A theoretical value that

captivated Wall Street and sent bond yields higher has come back down to a more typical level. The reversal suggests a relative calmness has returned to bond markets.

High government borrowing is usually associated with lower bond yields, Matt King wrote in the Financial Times.

That’s the case for advanced economies most of the time, going back to the 1880s, he added.

This record is counterintuitive to assumptions that bigger deficits force governments to raise rates to attract investors.

Rising alarm that Treasury yields will spiral higher amid deteriorating fiscal conditions won’t find much backing in history, Matt King wrote in the Financial Times.

Instead, higher borrowing levels in developed economies have almost always been associated with lower bond yields, according to the Satori Insights founder.

“This finding is not confined to the US: it holds in Germany, Italy, Japan, the UK, Switzerland and Australia back to the 1880s,” wrote King, who is also a former global markets strategist at Citigroup.

It also applies to overall debt levels as well as fiscal deficits, which he called “deeply counterintuitive.”

That goes against a growing consensus that current highs in US borrowing will drive bond yields up, assuming the government will need to lure wary investors with bigger returns.

Alarms about this “doom loop” scenario have been raised by market heavy hitters, such as Ray Dalio and Bill Gross. If left unchecked, the phenomenon could eventually help spur some form of default within two decades, a Penn Wharton Budget Model previously noted.

King offered three reasons why bond yields have fallen during borrowing binges and why the current surge will play out similarly.

One is that government intervention has ofter been employed to hold down yields. This includes an expansion in central bank balance sheets, accounting regulations, and capital controls.

Another is that economic strength and expectations of where rates are headed are the key drivers of bond yields, not deficits.

This outlook was recently echoed by Treasury Secretary Janet Yellen, who said in late October that confidence in the US economy was behind the rise in yields, as well as expectations of a higher-for-longer monetary environment.

And finally, the borrowing process is more self-funded than realized. For example, issuing a bond doesn’t actually draw down private-sector liquidity on net: the proceeds are instead invested into the real economy by governments, eventually flowing back into bank deposits.

“Stranger still is the impact on broad money, or credit. When an actor levers up, the system as a whole gains assets as well as liabilities,” King explained. “The process of borrowing therefore itself creates ‘money,’ at least in the broad sense of total credit, from nothing.”

That’s why aggregate borrowing levels correlate more closely with asset prices than with bond yields, he added.

To be sure, this dynamic doesn’t justify unlimited deficit spending, King cautioned, pointing to last year’s spike in UK bond yields after then-Prime Minister Liz Truss’s government proposed a budget that called for tax cuts and more borrowing.

“But just as increases in corporate defaults tend to be sparked less by looming debt maturities and more by collapses in earnings, so fiscal crises in bond markets tend to be driven less by the inevitability of compounding interest payments and more by sudden collapses in credibility, currency runs and imported inflation,” he said.

Read the original article on Business Insider

“T-Bill and Chill” is the best strategy to investors can take amid the higher-for-longer interest rate environment, according to the so-called “Bong King” Jeffrey Gundlach.

In an interview with CNBC’s “Closing Bell” program on Wednesday, Gundlach—who has a net worth of $2.2 billion—according to Forbes, said that higher-for-longer interest rates could trigger a major economic crisis in the United States.

On Wednesday, the Federal Reserve held interest rates steady at a 22-year high of 5.25% to 5.5%. In September, the central bank warned that rates would need to be stay higher for longer than previously expected in order to tame inflation.

Gundlach told CNBC that the current federal deficit—which hit almost $1.7 trillion in fiscal 2023—was “completely unsustainable” in the current interest rate environment.

“Higher-for-longer means we have a massive interest expense problem in this country that is going to be, I believe, the next financial crisis,” he warned.

With U.S. fiscal spending reaching unprecedented levels, the U.S. Treasury is expected to borrow more than $1 trillion via short-dated T-bills by the end of 2023 as the government looks to build its cash reserves.

According to the Cato Institute thinktank, federal interest payments doubled between 2015 and 2023, with the government set to pay $640 billion in net interest this year. By some estimates, interest payments will become the government’s single biggest expense by 2051.

Gundlach isn’t the only big name on Wall Street to have warned about the potential economic fallout of vast fiscal spending. JPMorgan boss Jamie Dimon and billionaire investors Stanley Druckenmiller and Ray Dalio have all sounded the alarm in recent months over the deficit.

Gundlach cofounded DoubleLine Capital—which today manages more than $140 billion in assets—in 2009, and was soon outperforming rival bond fund managers. His success earned him the nickname “King of Bonds” or the “Bond King.”

The billionaire bond trader also correctly predicted the 2007 housing crash.

Asked on Wednesday about his investment strategy as the Fed kept interest rates high, Gundlach said he wasn’t a fan of keeping a large cash holding despite cash having high returns right now.

“I think rates are going to fall as we move into a recession in the first part of next year,” he predicted.” I don’t like cash because I think your interest rate, which is very attractive presently, may decline quite substantially next year.”

Instead, he advised investors to look to short-term bonds for strong returns.

“I would rather be in something that’s about two to three years. So at least you’re getting that yield, around 8%, for more than six months,” he said. “T-Bill and Chill—you can buy the six-month T-Bill and get 5.5%. The rate is no longer going higher, it’s now starting to potentially decline, so I don’t think you want to be in cash.”

Gundlach said that although the yield curve was suggesting the Fed would cut rates by about 50 basis points next year, this was the “one thing I think will not happen.”

“I think either rates will stay high for longer, which is not my base case but I acknowledge that’s a possibility, but if the economy rolls over as I expect, the Fed is not going to cut rates 50 basis points, they’re going to cut rates 200 basis points,” he explained. “That’s what’s wrong with the cash strategy.”

This story was originally featured on Fortune.com

The U.S. Treasury has set the interest rate for the Series I bonds issued starting tomorrow through the end of April 2024 at 5.27%, up from 4.3% pegged for the bonds issued since May. But some advisors say you may be better off putting your money elsewhere.

I-bonds offer investors a fixed rate that is indexed to inflation and adjusted every six months to reflect changes in price levels. They are meant to shield investors from rising inflation, which can reduce the real, or inflation-adjusted, yield offered by a bond.

The U.S. Treasury adjusts the rates offered on I-bonds every six months, on May 1 and November 1 of each year. There are two components to the rate—a fixed rate and the inflation rate. It calculates the inflation rate based on changes to the Consumer Price Index (CPI), the most widely used barometer of consumer inflation.

But this time the Treasury has also raised the fixed rate to 1.3% from the prior 0.9%. That is a function of real interest rates going up, according to Wisconsin-based Keil Financial Partners’ Jeremy Keil.

I bonds soared in popularity last year amid the highest inflation in four decades. In May 2022, the U.S. Treasury raised the interest rate of I bonds to 9.62%, the highest ever, allowing investors who bought I bonds to lock in those record rates for six months. At almost 10%, yields on I bonds outpaced inflation every month of last year, even in June 2022 when consumer prices rose 9.1% from a year earlier, the fastest pace since 1981.

Investing in I bonds may be losing its appeal at a time when yields on even the safest Treasurys are well above 5%, as the Fed has raised interest rates to the highest level in well over a decade.

Jonathan Swanburg of Houston-based financial planner TSA Wealth Management said in an email that I bonds were “interesting” back when their yields far exceeded those of short-term Treasurys, but they no longer offer such a premium. Yields on even the safest Treasurys have soared above 5% and now exceed those of I bonds, with the 1-year Treasury yielding more than 5.39% and 1-month Treasury bill offering returns above 5.5%.

“Today’s rate landscape has shifted and Treasurys offer much more attractive returns. I would encourage any investor interested in buying I bonds to consider other Treasury investments instead,” Swanburg said.

Keil suggests alternative fixed-income investments such as certificates of deposit (CDs) or money market funds to generate higher returns over the next 1-2 years, especially given that you don’t know what the return on I bonds would be next May.

He also makes a case for Treasury Inflation-Protected Securities (TIPS) saying the 1.3% fixed rate for I bonds “is roughly half the fixed rate you could get with TIPS right now. If you don’t mind the volatility of the bond market, you could buy a TIPS that comes due in the next few years and lock in a higher fixed rate than I Bonds.”

Though Keil did say that you could consider I bonds if “you like your emergency fund savings to always beat inflation.”

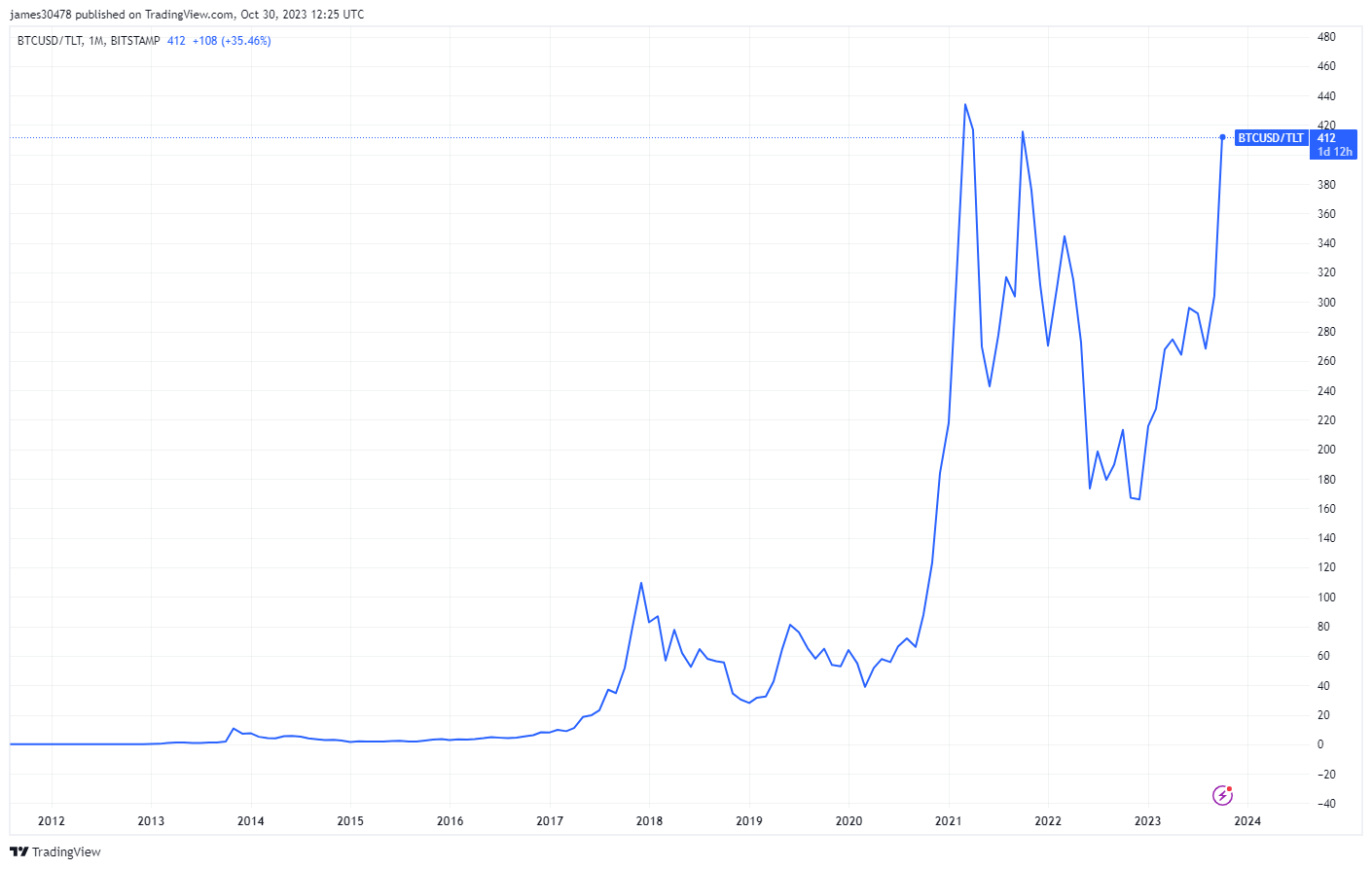

The U.S. dollar, reigning as the global reserve currency, has been the standard benchmark for valuing all assets. However, an intriguing shift occurs when we start benchmarking financial assets against Bitcoin instead of the traditional USD.

Take the U.S. long bond (TLT) as an example, which is currently trading at approximately $84. It would require a hefty sum of 411 TLT to match the value of a single Bitcoin, trading around $34,500. This ratio underscores a significant drawdown for TLT compared to Bitcoin, even more so when considering that in the 2021 bull run, the ratio was 432 TLT to one Bitcoin.

Similarly, when dissecting the Ethereum-Bitcoin relationship, it’s evident that the dynamics are changing. With Ethereum currently trading at just over $1,800, it would take a little over 19 Ethereum to equate to 1 Bitcoin. This ETH/BTC ratio continues to trend downwards, signaling a potential shift in the crypto hierarchy.

This unconventional method of asset denomination reveals a different perspective on the value of financial assets and may be a presage of a broader transformation in the financial realm sparked by the rise of cryptocurrency.

The post Bitcoin’s ratio to the U.S. long bond is nearing all-time highs appeared first on CryptoSlate.

An intensifying bond rout is piling pressure on the global economy and creating a “tremendously dangerous” outlook for equities, the chief investment officer of Livermore Partners hedge fund said Friday.

A new era of higher interest rates has caused bond yields to surge, hampering returns for investors and flipping on its head the status quo of the past decade-and-a-half, David Neuhauser told CNBC. Bond yields move inversely to prices.

Asked how worrying that landscape was for equities, he said: “I think it’s tremendously dangerous at this point.”

“We’re in this world of risk where, for almost 15 years, you had a bond market that was in a bull market, and you had rates negative for several years,” Neuhauser told “Squawk Box Europe.”

“That dynamic fed throughout the global economy, where housing prices were affordable, autos were affordable, and people were subjected to an environment and a lifestyle which had much lower interest rates.”

That environment has shifted as central banks have pushed ahead with rate hikes to tackle higher inflation. That, in turn, has pushed bond yields higher and sapped money from government budgets by raising borrowing costs.

In the U.S. Treasury market — a crucial component of the global financial system — bond yields have surged to highs not seen since the onset of the global financial crisis. In Germany, Europe’s largest economy, yields have hit their highest level since the 2011 euro zone debt crisis. And in Japan, where interest rates are still below 0%, yields have risen to 2013 highs.

“I think that is going to cause a lot of pain moving forward in terms of the economy,” Neuhauser said.

Those fiscal imbalances are giving “a lot of ammunition to the bond bears,” the hedge fund manager added, with interest rates likely to remain higher for longer.

“What you’re seeing now with the bond market is, you know, bond vigilantes are back in vogue, back from the 80s, back from the dead, and I think they’re leading the market today,” Neuhauser said.

Neuhauser’s statement echoes similar comments earlier this week from UBS Asset Management’s head of global sovereign and currency, Kevin Zhao, who said “the bond vigilante is coming back.”

NEW YORK, NY – FEBRUARY 27: Traders work on the floor of the New York Stock Exchange on February 27, 2020 in New York City. With concerns growing about how the coronavirus might affect the economy, stocks fell for the fourth straight day. The Dow Jones Industrial Average lost almost 1200 points on Thursday. (Photo by Scott Heins/Getty Images)

Scott Heins | Getty Images News | Getty Images

Central banks have been keen to stress that interest rates are unlikely to start falling any time soon. The European Central Bank reiterated the point Thursday, holding rates steady at a record high of 4%, while the U.S. Federal Reserve is expected to hold at 5.25%-5.50% next week.

Neuhauser said these higher rates will weigh heavily on consumers and corporates.

“I think that’s going to cause a lot of pressure on the credit markets, it’s going to cause a lot of pressure on the consumer going forward,” he said.

Corporates, too, are set to come under pressure from high debt and refinancing costs, Neuhauser said.

“Ultimately that will lead to the downtrend of the economy and also it’s going to hurt the stock market and you’re starting to see that today,” he added.

Consumers are about to feel the impact of soaring bond yields, Blackstone president Jonathan Gray told the FT.

The yield on the 10-year US Treasury continued to rise on Thursday, edging closer to 5%.

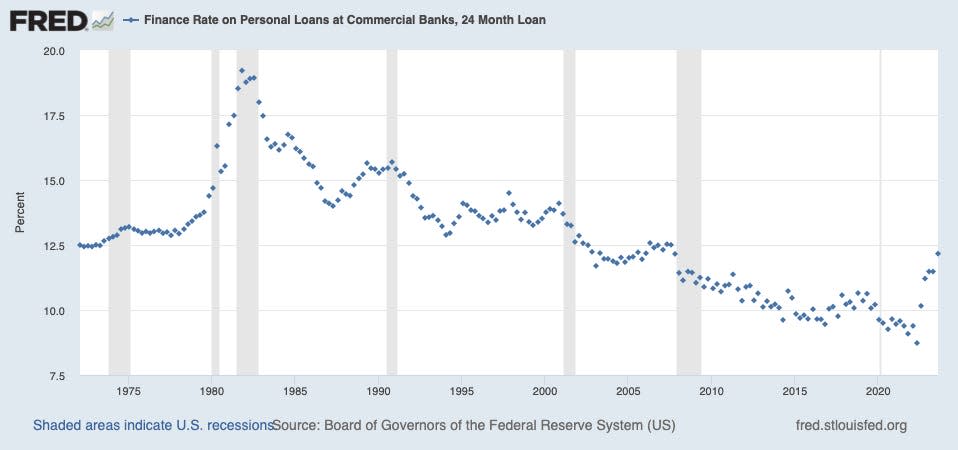

Higher bond yields are raising borrowing costs all over the economy, from mortgages to personal loans.

American consumers are about to feel the sting of soaring bond yields, Blackstone president Jonathan Gray said.

Bond yields, which impact borrowing costs for all kinds of loan products, moved higher this week as investors fretted over higher-for-longer interest rates. After notching a 16-year-record earlier this month, the yield on the 10-year Treasury bond continued to surge on Thursday, rising to 4.958%.

“When 30-year mortgages and car loans cost you 8 percent it will impact consumer behavior,” Gray said in an interview with Financial Times on Thursday. “Growth has been remarkably resilient, but if you keep policy this tight, this long, invariably you will cause the economy to slow down.”

In some corners of the economy, rising yields and higher borrowing costs have already been acutely felt. Rates on the 30-year fixed mortgage just notched 8% this week for the first time since 2000, with the steady rise to that level in the past year putting the US housing market in a state of paralysis and bringing transaction volume to a 13-year low.

Meanwhile, the rate on 24-month personal loans at commercial banks notched 12% in August, the highest borrowing cost since 2007, Federal Reserve data shows.

That’s bad news for US consumers, who have been a pillar of economic strength in the last 18 months of monetary policy tightening by the Federal Reserve.

Consumers’ resilient spending spree could soon grind to a halt though amid rising debt costs.

Households may have already run out of excess savings last quarter, according to the San Francisco Fed, and student loan payments for 43 million borrowers just resumed at the start of October. Around 34% of borrowers say they won’t be able to make their payments, according to a recent Morgan Stanley survey.

Read the original article on Business Insider

Rising Treasury yields helped provoke a frenzy of trading in a popular bond exchange-traded fund this week as dip buyers battled with bears on the cusp of a critical threshold for markets.

Trading volume for the iShares 20+ Year Treasury ETF

TLT,

which is widely referred to by its ticker, TLT, hit a record high on Thursday as 87.7 million shares changed hands, according to Dow Jones Market Data.

Heavy trading continued on Friday, leaving open the possibility that the total number of shares traded this week could exceed the previous record from earlier this month, when more than 270.9 million shares moved during the week ended Oct. 6, Dow Jones data show. The ETF was launched back in 2002.

The ETF’s holdings are heavily weighted toward 30-year Treasury bonds, some of these issues have seen their value fall precipitously, and now trade at less than 50 cents on the dollar. As a result, the ETF’s price has declined 14.8% year-to-date through Thursday’s close, FactSet data show.

While some on Wall Street expect yields to keep on climbing, many have stepped up to buy bonds during the latest selloff. According to FactSet, TLT has seen roughly $18 billion of inflows so far this year, while more than $900 million flowed into the fund during the month of September, the fastest pace this year, according to FactSet data.

Yields on 30-year bonds hit their highest levels since July 2007 on Thursday, but they came in a bit on Friday across the Treasury curve, with the 30-year yield

BX:TMUBMUSD30Y

down 2.7 basis points to 5.079%, while 10-year note

BX:TMUBMUSD10Y

yields were off by 7.7 basis points at 4.908%.

The 10-year yield traded close to 5% on Thursday, a level that has become one of Wall Street’s latest obsessions. Investors in both bonds and stocks are keeping a close eye on where the 10-year yield might be headed based on the notion that yields above 5% could heap more pressure on corporations and the U.S. economy.

See: Why stock-market investors are fixated on 5% as 10-year Treasury yield nears key threshold

Rising Treasury yields spurred losses across the U.S. bond market, saddling ETF investors with heavy losses. TLT, as well as two popular corporate-bond ETFs, the iShares Core U.S. Aggregate Bond ETF

AGG,

and the iShares iBoxx $ Investment Grade Corporate Bond ETF

LQD,

were on pace for their biggest weekly declines of the year, according to Dow Jones data.

TLT was up modestly in recent trade Friday, rising 0.7% to $83.35, but it remained down 4.9% for the week. On Thursday it closed at $82.77 a share, its lowest level since July 2007, according to Dow Jones data.

Treasurys are in the midst of a historic bear market that some have described as the worst of all time. Data from Bank of America showed that Treasury prices are on track to fall for a third straight year in 2023, what would be an unprecedented development.

When interest rates were low, it was difficult for bond investors to earn a decent yield.

Just ask DoubleLine Capital Founder Jeffrey Gundlach.

Speaking at a recent investment conference in New York, Gundlach recalled what the bond market was like in 2016. He said if you wanted to earn a 5% annual yield on a bond portfolio in those days, you had to buy a junk bond index, use leverage to boost returns and pray that issuers wouldn’t default.

Things have changed dramatically since then.

Bond yields have been surging. While high borrowing costs could slow the economy, it also means that investors can potentially earn higher returns on fixed-income investments.

Gundlach said that he’s “much happier” with bonds today than in 2016.

“Now you can buy a T-bill and chill,” he said.

Treasury bills, or T-bills, are short-term debt obligations issued by the U.S. Department of the Treasury. They’re considered among the safest investments because they are backed by the full faith and credit of the U.S. government.

Among the different types of government-issued securities, T-bills have the shortest maturity at one year or less.

The yield on the one-year Treasury bill stood at 5.432% on Oct. 6.

Compared to the hottest tickers in the stock market, T-bills may seem a bit boring. But remember, T-bills are backed by the U.S. government and are considered among the safest investments globally in terms of credit risk.

Because of their short-term nature, T-bills are less sensitive to interest rate fluctuations, making them less susceptible to interest rate risk.

Gundlach knows about bonds. Over the years, his uncanny ability to predict trends and make profitable decisions in the bond market has earned him the moniker Bond King.

If you want to follow the Bond King’s suggestion and “buy a T-bill and chill,” there are several ways to do it.

One of the most direct methods is through TreasuryDirect, an online platform offered by the U.S. Department of the Treasury, where people can purchase T-bills directly from the government.

Alternatively, many brokerage firms allow clients to buy T-bills either in competitive or noncompetitive bidding processes. Certain banks and financial institutions also might offer the option for their customers to invest in T-bills, so check with your local branch to explore available opportunities. Just make sure that you understand the maturity terms and associated fees before making a purchase.

Exchange-traded funds (ETFs) can provide another way for investors to gain exposure to T-bills. By investing in ETFs, you can access the performance of a basket of T-bills without having to buy each one individually. This method also provides the convenience of trading, as ETFs can be bought and sold on stock exchanges just like individual stocks.

Blackstone made a $13 billion bet on the growth in student housing. Here’s how you can carve out your own piece of the student housing market with just $500.

Don’t miss real-time alerts on your stocks – join Benzinga Pro for free! Try the tool that will help you invest smarter, faster, and better.

This article ‘Buy A T-Bill And Chill’: Bond King Jeffrey Gundlach Says He’s Happier As A Bond Investor Now — Here’s How To Get In On The Action originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.