El Salvador continues its daily bitcoin purchases, aiming to keep buying until the cryptocurrency becomes too expensive. The top 10 bitcoin mining rigs of 2024 show significant profit margins due to recent value increases. Blackrock, has submitted a form to the SEC for the initiation of a tokenized investment fund called “BUIDL.” “Rich Dad Poor […]

El Salvador continues its daily bitcoin purchases, aiming to keep buying until the cryptocurrency becomes too expensive. The top 10 bitcoin mining rigs of 2024 show significant profit margins due to recent value increases. Blackrock, has submitted a form to the SEC for the initiation of a tokenized investment fund called “BUIDL.” “Rich Dad Poor […]

Source link

BlackRocks

BlackRock’s IBIT Joins Elite ‘$10 Billion Club’ Amidst Soaring Demand

The demand for spot Bitcoin exchange-traded funds (ETFs) has surged since their recent approval on January 10, with BlackRock’s IBIT Bitcoin ETF leading the way. This ETF has reached impressive milestones in less than two months, attracting significant investor interest and opening doors for various market participants to invest in the largest cryptocurrency directly.

As institutional and retail investors flock to these new investment vehicles, market experts predict a bullish trend and anticipate a potential price surge.

Bitcoin ETF Frenzy

According to Bloomberg ETF expert Eric Balchunas, BlackRock’s IBIT Bitcoin ETF has quickly joined the esteemed “$10 billion club,” reaching the milestone faster than any other ETF, including Grayscale’s Bitcoin Trust (GBTC), noting that only 152 ETFs out of 3,400 have crossed the threshold.

Balchunas notes that IBIT’s ascent to this club was primarily driven by significant inflows, which accounted for 78% of its assets under management (AUM). This reflects the growing appetite for Bitcoin exposure among investors seeking diversified and regulated investment options.

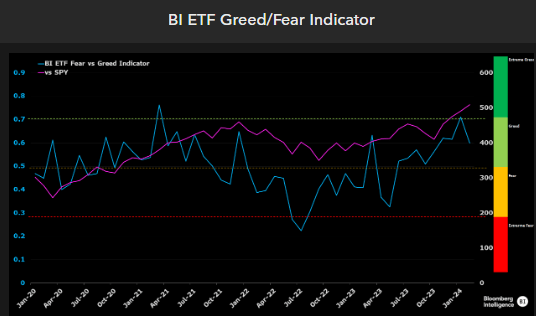

In particular, the current trajectory of the ETF market paints a picture of resilience and bullish sentiment in the market. Equity ETF flows, and leveraged trading levels are positive indicators, although they have not yet reached the euphoria seen in 2021, Balchunas notes.

However, Bloomberg’s new BI ETF Greed/Fear Indicator, which incorporates various inputs, highlights the optimistic outlook shared by ETF investors, as seen in the chart below.

On this matter, crypto analyst “On-Chain College” went to social media X (formerly Twitter) to emphasize the significant demand for Bitcoin as evidenced by its rapid departure from exchanges.

In its analysis, On-Chain College highlights that Bitcoin ETFs buy approximately ten times the daily amount of BTC mined. At the same time, the upcoming halving event will further reduce the mining supply. The analyst predicts when demand will exceed available supply, leading to potential upward price pressure.

Highest Monthly Close Since 2021

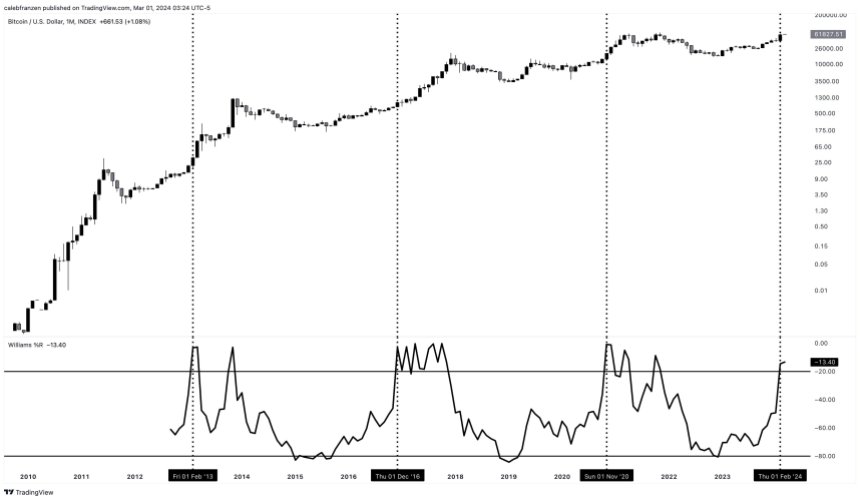

Bitcoin’s recent market performance has caught the attention of wealth manager Caleb Franzen, who highlights the significance of the highest monthly close since October 2021.

Franzen further emphasizes the bullish momentum by pointing out that the 36-month Williams%R Oscillator has closed above the overbought level for only the fourth time in history. Historical data reveals impressive returns following such signals, indicating the potential for substantial gains in the coming months.

Additionally, Franzen notes the changing dynamics of the market, with increased institutional participation and the ease of retail onboarding through ETFs.

Franzen presents a compelling case for the bullish nature of overbought signals, urging market participants to view them as momentum indicators rather than signals to fade. Previous instances of overbought signals have resulted in significant Bitcoin price appreciation:

- February 2013: +3,900% in 9 months

- December 2016: +1,900% in 12 months

- November 2020: +260% in 12 months

While acknowledging diminishing returns in each cycle, Franzen highlights the unprecedented level of institutional participation and the ease of retail access through ETFs.

Even if Bitcoin were to match the +260% gain from the November 2020 signal, it would reach a price of $180,000, surpassing Franzen’s minimum cycle target of $175,000.

Ultimately, Franzen notes that bull markets are typically characterized by a rising ETHBTC ratio and a falling BTC.D (Bitcoin dominance). While these characteristics have yet to manifest fully, Franzen suggests that a multi-quarter rally in the broader cryptocurrency market may be on the horizon.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Blackrock has amassed nearly 110,000 bitcoins for its spot bitcoin exchange-traded fund (ETF), Ishares Bitcoin Trust (IBIT), since its launch about a month ago. The world’s largest asset manager’s bitcoin ETF has a total net inflow of nearly $5 billion, leading the pack among all spot bitcoin ETFs. Blackrock CEO Larry Fink has stated that […]

Blackrock has amassed nearly 110,000 bitcoins for its spot bitcoin exchange-traded fund (ETF), Ishares Bitcoin Trust (IBIT), since its launch about a month ago. The world’s largest asset manager’s bitcoin ETF has a total net inflow of nearly $5 billion, leading the pack among all spot bitcoin ETFs. Blackrock CEO Larry Fink has stated that […]

Source link

SEC delays BlackRock’s spot Ethereum ETF; decisions are still due in May

The U.S. Securities and Exchange Commission (SEC) extended the decision period on BlackRock’s planned spot Ethereum ETF on Jan. 24.

That notice concerns a proposed rule change allowing Nasdaq to list and trade shares of the BlackRock iShares Ethereum Trust.

Previously, the SEC was required to approve, reject, or institute proceedings to approve or reject BlackRock’s proposal by Jan. 25, 2024. However, securities laws permit the agency to extend the decision period to March 10, 2024.

The SEC noted Nasdaq initially filed the proposed rule change on Nov. 21, 2023 and that the proposal was published for comment in the Federal Register on Dec. 11, 2023. The date of publication determines the deadlines described above.

The SEC added that it has not received any comments on BlackRock’s spot Ethereum ETF proposal. By contrast, BlackRock’s spot Bitcoin ETF proposal received about 15 comments within two months of its June 2023 filing.

SEC still expected to make decision in May

The delay around BlackRock is not expected to affect broader Ethereum ETF proceedings. Bloomberg ETF analyst James Seyffart said today:

“Spot Ethereum ETF Delays will continue to happen sporadically over the next few months. [The] next date that matters is May 23rd.”

May 23 is relevant as the SEC must approve or deny VanEck’s spot Ethereum ETF by that date without any possibility of further delays. The securities regulator will likely decide on other similar applications with different deadlines, including BlackRock’s, alongside VanEck’s application at that time.

The SEC similarly delayed proceedings around Fidelity’s spot Ethereum ETF this month. Once again, this will not impact the May decision deadline.

Though it is required to make a decision by May 23, it is unclear whether the SEC will opt to approve the funds. FOX Business’ Eleanor Terrett has reported internal resistance at the SEC while suggesting that some ETF issuers are optimistic.

Polymarket odds currently suggest a 54% chance of approval by May 31. Bloomberg ETF analyst Eric Balchunas predicts a 70% chance of approval.

Fake News on BlackRock’s iShares XRP Trust Sends Price Briefly to $0.74 Leading to High Liquidation

For several hours, the iShares XRP Trust appeared on the ICIS Delaware website suggesting that BlackRock had filed to list an XRP ETF, which was confirmed to be fake.

Amid the ongoing Bitcoin (BTC) and Ethereum (ETH), exchange-traded funds (ETFs) in the United States, the crypto community has questioned why the Ripple Labs-backed XRP has not been included and it has legal clarity. On Monday, reports circulated on the X platform that BlackRock Inc (NYSE: BLK) had filed to list an XRP exchange-traded fund (ETF). Notably, BlackRock’s iShares XRP Trust appeared on the ICIS Delaware website, which was highlighted to be fake and market manipulative. Moreover, the XRP price rallied 15 percent and briefly reached 76 cents before retracing to the former levels after it was confirmed to be fake news. According to our latest market data, XRP price traded around 66 cents on Tuesday during the early Asian market.

This is false! Confirmed by BlackRock by me. Some whacko must have added using BlackRock executive name etc. Cmon man. pic.twitter.com/cDpnycYwjQ

— Eric Balchunas (@EricBalchunas) November 13, 2023

According to Jeremy Hogan, a crypto-friendly legal expert with Hogan & Hogan, it is possible that a criminal filed two documents needed to list an XRP ETF and paid the fee of $500. Arguably, Hogan suggested that the criminal proceeded to place a bet on the XRP leverage and quickly sold at 74 cents to make a higher profit. Moreover, Bitcoin and Ether ETF application news have impacted the underlying value with higher volatility.

Are the BlackRock-related Rumors Signaling an Imminent XRP ETF in the United States?

The United States Securities and Exchange Commission (SEC) has been pushing for XRP to be regulated under securities law before the Ripple-backed instrument grows enormously amid the ongoing crypto mainstream adoption. However, the July summary judgment on the SEC vs Ripple lawsuit concluded that XRP exchange sales do not constitute investment contracts, thus resulting in more crypto firms relisting the instrument for trading.

The XRP trading volume and liquidity have since significantly improved as more investors doubled down on the instrument. As of this reporting, XRP had an average trading volume of about $3.1 billion, up approximately 230 percent in the past 24 hours following the ETF fake news. Notably, about $6.9 million in XRP was liquidated in the past 24 hours, according to market data from Coinglass.

Meanwhile, Yassin Mobarak, the founder of Dizer Capital, highlighted that it is peculiar that there is no XRP ETF application despite the notable legal clarity in the United States. The desire for crypto ETFs has been emanating from institutional investors’ demand to diversify their portfolios in digital assets to hedge against high fiat inflation.

Many applications for BTC spot ETF and now there’s a new ETH spot ETF application.

I find it peculiar that there’s no spot ETF application for the only crypto with actual legal clarity. That crypto is $XRP.

— Yassin Mobarak 🪝 (@Dizer_YM) November 11, 2023

Nonetheless, the XRP market will not be free until the ongoing SEC vs Ripple case is concluded, which is expected in early 2025, depending on the trial outcome in the first quarter of 2024.

next

Altcoin News, Blockchain News, Commodities & Futures, Cryptocurrency News, Market News

You have successfully joined our subscriber list.

BlackRock has taken the initial step toward filing for a spot Ether ETF, with the iShares Ethereum Trust recently registered in Delaware.

This move is reminiscent of BlackRock’s iShares Bitcoin Trust, which was registered in a similar fashion seven days before the ETF application was filed with the U.S. Securities and Exchange Commission (SEC).

In the context of an industry bristling with anticipation for the approval of a spot Bitcoin ETF, BlackRock’s move potentially signals a pivotal moment for Ethereum, shedding light on its status as a prospective asset class in institutional investment portfolios.

Despite the positive indications, it’s important to recall the precedent set by the SEC’s handling of Bitcoin ETFs. As reported by CryptoSlate in October 2023 Source, despite rumors indicating otherwise, the SEC had not approved the iShares Bitcoin ETF. The regulator had delayed its verdict on several proposed rule changes, which included applications from leading firms such as Fidelity (Wise Origin), VanEck, WisdomTree, and Invesco.

In light of this, BlackRock’s iShares Ethereum Trust registration, while a significant development, leads us into a territory of considerable uncertainty. The SEC’s previous hesitance to approve Bitcoin ETFs might cast a long shadow over BlackRock’s budding Ethereum trust, potentially heralding a new cycle of applications, approvals, delays, and rejections.

As the crypto community watches these developments with bated breath, two things have been game-changers for the industry: Grayscale’s court victory and BlackRock’s entry into the market. Ethereum ETFs, in this context, may just be the next frontier. However, for now, all eyes are trained on the SEC as the crypto industry awaits its verdict on the pending rule changes and the potential approval of BlackRock’s iShares Ethereum Trust.

BlackRock’s Ethereum Trust filing surfaces as another key narrative to monitor closely. As the crypto industry continues to evolve and mature, such developments underscore the increasing intersectionality of traditional finance and digital asset markets, hinting at a prospective future where digital currencies like Ethereum may become more commonplace in institutional investment portfolios.

Blackrock’s Bitcoin Spot ETF May Unleash $30 Trillion From US Advisors

The possibility of a Bitcoin spot Exchange Traded Fund (ETF) launching in the US, which has gained much attention over the past months, has again made headlines due to Bloomberg ETF analyst Eric Balchunas’s recent suggestions.

According to the analyst, should the US Securities and Exchange Commission (SEC) approve BlackRock’s Bitcoin spot ETF, a vast pool of $30 trillion capital overseen by US financial advisors could be directed toward Bitcoin investments.

Notably, Balchunas clarified that while the approval of a BTC spot ETF could serve as an accessible pathway for the $30 trillion managed by financial advisors to flow into BTC investments potentially, it is not particularly sure if the entirety of the $30 trillion would move into Bitcoin.

The analyst noted that only a fraction of that amount might consider investing. Balchunas noted: “But even if 0.5% of that allocates, it’s $150b.”

Hey I said that a spot ETF will be a bridge to the $30T advisors manage, a very small amt of which may invest, not all 30! 🙂 But even if 0.5% of that allocates it’s $150b

— Eric Balchunas (@EricBalchunas) September 5, 2023

Aftermath Of A BlackRock’s Bitcoin Spot ETF

It is worth noting that when BlackRock, boasting over $9 trillion in assets under management, lodged its Bitcoin spot ETF application, it didn’t merely mark its entry. It also dramatically tilted the probability scales for an ETF approval.

Before BlackRock stepped into the frame, the Bloomberg expert claimed that the odds of a BTC spot ETF seeing the light of day in the US hovered around a mere 1%. However, after BlackRock’s involvement, Balchunas disclosed in a podcast that the probability surged to 50%.

Their application had consequences. Balchunas observed a subsequent surge in similar applications from renowned entities, namely ARK Investment, Valkyrie, and Fidelity. This underscored BlackRock’s influence and the escalating competition in the space.

Balchunas noted:

Their application triggered a wave of similar filings by other prominent firms such as ARK Investment, Valkyrie, and Fidelity, setting the stage for a highly competitive environment.

Spot ETF Vs. Futures ETF: The Real Potential

The US isn’t entirely unacquainted with BTC ETFs. Bitcoin futures ETFs have already made their mark, albeit in a limited manner.

As it stands, these futures-based ETFs amass roughly $1 billion in total assets under management. A figure that, though impressive, may appear minor in the face of a spot ETF’s potential.

Balchunas went as far as to term the BTC spot ETF the “holy grail.” A product that, if approved, could overshadow existing futures ETFs and charge up the crypto domain in ways so far unseen.

Meanwhile, amid the race to approve a Bitcoin spot ETF, BTC has been in a continuous downtrend over the past week. The asset has dipped below the $26,000 mark, down by 5.7%. Bitcoin currently trades for $25,501, at the time of writing, down by nearly 1%.

Featured image from iStock, Chart from TradingView

SEC accepts BlackRock’s Bitcoin ETF application, signaling regulatory review

The United States Securities and Exchange Commission (SEC) has accepted BlackRock’s application for a spot Bitcoin (BTC) exchange-traded fund (ETF) following its acknowledgment of a similar application by Bitwise the day before.

The SEC’s acknowledgment indicates the commencement of the official review process for BlackRock’s ETF proposal. While it is an initial step in a lengthy regulatory journey, it signals the SEC’s readiness to explore the idea of a spot Bitcoin ETF and assess its potential market effects.

ETFs are investment funds that typically follow specific indexes and are commonly traded on exchanges. In the realm of cryptocurrencies, a fund that mirrors the value of one or multiple digital tokens and comprises a variety of cryptocurrencies is known as a cryptocurrency ETF.

On Friday, July 14, the regulator announced that it is also in the process of reviewing applications for various funds, including Wise Origin Bitcoin Trust, WisdomTree, VanEck and Invesco Galaxy.

BlackRock’s entry into the spot Bitcoin ETF race is significant due to its stature in the financial industry. Its filing for a spot Bitcoin ETF included an agreement for “surveillance-sharing” with cryptocurrency exchange Coinbase.

Related: Crypto will transcend international currencies — BlackRock CEO

The competition among companies vying to be the first to launch a Bitcoin ETF in the United States is seen by many as a positive development for the crypto industry. With multiple filings, the chances of success increase, with diverse proposals enabling the SEC to assess different strategies and concerns.

The SEC has yet to approve a spot Bitcoin ETF in the United States; however, in Canada, the financial product is already available. Three significant funds: Purpose Bitcoin, 3iQ CoinShares and CI Galaxy Bitcoin, have been approved by regulators in the country.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: SEC calls ETF filings inadequate, Binance loses euro partner and other news: Hodler’s Digest, June 25 – July 1

Traditional financial firms finally believe that digital assets are here to stay. Or so one might conclude from the slew of announcements last week from some of the world’s premiere financial players.

Among them is BlackRock — the world’s largest asset manager with $9 trillion in assets under management (AUM) — filed for permission to build a “spot market” Bitcoin-based exchange-traded fund (ETF) — something the United States Securities and Exchange Commission has resolutely resisted.

Others include Fidelity Investments, Charles Schwab and Citadel launching EDX, a new cryptocurrency exchange. In Germany, Deutsche Bank — boasting $1.4 trillion in balance sheet assets — applied for a license to custody crypto. There were others too.

Collectively, these developments boosted crypto trading markets. Bitcoin (BTC) gained 20% in the week, surpassing the $30,000 mark for the first time since April. If allowed, a BlackRock Bitcoin ETF listing on the Nasdaq stock exchange would arguably make Bitcoin more accessible to a larger investing public.

Some even anticipated a stampede to Bitcoin due to the BlackRock filing, as others followed with their own, including Invesco and WisdomTree. Fidelity Investments filed for a spot Bitcoin ETF on June 29.

“The Great Accumulation has begun,” declared Cameron Winklevoss on Twitter, while MicroStrategy’s Michael Saylor added, “The window to front-run institutional demand for #Bitcoin is closing.”

The Great Accumulation of bitcoin has begun. Anyone watching the flurry of ETF filings understands the window to purchase pre-IPO bitcoin before ETFs go live and open the floodgates is closing fast. If bitcoin was the most obvious and best investment of the previous decade, this…

— Cameron Winklevoss (@cameron) June 21, 2023

Others professed little shock about these developments, however, even after a year of crypto-related scandals, bankruptcies, lawsuits and regulatory uncertainty in the United States. By this view, the institutions were just bowing to the inevitable.

“I’m not surprised, since from a fundamental point of view, the movement of digital value is the next obvious evolution of the internet,” Jim Kyung-Soo Liew, associate professor of finance at Johns Hopkins Carey Business School, told Cointelegraph. “What is surprising is how the U.S. hasn’t embraced it.”

Last week’s events raise some questions: How enduring are Bitcoin’s most recent price gains? There have been institutional investor sightings before. Will this time be different, or will Bitcoin and other cryptocurrencies resume their sideways market activity?

On the other hand, a firm the size of BlackRock really could transform the BTC market, some believe.

Bitcoin has a fixed supply limit of 21 million BTC and its existing inventory is relatively illiquid. Sixty-eight percent of BTC in circulation hasn’t moved at all in the past year, according to Glassnode. There isn’t a lot of stock on the shelves for BlackRock and others to snap up, in other words. If demand exceeds supply, doesn’t that inevitably mean price gains for BTC?

Magazine: How smart people invest in dumb memecoins: 3-point plan for success

Also, where do retail investors fit in among the new institutional arrivals? Maybe ordinary crypto users are also needed to stabilize the price of Bitcoin.

Finally, assuming the so-called Great Accumulation really is happening, how far can it go? The cryptoverse has a market capitalization of about $1 trillion today, roughly half of which is in Bitcoin. Could the crypto market cap reach a 10-fold increase of $10 trillion in five years?

Has the “great accumulation” begun?

“Anyone watching the flurry of ETF filings understands the window to purchase pre-IPO bitcoin before ETFs go live and open the floodgates is closing fast,” declared Winklevoss, adding: “If bitcoin was the most obvious and best investment of the previous decade, this [spot Bitcoin ETF] will likely be the most obvious and best trade of this decade.”

Is the co-founder of the Gemini cryptocurrency exchange right?

“Clearly, there is significant investor demand for Bitcoin access through regulated investment funds from a broad spectrum of U.S. investors,” Sui Chung, CEO of CF Benchmarks, told Cointelegraph, “Otherwise, BlackRock, Fidelity, Invesco and other major asset managers would not have filed S-1s for Bitcoin ETFs.”

The entry of BlackRock and other investment managers into this new asset class isn’t so unexpected, either. “We’ve long known that BlackRock is enabling BTC investments for clients through their Aladdin platform and Bitcoin private fund,” Doug Schwenk, CEO of Digital Asset Research, told Cointelegraph.

The recent negative news stories swirling around Binance and Coinbase “are not related to Bitcoin and may be seen as an opportune time for a better-known, more regulated brand to provide alternatives that end-buyers can trust. A BTC ETF is a natural step.”

Winklevoss, Saylor and others warn that retail investors had better buy Bitcoin now to get its ostensibly cheaper “pre-IPO” price before BTC’s price skyrockets. Are they correct?

“There is some truth to that given the finite supply of Bitcoin and increasingly low rate of supply growth,” added Chung. “However, plenty of investors bought in the $50k to $69k range and they are still underwater; on top of that, cash earns 5%+ at the moment. To me, trying to time the market, especially one as volatile as crypto, is a fool’s errand.”

Moreover, the Winklevoss scenario “depends on how certain one is that institutions are truly coming and that the ETFs and other infrastructure plays by large institutions will play out,” Justin d’Anethan, head of business development for the Asia-Pacific region at Keyrock — a Europe-based digital asset market maker — told Cointelegraph.

“Forward-looking investors will probably try to front-run that move and buy before any of this is truly released. I’m personally a bit less certain about how soon this will happen, though,” d’Anethan added.

Assuming BlackRock succeeds in its ETF quest and other institutional investors follow, would that stabilize the price of Bitcoin at a substantially higher level than the current $30,000? Or does long-term price stability also require broad retail participation?

“It all depends how much AUM they can gather if they are approved,” answered Chung. “If it’s a substantial amount, then it stands to reason that it would lift the price substantially given the finite supply. Bitcoin and its price is agnostic as to who buys Bitcoin and through what means. Buying demand just has to outstrip selling demand and the price will appreciate.”

Carol Alexander, professor of finance at the University of Sussex Business School, told Cointelegraph that a slew of spot Bitcoin ETFs could actually make BTC less stable and more volatile. “If there’s too many ETFs, all these market makers trying to hedge their positions could be selling at the same time or buying at the same time. It could increase volatility… I disagree with what Winklevoss said.”

Alexander has her own BTC price scenario, which assigns retail investors a key role. In March, when BTC was trading around $20,000, she predicted the coin would rise to $30,000 by June and move sideways through the summer. That has largely come to pass. “So the question is, what’s going to be happening in September?” she asked.

“I’m not saying it will — but it could go up to around $50,000. That’s because people come back after the summer, and there’s more liquidity in the markets.”

But it’s also because retail investors are no longer scared after the long string of crypto drawdowns, scandals, bankruptcies and regulatory actions of the past year. The growing investment in the digital asset market by large financial institutions like Fidelity Investments and JPMorgan Chase has arguably had a calming effect on retail investors.

“I think we’re going to be seeing much more acceptance from really ordinary people starting in September as you get some more regulatory clarity about things. That extra volume of trades could bring the price back up to — I’m not saying $68,000 where it was, that would be too high […] — but there’s that sweet area around the $50,000 mark, which I think will be the next long-term resistance level.”

In a June 19 global survey by Nomura Laser Digital, 90% of professional investors said it was “important” that any digital-asset funds or investments have the backing of a large traditional financial institution — at least before considering putting their clients’ money into it. Maybe this past week’s announcements by BlackRock, Fidelity, Deutsche Bank, et al. are the signal they were waiting for.

“Perhaps,” Schwenk said. “Only time will tell. It’s hard to pick when the tipping point will be. We have had participation from other large traditional firms — BNY Mellon, State Street, Standard Chartered, Franklin Templeton, etc. That hasn’t been enough to satisfy the respondents in the survey yet, but eventually, they will see enough momentum.”

Ten-fold growth over five years?

In the medium term, how high could things go? With the active participation of large TradFi firms like BlackRock, Fidelity and Deutsche Bank, could crypto market capitalization grow from $1 trillion to $10 trillion or more over the next five years, for instance?

“Five years ago, the entire market cap of liquid crypto, as measured by the CF Large Cap Index, was around $250 billion and hit a high of around $2.6 trillion in late 2021,” said Chung. “So 10X would seem to be within the realms of possibility.”

Major institutions putting their distribution networks to work to support further adoption would also provide “a significant tailwind,” he added. “However, interest rates were not 5% in that previous five-year period — they are now. What impact that might have is impossible to know.”

Recent: Open source: Buzzword or real security for crypto wallets?

Alexander was less bullish. “A Bitcoin ETF — I don’t even see that it’s needed.” Most ETFs are a basket of equities or a basket of currencies. An ETF with a basket of cryptocurrencies like Bitcoin, Ether (ETH) and Solana (SOL) “would make a lot more sense,” in her view.

‘Exciting times’ for Bitcoin?

Sightings of institutional investors just outside the boundaries of the cryptoverse have been reported before, but they have never quite entered en masse. Why might this time be different?

“Institutional investors are very slow and thoughtful in their due diligence process,” Johns Hopkins’ Liew said, but “they have finally come to see the Bitcoin light. It’s just too exciting to pass up and their customers are pushing them for products.” From an empirical perspective, some crypto exposure is a good means of diversifying an investment portfolio, he noted, summarizing:

“If institutional investors enter the party, their demand would certainly drive prices higher. It would definitely be exciting times for BTC.”

“The involvement of large financial institutions, whether it be for ETF applications or the new EDX exchanges, represent a significant shift and a decisive moment for crypto markets, in the U.S. and globally,” concluded d’Anethan.

SEC under congressional scrutiny as BlackRock’s spot Bitcoin ETF application moves forward

U.S. House Financial Services Committee Chair Patrick McHenry said he would “closely” watch how the Securities and Exchange Commission (SEC) responds to BlackRock’s application for a spot Bitcoin ETF in a June 16 tweet.

McHenry noted that while the decision now rests with SEC Chair Gary Gensler, the financial regulator “must not pick winners and losers based on inconsistent factors.”

The lawmaker’s comment suggests that the SEC would have to explain why it rejected all the previous spot Bitcoin ETF applications from other crypto firms if it approves that of BlackRock.

Considering BlackRock’s status as one of the biggest investment firms in the world and its influence, several crypto community members believe the SEC will be under significant pressure to approve its application.

BlackRock’s ETF application

On June 15, BlackRock applied for a Bitcoin spot ETF. Coinbase Custody would act as the custodian for the digital assets, while the Bank of New York Mellon would hold the ETF’s fiat.

According to its application, the SEC has previously approved unregulated spot exchange-traded products in the commodities and currency markets by relying on the underlying futures market. Thus, “the regulated market of significant size test does not require that the spot bitcoin market be regulated in order for the Commission to approve this proposal.”

SEC has a history of rejecting Bitcoin spot ETFs

The Commission has rejected over 10 spot Bitcoin ETF applications from different firms, including Ark Invest, 21 Shares, WisdomTree, Fidelity, SkyBridge, Valkyrie Investments, and VanEck.

Additionally, the regulator has frustrated Grayscale Investments’ effort to convert its Bitcoin Trust into a spot ETF. The crypto investment firm is currently challenging the SEC’s decision in court.

In these cases, the Commission has consistently maintained that these firms’ applications failed to comply with certain sections of the Securities Exchange Act and were not designed to prevent fraud and market manipulation or protect investors and public interests.

However, the SEC has approved various Bitcoin futures ETFs since October 2021, including ProShares Bitcoin Strategy (BITO) and Valkyrie Bitcoin Strategy ETF (BTF).

The post SEC under congressional scrutiny as BlackRock’s spot Bitcoin ETF application moves forward appeared first on CryptoSlate.