Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, says bitcoin is “becoming an alternative currency on a global basis,” noting that “The world’s going towards intangible assets and bitcoin is the most significant in cryptos.” However, the strategist warned that as bitcoin’s price approaches $70,000, a key test for the cryptocurrency may come “when the U.S. […]

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, says bitcoin is “becoming an alternative currency on a global basis,” noting that “The world’s going towards intangible assets and bitcoin is the most significant in cryptos.” However, the strategist warned that as bitcoin’s price approaches $70,000, a key test for the cryptocurrency may come “when the U.S. […]

Source link

Bloomberg

Nvidia sets stock market record with $247 billion addition to market cap in one-day – Bloomberg

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

An analyst for Bloomberg Intelligence placed Coinbase’s chances of prevailing in its legal battle with the U.S. Securities and Exchange Commission (SEC) at an optimistic 70%.

In a Jan. 19 post on social media platform X (formerly Twitter), Elliot Stein, Bloomberg Intelligence’s senior litigation analyst, suggested that the cryptocurrency trading platform was likely to secure a complete dismissal of the regulatory case based on developments in the recent court hearing.

“I went into SEC v. Coinbase hearing thinking COIN would, on this motion, win dismissal of SEC’s primary claims (concerning trading) but maybe not staking and broker claims. I left thinking COIN would win full dismissal,” Stein stated.

CryptoSlate previously reported that Judge Katherine Polk Failla questioned why she should not dismiss the case, considering Coinbase’s stance finds support from influential stakeholders like Senator Cynthia Lummis.

Why Coinbase could win

Stein revealed that Judge Failla wanted the SEC to define “investment contract,” excluding collectibles.

The analyst further explained that Coinbase’s proposed definition of the term was more persuasive as it emphasized the necessity of investing in a business rather than merely an ecosystem, coupled with the presence of an enforceable action.

Throughout the case, Coinbase has consistently asserted that its platform does not facilitate trading “investment contracts.”

The company’s Chief Legal Officer, Paul Grewal, said the SEC’s insistence contradicts established legal precedents, including decades of Supreme Court decisions. Grewal said:

“By ignoring that precedent, the SEC has violated due process, abused its discretion, and abandoned its own earlier interpretations of the securities laws. By ignoring that precedent, the SEC has trampled the strict boundaries on its basic authority set by Congress.”

Other reasons

The analyst highlighted Ripple’s recent legal triumph against the regulator as further evidence that the traditional Howey Test may not seamlessly apply to digital assets sales on public exchanges.

According to him, this challenges the conventional notion of what qualifies as an investment contract. Stein further speculates that if the case advances to the Supreme Court, it will likely result in a more refined interpretation of the Howey Test, potentially narrowing its scope.

In addition, Stein asserted that the crypto trading platform effectively countered the SEC’s staking claims. Stein concluded:

“And Coinbase had good arguments that the SEC’s allegations don’t sufficiently plead that it was performing broker functions.”

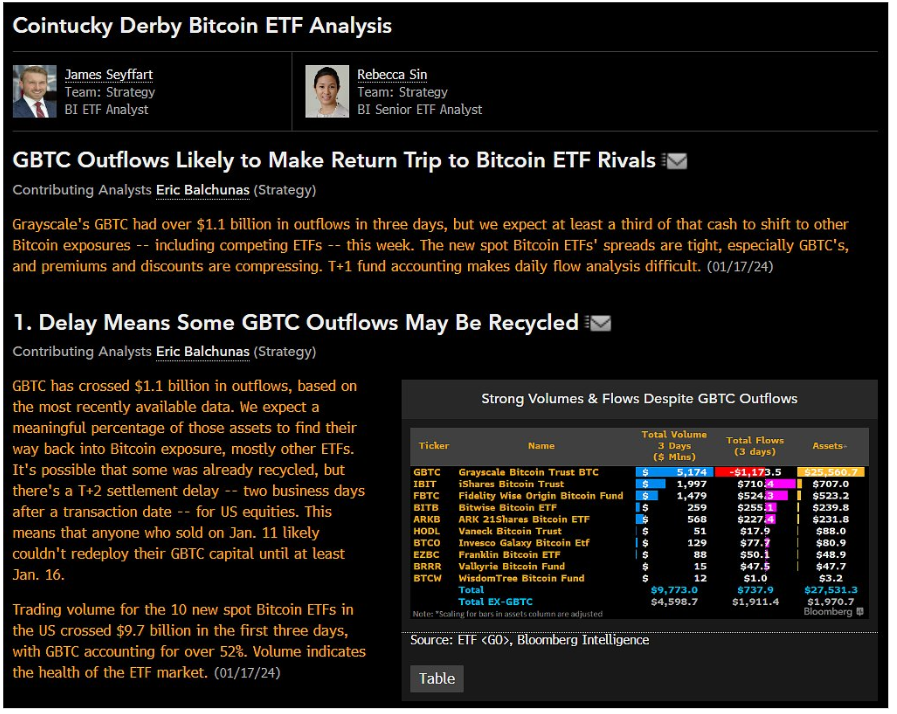

One-third of GBTC outflows could be redirected to Spot Bitcoin ETFs: Bloomberg Analysts

Quick Take

Notable financial analysts have corroborated that the recent outflows from Grayscale’s Bitcoin Trust (GBTC), to the tune of $1.6 billion in four days, may signal significant investors’ shifts towards other Bitcoin ETFs.

James Seyffart notes that as much as a third of the outflows could transition towards other ETFs and other Bitcoin exposures within the week, primarily due to their tighter spreads compared to GBTC, an advantageous attribute for investors. Furthermore, the complexities of T+1 fund accounting can make these daily flow shifts difficult to track, according to Seyffart.

On a similar note, analyst Blachunas goes a step further to predict that a large chunk of GBTC’s assets will eventually find their way back into other ETFs, although this movement might not be immediately visible due to the T+2 settlement data for US equities, causing a lag in the data. This means that sales from Jan 11, for example, may not reflect until Jan. 16.

Adding to this financial landscape is the fact that the trading volume for the top ten spot ETFs reached $10 billion in the first three days. As of Balchuna’s latest update, the total volume for all ten ETFs is now at $12 billion.

Interestingly, despite the outflows, GBTC accounted for over 52% of that volume, showcasing its still significant role in the market.

The post One-third of GBTC outflows could be redirected to Spot Bitcoin ETFs: Bloomberg Analysts appeared first on CryptoSlate.

Bitcoin ETFs could trade at 8bps premium to spot, in-kind redemptions still possible later: Bloomberg

In a Jan. 8 interview on Bloomberg ETF IQ, Reggie Browne from GTS, the trading and liquidity services provider, discussed the potential approval of a spot Bitcoin ETF in the U.S. and its implications. Browne predicted an initial premium of approximately 8% above fair value for the ETFs, a significant figure considering the typical premiums of more conventional ETFs.

Browne noted the unique challenges faced by U.S. broker-dealers in trading Bitcoin directly would affect the pricing of Bitcoin ETFs, primarily due to the reliance on futures contracts for hedging purposes, as futures are trading at a premium to spot Bitcoin prices.

Furthermore, Browne discussed the potential for ETF issuers to handle in-kind creations after amended S1 filings removed the methodology’s focus across the board. Most ETF applicants have settled on cash creations and redemptions, likely to appease the SEC, but Browne still anticipates a shift towards in-kind redemptions. This transition aims to align the trading practices within the ETF sphere with the regulatory structure of U.S. broker-dealers, which is not fully equipped for direct Bitcoin trades.

As the SEC continues to review applications from major financial institutions, including Valkyrie, WisdomTree, and BlackRock, the implications of Browne’s insights become increasingly relevant. The potential for an 8% premium on a spot Bitcoin ETF reflects the current regulatory challenges and the evolving nature of Bitcoin trading within mainstream financial structures.

Balchunas later added on X that he was “a bit shocked” at the 8% premium prediction, highlighting that the Canadian spot Bitcoin ETFs see 2% premiums at best. Bloomberg’s James Seyffart echoed Balchunas’ sentiment that “Reggie is a very experienced ETF market maker –not some random talking head.”

However, Eric Balchunas has since confirmed that Browne “actually meant 8bps not 8%,” which Balchunas said was “a big relief bc an ETF’s premium/discount is an imp measure of how arbitrage-able the ETF and its holdings are, which keep price close to fair value all day.”

The Bitcoin world holds its breath as it awaits the decision on whether the ETFs will be approved. The SEC issued further comments on the latest round of filings, returning to applicants on the same day, which is extremely out of the norm for such proceedings. Fox Business’ Eleanor Terrett stated that she had spoken with some issuers regarding the additional comments and

“they say they’re not worried, and the SEC hasn’t conveyed a change of plans. My sense is that they’re fairly confident this is just part of the process to get everything in before January 10th.”

Seyffart also argued that the additional comments were unlikely to mean a further delay to the approval and to “expect to see more amendments tomorrow because of this.”

Update: Added Balchunas’ confirmation of 8bps.

Bloomberg Analyst Cuts Probability of Bitcoin Spot ETF Rejection to 5%

Popular Bloomberg ETF analyst Eric Balchunas has lowered the possibility of the US Securities and Exchange Commission (SEC) denying the launch of the Bitcoin spot ETF to 5%. This latest forecast comes as crypto enthusiasts worldwide anticipate a wide-scale approval of various Bitcoin spot ETF proposals by the SEC on Wednesday, January 10.

Why The Bitcoin Spot ETF Approval Appears Nearly Certain: Bloomberg Analysts Weigh In

In October, Eric Balchunas and fellow Bloomberg analyst James Seyffart predicted that there is a 90% chance that ARK Invest and 21 shares would receive approval for their joint Bitcoin spot ETF bid on January 10, which marked the final deadline date for the SEC’s response on their application.

However, in a recent X post on January 6, Balchunas raised the probability of this greenlight to an astounding 95% after declaring that there was only a 5% probability the SEC would reject the ARK/21 ETF bid in the coming days.

Well said although I probably go with 5% at this point. But you gotta leave a little window open for these things.

— Eric Balchunas (@EricBalchunas) January 6, 2024

This new prediction is based on the implausibility of all scenarios, which could represent a possible delay or non-approval of the ARK/ 21 shares Bitcoin spot ETF application. In an earlier X post on January 6, James Seyffart had listed these scenarios starting with ARK/21 shares spontaneously withdrawing their ETF proposal from the SEC, which he claimed to be highly unlikely.

Another scenario is that the SEC discovers new reasons to reject the launch of a crypto spot ETF, resulting in a drawn-out court battle between the US regulator and ARK/21Shares, a situation that Seyffart believes the SEC would rather avoid, especially following its recent loud legal loss against Grayscale investment.

The final event that the Bloomberg analyst believes could prevent the clearance of the ARK/21 Shares ETF bid is a direct intervention from the US Presidency, another scenario that appears remotely possible.

The D-Day Approaches

The importance of ARK/21 Shares’ joint bid to the Bitcoin spot ETF saga revolves around its final deadline date for an SEC response, which is the earliest of the bunch. Now, it is believed that the SEC will rather approve several Bitcoin spot ETF applications at once regardless of their respective final deadline date in a similar fashion as it did with Ether-futures ETFs in August.

This belief is backed by the discussions between the US regulator and various applicants in the last few weeks, leading to amendments in respective proposals, which indicates the preparation of an incoming approval.

At the time of writing, the set date of expectation remains January 10, with crypto enthusiasts highly enthusiastic about the potential bullish effects of a spot ETF on Bitcoin’s price over the year. Meanwhile, Bitcoin continues to trade at $44,050, having gained by 4.50% in the last week.

BTC trading at $44,038.02 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Featured image from iStock, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Spot Bitcoin ETF exchanges and issuers instructed to submit final filings: Bloomberg

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

More Bitcoin ETF updates, SEC calls expected today, but decision next week: Bloomberg, Fox Analysts

The U.S. Securities and Exchange Commission (SEC) is on the verge of potentially approving several spot Bitcoin ETFs, as evidenced by the flurry of recent activities by major financial institutions. As Bloomberg’s James Seyffart highlights, the market eagerly anticipates amendments to 19b-4 filings, which is crucial for approval. These amendments are expected to address issues related to cash creation and redemption mechanisms, a vital component in the ETF approval journey.

Eleanor Terrett of Fox Business shares Seyffart’s view in light of the expected submission of amended 19b-4 filings in a closely watched development. The amendments and comments on S-1s are set to shape the potential launch dates of these ETFs. Terrett posted to X,

“Expecting some amended 19b-4 filings today as well as some eleventh hour phone calls concerning comments on S-1s and possible launch dates. The timeline for approvals still looking like next week but will all depend on how fast the SEC can read through comments and amendments made today.”

As Terrett notes, the process is now primarily about dotting the i’s and crossing the t’s.

We are waiting on decisions for applications from major players made up of Grayscale, Fidelity, Valkyrie, iShares BlackRock, Ark, VanEck, Franklin Templeton, Invesco Galaxy, WisdomTree, Global X, Hashdex, and 7RCC awaiting the SEC’s decision.

As of our last report, only VanEck, Grayscale, and Fidelity had filed Form 8-A. Since, Valkyrie and Ark filed late on Jan. 4, also signaling their readiness and progress toward launching a spot Bitcoin ETF. The filing of Form 8-A, while a critical step, does not guarantee approval but indicates the issuer’s preparedness to comply with SEC regulations.

Other recent SEC updates include Hashdex’s recent receipt of an EFFECT form for its Trust conversion, indicating the SEC’s approval for the reorganization of Hashdex Bitcoin Futures ETF into another fund on Jan. 2. However, it’s crucial to understand that this approval is separate from the approval of a spot Bitcoin ETF which is included in a related, but separate, filing.

The anticipation of the SEC’s decision is palpable, as evidenced by yesterday’s recovery in Bitcoin’s price. It saw a 6.89% increase from its Jan. 3 low, buoyed by market optimism, and has traded tumultuously between $42,600 and $44,200 throughout Jan. 5, which notably is the deadline for comments on several of the ETF applications. This increase reflects the high stakes and keen interest in approving a spot Bitcoin ETF, which would allow ETFs to directly gain exposure to Bitcoin, unlike Bitcoin futures.

Grayscale, Fidelity, Ark, VanEck, and Valkyrie are ‘on paper’ in the lead in terms of filing the required documents to launch a spot Bitcoin ETF. However, the current market consensus is that if the SEC approves the concept of a spot Bitcoin ETF, in principle, many, if not all, of the filings will be approved. The outcomes of these deliberations are eagerly awaited, with potential implications for the broader crypto market.

The crypto market is on the edge of its seat as the SEC deliberates on approving spot Bitcoin ETFs.

As the long-awaited deadline for a positive or negative decision on spot Bitcoin ETF applications approaches, Bloomberg reports that the BTC options market is seeing increased hedging activity as traders prepare for a crucial decision on January 10th.

The report indicates a surge in open interest for put options expiring on Jan. 12, suggesting that market participants are taking steps to mitigate potential losses in the event of a negative verdict by the US Securities and Exchange Commission (SEC) regarding these index funds holding the cryptocurrency.

Market Readies For Bitcoin ETF Verdict

The Bloomberg report highlights that the open interest for put options, which allow holders to sell Bitcoin, has seen a significant increase for contracts expiring on January 12.

This surge in open interest has resulted in a higher put-to-call ratio for these specific options compared to contracts with expiration dates further out from the January 10 deadline.

As seen in the chart below, the most prominent strike prices for the put contracts are $44,000, $42,000, and $40,000, respectively, indicating that put holders could exercise their options to minimize losses in case of a negative market reaction to the SEC decision.

The put-to-call ratio, considered a measure of overall market sentiment, stands at 0.67 for the January 12 options contracts, indicating a more cautious approach among traders.

Ryan Kim, head of derivatives at FalconX, suggests that leveraged/speculative traders are employing Bitcoin put options to protect their leveraged longs, anticipating significant price movements in either direction.

The higher put-call ratio for January 12 options further reflects the market’s desire for protection against a potential negative decision.

The surge in open interest for put options expiring on January 12 indicates a growing need for protection in case of an unfavorable ruling. While Bitcoin’s rally has softened the impact of its 2022 decline, market expectations for ETF approval may already be priced in, posing potential risks for the market.

BTC’s Price Resistance And Potential Dip

Bitcoin has experienced a remarkable rally this year, with expectations for ETF approval driving its price up by more than 60% since mid-October.

However, the Bloomberg report suggests that the surge in demand for the anticipated ETFs may already be factored into the token’s price, potentially exposing the market to a “sell the news” scenario in the second week of January.

Furthermore, QCP Capital, a Singapore-based crypto asset trading firm, predicts topside resistance for Bitcoin in the range of $45,000 to $48,500 and a possible retracement to $36,000 levels before the uptrend resumes.

Bitcoin is currently trading at $43,400, experiencing a 1% decline over the past 24 hours. Over the past 14 days, the cryptocurrency has shown a sideways price movement with a slight decrease of 0.4%.

Given Bitcoin’s well-known volatility, it remains uncertain how the market will react as the looming decision and potential catalysts draw near, and how these factors will impact its price dynamics.

However, the upcoming decision is not the sole catalyst that can potentially drive Bitcoin’s price in 2024. The cryptocurrency is also anticipated to experience a significant catalyst in April 2024, known as the halving event.

This event has historically resulted in an upward surge in Bitcoin’s price, and it is predicted to propel the cryptocurrency beyond its previous all-time high (ATH) of $69,000 throughout the upcoming year.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Binance representatives tipped off VIP traders about impending DOJ settlement in advance: Bloomberg

30As negotiations between Binance and U.S. authorities over legal violations came to a head in September, select high-value traders got an inside look at what was to come, according to new reporting from Bloomberg.

According to unnamed attendees of a Binance-hosted dinner in Singapore, company representatives suggested to VIP traders that Binance would likely pay around $4 billion to settle and survive its legal troubles with the Department of Justice. These personnel allegedly suggested the firm could afford to pay the penalty.

Binance has disputed these characterizations of the event but declined to clarify further.

Reckoning

In November, just two months later, Binance CEO Changpeng Zhao entered a guilty plea in a U.S. federal court for charges related to money laundering. Zhao stepped down as CEO as part of his plea agreement, while the company was fined $4.3 billion.

According to the U.S. Department of Justice (DOJ), Binance committed numerous financial crimes over the years, including failing to register as a money transmitter despite significant U.S. operations. It further alleged that Binance violated sanctions requirements, anti-money laundering rules, and know-your-customer protocols. Though Binance claimed to block U.S. users in 2019, the DOJ said it secretly kept providing services to critical high-net-worth traders.

The $4.3 billion settlement with the DOJ closes just one chapter of Binance’s ongoing legal saga. The Securities and Exchange Commission has filed separate charges against Binance, its U.S. affiliate BAM Trading, and founder Changpeng Zhao. The SEC alleges that Binance and its U.S. affiliate, BAM Trading, operated unregistered exchanges, broker-dealers, and clearing agencies while selling unregistered securities, including the BNB token and stablecoin BUSD, among other violations.

Zhao was succeeded as CEO by Richard Teng, who has held a number of leadership roles in the Binance organization since 2021. In a letter to VIP clients, incoming Teng expressed plans to deepen relationships as Binance enters its “best days” ahead. However, with some lawsuits still pending, storm clouds remain on the horizon.