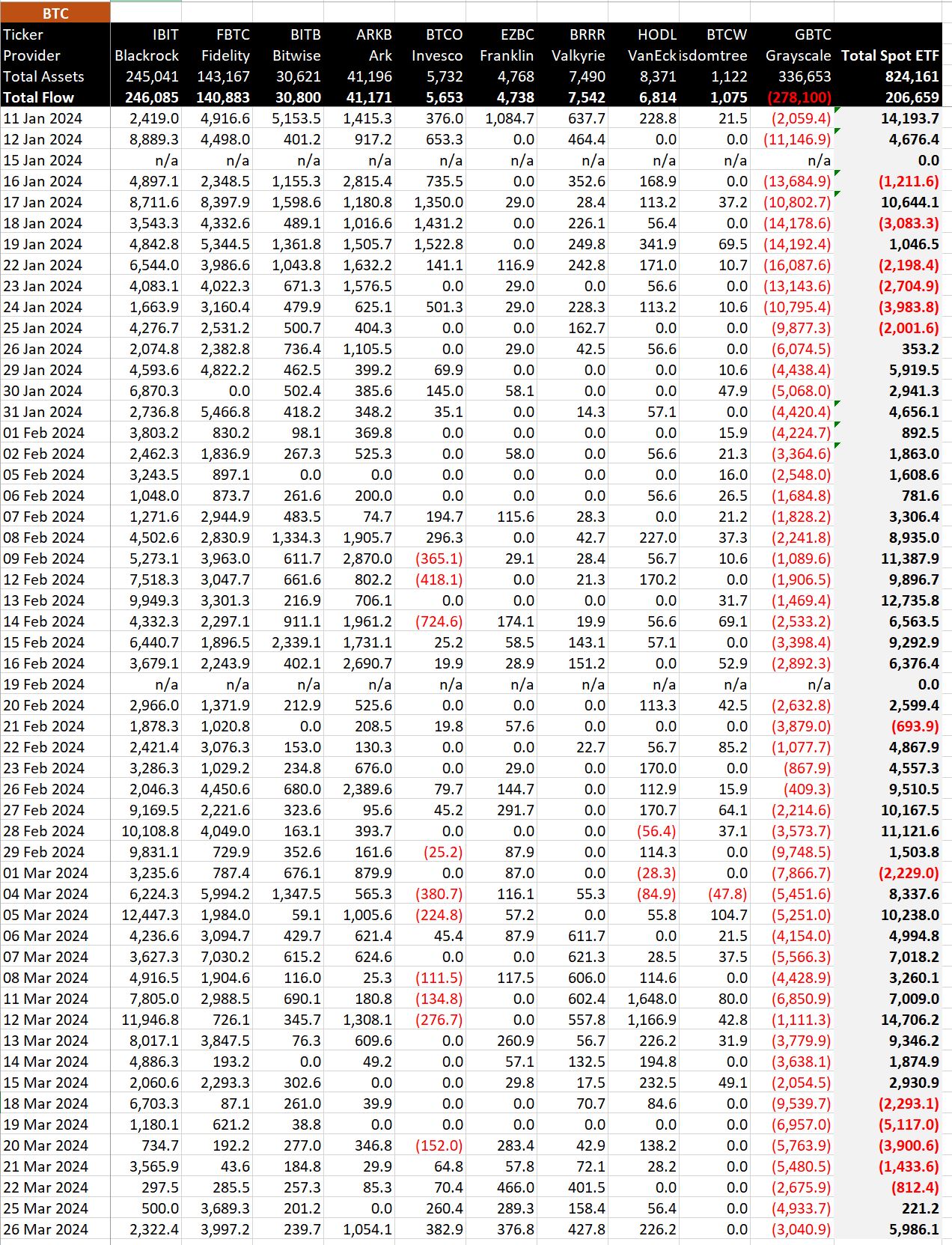

BitMEX’s recent data highlights a substantial inflow in Bitcoin (BTC) Exchange-Traded Funds (ETFs), showcasing their most significant day of inflows since March 13, with a total of $418.0 million, equivalent to 5,986.1 BTC. Notably, Fidelity’s FBTC ETF led the surge with an exceptional $279.1 million in net inflows, equivalent to 3,997.2 BTC, maintaining its strong sequence of consecutive inflow days. This increase has elevated their total net inflows to an impressive $7,492.5 billion, translating to 140,883 BTC.

BitMEX’s data reveals that BlackRock’s IBIT also experienced a solid inflow of $162.2 million, equal to 2,322.4 BTC, marking its best performance since March 21. This contribution boosted their total net inflows to $13,539 billion, corresponding to 246,085 BTC. Conversely, GBTC faced substantial outflows amounting to $212.3 million, or 3,040.9 BTC, leading to a cumulative net outflow of $14,362.9 billion and a net loss of 278,100 BTC.

Following five outflow data, the Bitcoin ETF sector continues a robust influx, with total net inflows reaching $11,702.8 billion, equivalent to a significant 206,659 BTC this year.

The post Fidelity and BlackRock ETFs lead massive Bitcoin inflow day appeared first on CryptoSlate.

BlackRock IBIT faces near-record low with mere $49 million inflow on March 20

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

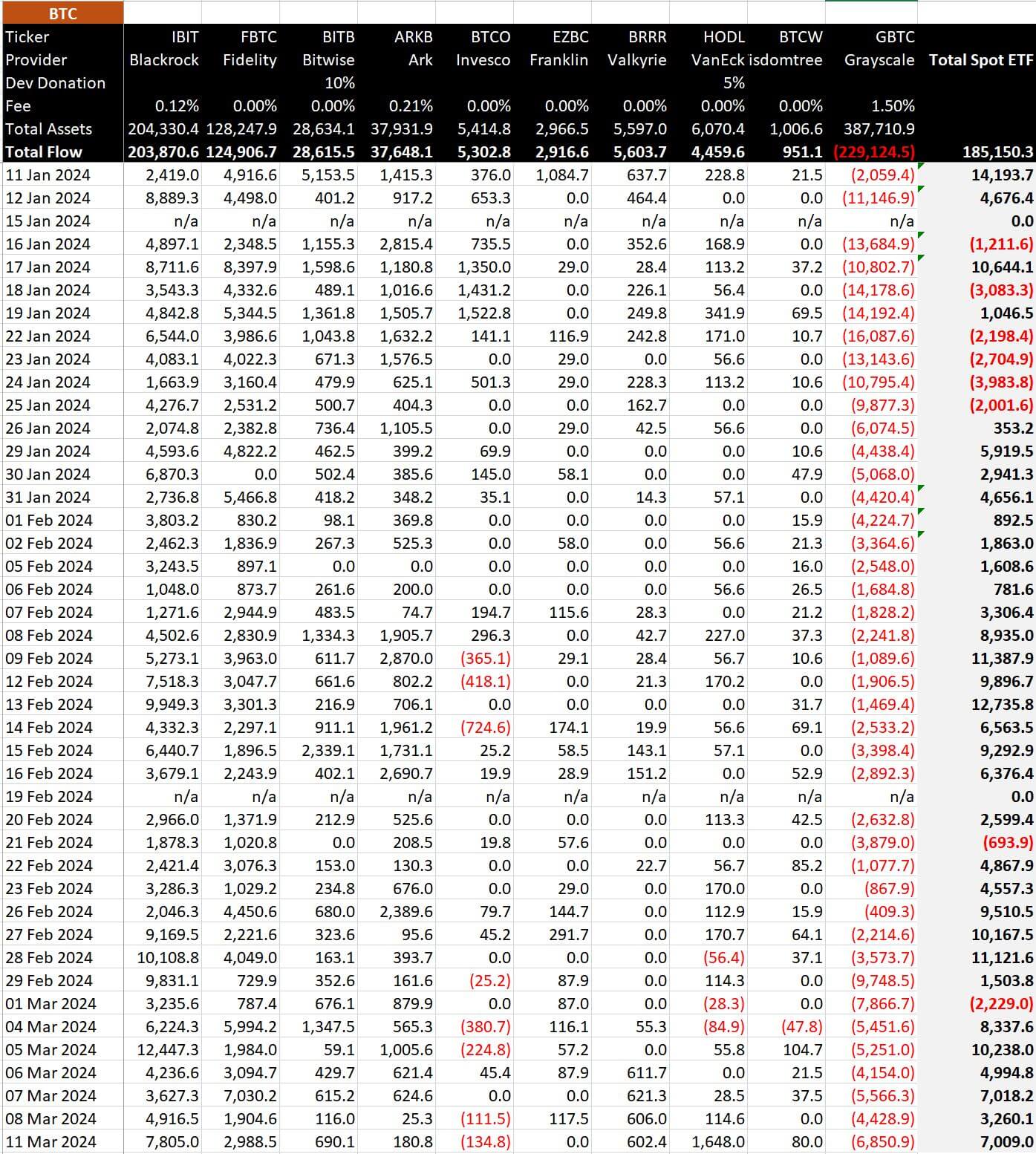

Bitcoin ETFs see $505 million total inflows led by BlackRock as VanEck breaks record

Bitcoin ETF inflows surged on March 11, 2024, with a net gain of $505.5 million, according to data from Bitmex Research. The strong performance was led by BlackRock’s iShares Bitcoin ETF (IBIT), which saw inflows of $562.9 million, representing a 0.12% increase in total assets. Fidelity’s FBTC fund also contributed to the positive momentum, attracting $215.5 million in new investments.

Other notable Newborn Nine ETFs with inflows included Bitwise’s BITB fund ($49.8 million), ARK Invest’s ARKB fund ($13.0 million), and VanEck’s BRRR fund ($118.8 million). VanEck’s announcement to waive fees until 2025 led to its strongest day by far. Previously, the fund had not seen more than $14.2 million in a single day. However, not all Newborn Nine funds experienced gains, with Invesco’s BTCO ETF reporting an outflow of $9.7 million.

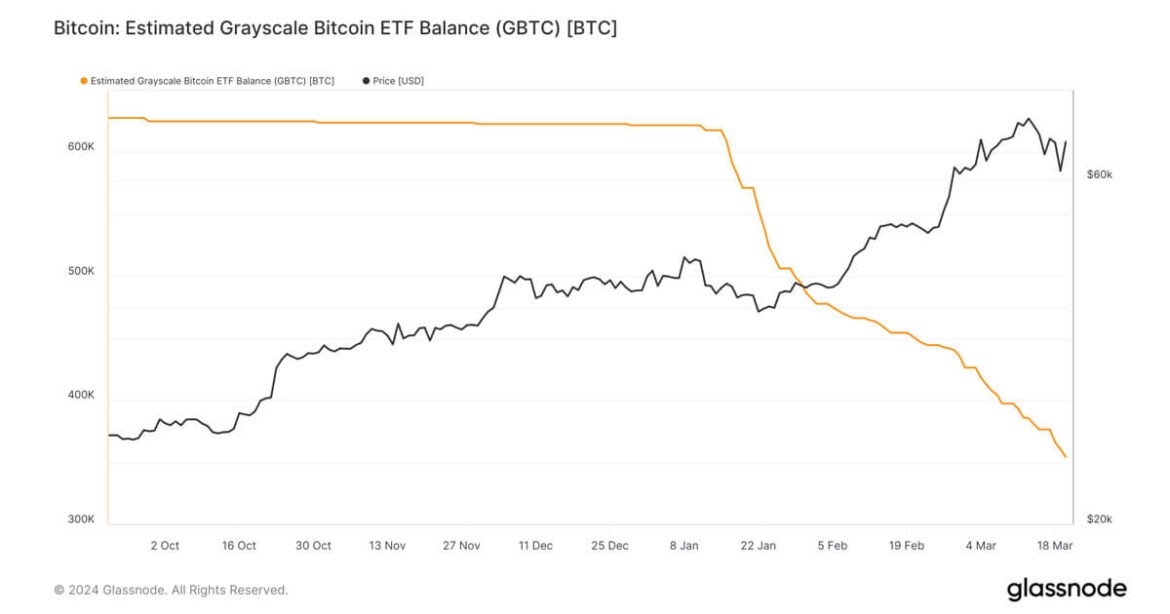

Further, Grayscale continued its outflows, with $494 million leaving the fund, the highest level since Feb. 29. Yet, the inflows into Newborn Nine ETFs significantly outweighed the Grayscale outflow for the sixth consecutive day. Only two days since Jan. 26 have total outflows surpassed inflows.

In terms of Bitcoin, the net inflow amounted to 7,009 BTC, with BlackRock’s IBIT fund accounting for 7,805 BTC of the total. Fidelity’s FBTC fund added 2,988 BTC, while Bitwise’s BITB fund saw an inflow of 690 BTC. ARK Invest’s ARKB fund and VanEck’s BRRR fund gained 180 BTC and 1,648 BTC, respectively.

The strong performance of Bitcoin ETFs on March 11, 2024, affirms the growing interest in Bitcoin investments among institutional and retail investors alike.

The post Bitcoin ETFs see $505 million total inflows led by BlackRock as VanEck breaks record appeared first on CryptoSlate.

BlackRock reaches $3.2 billion as Bitcoin ETFs continue to draw investor interest

Quick Take

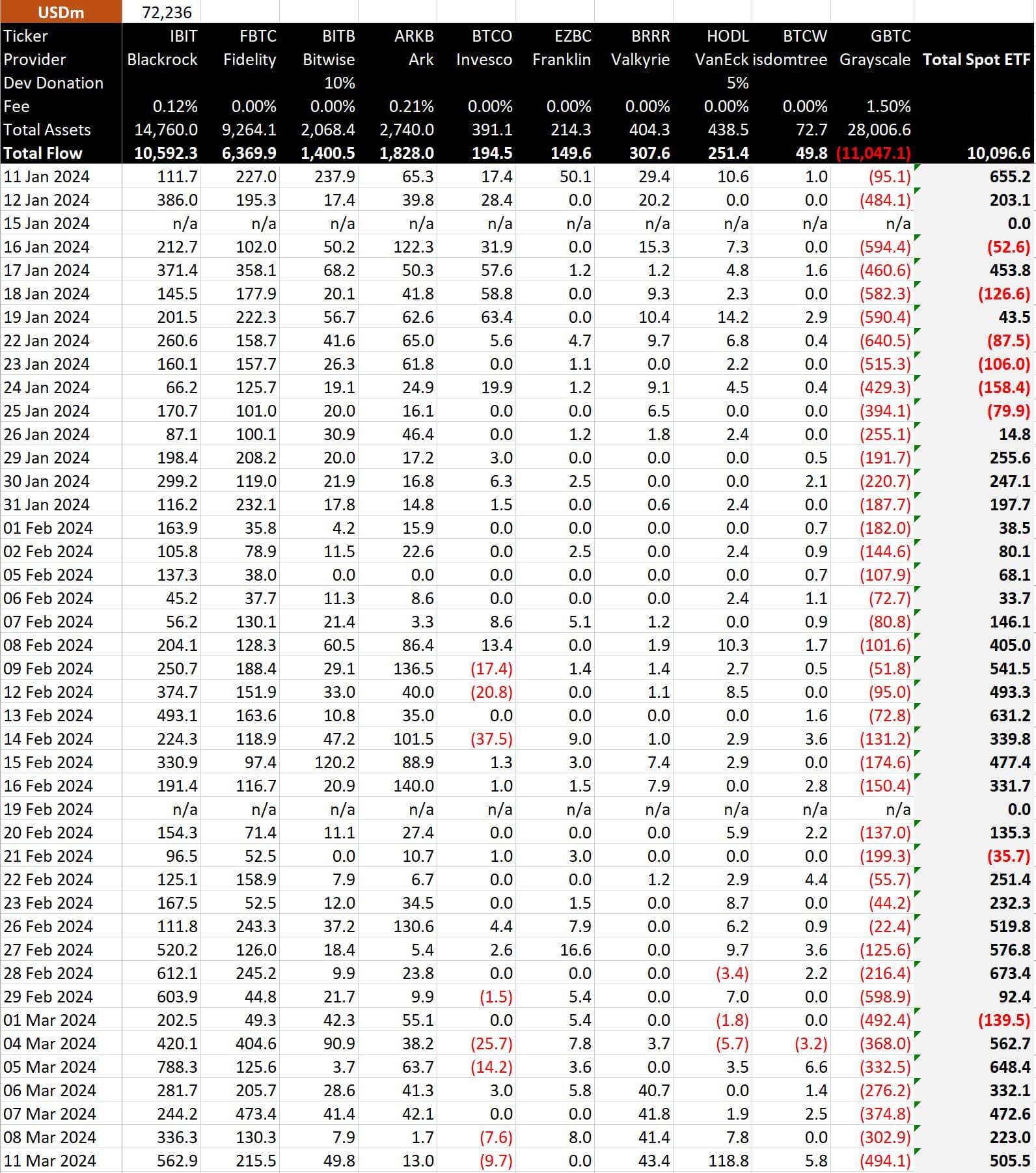

Net inflows into Bitcoin ETFs are seeing a slight uptick for the seventh straight trading day, emphasizing their growing appeal among investors. BlackRock IBIT is leading the pack, with an additional $137 million net inflow, taking its aggregate to an impressive $3.2 billion, according to BitMEX Research.

However, seven of the ten ETFs recorded zero inflows for the day as of press time, the only date where more than four ETFs have not reported inflows. Notably, only Grayscale Bitcoin Trust (GBTC) has reported outflows on any day since the SEC’s spot Bitcoin approval, with the Newborn Nine ETFs yet to report a day of outflows.

Further, GBTC observed its outflows tapering down to $108 million, the lowest since the first day of trading, pushing the total net outflows past $6 billion. However, the day saw a slower uptake of net inflows across other ETFs.

Since the inception of the ETFs, the sector has seen $1.5 billion of net inflows, which translates to a BTC equivalent of approximately 33,611 BTC. This data reflects positive momentum toward Bitcoin ETFs.

The post BlackRock reaches $3.2 billion as Bitcoin ETFs continue to draw investor interest appeared first on CryptoSlate.

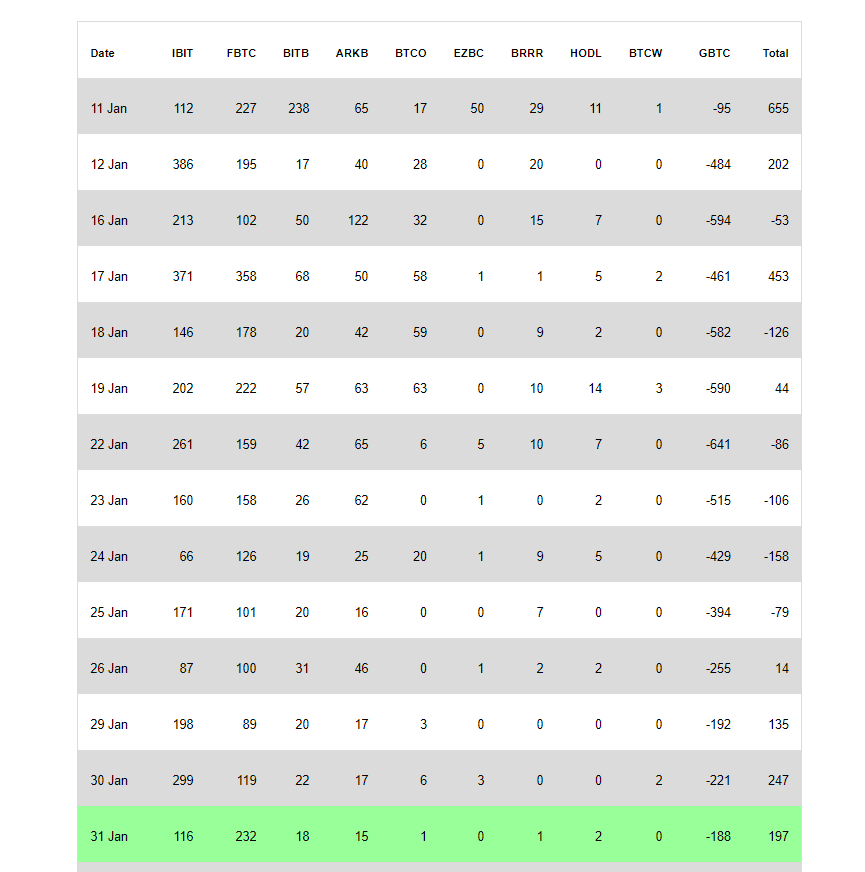

Bitcoin ETFs sees $197 million inflow, BlackRock and Fidelity lead the charge

Quick Take

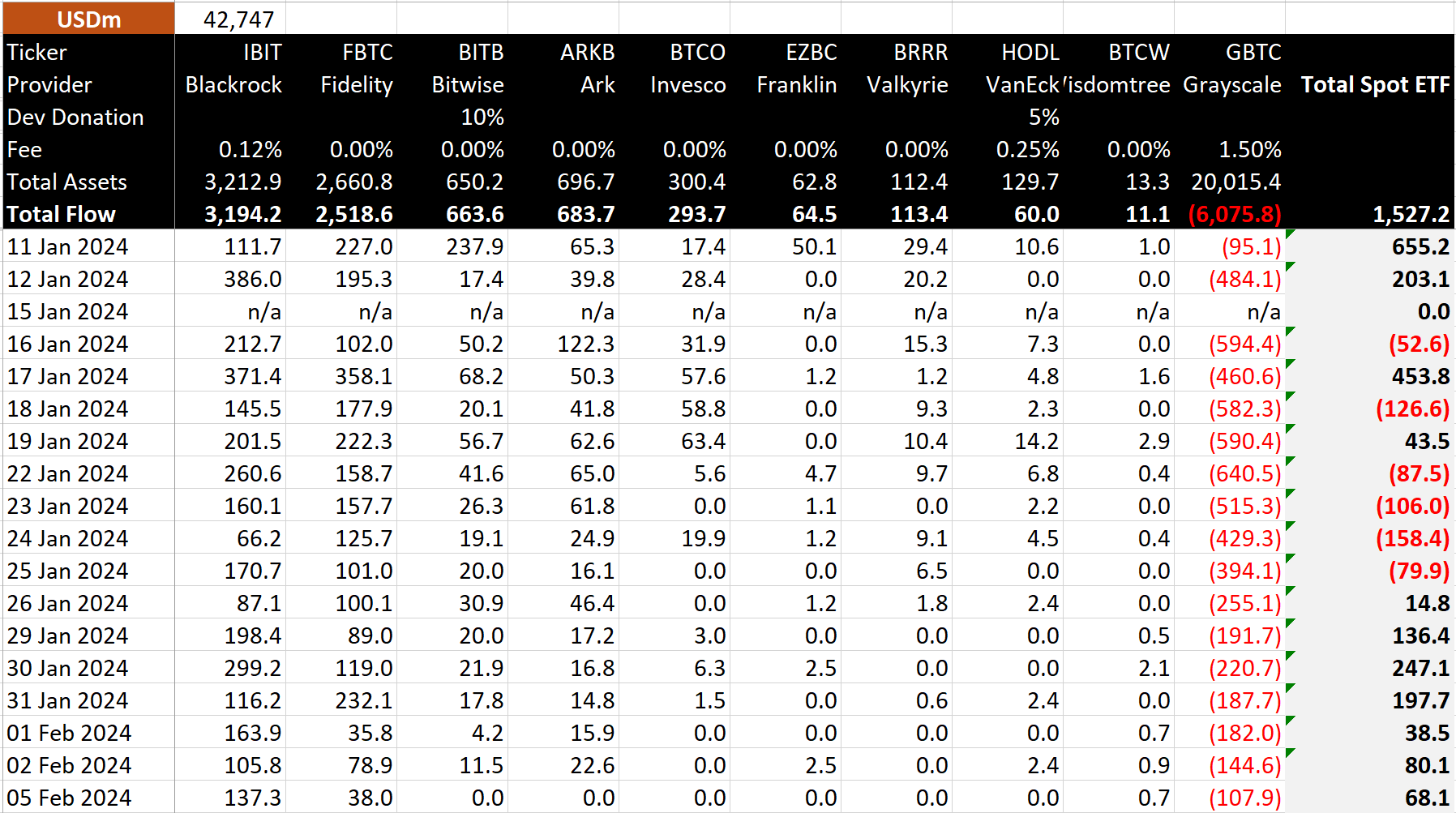

Day 14 for the new Bitcoin ETFs marked another day of net inflows, with a considerable $197 million entering the market on Jan. 31, according to Whale Panda.

This marks the fourth successive trading day of net inflows, underlining a trend in the market’s dynamic. Among the prominent contributors, BlackRock’s IBIT showed a strong performance, with net inflows of $116 million, according to Whale Panda, boosting its total to an impressive $2.8 billion.

Meanwhile, Fidelity’s FBTC recorded one of its strongest inflows since inception, with a significant $232 million, leading its total to $2.4 billion.

In contrast, GBTC experienced further outflows of $188 million, pushing its total to $5.6 billion outflows, showcasing the lowest amount since its launch.

In aggregate, the Bitcoin ETFs have acquired a hefty $1.3 billion in Bitcoin, suggesting a potent attraction for investors toward these financial products.

The post Bitcoin ETFs sees $197 million inflow, BlackRock and Fidelity lead the charge appeared first on CryptoSlate.